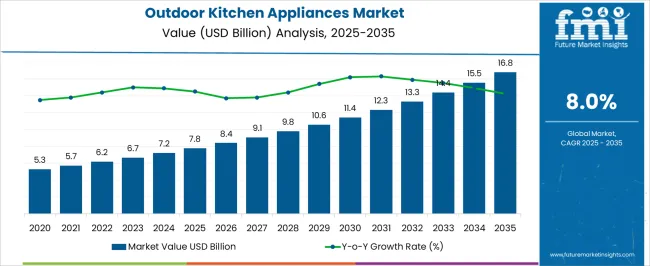

The outdoor kitchen appliances market is projected to expand from USD 7.8 billion in 2025 to USD 16.8 billion in 2035, advancing at a compound annual growth rate (CAGR) of 8%. The trajectory of growth, reflected in incremental increases from USD 7.8 billion to USD 11.4 billion by 2030, signals a strong appetite for outdoor living solutions where grilling stations, refrigeration units, and modular cooking systems are prioritized. This progression suggests that consumers are placing higher value on lifestyle-oriented products that enhance leisure experiences at home.

Market growth illustrates a broader cultural shift where outdoor entertainment has become a significant driver of purchasing behavior, making this market a consistently rewarding segment. By 2035, with a valuation expected to touch USD 16.8 billion, the outdoor kitchen appliances market will be recognized as a core category in premium household investments. The CAGR of 8% over the decade implies not just steady demand but also the willingness of households to adopt high-value equipment over conventional kitchen setups. This pattern reveals that the market is less vulnerable to short-term economic downturns, as it appeals to buyers who prioritize comfort, lifestyle, and social engagement.

The upward growth line from USD 12.3 billion in 2031 to USD 16.8 billion in 2035 reflects how product diversification and expanding availability through retail and e-commerce channels will keep fueling momentum, ensuring that outdoor kitchen appliances remain an aspirational yet attainable choice for many households worldwide.

| Metric | Value |

|---|---|

| Outdoor Kitchen Appliances Market Estimated Value in (2025 E) | USD 7.8 billion |

| Outdoor Kitchen Appliances Market Forecast Value in (2035 F) | USD 16.8 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The outdoor kitchen appliances market has established a strong foothold within its parent industries, driven by the rising preference for functional and stylish outdoor living spaces that merge leisure with convenience. In the household appliances market, outdoor kitchen appliances hold nearly 8–10% share, as grills, refrigerators, and cooktops designed for external use are increasingly purchased alongside indoor equipment.

Within the outdoor living products market, their share is far more pronounced at about 20–22%, with outdoor kitchens becoming a centerpiece of patios, gardens, and backyard setups. In the kitchen equipment market, the segment contributes around 12–14%, as specialized designs for weather resistance and durability set these appliances apart. The residential construction and remodeling market reflects close to 6–8% share, since many new-build homes and renovation projects integrate outdoor kitchens as value-enhancing features.

In the hospitality and foodservice equipment market, the share is about 10–12%, with resorts, hotels, and restaurants leveraging outdoor dining areas to attract customers. While skeptics may argue that outdoor kitchen appliances cater only to premium households or commercial settings, the steady uptake across middle-income consumers and expanding hospitality projects proves otherwise.

The outdoor kitchen appliances market is gaining momentum, supported by increasing consumer interest in outdoor living spaces and the rising trend of home entertainment. Manufacturers have expanded product portfolios to include energy-efficient and smart-enabled appliances that integrate seamlessly into outdoor environments.

Lifestyle changes, coupled with higher disposable incomes, have encouraged homeowners to invest in premium outdoor cooking and dining setups. Seasonal demand patterns have been influenced by a growing preference for social gatherings at home, boosting the adoption of multifunctional outdoor appliances.

Product innovation has focused on durability, weather resistance, and design aesthetics, addressing both functionality and style requirements. The expansion of e-commerce and specialty retail outlets has further enhanced market accessibility, while collaborations between appliance brands and home improvement companies have increased visibility. Growth is expected to remain strong as consumers continue to view outdoor kitchen spaces as an extension of their homes, with premium grills, mid-range pricing, and residential installations leading the way.

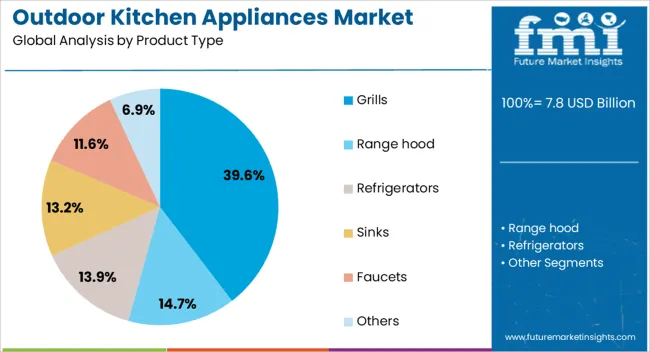

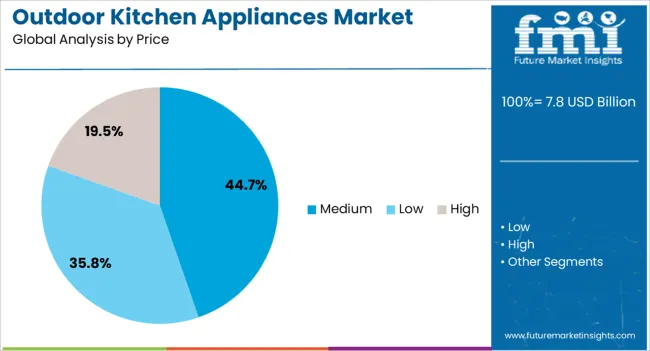

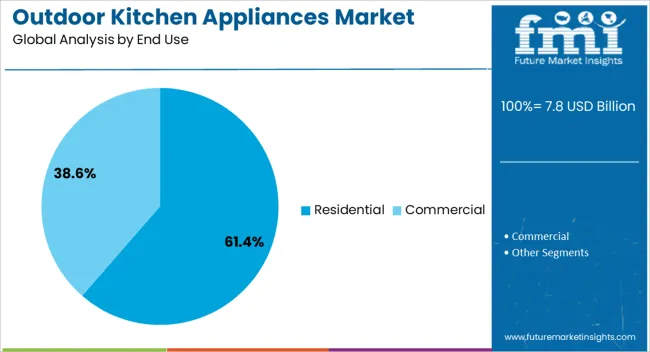

The outdoor kitchen appliances market is segmented by product type, price, end use, sales channel, and geographic regions. By product type, the outdoor kitchen appliances market is divided into Grills, Range hoods, Refrigerators, Sinks, Faucets, and Others. In terms of price, outdoor kitchen appliances market is classified into Medium, Low, and High. Based on end use, outdoor kitchen appliances market is segmented into Residential and Commercial.

By sales channel, outdoor kitchen appliances market is segmented into Offline and Online. Regionally, the outdoor kitchen appliances industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Grills segment is projected to account for 39.6% of the outdoor kitchen appliances market revenue in 2025, retaining its position as the dominant product category. This leadership is attributed to the central role grills play in outdoor cooking setups, offering versatility in preparing a variety of cuisines.

Advances in fuel options, including gas, electric, and hybrid grills, have broadened appeal among different consumer segments. Manufacturers have incorporated features such as precise temperature control, rotisserie functions, and easy-clean systems, enhancing user convenience.

The increasing popularity of barbecues and open-air dining has reinforced consumer interest in investing in high-quality grills. With ongoing innovations and lifestyle-driven demand, the Grills segment is set to remain a cornerstone of outdoor kitchen appliance sales.

The Medium price segment is projected to capture 44.7% of the market revenue in 2025, reflecting a balance between quality and affordability that appeals to a wide consumer base. Buyers in this range typically seek durable, well-featured appliances without paying a premium price.

The segment benefits from strong representation across both brick-and-mortar and online retail channels, offering consumers competitive choices. Manufacturers in this category have focused on incorporating advanced cooking features and premium materials while keeping costs accessible.

Seasonal promotions and bundled packages with complementary accessories have also driven adoption. The Medium price tier is likely to sustain its market share as it appeals to both first-time buyers and experienced consumers upgrading from entry-level products.

The Residential segment is expected to hold 61.4% of the market revenue in 2025, maintaining its lead as the largest end-use category. Growth in this segment has been fueled by the expansion of suburban housing, home renovation trends, and the desire to create personalized outdoor living spaces.

Residential buyers value outdoor kitchen appliances that combine style, functionality, and ease of maintenance, making them suitable for regular use. The rise of at-home entertaining, supported by social trends and health-conscious cooking preferences, has further boosted demand.

Appliance brands have responded with modular and customizable solutions that fit varied space requirements. As outdoor cooking becomes an integral part of modern home design, the Residential segment is expected to remain the driving force in the market’s expansion.

The outdoor kitchen appliances market is witnessing robust demand due to growing consumer interest in luxury outdoor living and hospitality adoption. Opportunities are strong in the commercial sector, while trends in smart technology, modularity, and eco-friendly designs are shaping product development. Despite challenges related to high costs and weather durability, the market outlook remains positive. Manufacturers focusing on durable, affordable, and customizable solutions are expected to benefit the most as outdoor kitchens transition from a luxury niche into a mainstream lifestyle investment.

The demand for outdoor kitchen appliances is growing as homeowners increasingly invest in luxury outdoor living experiences. The trend of extending indoor comforts to outdoor spaces has fueled interest in grills, refrigerators, sinks, and storage systems for patios and backyards. Rising disposable incomes and lifestyle changes have encouraged households to prioritize entertainment and social gatherings at home. As a result, outdoor kitchens are no longer limited to premium residences but are becoming mainstream features in suburban homes, driving consistent demand for high-quality appliances.

Opportunities are expanding as hotels, resorts, and restaurants embrace outdoor kitchen setups to enhance customer engagement. Outdoor dining has gained traction globally, with businesses investing in high-performance appliances to deliver unique culinary experiences. The growing preference for al fresco dining and themed outdoor events supports the adoption of specialized appliances such as pizza ovens and modular cooking units. Manufacturers offering customizable solutions tailored to both residential and commercial spaces can tap into new revenue streams while catering to evolving lifestyle and business trends in the hospitality industry.

A prominent trend in the market is the integration of smart technology into outdoor kitchen appliances, enabling remote operation, temperature control, and energy optimization. The popularity of eco-friendly products is also increasing, with consumers favoring energy-efficient grills, induction cooktops, and appliances made from recyclable materials. Modular designs that allow easy customization and adaptability are gaining traction, particularly among younger homeowners.

The outdoor kitchen appliances market faces challenges related to high upfront costs, which often limit adoption among middle-income households. Installation expenses, combined with the premium pricing of high-quality appliances, make affordability a significant barrier. Durability issues also arise, as appliances must withstand harsh weather conditions, including humidity, extreme heat, and freezing temperatures. Maintenance requirements and potential corrosion further deter buyers.

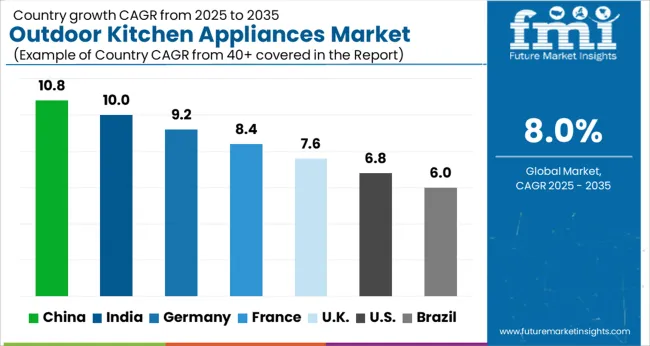

| Countries | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

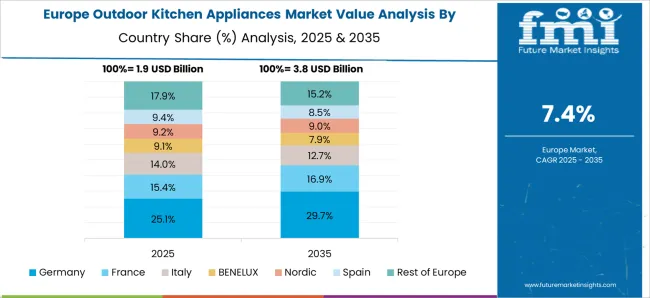

The global outdoor kitchen appliances market is projected to grow at a CAGR of 8% from 2025 to 2035. China is expected to lead with a CAGR of 10.8%, followed by India at 10% and Germany at 9.2%. The United Kingdom shows growth at 7.6%, while the United States records a slower pace at 6.8%. Rising consumer inclination toward premium home lifestyles, the popularity of outdoor gatherings, and higher disposable income are fueling this expansion. Emerging economies such as China and India benefit from growing urban middle-class households, while developed markets like Germany, the UK, and the USA emphasize luxury outdoor living concepts, high-performance appliances, and integration with modern residential spaces. This report includes insights on 40+ countries; the top markets are shown here for reference.

The outdoor kitchen appliances market in China is projected to expand at a CAGR of 10.8%. Rising urban affluence and the popularity of luxury residential spaces are driving the demand for outdoor living products. Outdoor dining, weekend grilling, and premium appliance adoption are becoming common in metropolitan households. The influence of Western lifestyle trends has contributed to greater acceptance of outdoor kitchens. Manufacturers are focusing on introducing versatile appliances such as modular grills, pizza ovens, and refrigeration units tailored for high-density urban homes. With growing investment in high-end residential projects, China’s market outlook remains robust.

The outdoor kitchen appliances market in India is forecasted to grow at a CAGR of 10%. Growth is supported by expanding urban middle-class households, rising disposable incomes, and a preference for modern lifestyle amenities. Weekend barbecues, terrace dining, and farmhouse gatherings are fueling demand for grills and outdoor cooking equipment. The market is witnessing rising imports of premium appliances alongside the emergence of local suppliers offering cost-effective solutions. Real estate developers in metropolitan areas are incorporating outdoor cooking spaces in gated communities, further enhancing adoption. The aspirational lifestyle shift positions India as one of the fastest-growing markets in this segment.

The outdoor kitchen appliances market in Germany is expected to record a CAGR of 9.2%. A well-established culture of backyard gatherings, barbecues, and outdoor dining drives steady demand. Consumers show strong interest in high-quality grills, smokers, and built-in kitchen units that emphasize durability and efficiency. Energy-efficient appliances and smart-integrated cooking systems are gaining attention among homeowners. The popularity of sustainable outdoor living and innovative design concepts boosts growth further. Germany’s robust manufacturing base and engineering expertise also support domestic supply, ensuring reliable product availability across residential and commercial applications.

The outdoor kitchen appliances market in the United Kingdom is projected to grow at a CAGR of 7.6%. Demand is supported by the rising popularity of garden-based dining and the integration of outdoor cooking into modern home renovations. Premium housing developments and luxury estates increasingly feature outdoor kitchen designs. British consumers show a preference for modular kitchens with built-in grills, refrigeration units, and fire pits for year-round use. While adoption is slower compared to continental Europe, growing interest in luxury home upgrades and outdoor lifestyle products sustains long-term growth.

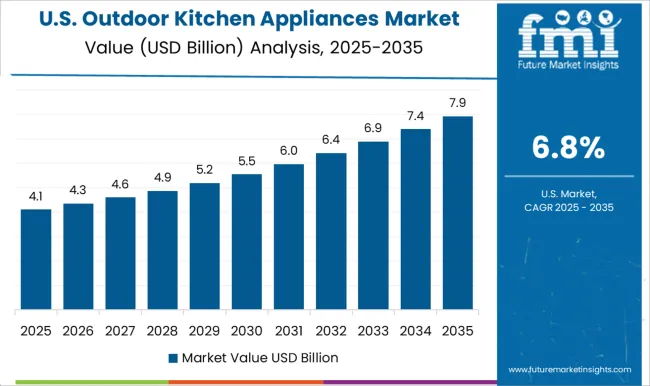

The outdoor kitchen appliances market in the United States is anticipated to expand at a CAGR of 6.8%. The country’s established backyard barbecue and outdoor dining culture continues to support steady demand. High-income households drive the adoption of premium outdoor kitchen solutions featuring grills, refrigeration, and entertainment units. Manufacturers are increasingly introducing smart-enabled outdoor appliances for convenience and integration with connected home systems. While growth is slower compared to Asian markets, the USA remains one of the largest global consumers due to its established outdoor lifestyle culture and strong aftermarket for premium equipment.

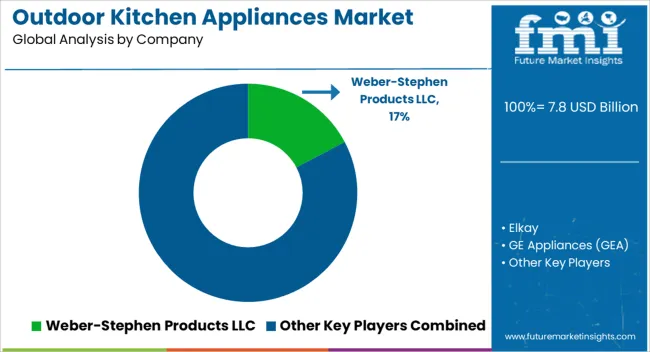

The outdoor kitchen appliances market is driven by premium grill and cooking system manufacturers who compete through performance, design, and brand recognition. Weber-Stephen Products LLC, Napoleon, and Lynx Grills dominate with brochures that stress high-heat precision, durability, and versatile cooking styles, targeting homeowners seeking professional-grade outdoor culinary experiences. KitchenAid and GE Appliances (GEA) leverage brand trust and wide distribution, positioning outdoor appliances as extensions of their established indoor ranges. Hestan Outdoor promotes luxury craftsmanship and vibrant customization, with brochures emphasizing sleek aesthetics and high-performance burners.

Competition in this tier focuses on creating aspirational lifestyle imagery through brochures, blending functionality with visual appeal to secure premium buyers. Mid-tier and specialist players balance affordability with innovation. Traeger pushes its wood-pellet technology in brochures that highlight flavor, automation, and app connectivity, creating strong appeal among barbecue enthusiasts. Elkay and Superior Equipment Solutions emphasize refrigeration, sinks, and modular setups, with brochures crafted around convenience and flexibility for diverse backyard layouts.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Product Type | Grills, Range hood, Refrigerators, Sinks, Faucets, and Others |

| Price | Medium, Low, and High |

| End Use | Residential and Commercial |

| Sales Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Weber-Stephen Products LLC, Elkay, GE Appliances (GEA), Hestan Outdoor, KitchenAid, Lynx Grills, Napoleon Home comfort Barrie Inc, Superior Equipment Solutions, The Middleby Corporation LLC, and Traeger |

| Additional Attributes | Dollar sales by appliance type (grills, refrigerators, ovens, sinks) and material (stainless steel, stone, ceramic, composite) are key metrics. Trends include rising demand for luxury outdoor living spaces, growth in residential remodeling projects, and preference for durable, weather-resistant appliances. Regional adoption, lifestyle changes, and technological innovations are driving market growth. |

The global outdoor kitchen appliances market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the outdoor kitchen appliances market is projected to reach USD 16.8 billion by 2035.

The outdoor kitchen appliances market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in outdoor kitchen appliances market are grills, range hood, refrigerators, sinks, faucets and others.

In terms of price, medium segment to command 44.7% share in the outdoor kitchen appliances market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA