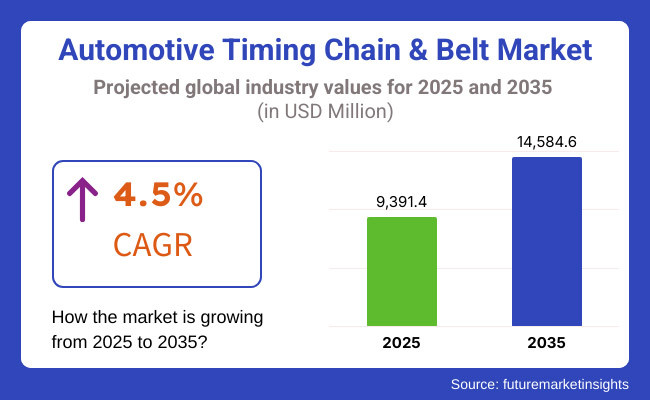

The Automotive Timing Chain & Belt Market is projected to witness steady growth from USD 9,391.4 million in 2025 to USD 14,584.6 million by 2035, reflecting a CAGR of 4.5% during the forecast period. The increasing demand for fuel-efficient and low-maintenance engine components, coupled with advancements in material technology, is driving market expansion.

The market currently experiences a transformation of traditional rubber-based belts shifting into advanced materials like high-strength polymer composites and metal-reinforced belts, thus increasing durability and less maintenance costs.

The automotive timing chain and belt market is primarily influenced by technological innovations in engine efficiency and durability. The market is witnessing a shift from traditional rubber-based belts to advanced materials like high-strength polymer composites and metal-reinforced belts, which enhance longevity and reduce maintenance costs.

The trend that is largely underlined with this technology is reflecting the ever-increasing preference of vehicle manufacturers for timing chains over timing belts in modern cars mainly because of their superior durability and lesser risks of failure due to the use of timing chains.

On the other hand, the timing belt which is quieter and cost-effective, prevails consumer vehicle usage above all. The expanding car industry and harsh environmental rules force manufacturers to turn towards more systematic and high-tech timing equipment, thus improving engine operations as well as reducing friction losses.

The North American circuit will rise steadily, rooted in the automotive sector's spectacular performance in the USA and Canada. The timing chain bogey service segment grows along with the light trucks and high-performance vehicles, which is the driving force for the demand of timing chains, as they are more durable and reliable.

Besides factors such as engine technology innovation, the variable valve timing and direct injection system are causing development in timing systems, which companies will employ to achieve stricter emission regulations. The promotion of fuel-efficient alternatives is a must for car manufacturers, in addition to the need for sophisticated timing belts and chains. The aftermarket will strengthen through high-quality replacement parts and consumers' preference for the durable and superior products they deem fit for their vehicles.

The European region shows a trend of lightweight timing belt introduction especially in the case of passenger automobiles as car manufacturers attend to the stringent Euro 7 emission regulations. The feature of the foremost automobile makers located in Germany, France, and the UK has brought about innovations in low-friction, high-durability components.

The transformation to hybrid and more fuel-efficient combustion engines is generating more requests for the use of modern materials in combustion engines. The view of the initial cost of maintenance going down for the consumer persuades the adaptation of longer-lived timing systems. The aftermarket branch is well known and regulated, as it is mandated by rules which are aiming for vehicle durability.

The Asia-Pacific region is the leader among the fastest-growing automotive timing chain and belt markets, with China, India, and Japan together spearheading this development. The passenger and commercial vehicle sector is part of the growth story driven by rapid industrialization, urbanization, and the increase of disposable income.

The government is pushing the local auto production and the local automobile manufacturers that are popping up are working on the materialize of the auto supply chain. Japan is the technological powerhouse, as carmakers are in the competition of the high-end engine parts segment. Growth of vehicle ownership and boost in automotive aftermarket being a direct consequence of it are also mentioned in this context.

The automotive sector is steadily climbing in the Latin American region which is rooted in the growth of the automotive sector throughout Brazil, Mexico, and Argentina. The rise in consumer demand for cheap vehicles and the increase of the middle class affect both the production and the sales. Timing belts are the main piece of equipment on the floor of the building as they are the most economic option for manufacturers, especially for those who sell low-end and mid-range vehicles.

As the car life spans are getting longer, timing chains are gaining ground in the market segment of commercial and premium cars that are to be fitted with more durable parts. The region has its problems due to the economic cycles and a high level of dependency on import, yet in the course of the expansion, opportunities in the aftermarket and the local manufacturing act as disruptive forces.

The Middle East & Africa (MEA) market gradually expands in the wake of the booming automobile sales in the GGC countries, South Africa, and Egypt. The rising demand for commercial vehicles and SUVs is flourishing in the Middle East due to the infrastructure projects that are scheduled and the industries that are to be developed as well.

The need for durable, heat resistant parts due to the high temperature and the bad weather goes to the timing components specifically, hence the chain is a preferred choice. In Africa, the market is driven by the aftermarket segment, with the finished vehicle imports coming from second-hand ones fueling the demand for spare parts. The anticipated developments in the economy and the urban population will bolster the car ownership rates and will consequently drive the belts and chains manufacture in the territories of emerging markets.

Rising Adoption of Electric Vehicles Reducing Market Scope

The electric vehicle (EV) movement is an important issue for the automotive timing chain and belt market. Timing chains do not exist in EVs as they do not require them thus, with their market share growing, the demand for timing chains and belts is falling off. The world governments are introducing subsidies and strict emission regulations in order to encourage EV growth which overall accelerates this transition.

The traditional automobile companies that are making a shift to EV production may see their market share decline. The hybrid vehicles which have a timing system still are in the market, thus it assures that for some years, the automotive industry will have a demand.

High Material Costs and Supply Chain Disruptions

The timing chain and belt market are significantly being impacted by it through the high costs of raw materials (steel, rubber, and plastic). Global supply chain disruptions, made worse by geopolitical tensions and trade restrictions, are responsible for the price volatility and longer lead times for production. On top of all the automotive industry is searching for a lightweight and high-performance material, because of which the costs of R&D have arisen, making the manufacturers go through hardship.

Supply shortages and transportation delays have an impact on the OEM production schedules which in turn affects overall vehicle assembly rates. Globalized supply chains, alternative materials, and improved inventory management practices to ensure production and pricing are stable are the measures to tackle these issues.

Advancements in Lightweight and High-Durability Materials

Technological innovations in the materials used for timing belts and chains are opening new horizons for development. High-carbon polymer composite technologies, carbon-fiber-reinforced belts, and self-lubricating chains along with such inventions are pushing the boundaries on durability, efficiency, and noise reduction. Lower losses in friction are the logic behind these advances which, together with the objectives of the manufacturers, are the backbone of fuel economy improvements.

Extending the lifespan of products and after-sale costs cutting tend to wear resistant coatings and hybrid belt design. Those manufacturers that are attentive to the new trends in R&D and consequently invest in the latest technology of the timing systems will have a great opportunity to be successful. As the emission rules become tougher, the request for efficient and lightweight materials in internal combustion and hybrid engines will rise accordingly.

Expanding Aftermarket Demand in Emerging Economies

The aftermarket part is largely an opportunity, especially in penetrating areas where car life is essential. In Asia-Pacific, Latin America, and Africa raising the used car sales and car ownership will drive the demand for replacing timing belts and chains. Customers of these markets have been searching for cheap maintenance which has resulted in the emergence of independent repair shops and online automotive parts resellers.

The localized manufacturing of auto components, which is being promoted by government initiatives, will serve as a new revenue source for suppliers. By focusing on affordable yet high-quality aftermarket products, companies can make the most of this growing sector, accordingly ensuring a stable revenue stream even with the global progress of EV adoption.

Automotive timing chains and belts have been one of the fundamental automotive industry components, ensuring the efficient operation of internal combustion engines (ICEs). Historically, the market development has stemmed from a push for fuel efficiency, fewer emissions, and better engine performance. Starting from 2025, the industry is expected to experience a stable increase, with the revenue rising from USD 9,391.4 million in 2025 to USD 14,584.6 million by 2035, at a CAGR of 4.5%.

The driver for this market will be the technological development of material science, the global vehicle manufacturing increase, and the necessity of longer life and freedom from maintenance of engine parts. Nevertheless, the rising share of electric vehicles (EVs) presents a serious challenge, as these vehicles do not use timing belts or chains and thus inhibit the growth in the long term. Nevertheless, the market continues to benefit from hybrid vehicles, commercial fleets as well as areas where ICE cars operate.

Comparative Market Analysis

| Market Shift | 2025 (Projected) |

|---|---|

| Regulatory Landscape | Stringent emission norms driving demand for high-efficiency, low-friction components. |

| Technological Advancements | Use of advanced materials like high-strength polymers and hybrid belts for durability. |

| Industry-Specific Demand | Passenger vehicles and light commercial vehicles dominate demand. |

| Sustainability & Circular Economy | Development of recyclable and eco-friendly belt materials. |

| Market Growth Drivers | Rising vehicle production, longer replacement cycles, and demand for cost-effective engine solutions. |

| Market Shift | 2035 (Forecasted) |

|---|---|

| Regulatory Landscape | Continued push for emission reductions, but EV adoption limits ICE component demand. |

| Technological Advancements | Integration of self-lubricating chains and wear-resistant coatings to enhance longevity. |

| Industry-Specific Demand | Hybrid vehicles and commercial fleets sustain demand amidst EV growth. |

| Sustainability & Circular Economy | Focus on sustainable supply chains and closed-loop material recycling. |

| Market Growth Drivers | Hybrid vehicle market expansion, technological innovations, and regional demand in ICE-dominant areas. |

Due to the solid vehicle production volume, the demand for high-performance components, as well as the increasing share of the aftermarket sector, the automotive timing chain & belt market in the USA is steadily growing. Car manufacturers are shifting to low-friction, long-life timing systems to fulfill fuel efficiency requirements set by the Environmental Protection Agency (EPA).

The growing popularity of hybrid cars has kept the market for timing belts in hybrid powertrains alive and well. Besides, the aftersales of replacement offerings have mostly been aided by the increasing number of old vehicles on the road. Investments in state-of-the-art materials like reinforced timing belts and high-strength timing chains are also a significant factor driving market growth throughout the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The ban on the internal combustion engine (ICE) vehicles which the UK government has imposed for the year of 2035 is creating a high demand for the efficient timing components found in hybrid powertrains. The premium and luxury car manufacturers in the UK are adopting low-friction, high-durability timing systems not only for environmental purposes but also to get better performance from the vehicles.

At the same time, the increase in the number of aftermarket sales of the timing chain and belt replacements is also a big factor for the growth, as the car owners are looking to use only high-quality and long-lasting products stuffed inside their vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

Automotive timing chain & belt market in Europe is getting bigger and bigger due to Euro 7 emission rules that push for fuel efficiency and engine performance. OEM (original equipment manufacturer) firms in Germany, France and Italy started to use next-generation timing systems that not only overcome the common problem of durability but also help in friction reduction.

The tall order of steering in hybrid and plug-in hybrid vehicles of the region is promising timing belts' stability. Investment in automotive R&D is the path for innovations in making timing materials lightweight and wearable, which in turn, amplifies the market growth. The aftermarket sector is, however, getting a boost of additional benefit from the trend of an aging vehicle fleet as well as the longer vehicle lifetime in Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

The automotive timing chain and belt sector in Japan has shown a consistent growth path, propelled by cutting-edge engine technology and a notable presence of hybrid vehicles. Japan has taken a strong position globally in the production of timing belts and chains that are precision-engineered, concentrating mainly on materials that breathe wear and low friction.

Car manufacturers in Japan have also put money into the research of next-generation timing mechanisms, which will, as they believe, improve the mechanics of fuel and resilience. The other main factor adding to this development is the automation of manufacturing processes and the introduction of robotics which are the main drivers of the high-performance timing components in industrial machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The automotive timing chain & belt market in South Korea is viewed as a viable one considering the factors that make it appealing to investors. The EV and hybrid vehicle growth, technological advances in transmission systems, and the development of automotive manufacturers in South Korea are the main factors that contribute to this remarkable increase. Time parts such as timing belt and chain are the main beneficiaries of the rise in the requirement for smart manufacturing and industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Chain Segment Dominates Due to Durability and High Performance

Domination of the chain segment due to durability and performance high is the roller chain for the market. A key of roller chains is their ability and thus their wide range of applications, e.g., high-performance and heavy-duty vehicles, where precision timing, and strength are crucial. Their elongation compared to plied in the gas and diesel engines they are well-suited for obligatory applications.

The negative impact of wear and heat is nullified furthermore by progress in low-friction coatings, and lightweight materials uplifting their adoption rates. The predominance of North America and Europe owes to the tendency of customers to prefer solutions that are both long-lasting and low-maintenance in the premium and commercial vehicle segments.

Belt in Oil Gaining Traction for Fuel Efficiency

Belt in Oil (BIO) is the area of fast enlargement because it is light and the friction is low which makes the fuel economy better and CO₂ emissions lower. BIO, unlike regular dry belts, operates in lubricating oil in the engine thereby reducing noise and increasing longevity.

The automakers are mostly adopting the BIO technology in compact and hybrid vehicles to follow emission regulations in Europe and Asia-Pacific. With major manufacturers of the vehicle joining the various turbo-systems to this technology, the demand of this segment remains in the market, therefore, selling off its presence.

Gasoline Inline Engines Lead with Mass Adoption in Passenger Cars

Gasoline inline engines are the front of the automotive timing chain & belt market, due to their simple design, fuel-efficient work, and widespread use in passenger cars. Inline engines are inexpensive to manufacture, so they are the most widely-loved cars of people from all across North America, Europe, and Asia-Pacific.

Timing chains and timing belts are the two types of alternate drive systems for inline engines. With the new technology has come the longer life and more efficient use of the belt and chain. Higher automobile production rates and full-fledged emission regulations have caused manufacturers to improve the engine, and in doing so, decrease the friction losses, and in turn, the demand on timing systems, ensuring stability in this segment.

Diesel V-Engines Maintain Market Share in Heavy-Duty Vehicles

The diesel V-engine is a model that for along time is highly valued among heavy duty applications for its torque and efficiency. The usual timing chains of these engines are made of roller type which perform better than belts in terms of temperature, stress and load. Commercial vehicles (HCVs & LCVs), as well as off-highway vehicles, extensively use V-engines for the power and longevity they promise.

Regions like Europe and North America play an important part in driving demand in an increasing number of Brdieran construction activities that require stable and reliable engine performance. Even with electrification being part of the general direction, diesel V-engines are still in the backbone in global transportation and industrial sectors.

Passenger Car Segment Dominates Due to High Production Volumes

The passenger car sector is the leader in the market and is currently for the most part the biggest in the adoption of the timing belts and chains. As the worldwide vehicle production remains increased with the cost-effective and fuel-efficient option being the key factor, the use of timing belts and chains is set to rise.

Innovating and using advanced materials that are lighter during the production of Belt in Oil are backward innovations in automotive industry which replace regular energy. The automakers are being guided by the lowering of emissions, the improvement of device life, and the promotion of the easy operation of the engines to the spreading of advanced timing systems. New rules to raise the fuel efficiency of vehicles have also brought benefits to this segment.

HCVs Depend on Timing Chains for Heavy-Duty Performance

HCVs dominate the timing chain segment as these vehicles demand heavy-duty and long-lasting components that can withstand the pressure of time and wear and tear. Timing Chains due to their high strength, minimal maintenance needs, and superior durability under heavy loads are preferred.

The strong suit of the board is being selling transportation freight, construction, and logistics industries, and both in North America and Europe. The manufacturers are investing in low friction and noise-free timing chains to enhance the performance of the vehicle because the government is implementing new emission norms and efficiency standards which in turn will keep the market alive in this segment.

The automotive timing chain and belt market is a vital sector in the stakes-is-higher industry, operating as a significant route for the ICE engine machinery. This sector is affected by multiple factors such as the technological development, the rise explosion in the production of the automobile, and the shift toward efficient and durable engine parts. The market is in a slow shift towards advanced materials that improve the performance of human and the longevity the goods.

Although ICE vehicles are still in mass market numbers, the rise of electric vehicles fluctuation to the market, with a challenge to both, long-term sector revenue and market reach. In this domain, the leading players worldwide are BorgWarner Inc., Continental AG, Schaeffler AG, Gates Corporation, and Dayco Products LLC. The market also has a substantial segment for regional players in terms of fulfilling aftermarket requirements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BorgWarner Inc. | 15-20% |

| Continental AG | 12-16% |

| Schaeffler AG | 10-14% |

| Gates Corporation | 8-12% |

| Dayco Products LLC | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| BorgWarner Inc. | Supplies advanced timing chains for high-performance engines, focusing on durability and low noise. |

| Continental AG | Develops high-performance timing belts with enhanced material technology for reduced friction and longer life. |

| Schaeffler AG | Specializes in precision-engineered timing chain systems with a focus on lightweight components. |

| Gates Corporation | Offers a wide range of OE and aftermarket timing belts with a strong global distribution network. |

| Dayco Products LLC | Manufactures OE-quality timing belts and chains, emphasizing thermal resistance and high-strength materials. |

BorgWarner Inc.

A worldwide frontrunner in powertrain solutions that focuses on timing chains characterized by high durability, low friction, and low noise is BorgWarner Inc. This company collaborates with the major OEMs to produce the high-performance parts that, in turn, improve the fuel efficiency and lower the emissions. The company, which is a leader in R&D, incorporates the newest materials like hardened steel alloys and coated chains into the company products so that they will last longer.

Its hybrid powertrains know-how and the inside that they offer assure of their adaptability to the changing trends in the industry. As the car manufacturing industry is nearing a transition to a fully sustainable model, BorgWarner is consistently taking action on the development of engine optimization technologies that are in line with the global regulations for emissions that car makers are in part responsible for.

Continental AG

Continental AG is the top company in the field of manufacturing high-performance timing belts with the help of advanced material science that boosts the efficiency of the engine. Thanks to the proprietary rubber compounds and fiber reinforcements, the company can now diminish friction and make the products work over longer periods, which makes them perfect for both gasoline and diesel applications.

As part of its dedication to protecting the environment, Continental has been focusing on not only reducing the CO₂ emissions but also the emissions from the rest of the manufacturing processes throughout its whole life cycle. The company is also a crucial player in the hybrid engine applications department, being able to adapt its timing belt technologies for modern vehicle architectures. Continental's position in the automotive timing belt sector is firm as a global player with a huge network and partnerships with top car makers.

Schaeffler AG

Schaeffler AG is the primary provider of precision-engineered timing chain systems, covering their lightweight design and fuel efficiency benefits. The innovative solutions from the company help prevent engine friction, improve durability, and the best part, contribute to lower emissions.

With strong attention paid to research and development, Schaeffler is constantly pushing the boundaries of its timing chain technology to keep up with the stringent industry rules. The company distributes parts to luxury brands, ensuring a high level of performance in different car models. Schaeffler is also moving into the hybrid vehicles by making the product more versatile and, in this way, being adapted to the electric and alternative powertrains.

Gates Corporation

Gates Corporation is a premier supplier of OE and aftermarket timing belts that present a broad spectrum of solutions for gasoline, diesel, and hybrid engines. The company follows rigorous product research and emphasizes plastic innovation, adding steel and glass-reinforced plastics to the belts for max performance.

The wide consumer distribution that Gates has plus the positive reputation it received from OEMs and independent repairers ensures the product is available wherever it is needed. The company's constant investment in development of material science and belt strength keeps its reputation for being reliable intact. Through the emphasis on international market growth and service improvements, Gates is successful in retaining its top position in the global automotive timing belt market.

Dayco Products LLC

Dayco Products LLC is a manufacturer of timing chains and belts which are high in quality, and they supply to both OEM and aftermarket sectors. The company is particularly interested in high-heat-resistant material that can withstand significantly high temperatures, thus guaranteeing a longer lifespan due to decreased wear even in extreme engine conditions.

The company, Dayco, which is hybrid and fuel-efficient engine applications focused, moves with the changing industry trends. Dayco intends to further its market presence by forming strategic partnerships and enhancing its supply chain as it continues to expand in North America and the Asia-Pacific. With the constant innovations, the manufacturer has kept its reliable edge in supplying the automakers and service providers with high-performance engine timing solutions worldwide.

Other Key Players

The global Automotive Timing Chain & Belt market is projected to reach USD 9,391.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.5% over the forecast period.

By 2035, the Automotive Timing Chain & Belt market is expected to reach USD 14,584.6 million.

The timing chain segment is expected to dominate due to its superior durability, lower maintenance requirements, and increasing adoption in high-performance and fuel-efficient engines.

Key players in the market include Continental AG, BorgWarner Inc., Schaeffler AG, Tsubakimoto Chain Co., and NTN Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 51: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: Asia Pacific excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: Asia Pacific excluding Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 55: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 56: Asia Pacific excluding Japan Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 57: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 58: Asia Pacific excluding Japan Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 59: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 60: Asia Pacific excluding Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 61: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 63: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 65: Japan Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 66: Japan Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 67: Japan Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 68: Japan Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 69: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 70: Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Engine Type, 2017 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Engine Type, 2017 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Engine Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Engine Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Engine Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Engine Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Engine Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: Asia Pacific excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: Asia Pacific excluding Japan Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 153: Asia Pacific excluding Japan Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 154: Asia Pacific excluding Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: Asia Pacific excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: Asia Pacific excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: Asia Pacific excluding Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 162: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 165: Asia Pacific excluding Japan Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 166: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 167: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 168: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 169: Asia Pacific excluding Japan Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 170: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 171: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 172: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 173: Asia Pacific excluding Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 174: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: Asia Pacific excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Asia Pacific excluding Japan Market Attractiveness by Engine Type, 2023 to 2033

Figure 178: Asia Pacific excluding Japan Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 179: Asia Pacific excluding Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 181: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Japan Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 183: Japan Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 184: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 192: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Japan Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 195: Japan Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 196: Japan Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 197: Japan Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 198: Japan Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 199: Japan Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 200: Japan Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 201: Japan Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 202: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 203: Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 204: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Japan Market Attractiveness by Engine Type, 2023 to 2033

Figure 208: Japan Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 209: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: Japan Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Engine Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Engine Type, 2017 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Engine Type, 2017 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Engine Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Engine Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Engine Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Timing Belt Market

Automotive Timing Chain Market

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Automotive Belts Market Growth - Trends & Forecast 2025 to 2035

Automotive Chain Tensioners Market

Automotive Tire Chains Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seat Belts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Automotive Inflatable Seat Belt Market

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Belt Trainers Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA