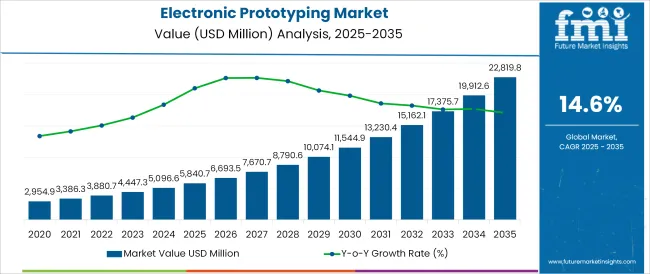

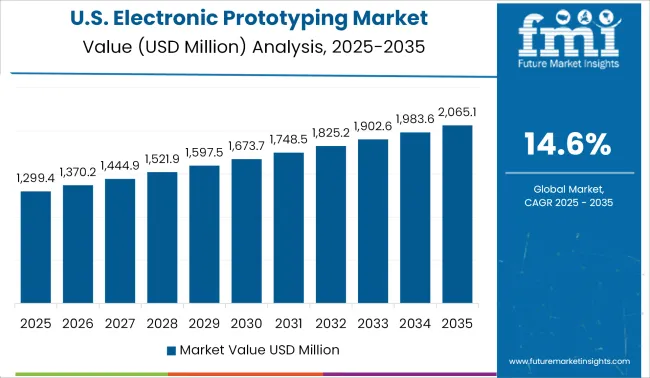

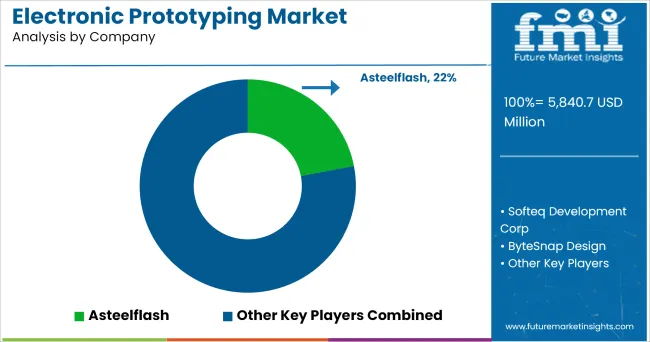

The Electronic Prototyping Market is estimated to be valued at USD 5840.7 million in 2025 and is projected to reach USD 22819.8 million by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period.

The electronic prototyping market is gaining strong traction as industries prioritize rapid innovation, faster time to market, and real-time testing of complex circuit designs. Shortened product development cycles in electronics manufacturing have created a sustained need for prototyping platforms that support fast iteration, modular design, and simulation accuracy. This demand is further fueled by the integration of advanced materials, IoT devices, and edge computing solutions that require precise electronic validation before mass production.

Software-based design environments with AI assisted layout optimization, real-time collaboration tools, and digital twin capabilities are redefining how prototypes are developed and tested. PCB layout platforms, 3D modeling environments, and simulation software are now critical to design validation across consumer, industrial, and automotive domains.

Additionally, the growing start-up ecosystem in hardware innovation, combined with the surge in low-volume/high-complexity device production, is opening up new opportunities. Future growth will depend on scalable, cloud-based platforms that integrate design, testing and compliance workflows seamlessly across distributed teams and geographies.

The market is segmented by Type, Solution, and Applications and region. By Type, the market is divided into PCB Prototyping and Electronic Product Prototyping. In terms of Solution, the market is classified into Software and Services. Based on Applications, the market is segmented into Consumer Electronics, Industrial, Automotive, Internet of Things, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

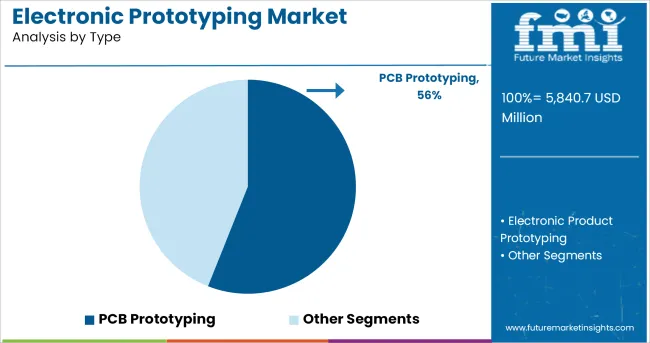

PCB prototyping is projected to account for 56.0% of the total revenue share in 2025, establishing it as the dominant type in the electronic prototyping market. This leadership is being driven by the central role of printed circuit boards in virtually all electronic devices, necessitating precise prototyping for layout validation, signal integrity, and manufacturability.

PCB prototyping platforms enable iterative testing of multi-layer designs, embedded components, and high-speed signal paths, reducing design errors and rework. With increasing complexity in circuit density and shrinking form factors, the need for high-fidelity PCB prototypes has intensified, particularly in high performance computing, wearable electronics, and automotive control systems.

The proliferation of high-speed prototyping tools such as laser etching, CNC milling, and 3D-printed substrates has further accelerated adoption. The ability to rapidly test, revise, and finalize PCBs before full-scale production has solidified this segment's dominance in the market.

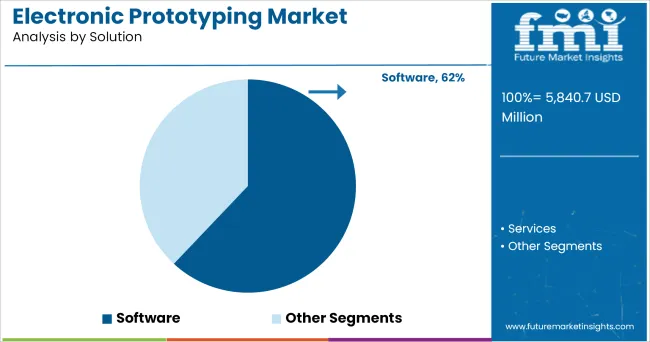

Software solutions are projected to hold 62.0% of the market share in 2025, leading the electronic prototyping solution segment. This dominance is attributed to the critical role software plays in design, simulation, and collaboration during the prototyping phase. Electronic design automation (EDA) tools, circuit simulation platforms, and layout editors have become indispensable in managing increasingly complex board designs.

Cloud-enabled platforms offer cross-team collaboration, AI-based design assistance, and integrated compliance checks, streamlining the entire prototyping workflow. The ability to visualize, test, and iterate virtually before physical fabrication reduces cost and shortens development cycles particularly important in agile development environments.

Additionally, open-source software ecosystems and API integrations with fabrication services have expanded accessibility, reinforcing software’s central role in prototyping processes across industries.

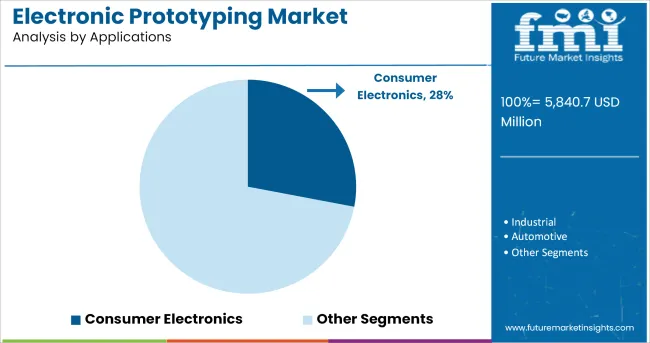

The consumer electronics segment is forecast to contribute 28.0% of total market revenue in 2025, making it the leading application area for electronic prototyping. This leadership has been fuelled by constant demand for product differentiation, rapid innovation, and miniaturization in smartphones, wearables, home automation, and entertainment devices.

Short product life cycles and high competition in this sector require companies to test new features, interfaces, and architectures quickly necessitating fast-turnaround prototyping platforms. Additionally, demand for customized hardware and IoT connectivity has increased the complexity of circuit design, further elevating the importance of accurate and agile prototyping.

Manufacturers are relying on integrated software and hardware testing environments to meet functionality, thermal management, and power efficiency requirements. With global consumer preferences evolving rapidly and supply chain timelines tightening, prototyping has become a critical enabler for success in the consumer electronics value chain.

PCB prototyping is used by PCB designers for testing the functionality of solutions with every new change. It also allows designers and teams to test at every stage of design. As per the requirements, they make adjustments to tailor the solution before the run of full production. Such benefits of electronic prototyping are helping the market to grow in upcoming years.

Before creating the final product, engineers go through several iterations for developing a PCB design and this can be a lengthy process. Electronic prototyping helps in speeding up the manufacturing process and design through complete testing, visual assistance and minimized rework. Reducing the timeline for fabricating prototypes is driving the growth of electronic prototyping.

Industries like consumer electronics are using electronic prototyping for functional testing, PCB design, conditional testing and final product design. The solution provides accurate and reliable prototypes, which makes it easier to solve issues of design throughout the development of the process.

Electronic prototypes help consumer electronics determine the adjustment of products or packaging for the final PCB design. At the back of such a trend, the market for electronic prototyping is expected to grow in upcoming years.

The automotive industry is adopting electronic prototyping as the solution that helps to reduce manufacturing costs. With the help of prototyping solutions, the industry is improving product quality and also reducing the cost of process of manufacturing. Such trends are continuously contributing to the growth of electronic prototyping.

South Asia is becoming one of the advanced regions for manufacturing PCB designs for many key vendors with the help of advanced technology as labour is cheap. The government is also supporting the development of new industries, working in this area of the solution.

It has been found that South Asia people are strongly supporting new technological advancements and also demand testing design, functionality, appearance, safety and manufacturability for an electronic product. Such penetration will create many opportunities for electronic prototyping in the upcoming years in this region.

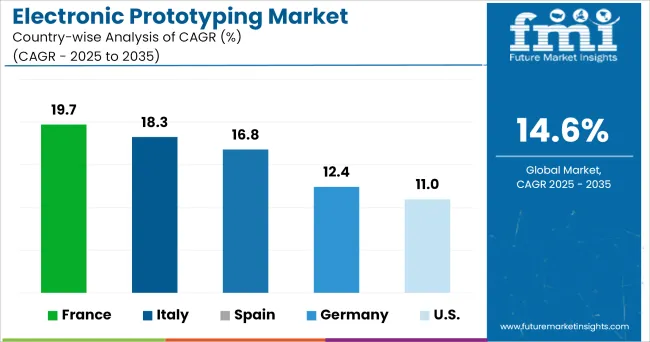

The Europe region is going to hold a significant share of the electronic prototyping market from 2024 to 2035. The reason behind this is the presence of major solution providers in the region. Europe region is having the largest market for PCB prototyping and electronic product prototyping in many industries like consumer electronics, automotive, industrial, internet of things and other.

Hence, due to extended boundaries of prototypes in electronics prototypes, computer software, and computer engineering, the demand for electronic prototypes continues to grow in this region during the forecast period.

Some of the leading vendors of electronic prototyping include

These vendors are adopting various key strategies, to increase their customer base locally and globally. They are also spending millions of dollars on product R&D to fulfil the unmet needs of their customers for electronic prototyping.

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global electronic prototyping market is estimated to be valued at USD 5,840.7 million in 2025.

The market size for the electronic prototyping market is projected to reach USD 22,819.8 million by 2035.

The electronic prototyping market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in electronic prototyping market are pcb prototyping and electronic product prototyping.

In terms of solution, software segment to command 62.0% share in the electronic prototyping market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA