The global workstation market is poised for significant growth over the next ten years, with an estimated market value of USD 63.8 billion in 2025 and expected to double, reaching USD 126.7 billion by 2035. This growth is driven by a significant CAGR of 7.4%, indicating strong demand for workstation solutions across various industries.

As enterprises increasingly rely on high-performance computing, workstations are no longer limited to specialized industries but are becoming an integral part of business operations across the globe. With rising technological innovations and an increasing dependency on complex computing tasks, workstations are positioned as a key enabler of digital transformation across sectors like finance, healthcare, engineering, and digital content creation.

Several factors are propelling the demand for workstations, particularly the surge in the need for high-performance computing solutions. Industries such as banking, financial services, and insurance (BFSI), healthcare, and IT are relying more on powerful workstations for tasks like artificial intelligence (AI), data analytics, 3D modeling, and content creation.

These tasks require cutting-edge configurations, including high-core count CPUs, powerful GPUs, and extensive memory bandwidth. Workstations equipped with such capabilities are essential for handling complex workloads, accelerating productivity, and supporting advanced research and development. As businesses adopt more cloud-based infrastructure and AI-powered solutions, the demand for tailored, high-performance computing continues to expand, further boosting market growth.

Another key driving force behind this expansion is the increased reliance on mobile workstations, especially in the context of remote and hybrid work models. Mobile workstations provide professionals with powerful computing capabilities on the go, without sacrificing performance or security. This is particularly important in fields like engineering, content creation, and data analysis, where professionals often need to work from various locations but require a portable solution that can handle resource-intensive tasks.

Additionally, governments and enterprises are investing more in mobile workstations to support remote workforces, contributing to the growing demand for these flexible computing solutions. As mobile workstations continue to evolve with advanced security features and enhanced computing power, they are expected to be a major driver in the market's growth between 2025 and 2035.

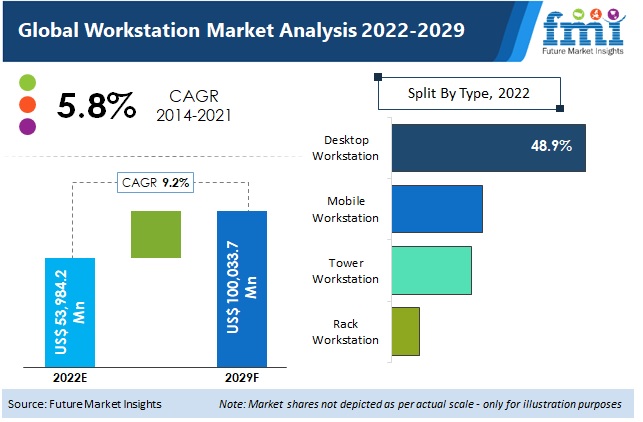

The section contains information about the leading segments in the industry. By type, the mobile workstation segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by core, the 6 cores segment holds a dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| Mobile Workstation | 10.0% |

Mobile Workstation segment is expected to grow at a CAGR of 10.0% from the period 2025 to 2035. The increasing adoption of remote and hybrid work models has played an important role in boosting demand for mobile workstations.

Professionals in fields (like digital content creation, engineering, and financial analytics) want power-enabled but portable devices to work from different places without losing computing power. Mobile workstations have powerful processing, dedicated GPUs, and security features similar to desktops, addressing mobile flexibility for professionals.

Moreover, companies are rapidly empowering their employees with mobile workstations to boost productivity while providing secure access to corporate networks.

Governments are also coming to realize they need flexible computing solutions. In the breadth of the problem, this new federal government effort led to increased investment by 35% in mobile workstations for remote employees working in industries such as public administration and defense.

| Core | Value Share (2025) |

|---|---|

| 6 Cores | 29.1% |

The Banks & Financial Institution segment is poised to capture share 29.1% in 2025. Among various workstations, 6-core chips are the best value overall thanks to their power, performance, and price point. These processors are used across various industries where specific workloads can benefit from high frequency and fewer cores, such as digital design, software development, and financial modeling.

A solution that is capable of handling multiple tasks, data processing and medium-intensity workloads seamlessly is why 6-core workstations became the ultimate choice for both SMEs and enterprise experts.

Government-sponsored digital infrastructure initiatives are further driving the demand. A use case in education technology found a 40% increase in the adoption of 6-core workstations across educational institutions focused on training people in AI and data science, reaffirming the importance of such machines in human skill development.

| Company | Dell Technologies |

|---|---|

| Contract/Development Details | Awarded a contract by a global engineering firm to supply high-performance workstations equipped with advanced graphics capabilities, supporting complex design and simulation tasks in various engineering projects. |

| Date | April 2024 |

| Contract Value (USD Million) | Approximately USD 30 |

| Renewal Period | 3 years |

| Company | HP Inc. |

|---|---|

| Contract/Development Details | Partnered with a leading animation studio to provide customized workstations optimized for rendering and visual effects production, enhancing creative workflows and reducing project turnaround times through improved processing power and reliability. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 25 |

| Renewal Period | 4 years |

Increasing adoption of 3D modeling, digital content creation, and advanced data processing

3D modeling, digital content creation, and advanced data processing have all had an explosive impact on the workstation market. 3D modeling is utilized in multiple industries, including entertainment, architecture, and healthcare, for 3D animation, design visualization, and medical imaging respectively. This transition requires computing workstations that can perform intensive computation and rendering efficiently.

For example, the National Institutes of Health hosted a "Science in 3D" festival to encourage the use of 3D technology in bioscience, which draws attention to the expanding relevance of 3D modeling in research and development.

Likewise, the area of digital content creation has transcended into almost every marketing, education, and entertainment area, necessitating demand for a workstation that can handle complex software applications. Big data analytics and machine learning need power computation and thus push for higher end workstations.

Rising cybersecurity concerns driving demand for secure workstations

The rise in cyber threats is pushing organizations to focus on protecting their digital assets, which is why the demand for secure workstations is rising.

Act (HIPAA)Regular Operation - National StandardsIt helps keep electronic health information safe and secure Electronic health information Privacy and Security of Health InformationAct (HIPAA) Health Insurance Portability and Accountability Act (HIPAA) Regular Operation - National Standards Security Computing Environment to Outreach New Computing Environment.

Public companies are also subject to new rules adopted by the USA Securities and Exchange Commission on enhanced and standardized disclosures by public companies on cybersecurity risk management, strategy, governance, and incidents.

Some industries will find themselves with few compliance requirements, thus leading organizations not to invest in workstations with superior security functionality; however, legislation factors that seek to safeguard sensitive data compel such organizations to be compliant.

This leads to an increasing number of launches in the workstation market that have advanced security protocols, encryption abilities, and secure access control, driven by the growth in the occurrence of cybersecurity threats in every industry.

Growth in compact and mobile workstations for enhanced flexibility

The increasing popularity of compact and mobile workstations is due to the new move and flexibly evolving workforce. Individuals specializing in design, engineering, content creation, etc., need portable but robust computers to get work done from different places.

Manufacturers have responded by creating lightweight workstations that offer uncompromised performance. With mobile devices equipped with powerful processors, sophisticated graphics capabilities, and long-lasting battery life, professionals can remain productive away from the office. Bass Parsons is a leading authority on mobile workstations, which have become increasingly popular in recent years with the rise of remote work and decentralized teams.

Growing Preference for Lightweight, Portable Devices Challenges Traditional Workstation Demand

The evolution towards lighter, more portable devices is changing workstations and becoming a competitor to the desktop and tower class workstations. In fact, now professionals across industries, such as engineering, media, and world-class software development, expect computing solutions that are mobile and perform well.

Powerful processors and top-tier GPUs in laptops, ultrabooks, and mobile workstations are replacing traditional bulky workstations. This change is mainly attributed to the changing landscape of work settings with the rise of remote work and hybrid office arrangements. Employees and freelancers need to work from several locations with mthe ost efficient computing solution.

To compound this, hardware technology has also made it possible for small devices to provide computing capabilities that were once limited to expensive desktop workstations. Longer battery life, enhanced thermal needs, and better processing potentials in portable devices have made them a credible alternative.

The global workstation market is segmented into three vendor tiers based on market presence, product portfolio, and reach to customers. Leading vendors in the space with product offerings and global reach are obvious tier 1, such as Dell Technologies, HP Inc., and Lenovo. These companies build high-performance workstations for the engineering, media, and healthcare industries.

With significant investments in research and development, brand reputation, and enterprise-level offering, they cater to large business needs through their scale and custom internal solutions, thus reigning as the market leader.

Tier 2 vendors have a competitive edge with specialization in regions or industries. While generic x86 and related brands dominate general-purpose markets, niche players like Fujitsu, Apple, and Acer turn out one box at a time to service specific markets - be it creative professionals, high-end industrial applications, or enterprise needs in a particular region.

Apple’s Mac Pro: a staple of media and design, and Fujitsu has focused on CELSIUS workstations in European and Asian markets. Such vendors rely on distinctive capabilities, hardware coupling, and long-standing regional expertise to sustain a steady stream of customers without directly competing with Tier 1 vendors.

Tier 3 vendors consist of newer and niche-targeted companies like BOXX Technologies, MSI, and Origin PC, providing more specialized and tailored workstations. These vendors are drawing customers with unique configurations, high-end graphics capabilities, and customized solutions for various industries - including gaming, animation, and high-performance computing.

Their smaller market reach does not stop them from competing effectively in the sectors most customized for and innovative while bringing diversity and a competitive edge to the workstation market, with great potential for innovation and determination.

The section highlights the CAGRs of countries experiencing growth in the Workstation market, along with the latest advancements contributing to overall market development. Based on current estimates, China, India, and the USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 12.7% |

| China | 11.3% |

| Germany | 7.2% |

| Japan | 8.5% |

| United States | 9.4% |

In China’s manufacturing and engineering sectors, AI-driven workstations are the secret sauce for increased productivity and innovation. They are also excellent at performing a variety of resource-hungry tasks, from complex simulations to real-time analytics and automated design processes, which make them ideal for industries such as automotive, aerospace, and industrial machinery.

And it continues to spread the same philosophy via "Made in China 2025" plans focusing on high-tech manufacturing and smart factories. Over the past few years, initiatives for enterprises to update their hardware infrastructure further promoted the increase in the number of AI-compatible workstations.

In November, an AI-driven workstation system from Sinai Group was integrated with a state-owned manufacturing center for government-funded industrial undertakings, accelerating production lines by an average of 30%.

In addition, companies are replacing their workstations with those equipped with deep-learning capabilities to decrease machine downtimes, owing to the growing penetration of AI-based predictive maintenance. China is anticipated to see substantial growth at a CAGR of 11.3% from 2025 to 2035 in the Workstation market.

Advanced computing for research, diagnostics, and skill development is becoming more and more commonplace in the education and healthcare industries making way for a new era of PC adoption and influencingthe growth of the Workstation segment.

Universities and technical institutions are putting high-performance workstations to use, offering AI, data science, and engineering simulations, leading to better learning results with and at scale and moving into the cloud. At the same time, hospitals and medical research institutions in India are incorporating workstations for medical imaging, genomic sequencing, and AI-assisted diagnostics.

India, for example, and the Indian government have already launched many initiatives to increase digital infrastructure in education and healthcare, thereby boosting the demand for computing power to higher levels.

This week, the government launched a nationwide plan to supply medical facilities with state-of-the-art AI diagnostic tools, resulting in a 40% increase in demand for healthcare workstations. India's Workstation market is growing at a CAGR of 12.7% during the forecast period.

The transition to remote and hybrid work models in the United States has boosted demand for mobile and compact workstations. More businesses are empowering their workforce with portable, lightweight but strong machines capable of running professional applications, ranging from video editing and CAD modeling to financial analytics.

The US government is among those that have encouraged flexible work environments, with federal agencies adopting policies to facilitate remote work. As a result, we are witnessing an increase in the demand for mobile workstations that can match the processing capabilities of conventional desktops yet are portable.

According to a recent government report, 25% of federal agencies are now investing in secure, high-performance mobile workstations to enable remote operations. Moreover, cybersecurity is a major concern, so businesses are choosing mobile workstations that encompass built-in security features like biometric authentication and AI-powered threat detection.

Demand for compact yet powerful computing solutions has been even more accelerated by the rise of gig economy professionals and freelance digital creators. The USA. is anticipated to see substantial growth in the Workstation market, significantly holding a dominant share of 78.5% in 2025.

The workstation ecosystem is extremely competitive, with advances in processing power, A.I. integration, and evolving user demand. Companies are focusing on the performance and energy efficiency delivered by their products, and on security capabilities.

Mobile and cloud-based workstations are on the rise, and the competition among vendors who must innovate is increasing. Pricing, customization, and after-sales support - to name a few - are some of the major drivers that determine buyer preferences in this space.

Recent Industry Developments in the Workstation Market

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 63.8 billion |

| Projected Market Size (2035) | USD 126.7 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in thousand workstation units |

| Segments by Type | Rack Workstation, Desktop Workstation, Mobile Workstation, Tower Workstation |

| Segments by Cores | 6 Cores, 8 Cores, 12 Cores, 18 Cores, 28 Cores, 32 Cores, 56 Cores, Other |

| Segments by Industry | Healthcare, Education, BFSI, Manufacturing, Media & Entertainment, Engineering & Design, Other Industry |

| Key Regions | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Dell Technologies, HP Inc., Lenovo Group Ltd., Apple Inc., Fujitsu Ltd., Microsoft Corp., Acer Inc., ASUS, MSI (Micro-Star International), Intel Corp. |

| Additional Attributes | Growth driven by remote design workflows, AI/ML workstation builds, GPU-accelerated rendering, and enterprise refresh cycles |

| Customization and Pricing | Customization and pricing details available on request |

In terms of type, the segment is divided into Rack Workstation, Desktop Workstation, Mobile Workstation and Tower Workstation.

In terms of core, the segment is segregated into 6 Cores, 8 Cores, 12 Cores, 18 Cores, 28 Cores, 32 Cores, 56 Cores and Other.

The industry is classified by segment as Healthcare, Education, BFSI, Manufacturing, Media and Entertainment, Engineering & Design and Other Industry.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Workstation industry is projected to witness CAGR of 7.4% between 2025 and 2035.

The Global Workstation industry stood at USD 63.8 billion in 2025.

The Global Workstation industry is anticipated to reach USD 126.7 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.4% in the assessment period.

The key players operating in the Global Workstation Industry Dell Technologies, HP Inc., Lenovo Group Ltd., Apple Inc., Fujitsu Ltd., Microsoft Corporation, Acer Inc., ASUS, MSI (Micro-Star International), Intel Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 6: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 12: North America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 16: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 18: Latin America Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 20: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: Western Europe Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 26: Western Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 28: Western Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 45: East Asia Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 46: East Asia Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 47: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 48: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Operating System, 2019 to 2034

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Core, 2019 to 2034

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Core, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Industry, 2024 to 2034

Figure 7: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 18: Global Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 19: Global Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 20: Global Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 26: Global Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 27: Global Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 28: Global Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 29: Global Market Attractiveness by Type, 2024 to 2034

Figure 30: Global Market Attractiveness by Operating System, 2024 to 2034

Figure 31: Global Market Attractiveness by Core, 2024 to 2034

Figure 32: Global Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 33: Global Market Attractiveness by Application, 2024 to 2034

Figure 34: Global Market Attractiveness by Industry, 2024 to 2034

Figure 35: Global Market Attractiveness by Region, 2024 to 2034

Figure 36: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 38: North America Market Value (US$ Million) by Core, 2024 to 2034

Figure 39: North America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 40: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 46: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 47: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 48: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 49: North America Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 56: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 57: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 58: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 59: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 60: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 61: North America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 62: North America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 63: North America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 64: North America Market Attractiveness by Type, 2024 to 2034

Figure 65: North America Market Attractiveness by Operating System, 2024 to 2034

Figure 66: North America Market Attractiveness by Core, 2024 to 2034

Figure 67: North America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 68: North America Market Attractiveness by Application, 2024 to 2034

Figure 69: North America Market Attractiveness by Industry, 2024 to 2034

Figure 70: North America Market Attractiveness by Country, 2024 to 2034

Figure 71: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 72: Latin America Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 73: Latin America Market Value (US$ Million) by Core, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 75: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 76: Latin America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 77: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Latin America Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 90: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 93: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 96: Latin America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 99: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 100: Latin America Market Attractiveness by Operating System, 2024 to 2034

Figure 101: Latin America Market Attractiveness by Core, 2024 to 2034

Figure 102: Latin America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 104: Latin America Market Attractiveness by Industry, 2024 to 2034

Figure 105: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 106: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 107: Western Europe Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) by Core, 2024 to 2034

Figure 109: Western Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 110: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: Western Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 119: Western Europe Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 122: Western Europe Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 125: Western Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 128: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 131: Western Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 134: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 135: Western Europe Market Attractiveness by Operating System, 2024 to 2034

Figure 136: Western Europe Market Attractiveness by Core, 2024 to 2034

Figure 137: Western Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 138: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 139: Western Europe Market Attractiveness by Industry, 2024 to 2034

Figure 140: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 141: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 143: Eastern Europe Market Value (US$ Million) by Core, 2024 to 2034

Figure 144: Eastern Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 146: Eastern Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 169: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 170: Eastern Europe Market Attractiveness by Operating System, 2024 to 2034

Figure 171: Eastern Europe Market Attractiveness by Core, 2024 to 2034

Figure 172: Eastern Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 173: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 174: Eastern Europe Market Attractiveness by Industry, 2024 to 2034

Figure 175: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 176: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 178: South Asia and Pacific Market Value (US$ Million) by Core, 2024 to 2034

Figure 179: South Asia and Pacific Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 180: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 181: South Asia and Pacific Market Value (US$ Million) by Industry, 2024 to 2034

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 204: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 205: South Asia and Pacific Market Attractiveness by Operating System, 2024 to 2034

Figure 206: South Asia and Pacific Market Attractiveness by Core, 2024 to 2034

Figure 207: South Asia and Pacific Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 208: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 209: South Asia and Pacific Market Attractiveness by Industry, 2024 to 2034

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 211: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 212: East Asia Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 213: East Asia Market Value (US$ Million) by Core, 2024 to 2034

Figure 214: East Asia Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 215: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 216: East Asia Market Value (US$ Million) by Industry, 2024 to 2034

Figure 217: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 221: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 224: East Asia Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 227: East Asia Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 230: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 233: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 236: East Asia Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 239: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 240: East Asia Market Attractiveness by Operating System, 2024 to 2034

Figure 241: East Asia Market Attractiveness by Core, 2024 to 2034

Figure 242: East Asia Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 243: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 244: East Asia Market Attractiveness by Industry, 2024 to 2034

Figure 245: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 246: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 247: Middle East and Africa Market Value (US$ Million) by Operating System, 2024 to 2034

Figure 248: Middle East and Africa Market Value (US$ Million) by Core, 2024 to 2034

Figure 249: Middle East and Africa Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 250: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 251: Middle East and Africa Market Value (US$ Million) by Industry, 2024 to 2034

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Operating System, 2019 to 2034

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Operating System, 2024 to 2034

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Operating System, 2024 to 2034

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Core, 2019 to 2034

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Core, 2024 to 2034

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Core, 2024 to 2034

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 274: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 275: Middle East and Africa Market Attractiveness by Operating System, 2024 to 2034

Figure 276: Middle East and Africa Market Attractiveness by Core, 2024 to 2034

Figure 277: Middle East and Africa Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 278: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 279: Middle East and Africa Market Attractiveness by Industry, 2024 to 2034

Figure 280: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Workstation Software Market Size and Share Forecast Outlook 2025 to 2035

ESD workstations Market

IVF Workstation Market

Centralized Workstation Market Size and Share Forecast Outlook 2025 to 2035

Sterile Prep-Pack Workstations Market Size and Share Forecast Outlook 2025 to 2035

The Mobile Endoscopic Workstations Market is segmented by Colonoscopes, Enteroscopes, and Gastrointestinal endoscopes from 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA