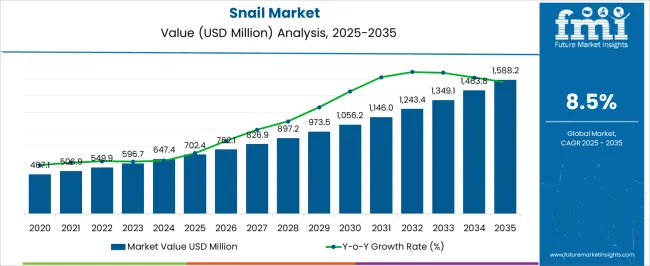

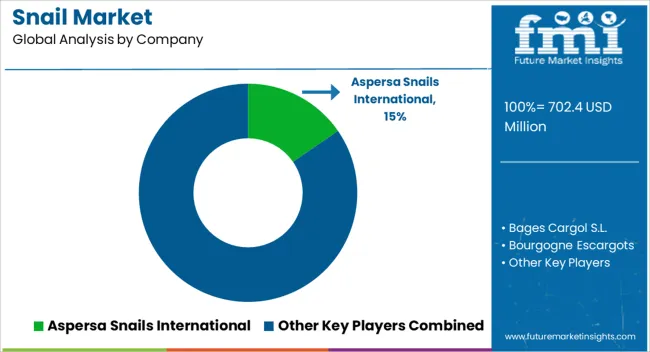

The global snail market is expected to reach approximately USD 702.4 million by 2025 and is projected to grow to nearly USD 1,588.2 million by 2035, advancing at a compound annual growth rate (CAGR) of 8.5% during the forecast period. The year-on-year (YoY) growth analysis indicates a steady increase, starting from USD 467.1 million and rising to USD 506.9 million, with an approximate YoY growth rate of 8.5%. This pace continues as the market grows from USD 506.9 million to USD 549.9 million, showing an 8.5% increase, and then advances to USD 596.7 million, up by about 8.5% again.

The subsequent rise from USD 596.7 million to USD 647.4 million maintains this pace at 8.5%, followed by an increase to USD 702.4 million, again about 8.5%. The upward momentum strengthens in later years, with USD 762.1 million to USD 826.9 million, marking an 8.5% surge, and the jump to USD 897.2 million continues the same trajectory. Further, the market moves to USD 973.5 million and USD 1,056.2 million, each showing around 8.5% YoY growth. The climb remains consistent, reaching USD 1,146.0 million, USD 1,243.4 million, and USD 1,349.1 million, each marking around 8.5% growth. The rise to USD 1,463.8 million and finally to USD 1,588.2 million mirrors the same pace. This continual expansion highlights growing culinary preferences for snail-based delicacies, increased use of snail extracts in cosmetic formulations, and heightened commercial farming activities, all of which are fueling consistent revenue gains and positioning the market on a sustained growth path throughout the forecast period.

| Metric | Value |

|---|---|

| Snail Market Estimated Value in (2025 E) | USD 702.4 million |

| Snail Market Forecast Value in (2035 F) | USD 1588.2 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The snail market is closely influenced by five interconnected parent markets that collectively drive its commercial growth and long-term demand. The largest contributor is the gourmet and specialty food market, which accounts for about 40% share, as snails are widely consumed as delicacies in fine-dining restaurants and specialty food outlets, especially in regions with strong culinary traditions for escargot and other snail-based dishes. The aquaculture and livestock farming sector contributes around 25%, as snail farming practices rely on controlled breeding, feed management, and farm infrastructure, which directly support consistent supply chains for both domestic consumption and export. The cosmetics and personal care ingredients market holds close to 15% influence, supported by the rising use of snail mucin in skincare formulations due to its perceived anti-aging and regenerative properties.

The pharmaceutical and nutraceutical industry adds nearly 12%, as bioactive compounds derived from snails are studied and utilized for their potential therapeutic benefits in wound healing and health supplements. The agricultural by-products and animal feed market contributes close to 8%, as snail farming integrates with organic waste recycling and provides nutrient-rich by-products for feed applications. In an opinionated view, the distribution of market influence shows that the culinary and farming sectors serve as the backbone of this market, while cosmetic and pharmaceutical applications continue to expand their commercial scope.

The snail market is steadily evolving due to rising demand in both the culinary and pharmaceutical sectors, with increased consumer interest in protein-rich, low-fat, and sustainable food sources. As gourmet and exotic food trends grow, particularly in high-income regions, snails have gained traction for their nutritional value and delicacy appeal.

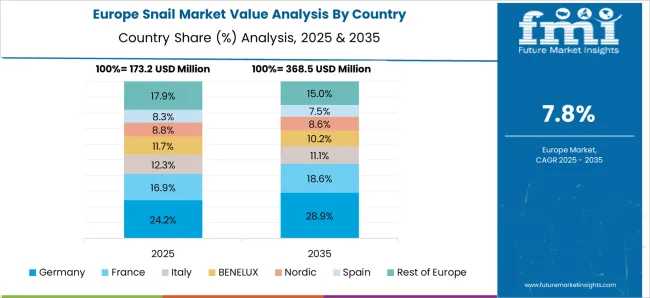

Beyond food, snail-derived ingredients, such as mucin, are being increasingly utilized in cosmetics and dermatological products, thereby further diversifying market potential. The expansion of snail farming practices, particularly in Europe and Africa, has enhanced supply chain efficiency, allowing producers to meet increasing domestic and export demands.

The market outlook is positive, driven by rising awareness, improved cold chain logistics, and supportive agricultural policies that promote heliciculture. Continued investment in farming technology and product standardization is expected to drive both volume and value growth across multiple end-use categories.

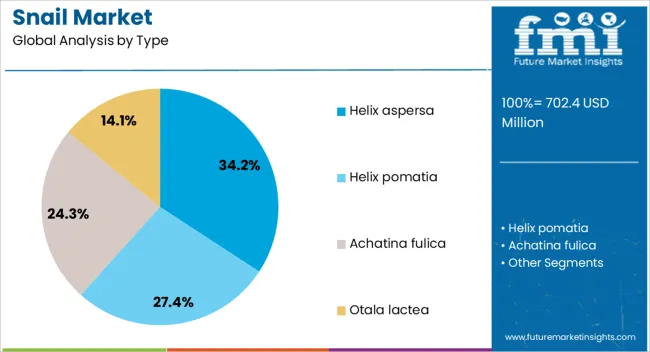

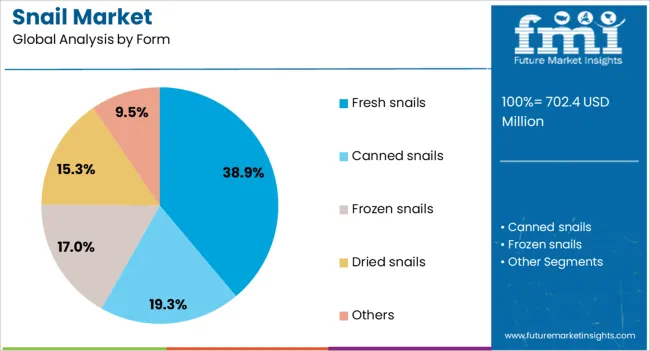

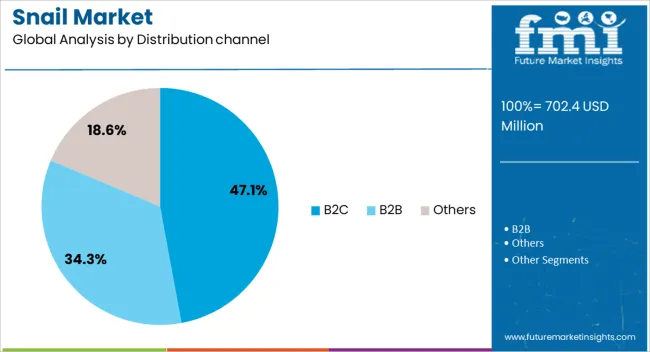

The snail market is segmented by type, form, distribution channel, application, and geographic regions. By type, snail market is divided into Helix aspersa, Helix pomatia, Achatina fulica, and Otala lactea. In terms of form, snail market is classified into Fresh snails, Canned snails, Frozen snails, Dried snails, and Others. Based on distribution channel, snail market is segmented into B2C, B2B, and Others.

By application, snail market is segmented into Cosmetics and skincare, Pharmaceuticals, Food and beverages, Pet food, Agriculture and farming, and Others. Regionally, the snail industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Helix aspersa segment accounts for 34% of the snail market, supported by its widespread use in gastronomy and favorable breeding characteristics. Known for its adaptability and high reproduction rate, Helix aspersa has become the preferred species for commercial snail farming operations.

Its tender texture and palatability contribute to strong demand in gourmet cuisines, particularly in European markets where escargot remains popular. Farmers favor this species due to its resilience and relatively short growth cycle, enabling more efficient production turnover.

Moreover, its suitability for various processing forms, fresh, canned, or frozen, adds to its commercial viability. As farming techniques advance and international demand increases, the Helix aspersa segment is positioned to maintain its leading role in global snail production.

The fresh snails segment dominates the form category with a 39% market share, driven by consumer preference for natural and minimally processed food products. This segment benefits from strong demand in foodservice establishments and specialty retail channels that emphasize freshness, traceability, and authentic culinary experiences.

Fresh snails are commonly sourced by restaurants for direct preparation, making them a premium product in gourmet and ethnic cuisines. The growth of local snail farming initiatives and improved cold chain distribution has enhanced the availability and safety of fresh snails in various regional markets.

As consumer interest in farm-to-table and clean-label foods rises, the fresh segment is expected to sustain momentum, supported by seasonal promotions and increasing household acceptance.

The B2C segment holds a 47% share of the snail market, reflecting a significant shift toward direct-to-consumer channels driven by growing retail penetration and online availability. Consumers are increasingly exploring snails as a protein alternative in home cooking, inspired by culinary trends and the influence of global food cultures.

This trend is further supported by the introduction of value-added snail products such as pre-cooked, marinated, or frozen packs aimed at convenience-oriented shoppers. Retailers are expanding their offerings in gourmet and specialty sections, making snails more accessible to urban and health-conscious buyers.

The rise of e-commerce and delivery services has also enabled producers to reach broader audiences with fresh and processed snail products. Continued marketing efforts and product education are expected to drive further growth in the B2C channel, making it a vital component of future market expansion.

The snail market is being shaped by rising culinary demand, growth in skincare uses, pharmaceutical applications, and the expansion of commercial farming. Food industry demand has driven higher production volumes, while the cosmetic sector has created new high-value revenue streams through snail mucin. Pharmaceutical research is opening up novel applications that could further raise the market’s profile. At the same time, structured farming practices are improving supply consistency and expanding global trade potential. These combined dynamics are transforming the snail market from a niche sector into a diverse and commercially significant global industry with multiple growth pathways.

The snail market is witnessing rising demand from the global food industry, especially in gourmet and specialty culinary segments. Snails are regarded as delicacies in several European, Asian, and African cuisines, which has increased their commercial value. Restaurants and food processors are sourcing farmed snails to meet growing consumer interest in exotic dishes. This surge in demand has encouraged more farmers to adopt heliciculture, creating a steady supply chain. The growing presence of snails in fine dining and packaged gourmet products is driving market growth. Seasonal consumption peaks during festive periods in several regions, which further supports higher production volumes and stronger trade flows across key markets.

Snail derivatives, particularly snail mucin, are being widely used in the cosmetic and skincare industry. Known for their moisturizing and regenerative properties, snail-based ingredients are included in creams, serums, and masks. Brands are promoting these products as effective solutions for skin hydration, anti-aging, and scar healing. This rising commercial interest has created a parallel value chain beyond food, giving farmers and suppliers access to higher-value markets. The inclusion of snail extracts in premium personal care products has also attracted attention from international beauty brands. Growing consumer demand for natural skincare solutions has led to an expansion in snail farming activities, supporting the overall growth of the market.

Pharmaceutical researchers are exploring snails for their bioactive compounds and potential therapeutic benefits. Certain snail species produce substances with antimicrobial and pain-relief properties, making them useful in developing new drugs and treatments. Snail venoms are being studied for their neurological effects, which could lead to breakthroughs in pain management medications. This trend has encouraged investment from pharmaceutical firms seeking novel biological resources. The medical potential of snails is expanding the market’s scope beyond traditional food and cosmetic uses. As more clinical studies confirm the efficacy of snail-derived compounds, the sector is expected to gain further traction from pharmaceutical companies and research institutions.

Commercial snail farming, or heliciculture, has been expanding rapidly to meet rising demand across industries. Farmers are adopting controlled farming systems to produce consistent, high-quality snails throughout the year. These practices reduce the risk of disease, improve breeding efficiency, and allow for large-scale operations. The expansion of structured snail farms is helping create organized supply chains, ensuring reliable availability for exporters, processors, and manufacturers. Governments and agricultural agencies in several regions are offering training and support to encourage farmers to enter the sector. The shift from wild collection to managed farming is transforming the industry, providing stable supply and boosting global market activity.

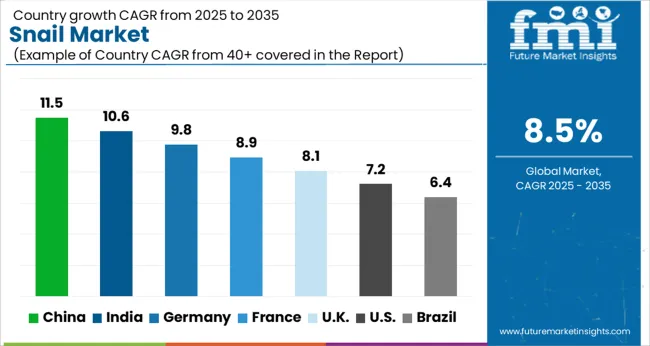

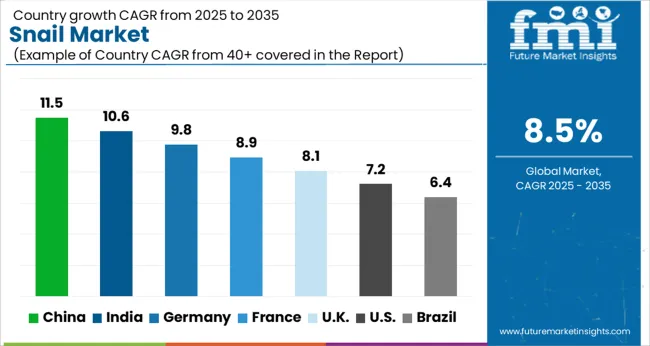

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global snail market is projected to grow at a CAGR of 8.5% between 2025 and 2035. China leads the expansion with an anticipated 11.5% CAGR, followed by India at 10.6% and Germany at 9.8%. United Kingdom is expected to grow at 8.1%, while United States follows at 7.2%. Growth is driven by rising demand for edible snails in gourmet cuisine, increased use of snail mucin in cosmetic formulations, and expanding exports of processed snail products. Asian markets such as China and India are strengthening production through intensive farming and government-backed agribusiness support, while European regions like Germany and the United Kingdom emphasize high-quality processing standards and culinary applications. The United States continues to progress through growing consumer interest in specialty foods and niche gastronomy. The analysis covers over 40 countries, with the leading markets detailed below.

The snail market in China is projected to grow at a CAGR of 11.5% from 2025 to 2035, supported by rising demand for snail-based skincare and gourmet products. Large-scale heliciculture farms are supplying both domestic processors and export-oriented brands, ensuring consistent raw material availability. Cosmetic companies are investing in advanced mucin extraction technologies to produce high-yield serums and stable formulations for anti-aging and skin-repair segments. Processed edible snail products are also gaining traction among high-end restaurants and specialty retailers. The regulatory landscape for cosmetic ingredients has become clearer, encouraging faster product launches and wider distribution. E-commerce platforms have expanded product reach across urban centers, while domestic brands are using influencer-driven marketing to build premium appeal. China’s dominance in manufacturing and supply networks positions it as a central hub for snail-based cosmetics and specialty food exports.

India’s snail market is expected to grow at a CAGR of 10.6% between 2025 and 2035, driven by increasing interest in snail-derived cosmetics and niche edible products. Expanding online beauty retail channels and rising disposable incomes are supporting this demand shift. Local heliciculture initiatives have emerged to reduce import dependence and supply mucin to domestic dermatology clinics. Collaborative efforts between private firms and research institutions are helping to develop standardized extraction protocols and quality benchmarks. High-end restaurants in metropolitan cities are experimenting with gourmet snail dishes, contributing to the foodservice segment’s gradual expansion. Efforts are underway to formalize supply chains for traceability and hygiene, ensuring market readiness for both cosmetic and edible use. Private investors are backing processing facilities to retain value domestically rather than exporting raw materials. Marketing strategies emphasize efficacy and luxury positioning to attract urban beauty consumers.

The snail market in Germany is projected to grow at a CAGR of 9.8% from 2025 to 2035, supported by growing interest in clean-label skincare and gourmet delicacies. German cosmetic formulators are focusing on standardized mucin fractions with proven safety profiles to meet EU regulatory norms. Fine-dining restaurants and specialty grocers sustain steady demand for edible snail products, while research into pharmaceutical applications of snail extracts is gaining funding support. Supply chains have been structured to emphasize traceability, animal welfare, and hygiene to meet strict EU food and cosmetic standards. Industrial partnerships are piloting scalable extraction technologies that improve mucin stability and reduce solvent use. The market is shifting toward exporting finished skincare products rather than raw mucin to capture greater value. Germany’s position as a leader in premium skincare manufacturing enhances its competitiveness in the European snail products landscape.

The snail market in the UK is expected to grow at a CAGR of 8.1% between 2025 and 2035, supported by rising consumer interest in K-beauty trends and mucin-based skincare. Dermatology clinics are selectively using snail-derived treatments in specialized therapies, while mainstream retail has introduced snail serums and creams. Distribution has expanded across drugstores and online platforms, improving product availability nationwide. Brands are investing in clinical trials and product certifications to build trust among health-conscious consumers. Gourmet demand remains niche but is increasing among fine-dining restaurants experimenting with contemporary escargot dishes. Importers are establishing partnerships with overseas snail farms to secure consistent raw supply, while domestic startups are entering the mucin-based cosmetic segment. Marketing efforts emphasize visible results and influencer endorsements to appeal to trend-driven beauty shoppers.

The snail market in the USA is projected to grow at a CAGR of 7.2% from 2025 to 2035, fueled by rising consumer acceptance of novel cosmetic ingredients and growing luxury skincare demand. American beauty brands are incorporating snail mucin in anti-aging, hydrating, and skin-repair product lines to differentiate offerings in a competitive market. Specialty retailers and dermatology clinics are showcasing mucin-based treatments, enhancing visibility and consumer awareness. Culinary demand remains niche yet steady among high-end restaurants and gourmet distributors. Regulatory frameworks are well-defined, enabling smoother product approvals and imports for mucin-based formulations. Domestic startups are partnering with global snail mucin suppliers to secure high-quality raw materials, while contract manufacturers are being used to scale production efficiently. Marketing campaigns highlight scientific validation and premium positioning to appeal to wellness-focused consumers seeking high-performance skincare solutions.

Competition in the snail market is defined by farm-to-fork traceability, yield consistency, and integration into gourmet and bulk supply channels. Leadership is held by Bourgogne Escargots, which has long-standing market presence in premium French and European culinary channels. Romanzini and ESCAL S.A. follow with established processing facilities and export-oriented product lines that serve retail and foodservice segments. Bages Cargol S.L., Aspersa Snails International, and LUMACA Italia are positioned through scalable farming operations and frozen product export programs. Gaelic Escargot, Peconic Escargot, Darvja Ltd, SABAROT WASSNER, SC EGAN PROD SSRL, and UAB Gardumeli contribute by focusing on live-breeding stock, niche artisan product ranges, and regional distribution networks aimed at specialty restaurants and gourmet retailers. Strategies across suppliers are concentrated on biosecure farming, consistent meat quality, and channel partnerships. Controlled-feed protocols, standardised breeding methods, and cold-chain logistics are emphasised to ensure uniform size, texture, and year-round availability. Co-development with private-label retailers and culinary houses is being used to shorten product qualification cycles. Premium positioning is pursued through provenance claims, organic or certified production routes, and ready-to-cook formats that command higher margins. Price competition is managed by offering a spectrum from live breeding stock and bulk frozen meat to retail-ready, seasoned escargot in shells. Product literature is presented with culinary and procurement clarity. Specifications such as average shell size, meat yield per kilogram, protein content, farm origin, and recommended refrigeration or freezing protocols are highlighted. Formats including live snails, frozen meat, canned escargot, and pre-seasoned retail packs are documented for buyer selection. Handling notes, shelf-life metrics, and HACCP-compliant processing descriptions are provided to assist importers and foodservice operators in qualification. Value-added services such as contract farming support, private-label packaging, and export documentation assistance are promoted as differentiators for suppliers seeking broader market access.

| Item | Value |

|---|---|

| Quantitative Units | USD 702.4 Million |

| Type | Helix aspersa, Helix pomatia, Achatina fulica, and Otala lactea |

| Form | Fresh snails, Canned snails, Frozen snails, Dried snails, and Others |

| Distribution channel | B2C, B2B, and Others |

| Application | Cosmetics and skincare, Pharmaceuticals, Food and beverages, Pet food, Agriculture and farming, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aspersa Snails International, Bages Cargol S.L., Bourgogne Escargots, Darvja Ltd, ESCAL S.A., Gaelic Escargot, LUMACA Italia, Peconic Escargot, Romanzini, SABAROT WASSNER, SC EGAN PROD SSRL, and UAB Gardumeli |

| Additional Attributes | Dollar sales, share, consumption trends, key species demand, regional production hubs, pricing patterns, trade regulations, distribution channels, competitor landscape, emerging end-use applications. |

The global snail market is estimated to be valued at USD 702.4 million in 2025.

The market size for the snail market is projected to reach USD 1,588.2 million by 2035.

The snail market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in snail market are helix aspersa, helix pomatia, achatina fulica and otala lactea.

In terms of form, fresh snails segment to command 38.9% share in the snail market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA