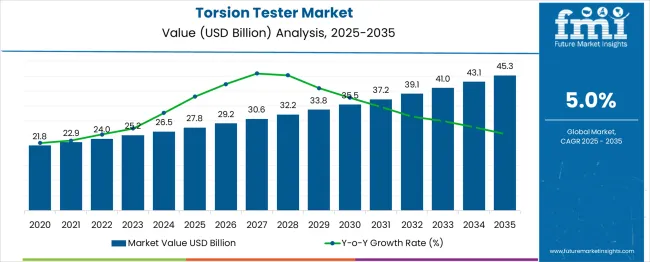

The torsion tester market is valued at USD 27.8 billion in 2025 and is projected to reach USD 45.3 billion by 2035 at a CAGR of 5.0%. Market progression through the decade is shaped by expanding construction output, rising automotive production, and the accelerating need for fatigue, shear, and torque analysis across industrial materials. Electromechanical torsion testers hold a leading 51.8% share in 2025, supported by their precision, controllability, and integration with digital data-logging systems across laboratories and industrial testing facilities. Growth is reinforced by increasing adoption of automated quality-assurance workflows and expanded reliance on torsional performance assessment in metals, composites, plastics, and medical-device components.

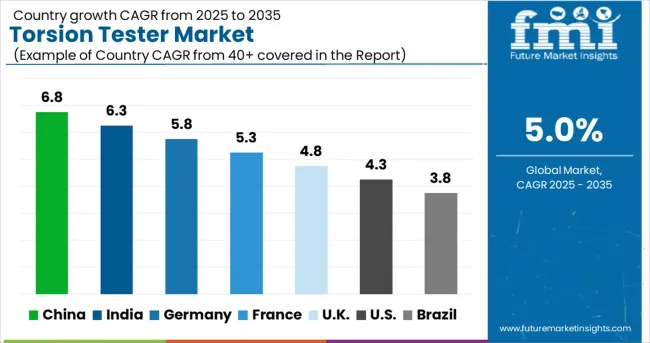

Demand intensifies as aerospace programs strengthen material-validation requirements, industrial fabrication volumes increase, and manufacturers emphasize structural integrity under cyclic loading. Torsion testers below 10 Hz account for 43.6% of the frequency-range share, reflecting widespread use of low-frequency systems for routine mechanical property evaluation, component qualification, and regulatory-driven durability testing. North America, Asia-Pacific, and Europe remain the dominant growth clusters, supported by strong automotive, aerospace, and infrastructure construction activity, alongside rising investments in certified testing laboratories.

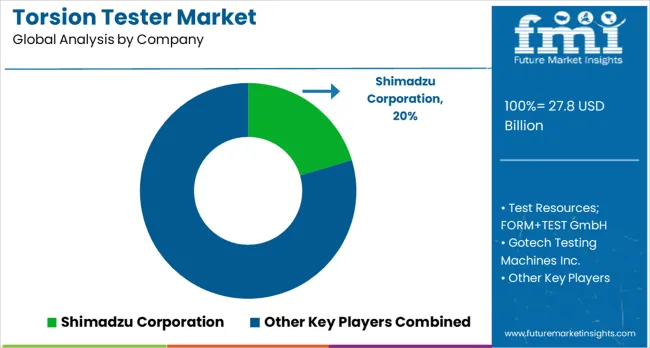

Restraints primarily relate to high equipment costs and limited awareness among small and mid-sized manufacturers, especially in developing economies, where capital-intensive test systems face adoption barriers. Despite these challenges, sustained advancements from Shimadzu, TestResources, FORM+TEST, Gotech, Qualitest, Tinius Olsen, ITW, and Nordson continue to enhance torque accuracy, control stability, automation capability, and long-term calibration reliability. As global industries expand material-performance benchmarking and compliance-driven testing, torsion testers maintain their position as essential apparatus within modern mechanical testing ecosystems.

| Metric | Value |

|---|---|

| Torsion Tester Market Estimated Value in (2025 E) | USD 27.8 billion |

| Torsion Tester Market Forecast Value in (2035 F) | USD 45.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The electromechanical torsion testers segment is projected to account for 51.8% of the market revenue share in 2025, positioning it as the dominant product type. This leadership is driven by its widespread acceptance across industrial, academic, and laboratory environments due to its superior precision, controllability, and low maintenance needs. Engineering case studies and testing-equipment releases emphasize the segment’s growing prominence as electromechanical systems deliver stable torque output, enhanced measurement accuracy, and smoother operational cycles compared to hydraulic alternatives.

Advancements in digital controls, servo-motors, and feedback-loop mechanisms have improved reliability, reinforcing customer preference for electromechanical designs in routine and high-frequency testing applications. The segment is further supported by increasing adoption in material sciences, metal fabrication quality control, and product durability assessments. Its compatibility with automation software, remote operation systems, and data-logging tools has increased its appeal in sectors transitioning to Industry 4.0 environments. These factors collectively sustain the segment’s stronghold as the primary torsion tester configuration.

The torsion testers below 10 Hz segment is expected to hold 43.6% of the market revenue share in 2025, making it the leading frequency-range category. Its dominance is attributed to the fact that most routine torsional evaluations, such as material elasticity, shear strength measurement, fastener torque testing, and low-cycle fatigue analysis, occur within this frequency band. Industrial quality-assurance guidelines, laboratory testing manuals, and equipment-usage patterns consistently highlight that lower-frequency testers are sufficient for the majority of structural testing requirements.

The segment’s growth is also supported by its widespread use in construction materials, automotive components, medical devices, and engineered plastics, where low-frequency torsion behavior provides essential indicators of durability and performance. Lower capital cost, simpler calibration routines, and broader availability across global markets make sub-10 Hz testers accessible to small and large testing facilities alike. As most standardized testing protocols are structured around low-frequency torsional loading, this range maintains its position as the preferred operational bandwidth in the market.

Growing population and increased urbanization is leading to a surge in building and construction activities. Growth of the building & construction industry will propel the demand for torsion testers. Growing automotive production owing to the increasing spending capacity, has led to the growth of the automotive industry.

Growth of the automotive industry will fuel the demand for torsion testers. Owing to the constant research and development activities and advancement of medical science is boosting the demand for torsion testers for testing of medical devices.

Growth of the aerospace industry and increasing metal fabrication activities due to growing industrialization across the world is increasing the demand for torsion testers. Increasing focus towards maintaining quality of products and keeping the safety standards and norms are among the other factors responsible for the growth of torsion tester market.

Rising emphasis towards product innovation and modification is having a positive impact on the torsion tester market. Slightly less product awareness and high price of torsion testers will hinder the growth of torsion tester market.

Increasing population and urbanization along with technological advancement is leading to the growth of building & construction industry in Asia Pacific region, also there is increasing automotive production and industrialization in Asia Pacific region, owing to the above factors Asia Pacific is estimated to be a prominent market for torsion tester.

According to Future Market Insights, there is predominance of the automotive industry in the Europe region, also the increasing building and construction activities makes Europe a significant market for torsion testers. In the regions such as North America there is significant presence of the automotive & aerospace industry.

Also, an increase in building and construction projects and growing industrialization is expected to make North America a potential market. Regions such as Latin America along with Middle East & Africa will together make a potential market for torsion testers owing to the increasing demand from various end use applications.

Currently, the market is considerably competitive, with continuous product and technology developments by established as well as new players. Some of the key players in the torsion tester market are Shimadzu Corporation, Test Resources, FORM+TEST GmbH, Gotech Testing Machines Inc., Qualitest International Inc., Illinois Tool Works Inc., Tinius Olsen TMC, and Nordson Corporation among others.

Attributed to the presence of such a high number of participants, the market is highly competitive. a torsion tester market report also contains projections using a suitable set of assumptions and methodologies. Global torsion tester research report provides analysis and information according to market segments such as geographies, application, and industry. Globally, the torsion tester market is expected to be fragmented in nature owing to the presence of a large number of players in the local as well as global market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5% from 2025 to 2035 |

| Market Value for 2025 | USD 27.8 billion |

| Market Value for 2035 | USD 45.3 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Frequency Range, Material Type, End-use Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Mexico, Chile, Peru, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Russia, Poland, China, India, ASEAN, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | Shimadzu Corporation; Test Resources; FORM+TEST GmbH; Gotech Testing Machines Inc.; Qualitest International Inc.; Illinois Tool Works Inc.; Tinius Olsen TMC; Nordson Corporation |

| Customization | Available Upon Request |

The global torsion tester market is estimated to be valued at USD 27.8 billion in 2025.

The market size for the torsion tester market is projected to reach USD 45.3 billion by 2035.

The torsion tester market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in torsion tester market are electromechanical torsion testers, electric torsion testers and servo hydraulic torsion testers.

In terms of frequency range, torsion testers below 10 hz segment to command 43.6% share in the torsion tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Scuff Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Hipot Tester Market Analysis – Share, Size, and Forecast 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Torque Testers Market

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA