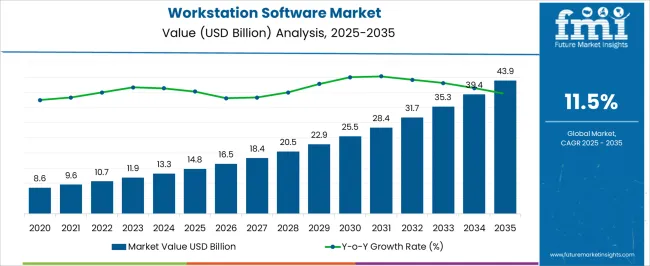

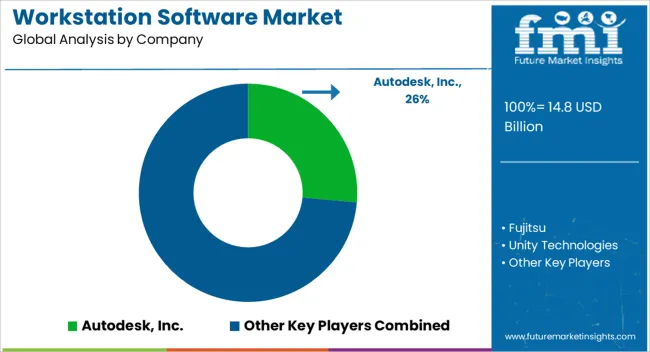

The Workstation Software Market is estimated to be valued at USD 14.8 billion in 2025 and is projected to reach USD 43.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

| Metric | Value |

|---|---|

| Workstation Software Market Estimated Value in (2025 E) | USD 14.8 billion |

| Workstation Software Market Forecast Value in (2035 F) | USD 43.9 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The workstation software market is witnessing steady momentum driven by the increasing demand for advanced visualization, simulation, and design tools across industries such as manufacturing, architecture, and media. The rising complexity of product development cycles and the need for high precision have accelerated the adoption of specialized workstation software.

Continuous advancements in GPU acceleration, cloud integration, and AI powered modeling tools are expanding the capabilities of workstation environments. Furthermore, enterprises are investing in collaborative platforms that enable real time project execution across geographically dispersed teams.

Regulatory and compliance requirements in engineering and design projects are also reinforcing reliance on professional grade workstation solutions. The outlook remains positive as digital transformation initiatives and the pursuit of operational efficiency continue to create growth opportunities for software providers catering to professionals in high performance design and engineering roles.

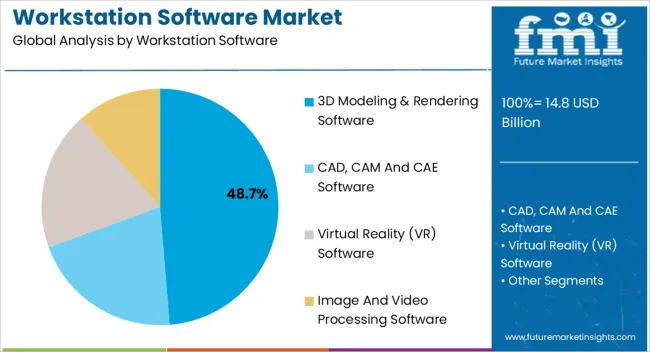

The 3D modeling and rendering software segment is projected to hold 48.70% of total revenue by 2025 within the product category, establishing it as the dominant segment. Its leadership is attributed to growing adoption in industries that rely heavily on visualization, prototyping, and detailed design workflows.

The segment benefits from increasing demand for immersive and realistic rendering, particularly in sectors such as product design, construction, and entertainment. Integration of cloud rendering, real time simulation, and AI assisted design capabilities has enhanced productivity and accuracy for professionals.

This has reinforced preference for 3D modeling and rendering tools, making them a critical component in the workstation software ecosystem and securing their dominant share within the market.

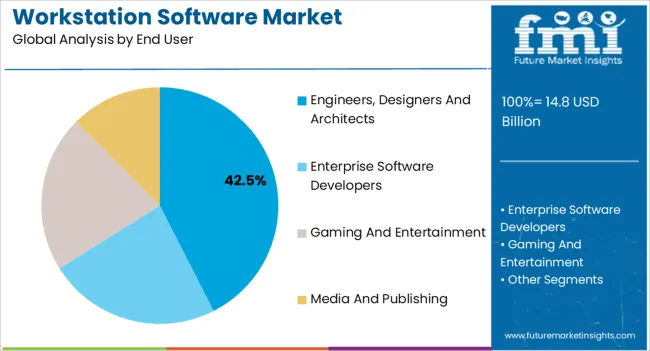

The engineers, designers and architects segment is expected to account for 42.50% of the total revenue by 2025, making it the leading end user group. This dominance is driven by the increasing need for precise design validation, structural visualization, and collaborative development environments.

Professionals in these fields require high performance software to manage complex datasets, conduct simulations, and deliver projects with both accuracy and efficiency. The rising adoption of Building Information Modeling practices and the growing importance of digital twin technologies have further strengthened demand.

Enhanced integration of workstation software with cloud based collaborative platforms has expanded accessibility for distributed teams. These factors have positioned engineers, designers, and architects as the primary users, reinforcing their central role in driving growth within the workstation software market.

The workstation software market was estimated to grow at a CAGR of 9.4% from 2020 to 2025. The rise of requirements for 3D modeling software in the architecture and building sectors is expected to propel the workstation software market forward.

3D modeling is a procedure that uses specialized software for generating a three-dimensional representation of an object. The outcome of this object is referred to as a 3D model, and these 3-dimensional models are employed in a wide range of businesses such as production; entertainment and multimedia, building and architecture, and others.

3D modeling software is becoming more popular in the architecture and construction industries. This is due to the fact that design projects are becoming exceedingly resource-demanding, requiring a lot of memory, processing capacity, and significant graphical processing units.

3D modeling is primarily represented by one CPU core and communication with a 3D program. To succeed in 3D modeling, however, the user must have a workstation CPU with a faster clock rate. A number of firms provide high-configuration workstations with substantial processing power and top clock speed to assist structural and construction firms in creating operational 3D models of buildings and infrastructure designs, consequently boosting demand for 3D modeling software in the workstation software market.

The volume of work accomplished by an application in a particular time frame is referred to as its workload. Every application's ability to administer and process work is limited.

Several organizations use heavy applications for company operations such as financial evaluation, layout, Computer Aided Design (CAD), bulky video editing, and graphics, and if the allocated applications exceed the workload capability, it may take a while to finish or may crash. It turns even more severe when circumstances where a workload requires a large number of computing resources, especially servers or database systems that are assigned a workload at the time of creation.

Workstations, regardless of platform or industry, provide an efficient and optimal solution to the problem of heavy workload applications. Workstations allow for the parallel processing of large applications.

When personal computers first became prevalent the gaming landscape was drastically different. Several gadgets and breakthroughs emerged in response to the major advances in digital technology. However, today's gamers crave high-end games to have superior graphics functionality and a diverse range of genres to discover.

Contemporary gamers now desire near-realistic graphics and a fluid gameplay experience irrespective of the game. As a result, most gamers desire to be competent to play the latest versions with the finest graphics configurations, and heavy-powered gaming workstations are in popular demand. As a result, game enthusiasts spend a significant amount of money on extensively configured workstations in order to play high-end graphics quality games.

Companies have boosted their expenditures on information technology to run business applications effectively and satisfy deadlines as the requirement for workstations in businesses has surged. However, for numerous companies, including SMEs, these expenditure costs are a source of concern.

The dearth of adequate budget remains a major issue for business leaders in order to carry out their IT tasks seamlessly. As a result, the elevated starting price is expected to be an important obstacle in the global workstation software market.

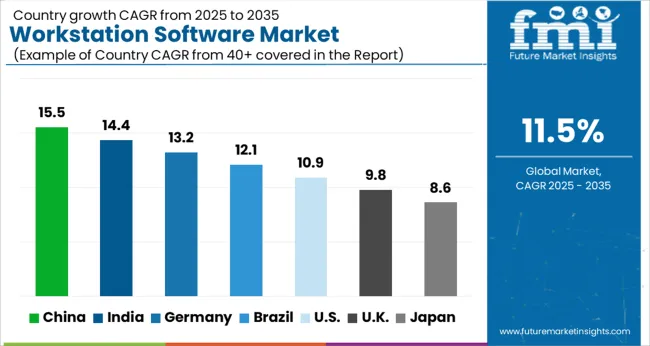

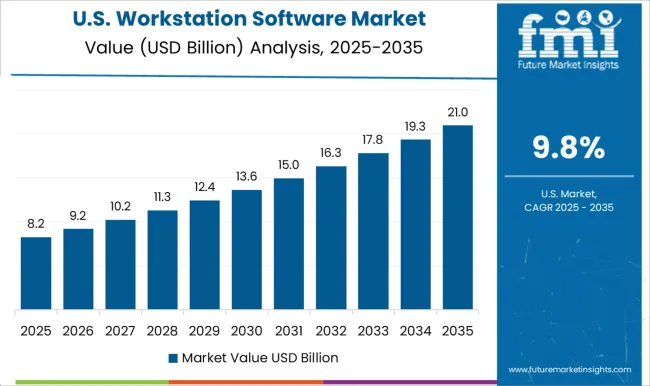

The market is expected to grow at a CAGR of 10.2% through 2035. As a result of the existence of significant workstation software companies in the country, FMI expects the United States to continue as one of the most profitable markets in North America throughout the duration of the forecast. In accordance with projections, the market share of workstations in the United States was expected to be 29.4% in 2025, owing to an increase in mobile workstations throughout the country.

Increased demand, particularly from the architecture and production industries, has fueled the growth of the USA workstation software market. In addition, the rapid rise in demand for 3D animation innovation, constant technological advancement, and ongoing studies and research are expected to contribute to market growth in this country.

Europe is making significant strides in the fields of content development, advertising and marketing, and video gaming sectors. The market in the United Kingdom is expected to expand at a CAGR of 13.9% over the upcoming decades.

In regard to market share, the United Kingdom controls more than 20% of the 3D rendering and modeling market. The requirement is primarily coming from automobile makers, who are looking for novel technologies and approaches that decrease development duration, minimize production intensity, fully utilize external resources, and incorporate and collaborate with their global suppliers.

The rising demand for workstation software products across a variety of industries is propelling the United Kingdom’s workstation software market forward.

China has one of the world's largest markets for computing resources. Dell and Huawei are among the companies best positioned to profit. The workstation software market in China is anticipated to expand at a CAGR of 10.1% over the forecast period.

The Chinese government prioritizes the early adoption of new technologies and heavily subsidizes firms in developing industries. It is committed to propelling the country's virtual and computing markets, creating significant business opportunities for workstation software vendors. The government is constantly investing in cloud and related ICT technologies to improve digital transformation, which is estimated to drive the growth of the China workstation software systems market.

Over the past few years, the demand for workstation software has increased in industries such as media & entertainment, and gaming.

According to the study, the demand from the media & publishing segment will continue rising at a high pace. It was expected to account for over 33.5% of sales in the global market.

Increasing access to Virtual Reality (VR) is creating new opportunities for product design and manufacturing, from initial design concepts to sales. Some uses of VR are extensions of existing use cases, while others are completely new. These technologies have huge market potential to become the next-generation computing platform.

For users that are creating VR content, additional CPU cores can make a difference, depending on the VR content creation software. Many 3D manipulation and rendering programs scale well with multiple cores, as does stereoscopic video editing. Several 3D modeling software development companies are continuously innovating, upgrading, and developing advanced software to expand their presence in the VR market.

Recent Developments

To achieve a competitive edge, market participants are concentrating on innovation and strategic collaborations. For instance,

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 11.5% from 2025 to 2035 |

| Market Value in 2025 | USD 14.8 billion |

| Market Value in 2035 | USD 43.9 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Segments Covered | Workstation Software, End User, Region |

| Key Companies Profiled | Autodesk, Inc.; Fujitsu; Unity Technologies; Adobe Inc.; Virtuix; Corel Corporation; Microsoft Corporation; Dassault Systèmes SolidWorks Corporation; GIMP; SubVRsive Inc.; Survios; Luxion Inc. |

| Customization & Pricing | Available upon Request |

The global workstation software market is estimated to be valued at USD 14.8 billion in 2025.

The market size for the workstation software market is projected to reach USD 43.9 billion by 2035.

The workstation software market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in workstation software market are 3D modeling & rendering software, cad, cam and cae software, virtual reality (vr) software and image and video processing software.

In terms of end user, engineers, designers and architects segment to command 42.5% share in the workstation software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Workstation Market Trends - Growth & Forecast 2025 to 2035

ESD workstations Market

IVF Workstation Market

Centralized Workstation Market Size and Share Forecast Outlook 2025 to 2035

Sterile Prep-Pack Workstations Market Size and Share Forecast Outlook 2025 to 2035

The Mobile Endoscopic Workstations Market is segmented by Colonoscopes, Enteroscopes, and Gastrointestinal endoscopes from 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Multichannel Electrochemical Workstation Market Size and Share Forecast Outlook 2025 to 2035

Demand for Multichannel Electrochemical Workstations in UK Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA