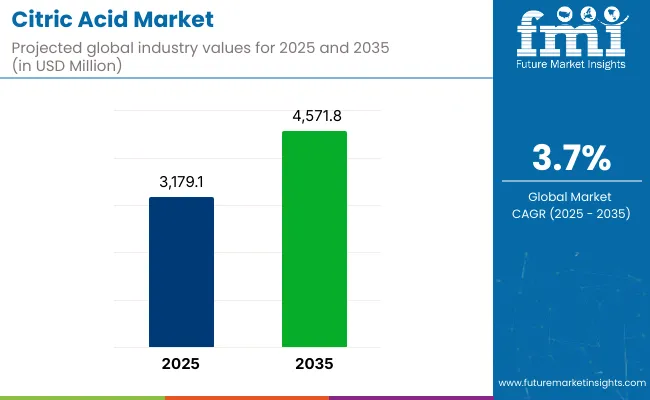

As of 2025, the global citric acid market is valued at approximately USD 3,179.1 million and is likely to register a CAGR of 3.7% to surpass USD 4,571.8 million by the end of 2035. This moderate but consistent expansion reflects increasing reliance on citric acid as a GRAS-certified ingredient in food, beverages, pharmaceuticals, and personal care.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 3,179.1 million |

| Projected Industry Value (2035F) | USD 4,571.8 million |

| Value-based CAGR (2025 to 2035) | 3.7% |

The global demand is shaped not only by the functional attributes of citric acid but also by its biodegradability and alignment with clean-label and eco-conscious formulations. The market is experiencing steady momentum with demand intensifying across diverse industries, particularly food processing and pharmaceutical sectors.

Regulatory approvals, cost-effectiveness, and its ability to act as a natural preservative continue to enhance its adoption. However, pricing volatility of raw materials, especially derived from molasses and corn, is creating cost pressures on manufacturers.

A growing concern around overdependence on synthetic production routes is also pushing select players to explore bio-based fermentation methods. Key players are aggressively expanding production capacities, especially in Asia-Pacific, to meet surging downstream needs and offset import dependencies in developed markets. Industry stakeholders are also realigning strategies to comply with shifting regional food safety and sustainability standards.

Over the forecast period, demand for citric acid is expected to incline toward more functional and pharmaceutical-grade applications. Anhydrous and monohydrate forms will remain central, yet the pharmaceutical and cosmetics industries are likely to contribute a higher-value share due to the tightening of purity standards and multifunctional role of citric acid in stabilizing active compounds.

Innovations in organic acid blends, combined with improved granulation and encapsulation techniques, are poised to strengthen performance across specialized applications. By 2035, the citric acid industry is anticipated to achieve deeper penetration in non-food applications, creating new revenue pathways for both incumbent and emerging suppliers.

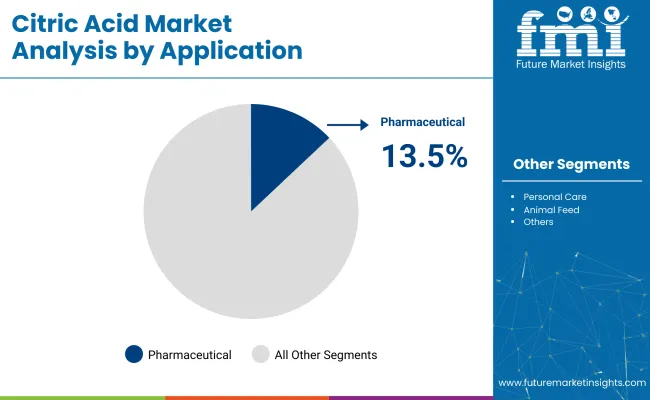

Pharmaceutical-grade citric acid is projected to account for approximately 13.5% of the market share in 2025, reflecting its increasing integration in excipient systems, effervescent dosage forms, and pH-controlled delivery formats. Its role extends beyond acidulant functions, acting as a chelating agent and bioavailability enhancer in complex APIs.

Regulatory recognition by bodies such as the USA FDA and EMA for its Generally Recognized As Safe (GRAS) status in pharmaceutical formulations reinforces its credibility. Market traction is particularly notable in North America and Western Europe, where cGMP-compliant production and stringent pharmacopeial requirements are mandating higher-quality inputs.

Companies like Jungbunzlauer and Tate & Lyle have significantly scaled their pharmaceutical-grade offerings, aligning with the growing demand for multifunctional excipients in oncology, gastroenterology, and cardiovascular therapeutic areas. The shift toward effervescent nutraceuticals, chewable tablets, and liquid suspensions further contributes to this segment’s premiumization.

In line with European Pharmacopoeia and USP monographs, suppliers are optimizing granulometry and solubility characteristics to meet evolving formulation complexities. As personalization of medicine intensifies, pharmaceutical-grade citric acid is expected to witness compound applications in solubility enhancement and stability optimization, particularly in pediatric and geriatric drug delivery. This segment is poised to generate value beyond commoditized acidulants through IP-sensitive and functionally integrated use cases.

Accounting for 9.8% of the total market in 2025, industrial-grade citric acid is increasingly being leveraged in eco-efficient cleaning systems, metal finishing, and biopolymer synthesis. The demand is underpinned by its role as a biodegradable chelating agent and descaler, providing a safer alternative to phosphates and synthetic acids in industrial and institutional (I&I) cleaning. North America and Western Europe lead adoption due to environmental mandates from agencies such as the European Chemicals Agency (ECHA) and the USA.

Environmental Protection Agency (EPA). Industrial players such as Gadot Biochemical and Cargill have expanded their B2B portfolios to offer bulk citric acid in granular and solution forms tailored for industrial detergent and wastewater treatment formulations. The transition to low-toxicity, non-phosphate cleaning agents across manufacturing, hospitality, and healthcare is accelerating its uptake.

Moreover, citric acid is gaining relevance in the synthesis of biodegradable polymers such as poly(citric acid), which are being explored for food packaging and biomedical applications. As the industrial sector intensifies its transition toward green chemistry principles and circular inputs, industrial-grade citric acid is set to capture higher downstream value and reduce reliance on petrochemical-based alternatives.

Increase in Beverages is Driving the Market Growth

A common sweetener in many baked and frozen foods citric acid anhydrous also has sour applications. Given the recent expansion in the production of meat and dairy substitutes there may be an increase in demand for citric acid anhydrous on the market.

Because of its acidic qualities citric acid anhydrous is widely used in the production of alcoholic beverages and carbonated soft drinks. Juices syrups ready-to-drink (RTD) tea and coffee as well as various sports and energy drinks all contain it. Because of the products extensive use in the food and beverage sector the market for citric acid anhydrous is anticipated to grow in terms of both sales and revenue.

Tier 1 companies comprises industry leaders acquiring a 50% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

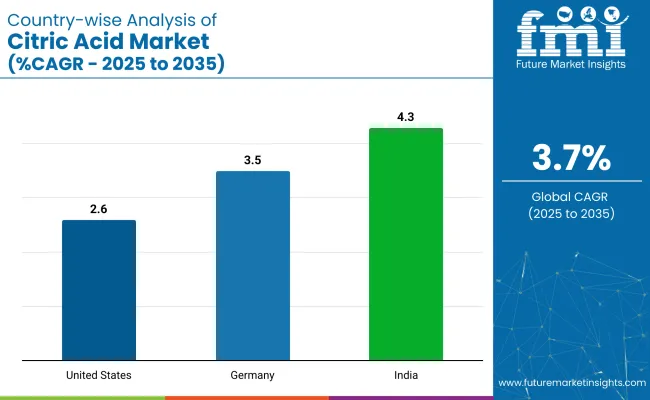

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 2.6%, 3.5% and 4.3%, respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| Germany | 3.5% |

| India | 4.3% |

The USA citric acid market is expected to grow at a compound annual growth rate (CAGR) of 2.6% through 2035. Despite the fact that this growth is slower than in some emerging markets the nation benefits from a well-established food and beverage sector that regularly uses citric acid. Natural sources of citric acid are also well-positioned to meet the growing demand from health-conscious consumers for clean-label products.

Through 2035 the citric acid industry in India is anticipated to sustain a robust compound annual growth rate of 4.3%. As Indias economy grows more people have more money to spend on processed foods and drinks that contain citric acid.

Furthermore, the demand for foods made with these flavors is being driven by the trend toward quick easy meals that take over as urbanization picks up speed. Additionally, because of its versatility as a flavor enhancer and preservative it has been found to be used in many Indian diets that prioritize health though this is mostly due to personal preferences. Examining pharmaceuticals and other sectors that might discover new applications for them can also yield growth potential in the future.

By 2035 the citric acid market in Germany is expected to continue growing at a CAGR of 3.5%. This consistent rise suggests that the German food and beverage industry has a strong foundation and as a result depends heavily on citric acid for a number of applications.

Naturally produced citric acid is expected to benefit from the preference for organic and natural foods among quality-conscious German consumers. Germany has a stable market for this product and is a desirable destination due to its quality orientation and exploration opportunities in new applications even though its progress may be slower than that of emerging economies.

A stable supply chain is maintained by some players by leveraging their current sales network and large-scale production while others begin their service by focusing on local economic needs. The dynamics are starting to shift as new players enter the market. These days new market disruptors concentrate on niche markets sustainability (the production of organic or bio-citric acid) and meeting the rising demand for eco-friendly clean label products.

The market is expected to grow at a CAGR of 3.7% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 4,571.8 million.

Demand for beverages is increasing demand for Citric Acid Market.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Tate & Lyle Plc., Pfizer Inc., RZBC GROUP and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Citric Acid Market

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA