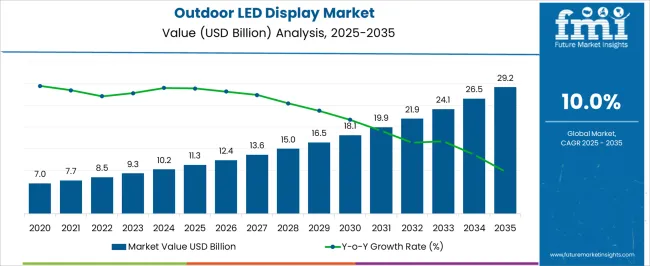

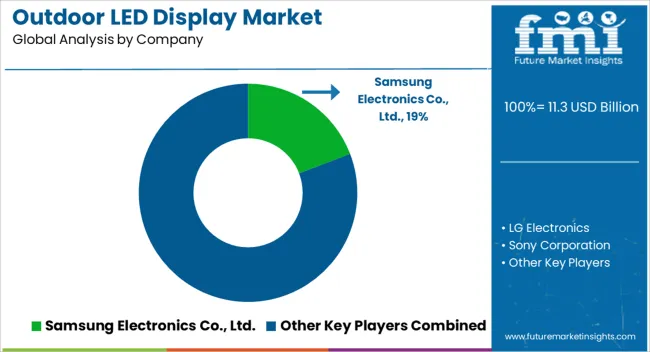

The Outdoor LED Display Market is estimated to be valued at USD 11.3 billion in 2025 and is projected to reach USD 29.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Between 2025 and 2028, growth remains gradual as adoption builds, moving from USD 11.3 billion to USD 16.0 billion. Momentum strengthens post-2028, with annual increments becoming more pronounced, driven by expanding deployment in advertising, sports arenas, transportation hubs, and entertainment venues.

By 2030, the market surpasses USD 18.1 billion, marking the start of accelerated adoption as LED technology becomes the industry standard for outdoor communication. From 2030 to 2035, the curve steepens, adding over USD 11 billion in just five years, underscoring rapid digital transformation. The YoY growth rate, though showing a slight tapering trend, remains consistently strong, reflecting a balanced mix of replacement demand, new installations, and upgrades to higher-resolution and energy-efficient systems. The trajectory illustrates a market moving beyond early expansion into large-scale mainstream adoption, with high-value applications ensuring resilient growth throughout the decade.

| Metric | Value |

|---|---|

| Outdoor LED Display Market Estimated Value in (2025 E) | USD 11.3 billion |

| Outdoor LED Display Market Forecast Value in (2035 F) | USD 29.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The outdoor LED display market is expanding rapidly due to increased demand for dynamic advertising and public information systems. Urban development and the rise of smart cities have driven the need for high-visibility digital signage that can operate reliably in varying weather conditions.

Technological advancements have improved display brightness, energy efficiency, and durability, making outdoor LED displays more appealing for advertisers and municipalities. The growing adoption of digital billboards, event displays, and transportation signage has broadened the market base.

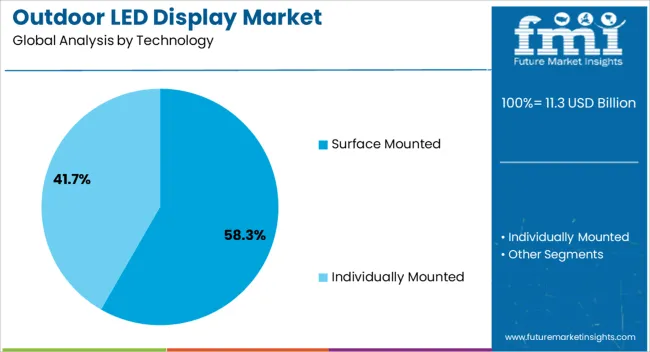

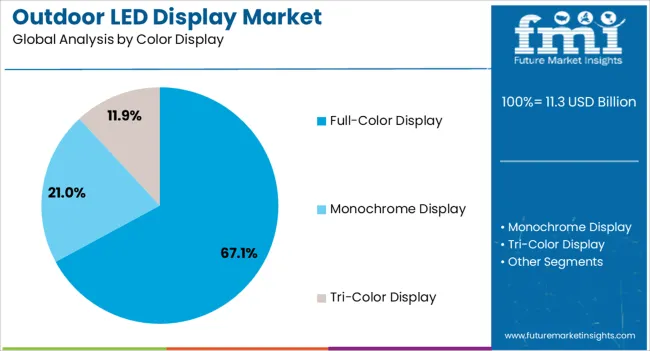

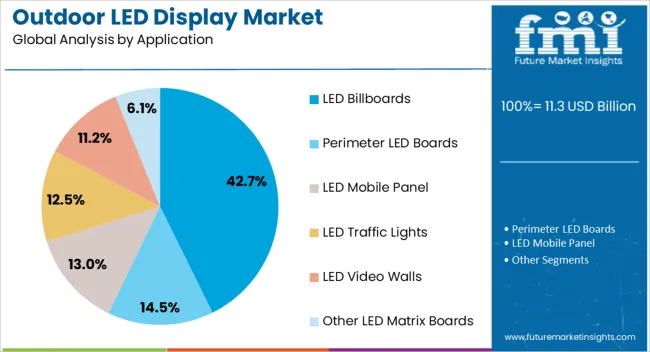

Increased consumer engagement with visual content and the shift from traditional static billboards to dynamic digital displays are key factors fueling market expansion. Innovations in display resolution, control systems, and the integration of IoT technologies will support future growth. Segmental growth is expected to be led by surface-mounted technology, full-color displays, and applications focused on LED billboards.

The outdoor LED display market is segmented by technology, color display, application, and geographic regions. By technology, the outdoor LED display market is divided into Surface Mounted and Individually Mounted. In terms of color display, the outdoor LED display market is classified into Full-Color Display, Monochrome Display, and Tri-Color Display.

Based on application, the outdoor LED display market is segmented into LED Billboards, Perimeter LED Boards, LED Mobile Panels, LED Traffic Lights, LED Video Walls, and Other LED Matrix Boards. Regionally, the outdoor LED display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface mounted technology segment is expected to hold 58.3% of the outdoor LED display market revenue in 2025, retaining its position as the leading technology type. This segment benefits from the ability to produce high-density displays with enhanced brightness and energy efficiency.

The surface mounted LEDs allow for better heat dissipation and longer service life, which is crucial for outdoor environments. Installation flexibility and improved weather resistance have made this technology favored among display manufacturers and end users.

As display performance requirements continue to rise, surface mounted technology is expected to maintain dominance in the market.

The full-color display segment is projected to account for 67.1% of the market revenue in 2025, maintaining its lead in color technology. Full-color LED displays offer vibrant and eye-catching visuals that effectively capture audience attention, making them the preferred choice for outdoor advertising and public information displays.

The ability to deliver dynamic content, including videos and animations, has driven widespread adoption. Consumer demand for high-quality visual experiences and the need for versatile advertising platforms have supported this segment’s growth.

Full-color displays also enable brand differentiation and improved message delivery, reinforcing their market position.

The LED billboards application segment is expected to contribute 42.7% of the outdoor LED display market revenue in 2025, solidifying its position as the dominant application. LED billboards have become a preferred medium for advertisers due to their high visibility, flexibility in content updates, and ability to reach large audiences.

Urban centers and commercial hubs have seen increased installation of LED billboards to maximize advertising impact. The effectiveness of digital billboards in delivering targeted and real-time content has made them attractive to marketers and city planners.

As advertising budgets continue to shift towards digital channels, the demand for LED billboards is expected to grow steadily.

Outdoor LED displays are strengthening their role across advertising, sports, public infrastructure, and display performance. Their versatility and visual impact continue to expand global market adoption.

Outdoor LED displays are increasingly central to the digital out-of-home (DOOH) advertising sector, providing brands with dynamic messaging, vivid visuals, and real-time content flexibility. Their ability to engage large audiences in high-traffic areas such as city centers, airports, and transit hubs has driven rapid adoption. Programmatic ad placements allow multiple advertisers to share premium spaces, boosting revenue for operators. The shift from static billboards to digital displays is also supported by the demand for measurable campaign performance and consumer engagement. Advertisers are prioritizing large-scale LED walls to capture attention, making these displays a critical tool in the evolution of modern outdoor advertising strategies.

Sports arenas, concert venues, and entertainment complexes are embracing outdoor LED displays for scoreboards, live broadcasts, and fan engagement experiences. Their scalability, high brightness, and ability to deliver clear images under varying light conditions make them suitable for large venues. Event organizers are using LED screens to enhance audience experiences through instant replays, live updates, and sponsorship promotions. This has created a robust revenue stream for display providers and increased demand from sports clubs and concert organizers. Outdoor LED displays are no longer just functional but are also becoming entertainment assets, strengthening their position in the sports and entertainment industry worldwide.

Governments and municipal authorities are increasingly deploying outdoor LED displays in public infrastructure projects for communication, safety alerts, and information dissemination. Applications range from smart city traffic systems to public awareness campaigns in transit hubs and civic spaces. Their durability and weather-resistant features allow continuous performance in challenging outdoor environments. Municipal investments in digital communication platforms have made LED screens essential for emergency messaging, real-time transportation updates, and tourism promotion. With expanding infrastructure budgets, outdoor LED displays are being integrated into urban landscapes as tools for information sharing and civic engagement, reinforcing their importance in government-led initiatives globally.

Continuous improvements in LED chip design, panel resolution, and modular architecture are enabling sharper visuals, energy efficiency, and cost reduction for outdoor displays. High-definition and ultra-high-definition panels are now widely deployed for immersive experiences in advertising and entertainment. Innovations in weatherproofing, thermal management, and anti-glare coatings enhance display durability, allowing consistent performance in varying climates. Modular panel structures simplify installation and maintenance, making large-scale deployments more feasible. As pixel pitches shrink, even closer viewing distances are supported, expanding opportunities beyond traditional billboards into retail facades and urban plazas. This progress ensures outdoor LED displays remain competitive in delivering impactful, high-quality visuals.

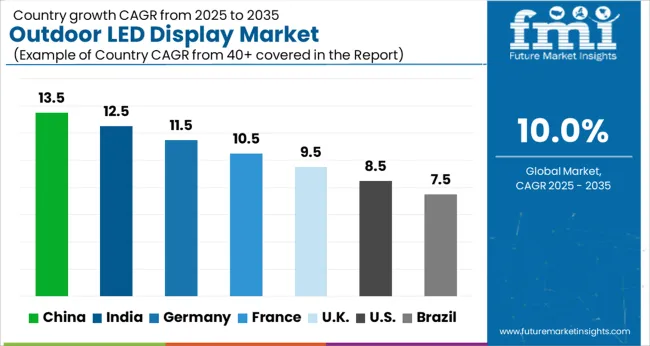

The outdoor LED display market is projected to expand at a global CAGR of 10.0% between 2025 and 2035, supported by rising investments in digital advertising, large-scale event displays, and demand for energy-efficient visual technologies. China leads with a CAGR of 13.5%, driven by aggressive infrastructure upgrades, nationwide adoption of smart city concepts, and the presence of major LED manufacturers.

India follows at 12.5%, supported by rapid urban development, government-backed digital signage initiatives, and increasing corporate expenditure on brand visibility. France achieves 10.5%, shaped by retail modernization, advertising expansion across transport hubs, and growing entertainment sector deployments.

The United Kingdom records 9.5%, influenced by strong demand for digital billboards, technology upgrades in retail spaces, and expansion of outdoor event infrastructure, while the United States posts 8.5%, reflecting the maturity of its advertising landscape, steady replacement cycles, and competition among established display solution providers. This analysis indicates how these countries are setting benchmarks in outdoor digital signage adoption, driving visual technology upgrades, and reshaping brand communication strategies that define the future trajectory of the outdoor LED display industry.

China’s outdoor LED display market expanded at a CAGR of 11.2% during 2020-2024, powered by extensive rollouts across transit hubs, retail façades, and sports venues. From 2025 to 2035, the CAGR improves to 13.5%, above the 10.0% global baseline, as province-level programs, stadium upgrades, and large video walls in commercial districts accelerate deployments. Local manufacturers are expected to scale fine-pitch products and weather-hardened cabinets, which lifts replacement cycles and project value. DOOH networks are being densified in Tier-2 and Tier-3 cities, raising ad inventory and screen time yields. Supply chains anchored in Shenzhen and Fujian are supporting faster lead times and sharper price discipline, strengthening competitiveness in exports and domestic tenders.

India recorded a 10.3% CAGR in 2020-2024 as metro rail corridors, airports, and large retail formats adopted digital billboards. The CAGR reaches 12.5% in 2025-2035, outpacing the global 10.0% mark. National highway concessions and municipal upgrades are broadening high-impact locations for advertisers. Media owners have been shifting static inventory to programmatic-ready LED, improving monetization per square meter. Tier-2 cities are posting faster adoption as local brands seek higher reach at controlled costs. Event rental companies are adding modular panels for festivals and sports, which supports frequent refresh cycles. Price points for IP-rated cabinets are trending downward, enabling faster payback for operators and widening the base of buyers.

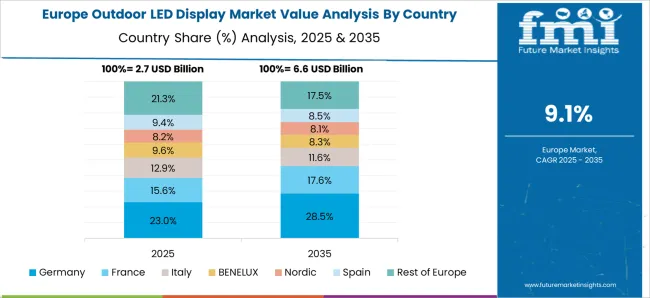

France posted a 9.1% CAGR during 2020-2024 as transport authorities and city centers increased screen density for passenger information and ad inventory. The market advances to 10.5% CAGR in 2025-2035. Rollouts tied to cultural events and sports tournaments are lifting demand for large outdoor canvases and fine-pitch perimeter boards. Retail modernization is prompting façade upgrades, while municipal projects favor vandal-resistant, low-glare surfaces for heritage zones. Media owners are refining daypart and audience models, which raises slot pricing in prime districts. Supply agreements with European integrators are shortening installation windows and supporting standardized maintenance contracts across regions, improving asset uptime and lifetime ROI.

The United Kingdom expanded at 7.9% CAGR in 2020-2024 as operators upgraded select high-street sites and transit nodes. Growth improves to 9.5% for 2025-2035, near yet below the 10.0% global baseline. Inventory quality is expected to rise through fine-pitch retrofits at landmark junctions, while sports venues and festivals increase rental screen demand. Retail parks, stadium precincts, and travel interchanges are being prioritized for higher dwell-time audiences. Media owners are shifting to programmatic scheduling to raise sell-through and reduce make-goods. Supply reliability improves as distributors expand regional spares and service teams, which boosts uptime and contract renewal rates.

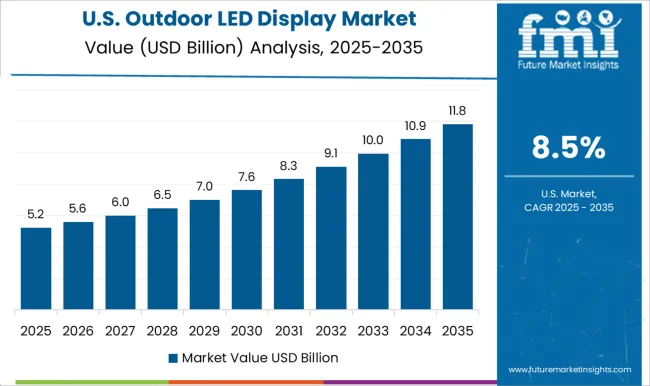

The United States grew at 7.2% CAGR during 2020-2024, supported by replacements on key interstates, sports venues, and destination entertainment zones. The CAGR edges to 8.5% in 2025-2035 as operators prioritize high-impact corridors and premium urban districts. DOOH networks are optimizing loops with audience-based pricing, while venue owners invest in perimeter boards, large plaza screens, and temporary event rigs. Competition among established integrators maintains disciplined pricing and robust service SLAs, keeping uptime high. Corporate campuses and mixed-use projects provide incremental demand for plaza-scale canvases. Replacement cycles are steady as owners pivot to finer pitch, higher brightness stability, and improved thermal management for consistent image quality.

The outdoor LED display industry features strong rivalry among global electronics giants, specialized display solution providers, and innovation-focused firms. Samsung Electronics Co., Ltd. leads with advanced OLED and MicroLED innovations, leveraging a diverse portfolio across smartphones, televisions, and digital signage. LG Electronics maintains a strong foothold in OLED displays and large-format panels, capitalizing on its premium positioning in consumer electronics and B2B segments. Sony Corporation emphasizes high-end displays for professional and entertainment applications, enhancing its competitive edge through image processing expertise.

Panasonic Holdings Corporation expands influence through immersive display systems and interactive solutions tailored for enterprise and education. Barco specializes in visualization and projection systems, capturing demand from healthcare, corporate, and cinema sectors. NEC Display Solutions holds prominence in commercial and educational display integration, with a strong emphasis on modular and scalable solutions.

Toshiba Corporation continues to maintain relevance through selective display applications, emphasizing reliability and cost efficiency. Strategies revolve around product diversification, miniaturization of display technologies, integration of AI-driven features, and strengthening partnerships with enterprise and institutional clients. Market leaders are focusing on large-format, energy-efficient, and interactive displays to capture demand from professional and consumer domains. Acquisitions, R&D investments, and supply chain optimization remain key approaches for ensuring competitive positioning and addressing evolving global demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.3 Billion |

| Technology | Surface Mounted and Individually Mounted |

| Color Display | Full-Color Display, Monochrome Display, and Tri-Color Display |

| Application | LED Billboards, Perimeter LED Boards, LED Mobile Panel, LED Traffic Lights, LED Video Walls, and Other LED Matrix Boards |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co., Ltd., LG Electronics, Sony Corporation, Panasonic Holdings Corporation, Barco, NEC Display Solutions, and Toshiba Corporation |

| Additional Attributes | Dollar sales, share, growth by application, regional opportunities, pricing trends, competitive strategies, distribution channels, raw material costs, and demand shifts across advertising, sports, and retail sectors. |

The global outdoor LED display market is estimated to be valued at USD 11.3 billion in 2025.

The market size for the outdoor LED display market is projected to reach USD 29.2 billion by 2035.

The outdoor LED display market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in outdoor LED display market are surface mounted and individually mounted.

In terms of color display, full-color display segment to command 67.1% share in the outdoor LED display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Monochrome Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA