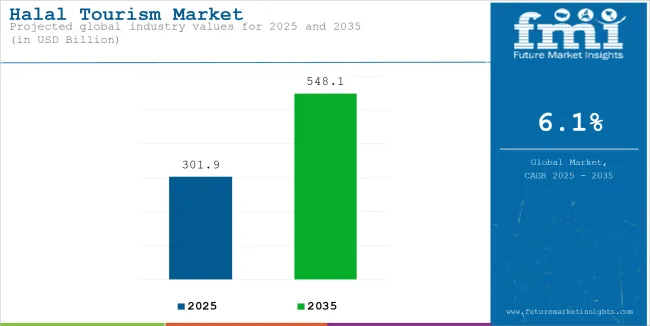

Global Halal tourism is likely to grow approximately to USD 301.9 billion by 2025 and expand further up to USD 548.1 billion by 2035 at a robust CAGR of 6.1% for the forecast period from 2025 to 2035.

This growth comes from the expansion of the Muslim population, surging demand for religiously compliant travel experiences, and growing accessibility of halal-friendly services and destinations across the globe. Muslim travelers nowadays seek a luxurious, comfortable, and convenient destination while adhering to religious guidelines.

The market includes several services targeting the Muslim traveller from halal-approved accommodations, dining, and amusement to fully designated destinations that satisfy the needs of Muslim visitors. These services are designed to provide Muslim travelers with the opportunity to enjoy their journey while maintaining religious practices, from halal food to prayer facilities or avoiding situations that are incompatible with the Islamic faith.

Halal tourism now is being revamped with new sophisticated services to fit the Muslim world's growing interests in diverse tourist experiences around the globe.

| Attribute | Details |

|---|---|

| Current Halal Tourism Industry Size (2024A) | USD 285.1 Billion |

| Estimated Halal Tourism Industry Size (2025E) | USD 301.9 Billion |

| Projected Halal Tourism Industry Size (2035F) | USD 548.1 Billion |

| Value CAGR (2025 to 2035) | 6.1% |

Steadily, the halal tourism market has been increasing between 2020 and 2024 with the increased awareness of halal travel, demand for religiously compliant tourism experiences, and the increasing availability of services. However, the market is going to gain pace from 2025 to 2035 with an even higher CAGR of 6.1% as against 5.3% that is seen in the previous period.

The growth in this market is particularly driven by the surge in Muslim travelers who increasingly seek destinations offering halal-certified facilities and services. In addition to this, rapid development in digital platforms has significantly enhanced the access of halal-friendly tours and accommodations, thereby making planning more convenient for travel.

Key Drivers of Growth in the Global Halal Tourism Industry

The halal tourism market is experiencing rapid expansion due to several key factors. The growing Muslim population, increasing demand for ethical and religiously compliant travel, and the expanding availability of halal services worldwide are all contributing to the sector’s growth.

Increasing Muslim Population

The world population of Muslims continues to increase positively, thus implying an increased call for travel and tourism services as halal. The growing size of the population of Muslims necessitates increased size in demand that can cater for religious activities or practices, among them, taking halal, praying places, and sex orientation. This can be termed one of the ways through which there is increased tourism in terms of halal and, thus leading to growth and development.

Expanding Availability of Halal Services

Halal-certified hotels, restaurants, transport services, and entertainment venues are increasingly becoming popular. These services allow Muslim travelers to travel comfortably while maintaining their religious practices. Halal tourism destinations now encompass accommodations with prayer rooms, halal dining options, gender-segregated services, and cultural experiences aligned with Islamic values. Many countries have started investing heavily in halal tourism infrastructure, thus creating a seamless travel experience that aligns with religious principles.

Technological Advancements in Booking Platforms

Digital platforms which provide halal-friendly services to travelers have even made booking relatively easier for a Muslim traveler. Now, platforms are providing thorough information about restaurants, accommodations, and activities halal-certified, making planning easier and readily available. Ease is added; the Muslim travelers can search the destinations which they want according to their specific religion, such as halal food and a proper place for offering prayers.

Rise of Muslim Travel Demand in Emerging Markets

Outbound halal tourism in the Middle East, Southeast Asia, and parts of Africa have contributed substantially to the growth of this market, while the majority of Muslim-majority regions, particularly those in these regions, are emerging as leaders in the global halal tourism market.

Expansion of Halal Tourism

Halal tourism has been picking up in many countries and regions with Muslim-extensive and Muslim minority population. The Middle East has been the central hub for halal tourism for a long time, especially countries like the UAE, Saudi Arabia, and Qatar. Dubai has become one of the prime destinations for Muslim travelers, providing luxury experiences with an adherence to Islamic principles.

Many international Muslim tourist destinations enjoy mosques and accessible halal food options, luxury hotels that have prayer facilities, and cultural landmarks such as the Grand Mosque and Al Fahidi Historical District. Tourism efforts also concentrate on making shopping, entertainment, and cultural activities become in line with Islamic values.

Countries such as Malaysia, Indonesia, and Singapore in Southeast Asia are also gaining popularity as emerging halal tourism destinations. Among them, Malaysia is even famous as it has very strong halal tourism infrastructure, including halal hotels and restaurants and Islamic heritage sites. The country has actively strived to provide diverse ranges of halal services that have postured it as a leading hub for Muslim tourists.

Africa is slowly taking its place as a very key region in halal tourism. Islamic-friendly tourist destinations and accommodations of Morocco, Egypt, and Tunisia have become hot places for increasing numbers of Muslim travelers who find facilities for prayer; meanwhile, dining is also Islamic-friendly. It is a kind of cultural and historical heritage destination, having several Islamic landmarks for tourism visits, in the case of providing culture, history, and religious observance.

Technological Innovations and Advancements

Technology is playing a major role in increasing the size of the halal tourism market. Innovations in mobile apps, as well as online booking portals, are making travel more convenient for Muslims and helping travelers find destinations that suit their specific needs. The improved experience for Muslim tourists is assured with these technological advancements.

Halal Travel Apps

Several mobile apps have been designed to meet the needs of Muslim travelers. Some of the key features of these apps include the locators of halal restaurants, reminders of prayer times, and booking for halal-friendly accommodations and tours. These tools make it easier for Muslim travelers to plan their trips and ensure that they can find destinations and services that comply with Islamic principles.

Online Booking Platforms

Online booking platforms are increasingly being used in the halal tourism industry. These platforms enable Muslim travelers to easily book halal-friendly hotels, tours, and activities. Detailed information and streamlined booking processes make halal travel accessible to a global audience. Some platforms also provide user reviews and ratings for halal services, which can be very transparent and confidence-inspiring in travel choices.

Increasing Focus on Eco-Tourism and Sustainable Practices

Sustainability is a growing concern in the halal tourism sector. With the increasing focus on eco-friendly and socially responsible travel, many Muslim travelers are looking for destinations that are in line with Islamic values of environmental stewardship and ethical practices. The halal tourism market is responding by offering more eco-conscious options.

Eco-Friendly Halal Tourism

Eco-friendly initiatives in the halal tourism sector are gaining traction, with destinations and operators focusing on sustainable tourism practices. Eco-resorts, green-certified hotels, and conservation-focused tours are becoming more popular among Muslim travelers who value the preservation of the environment. The focus on responsible travel, which includes reducing carbon footprints and supporting local communities, aligns with the ethical values upheld in Islam.

The Middle East country continues to be one of the biggest halal tourism markets in the world, where millions of Muslim tourists visit yearly for religious pilgrimages, Hajj and Umrah. To meet the requirements of Muslim tourists, the country has invested highly in infrastructure and services that meet their needs so that they enjoy comfortable, luxurious accommodations while observing their religious practices.

Halal tourism in Saudi Arabia is built around the holy cities of Mecca and Medina, with extensive halal certification for services in hotels, restaurants, and modes of transportation. The expansion of the Holy Mosque in Mecca will further add to the count of visitors in Saudi Arabia.

The Vision 2030 of Saudi Arabia focuses on diversifying tourism offers in the country, one of which is to develop new destinations for halal tourism. It draws religious and leisure tourists by developing new resorts, cultural experiences, and destinations in the form of high-end lifestyles that appeal to the growing halal tourism market.

Malaysia has become one of the prime destinations for Southeast Asian halal tourism in terms of comprehensive halal services, Muslim-friendly attractions, and cultural heritage tourism. The tourism infrastructure of the country has been developed especially for Muslim travelers.

Malaysia is highly acclaimed around the globe for its halal certification system, which ensures tourism-related businesses are in accordance with a really strict halal standard. The government further promotes Malaysia as a prominent destination for halal tourism and hosts international events and initiatives to woo Muslim travelers to its destination.

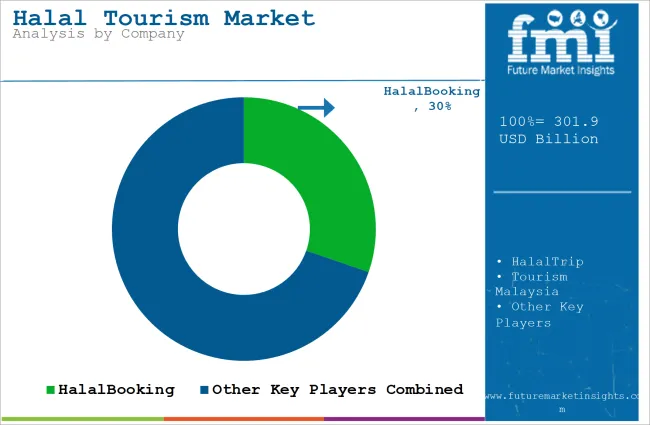

The halal tourism market is highly competitive, with numerous companies offering halal-friendly services and experiences. Leading companies in the global halal tourism industry include HalalTrip, HalalBooking, and Halal Tour.

Recent Developments in the Halal Tourism Market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million/Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; MEA |

| Key Segments Covered | Tour Type, Tourist Type, Tourist Demography, Age Group |

| Key Companies Profiled | HalalBooking; HalalTrip; Tourism Malaysia; Al Habtoor Group; Halal Tours; Carisa Travel Group; Rooh Travel Limited; HalalBooking Ltd; Dintravel; Dreamcation Cruises and Tours |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global halal tourism market is expected to reach USD 301.9 billion by 2025.

The global halal tourism market grew at a CAGR of 6.1% between 2025 and 2035.

Leading players in the halal tourism market include Halal Tour, and HalalBooking.

The Middle East halal tourism market is projected to grow at a 5.6% CAGR during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 21: Global Market Attractiveness by Tour Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 23: Global Market Attractiveness by Tourist Type, 2024 to 2034

Figure 24: Global Market Attractiveness by Age Group, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 46: North America Market Attractiveness by Tour Type, 2024 to 2034

Figure 47: North America Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 48: North America Market Attractiveness by Tourist Type, 2024 to 2034

Figure 49: North America Market Attractiveness by Age Group, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Tour Type, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Tourist Type, 2024 to 2034

Figure 74: Latin America Market Attractiveness by Age Group, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Tour Type, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Tourist Type, 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Age Group, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Tour Type, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Tourist Type, 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Age Group, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Tour Type, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Tourist Type, 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Age Group, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Tour Type, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Tourist Type, 2024 to 2034

Figure 174: East Asia Market Attractiveness by Age Group, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Tour Type, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Tourist Type, 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Age Group, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Halal Tourism Services

UK Halal Tourism Market Analysis – Growth, Applications & Outlook 2025-2035

United States Halal Tourism Market Outlook – Trends, Demand & Forecast 2025–2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Germany Halal Tourism Market Report – Trends & Innovations 2025-2035

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Halal Ingredient Market Analysis - Size, Growth, and Forecast 2025 to 2035

Halal Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Halal Cheese Market

Ortho Phthalaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA