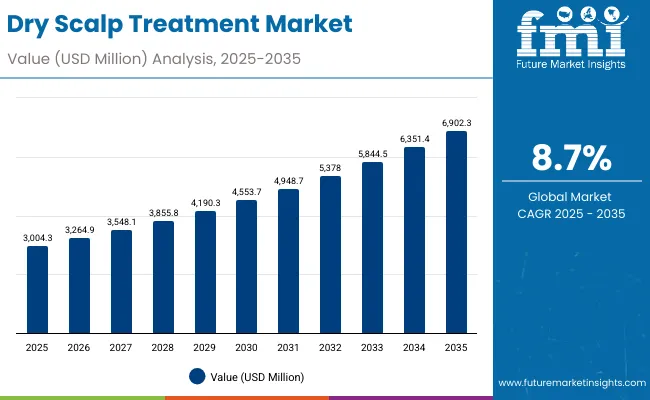

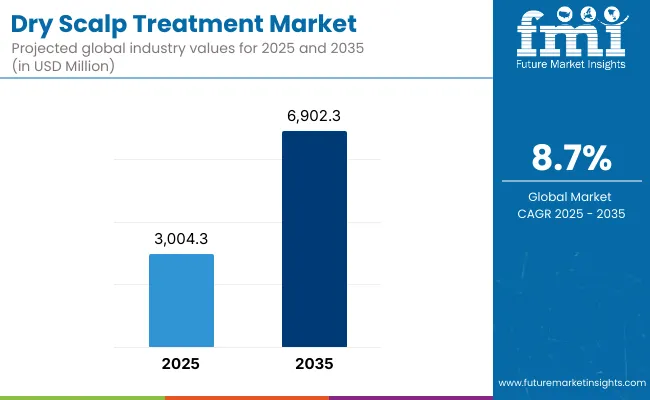

A valuation of USD 3,004.3 Million is anticipated for the dry scalp treatment market in 2025, with the size projected to reach USD 6,902.3 Million by 2035. This progression reflects an absolute increase of USD 3,898.0 Million over the decade, equivalent to a near doubling of the market. Growth is forecast at a CAGR of 8.7% during 2025 to 2035, positioning the industry for consistent expansion as scalp health becomes a higher consumer priority.

Dry Scalp Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| DRY SCALP TREATMENT Market Estimated Value in (2025E) | USD 3,004.3 Million |

| DRY SCALP TREATMENT Market Forecast Value in (2035F) | USD 6,902.3 Million |

| Forecast CAGR (2025 to 2035) | 8.7% |

During the initial half of the forecast period, spanning 2025 to 2030, the market is set to grow from USD 3,004.3 Million to USD 4,553.7 Million, adding USD 1,549.4 Million. This phase is expected to account for nearly 40% of the total decade’s growth, supported by steady adoption of medicated shampoos and growing availability of multifunctional scalp solutions.

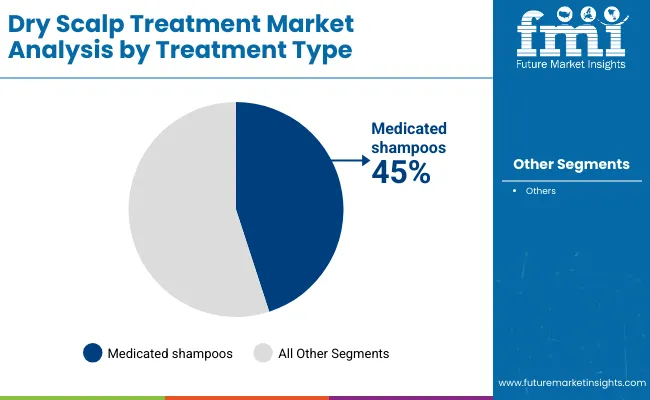

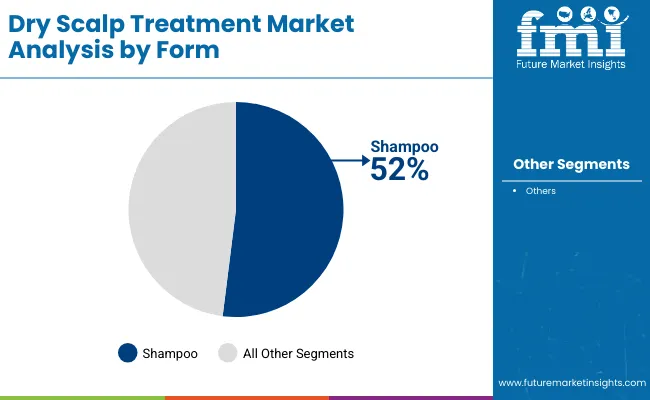

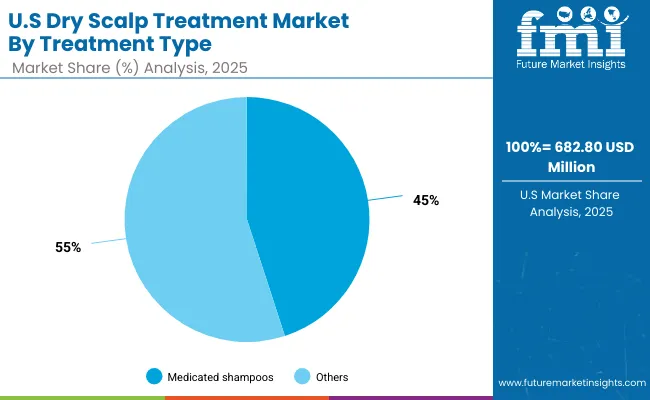

Medicated shampoos are projected to dominate the treatment type segment with a 45% share in 2025, reflecting strong consumer trust in clinically validated products. Shampoos by form are also expected to lead the market with a 52% share in 2025, as convenience-driven formats remain the preferred choice.

The second half of the forecast horizon, from 2030 to 2035, is anticipated to contribute USD 2,348.6 Million, equal to around 60% of the decade’s growth, as the market expands from USD 4,553.7 Million to USD 6,902.3 Million. This acceleration is expected to be driven by broader penetration of advanced active ingredients, rising consumer interest in sensitive-skin safe and dermatologist-tested formulations, and sustained momentum across emerging regions such as China and India.

From 2020 to 2024, the market has been shaped by heightened awareness of scalp health and the rising need for clinically proven formulations. By 2025, the industry is expected to reach USD 3,004.3 Million, with medicated shampoos projected to dominate the treatment type category due to their high clinical acceptance. Shampoos as a form are anticipated to secure the highest share at 52%, reflecting their convenience and consumer familiarity.

Over the decade, revenue is projected to expand to USD 6,902.3 Million by 2035, nearly doubling in size. Growth is expected to be driven by increasing demand in China and India, supported by double-digit CAGR trajectories. Competitive positioning is likely to shift as established players emphasize dermatologist-tested and sensitive-skin safe innovations, while emerging brands leverage natural and clean-label claims. Market advantage is expected to increasingly rely on formulation science, efficacy validation, and consumer trust rather than price competitiveness alone.

Growth in the dry scalp treatment market is being propelled by rising awareness of scalp health and the increasing prioritization of holistic personal care. Greater consumer focus on dermatologist-tested and sensitive-skin safe products is expected to support consistent adoption. The prevalence of lifestyle-related scalp conditions has been observed to expand demand for targeted formulations, while the clean-label trend is projected to reinforce consumer trust in natural and sustainable solutions.

Rapid urbanization and increased exposure to environmental pollutants are being linked with higher incidences of scalp irritation, creating broader opportunities for specialized treatments. Expansion of e-commerce channels has been enabling improved product accessibility, particularly in emerging regions such as China and India where double-digit growth rates are anticipated.

Formulation advances, including the integration of active ingredients such as salicylic acid and botanicals, are projected to strengthen product efficacy. The market outlook is expected to remain favorable as innovation, efficacy validation, and premium positioning reshape consumer preferences.

The dry scalp treatment market has been segmented on the basis of treatment type, form, active ingredient, distribution channel, and geography. Each of these segments is projected to shape growth patterns differently, reflecting distinct consumer needs and evolving product preferences. By treatment type, medicated shampoos are anticipated to remain highly relevant, supported by strong dermatologist endorsements and clinical credibility.

Alternative categories such as serums, oils, and scalp masks are expected to expand more rapidly, driven by demand for holistic and lifestyle-oriented solutions.In terms of form, shampoos are forecast to dominate as the most widely adopted format due to ease of integration into daily routines.

However, niche categories like serums and scrubs are likely to gain momentum as consumers explore multi-step scalp care. Active ingredients are anticipated to play a decisive role in market differentiation, with salicylic acid retaining trust as a proven clinical option, while botanicals and antifungal agents broaden the product spectrum.

Distribution through pharmacies and drugstores is expected to remain strong, while e-commerce channels are projected to gain prominence, particularly in Asia and emerging markets. Collectively, these segments are likely to define the market’s growth trajectory through 2035.

| Treatment Type | Market Value Share, 2025 |

|---|---|

| Medicated shampoos | 45% |

| Others | 55.0% |

In 2025, medicated shampoos are expected to command 45% of the global market, valued at USD 1351.94 Million. Their dominance is projected to continue as consumer preference for clinically validated and dermatologist-approved products strengthens. These formulations are being increasingly relied upon for long-term scalp health management, particularly in addressing persistent dandruff and irritation.

Other treatment types are anticipated to contribute USD 1652.37 Million, supported by rising adoption of leave-in solutions, oils, and scalp masks that appeal to natural and holistic care seekers. Continued innovation across categories is expected to fuel balanced growth, but medicated shampoos are projected to remain the foundation of the segment owing to their credibility and proven effectiveness.Insights into the Form Segment with Shampoos Dominating the Market

| Form | Market Value Share, 2025 |

|---|---|

| Shampoo | 52% |

| Others | 48.0% |

By 2025, shampoos are projected to capture 52% of the dry scalp treatment market, valued at USD 1562.24 Million. This dominance is anticipated as shampoos remain a preferred form due to ease of use, integration into daily routines, and widespread availability across channels. Consumer trust in this format is expected to secure continued relevance, especially as medicated and specialized variants gain traction.

Other forms, valued at USD 1442.06 Million, are also forecast to grow, driven by rising acceptance of serums, scrubs, and masks that support intensive scalp care routines. Diversification of product formats is likely to intensify, yet shampoos are expected to retain leadership through their accessibility, affordability, and consistent performance across global markets.

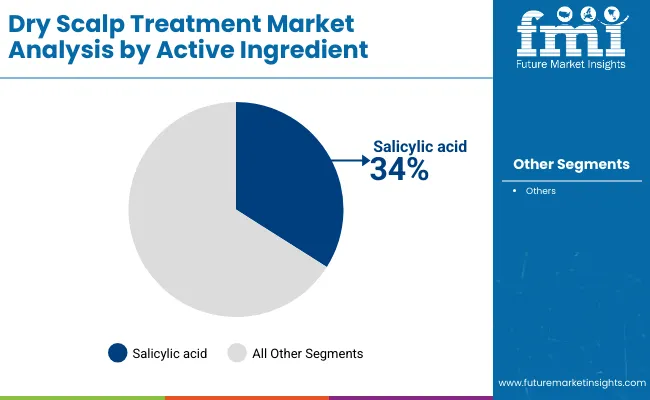

| Active Ingredient | Market Value Share, 2025 |

|---|---|

| Salicylic acid | 34% |

| Others | 66.0% |

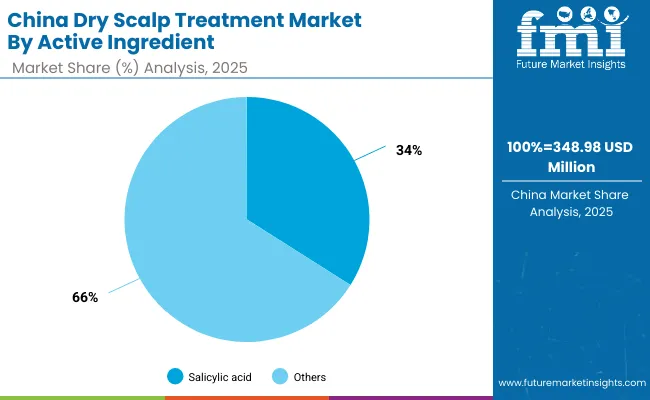

Salicylic acid-based formulations are forecast to account for 34% of the dry scalp treatment market in 2025, valued at USD 1021.46 Million. Growth is being driven by their proven efficacy in exfoliation, flake reduction, and scalp renewal. These properties are expected to keep salicylic acid highly relevant in treatment-focused products, particularly in medicated shampoos.

Other active ingredients are projected to dominate with 66% of the market, equivalent to USD 1982.84 Million, fueled by increased interest in botanical solutions, antifungal agents, and advanced synthetic blends. Expansion of dermatologist-tested and sensitive-skin safe options is anticipated to enhance this segment further. While broader innovation will diversify ingredient profiles, salicylic acid is projected to remain a benchmark active, sustaining strong consumer confidence.

Increasing consumer awareness of scalp health is being balanced against affordability concerns, as premium formulations gain prominence. While broader access to evidence-backed treatments is anticipated, cost sensitivity in emerging regions may shape the speed and scale of overall market adoption.

Dermatologist-Tested and Sensitive-Skin Safe Innovations Market momentum is expected to be accelerated by the rising validation of products through dermatologist endorsements and sensitive-skin certifications. Greater clinical backing is being translated into higher consumer trust, particularly among individuals experiencing recurrent scalp conditions.

As regulatory bodies and dermatology associations emphasize science-backed formulations, adoption of these products is projected to expand significantly. The influence of dermatologist-tested claims is anticipated to extend beyond premium categories, reshaping mass-market portfolios and fueling competitive differentiation across geographies.

Price Accessibility and Consumer Affordability Gaps

Despite the market’s upward trajectory, challenges are anticipated due to the higher costs associated with medicated shampoos, specialized serums, and branded clean-label treatments. In price-sensitive economies, the gap between premium and mass-market offerings is expected to hinder uniform adoption.

Consumers may delay switching to clinically validated options, particularly where traditional or low-cost remedies remain available. Unless affordability strategies and scaled distribution models are introduced, this restraint could slow penetration rates in developing markets. Consequently, cost barriers are expected to remain a limiting factor for widespread access, even as product innovation and efficacy continue to advance.

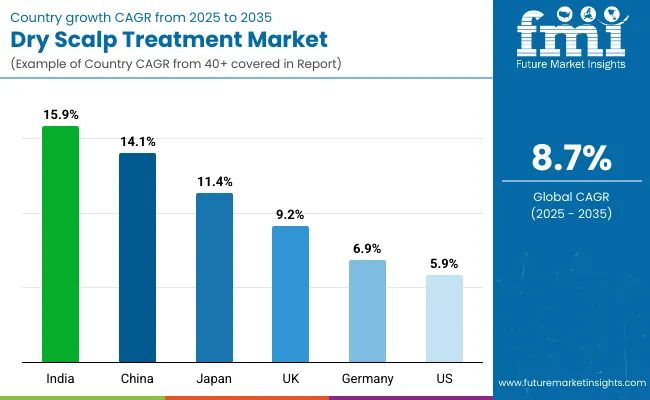

| Country | CAGR |

|---|---|

| China | 14.1% |

| USA | 5.9% |

| India | 15.9% |

| UK | 9.2% |

| Germany | 6.9% |

| Japan | 11.4% |

The growth trajectory of the dry scalp treatment market is projected to vary significantly across leading economies, shaped by consumer awareness, dermatological focus, and retail expansion. Asia is expected to emerge as the fastest-growing region, anchored by India at a CAGR of 15.9% and China at 14.1%. India’s momentum is anticipated to be supported by expanding urban middle-class consumers and increasing acceptance of specialized scalp care beyond traditional remedies. China’s growth is expected to be driven by rising consumer sophistication, broader access to e-commerce platforms, and stronger preference for dermatologist-tested solutions.

Japan, with a CAGR of 11.4%, is projected to advance on the back of premium positioning and long-standing consumer demand for high-quality formulations. In Europe, the UK at 9.2% and Germany at 6.9% are forecast to maintain steady expansion, supported by preference for clean-label and sensitive-skin safe innovations.

Europe overall is expected to grow at 7.2%, reflecting balanced demand across developed markets. The USA, at 5.9% CAGR, is projected to reflect slower growth due to market maturity but will remain significant in value terms, driven by continued innovation in scalp-focused shampoos and serums. Collectively, these markets are expected to define the future competitive landscape of global scalp care.

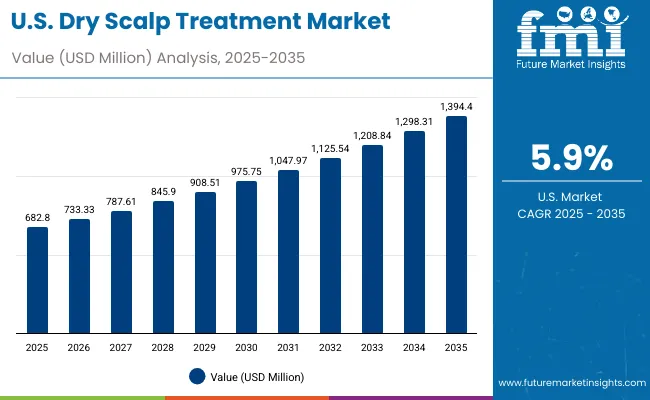

| Year | USA Dry Scalp Treatment Market (USD Million) |

|---|---|

| 2025 | 682.80 |

| 2026 | 733.33 |

| 2027 | 787.61 |

| 2028 | 845.90 |

| 2029 | 908.51 |

| 2030 | 975.75 |

| 2031 | 1047.97 |

| 2032 | 1125.54 |

| 2033 | 1208.84 |

| 2034 | 1298.31 |

| 2035 | 1394.40 |

The dry scalp treatment market in the United States is projected to grow at a CAGR of 5.9%, expanding from USD 682.80 Million in 2025 to USD 1394.40 Million by 2035. This trajectory reflects steady expansion, underscoring the maturity of the market while signaling consistent demand. The growth outlook is anticipated to be reinforced by stronger consumer preference for dermatologist-tested and sensitive-skin safe solutions, coupled with continued product premiumization in medicated shampoos and scalp serums.

Clean-label claims and advanced formulations are expected to differentiate brands, while digital retail channels are projected to accelerate accessibility across both urban and suburban markets. Increased consumer education around scalp health is anticipated to elevate adoption beyond niche dermatology, making treatment-focused solutions a more mainstream part of personal care.

The dry scalp treatment market in the United Kingdom is projected to grow at a CAGR of 9.2% from 2025 to 2035, reflecting strong momentum in premium personal care adoption. This expansion is anticipated to be driven by rising consumer focus on sensitive-skin safe and clean-label products. Regulatory support for ingredient transparency is expected to reinforce consumer trust, while established pharmacy networks continue to anchor distribution.

The adoption of digital channels is projected to accelerate product reach across wider demographics, particularly among younger consumers who favor dermatologist-tested innovations. By 2035, the UK market is likely to consolidate its role as one of Europe’s key contributors to scalp health innovation.

The dry scalp treatment market in India is forecast to record a CAGR of 15.9% during 2025 to 2035, establishing it as the fastest-growing market globally. This trajectory is expected to be driven by rapid urbanization, rising middle-class incomes, and increasing awareness of scalp health.

Traditional remedies are being gradually replaced by modern medicated shampoos and serums, reflecting growing trust in clinically validated products. E-commerce expansion is projected to be a key enabler, ensuring broader access beyond metropolitan cities. With strong demand for affordable yet effective solutions, India is expected to serve as a growth hub for both international and regional brands by 2035.

The dry scalp treatment market in China is projected to grow at a CAGR of 14.1% from 2025 to 2035, supported by strong consumer adoption of dermatologist-tested and premium scalp care products. Digital retail ecosystems are expected to be the most significant driver, as leading e-commerce platforms enable nationwide product availability.

The preference for advanced active ingredients, including salicylic acid and botanical formulations, is anticipated to reinforce premiumization trends. By 2035, China is projected to emerge as one of the most lucrative markets, supported by expanding consumer sophistication and rising demand for evidence-backed solutions.

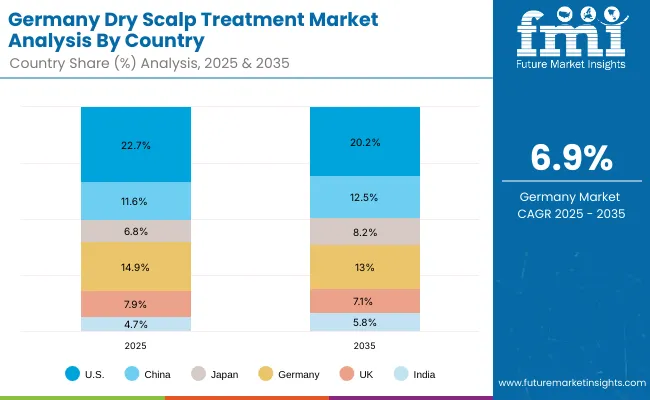

| Country | 2025 |

|---|---|

| USA | 22.7% |

| China | 11.6% |

| Japan | 6.8% |

| Germany | 14.9% |

| UK | 7.9% |

| India | 4.7% |

| Country | 2035 |

|---|---|

| USA | 20.2% |

| China | 12.5% |

| Japan | 8.2% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 5.8% |

The dry scalp treatment market in Germany is forecast to expand at a CAGR of 6.9% between 2025 and 2035, reflecting stable yet sustained growth in Europe’s largest economy. Consumer demand is expected to be anchored by preference for clean-label and sensitive-skin safe formulations, in line with strict regulatory standards.

Pharmacy-led distribution remains a key strength, with medicated shampoos anticipated to dominate treatment choices due to their proven efficacy. Broader adoption of e-commerce and digital pharmacies is projected to enhance accessibility, particularly in younger consumer groups. Germany’s steady expansion is expected to reflect its mature market profile, contributing strongly to Europe’s balanced growth outlook.

| USA By Treatment Type | Market Value Share, 2025 |

|---|---|

| Medicated shampoos | 45% |

| Others | 55.0% |

The dry scalp treatment market in the United States is projected at USD 682.80 Million in 2025. Others contribute 55%, while medicated shampoos hold 45%, which shows a slight consumer leaning toward broader product categories beyond clinical shampoos. This balance reflects the growing popularity of alternative solutions such as scalp serums, oils, and holistic care formulations that complement traditional medicated offerings.

The medicated shampoos segment is expected to retain relevance as dermatologist-backed efficacy continues to build trust, particularly among consumers with recurring scalp conditions. Others are anticipated to expand more rapidly as clean-label claims, botanical ingredients, and multifunctional benefits reshape consumer expectations. The overall landscape is projected to evolve toward product diversification, with a stronger interplay between clinical science and lifestyle-driven formulations.

| China By Active Ingredient | Market Value Share, 2025 |

|---|---|

| Salicylic acid | 34% |

| Others | 66.0% |

The dry scalp treatment market in China is projected at USD 348.98 Million in 2025. Others contribute 66%, while salicylic acid-based products hold 34%, showing a clear dominance of diversified ingredient portfolios. Broader adoption of botanical extracts, antifungal agents, and multifunctional blends is expected to drive the Others category, reflecting evolving consumer preference for natural and holistic scalp solutions. Salicylic acid is anticipated to maintain relevance due to its proven exfoliation and renewal benefits, positioning it as a clinically trusted benchmark for targeted scalp care.

Market expansion is projected to be reinforced by rising consumer sophistication, the rapid growth of digital retail channels, and strong interest in dermatologist-tested claims. By 2035, ingredient diversification is expected to define competition, with salicylic acid sustaining a strong role while new formulations secure expanding consumer acceptance.

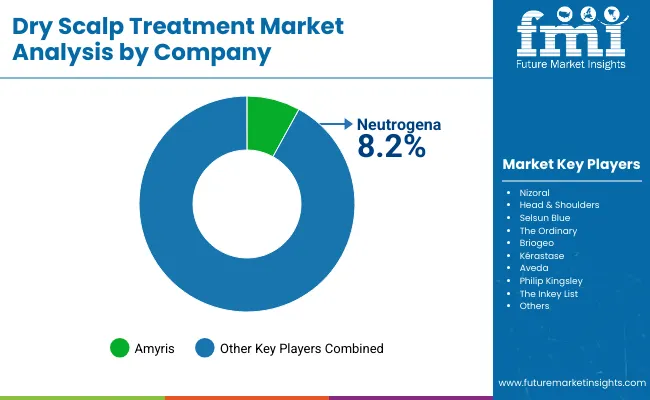

| Company | Global Value Share 2025 |

|---|---|

| Neutrogena | 8.2% |

| Others | 91.8% |

The dry scalp treatment market is moderately fragmented, with global personal care leaders, established dermatology-backed brands, and emerging niche specialists competing for consumer loyalty. Neutrogena is projected to lead globally with an 8.2% market share in 2025, positioning itself as the most dominant player due to its extensive medicated shampoo portfolio and dermatologist-trusted image. Its early entry into therapeutic scalp formulations has created sustained consumer preference, particularly in North America and Europe.

Other multinational brands such as Nizoral, Head & Shoulders, and Selsun Blue are expected to remain highly influential, leveraging scale, retail penetration, and strong associations with dandruff and scalp therapy. Premium-focused players like Kérastase, Aveda, and Philip Kingsley are competing by emphasizing clean-label claims, salon-grade quality, and sensitive-skin safe positioning. New entrants such as The Ordinary and The Inkey List are anticipated to build traction by targeting younger, ingredient-conscious consumers through digital-first channels.

Competitive differentiation is increasingly being shaped by innovation in active ingredients, the credibility of dermatologist-tested claims, and the rise of clean-label certifications. Market dynamics are projected to shift toward integrated product ecosystems where efficacy validation, sustainability, and brand trust define long-term competitiveness rather than pricing alone.

Key Developments in Dry Scalp Treatment Market

| Item | Value |

|---|---|

| Quantitative | USD 3,004.3 Million (2025E); USD 6,902.3 Million (2035F); 8.7% CAGR (2025 to 2035) |

| Treatment Type | Medicated shampoos; Others |

| Form | Shampoo; Others |

| Active Ingredient | Salicylic acid; Others |

| Distribution Channel | Pharmacies/drugstores; E-commerce; Mass retail; Salons/professional |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan; Europe (aggregate) |

| Key Companies Profiled | Neutrogena; Nizoral; Head & Shoulders; Selsun Blue; The Ordinary; Briogeo; Kérastase; Aveda; Philip Kingsley; The Inkey List |

| Additional Attributes | Dollar sales by treatment type and form; adoption of dermatologist-tested and sensitive-skin safe products; premiumization and clean-label positioning; ingredient innovation (e.g., salicylic acid, botanicals, antifungal agents); e-commerce-led accessibility; pharmacy-led trust dynamics; regional growth led by India and China; evidence-based efficacy claims guiding consumer choice; pricing and affordability shaping penetration in emerging markets. |

The global Dry Scalp Treatment Market is estimated to be valued at USD 3,004.3 Million in 2025.

The Dry Scalp Treatment Market size is projected to reach USD 6,902.3 Million by 2035.

The Dry Scalp Treatment Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Dry Scalp Treatment Market include medicated shampoos and other treatment formats such as serums, oils, and scalp masks.

By form, shampoos are projected to command 52% share in 2025, maintaining dominance as the most accessible and widely adopted treatment option.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA