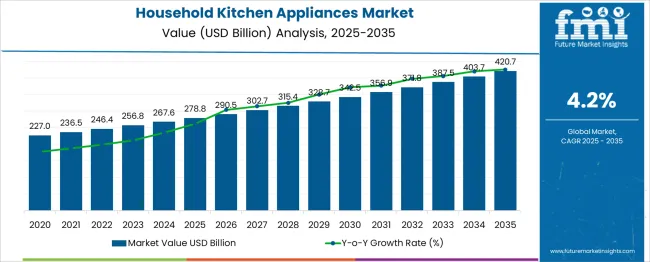

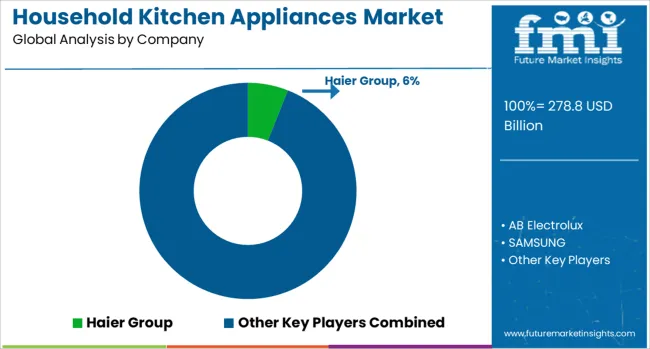

The global household kitchen appliances market is projected to grow from USD 278.8 billion in 2025 to approximately USD 420.7 billion by 2035, recording an absolute increase of USD 141.89 billion over the forecast period. This translates into a total growth of 50.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.2% between 2025 and 2035. The market size is expected to grow by nearly 1.51X during the same period, supported by rising disposable incomes in emerging markets, increasing urbanization rates, and growing consumer preference for energy-efficient and technologically advanced kitchen solutions.

Between 2025 and 2030, the household kitchen appliances market is projected to expand from USD 278.8 billion to USD 342.47 billion, resulting in a value increase of USD 63.67 billion, which represents 44.9% of the total forecast growth for the decade. This phase of growth will be shaped by a rising middle-class population in emerging economies, increasing nuclear family structures, and growing demand for convenience-oriented cooking solutions. Manufacturers are focusing on energy efficiency improvements, smart connectivity features, and design aesthetics to meet evolving consumer preferences and regulatory requirements.

From 2030 to 2035, the market is forecast to grow from USD 342.47 billion to USD 420.69 billion, adding another USD 78.22 billion, which constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of Internet of Things integration, artificial intelligence-powered cooking features, and manufacturing practices. The growing emphasis on health-conscious cooking methods and premium appliance segments will drive demand for advanced kitchen appliances with enhanced functionality and performance capabilities.

Between 2020 and 2025, the household kitchen appliances market experienced accelerated growth driven by the COVID-19 pandemic, increasing home cooking activities, and renovation projects. The market developed as consumers invested in upgrading their kitchen infrastructure to support extended periods of home-based meal preparation and entertainment.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 278.8 billion |

| Market Forecast Value (2035) | USD 420.7 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

Market expansion is being supported by rapid urbanization in developing countries, creating demand for complete kitchen solutions and the increasing number of nuclear families requiring individual household setups. Rising disposable incomes and changing lifestyle patterns are driving consumer preference for time-saving, convenient cooking appliances that enhance meal preparation efficiency. The growing awareness of energy conservation and eco-friendliness is compelling manufacturers to develop eco-friendly appliances that meet stringent efficiency standards.

The expanding real estate development and housing construction activities are creating consistent demand for new kitchen appliance installations across residential segments. Consumer preference for premium and technologically advanced appliances is driving market value growth as households invest in high-quality, feature-rich products that offer enhanced cooking experiences. The increasing popularity of cooking shows, celebrity chefs, and culinary education is fostering consumer interest in professional-grade kitchen equipment for home use.

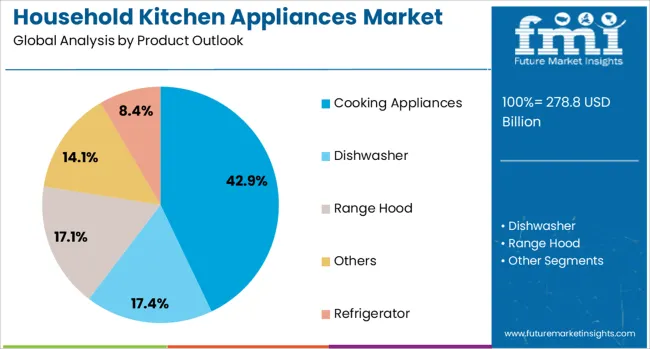

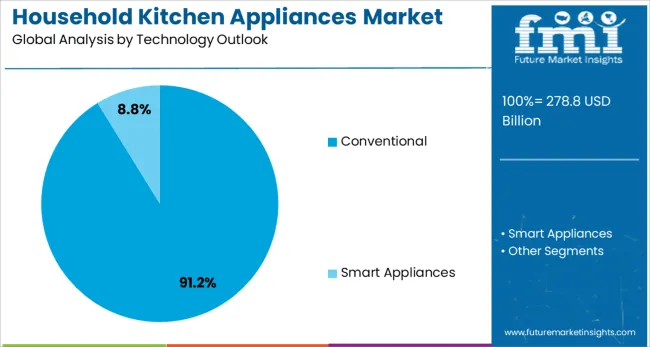

The market is segmented by product outlook, technology outlook, and region. By product outlook, the market is divided into cooking appliances, dishwashers, range hoods, refrigerator, and others. Cooking appliances segment includes cooktops & cooking range, ovens, and others. Based on technology outlook, the market is categorized into conventional and smart appliances. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Cooking appliances are projected to hold 42.9% of the Household Kitchen Appliances market in 2025. This leading share is supported by the fundamental importance of cooking functionality in kitchen operations and the diverse range of cooking appliance categories, including cooktops, ranges, and ovens. Cooking appliances represent essential kitchen equipment that requires regular replacement cycles and continuous technological advancement. The segment benefits from increasing consumer interest in diverse cooking methods, premium cooking experiences, and energy-efficient cooking solutions.

Conventional technology is expected to represent 91.2% of household kitchen appliance demand in 2025. This dominant share reflects the widespread preference for proven, reliable appliance technologies that offer cost-effective solutions for basic kitchen functionality. Conventional appliances provide essential cooking, cleaning, and food preservation capabilities without advanced connectivity features. The segment benefits from established manufacturing processes, competitive pricing structures, and broad consumer acceptance across diverse economic segments and geographic markets.

The household kitchen appliances market is advancing steadily due to urbanization trends and rising living standards, driving appliance adoption. However, the market faces challenges including raw material cost volatility, supply chain complexities, and intense price competition among manufacturers. Energy efficiency regulations and environmental standards continue to influence product development and market dynamics across different regions.

The growing deployment of smart technology features and Internet of Things connectivity in kitchen appliances is enabling remote monitoring, automated cooking programs, and integration with home automation systems. Smart appliances provide users with enhanced control capabilities, energy usage monitoring, and predictive maintenance alerts that improve operational efficiency. These technologies support busy lifestyles by enabling meal preparation scheduling, recipe guidance, and inventory management through connected mobile applications.

Manufacturers are prioritizing energy efficiency improvements and manufacturing practices to meet regulatory requirements and consumer environmental preferences. Advanced insulation technologies, efficient motor systems, and eco-friendly refrigerants are reducing operational costs while minimizing environmental impact. Manufacturing approaches include recyclable materials, reduced packaging, and extended product lifecycles that appeal to environmentally conscious consumers.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4% |

| USA | 3.6% |

| Brazil | 3.2% |

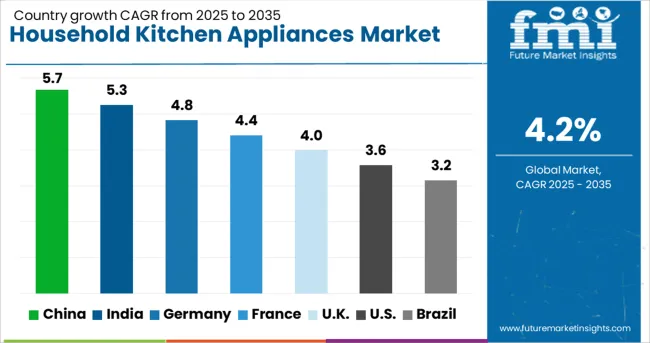

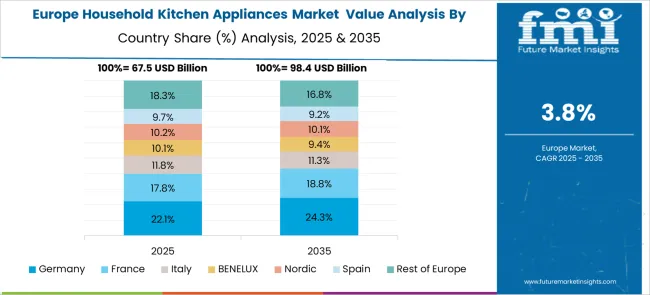

The household kitchen appliances market demonstrates varied growth patterns across key countries, with China leading at a 5.7% CAGR through 2035, driven by rapid urbanization, rising middle-class population, and increasing adoption of modern kitchen infrastructure. India follows closely at 5.3%, supported by growing disposable incomes, nuclear family formation, and expanding urban housing development. Germany records 4.8% growth, emphasizing premium appliances and energy efficiency innovations. France advances at 4.4%, focusing on design aesthetics and culinary excellence. The UK shows growth at 4%, driven by kitchen renovation projects and smart appliance adoption. The USA maintains steady expansion at 3.6%, supported by replacement cycles and premium appliance demand. Brazil records 3.2% growth, driven by economic development and urbanization, creating demand for modern kitchen solutions.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from household kitchen appliances in China is projected to exhibit the highest growth rate with a CAGR of 5.7% through 2035, driven by unprecedented urbanization rates creating demand for complete kitchen solutions and the rapidly expanding middle-class population investing in modern home infrastructure. The country's massive residential construction activities and urban housing development projects are generating substantial demand for kitchen appliance installations. Rising disposable incomes and changing lifestyle patterns are driving consumer preference for premium appliances with advanced features and superior performance capabilities. Government initiatives promoting energy efficiency and environmental protection are encouraging adoption of eco-friendly appliances that meet stringent performance standards. The growing influence of cooking culture and culinary education is fostering consumer interest in professional-grade kitchen equipment and specialized cooking appliances.

Revenue from household kitchen appliances in India is expanding at a CAGR of 5.3%, supported by robust economic growth, an expanding middle-class population, and increasing nuclear family formations requiring individual household setups. The country's rapid urbanization and modern housing development are creating consistent demand for kitchen appliance installations across diverse price segments. Rising disposable incomes and changing consumer preferences are driving adoption of convenience-oriented appliances that support busy lifestyles and dual-income households. Government initiatives promoting domestic manufacturing and energy efficiency are encouraging local production capabilities while establishing quality standards. The growing retail infrastructure and e-commerce penetration are improving appliance accessibility and consumer awareness across urban and semi-urban markets.

Demand for household kitchen appliances in Germany is projected to grow at a CAGR of 4.8%, supported by the country's emphasis on premium quality products and leadership in energy efficiency innovation. German consumers demonstrate a strong preference for durable, high-performance appliances that offer superior functionality and a long-term value proposition. The emphasis on environmental and energy conservation is driving demand for appliances that meet stringent efficiency standards and incorporate eco-friendly technologies. Advanced manufacturing capabilities and engineering excellence are establishing German companies as leaders in premium appliance segments and innovative design solutions. The focus on smart home integration and digital connectivity is accelerating adoption of intelligent appliances that enhance user experience and operational efficiency.

Demand for household kitchen appliances in France is expanding at a CAGR of 4.4%, driven by the country's culinary heritage, creating consumer preference for appliances that support sophisticated cooking techniques and presentation standards. French consumers demonstrate strong appreciation for design aesthetics, functionality, and craftsmanship in kitchen equipment selection. The emphasis on culinary education and cooking culture is fostering demand for professional-grade appliances and specialized cooking equipment that enhance meal preparation capabilities. Growing interest in healthy cooking methods and organic food preparation is driving adoption of appliances that preserve nutritional value and flavor integrity. The focus on kitchen renovation projects and home improvement activities is creating opportunities for premium appliance upgrades and complete kitchen modernization.

Demand for household kitchen appliances in the UK is projected to grow at a CAGR of 3.9%, supported by active kitchen renovation market and increasing consumer interest in smart technology integration. British households are investing in kitchen modernization projects that incorporate energy-efficient appliances and contemporary design elements. The emphasis on convenience and time-saving solutions is driving adoption of appliances that streamline meal preparation and cleanup processes. Growing environmental consciousness is encouraging selection of energy-efficient appliances that reduce operational costs and environmental impact. The expanding smart home adoption and digital connectivity preferences are accelerating integration of intelligent appliances that offer remote monitoring and automated functionality.

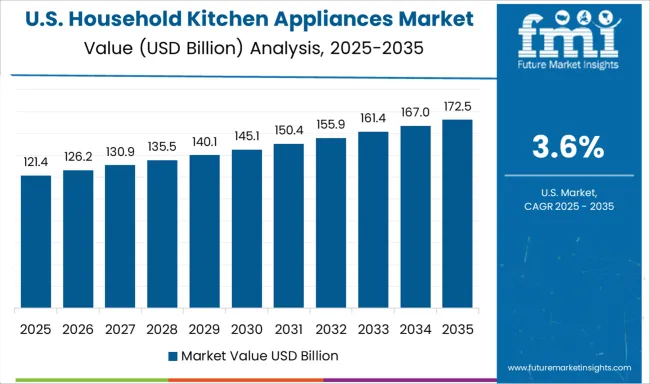

Demand for household kitchen appliances in the USA is expanding at a CAGR of 3.6%, driven by established replacement cycles for mature appliance installations and growing consumer preference for premium appliances with advanced features. American households demonstrate consistent investment in kitchen upgrades that enhance functionality, aesthetics, and energy efficiency. The emphasis on home entertainment and cooking experiences is driving adoption of professional-style appliances and specialized equipment that support diverse culinary activities. Rising energy costs and environmental awareness are encouraging selection of energy-efficient appliances that provide long-term operational savings. The growing influence of home improvement television programs and social media is fostering consumer interest in kitchen modernization and premium appliance adoption.

Demand for household kitchen appliances in Brazil is projected to grow at a CAGR of 3.2%, driven by the country's economic development, creating an expanding middle-class population and increasing urbanization rates that generate demand for modern kitchen infrastructure. The growing real estate development and housing construction activities are creating consistent opportunities for new appliance installations across residential segments. Rising disposable incomes and changing consumer preferences are encouraging adoption of energy-efficient appliances that provide operational cost savings and enhanced functionality. Government initiatives supporting domestic manufacturing and import substitution are encouraging local production capabilities while improving product affordability and availability. The expanding retail infrastructure and consumer financing options are enhancing appliance accessibility across diverse economic segments and geographic regions. Brazilian households are increasingly investing in kitchen modernization projects that incorporate reliable, feature-rich appliances supporting contemporary cooking practices and lifestyle requirements.

The household kitchen appliances market is characterized by intense competition among global appliance manufacturers, regional specialists, and emerging technology-focused companies. Companies are investing in energy efficiency improvements, smart technology integration, design innovation, and manufacturing optimization to deliver reliable, efficient, and aesthetically appealing appliance solutions. Strategic partnerships, brand positioning, and geographic expansion are central to strengthening market presence and customer loyalty.

Haier Group, China-based, offers a comprehensive household appliance portfolio with a focus on innovation, quality, and global market expansion across diverse price segments. AB Electrolux, operating globally, provides premium appliance solutions with emphasis on design excellence and advanced functionality. Samsung delivers technologically advanced appliances with smart connectivity features and energy-efficient performance. LG Electronics emphasizes innovative design, reliable performance, and a comprehensive product portfolio addressing diverse consumer requirements.

Morphy Richards focuses on convenience-oriented appliances with emphasis on user-friendly design and functional excellence. Panasonic Holdings Corporation provides reliable, energy-efficient appliances with advanced technology integration and superior build quality. Miele & Cie. KG delivers premium appliances renowned for durability, performance, and sophisticated engineering. Whirlpool Corporation offers comprehensive appliance solutions with a focus on innovation, reliability, and customer satisfaction. Robert Bosch GmbH provides high-quality appliances with emphasis on precision engineering and energy efficiency. Smeg S.p.A delivers design-focused appliances combining Italian aesthetics with advanced functionality and performance capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 278.8 billion |

| Product Outlook | Cooking Appliances (Cooktops & Cooking Range, Ovens, Others), Dishwasher, Range Hood, Refrigerator, Others |

| Technology Outlook | Conventional, Smart Appliances |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Haier Group, AB Electrolux, Samsung, LG Electronics, Morphy Richards, Panasonic Holdings Corporation, Miele & Cie. KG, Whirlpool Corporation, Robert Bosch GmbH, Smeg S.p.A |

| Additional Attributes | Dollar sales by product category, technology type, and price segment, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established appliance manufacturers and emerging smart technology providers, consumer preferences for conventional versus smart appliance features, integration with home automation systems and energy management solutions, innovations in energy efficiency technologies and manufacturing practices, and adoption of advanced cooking technologies with embedded connectivity and automated functionality for enhanced user experience. |

The global household kitchen appliances market is estimated to be valued at USD 278.8 billion in 2025.

The market size for the household kitchen appliances market is projected to reach USD 420.7 billion by 2035.

The household kitchen appliances market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in household kitchen appliances market are cooking appliances, _cooktops & cooking range, _ovens, _others, dishwasher, range hood, others and refrigerator.

In terms of technology outlook, conventional segment to command 91.2% share in the household kitchen appliances market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Household R290 Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Household Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Household Refrigerators and Freezers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Household Water Dispensers Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Household Robot Market Insights – Growth & Forecast 2024-2034

Household & Cleaning Container Market

Household Aluminum Foil Market

Household Appliances Market Trends – Growth & Forecast 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

MEA Kitchen Storage Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA