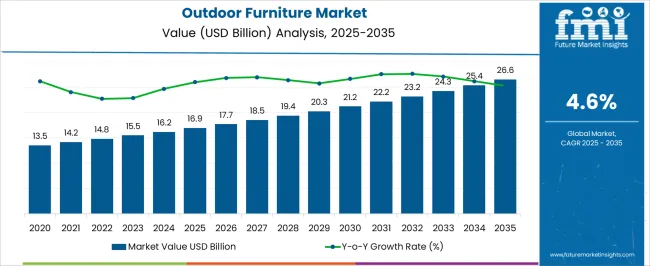

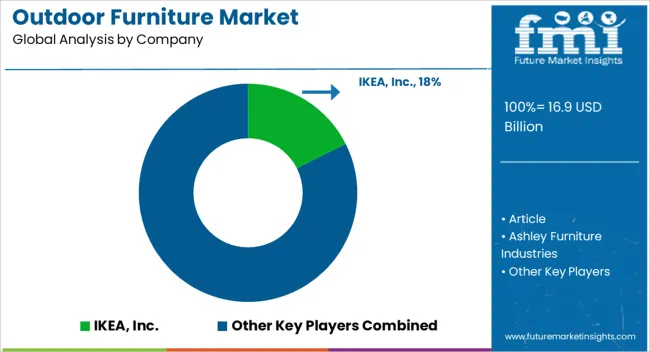

The outdoor furniture market,estimated at USD 16.9 billion in 2025 and projected to reach USD 26.6 billion by 2035, is growing at a CAGR of 4.6%. From 2020 to 2024, the market advances from USD 13.5 billion to USD 16.2 billion, with year-on-year increments such as USD 14.2 billion in 2021, USD 14.8 billion in 2022, and USD 15.5 billion in 2023 highlighting steady expansion. This early growth is driven by rising consumer interest in outdoor living spaces, increasing investments in patios, gardens, and terraces, and strong demand from the hospitality sector, particularly in resorts and restaurants that emphasize outdoor seating and décor. By 2025, the market enters a scaling phase at USD 16.9 billion, marking around 16% of the total projected increase. Between 2026 and 2030, values rise from USD 17.7 billion to USD 21.2 billion, contributing about 40% of the overall growth. This period is supported by growing use of weather-resistant materials, including aluminum, resin, and treated wood, along with innovations in modular and multifunctional furniture designs. From 2031 to 2035, the market progresses from USD 22.2 billion to USD 26.6 billion, generating roughly 36% of total gains. The final phase is characterized by strong replacement demand, expansion in commercial applications, and greater emphasis on aesthetics, durability, and comfort. Overall, the outdoor furniture market reflects a consistent growth path, fueled by evolving consumer lifestyles, hospitality sector upgrades, and material innovations that extend product longevity.

| Metric | Value |

|---|---|

| Outdoor Furniture Market Estimated Value in (2025 E) | USD 16.9 billion |

| Outdoor Furniture Market Forecast Value in (2035 F) | USD 26.6 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The outdoor furniture market holds a significant share within the broader furniture and home furnishing industry, accounting for approximately 10–12% of the global furniture sector. Within residential and commercial furnishing segments, outdoor furniture captures nearly 8–10% share, driven by rising consumer interest in garden, patio, balcony, and terrace furnishings that combine durability with aesthetic appeal. In hospitality, leisure, and resort applications, the market accounts for about 6–8% share, reflecting increasing investments in luxury resorts, restaurants, and recreational spaces where high-quality outdoor seating and tables are essential. The retail and e-commerce channels contribute roughly 4–6% share, with growing preference for modular, lightweight, and weather-resistant designs that suit varied climates. Expansion is further supported by adoption of materials such as aluminum, synthetic rattan, teak, and high-density polyethylene, which provide low-maintenance, long-lasting performance. Manufacturers are focusing on innovative design, ergonomic comfort, and color customization to differentiate offerings. Regional variations, import-export dynamics, and competitive pricing also influence market positioning, ensuring outdoor furniture maintains relevance across multiple consumer and commercial applications.

The outdoor furniture market is undergoing strong growth driven by increased consumer spending on outdoor living spaces, rising urbanization, and a shift toward lifestyle-oriented landscaping. With a surge in residential renovations and hospitality expansion, demand for functional and aesthetic outdoor furniture has accelerated.

Improvements in weather-resistant materials and the adoption of modular, space-saving designs have expanded deployment across patios, balconies, gardens, and commercial open-air venues. Additionally, rising interest in home gardening and the premiumization of outdoor environments have led consumers to invest in durable, stylish pieces.

This momentum is being supported by multichannel retail expansion, including online platforms offering customizable and eco-conscious furniture options.

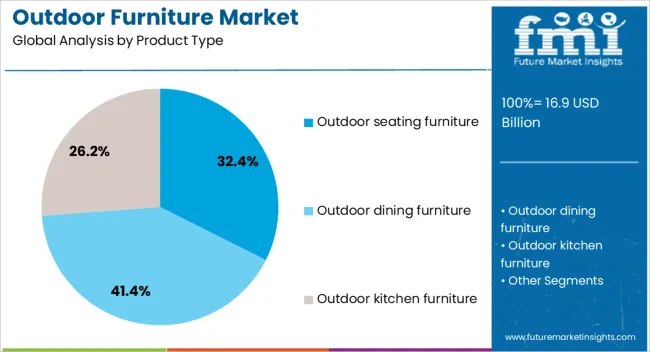

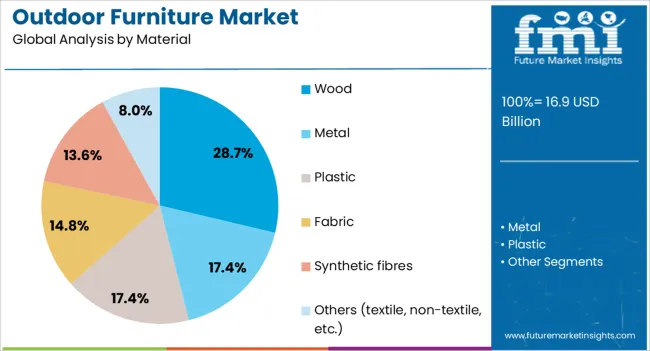

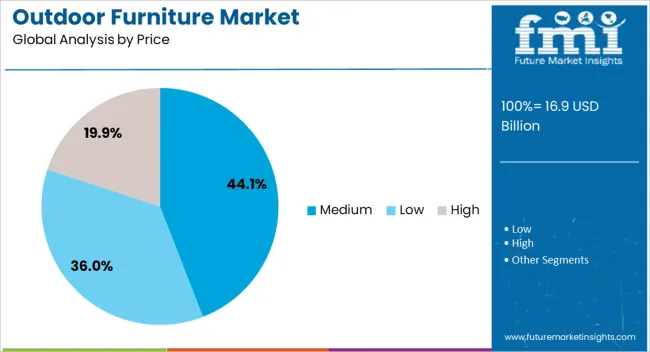

The outdoor furniture market is segmented by product type, material, price, end use, distribution channel, and geographic regions. By product type, outdoor furniture market is divided into Outdoor seating furniture, Outdoor dining furniture, Outdoor kitchen furniture, Accessories, and Others. In terms of material, outdoor furniture market is classified into Wood, Metal, Plastic, Fabric, Synthetic fibres, and Others (textile, non-textile, etc.). Based on price, outdoor furniture market is segmented into Medium, Low, and High. By end use, outdoor furniture market is segmented into Residential and Commercial. By distribution channel, outdoor furniture market is segmented into Offline and Online. Regionally, the outdoor furniture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Outdoor seating furniture is projected to lead the market with a 32.4% share in 2025, driven by its essential role in residential and commercial exterior layouts. The versatility of seating options ranging from lounge chairs and benches to sectional sofas has made them central to the outdoor living trend.

Consumers are investing in durable and stylish seating to enhance relaxation, entertainment, and social interactions outdoors. Hospitality businesses are also boosting demand through patio expansions and alfresco service areas.

Innovations such as foldable designs, cushion customization, and integrated storage are further enhancing product appeal and functional value.

Wood is anticipated to hold the leading material share at 28.7% in 2025, owing to its timeless aesthetic, structural strength, and sustainability appeal. Natural wood varieties such as teak, eucalyptus, and acacia are popular for their weather resistance and organic look, aligning with modern outdoor aesthetics.

Additionally, manufacturers are increasingly adopting FSC-certified and reclaimed wood, which resonates with eco-conscious buyers. Technological advancements in finishes and treatments have extended wood’s lifecycle, making it more resilient to moisture, UV exposure, and pests.

As design trends shift toward rustic and biophilic styles, wood remains a favored material for premium outdoor installations.

The medium price segment is expected to dominate with a 44.1% share by 2025, as consumers seek a balance between quality, durability, and affordability. This segment attracts both cost-sensitive homeowners and mid-tier hospitality providers looking for value-driven options without sacrificing aesthetics.

Manufacturers catering to this segment are offering weatherproof materials, ergonomic designs, and modular features that meet a wide range of preferences and use cases.

Online and offline retailers are enhancing access to this price tier through seasonal promotions and bundled outdoor furniture sets, making medium-priced options more appealing and accessible across urban and suburban markets.

Outdoor furniture demand is increasing across residential and commercial sectors, driven by premium design, ergonomic comfort, and hospitality projects. Material innovation and multi-channel distribution continue to strengthen market penetration and adoption globally.

Consumer interest in enhancing outdoor living areas is driving adoption of outdoor furniture across residential and commercial sectors. Garden, patio, balcony, and rooftop settings are increasingly being outfitted with ergonomic seating, multifunctional tables, and modular arrangements. Demand is influenced by aesthetics, durability, and ease of maintenance. Homeowners and hospitality operators prioritize materials resistant to weather, corrosion, and wear, such as aluminum, synthetic rattan, and treated wood. The growing trend for multifunctional outdoor setups, including dining, lounging, and recreational spaces, supports broader adoption. Retailers and e-commerce platforms are facilitating this growth through diverse offerings and customization options. Premium designs, color variety, and comfort features are becoming key differentiators in competitive positioning.

The hospitality and leisure sector is a major driver for outdoor furniture adoption, accounting for a substantial share of the market. Hotels, resorts, restaurants, and recreational facilities are investing in high-quality outdoor seating, tables, and lounge systems to enhance guest experience. Furniture designs are selected for comfort, aesthetics, and resistance to heavy usage and weather conditions. Large-scale installations often feature coordinated themes to maintain brand consistency. Growth is further supported by event management and tourism sectors requiring temporary or seasonal outdoor setups. Customization, bulk procurement, and service agreements influence purchasing decisions. In addition, increasing renovations and upgrades of commercial properties sustain ongoing demand for high-quality outdoor furniture.

Material selection plays a critical role in outdoor furniture adoption, impacting durability, maintenance, and design flexibility. Aluminum, steel, teak, synthetic rattan, and high-density polyethylene are widely used for weather resistance, corrosion protection, and load-bearing capacity. Coating techniques, UV treatment, and modular assembly further enhance longevity and usability. Lightweight materials enable easier handling and relocation, while premium wood options appeal to aesthetics-focused segments. Increasing availability of multi-material combinations allows for ergonomic design without compromising strength. Suppliers are focusing on cost-effective material sourcing and fabrication techniques to reduce production costs while maintaining product quality. Material differentiation is a key lever for competitive advantage in both commercial and residential applications.

Outdoor furniture adoption is being reinforced by growing retail and e-commerce channels. Brick-and-mortar stores offer tangible product experience, while online platforms provide convenience, customization, and delivery options. International and domestic brands are expanding regional networks to increase market reach. Omni-channel strategies, seasonal promotions, and flexible financing options stimulate consumer purchases. Partnerships with property developers, interior designers, and commercial buyers further drive sales. Logistics capabilities, packaging standards, and after-sales service are becoming critical differentiators. Efficient supply chains enable timely delivery for bulk orders in hospitality and residential segments, ensuring growth continuity. Competitive pricing combined with design differentiation is shaping consumer choice across global markets.

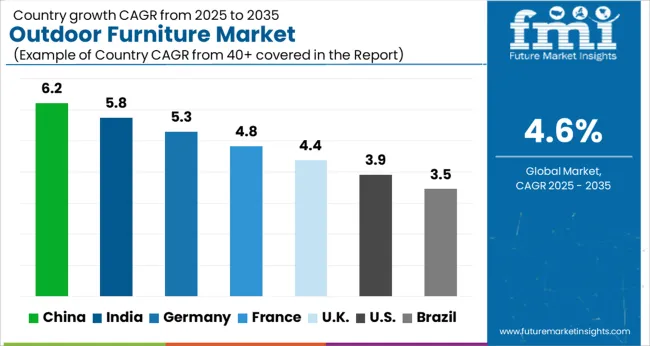

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

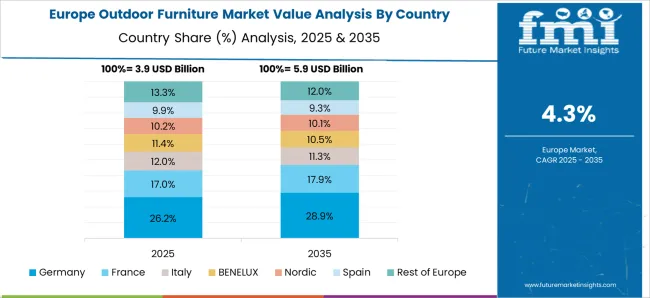

The outdoor furniture market is projected to grow at a global CAGR of 4.6% between 2025 and 2035, driven by increasing adoption across residential, commercial, and hospitality sectors. China leads with a CAGR of 6.2%, supported by rising demand for garden, patio, and balcony furniture, growing hospitality infrastructure, and expansion of e-commerce and retail networks offering customizable options. India follows at 5.8%, fueled by residential housing growth, urban property upgrades, and rising investment in resorts, hotels, and recreational spaces. France records a CAGR of 4.8%, backed by hospitality renovations, seasonal outdoor installations, and demand for ergonomic, premium designs. The United Kingdom grows at 4.4%, shaped by commercial and residential outdoor furnishing projects, while the United States posts 3.9%, influenced by premium landscaping, leisure, and hospitality upgrades. The analysis spans over 40 global markets, with these five countries serving as benchmarks for evaluating consumer adoption, material preferences, and strategic investments in outdoor furniture supply, design, and distribution worldwide.

China recorded a CAGR of 5.5% during 2020–2024, which is projected to rise to 6.2% during 2025–2035, well above the global average of 4.6%. Early growth was driven by rising residential and commercial outdoor furnishing projects, expansion in hospitality infrastructure, and the rapid growth of e-commerce platforms offering customized furniture solutions. From 2025 onward, accelerated growth is expected due to increasing disposable income, large-scale resort and hotel renovations, and higher demand for ergonomic and premium outdoor designs. Manufacturers are scaling production, improving material quality, and leveraging online and offline retail channels to meet rising demand, reinforcing China’s leading position in the global outdoor furniture market.

India posted a CAGR of 5.2% during 2020–2024, which is anticipated to increase to 5.8% during 2025–2035, outperforming the global average of 4.6%. Early growth was supported by rising housing developments, growing middle-class income, and increasing adoption of patio and garden furniture in urban and semi-urban areas. From 2025 onward, growth is expected to accelerate due to increased investments in hotels, resorts, and recreational infrastructure, as well as expanding commercial furnishing projects. Indian manufacturers are focusing on cost-effective production, diversification of designs, and strengthening distribution networks to cater to both domestic and export markets, contributing to stronger demand and dollar sales.

France recorded a CAGR of 4.4% during 2020–2024, which is projected to rise to 4.8% during 2025–2035, slightly above the global average of 4.6%. Early-stage growth was driven by hospitality refurbishments, seasonal outdoor installations, and increasing consumer preference for ergonomically designed and weather-resistant furniture. Moving into 2025–2035, higher growth is expected as hotels, resorts, and urban residential projects expand their outdoor living spaces, and consumer demand shifts toward premium and durable designs. Manufacturers are investing in advanced materials, eco-friendly finishes, and design innovations to capture higher market share and drive consistent dollar sales across regions.

The United Kingdom posted a CAGR of 4.0% during 2020–2024, which is expected to rise to 4.4% during 2025–2035, slightly below China and India but above the global baseline of 4.6%. Initial growth was influenced by increasing residential patio upgrades, commercial outdoor seating projects, and adoption in boutique hotels and leisure resorts. Between 2025 and 2035, market growth accelerates due to higher investment in outdoor hospitality infrastructure, premium landscaping projects, and rising demand for weather-resistant and ergonomic furniture. Manufacturers are focusing on supply chain optimization, product differentiation, and design innovation to capture larger share and maximize dollar sales in the UK market.

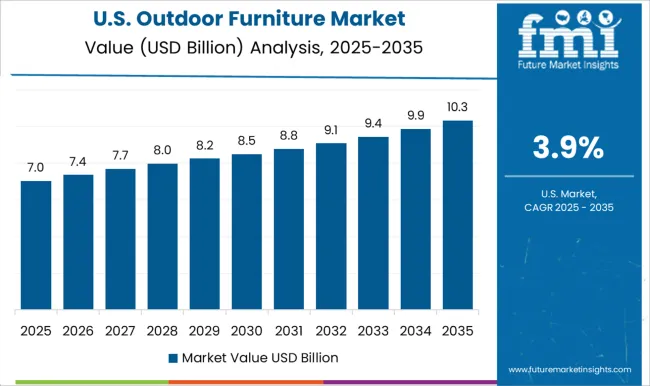

The United States recorded a CAGR of 3.6% during 2020–2024, which is projected to increase to 3.9% during 2025–2035, slightly below the global average of 4.6%. Early growth was driven by residential landscaping projects, commercial outdoor installations, and seasonal furniture purchases for leisure and hospitality applications. From 2025 onward, growth is expected to continue due to premium residential property development, expansion of resort and hotel infrastructure, and higher consumer preference for durable, high-quality designs. USA manufacturers are leveraging advanced materials, supply chain improvements, and product diversification to meet market demand, enhancing share and overall dollar sales.

The outdoor furniture market is shaped by global brands, specialty designers, and regional manufacturers that provide durable and premium solutions for residential, commercial, and hospitality applications. IKEA, Inc. holds a dominant position through large-scale production, global retail presence, and affordable design offerings that cater to mass-market demand. Article leverages direct-to-consumer online strategies to provide customizable and stylish furniture options. Ashley Furniture Industries, Brown Jordan International, Inc., and Burrow Inc. focus on diversified portfolios spanning indoor-outdoor applications, emphasizing design, durability, and comfort. Dedon GmbH, Ebel Inc., Fermob USA, Inc., and Gloster Furniture specialize in high-end, weather-resistant materials for luxury outdoor spaces.

Grandin Road, Kingsley Bate, Polywood LLC, and Sifas USA offer niche products emphasizing sustainability, modularity, and premium finishes, while Sunset West, Terra Outdoor Living, TUUCI, and Woodard Furniture address commercial, resort, and hospitality segments with tailored designs and robust construction. Key strategies across this competitive landscape include product differentiation through material quality, ergonomic design, and weather-resistant coatings, strategic partnerships with hospitality and resort operators, and the integration of omni-channel retail and direct-to-consumer platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Outdoor seating furniture, Outdoor dining furniture, Outdoor kitchen furniture, Accessories, and Others |

| Material | Wood, Metal, Plastic, Fabric, Synthetic fibres, and Others (textile, non-textile, etc.) |

| Price | Medium, Low, and High |

| End Use | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IKEA, Inc., Article, Ashley Furniture Industries, Brown Jordan International, Inc., Burrow Inc., Dedon GmbH, Ebel Inc., Fermob USA, Inc., Gloster Furniture, Grandin Road, Kingsley Bate, Polywood LLC, Sifas USA, Sunset West, Terra Outdoor Living, TUUCI, and Woodard Furniture |

| Additional Attributes | Dollar sales, market share by material and design type, growth by residential, commercial, and hospitality segments, emerging trends, competitive pricing strategies, supply chain efficiency, and seasonal demand patterns. |

The global outdoor furniture market is estimated to be valued at USD 16.9 billion in 2025.

The market size for the outdoor furniture market is projected to reach USD 26.6 billion by 2035.

The outdoor furniture market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in outdoor furniture market are outdoor seating furniture, _lounge chairs, _sofas, _loungers, _benches, outdoor dining furniture, _dining chairs, _outdoor tables, _side tables, _outdoor dining sets, outdoor kitchen furniture, _side tables, _bbq tables, _cabinets, _back panels, _shelf-units, _others, accessories, _umbrella bases, _pillows, _others (cushions, deck patios, bar carts, etc.) and others.

In terms of material, wood segment to command 28.7% share in the outdoor furniture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA