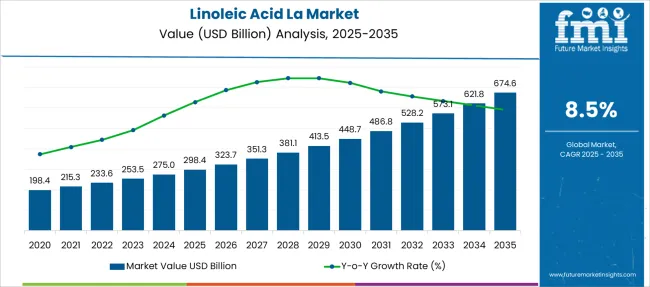

The Linoleic Acid (LA) Market is estimated to be valued at USD 298.4 billion in 2025 and is projected to reach USD 674.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Linoleic Acid (LA) Market Estimated Value in (2025E) | USD 298.4 billion |

| Linoleic Acid (LA) Market Forecast Value in (2035F) | USD 674.6 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

Cosmetics have emerged as a key application area due to linoleic acid's recognized role in skin hydration and barrier repair. This has led to its incorporation in a wide range of skincare and personal care products. Growing consumer awareness around natural and effective ingredients has boosted demand in the cosmetics segment. Additionally, advancements in extraction and purification technologies have improved the quality and availability of linoleic acid.

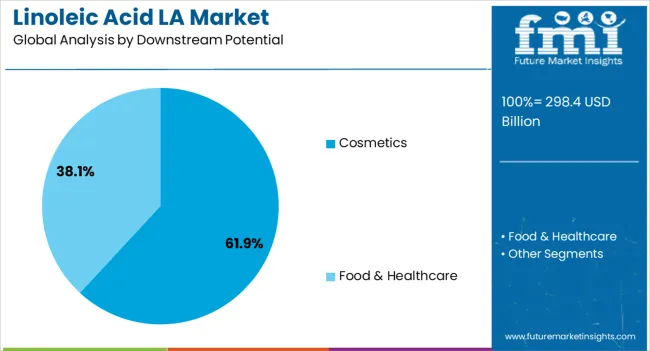

The market is also shaped by evolving regulations promoting the use of plant-based and sustainable ingredients. Downstream potential is largely dominated by ethyl linoleic acid, which is favored for its versatility in formulations and enhanced bioavailability. Increasing research into its applications and benefits is expected to support long-term market growth. Segment expansion is anticipated to be led by cosmetics as the primary application and ethyl linoleic acid as the dominant downstream product.

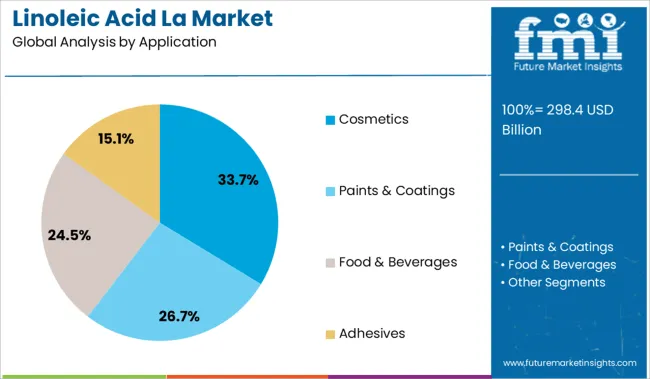

The market is segmented by Application, Downstream Potential, and region. By Application, the market is divided into Cosmetics, Paints & Coatings, Food & Beverages, and Adhesives. In terms of Downstream Potential, the market is classified into Ethyl Linoleic Acid.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cosmetics segment is projected to account for 33.7% of the linoleic acid LA market revenue in 2025, establishing itself as the leading application. This growth is attributed to linoleic acid’s well-documented skin benefits, including anti-inflammatory properties and its ability to improve skin barrier function. Formulators have incorporated linoleic acid into moisturizers, sunscreens, and anti-aging products to enhance efficacy and consumer appeal. The rise in demand for clean beauty products that contain natural fatty acids has further increased their use.

Additionally, trends in personalized skincare have encouraged brands to utilize linoleic acid in targeted treatments for dry and sensitive skin types.

As consumers continue to prioritize ingredient transparency and product performance, the cosmetics segment is expected to maintain strong demand for linoleic acid.

The ethyl linoleic acid segment is forecasted to hold 61.9% of the linoleic acid LA market revenue in 2025, securing its position as the dominant downstream product. Ethyl linoleic acid has gained preference due to its enhanced solubility and compatibility with a wide range of formulations, making it ideal for cosmetics, pharmaceuticals, and nutraceuticals.

Its bioavailability and stability advantages have made it a favored ingredient in skin care and therapeutic applications. Production techniques have improved to yield high-purity ethyl linoleic acid at competitive costs, supporting its adoption.

Its role as a building block for more complex derivatives has expanded its downstream potential. Growing consumer demand for multifunctional and natural ingredients is expected to drive the continued growth of the ethyl linoleic acid segment.

Surging demand in food, cosmetics, and bio-based materials drives the linoleic acid market. Opportunities lie in sustainable sourcing, high-purity derivatives for pharmaceuticals, and expansion across emerging health-conscious regions.

Linoleic acid is increasingly used in cooking oils, margarine, and plant-based food formulations due to its essential fatty acid status and health benefits, fueling demand in food processing. In cosmetics and personal care, LA’s skin-conditioning and anti-inflammatory properties make it a popular ingredient in moisturizers, serums, and hair care. Industrially, LA finds roles in bio-lubricants, resins, and biodegradable materials, aligning with eco-conscious trends. Rising health awareness globally accelerates its use in functional foods and nutraceuticals. Moreover, expanding foodservice and packaged food sectors in Asia-Pacific and Latin America bolster consumption. Regulatory emphasis on trans-fat replacement further reinforces LA’s position as a favorable unsaturated fat alternative, supporting sustained market momentum.

Growth opportunities in the LA market stem from innovation in sustainable extraction, refining technologies, and higher-purity derivatives for niche applications. Manufacturers investing in cold-pressed, non-GMO, or organic oils can attract premium segments in food and personal care. Development of high-purity LA and specialized formulations—such as pharmaceutical-grade esters and conjugated forms- opens doors in medical and skincare industries. Emerging markets, particularly in Southeast Asia and Africa, present untapped potential as dietary awareness increases. Partnerships with agricultural producers and a focus on supply chain traceability offer brand differentiation. Additionally, application in biodegradable plastics and bio-based polymers supports the trend toward circular economy materials. Investing in value-added formulations and green credentials positions suppliers for long-term growth.

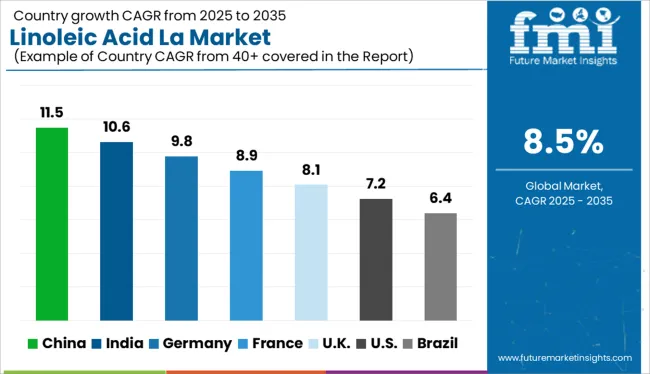

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

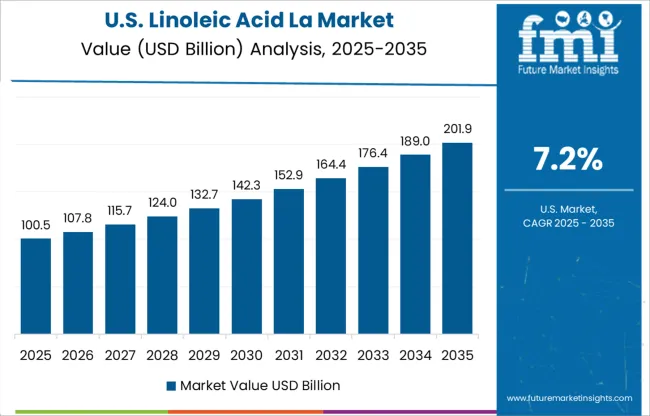

| USA | 7.2% |

| Brazil | 6.4% |

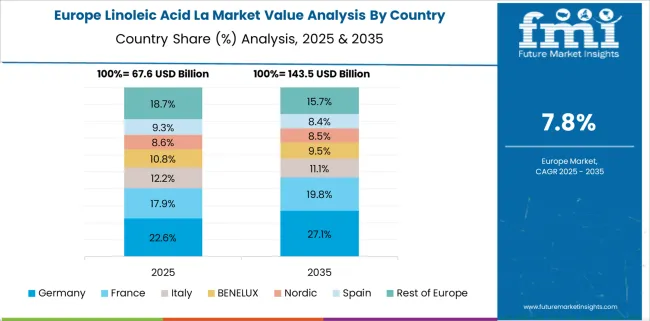

The global linoleic acid (LA) market is expected to grow at a CAGR of 8.5% from 2025 to 2035, driven by demand across cosmetics, dietary supplements, pharmaceuticals, and fortified foods. Among BRICS nations, China leads with an 11.5% CAGR, supported by large-scale oleochemical processing, rising exports, and booming personal care consumption. India follows at 10.6%, fueled by the expansion of plant-based nutrition, Ayurveda-inspired formulations, and edible oil diversification. Germany, at 9.8%, represents one of the strongest-performing OECD markets, driven by pharmaceutical-grade LA demand and EU-compliant clean-label innovation. The United Kingdom (8.1%) shows steady growth aligned with sustainability trends, while the United States, at 7.2%, reflects mature market dynamics with functional ingredient consolidation across healthcare and wellness sectors. This report covers a detailed analysis of 40+ countries, and the top countries have been shared as a reference.

From 2025 to 2035, the linoleic acid market across China is expected to grow at a robust CAGR of 11.5%, with annual growth fluctuating between 11.0% and 12.0%. Increased demand from cosmetics, dietary supplements, and industrial lubricants is pushing linoleic acid consumption to new highs. Beauty and skincare brands are expanding their product lines using LA as a core emollient, supported by consumer preference for plant-derived ingredients. The food processing industry is also incorporating LA into functional food items, targeting health-conscious demographics. Additionally, rapid growth in industrial coatings and alkyd resin applications is diversifying its commercial footprint.

With a projected CAGR of 10.6% between 2025 and 2035, the linoleic acid market across India is showing strong upward momentum, with yearly growth rates ranging from 10.1% to 11.0%. Rising consumer awareness about essential fatty acids is driving demand in the nutraceutical and edible oil segments. Local manufacturers are scaling up production from sunflower and safflower sources to meet dietary supplement and health food demand. In the personal care space, LA is gaining traction in formulations targeting dry skin and eczema treatment. Regulatory support for plant-based cosmetics and wellness foods is further energizing the supply chain.

Linoleic acid market in Germany is projected to grow at a CAGR of 9.8% from 2025 to 2035, with annual gains ranging from 9.3% to 10.2%. LA is gaining popularity in both cosmetic chemistry and high-performance industrial applications. German skincare brands are enhancing anti-inflammatory formulations using LA sourced from sustainable botanical oils. Simultaneously, the country’s eco-conscious construction sector is promoting the use of bio-based alkyd resins in paints and sealants. Regulatory frameworks supporting green chemicals and biodegradable additives are creating favorable market conditions across both consumer and industrial domains.

From 2025 to 2035, the linoleic acid market in the United Kingdom is projected to grow at a CAGR of 8.1%, with year-over-year increases ranging from 7.7% to 8.5%. Rising consumer demand for clean-label personal care products and essential fatty acid supplementation is fueling market growth. Linoleic acid is being integrated into a new wave of moisturizers, serums, and plant-based omega supplements. Meanwhile, food technologists are experimenting with LA-enriched functional products aimed at cardiovascular and skin health. Startups in the wellness space are also introducing LA as part of premium, organic beauty regimens.

The linoleic acid market across the United States is forecast to grow at a CAGR of 7.2% during 2025–2035, with annual growth ranging from 6.8% to 7.5%. As interest in plant-based and functional wellness ingredients continues to rise, LA is being adopted widely in personal care, dietary, and pharmaceutical formulations. Skin sensitivity and anti-aging concerns are prompting skincare companies to prioritize LA for its barrier-repair and anti-inflammatory properties. In parallel, food supplement brands are offering LA in capsule and softgel formats targeting general wellness. Regulatory compliance and clean-label trends are shaping its use in over-the-counter and cosmeceutical products.

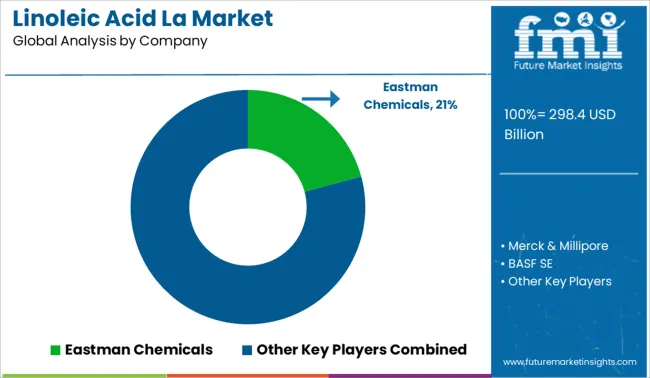

The linoleic acid (LA) market is fragmented, comprising a wide mix of global chemical producers and specialized suppliers serving industries such as food, cosmetics, pharmaceuticals, and industrial chemicals. Tier 1 players like Eastman Chemicals, BASF SE, and Merck & Millipore dominate through high-purity offerings, large-scale production, and regulatory-compliant supply chains across multiple geographies. Tier 2 companies such as Cayman Chemicals, Avantor, and Univar provide versatile grades of LA tailored for research, nutraceuticals, and specialty formulations. Tier 3 suppliers including Sisco Research, Caila & Pares, and Beijing Lys Chemicals cater to regional and custom formulation needs, focusing on price competitiveness and flexible batch sizes. Market growth is driven by rising demand in functional foods, skincare, and pharmaceutical excipients.

| Item | Value |

|---|---|

| Quantitative Units | USD 298.4 Billion |

| Application | Cosmetics, Paints & Coatings, Food & Beverages, and Adhesives |

| Downstream Potential | Ethyl Linoleic Acid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eastman Chemicals, Merck & Millipore, BASF SE, Cayman Chemicals, Acme Synthetic, Penta Manufacturing, Caila & Pares, Univar, Inc., Beijing Lys Chemicals, Charkit Chemical, Lluch Essence Sl, Synerzine, S A Pharmachem Pvt. Ltd., Sisco Research Laboratories Pvt. Ltd., and Avantor |

| Additional Attributes | Dollar sales by source type (plant-based, animal-based), application segment (food & beverages, cosmetics & personal care, pharmaceuticals, industrial uses), and grade (refined, crude); regional consumption trends influenced by dietary awareness and regulatory policies; supply chain dynamics related to oilseed crop production and processing capacity; innovation in formulation for nutraceutical and dermatological products; environmental impact of large-scale extraction and refining processes; and emerging use cases in biodegradable polymers and functional food ingredients. |

The global linoleic acid (LA) market is estimated to be valued at USD 298.4 billion in 2025.

The market size for the linoleic acid (LA) market is projected to reach USD 674.6 billion by 2035.

The linoleic acid (LA) market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in linoleic acid (LA) market are cosmetics, paints & coatings, food & beverages and adhesives.

In terms of downstream potential, ethyl linoleic acid segment to command 61.9% share in the linoleic acid (LA) market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactic Acid Cosmic Blends Market Size and Share Forecast Outlook 2025 to 2035

Lauric Acid Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactic Acid Bacteria Market Analysis by End-use Application, Functionality and Other Strains Type Through 2035

Lactic Acid Blends Market

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Lactic Acid Esters Market Trends & Demand 2022 to 2032

Azelaic Acid Derivatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Azelaic Acid Market

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Pelargonic Acid Market Size and Share Forecast Outlook 2025 to 2035

UK Lactic Acid Market Outlook – Size, Share & Forecast 2025-2035

USA Lactic Acid Market Analysis – Trends, Growth & Industry Insights 2025-2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Polylactic Acid Market Expansion - Biodegradable Materials & Industry Trends 2024 to 2034

Glacial Acetic Acid Market Growth – Trends & Forecast 2024-2034

Glacial Methacrylic Acid Market Growth & Demand 2025 to 2035

Europe Lactic Acid Market Trends – Demand, Growth & Forecast 2025-2035

Chloroplatinic Acid Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA