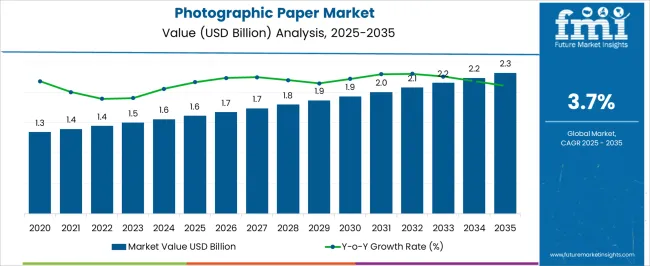

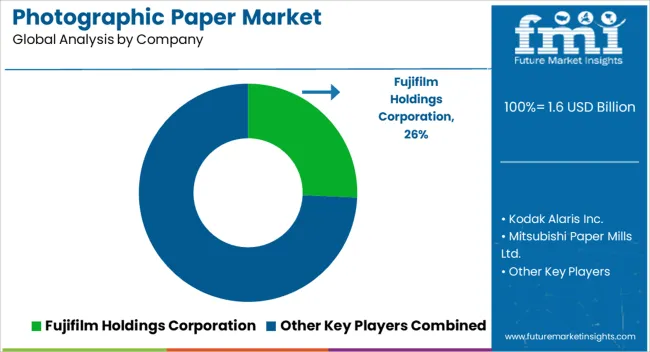

The Photographic Paper Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Photographic Paper Market Estimated Value in (2025 E) | USD 1.6 billion |

| Photographic Paper Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The Photographic Paper market is experiencing steady growth driven by the sustained demand for high-quality imaging solutions across commercial, professional, and consumer applications. The current market scenario is characterized by the adoption of advanced materials and coating technologies that improve print clarity, durability, and color fidelity. The market is being shaped by rising popularity of photography-based businesses, increasing personalization of prints, and expanding e-commerce platforms facilitating easy access to photographic products.

Additionally, the shift towards high-resolution imaging devices has heightened the need for papers that support superior print quality and longevity. Investments in innovative material compositions and manufacturing processes are allowing producers to cater to varying thickness requirements and application-specific needs.

The future outlook for this market is promising, with growth being driven by consumer preference for premium photographic experiences, increasing digitization of print services, and the availability of diversified distribution channels that enhance product accessibility As professional and personal printing applications continue to expand, the Photographic Paper market is anticipated to sustain strong revenue growth globally.

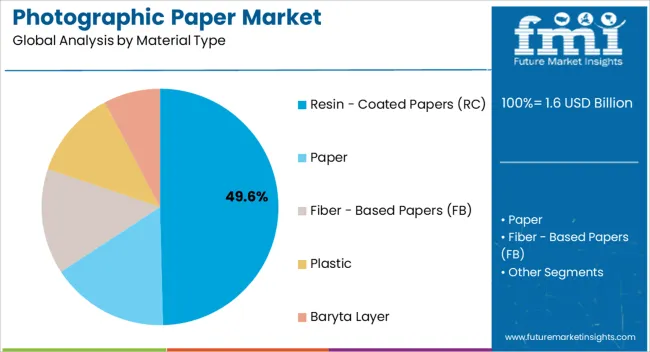

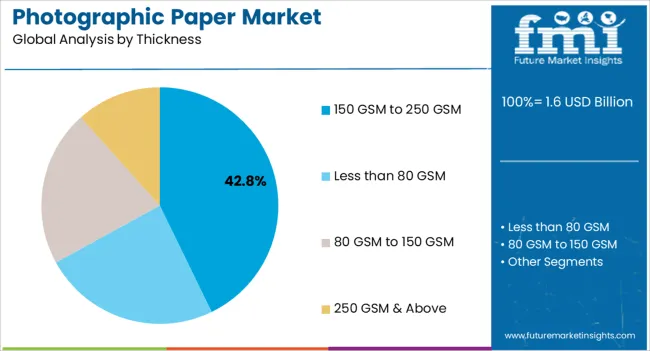

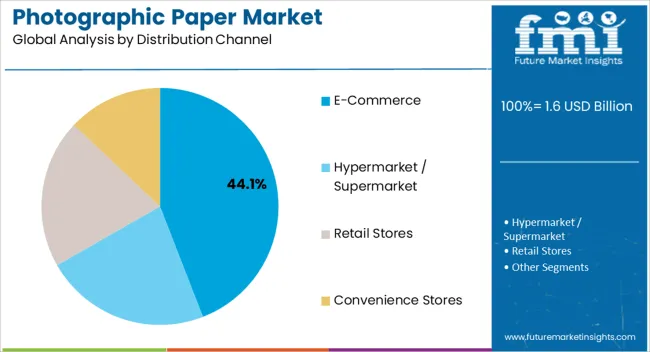

The photographic paper market is segmented by material type, thickness, distribution channel, end use, and geographic regions. By material type, photographic paper market is divided into Resin - Coated Papers (RC), Paper, Fiber - Based Papers (FB), Plastic, and Baryta Layer. In terms of thickness, photographic paper market is classified into 150 GSM to 250 GSM, Less than 80 GSM, 80 GSM to 150 GSM, and 250 GSM & Above. Based on distribution channel, photographic paper market is segmented into E-Commerce, Hypermarket / Supermarket, Retail Stores, and Convenience Stores. By end use, photographic paper market is segmented into Commercial, Household, and Others. Regionally, the photographic paper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Resin-Coated Papers (RC) material type is projected to hold 49.60% of the Photographic Paper market revenue share in 2025, making it the leading material segment. This dominance is being attributed to the superior water resistance, faster drying time, and enhanced image sharpness provided by RC papers. The coating enables high-gloss finishes that improve print aesthetics and durability, which are particularly valued in professional photography and commercial printing environments.

Growth has been further reinforced by the material’s compatibility with a wide range of printing devices and its ability to produce consistent results across multiple print runs. Resin-coated papers also offer improved archival quality and reduced susceptibility to environmental damage, factors that have enhanced their preference among end users.

The widespread adoption of RC papers in studio setups, photo labs, and specialized printing services has cemented its leading position in the market Future expansion is expected to be supported by continued innovations in coating formulations and production processes that further enhance performance and cost-effectiveness.

The 150 GSM to 250 GSM thickness segment is expected to account for 42.80% of the Photographic Paper market revenue share in 2025, emerging as the most preferred range. This prominence is being driven by the balance between flexibility, print quality, and durability offered by papers within this thickness range. These papers are capable of handling high-resolution printing while maintaining structural integrity, which is particularly important for professional photo albums, commercial displays, and high-quality prints.

Adoption has been encouraged by the growing demand for standardized thickness ranges that ensure compatibility with a wide array of printers and finishing equipment. The thickness range also facilitates ease of handling and framing without compromising print fidelity.

As photographers and commercial printers increasingly seek reliable and versatile paper options, the 150 GSM to 250 GSM segment is expected to continue leading the market Continuous improvements in paper density uniformity and surface coatings are likely to enhance the appeal of this segment further in the coming years.

The E-Commerce distribution channel segment is projected to hold 44.10% of the Photographic Paper market revenue share in 2025, representing the largest distribution method. This dominance is being fueled by the convenience, wide selection, and accessibility offered to consumers and businesses through online platforms. E-commerce channels enable end users to compare products, access premium photographic papers, and benefit from home delivery or bulk ordering, which has strengthened adoption.

Growth is being supported by the increasing penetration of digital platforms, rising internet connectivity, and the convenience of integrated payment and logistics services. Moreover, E-commerce facilitates direct engagement between manufacturers and consumers, allowing for faster introduction of innovative products and materials.

The segment has further benefited from global trends toward contactless and remote purchasing, particularly in regions where retail availability is limited As the shift toward online shopping continues across commercial and professional sectors, E-commerce is expected to remain the leading distribution channel in the Photographic Paper market.

In the recent years, the printing industry has seen significant growth due to adoption of better printing technology, which increases aesthetic look of the product. Photographic paper is layered with a light sensitive chemical that is used for creating photographic prints. Photographic paper when exposed to light can capture the image/picture and can be developed as a visible picture. Photographic paper is mainly made of fiber-based paper (FB) and resin-coated paper (RC) with baryta layer (barium sulfate) as a photographic emulsion.

In addition, photographic paper also helps in developing image on the paper only by fixing and clearing. Furthermore, photographic paper can also imprint high-quality image in order to replicate a better captured object. Due to excellent high-quality imaging on photographic paper, it can be used for making hoardings, posters, magazines, etc.

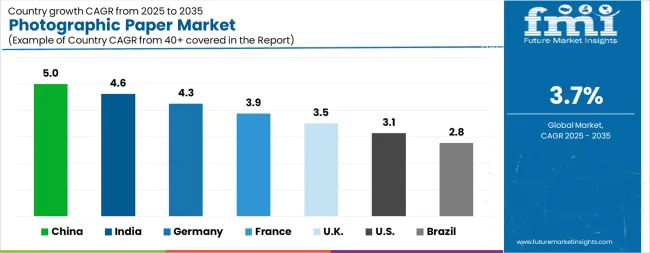

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| U.K. | 3.5% |

| U.S. | 3.1% |

| Brazil | 2.8% |

The Photographic Paper Market is expected to register a CAGR of 3.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.0%, followed by India at 4.6%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.8%, yet still underscores a broadly positive trajectory for the global Photographic Paper Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.3%. The U.S. Photographic Paper Market is estimated to be valued at USD 554.4 million in 2025 and is anticipated to reach a valuation of USD 755.6 million by 2035. Sales are projected to rise at a CAGR of 3.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 80.2 million and USD 44.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Material Type | Resin - Coated Papers (RC), Paper, Fiber - Based Papers (FB), Plastic, and Baryta Layer |

| Thickness | 150 GSM to 250 GSM, Less than 80 GSM, 80 GSM to 150 GSM, and 250 GSM & Above |

| Distribution Channel | E-Commerce, Hypermarket / Supermarket, Retail Stores, and Convenience Stores |

| End Use | Commercial, Household, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fujifilm Holdings Corporation, Kodak Alaris Inc., Mitsubishi Paper Mills Ltd., Hahnemühle FineArt GmbH, HP Inc., Ilford Imaging Europe GmbH, Canon Inc., Epson America, Inc., Harman Technology Limited, and Canson Infinity |

The global photographic paper market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the photographic paper market is projected to reach USD 2.3 billion by 2035.

The photographic paper market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in photographic paper market are resin - coated papers (rc), paper, fiber - based papers (fb), plastic and baryta layer.

In terms of thickness, 150 gsm to 250 gsm segment to command 42.8% share in the photographic paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Photographic Film Processing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA