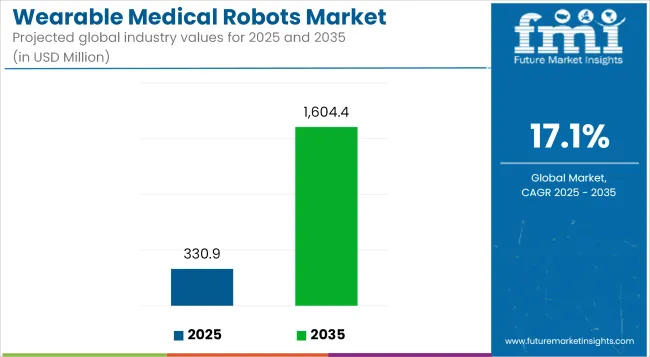

The Wearable Medical Robots Market is estimated to reach USD 330.9 Million by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 17.1%, reaching a total value of USD 1,604.4 Million by the end of the assessment period.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 330.9 Million |

| Market Value (2035) | USD 1,604.4 Million |

| CAGR (2025 to 2035) | 17.1% |

The wearable medical robots market is set to expand rapidly, propelled by technological convergence in robotics, artificial intelligence, and sensor-based feedback systems. Healthcare providers are increasingly prioritizing wearable exoskeletons and assistive devices to improve gait rehabilitation and reduce caregiver burden, especially in post-stroke and spinal cord injury populations.

Regulatory agencies have progressively refined approval pathways for wearable robotic systems, creating a favorable environment for commercialization and clinical deployment. Strategic funding initiatives and public-private partnerships have further strengthened research and development pipelines.

The market growth is expected to be underpinned by expanding reimbursement policies, growing demand for aging-related mobility solutions, and the adoption of personalized robotic interventions tailored to individual rehabilitation needs.

In 2025, assistive robots are anticipated to hold a 38.2% revenue share in the wearable medical robots market. This segment’s prominence has been driven by their ability to augment patient strength, stabilize gait, and facilitate independent movement in daily living activities. Clinical evidence has reinforced the role of assistive robots in enhancing safety and reducing fall risks among individuals with neurological impairments.

Regulatory bodies have approved several assistive platforms after demonstrating favorable safety profiles and tangible functional improvements. Advances in lightweight materials, ergonomic designs, and adaptive control systems have improved patient comfort and usability, further catalyzing demand.

Rehabilitation applications are projected to account for 41.7% of the market share in 2025. This segment’s growth has been supported by strong clinical validation showing significant improvements in muscle re-education, range of motion, and neuroplasticity when wearable robots are used as part of therapy protocols.

Healthcare systems have increasingly integrated robotic rehabilitation programs to address the growing burden of stroke, traumatic injuries, and degenerative neurological disorders. Physicians and Rehabilitation therapists have endorsed wearable robots as effective adjuncts to conventional physiotherapy, driving patient engagement and compliance.

High Development and Acquisition Costs

Wearable medical robots, in particular, exoskeletons, are costly in their development and manufacturing because these require advanced materials, sensors, and control algorithms. This exorbitant cost then carries to the retail price of such products, which keeps them far from the reach of smaller health institutions and individual users in poor areas.

Complex Regulatory and Safety Approvals

Heavy expense will be incurred by health care environment under patient interactions for safety as well as regulatory standards. Non-harmonized approving processes all over the world, therefore, also slow down the commercialization process with very long clinical testing periods.

Rising Demand for Rehabilitation and Mobility Assistance

The need for effective rehabilitation tools is growing with the increasing old population, rising incidence of stroke, spinal cord injuries, and musculoskeletal disorders. More and more wearable medical robots are coming into practice to assist patients with mobility problems and speed up their healing process while improving their quality of life.

Integration of AI and Smart Technologies

The advancement of artificial intelligence, machine learning, and wearable sensor technology gives way towards the manufacture of highly adaptive and responsive robotic systems. This technological incorporation makes wearable robots so much more intuitive, efficient, and user-friendly that their application would extend beyond hospitals into the home and workplace support.

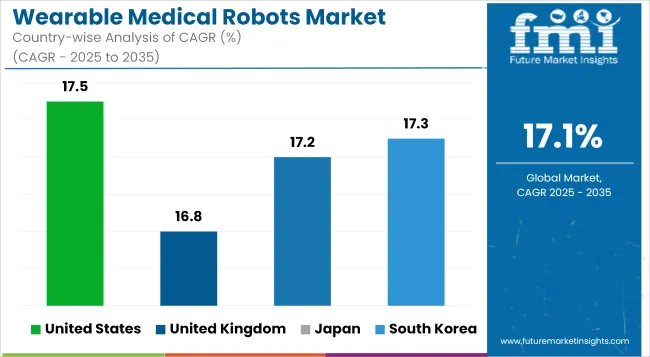

USA has its dominance because of the very high adoption rate of medical robotics, significant investments in R&D, and also very important tech-innovators. In rehabilitation, focused multipurpose hospitals and military healthcare systems have developed very quickly the use of wearable mobility exoskeletons for older and disabled populations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 17.5% |

UK market of wearable medical robots is growing with new NHS-backed pilot trials and partnerships with academia to foster innovation. To add, public and private healthcare facilities are improving technologies such as assisted living and rehabilitation robotics for stroke and spinal cord patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 16.8% |

The EU Market is thriving because of cooperative research projects and the funding it receives under Horizon Europe. Furthermore, it is very well embedded in eldercare and neuro-rehabilitation. Germany, France and the Netherlands have a leading role in terms of clinical trials and early stages of the commercial deployment of robotic wearables, especially in the areas of orthopaedics and neurology.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 17.0% |

Highly bent toward action by its rapidly aging populace and government support for robotics in the health care field place an emerging growth hub into Japan. Local companies are making strides in developing small and easy-to-use exoskeletons for senior mobility and physical rehabilitation. The demand generated from hospitals and homecare sections is becoming less stable.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.2% |

South Korea's smart medical infrastructures and university-industry collaboration with robotics startups, market penetration is thus hastened. However, there is increasing demand for wearable robotic suits in rehabilitation centers and used by the elderly for house assist, in metropolitan cities with an aging population.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.3% |

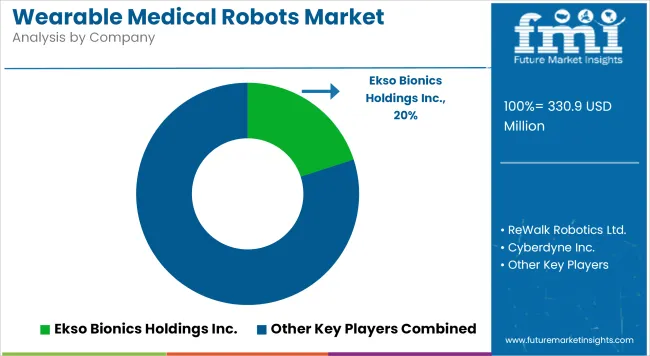

The wearable medical robots market is an emerging and competitive segment at the intersection of robotics, rehabilitation, and assistive technology. Leading companies are developing advanced exoskeletons and robotic orthoses to restore mobility, enhance strength, and support recovery after neurological or musculoskeletal injuries.

Strategic acquisitions, clinical partnerships, and regulatory milestones are driving commercialization and broadening applications from rehabilitation centers to home-based care. Additionally, the integration of AI, machine learning, and adaptive control algorithms is enabling more personalized, responsive assistance. Emphasis on lightweight designs, intuitive interfaces, and improved battery life is further differentiating products in this evolving landscape.

The overall market size for Wearable Medical Robots market was USD 330.9 Million in 2025.

The Wearable Medical Robots market is expected to reach USD 1,604.4 Million in 2035.

The demand for wearable medical robots will be driven by rising cases of physical disabilities, growing adoption in rehabilitation and surgery, technological advancements, and increased demand for patient-specific mobility and therapeutic support solutions.

The top 5 countries which drives the development of Wearable Medical Robots market are USA, European Union, Japan, South Korea and UK

Assistive Robots demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Beauty Market Size, Growth, and Forecast for 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Wearable Fitness Technology Market Insights - Trends & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Wearable Healthcare Devices Market Insights - Growth & Forecast 2024 to 2034

Wearable Glucometers Market

Wearable Thermometers Market

Wearable Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA