The brittleness tester market is experiencing steady growth, driven by a growing need for material quality assurance across a range of industries, including automotive, aerospace, construction, and manufacturing.

The brittleness testers are imperative for assessing the durability and performance of materials when exposed to various stressors, thus creating the need to manufacture materials that offer product durability and compliance with regulatory standards. Growing emphasis on material innovations and new, lightweight composites with improved performance properties are also driving the demand for advanced brittleness testing equipment.

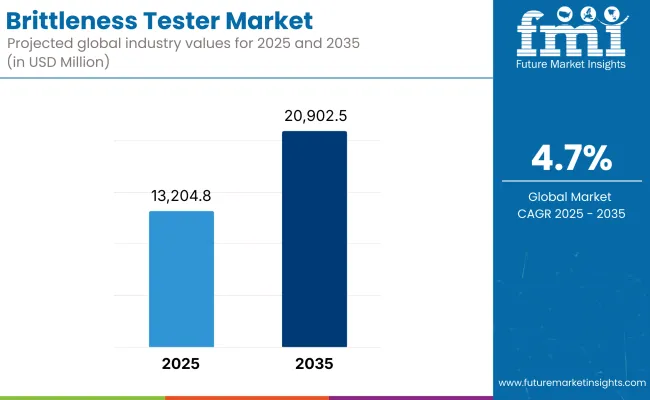

In 2025, the brittleness tester market size is projected to be around USD 13,204.81 million. By 2035, it is expected to reach approximately USD 20,902.53 million, growing at a compound annual growth rate (CAGR) of 4.7%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 13,204.81 Million |

| Projected Market Size in 2035 | USD 20,902.53 Million |

| CAGR (2025 to 2035) | 4.7% |

This growth is attributed to technological advancements in testing equipment, increasing R&D investments across industries, and the expanding application scope of brittleness testing in emerging markets. The push towards sustainability and product longevity is also boosting the adoption of brittleness testers in various sectors.

The North America brittleness testers market is driven by stringent quality control standards in the aerospace, automotive, and medical devices sectors. The vast use of advanced testing equipment which is supposed to be used in accordance though specific regulatory framework rather ensuring final products safety will also help in making the USA and Canada as a leading figure in global market. However, continuous innovative development in materials and the growing focus on R&D activities in the region is likely to propel the adoption of highly accurate and automated brittleness testers in the region.

Europe is anticipated to dominate the brittleness tester market owing to the presence of major manufacturing countries and focus on quality and safety of product in this region. France, Germany, and UK are leaders to advancements in automotive, construction, and aerospace. Moreover, demand for brittleness testers is being further propelled by regulatory mandates governing the testing and certification standards of materials, especially composites and lightweight materials.

Between these regions, the Asia-Pacific region is anticipated to witness the highest growth in the brittleness testers market owing to the rising industrialization, urbanization, and end-use industries in this region. It has long been the recipient of large doses of direct investment, mostly from China, India, Japan and South Korea, especially in auto manufacturing, electronics and infrastructure development. Factors such as the growing consciousness towards product quality, safety specifications, and the risk of unreliable materials are boosting the need of brittle measure testing machinery in the region.

The brittleness tester is implemented across different industries, most commonly in the plastic manufacturing, automotive and aerospace, construction material testing, and electronics, coatings, and adhesives industries for quality, safety, and regulatory compliance. Emerging technologies include automation, high-precision testing capabilities, etc. these are changing the market landscape.

The increasing investment on 3D printing, along with such developments as composite materials, will create a need for new brittleness testing solutions to drive growth. Soothing industrial applications and stringent quality control measures are likely to drive the market over the next ten years.

Challenges

High Initial Investment Costs

Dedicated brittleness testers, particularly the advanced types used for research purposes and in industrial quality control, can carry a steep initial price tag. The cost of acquiring and maintaining these precision instruments is often a significant barrier, particularly for small manufacturers and academic institutions. This financial issue impedes mass-scale deployment, especially in price-sensitive geographies and amongst SMES, affecting the overall opportunity for market growth.

Limited Awareness in Emerging Markets

Brittleness testing is still under recognized in developing regions for product quality assurance and regulatory compliance. Consequently, brittle failure testers are often not invest by the plastic, rubber & automotive industries in the regions. In addition, low technical awareness and a lack of strict product quality regulations further inhibit market penetration in emerging economies.

Opportunities

Growth in Material Testing Across Industries

Increasing quality standards in various industries including aerospace, automotive, and construction are anticipated to boost the demand for advanced material testing equipment. Testers of brittleness are important in guaranteeing that products have the durability and safety that the producers require. Owing to this increased focus on product reliability, new opportunities are opening for market players, especially portable and automated solutions.

Technological Advancements in Testing Equipment

Advances in technology have resulted in small, digital brittleness testers that automatically collect data and increase the accuracy of the brittleness test. New customers are lured with features such as real-time monitoring, integration with quality management systems, and the Internet of Things (IoT). Over the next decade, manufacturers that invest in R&D to provide user-friendly, high-precision instruments are expected to win an edge over its competitors.

From 2020 to 2024, the brittleness tester market has been witnessing moderate growth due to the increasing demand for accurate quality assurance procedures, particularly in the plastics and rubber industries. But supply chains and industrial activities were disrupted by the COVID-19 pandemic, which temporarily limited growth.

The market is likely to witness significant changes between 2025 and 2035 with the advent of Industry 4.0 technologies. Automation, remote testing capabilities and AI-based defect prediction will revolutionize brittleness testing. Increased demand from end-use industries such as aerospace composites, electric vehicles, and biodegradable materials are also contributing to the demand for advanced brittleness testers worldwide.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Aspect | 2020 to 2024 Trends |

|---|---|

| Key Growth Driver | Demand for quality control in plastics and rubber |

| Material Innovations | Testing of conventional rubbers and plastics |

| Technological Advancements | Digital readouts, improved accuracy |

| Main Application Areas | Automotive, rubber manufacturing |

| Dominant Regions | North America, Europe |

| Regulatory Landscape | Safety compliance for industrial goods |

| Investment Trends | Expansion in industrial material testing |

| Customer Base | Plastics and rubber industries |

| Competitive Strategy | Product reliability enhancement |

| Market Aspect | 2025 to 2035 Projections |

|---|---|

| Key Growth Driver | Rise in EVs, aerospace composites, and biodegradable materials |

| Material Innovations | New standards for composites, bio-based polymers |

| Technological Advancements | IoT-enabled testers, AI-based defect prediction |

| Main Application Areas | Aerospace, EV manufacturing, sustainable materials |

| Dominant Regions | Asia-Pacific, Middle East, Latin America |

| Regulatory Landscape | Stringent durability and eco-sustainability norms |

| Investment Trends | Investments in smart material testing infrastructure |

| Customer Base | Advanced composites, EV battery manufacturers |

| Competitive Strategy | Smart testing integration, remote diagnostic capabilities |

The brittle tester market for the USA is developing at a however pace, motivated by increasing demand for durable and fine overall performance materials in the automotive, aerospace, and healthcare sectors. Evolving regulatory benchmarks for product quality and material safety are driving the adoption of advanced brittleness testing solutions.

Furthermore, increasing investments in R&D for high-performing next-generation polymers and composites is also contributing towards the growing demand for efficient testing equipment with high precision. As industries continue to focus on material reliability, growth is expected to be stable.

| Country | CAGR (2025 to 2035) |

|---|---|

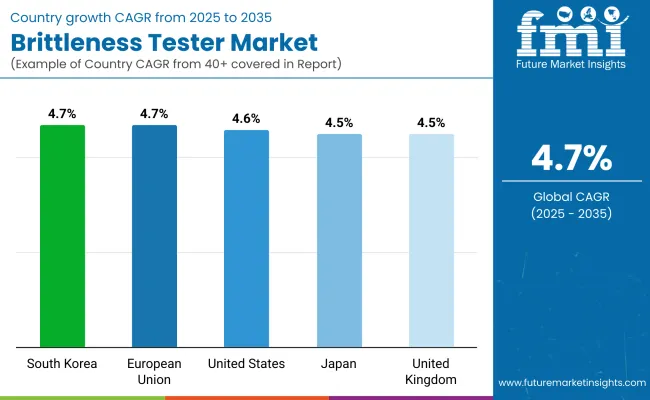

| United States | 4.6% |

The brittleness tester market in the United Kingdom is responsible for robust industrial quality control practices and a trend toward environmentally friendly high-performance materials. The advanced material testing is heavily needed by the country’s automotive, defense and construction sectors to meet the changing regulatory norms.

The increased focus on lightweight materials for EVs and green building initiatives is driving market adoption. Government measures are further anticipated to drive the demand with an aim to support innovation in manufacturing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

Stringent regulations and strong manufacturing traditions in the European Union have fuelled the proliferation of brittleness testers. Germany, France, and Italy, because of their strong automotive, aerospace, and construction industries, dominate.

Automation of materials testing is pushed due to the high demand for renewable energy technologies, such as wind turbines and EV batteries, driving a need for materials of higher quality and fatigue resistance, and in turn, more brittle testing. Another growth factor propelling material sciences and related testing equipment innovation is EU's emphasis on carbon-neutral strategies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan’s brittleness tester market is highly competitive and has long been defined by a culture of precision engineering and ongoing innovation. Japan demands strict testing standards for materials due to its leadership in the electronics, automotive components and robotics industries.

Growing utilization of smart materials and miniaturized components have heightened the demand for highly sensitive and automated brittleness testers. Ongoing collaborations are driving technological innovations in the market among various industry players and research organizations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

In South Korea, the brittleness tester market is expanding steadily, driven by growth in the automotive, electronics, and construction sectors where material quality assurance is critical. The country's strong manufacturing base and increasing exports of high-precision components are encouraging greater adoption of advanced testing equipment.

Furthermore, rising investments in research and development, alongside strict regulatory standards for material performance, are boosting demand for innovative brittleness testing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

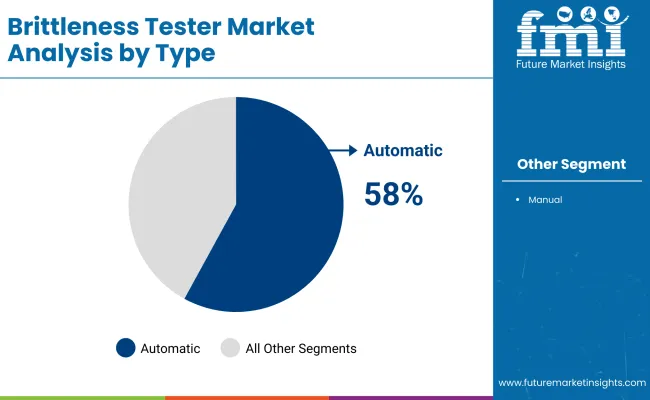

| Type | Market Share (2025) |

|---|---|

| Automatic Brittleness Tester | 58% |

The increasing adoption of automatic brittleness testing’s in all sectors of manufacturing is attributed to their capacity for providing accurate and consistent results, whenever the quality of material is assessed, while also eliminating a large proportion of human error during the same time. Here are some examples of industries that depend on precise brittleness testing: automotive, aerospace, plastics, and packaging.

The automation of brittleness testing enables the delivery of critical benefits, such as quicker test cycles, enhanced consistency, and a greater degree of data reliability all of which are essential challenges in high-volume production environments and stringent quality assurance environments. And these systems can be incorporated easily within wider automated quality control processes that help to streamline operations and reduce the need for human intervention.

Additionally, automatic testers also boast a wide range of advanced features, including programmable test parameters, digital data recording, and real-time analytics, seamlessly enhancing traceability and adherence to international testing standards. Less manual handling not just increases safety but releases skilled people for more complex jobs.

The increasing emphasis on precision-focused manufacturing and the requirement for cost-effective and efficient testing solutions are likely to boost the adoption of automatic brittleness testers. With industries prioritizing quality, repeatability, and speed, these systems will further entrench their position at the ahead in the brittleness testing equipment market.

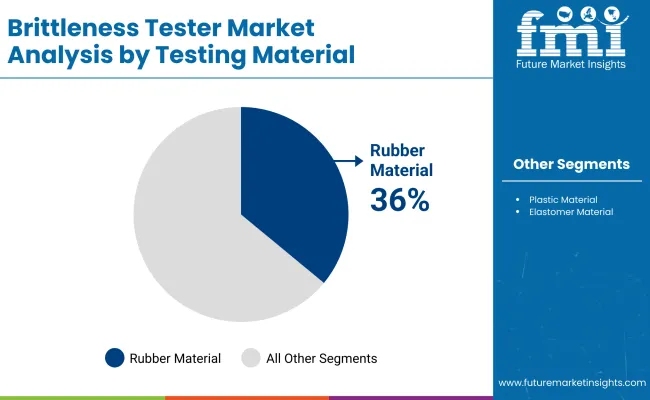

| Testing Material | Market Share (2025) |

|---|---|

| Rubber Material Brittleness Tester | 36% |

Rubber material brittleness testers have gained market dominance, driven by a phenomenal growth in the automotive industry and increasing safety requirements for tire, gasket, and sealing system applications. Most of the rubber part manufacturers these days are facing challenges regarding quality of the rubber parts as vehicle manufacturers are trying to improve the durability, reliability, and safe operation of their vehicles.

These specialized testers help manufacturers determine the bulk-temperature at which rubber materials crack or fail to perform, enabling formulation improvement for harsher locations. Brittle failure in tires, for example, can affect traction and handling, while in seals and gaskets, it can cause leaks or mechanical failures, so that brittleness testing is important for the integrity of products and consumer safety. Brittleness testing equipment that offers high reliability is in demand with regulations tightening on testing of automotive rubber components, leading to increased efforts from regulatory bodies worldwide.

In addition, the growing adoption of electric vehicles (EVs), which require enhanced material performance for battery seals and insulation systems, is widening the application base for rubber brittleness testers. New developments like captured digital data, programmable test cycles, and rapid cooling technologies make the modern rubber material brittleness tester faster, more accurate, and more consistent.

Health care, aerospace, and the manufacturing of industrial equipment and consumer goods, among other sectors. Considering the importance of material resilience in modern performance-focused high-demand markets, the authority of rubber material brittleness testers is more likely to expand throughout the upcoming years.

The market for brittleness testers is growing steadily, as quality assurance becomes increasingly crucial in sectors such as automotive, aerospace, construction and plastics manufacturing. Another application of brittleness testers is to assess the durability of a material under different environmental conditions. Burgeoning regulations around material standards, particularly in emerging economies, are also driving up adoption rates.

Integration of automation and data analytics in testing technologies is further contributing positively to purchasing decisions. Moreover, the shift toward lightweight and high-performance materials is driving the demand for accurate brittleness testing further to provide global market players with potential market avenues.

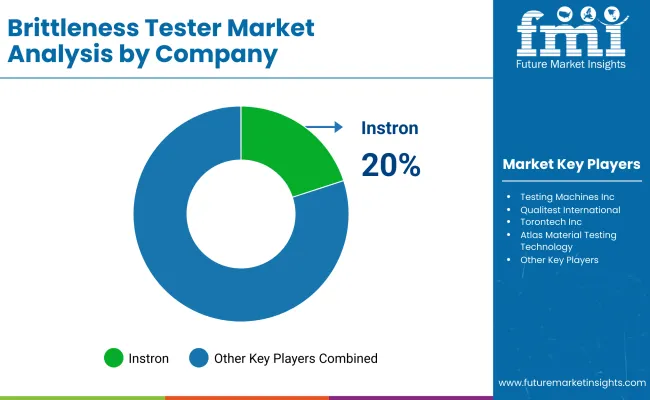

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Instron (Illinois Tool Works Inc.) | 20-23% |

| Testing Machines Inc. | 15-18% |

| Qualitest International | 12-15% |

| Torontech Inc. | 8-10% |

| Atlas Material Testing Technology | 5-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Instron (Illinois Tool Works Inc.) | In 2025 , introduced next-generation brittleness testers with AI-enabled fault detection, enhancing accuracy. Expanded global customer support hubs to strengthen after-sales services and field assistance for remote areas. |

| Testing Machines Inc. | In 2024 , launched compact, energy-efficient brittleness testers for small labs. Developed cloud-connected systems for real-time monitoring, providing quicker turnaround for quality checks and maintenance predictions. |

| Qualitest International | In 2025 , introduced modular brittleness testers, enabling scalable solutions for research and industrial applications. Focused on improving tester adaptability for new-age polymer composites and bio-based materials. |

| Torontech Inc. | In 2024, released user-friendly touchscreen-controlled brittleness testing machines. Prioritized software updates that enable customized testing protocols tailored to diverse international material testing standards. |

| Atlas Material Testing Technology | In 2025 , invested in R&D to enhance environmental chamber integration within brittleness testers. Focused on accelerated testing under simulated environmental conditions for faster material life-cycle evaluation. |

Key Company Insights

Instron (Illinois Tool Works Inc.) (20-23%)

With advancements such as AI-guided brittleness testing, it leads a wealth of competitors and new entrants focused on improvements in accuracy and predictive maintenance. Expanding the number of service hubs is critical for strengthening customer trust and reducing downtime. Overall, you have a strong pedigree in precision and a track record for reliability- which is why, to this day, we lead high-value contracts with automotive OEMs and global research labs, consolidating our leadership within the premium segment.

Testing Machines Inc. (15-18%)

Testing Machines Inc. has created a strong position in the market by providing compact, energy-efficient solutions, enabling medium and small-scale facilities to easily afford quality testing. Its cloud monitoring tools are clearly hitting the mark with industries pursuing digital transformation. This, combined with their ability to offer fast service and flexible testing packages, gives them a good advantage over new players in the market and mid-sized manufacturers.

Qualitest International (12-15%)

With the trends in material science changing rapidly, Qualitest International is on the rise by delivering scalable, modular testing systems. It can serve traditional plastics, advanced composites and bio-materials, offering the potential for diverse revenue streams. Qualitest is paving the way to future industries centered on green and lightweight materials by aligning product development with green materials innovation.

Torontech Inc. (8-10%)

Torontech’s touchscreen-driven interface and custom test protocols make it unique in usability-oriented segments. Such an approach balances accessibility for users who have limited knowledge to complex mechanical tests. Their position in emerging material testing compliance markets like Southeast Asia and Eastern Europe will also enhance their global market and Long-term growth opportunities.

Atlas Material Testing Technology (5-7%)

Atlas specializes in environmental simulation integration, making it the top choice for these industries focusing on lifecycle and durability analysis in those extreme conditions. Their R&D investments are influencing future trends in accelerated material testing, enabling quicker product validation cycles. Such targeted efforts are attracting interest from aerospace, automotive, and renewable energy sectors seeking innovative, speedy testing approaches.

Other Key Players (30-40% Combined)

The overall market size for brittleness tester market was USD 13,204.81 million in 2025.

The brittleness tester market expected to reach USD 20,902.53 million in 2035.

Key drivers for brittleness tester market demand include growing quality control needs, advancements in material testing, industrial automation trends, and increased R&D in manufacturing sectors.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Automatic brittleness tester segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Scuff Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Hipot Tester Market Analysis – Share, Size, and Forecast 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Torque Testers Market

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA