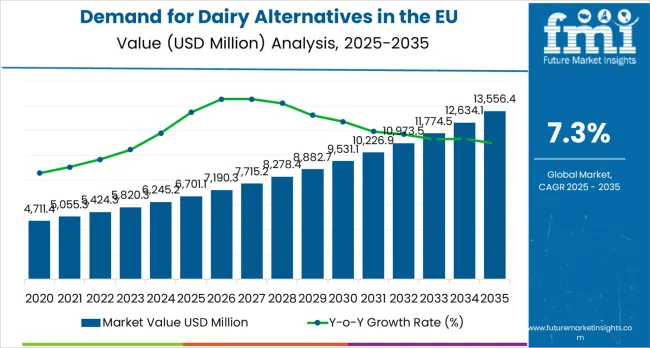

European Union dairy alternatives sales are projected to grow from USD 6,701.1 million in 2025 to approximately USD 13,556.4 million by 2035, recording an absolute increase of USD 6,701.7 million over the forecast period. This translates into total growth of 100.0%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2035.

As per FMI’s latest global food industry intelligence, widely referenced in health and ingredients studies, the overall industry size is expected to double during the same period, supported by the accelerating shift toward plant-based diets, increasing lactose intolerance awareness, and developing applications across non-dairy milk, yogurt, cheese, ice cream, and butter alternatives throughout European markets.

Between 2025 and 2030, EU dairy alternatives demand is projected to expand from USD 6,701.1 million to USD 9,503.6 million, resulting in a value increase of USD 2,801.9 million, which represents 41.8% of the total forecast growth for the decade.

This phase of development will be shaped by rising consumer adoption of flexitarian and plant-based diets, increasing availability of diverse product varieties across milk, yogurt, cheese, and ice cream alternatives, and growing mainstream acceptance of dairy alternatives across retail and foodservice channels. Manufacturers are expanding their product portfolios to address evolving preferences for improved taste profiles, authentic dairy-like textures, and nutritionally fortified formulations comparable to conventional dairy products.

From 2030 to 2035, sales are forecast to grow from USD 9,503.6 million to USD 13,556.4 million, adding another USD 3,899.8 million, which constitutes 58.2% of the overall ten-year expansion. This period is expected to be characterized by further expansion of foodservice and HoReCa (hotels, restaurants, cafes) adoption, integration of precision fermentation technologies for improved taste and functionality, and development of premium artisanal dairy alternative varieties targeting gourmet applications.

The growing emphasis on environmental sustainability and increasing consumer willingness to pay premium prices for plant-based alternatives will drive demand for innovative dairy alternative products that deliver authentic dairy experiences.

Between 2020 and 2025, EU dairy alternatives sales experienced robust expansion at a CAGR of 6.5%, growing from USD 4,999.8 million to USD 6,701.7 million. This period was driven by increasing environmental consciousness among European consumers, rising awareness of lactose intolerance and dairy allergies, and growing recognition of plant-based nutrition benefits.

The industry developed as major food companies and specialized plant-based brands recognized the commercial potential of dairy alternatives. Product innovations, improved taste characteristics, and functional enhancements began establishing consumer confidence and mainstream acceptance of dairy alternative products.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6,701.1 million |

| Market Forecast Value (2035) | USD 13,556.4 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

Industry expansion is being supported by the rapid increase in flexitarian, vegetarian, and vegan consumers across European countries and the corresponding demand for sustainable, ethical, and health-conscious dairy alternatives with proven functionality in culinary applications.

Modern consumers rely on dairy alternatives as direct replacements for conventional dairy in coffee beverages, cereal consumption, cooking, baking, and snacking occasions, driving demand for products that match or exceed dairy's functional properties, including foaming capability for coffee, creamy texture for yogurts, and melting behavior for cheeses. Even minor dietary concerns, such as lactose intolerance, dairy allergies, or cholesterol management, can drive comprehensive adoption of dairy alternatives to maintain optimal wellness and support sustainable consumption patterns.

The growing awareness of animal welfare issues and increasing recognition of dairy production's environmental impact are driving demand for dairy alternatives from certified producers with appropriate sustainability credentials and ethical sourcing practices.

Regulatory authorities are increasingly establishing clear guidelines for dairy alternative labeling, nutritional fortification standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and nutritional analyses are providing evidence supporting dairy alternatives' environmental advantages and nutritional adequacy, requiring specialized processing methods and standardized formulation protocols for authentic dairy flavor development, optimal texture characteristics, and appropriate nutritional profiles, including calcium, vitamin D, and vitamin B12 fortification.

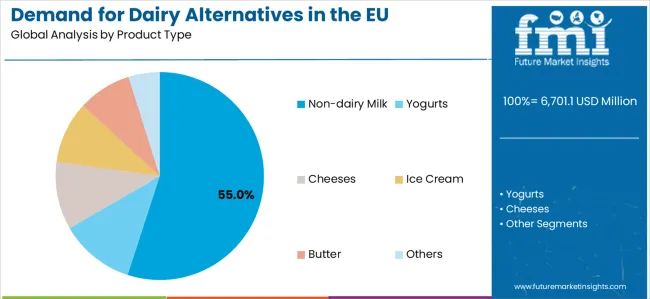

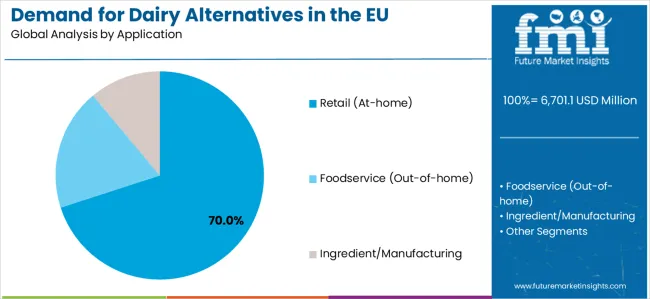

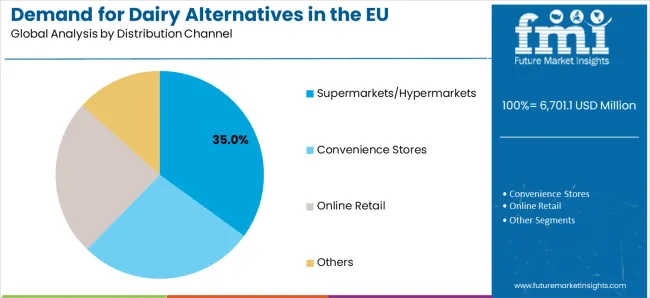

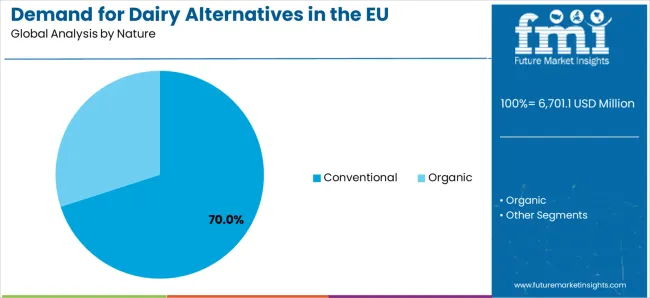

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into non-dairy milk, yogurts, cheeses, ice cream, butter, and others. Based on application, sales are categorized into retail (at-home), foodservice (out-of-home), and ingredient/manufacturing. In terms of distribution channel, demand is segmented into supermarkets/hypermarkets, convenience stores, online retail, and others. By nature, sales are classified into conventional and organic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The non-dairy milk segment is projected to account for 55.0% of EU dairy alternatives sales in 2025, establishing itself as the dominant product category across European markets, declining slightly to 48.0% share by 2035 as other categories grow faster.

This commanding position is fundamentally supported by non-dairy milk's long-established presence in plant-based food consumption, versatile applications spanning beverages, cereal consumption, coffee additions, and cooking applications, and superior consumer acceptance compared to other dairy alternative categories. The non-dairy milk format delivers exceptional convenience, providing consumers with ready-to-drink products that directly replace conventional milk across all traditional usage occasions.

This segment benefits from extensive product variety, including soy milk, almond milk, oat milk, coconut milk, rice milk, and emerging alternatives like pea milk and cashew milk, each appealing to different consumer preferences for taste, nutritional profiles, and sustainability considerations. Additionally, non-dairy milk offers versatility across barista-quality formulations for coffee applications, fortified options matching dairy's nutritional profile, and flavored varieties supporting broader consumer appeal beyond core plant-based demographics.

The non-dairy milk segment experiences relative share decline from 55.0% to 48.0% through 2035, reflecting accelerated growth in yogurt and cheese alternatives as these categories mature and gain mainstream acceptance, while non-dairy milk maintains absolute growth but represents smaller proportion of expanding overall market.

Non-dairy yogurt is positioned to expand from 15.0% market share in 2025 to 17.0% by 2035, while plant-based cheese accelerates from 12.0% to 16.0% share, reflecting these categories' rapid development as manufacturers optimize formulations and consumers increase acceptance.

Non-dairy yogurt benefits from growing breakfast and snacking occasions, probiotic fortification supporting gut health positioning, and flavor variety expansion matching conventional yogurt offerings. Plant-based cheese demonstrates exceptional growth potential as melting technology improvements, taste profile enhancements, and culinary application versatility drive foodservice and retail adoption.

These expanding categories represent critical growth opportunities for dairy alternative manufacturers, as yogurt and cheese traditionally represented challenging formulation categories requiring sophisticated texture development, authentic taste replication, and functional performance matching dairy benchmarks. Modern food technology advances, including precision fermentation enabling casein protein production and advanced emulsification systems delivering authentic cheese characteristics, are systematically addressing historical performance gaps and enabling mainstream consumer acceptance.

The combined yogurt and cheese segment expansion from 27.0% to 33.0% of total market share demonstrates category maturation and successful product innovation enabling authentic dairy alternative experiences across challenging product categories beyond foundational non-dairy milk.

Retail (at-home) consumption is strategically estimated to control 70.0% of total European dairy alternatives sales in 2025, declining slightly to 65.0% by 2035 as foodservice expands, reflecting the primary consumption pattern of dairy alternative products purchased through retail channels for home consumption.

European consumers consistently demonstrate growing demand for dairy alternatives available through convenient retail locations, offering diverse product varieties, and positioned prominently within refrigerated dairy sections to facilitate discovery and trial among mainstream consumers transitioning toward plant-based options.

The segment provides essential market foundation through consistent repeat purchase behavior, brand loyalty development, and household penetration expansion as families integrate dairy alternatives into regular shopping routines. Major European retailers, including supermarket chains, discounters, and specialized organic stores, systematically expand dairy alternative selections, often dedicating extensive refrigerated space to accommodate growing variety across milk, yogurt, cheese, and ice cream alternatives.

The segment experiences modest share decline from 70.0% to 65.0% throughout the forecast period as foodservice channel accelerates from 20.0% to 25.0%, reflecting growing restaurant, café, and hotel adoption of dairy alternatives supporting consumer demand for plant-based menu options, while retail maintains absolute growth but represents smaller proportion of expanding market.

Supermarkets and hypermarkets are strategically positioned to contribute 35.0% of total European dairy alternative sales in 2025, declining slightly to 33.0% by 2035 as online retail expands, representing traditional brick-and-mortar retail channels providing comprehensive product selection and convenient shopping experiences.

These conventional retail channels successfully deliver accessible shopping locations, extensive product variety supporting comparison shopping, and mainstream positioning normalizing dairy alternative consumption across general population beyond specialized health food stores.

Supermarket and hypermarket distribution serves mainstream consumers, price-conscious shoppers, and households conducting regular grocery shopping, providing reliable product availability and promotional pricing supporting trial and adoption. The segment derives competitive advantages from established customer traffic, comprehensive category management supporting optimal product placement, and economies of scale enabling competitive retail pricing compared to specialized organic retailers.

The segment maintains substantial share throughout the forecast period, with slight decline from 35.0% to 33.0% reflecting online retail acceleration from 25.0% to 30.0% as e-commerce platforms gain dairy alternative market share through convenience, subscription services, and direct-to-consumer brand offerings, while supermarkets maintain absolute growth but capture smaller proportion of expanding market.

Conventional dairy alternative products are strategically positioned to contribute 70.0% of total European sales in 2025, declining to 60.0% by 2035 as organic alternatives expand from 30.0% to 40.0% share, representing products produced through standard agricultural methods without organic certification requirements.

These conventional products successfully deliver accessible pricing and consistent quality while ensuring broad commercial availability across all retail channels and foodservice operations that prioritize volume scalability and cost competitiveness over organic certification.

Conventional production serves price-conscious consumers, mainstream retail applications, and large-volume foodservice operators, including coffee chains, quick-service restaurants, and institutional catering requiring reliable supply at competitive price points.

The segment derives significant competitive advantages from established ingredient supply chains, economies of scale in manufacturing, and the ability to meet substantial volume requirements from major retailers and foodservice distributors without organic certification constraints limiting ingredient sourcing options.

The segment experiences declining share from 70.0% to 60.0% through 2035 as organic alternatives accelerate, reflecting growing European consumer preferences for organic certification, increasing retail space allocation to organic products, and premium positioning enabling margin expansion, with conventional products maintaining majority position but capturing smaller proportion of expanding market.

EU dairy alternatives sales are advancing rapidly due to accelerating flexitarian diet adoption, growing lactose intolerance awareness, and increasing environmental consciousness regarding dairy production impacts. The industry faces challenges, including persistent taste and texture gaps compared to premium conventional dairy for discerning consumers, higher price points limiting mass-market penetration among price-sensitive households, and nutritional concerns regarding fortification adequacy. Continued innovation in fermentation technologies, flavor development, and nutritional optimization remains central to industry development.

The rapidly accelerating development of precision fermentation technologies is fundamentally transforming dairy alternative production from traditional plant-based ingredient blending to bioidentical dairy protein synthesis, enabling authentic dairy characteristics previously unattainable through conventional formulation.

Advanced fermentation platforms featuring engineered microorganisms producing casein, whey proteins, and specific dairy enzymes identical to cow milk-derived molecules allow manufacturers to create dairy alternatives with authentic taste profiles, characteristic textures, and genuine functional properties through biotechnology rather than agricultural production. These innovations prove particularly transformative for cheese and yogurt applications, where authentic dairy protein structures prove essential for texture development, fermentation behavior, and consumer acceptance.

Major dairy alternative brands invest heavily in fermentation technology partnerships, pilot-scale production development, and regulatory approval processes for precision fermentation ingredients, recognizing that bioidentical dairy proteins represent breakthrough solutions for taste and texture challenges limiting broader consumer adoption.

Manufacturers collaborate with biotechnology companies, fermentation technology providers, and ingredient suppliers to develop scalable production systems that reduce fermentation-derived protein costs while maintaining quality standards supporting premium positioning and mainstream market penetration.

Modern dairy alternative producers systematically incorporate oat-based formulations featuring superior taste profiles, naturally creamy textures, and environmental sustainability advantages compared to almond and soy alternatives requiring intensive water usage. Strategic integration of oat milk across coffee-focused barista editions, cooking applications, and ready-to-drink beverages enables manufacturers to position oat-based alternatives as premium offerings delivering authentic dairy experiences while supporting environmental messaging.

Oat-based formulations prove particularly successful in European markets where consumers demonstrate strong preferences for locally sourced ingredients, sustainable agriculture, and products supporting European farming communities rather than imported tropical alternatives.

Companies implement extensive flavor development programs, texture optimization targeting specific applications, and barista training initiatives supporting café adoption. Manufacturers leverage oat sustainability credentials in marketing campaigns, emphasizing reduced water usage compared to almond milk, lower greenhouse gas emissions versus dairy milk, and European agricultural supply chains supporting local economies.

Beyond oat, emerging alternatives including pea protein, faba bean, and lupine demonstrate growing commercial interest as manufacturers diversify protein sources to address allergen concerns, optimize nutritional profiles, and expand flavor variety.

European consumers increasingly scrutinize dairy alternative nutritional profiles, requiring fortification matching conventional dairy's calcium, vitamin D, vitamin B12, and protein content to justify complete dairy replacement. This nutritional emphasis enables manufacturers to differentiate premium offerings through comprehensive fortification programs, bioavailable nutrient forms ensuring absorption equivalency, and transparent labeling communicating nutritional adequacy. Nutritional positioning proves particularly important for parents selecting dairy alternatives for children, health-conscious consumers managing specific dietary requirements, and athletes requiring protein supplementation.

The development of advanced fortification technologies, bioavailable nutrient systems, and protein enrichment strategies expands manufacturers' abilities to create nutritionally equivalent products supporting complete dairy replacement without nutritional compromise. Brands collaborate with nutrition scientists, clinical researchers, and health organizations to validate nutritional adequacy, support health claims, and develop evidence-based marketing communications positioning fortified dairy alternatives as nutritionally appropriate dairy substitutes across all life stages and demographic segments.

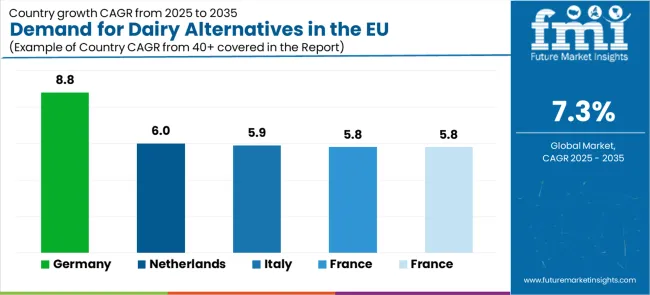

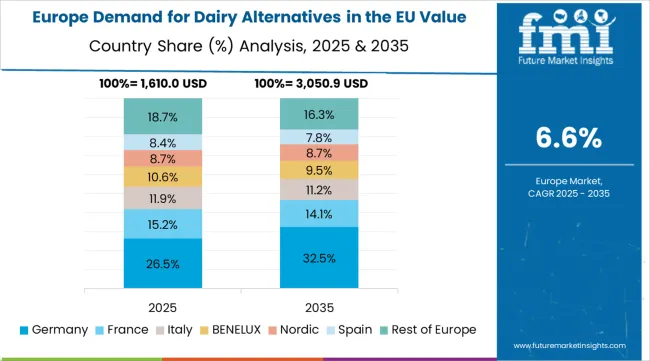

EU dairy alternatives sales are projected to grow from USD 6,701.7 million in 2025 to USD 13,556.4 million by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with an 8.8% CAGR, supported by established vegan infrastructure, progressive consumer attitudes, and comprehensive retail distribution. The Netherlands and Italy follow with 6.0% and 5.9% CAGR respectively, attributed to sustainability leadership and growing flexitarian adoption.

France and Spain demonstrate 5.8% CAGR each, supported by evolving dietary preferences despite traditional dairy consumption cultures. The Rest of Europe shows 5.6% CAGR, reflecting emerging market development and gradual adoption across smaller European economies.

| Country | CAGR % |

|---|---|

| Germany | 8.8% |

| Netherlands | 6.0% |

| Italy | 5.9% |

| France | 5.8% |

| Spain | 5.8% |

EU dairy alternatives sales demonstrate strong growth across major European economies, with Germany leading expansion at 8.8% CAGR through 2035, driven by exceptional vegan culture development and mainstream acceptance. The Netherlands emphasizes sustainability leadership and food technology innovation.

Italy leverages progressive urban markets and health-conscious consumers. France and Spain benefit from evolving dietary preferences despite traditional dairy consumption patterns. The Rest of Europe shows steady development reflecting gradual adoption across emerging markets. Overall, sales show robust regional development reflecting EU-wide cultural shifts toward plant-based consumption and dairy alternative acceptance.

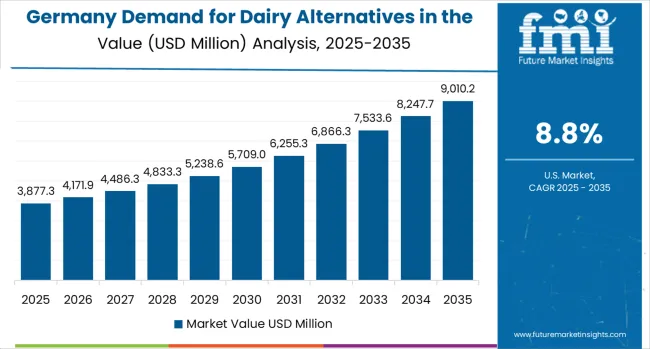

Revenue from dairy alternatives in Germany is projected to exhibit exceptional growth with a CAGR of 8.8% through 2035, driven by exceptionally well-developed vegan food culture, comprehensive retail infrastructure for plant-based products, and strong consumer commitment to environmental sustainability throughout the country.

Germany's sophisticated understanding of plant-based nutrition and internationally recognized leadership in vegan product innovation are creating substantial demand for diverse dairy alternative varieties across all consumer segments and product categories.

Major retailers, including Edeka, Rewe, Aldi, Lidl, and specialized organic chains such as Alnatura, denn's Biomarkt, and Bio Company, systematically expand dairy alternative selections, often dedicating extensive refrigerated sections to plant-based products and positioning them prominently alongside conventional dairy to facilitate discovery and encourage trial.

German demand benefits from high environmental consciousness, substantial disposable income supporting premium organic products, and cultural openness to dietary innovation that naturally supports dairy alternative adoption across mainstream consumers beyond core vegan demographics.

Revenue from dairy alternatives in France is expanding at a CAGR of 5.8%, substantially supported by evolving consumer attitudes toward plant-based options despite France's strong traditional dairy culture and culinary heritage centered on cheese and butter consumption. France's growing environmental consciousness among younger urban consumers and increasing lactose intolerance awareness are systematically driving demand for high-quality dairy alternatives across diverse demographic segments, particularly in metropolitan areas.

Major retailers, including Carrefour, Auchan, Leclerc, Intermarché, and specialized organic chains including Naturalia and Biocoop, are gradually establishing comprehensive dairy alternative ranges to serve continuously growing demand.

French sales particularly benefit from sophisticated culinary culture that demands superior taste and quality standards, driving product innovation and premiumization within the dairy alternative category. Consumer education initiatives, chef endorsements, and celebrity advocacy are significantly enhancing penetration rates despite historical resistance to dairy alternatives in traditionally cheese-centric food culture.

Revenue from dairy alternatives in Italy is growing at a robust CAGR of 5.9%, fundamentally driven by increasing health consciousness, progressive urban consumer segments, and gradual modernization of Italian dietary patterns to incorporate plant-based alternatives. Italy's traditionally dairy-heavy cuisine, featuring extensive cheese consumption and milk-based preparations, is gradually accommodating plant-based options as consumers recognize health benefits and environmental advantages of reducing dairy consumption while maintaining culinary traditions.

Major retailers, including Coop Italia, Esselunga, Conad, Carrefour Italia, and Lidl Italia, strategically invest in dairy alternative category expansion and consumer education programs to address growing interest in plant-based options. Italian sales particularly benefit from strong coffee culture creating natural demand for high-quality barista-edition oat and soy milk alternatives, combined with increasing vegan communities in Milan, Rome, Florence, and other major cities contributing to expansion through cultural influence and mainstreaming of plant-based options.

Demand for dairy alternatives in Spain is projected to grow at a CAGR of 5.8%, substantially supported by tourism industry exposure to international dietary preferences, expanding retail availability through major supermarket chains, and increasing environmental awareness among younger Spanish consumers, particularly in urban coastal regions. Spanish food culture's emphasis on fresh, natural ingredients positions dairy alternatives as natural evolution rather than radical departure from culinary heritage.

Major retailers, including Mercadona, Carrefour España, Alcampo, Lidl España, and Eroski, systematically expand dairy alternative offerings, with Mercadona's private-label plant-based products proving particularly successful in driving mainstream adoption through accessible pricing and prominent shelf placement. Spain's substantial tourism industry exposes domestic consumers to dairy alternatives through hotel breakfasts, café menus, and international restaurant chains, normalizing plant-based options and encouraging trial among curious consumers.

Demand for dairy alternatives in the Netherlands is expanding at a CAGR of 6.0%, fundamentally driven by exceptionally strong environmental consciousness, leadership in sustainable food innovation, and comprehensive retail support for plant-based products across mainstream and specialized channels.

Dutch consumers demonstrate particularly high receptivity to sustainability messaging and willingness to modify consumption patterns to reduce environmental impact, despite the country's significant dairy industry heritage.

Netherlands sales significantly benefit from well-developed organic retail infrastructure, including Albert Heijn's extensive plant-based sections, Ekoplaza's specialized organic stores, and Marqt's premium positioning, combined with innovative food startups testing new products in receptive Dutch environment.

The country's dairy industry heritage paradoxically coexists with growing dairy alternative adoption, as consumers increasingly recognize environmental contradictions between traditional dairy production and sustainability goals. The Netherlands also serves as innovation testing ground for European market, with successful Dutch product launches often expanding to broader European markets.

EU dairy alternatives sales are defined by competition among multinational food corporations with plant-based divisions, specialized dairy alternative brands, and emerging precision fermentation startups. Companies are investing in flavor development research, texture optimization technologies, nutritional fortification programs, and sustainability communication to deliver high-quality, functionally superior, and environmentally responsible dairy alternative solutions. Strategic partnerships with foodservice operators, retail expansion initiatives, and marketing campaigns emphasizing taste improvements and nutritional adequacy are central to strengthening competitive position.

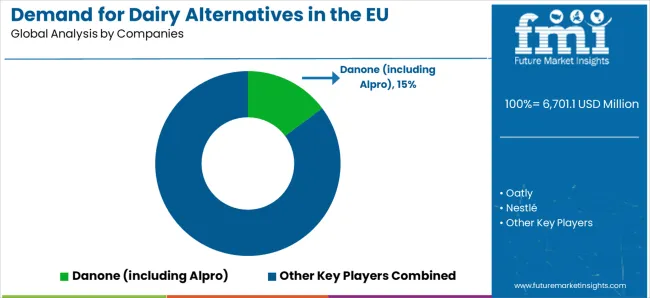

Major participants include Danone (including Alpro brand) with an estimated 15.0% share, leveraging its multinational presence, comprehensive product portfolio spanning milk, yogurt, and dessert alternatives, and established European distribution relationships supporting market leadership. Danone benefits from Alpro brand recognition as European dairy alternative pioneer, technical expertise in plant-based formulation, and corporate commitment to sustainable food production. The company's vertical integration spanning ingredient sourcing through retail distribution creates competitive advantages in cost management and supply chain reliability.

Oatly holds approximately 7.0% share, emphasizing oat-based product specialization, barista-quality formulations driving café adoption, and distinctive brand positioning targeting younger urban consumers. Oatly's success in establishing oat milk as premium alternative to almond and soy options creates strong market positioning and brand loyalty, supported by sustainability messaging, creative marketing campaigns, and foodservice partnerships with major coffee chains driving consumer trial and repeat purchase.

Other companies collectively hold 78.0% share, reflecting highly fragmented nature of European dairy alternative sales, where numerous international brands including Nestlé, Unilever, emerging precision fermentation companies, and regional specialized producers serve diverse consumer preferences, specific product categories, and niche market segments. This fragmentation provides opportunities for differentiation through specialized formulations (barista editions, protein-enriched), innovative production methods (precision fermentation, traditional fermentation), regional flavor preferences, and premium positioning resonating with sophisticated consumers seeking authentic dairy alternative experiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 13,556.4 million |

| Product Type | Non-dairy Milk, Yogurts, Cheeses, Ice Cream, Butter, Others |

| Application | Retail (At-home), Foodservice (Out-of-home), Ingredient/Manufacturing |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Nature | Conventional, Organic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Danone (Alpro), Oatly, Nestlé, Unilever, Regional specialized brands |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established food corporations and specialized dairy alternative brands; consumer preferences for various product categories and flavor profiles; integration with precision fermentation technologies; innovations in taste development and nutritional fortification; adoption across retail and foodservice channels; regulatory framework analysis for dairy alternative labeling and nutritional standards; supply chain strategies; and penetration analysis for mainstream and health-conscious European consumers. |

The global demand for dairy alternatives in the EU is estimated to be valued at USD 6,701.1 million in 2025.

The market size for the demand for dairy alternatives in the EU is projected to reach USD 13,556.4 million by 2035.

The demand for dairy alternatives in the EU is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in demand for dairy alternatives in the EU are non-dairy milk, yogurts, cheeses, ice cream, butter and others.

In terms of application, retail (at-home) segment to command 70.0% share in the demand for dairy alternatives in the EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Comprehensive Analysis of Europe Non-Dairy Creamer Market by Form Type, Source Type, Packaging Type, Distribution Channel, Flavour Type, and Country through 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA