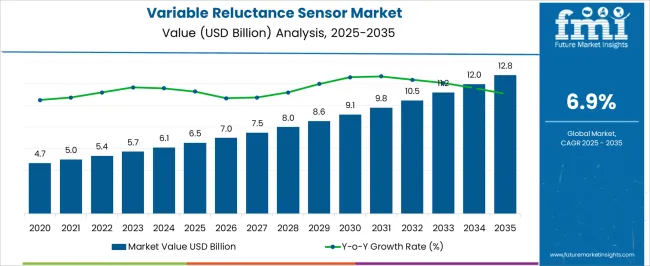

The Variable Reluctance Sensor Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. The market is predominantly supported by magnetic-based variable reluctance sensors, which constitute the foundational technology due to their reliability, cost-effectiveness, and compatibility with traditional automotive and industrial systems. From 2025 to 2027, the market grows from USD 6.5 billion to USD 7.5 billion, with incremental contributions from enhanced magnetic sensing technologies improving detection accuracy, signal stability, and integration with electronic control units.

Between 2028 and 2032, as the market expands from USD 8.0 billion to USD 11.2 billion, advancements in miniaturization and high-temperature-tolerant materials elevate the adoption of variable reluctance sensors in electric and hybrid vehicles, industrial automation, and aerospace applications. These technological enhancements allow for higher precision and durability, increasing their share in the overall market contribution.

Emerging sensor technologies, including multi-axis reluctance sensors and hybrid configurations, are beginning to influence market composition, contributing to niche segments and adding incremental value. By 2035, with the market projected to reach USD 12.8 billion, the dominant contribution will remain with core magnetic variable reluctance sensors, while supplementary technologies enhance performance, reliability, and system integration. The market demonstrates a balanced technology contribution, where foundational sensors drive the bulk of growth and emerging innovations provide incremental value, ensuring sustained expansion across automotive, industrial, and aerospace applications.

| Metric | Value |

|---|---|

| Variable Reluctance Sensor Market Estimated Value in (2025 E) | USD 6.5 billion |

| Variable Reluctance Sensor Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The variable reluctance sensor market is gaining strong traction due to its robust design, low cost, and suitability for extreme operating conditions. These sensors are widely recognized for their non-contact nature and capability to detect motion, speed, and position without requiring external power, making them ideal for use in rugged environments such as automotive and industrial applications.

Technological developments in signal processing and sensor calibration are enabling enhanced accuracy, real-time data acquisition, and compatibility with modern electronic control units. Additionally, the market is benefiting from the growing demand for reliable sensing mechanisms in electric powertrains, anti-lock braking systems, and drive-by-wire technologies.

The shift towards electrification in mobility and the emphasis on smart transportation systems are further reinforcing the role of variable reluctance sensors in enhancing system responsiveness and reliability Looking forward, the integration of these sensors with digital interfaces and their adaptability to high-vibration and temperature-extreme environments are expected to support sustained growth across automotive, aerospace, and rail applications.

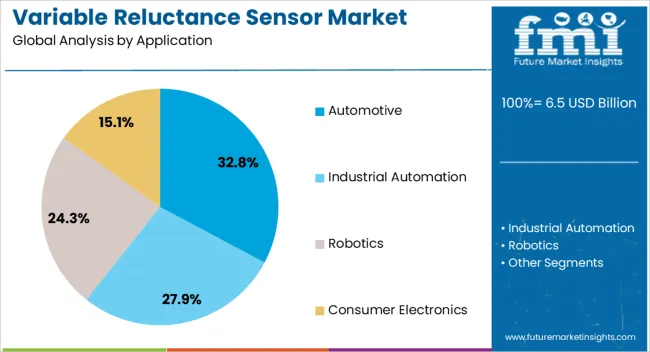

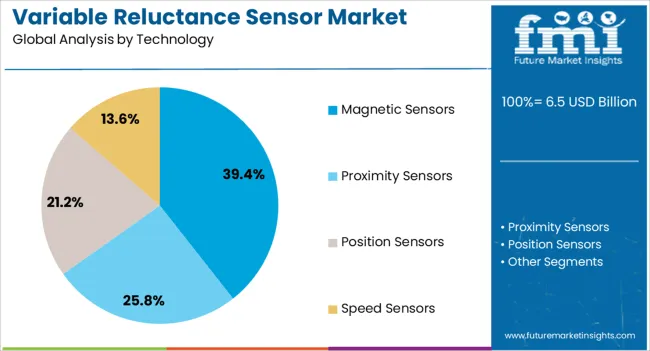

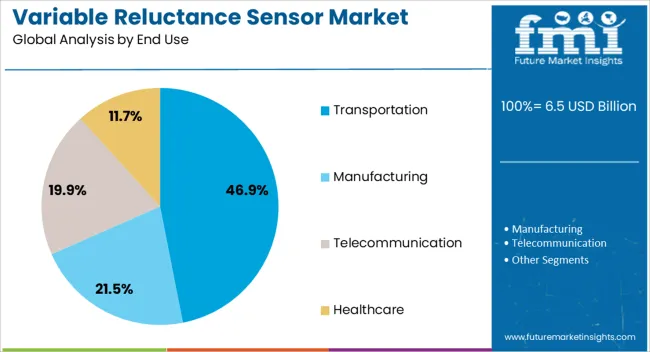

The variable reluctance sensor market is segmented by application, technology, end-use sensor type, and geographic regions. By application, the variable reluctance sensor market is divided into Automotive, Industrial Automation, Robotics, and Consumer Electronics. In terms of technology, the variable reluctance sensor market is classified into Magnetic Sensors, Proximity Sensors, Position Sensors, and Speed Sensors. Based on end use, the variable reluctance sensor market is segmented into Transportation, Manufacturing, Telecommunication, and Healthcare.

By sensor type, the variable reluctance sensor market is segmented into Multi-Axis Sensors, Single-Axis Sensors, and Digital Sensors. Regionally, the variable reluctance sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automotive application segment is projected to contribute 32.8% of the total revenue share in the variable reluctance sensor market in 2025. This growth is being driven by the increasing adoption of these sensors in vehicle speed sensing, crankshaft and camshaft position monitoring, and braking systems.

The ability of variable reluctance sensors to function accurately in high-temperature and high-vibration environments has made them particularly valuable in internal combustion engine configurations. Automotive manufacturers are incorporating these sensors in both conventional and hybrid vehicle platforms due to their reliability, simplicity, and cost efficiency.

Their contactless nature and compatibility with rotating metallic targets have further supported their use in critical safety systems As vehicle electrification and onboard diagnostics systems continue to evolve, the need for real-time, high-resolution feedback on rotational motion is reinforcing the role of variable reluctance sensors in modern automotive architectures.

The magnetic sensors segment is expected to account for 39.4% of the revenue share in the variable reluctance sensor market in 2025, reflecting its dominant technological influence. This share is being driven by the inherent sensitivity of magnetic sensor technology to variations in magnetic field strength, which is essential in detecting positional and speed changes with high precision.

The compatibility of magnetic sensing with miniaturized designs and its low power requirements are key advantages that have facilitated its integration into compact and space-constrained environments. Advancements in magneto-resistive materials and digital signal conditioning are further enhancing detection performance, enabling magnetic sensors to operate efficiently in noisy or magnetically contaminated settings.

Their scalability and high reliability across a broad temperature range are supporting their widespread use in embedded systems, automotive subassemblies, and industrial automation environments As demand for real-time motion monitoring and predictive maintenance grows, magnetic sensor technology is expected to remain central to innovation in this market.

The transportation end use segment is anticipated to hold 46.9% of the variable reluctance sensor market revenue share in 2025, making it the leading end use category. The critical need for robust and durable sensing components in vehicles, trains, and other mobile systems is driving this dominance. Variable reluctance sensors are extensively used in transportation systems to measure rotational speed, detect wheel movement, and support braking and traction control operations.

Their resistance to harsh environmental conditions and mechanical stress has made them ideal for integration into drivetrain systems and safety-critical modules. In railways, these sensors are applied in axle counting, wheel slip detection, and locomotive feedback systems, offering real-time and highly dependable data for safe operation.

The segment’s growth is also supported by investments in connected mobility, fleet modernization, and the electrification of public transport. As transportation networks increasingly rely on sensor-based automation for operational efficiency and safety, the deployment of variable reluctance sensors is expected to grow consistently.

The market has been expanding due to increasing demand for precise rotational and positional measurement in automotive, industrial, and robotics applications. Variable reluctance sensors have been valued for their reliability, high-speed response, and ability to operate under extreme temperatures and harsh conditions. Market growth has been reinforced by advancements in materials, miniaturization, and signal processing technologies. Rising adoption of electric vehicles, industrial automation, and advanced machinery has further strengthened demand, positioning variable reluctance sensors as critical components in motion detection, speed monitoring, and control systems worldwide.

The market has been significantly driven by adoption in automotive and transportation applications. Sensors have been employed in engine crankshaft and camshaft position monitoring, wheel speed detection for ABS, and transmission control systems. Their high-speed response, durability, and ability to operate in extreme temperatures have made them preferable over alternative sensor technologies in critical automotive systems. The growth of electric vehicles, hybrid drivetrains, and connected vehicle technologies has further reinforced market adoption, as precise motion detection is required for motor control, regenerative braking, and torque optimization. Automotive OEMs and tier-one suppliers have integrated variable reluctance sensors into engine management systems, powertrains, and safety modules. Increasing focus on vehicle efficiency, performance optimization, and regulatory compliance has strengthened the importance of these sensors in modern transportation systems globally.

Technological innovations have strengthened the market by improving sensitivity, signal accuracy, and environmental tolerance. Advances in ferromagnetic core materials, coil design, and digital signal processing have enabled high-precision detection of rotational and linear motion. Miniaturized sensor assemblies and integrated electronics have facilitated installation in compact and high-density systems. Multi-channel configurations and real-time monitoring capabilities have allowed precise feedback for industrial machinery, robotics, and automotive systems. In addition, improvements in EMI shielding, thermal stability, and vibration resistance have enhanced operational reliability in harsh environments. These technological advancements have allowed variable reluctance sensors to support applications requiring fast response, accurate position sensing, and robust performance, making them indispensable in automotive, industrial automation, and high-speed rotational measurement applications worldwide.

The market has been reinforced by adoption in industrial automation and robotics. Sensors have been utilized for precise motor control, rotational speed feedback, and position monitoring in CNC machines, conveyor systems, and robotic arms. Integration with PLCs, servo controllers, and motion control units has enabled real-time performance monitoring and process optimization. High durability, resistance to dust, moisture, and vibration, and compatibility with automated systems have made variable reluctance sensors highly preferred in manufacturing and process automation. Robotics applications, including assembly lines and material handling, have leveraged these sensors for accurate positioning and speed regulation. Increasing investments in smart factories, automated warehouses, and Industry 4.0 technologies have further strengthened demand, establishing variable reluctance sensors as essential components in industrial and robotic systems globally.

Despite strong growth, the market has faced challenges associated with manufacturing costs, calibration complexity, and susceptibility to magnetic interference. High-quality ferromagnetic cores, precision coil winding, and advanced signal conditioning have increased production expenses. Proper calibration and alignment have been critical to ensure accurate output, particularly in high-speed and high-precision applications. Environmental factors such as strong magnetic fields, temperature fluctuations, and mechanical vibration have influenced performance, requiring robust sensor design and protective measures. Manufacturers have addressed these challenges with modular designs, integrated compensation circuits, and automated calibration procedures. Continuous improvements in accuracy, reliability, and environmental tolerance have remained essential for sustaining adoption across automotive, industrial, and robotics applications worldwide.

| Countries | CAGR |

|---|---|

| China | 9.4% |

| India | 8.7% |

| Germany | 8.0% |

| France | 7.3% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

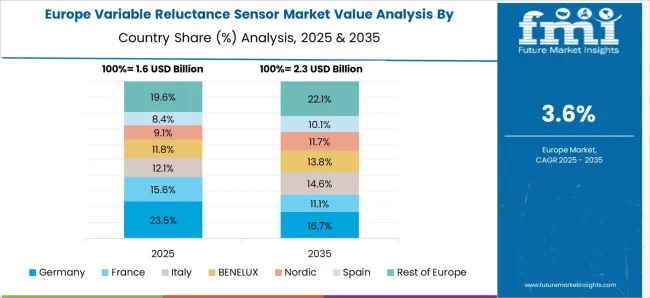

The market is expected to grow at a CAGR of 6.9% from 2025 to 2035, driven by increasing automotive automation, industrial machinery upgrades, and rising adoption of advanced sensing technologies. China leads with a 9.4% CAGR, producing sensors at scale for automotive and industrial applications. India follows at 8.7%, expanding due to growing automotive manufacturing and industrial automation initiatives. Germany, at 8.0%, benefits from precision engineering and established sensor technology expertise. The UK, growing at 6.6%, innovates through integration in smart manufacturing systems, while the USA, at 5.9%, witnesses’ steady adoption in automotive and industrial sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a country-specific CAGR of 9.4% during the forecast period, driven by rising adoption in automotive, industrial automation, and robotics applications. Increasing demand for high-precision sensing technologies in electric vehicles and smart manufacturing is fueling growth. Manufacturers are focusing on developing compact, durable sensors capable of operating in harsh environments while ensuring accuracy in speed, position, and torque measurement. Government initiatives supporting intelligent transportation systems and Industry 4.0 adoption provide additional market momentum. Collaborations between local and global technology providers enhance product development and feature integration. Expansion of automotive production and modernization of industrial plants are expected to further increase demand for variable reluctance sensors.

India’s market is projected to grow at a CAGR of 8.7%, supported by increasing industrial automation and automotive production. Rising demand for energy-efficient, compact, and high-accuracy sensors is encouraging manufacturers to innovate in sensor design and connectivity. Expansion of electric vehicle adoption and smart manufacturing plants is boosting market penetration. Government programs promoting industrial modernization and technology integration accelerate the demand for advanced sensing solutions. Partnerships between Indian sensor manufacturers and global technology providers allow faster adoption of best practices and advanced features. The growing requirement for predictive maintenance and real-time monitoring in industrial equipment also contributes to market growth.

Germany is expected to witness growth at a CAGR of 8.0%, propelled by advanced manufacturing sectors and automotive innovation. High precision, reliability, and robustness are key factors driving adoption in industrial and vehicular applications. Regulatory emphasis on safety, emissions, and automation encourages integration of advanced sensing technologies. Local manufacturers are focusing on sensors that provide accurate measurements under extreme operating conditions, while supporting predictive maintenance and smart monitoring in industrial equipment. The rise of electric and hybrid vehicles and intelligent factory systems further enhances demand. Collaborations with tech startups and research institutions accelerate product innovation and deployment in automotive and industrial sectors.

The market in the United Kingdom is forecasted to grow at a CAGR of 6.6%, fueled by adoption in automotive, aerospace, and industrial machinery. Increasing focus on connected and automated vehicles necessitates precise speed and position sensors. Manufacturers are introducing compact, high-accuracy sensors with long operational lifetimes to cater to industrial automation requirements. Research and development efforts emphasize integration with IoT-enabled predictive maintenance systems. Government regulations and standards on vehicle safety and industrial process efficiency provide additional impetus to the market. The growing trend toward hybrid and electric vehicles drives the need for advanced sensing technologies.

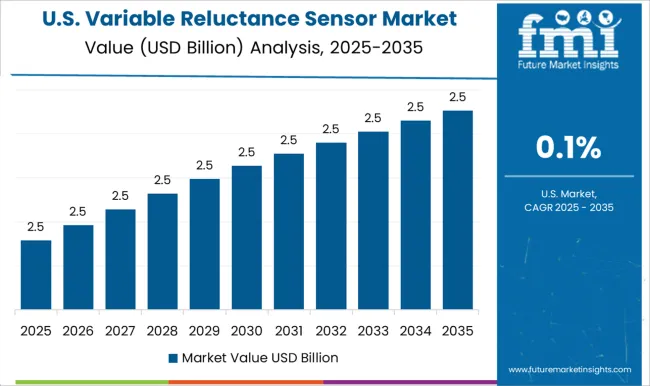

In the United States, the market is anticipated to expand at a CAGR of 5.9%, driven by adoption across automotive, aerospace, and industrial automation industries. Consumers and manufacturers demand sensors capable of high precision, durability, and energy efficiency for electric vehicles and smart factories. Technological innovations include advanced materials, miniaturization, and integration with IoT-enabled monitoring systems. Strategic collaborations between US manufacturers and global technology providers enhance product development, ensuring compliance with regulatory standards for safety and environmental performance. Increasing investments in smart manufacturing and predictive maintenance technologies support market expansion.

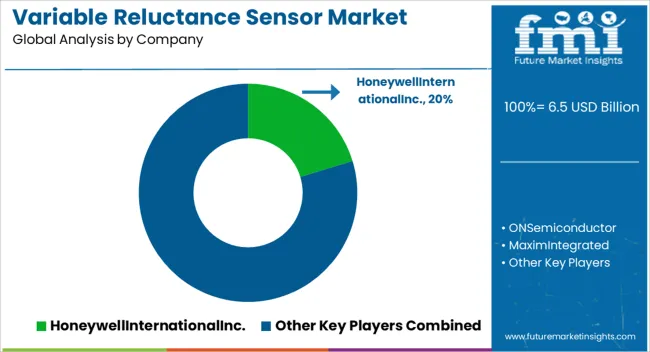

The market is driven by the increasing demand for precise motion detection, position sensing, and speed measurement across automotive, industrial, and aerospace sectors. Honeywell International Inc., ON Semiconductor, and Maxim Integrated are recognized as key leaders, offering advanced sensor technologies with high accuracy, reliability, and durability. Their products are widely implemented in engine control systems, anti-lock braking systems, and industrial automation applications, addressing the need for robust and efficient sensing solutions. National Semiconductor (acquired by Texas Instruments), Diamond Electric Manufacturing Corp., and Magnetic Sensor Corporation contribute to the market by providing specialized variable reluctance sensors with enhanced signal processing capabilities and compact designs. These solutions focus on optimizing energy efficiency, reducing system complexity, and improving overall operational performance, which are critical factors in automotive and industrial applications.

Harco Semco and Sensoronix expand the market portfolio with cost-effective, customizable sensors suitable for diverse applications, including robotics, transportation, and machinery monitoring. These leading variable reluctance sensor providers continue to innovate by integrating high-performance materials, miniaturization technologies, and enhanced signal conditioning, ensuring precise, reliable, and long-lasting sensor performance. Their combined efforts drive market growth, meeting evolving technological demands and supporting the increasing adoption of smart, sensor-driven systems across multiple industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Application | Automotive, Industrial Automation, Robotics, and Consumer Electronics |

| Technology | Magnetic Sensors, Proximity Sensors, Position Sensors, and Speed Sensors |

| End Use | Transportation, Manufacturing, Telecommunication, and Healthcare |

| Sensor Type | Multi-Axis Sensors, Single Axis Sensors, and Digital Sensors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HoneywellInternationalInc., ONSemiconductor, MaximIntegrated, NationalSemiconductor(TexasInstruments), DiamondElectricManufacturingCorp., MagneticSensorCorporation, HarcoSemco, and Sensoronix |

| Additional Attributes | Dollar sales by sensor type and application, demand dynamics across automotive, industrial, and aerospace sectors, regional trends in sensor adoption, innovation in accuracy, durability, and integration, environmental impact of manufacturing and disposal, and emerging use cases in motion detection, position sensing, and predictive maintenance. |

The global variable reluctance sensor market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the variable reluctance sensor market is projected to reach USD 12.8 billion by 2035.

The variable reluctance sensor market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in variable reluctance sensor market are automotive, industrial automation, robotics and consumer electronics.

In terms of technology, magnetic sensors segment to command 39.4% share in the variable reluctance sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Variable Air Volume System Market Size and Share Forecast Outlook 2025 to 2035

Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Variable Valve Timing Market Size and Share Forecast Outlook 2025 to 2035

Variable Displacement Compressor Market Size and Share Forecast Outlook 2025 to 2035

Variable Speed Generators Market Analysis & Forecast by Technology, End Use and Region through 2035

Variable Data Printing Market Analysis – Growth & Forecast through 2034

Variable Frequency Drive Market Growth – Trends & Forecast 2024-2034

Marine Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Air Core Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Variable Displacement Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Variable Oil Pump Market Growth – Trends & Forecast 2024-2034

Automotive Variable Discharge Oil Pump Market

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

North America Variable Frequency Drives Market Growth – Trends & Forecast 2024-2034

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA