The Household Care Wipes Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Household Care Wipes Market Estimated Value in (2025 E) | USD 5.1 billion |

| Household Care Wipes Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The household care wipes market is experiencing steady growth, driven by rising consumer demand for convenient cleaning solutions and heightened emphasis on hygiene in residential environments. Industry updates and product announcements have highlighted increased adoption of multi-purpose cleaning wipes designed to simplify household chores while ensuring effective germ removal.

The shift toward urban lifestyles and dual-income households has amplified the preference for ready-to-use cleaning products that save time and effort. Additionally, heightened awareness of infection control since recent public health crises has reinforced the use of disposable wipes for everyday cleaning routines.

Manufacturers have focused on developing biodegradable and eco-friendly alternatives, responding to sustainability concerns and consumer demand for environmentally responsible products. Strategic retail expansions, especially in organized outlets, have increased product availability and visibility. Future growth is expected to be fueled by innovation in material technology, fragrance variety, and multi-surface applications, with segmental demand led by Floor Wipes and Hypermarkets or Supermarkets as the dominant sales channel.

The Floor Wipes segment is projected to account for 41.60% of the household care wipes market revenue in 2025, sustaining its leadership among product categories. This segment’s growth has been shaped by the increasing consumer preference for efficient and disposable solutions that simplify floor cleaning compared to traditional mops.

Floor wipes are designed to offer strong absorption, ease of use, and compatibility with both manual cleaning and mop systems, meeting diverse household needs. Industry reports have noted rising consumer adoption in urban households where quick turnaround cleaning is prioritized.

Additionally, product innovations in antibacterial and scented floor wipes have enhanced appeal by combining cleanliness with added freshness. The segment has also benefitted from the surge in demand for hygienic solutions in households with children and pets, where frequent floor cleaning is necessary. With growing awareness of hygiene and continued preference for convenience, the Floor Wipes segment is expected to maintain its dominant position.

The Hypermarkets or Supermarkets segment is projected to hold 46.20% of the household care wipes market revenue in 2025, positioning itself as the leading sales channel. Growth of this segment has been supported by consumer preference for organized retail outlets that provide a wide variety of brands, promotions, and bulk purchase options.

Hypermarkets and supermarkets have remained primary shopping destinations for household cleaning products due to their accessibility and ability to showcase multiple product types in one place. Retail partnerships and in-store marketing campaigns have further boosted the visibility of household care wipes, encouraging consumer trial and repeat purchases.

The segment has also been reinforced by impulse buying behavior, where wipes are often added to shopping baskets alongside other daily essentials. Additionally, the increasing expansion of supermarket chains into emerging economies has widened consumer access to branded household wipes. As organized retail networks continue to expand and emphasize hygiene-related product ranges, the Hypermarkets or Supermarkets segment is expected to retain its dominant role in distribution.

The global essential care wipes market grew rapidly during the historical period from 2020 to 2025, reaching a value of around USD 5.1 billion in 2025. According to our market survey, the worldwide consumption of wipes market developed at a CAGR of 6.3% from 2020 to 2025. The positive implications of this growth trajectory were also experienced in the sales of household cleaning wipes during those years.

The expansion in personal care wipes market demand was supported by numerous essential characteristics that define this period. The overall market witnessed an upward trajectory during the years 2024 and 2024 after the emergence of the Covid-19 pandemic. These difficult times, in turn, inculcated a behavioral change among the general populace for the adoption of cleanliness and hygiene products. The market share of baby wipes to old age care wipes skyrocketed during these years and is poised to continue in the coming years as well.

The increase in demand for disinfecting wipes is fueled by a growing awareness of the essential role it plays in preventing the spread of illnesses. According to the market exerts, the demand for healthcare items and services has no chance of dropping in the near future.

Advancements in the global alcoholic wipes market, such as convenience and simplicity of disposal, could also have a huge impact on the industry's rising prosperity. Moreover, the growing demand for scented and fragmented wipes is an emerging opportunity that could drive the market further.

In 2025, the United States market was worth around USD 781.4 million, making it the leading market in comparison to other countries. Besides a higher demand for surface wipes and window wipes, there has been an emerging demand for pet wipes in the country in recent years. Such emerging trends are projected to drive this regional market, further evolving the market strategy for wet wipes globally.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| United States | 18.3% |

| Canada | 3.2% |

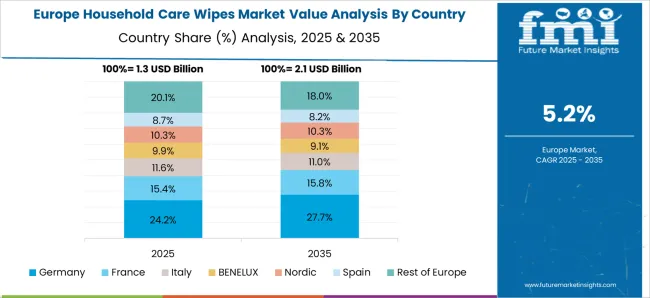

Germany, with a strong base for manufacturing industries, currently dominates the disinfectant wipes market in Europe. According to market survey figures, in the year 2025, the revenue generated by this regional market was almost USD 205 million. Over the coming years, the Germany market is expected to retain its dominance over the consumer wipes market in Europe by supplying to Eastern European countries.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| United Kingdom | 5.1% |

| Germany | 4.8% |

| France | 4.1% |

| Italy | 4.3% |

| Spain | 3.6% |

Demand for healthcare surface wipes has grown significantly in many European countries in the last few years. Prominent countries like the United Kingdom, with higher demand for cleaning cloth wipes, now have highly developed and saturated markets with numerous market players. However, to accommodate the further rising regional demand, several European firms are developing novel flushable wipes that have gained higher traction in recent years.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| China | 8.4% |

| India | 7.5% |

| Japan | 5.2% |

| Australia | 2.8% |

| Singapore | 2% |

In Asia Pacific, China is the country with higher demand for all types of sanitary wipes. In the year 2025, the total revenue generated by this regional market was around USD 403.2 million. During the projection period, China may account for a substantial share of the Asia market for household care or sanitizing wipes.

Owing to rising hygiene concerns with improving living standards in India, there is a higher demand for healthcare wipes for home applications. Particularly, the demand for kitchen wipes and bathroom wipes in India is expected to expand at a remarkable rate during the forecasted years. Moreover, the increasing pharmaceutical sector and increased export volume of novel healthcare goods might drive this regional market further in the near future.

| Attributes | Details |

|---|---|

| Top Product Type | Floor Wipes |

| Market Share in 2025 | 32.5% |

Currently, multipurpose wipes are available at hospital pharmacies, retail pharmacies, and convenience stores around the world. However, the demand for floor wipes still holds a significant share of the overall market.

Among the major types of household care wipes, the glass cleaning wipes segment is observed to be growing at a higher rate these years. This segment is expected to acquire a higher market share by 2035, followed by leather cleaning wipes.

| Attributes | Details |

|---|---|

| Top Product Type | Hypermarkets or Supermarkets |

| Market Share in 2025 | 29.5% |

As a variety of cleaning goods can be found in a single location, the supermarket sector dominates the sales of household care wipes worldwide. However, the recent upsurge in sales of household care wipes over online retail channels is expected to reduce the share of this segment.

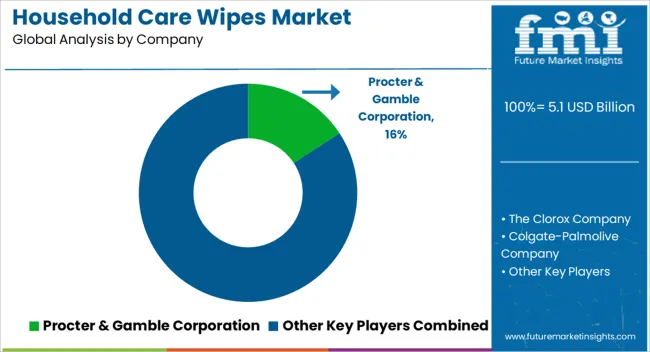

The worldwide household care wipes business is distinguished as highly fragmented and competitive due to the presence of both established firms and new entrants. Recognizing the growing trend of biodegradable wipes, key household care wipes manufacturers are stepping up their efforts to seize this market potential.

Besides using biodegradable materials, key market players are also focussing on the adoption of environmental best practices to establish future sustainability of household care wipes. For instance, Kimberly-Clark Company is the most well-known firm continually concentrating on minimizing CO2 footprints from their operations, ultimately contributing to environmental sustainability.

With novel goods and technologies, several start-ups have joined the electronics cleaning wipes and furniture polish wipes business growing worldwide. By utilizing company-owned e-commerce and affiliate stores, they are employing various online marketing tactics to increase income from the sanitary and hygiene product areas.

Recent Developments by the Household Care Wipes Manufacturers

The Honest Company Incorporation introduced its Clean Conscious Wipes product line, which includes a mild cleanser, in February 2025. Because these are made without plastic, quaternary compounds, fragrances, chlorine processing, or parabens, these biodegradable wipes are suitable for sensitive skin.

In August 2024, Rockline incorporated invested nearly USD 20 million to build a cutting-edge wipes manufacturing facility in Wisconsin, United States.

Diamond Wipes International Company released a new product line under the 'HandyClean Steridol' wipe in January 2024. The company claims these antibacterial wipes have excellent germ protection capacity that would be popular among the public.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 5.8% from 2025 to 2035 |

| Projected Market Size (2035) | USD 9.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million or billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | By Product Type, By Sales Channel, By Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan (APEJ); Japan; The Middle East and Africa (MEA) |

| Countries Covered | United States, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Procter & Gamble Corporation; The Clorox Company; Colgate-Palmolive Company; Weiman Products, LLC; Seventh Generation; Nice-Pak Products, Inc.; Rockline Industries, Amway; S. C. Johnson & Son, Inc.; 3M Company; Method Products, pbc; Reckitt Benckiser Group PLC |

| Customization& Pricing | Available Upon Request |

The global household care wipes market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the household care wipes market is projected to reach USD 9.0 billion by 2035.

The household care wipes market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in household care wipes market are floor wipes, cleaning or disinfectant wipes, electrostatic wipes, mops, glass or furniture wipes and others.

In terms of sales channel, hypermarkets or supermarkets segment to command 46.2% share in the household care wipes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Household Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Household Refrigerators and Freezers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Household Water Dispensers Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Household Appliances Market Trends – Growth & Forecast 2025 to 2035

Household Robot Market Insights – Growth & Forecast 2024-2034

Household & Cleaning Container Market

Household Aluminum Foil Market

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA