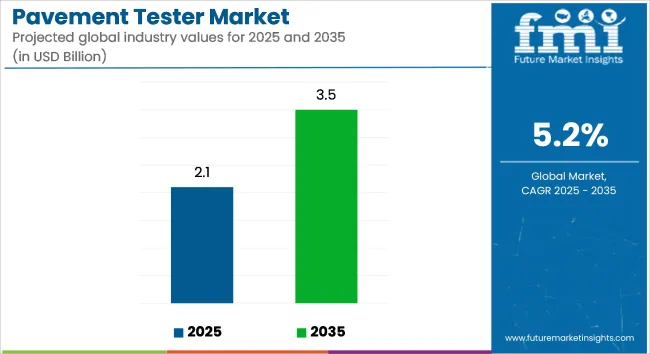

The global pavement tester market is projected to be expanded from USD 2.1 billion in 2025 to USD 3.5 billion by 2035, registering a Compound Annual Growth Rate (CAGR) of 5.2% over the forecast period.

This growth is being driven by ongoing infrastructure development and the widespread implementation of lifecycle monitoring programs. Non-destructive testing tools such as falling weight deflectometers and dynamic cone penetrometers are being extensively employed in road asset management systems to assess pavement conditions without inflicting structural damage.

A significant advancement in this domain has been recorded through patent CN221224455U, which outlines a newly developed road bearing capacity tester. This device has been designed with an adjustable loading structure and sensor calibration capabilities, allowing for improved efficiency and accuracy during on-site pavement evaluations-particularly under variable environmental conditions.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2.1 Billion |

| Market Value (2035F) | USD 3.5 Billion |

| CAGR (2025 to 2035) | 5.2% |

In April 2025, a collaborative innovation was introduced by GSSI and Hamm AG with the launch of the RealTime Density Scan, a high-speed ground-penetrating radar (GPR) sensor integrated into Hamm’s Smart Compact system for tandem rollers.

Through this integration, compaction data can now be delivered in real time, enabling operators to ensure consistent density across paving surfaces. As emphasized by Dr. David Cist, Chief Technology Officer at GSSI, “DOTs pay bonuses for good density because their research shows that each 1% change in compaction can extend or shorten road life by 10% or more.”

An integrated approach involving GPR, LiDAR, and ultrasonic pulse-echo testing is also being explored to deliver a more comprehensive evaluation of pavement structures. Through this combination, both surface-level anomalies and subsurface deterioration can be identified more reliably, which supports proactive maintenance interventions and longer pavement service life.

As urban centers continue to expand and the demand for resilient transportation infrastructure increases, the adoption of advanced pavement testing technologies is expected to be accelerated. These tools are being positioned as essential assets in optimizing maintenance cycles, extending roadway lifespan, and supporting safety-driven asset management strategies for road authorities and transportation agencies worldwide.

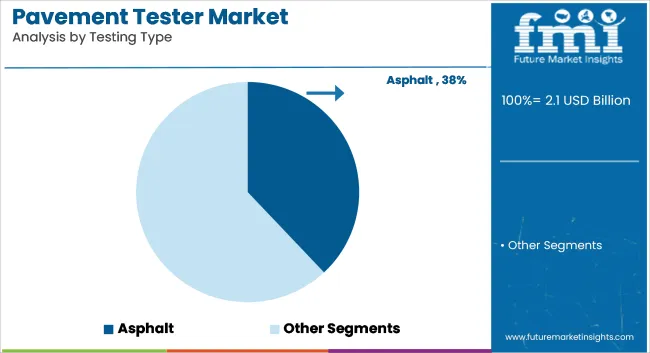

Asphalt content testing is projected to account for approximately 38% of the global pavement testing equipment market by 2025, making it the leading testing type.

Over the forecast period from 2025 to 2035, this segment is expected to grow at a CAGR of 5.5%, slightly above the overall industry growth rate of 5.2%. The importance of determining the precise bitumen content in asphalt mixtures has made this test a critical component of pavement quality control and assurance protocols.

Accurate asphalt content testing ensures proper binder proportions in hot mix asphalt, which directly affects pavement durability, flexibility, and resistance to fatigue and rutting. Road construction firms and quality assurance laboratories are increasingly adopting automated ignition ovens and solvent extraction systems to enhance result accuracy and reduce testing time.

Regulatory requirements from transportation authorities in North America, Europe, and Asia have further mandated routine asphalt content validation as part of standardized road construction processes. Additionally, asphalt recycling initiatives in both urban and highway projects have reinforced the need for repeatable and precise testing of reclaimed materials.

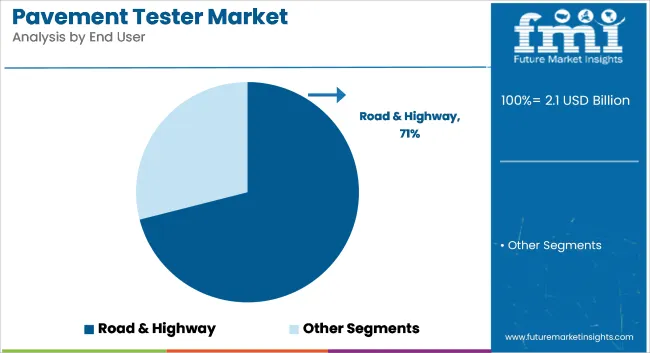

The road and highway construction industry is expected to remain the primary end-user of pavement testing equipment, capturing an estimated 71% of total market share in 2025. This segment is projected to expand at a CAGR of 5.4% between 2025 and 2035, driven by large-scale infrastructure modernization, smart mobility corridors, and public investment in transportation networks.

National infrastructure development programs-such as India’s Bharatmala, the USA Infrastructure Investment and Jobs Act, and Europe’s Trans-European Transport Network (TEN-T)-are driving demand for consistent pavement performance evaluation.

Road contractors and engineering, procurement, and construction (EPC) companies are adopting advanced testing equipment to comply with quality standards and extend road service life. Moreover, the shift toward sustainable and climate-resilient pavements has placed greater emphasis on pre- and post-construction testing for load-bearing capacity, material behavior, and surface friction. This has positioned road construction players as the most critical stakeholder group in the adoption of pavement testing technologies.

The United States Pavement Tester Market is witnessing steady growth due to increasing investments in infrastructure development, road safety initiatives, and the need for advanced testing methods to assess pavement durability. The presence of leading research institutions and government-backed road maintenance programs significantly contributes to the demand for innovative pavement testing equipment.

The growth of highway networks, city roads, and airport pavements has made pavement performance testing more critical than ever. The DOTs and private contractors need extremely accurate pavement testers to measure the effect of traffic loads, temperature changes, and material behavior. The implementation of automated pavement testers and non-destructive testing technologies like Falling Weight Deflectometers (FWDs) and Ground Penetrating Radar (GPR) is improving pavement analysis efficiency and accuracy.

Further, the increased growth in Smart Infrastructure Projects and deployment of Artificial Intelligence (AI) in road surveillance are driving market growth. Various state governments are making frequent road quality evaluations compulsory, resulting in higher demand for portable pavement testers and high-precision software solutions that allow real-time monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The United Kingdom Pavement Tester Market is experiencing significant growth due to increasing investments in transportation infrastructure, government initiatives on road sustainability, and compliance with stringent pavement durability standards. The UK government, through the Department for Transport (DfT) and Highways England, continues to emphasize pavement lifecycle analysis to reduce long-term maintenance costs.

Pavement deterioration due to frequent weather fluctuations has led to a rising need for advanced road testing equipment that can evaluate skid resistance, surface texture, and structural integrity. The UK construction industry has been shifting towards sustainable road materials, requiring more comprehensive testing equipment to assess their long-term durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

The European Union Pavement Tester Market is fueled by the region's vast transportation system, stringent environmental policies, and growing focus on road durability. Germany, France, and Italy are major drivers of the market with their huge highway and airport infrastructure.

The EU's focus on sustainability has propelled the use of environmental-friendly road materials, thus enhancing the demand for high-precision pavement testing. Germany's Autobahn development and France's upgrade of their road network are major market drivers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

Japan’s Pavement Tester Market is expanding rapidly due to the country’s aging road infrastructure, high frequency of natural disasters, and the adoption of advanced technology in road maintenance. With Japan’s heavy reliance on road networks for logistics and urban mobility, the government is prioritizing the development of resilient pavement materials that can withstand extreme weather conditions, earthquakes, and typhoons.

The country is a leader in smart infrastructure solutions, integrating AI-powered pavement monitoring and robotic testing units for real-time analysis of road health. The demand for non-destructive testing (NDT) equipment, including falling weight deflectometers (FWDs), ultrasonic testers, and GPR systems, is growing as Japan aims to reduce maintenance downtime.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The South Korean Pavement Tester Market is rapidly growing due to the country’s investments in transportation infrastructure, smart roads, and high-tech road maintenance solutions. With a strong focus on automated and AI-integrated pavement analysis, South Korea is at the forefront of adopting cutting-edge road testing technologies.

With one of the highest vehicle densities in the world, road deterioration is a major challenge. The government is focusing on real-time monitoring of road conditions, integrating AI and IoT-based pavement testers to assess cracks, roughness, and load-bearing capacity.

South Korea is also pioneering the adoption of drone-based pavement analysis to enhance testing accuracy, reduce operational costs, and improve road safety. The country’s focus on smart cities and autonomous vehicles is increasing demand for intelligent road maintenance systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Controls Group (12-17%)

Controls Group leads the pavement tester market, offering advanced road performance evaluation systems for asphalt durability, fatigue analysis, and crack propagation studies. The company focuses on automated data logging, AI-driven predictive maintenance, and IoT-integrated pavement monitoring systems.

PaveTesting Ltd. (10-14%)

PaveTesting specializes in skid resistance measurement, rolling wheel deflection, and road texture analysis. The company’s emphasis on non-destructive pavement assessment makes it a key player in urban road and highway infrastructure testing.

Dynatest International (8-12%)

Dynatest provides high-performance pavement deflection and loading simulators, catering to airport, highway, and urban road management. The company integrates advanced geotechnical evaluation techniques to enhance infrastructure durability.

Interlaken Technology Company (7-11%)

Interlaken focuses on pavement fatigue testing, freeze-thaw analysis, and asphalt layer performance evaluation. The company develops automated lab-based testing systems for civil engineering research and road safety projects.

Cooper Research Technology Ltd. (5-9%)

Cooper Research Technology manufactures high-precision asphalt and pavement testing systems, supporting construction firms, research institutions, and regulatory agencies in assessing pavement durability and long-term performance.

Other Key Players (45-55% Combined)

Several manufacturers contribute to regional infrastructure projects, government-led road durability programs, and cost-effective pavement evaluation solutions. These include:

The overall market size for Pavement Tester Market was USD 2.1 Billion in 2025.

The Pavement Tester Market is expected to reach USD 3.5 Billion in 2035.

The demand for pavement testers is expected to rise due to rapid urbanization, increasing infrastructure development, and the growing need for quality assurance in road construc-tion and maintenance. Additionally, advancements in testing technologies and the empha-sis on sustainable and durable pavement solutions are driving market growth.

The top 5 countries which drives the development of Pavement Tester Market are USA, UK, Europe Union, Japan and South Korea.

Instruments to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Testing Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Testing Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Testing Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Testing Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Testing Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Testing Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Testing Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Testing Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pavement Overlay Fabrics Market Size and Share Forecast Outlook 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Scuff Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Hipot Tester Market Analysis – Share, Size, and Forecast 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Torque Testers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA