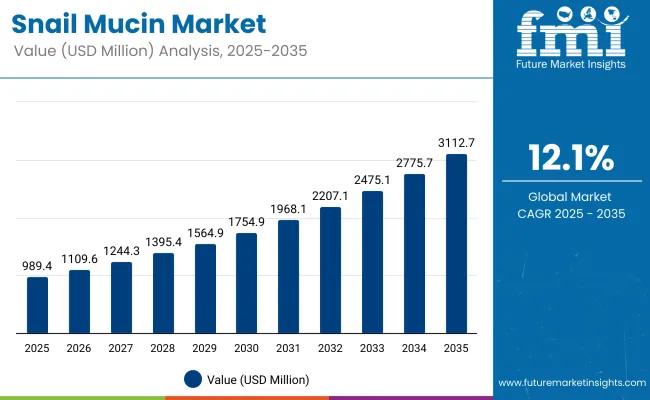

The Global Snail Mucin Market is expected to record a valuation of USD 989.4 million in 2025 and USD 3,112.7 million in 2035, with an increase of USD 2,123.3 million, which equals a growth of ~214% over the decade. The overall expansion represents a CAGR of 12.1% and more than a 3X increase in market size.

Global Snail Mucin Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 989.4 million |

| Market Forecast Value in (2035F) | USD 3,112.7 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

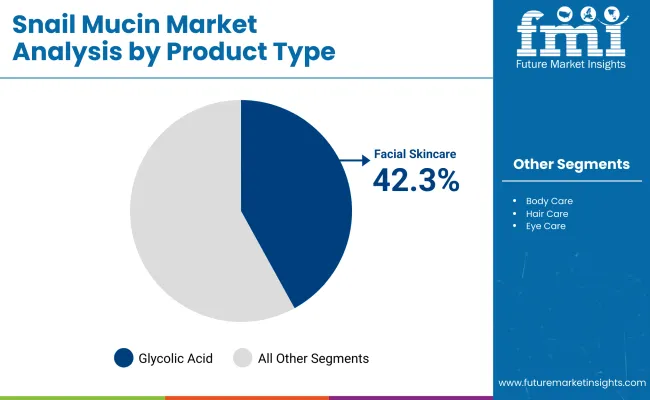

During the first five-year period from 2025 to 2030, the market increases from USD 989.4 million to USD 1,754.9 million, adding USD 765.5 million, which accounts for 36% of the total decade growth. This phase records steady adoption across premium beauty brands, K-beauty exports, and cosmeceutical innovation, driven by demand for proven natural actives. Facial Skincare dominates this period, catering to over 42% of product applications, especially in concentrated serums and ampoules.

The second half from 2030 to 2035 contributes USD 1,357.8 million, equal to 64% of total growth, as the market jumps from USD 1,754.9 million to USD 3,112.7 million. This acceleration is powered by global brand diversification into personal care lines, rapid e-commerce penetration in emerging markets, and rising adoption of snail mucin in multifunctional products like hybrid skincare-makeup formats.

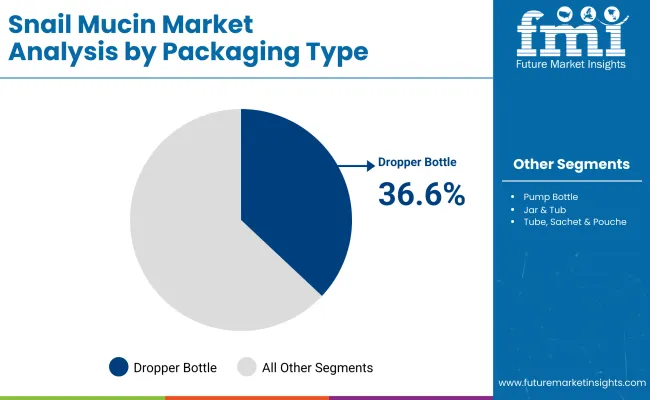

Dropper Bottles maintain their lead in packaging due to association with premium active formulations, while growing demand for eco-friendly refill systems begins reshaping packaging dynamics by the end of the decade.

From 2020 to 2024, the Global Snail Mucin Market expanded steadily from an estimated USD 740 million to USD 920 million, driven by K-beauty brand penetration in Western markets and increased awareness of natural regenerative skincare actives.

During this period, the competitive landscape was dominated by South Korean ingredient manufacturers controlling nearly 60% of the global supply, with leaders like CoSeedBioPharm and Bioland specializing in high-purity, cruelty-free snail secretion filtrate. Competitive differentiation relied on extraction quality, purity levels, and cruelty-free certifications, while branding focused on efficacy claims backed by clinical testing.

Demand for snail mucin-based products will expand to USD 989.4 million in 2025, and the revenue mix will evolve as personal care applications gain share alongside facial skincare. Traditional ingredient suppliers face rising competition from vertically integrated brands and cosmetic OEM/ODM manufacturers offering white-label snail mucin formulations.

Major suppliers are pivoting to sustainability-led sourcing, traceability, and clean-beauty positioning to retain relevance. Emerging entrants with novel encapsulation technologies, fermentation-based extraction, and vegan-alternative mucin solutions are gaining share. The competitive advantage is moving away from basic supply capacity to innovation, ethical sourcing, and strong brand partnerships.

The Global Snail Mucin Market is expanding rapidly due to the rising popularity of natural, clinically proven active ingredients in skincare and personal care. Advances in extraction technologyincluding low-stress harvesting, enzymatic processing, and multi-stage filtrationhave improved purity, stability, and consumer safety. Snail mucin is widely recognized for its anti-aging, hydration, and barrier repair benefits, driving demand in both premium facial skincare and emerging personal care categories.

E-commerce platforms, especially in Asia-Pacific and North America, are boosting cross-border sales of snail mucin products, with K-beauty brands playing a major role in global adoption. Innovation in serums, ampoules, creams, and hybrid products is expanding market reach, while sustainability trendssuch as traceable sourcing, cruelty-free certification, and eco-friendly packagingare increasingly influencing brand strategies.

The Global Snail Mucin Market is segmented by product type, skin/hair concern, packaging type, application area, and region. Product types include facial skincare, body care, lip care, hair & scalp care, sun & after-sun care, and men’s grooming. Skin/hair concerns cover anti-aging & fine lines, hydration, barrier repair, post-acne care, redness relief, scar & stretch-mark care, elasticity & firmness, post-procedure recovery, and scalp care.

Packaging types include dropper bottles, airless pumps, tubes, jars, single-dose capsules, sachet/mask packs, and stick formats. Application areas span face, eye contour, lips, body, hands, feet, and scalp. Regionally, the market covers North America, Latin America, Europe, East Asia, South Asia & Pacific, Central Asia, and the Middle East & Africa.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Facial Skincare | 42.3% |

| Others | 57.7% |

The Facial Skincare segment is projected to contribute USD 418.52 million in 2025, representing 42.3% of the global snail mucin market and making it the dominant product category. This leadership is driven by the widespread adoption of snail mucin-based serums, ampoules, creams, and masks, which are valued for their targeted delivery of actives for anti-aging, hydration, and skin repair. Premium branding strategies, the global influence of K-beauty, and visible, clinically backed results have reinforced this dominance.

The segment’s strength also comes from higher snail mucin concentrations in facial formulations compared to other categories, which increases ingredient demand per unit sold. Innovation is strong, with brands introducing hybrid skincare-makeup formats and combining mucin with complementary actives such as hyaluronic acid, peptides, and niacinamide. By 2035, Facial Skincare is expected to retain its top position with a forecast value of USD 1,310 million, supported by ongoing consumer preference for premium, result-oriented products.

| Skin/Hair Concern Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging & Fine Lines | 38.7% |

| Others | 61.3% |

The Anti-aging & Fine Lines segment within the skin/hair concern category will lead in 2025 with USD 382.90 million in sales, representing 38.7% of the global snail mucin market. Its dominance is rooted in snail mucin’s proven ability to promote collagen production, improve skin elasticity, and reduce fine lines, making it highly appealing to both preventive and corrective skincare consumers. This category has particular strength among 25-45-year-old urban buyers who seek natural alternatives to synthetic anti-aging actives such as retinoids.

Its growth is further reinforced by cross-category presence in serums, all-in-one creams, under-eye treatments, and night repair masks, enabling brands to command premium price points. Anti-aging claims have positioned this segment as the most commercially valuable concern-based category, with its value projected to rise to USD 1,200 million by 2035 while maintaining a clear lead over hydration and barrier-repair claims.

| Packaging Type Segment | Market Value Share, 2025 |

|---|---|

| Dropper Bottles | 36.3% |

| Others | 63.7% |

In the packaging type category, Dropper Bottles will dominate in 2025 with USD 359.15 million in sales, representing 36.3% of the global snail mucin market. Their leadership stems from their suitability for premium, concentrated formulations such as serums and ampoules, offering precise dosage, reduced contamination risk, and a sophisticated look and feel. This format’s association with high-value, active-rich products has made it a staple in both offline retail and e-commerce channels.

Additionally, brands are increasingly introducing eco-friendly dropper options using recyclable glass, PCR plastics, and refillable systems to align with sustainability trends without compromising product integrity. By 2035, the dropper bottle segment is expected to reach USD 1,130 million, maintaining its position as the most preferred packaging format for snail mucin products while evolving in design and material innovation to meet shifting consumer expectations.

Drivers

Diversification into New Personal Care Categories

The Global Snail Mucin Market is witnessing strong growth as the ingredient expands beyond its traditional K-beauty facial care roots into adjacent personal care segments such as scalp serums, body lotions, and hand creams. This expansion is driven by targeted R&D efforts that adapt snail mucin’s regenerative, hydrating, and barrier-repair properties to different skin and hair needs.

By tailoring formulations for specific applications, brands are able to deliver highly specialized solutions, reinforcing snail mucin’s premium positioning. The result is a broader addressable market, with increased product launches across diverse beauty and personal care categories.

Premiumization through Dermatology-Led and Ethical Branding

Snail mucin’s integration into high-purity, cruelty-free, and clinically tested formulations in luxury and dermatology-led cosmeceutical brands is accelerating market penetration, particularly in North America and Europe. Consumers in these regions are increasingly drawn to active ingredients with proven efficacy, backed by ethical sourcing and traceability. This demand is prompting suppliers to invest in transparent supply chains, small-batch extraction, and advanced purification methods, enabling brands to justify higher price points and capture a more premium consumer base.

Restraints

Supply Chain Vulnerability from Climate and Disease Risks

The reliance on farmed snail populations creates a unique supply chain vulnerability for the market. Climate fluctuations, disease outbreaks, and environmental stressors can impact snail health and secretion yield, leading to inconsistencies in quality and supply shortages. These disruptions are particularly challenging for large-scale production contracts where brands require consistent purity levels, making long-term planning and global expansion strategies more complex.

Regulatory Pressures and Compliance Costs

Markets such as the EU are imposing stricter regulations on animal welfare, traceability, and ingredient origin disclosures, pushing snail mucin suppliers to undertake rigorous certification processes. These compliance requirements not only increase operational costs but can also delay product launches, especially for brands entering highly regulated regions. The rising need for verifiable ethical claims is reshaping sourcing strategies and adding to the overall production burden.

Key Trends

Rise of Biotechnology-Derived “Vegan Mucin”

Biotechnology innovation is giving rise to fermentation-based snail mucin alternatives that replicate the bioactive composition of traditional mucin without involving live snails. These vegan mucin solutions appeal to cruelty-free and plant-based brands while reducing the supply chain risks associated with snail farming. This trend is expanding the potential consumer base, particularly among ethically conscious and vegan beauty buyers, while positioning snail mucin-like actives as a future-proof skincare ingredient.

Multi-Active Hybrid Formulations for Advanced Skincare

Brands are increasingly incorporating snail mucin alongside trending actives such as bakuchiol, ceramides, and tranexamic acid to create hybrid formulations targeting multiple skin concerns in a single product. This approach enhances perceived value, boosts consumer loyalty, and allows brands to position their offerings as science-backed, multifunctional solutions rather than single-ingredient products. The hybrid trend is particularly strong in premium skincare, where innovation and efficacy are central to competitive differentiation.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

| India | 9.2% |

| Germany | 4.1% |

| USA | 3.8% |

| UK | 4.3% |

| Japan | 4.5% |

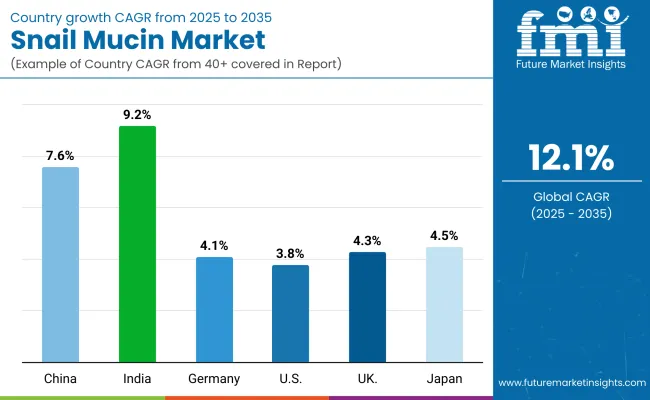

The Global Snail Mucin Market displays notable regional differences in growth momentum, shaped by consumer awareness, beauty culture influence, and the pace of premium skincare adoption. Asia-Pacific stands out as the fastest-growing region, anchored by India at 9.2% CAGR and China at 7.6% CAGR. India’s rapid growth is fueled by rising disposable incomes, increased penetration of K-beauty brands, and a surge in domestic cosmeceutical manufacturing, particularly targeting hydration and anti-aging categories.

China’s expansion is supported by its large-scale beauty and personal care manufacturing ecosystem, aggressive marketing of multifunctional actives, and government-backed initiatives promoting innovation in cosmetic R&D and exports. Europe maintains a steady but more moderate growth profile, led by the UK at 4.3% CAGR, Germany at 4.1% CAGR, and France following closely. Germany’s growth is underpinned by its strong premium skincare market, strict EU product compliance standards, and demand for traceable, ethically sourced snail mucin.

The UK market benefits from high consumer receptivity to K-beauty trends and a strong e-commerce channel presence for imported brands, while sustainability certifications remain a major purchase driver across the continent. North America, led by the USA at 3.8% CAGR, shows the lowest growth rate among major economies, reflecting a mature beauty market where snail mucin adoption is already well-established in niche premium skincare. Growth in the USA is being driven more by product innovation such as hybrid actives and biotech-derived vegan mucin rather than new consumer acquisition.

Meanwhile, Japan posts a 4.5% CAGR, reflecting its steady demand for high-purity, clinically backed skincare actives and its role as both a consumer and influencer market for broader Asia-Pacific beauty trends. This stable growth is supported by Japan’s integration of snail mucin into high-end cosmetic formulations with a strong focus on texture refinement and skin barrier repair.

| Year | USA Snail Mucin Market (USD Million) |

|---|---|

| 2025 | 198.87 |

| 2026 | 221.18 |

| 2027 | 245.99 |

| 2028 | 273.58 |

| 2029 | 304.27 |

| 2030 | 338.41 |

| 2031 | 376.37 |

| 2032 | 418.59 |

| 2033 | 465.54 |

| 2034 | 517.77 |

| 2035 | 575.85 |

The USA Snail Mucin Market is set to grow from USD 198.87 million in 2025 to USD 575.85 million by 2035, at a CAGR of 11.2%. This expansion is led by rising consumer interest in K-beauty-inspired formulations and dermatologist-backed claims around hydration, skin repair, and barrier strengthening.

Premium positioning is reinforced by the demand for concentrated snail mucin serums, with facial skincare emerging as the dominant category, accounting for 45.8% (USD 91.08 million) of 2025 sales. Growth is also supported by e-commerce-led availability of niche Korean brands, strategic retail partnerships, and increasing adoption among men’s grooming lines.

The UK Snail Mucin Market is projected to expand at a CAGR of around 8.5% between 2025 and 2035, though its share will decline from 6.3% to 5.2% as faster-growing Asian markets increase their dominance. In the UK, adoption is concentrated in hydration-focused and anti-aging products, supported by strong penetration of beauty subscription boxes, influencer-driven marketing, and expansion of premium K-beauty retail displays in department stores. While facial skincare leads the adoption, growth in multi-benefit productscombining snail mucin with niacinamide, ceramides, or peptidesis emerging as a key differentiator.

India is set to record one of the highest growth rates globally, with market share rising from 12.3% in 2025 to 15.2% in 2035. The rapid adoption is driven by urban middle-class consumers embracing multi-step skincare routines and the entry of both affordable and premium snail mucin products into modern trade and online platforms.

High climate variability across regionsfrom dry winters to humid summershas encouraged year-round use. Indian consumers are increasingly drawn to anti-aging and barrier-repair benefits, and domestic manufacturers are exploring hybrid products that blend snail mucin with Ayurveda-inspired actives to capture both traditional and modern beauty segments.

| Market Share | 2025 |

|---|---|

| China | 17.2% |

| India | 12.3% |

| Germany | 7.2% |

| USA | 20.1% |

| UK | 6.3% |

| Japan | 9.4% |

| Market Share | 2035 |

|---|---|

| China | 19.2% |

| India | 15.2% |

| Germany | 6.1% |

| USA | 18.5% |

| UK | 5.2% |

| Japan | 8.3% |

China is expected to grow at a CAGR of 12.7% from 2025 to 2035, with market share increasing from 17.2% to 19.2% and a 2035 market value of USD 170.18 million. The Anti-aging & Fine Lines category leads the market, holding 39.2% (USD 66.71 million) of 2025 sales.

Growth is fueled by the popularity of snail mucin as a high-performance, naturally derived ingredient capable of improving elasticity and reducing fine lines. Social commerce platforms like Douyin and Xiaohongshu are accelerating product discovery, while local brands continue to innovate with snail mucin sheet masks, sprays, and creams targeting younger demographics for preventive skincare.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Facial Skincare | 45.8% |

| Others | 54.2% |

The Snail Mucin Market in the United States is projected at USD 198.87 million in 2025, with Facial Skincare products contributing 45.8% of total value. This dominance stems from the rising demand for targeted solutions such as snail mucin serums, creams, and masks, which are perceived as high-efficacy products for hydration, skin barrier repair, and visible anti-aging results. The category’s growth is also reinforced by premium positioning through K-beauty influence and strong penetration in both online and offline specialty beauty channels.

While the “Others” categoryincluding body care, hair care, and multi-purpose formulationsstill holds a slight majority share, the faster growth trajectory lies within facial skincare due to its higher consumer willingness to pay for concentrated actives. USA consumers are increasingly aligning skincare purchases with dermatological claims and clean beauty credentials, making snail mucin-based facial products a prime beneficiary of these trends.

| Skin/Hair Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging & Fine Lines | 39.2% |

| Others | 60.8% |

The Snail Mucin Market in China is valued at USD 170.18 million in 2025, with Anti-aging & Fine Lines products accounting for 39.2% of sales. This segment’s strength reflects the high prioritization of preventive and corrective anti-aging solutions among Chinese consumers, particularly within the 25-45 demographic. Snail mucin’s reputation for enhancing collagen production, improving skin elasticity, and delivering a smoother texture aligns closely with these needs, making it a favored active in both domestic and international brand portfolios.

The “Others” category, encompassing hydration, skin barrier repair, and brightening concerns, holds the majority share, but anti-aging continues to be the primary image-building and premium-priced segment. Influencer marketing, livestreaming e-commerce, and local innovation in sheet masks and ampoules are further driving awareness and trial among younger, skincare-savvy buyers.

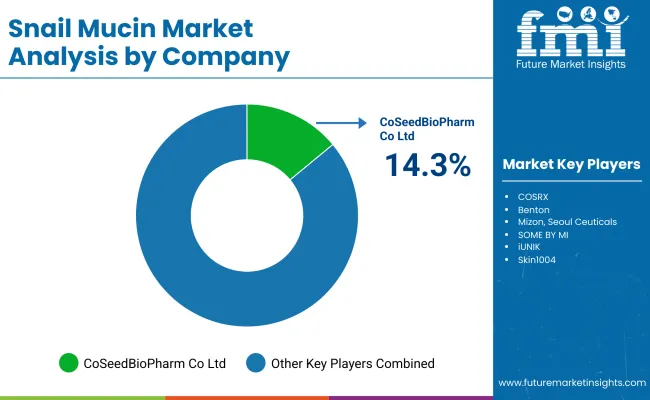

The Global Snail Mucin Market is moderately fragmented, with a mix of large-scale ingredient producers, mid-tier cosmetic formulators, and niche artisanal brands competing across diverse end-use applications. CoSeedBioPharm Co., Ltd. holds the largest individual market share at 14.3% in 2025, driven by its vertically integrated supply chain from snail farming to purified mucin extraction, ensuring consistent quality and bioactive concentration.

The company’s partnerships with leading K-beauty brands and expansion into cosmeceutical-grade formulations for anti-aging and skin repair have further strengthened its global footprint. The remaining 85.7% share is distributed among a wide range of playersfrom established Asian cosmetic manufacturers to emerging clean beauty startupseach leveraging unique positioning.

Mid-sized innovators are focusing on high-purity, cruelty-free snail mucin variants, investing in biotechnology-based extraction processes to appeal to ethically conscious consumers. Brands are increasingly differentiating through proprietary formulation blends that combine snail mucin with hyaluronic acid, peptides, or plant-based antioxidants to enhance efficacy and marketing appeal.

Specialized providers, including small-scale regional producers in Southeast Asia and Latin America, are catering to localized preferences by integrating snail mucin into traditional beauty regimens and multi-functional skin treatments. Competitive strategies are evolving beyond ingredient purity to emphasize sustainability, traceability, and brand storytellingwith transparency on sourcing and processing becoming a key purchase driver in both online and offline premium beauty channels.

Key Developments in Global Snail Mucin Market

| Item | Value |

|---|---|

| Quantitative Units | USD 989.4 million |

| Product Type | Facial Skincare, Body Care, Hair Care, Eye Care, Lip Care, Others |

| Skin/Hair Concern | Anti-aging & Fine Lines, Hydration & Moisturization, Brightening & Pigmentation, Acne & Blemishes, Hair Repair & Strengthening, Others |

| Packaging Type | Dropper Bottles, Pump Bottles, Jars & Tubs, Tubes, Sachets & Pouches, Others |

| Sales Channel | Online (E-commerce Marketplaces, Brand-owned Websites), Offline (Specialty Stores, Supermarkets & Hypermarkets, Pharmacy/Drugstores, Beauty Salons), Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CoSeedBioPharm Co., Ltd., COSRX, Benton, Mizon, Seoul Ceuticals, SOME BY MI, iUNIK, Skin1004, ElishaCoy, BIO-FD&C Co., Ltd., The Saem, TONYMOLY, It’s Skin, Missha, Nature Republic, Holika Holika, A’PIEU, Medipeel, Dewytree, Secret Key |

| Additional Attributes | Dollar sales by product type, skin/hair concern, packaging type, end-use, and sales channel; adoption trends in K-beauty and natural actives; surging demand for anti-aging and hydration-focused formulations; expansion of premium and clean beauty product lines; professional and salon-oriented offerings; rapid e-commerce penetration; regional growth driven by influencer marketing, TikTok virality, and celebrity endorsements; innovation in snail secretion extraction, purification, and stability-enhancing encapsulation technologies. |

The Global Snail Mucin Market is estimated to be valued at USD 989.4 million in 2025.

The market size for the Global Snail Mucin Market is projected to reach USD 1,873.9 million by 2035.

The Global Snail Mucin Market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types include Facial Skincare, Body Care, Hair Care, Eye Care, Lip Care, and Others.

In China, Anti-aging & Fine Lines is projected to command a 39.2% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Snail Mucin Skincare Market Growth – Trends & Forecast 2024-2034

Snail Market Size and Share Forecast Outlook 2025 to 2035

Snail Beauty Products Market

Mucinoses Management Market - Drug Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA