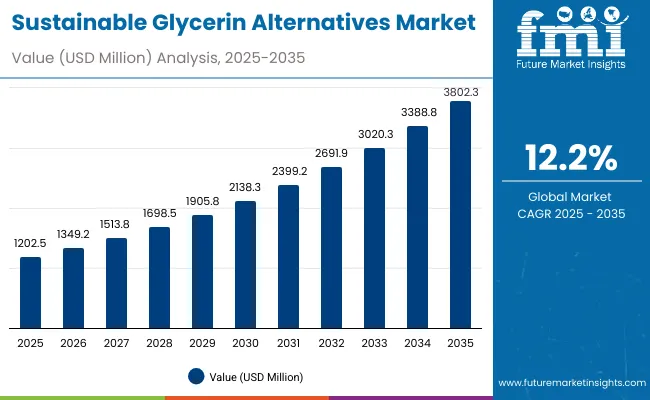

A market valuation of USD 1,202.5 million is anticipated in 2025 for the Sustainable Glycerin Alternatives Market, with the size projected to rise to USD 3,802.3 million by 2035. This trajectory indicates a cumulative addition of USD 2,599.8 million across the decade, reflecting a growth of nearly 216%. The overall expansion is expected to be underpinned by a CAGR of 12.2%, showcasing the accelerating transition toward palm-free and bio-based alternatives in personal care, pharmaceuticals, and consumer goods.

Sustainable Glycerin Alternatives Market Key Takeaways

| Metric | Value |

|---|---|

| Sustainable Glycerin Alternatives Market Estimated Value in (2025E) | USD 1,202.5 million |

| Sustainable Glycerin Alternatives Market Forecast Value in (2035F) | USD 3,802.3 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

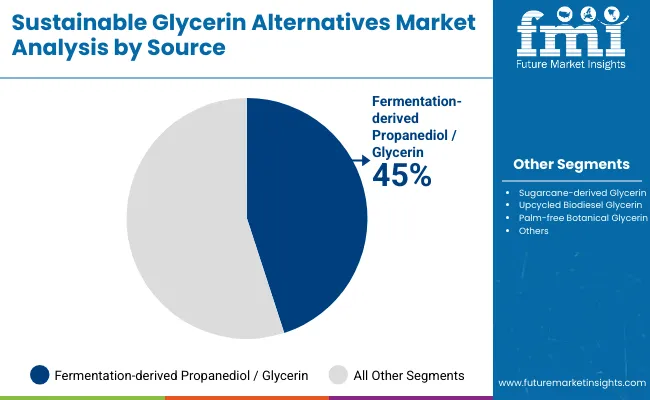

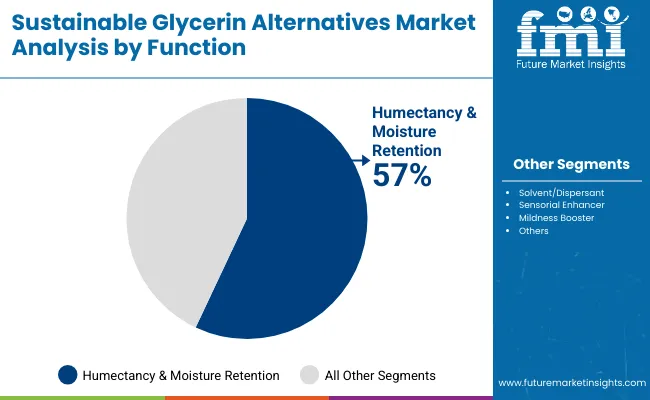

The first half of the forecast horizon from 2025 to 2030 is likely to see market size advance from USD 1,202.5 million to USD 2,138.3 million, contributing USD 935.8 million or 36% of total decade growth. This initial expansion is set to be shaped by consistent adoption of fermentation-derived propanediol/glycerin, which is forecasted to hold a 45% share in 2025, alongside sustained demand for humectancy and moisture retention functions that account for 57% of total value. Channel shifts are also expected to influence early growth, with e-commerce emerging as a leading contributor at 51% share in 2025, driven by faster consumer education on sustainability claims.

The subsequent phase from 2030 to 2035 is projected to accelerate, adding USD 1,664 million and contributing nearly 64% of total decade growth. Market size is expected to advance from USD 2,138.3 million to USD 3,802.3 million, supported by rising demand from emerging economies, particularly China and India, where double-digit CAGRs of 20% and 23% respectively are anticipated. Verified palm-free and carbon-reduced claims, along with expanded multifunctional performance, are expected to strengthen premium positioning and secure long-term competitiveness.

From 2020 to 2024, momentum was gradually established through early adoption of fermentation-based and sugarcane-derived inputs, laying the foundation for broader scaling post to 2025. By 2025, the market is positioned at USD 1,202.5 million, with fermentation-derived propanediol/glycerin holding the largest share at 45%. Competitive dynamics are expected to remain fragmented, with leading innovators holding a global share below 10%, while regional players capture value through niche positioning and feedstock specialization.

The decade ahead is projected to be marked by a shift toward carbon-reduced and palm-free alternatives, with Asia emerging as the fastest-expanding region led by China and India. E-commerce distribution is forecasted to retain an advantage in finished goods, holding over half of 2025 sales. Competitive advantage is expected to shift from cost efficiency alone to verification of sustainability claims, backward integration of feedstocks, and the ability to demonstrate multifunctional performance in formulations. Industry leaders are anticipated to expand investment in application labs and certification frameworks to strengthen credibility and secure long-term partnerships.

Growth in the Sustainable Glycerin Alternatives Market is being driven by structural shifts toward palm-free, bio-based, and carbon-reduced inputs, as brand owners and manufacturers seek verified sustainable replacements for conventional glycerin.

Rising consumer preference for clean-label and ethical formulations has reinforced the demand for alternatives that combine transparency with multifunctional performance. The accelerated adoption of fermentation-derived propanediol/glycerin is being fueled by its consistent purity, scalability, and reduced land-use intensity, making it a preferred option across personal care, pharmaceutical, and household segments.

Emerging economies such as China and India are providing strong momentum, supported by double-digit CAGRs as local production expands and premium personal care categories gain traction. The surge in e-commerce has enabled rapid dissemination of sustainability claims, helping to educate consumers and influence purchasing decisions.

Competitive dynamics are expected to be shaped by innovations in certification, lifecycle assessments, and feedstock integration, which will sustain long-term market expansion and reinforce resilience.

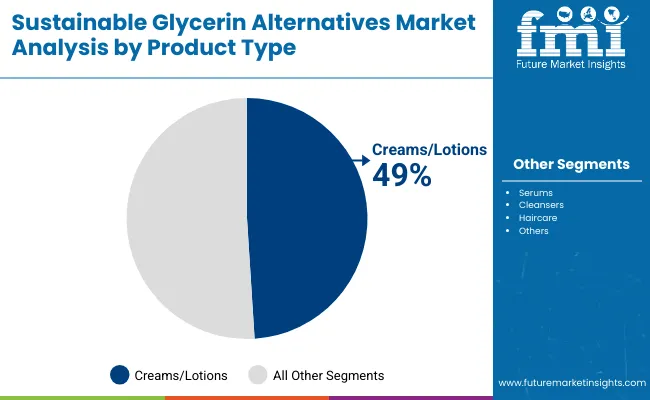

The Sustainable Glycerin Alternatives Market is categorized by source, function, and channel, each contributing unique dynamics to overall growth. Sources include fermentation-derived propanediol/glycerin, sugarcane-derived glycerin, upcycled biodiesel glycerin, and palm-free botanical glycerin, reflecting the transition to low-carbon and palm-free supply chains.

Functions are segmented into humectancy and moisture retention, solvent/dispersant, sensorial enhancer, and mildness booster, highlighting the diverse roles alternatives serve across formulations. Channels include B2B ingredient supply, e-commerce, pharmacies, and mass retail, showing how adoption spreads through both institutional buyers and direct-to-consumer pathways.

Regional performance is influenced by sustainability claims such as palm-free, clean-label, and carbon-reduced, each shaping consumer preferences. These dimensions illustrate how growth is being driven by both structural innovation and evolving market priorities.

| Segment | Market Value Share, 2025 |

|---|---|

| Fermentation-derived propanediol/glycerin | 45% |

| Others | 55.0% |

Fermentation-derived propanediol/glycerin is expected to dominate the market with a 45% share in 2025, reflecting its consistent purity, scalability, and reduced reliance on palm-based feedstocks. Its adoption is being reinforced by brand owners prioritizing traceability and environmental transparency.

Other sources, including sugarcane-derived and upcycled biodiesel glycerin, are anticipated to sustain complementary growth, particularly in regions emphasizing feedstock availability and lifecycle-carbon savings. Botanical palm-free glycerin is projected to carve out niche demand where premium narratives hold importance. As fermentation technologies advance and scale efficiencies are unlocked, this segment is positioned to reinforce its leadership throughout the decade.

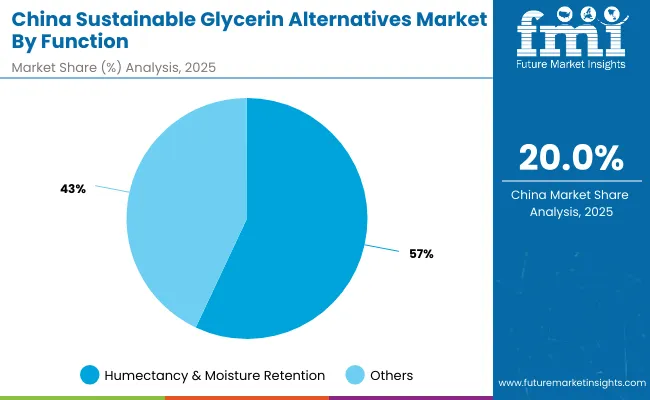

| Segment | Market Value Share, 2025 |

|---|---|

| Humectancy & moisture retention | 57% |

| Others | 43.0% |

Humectancy and moisture retention functions are projected to command the largest share at 57% in 2025, underscoring their vital role in personal care and pharmaceutical formulations. This dominance is expected to be maintained as consumers consistently value hydration and skin health in product claims.

Solvent/dispersant, sensorial enhancement, and mildness booster functions are anticipated to grow steadily, driven by multifunctional needs in clean-label formulations. As regulatory scrutiny on ingredient transparency increases, humectancy-led adoption is forecasted to remain central. Continued R&D investments are expected to enhance performance, strengthening the segment’s resilience as sustainability-driven formulations scale further.

| Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 49% |

| Others | 51.0% |

E-commerce channels are projected to lead with a 51% share in 2025, reflecting the rapid digitalization of consumer engagement and the effectiveness of online education on sustainability claims. Direct-to-consumer pathways are expected to accelerate the adoption of palm-free and clean-label formulations, particularly in Asia-Pacific and North America. B2B ingredient supply, accounting for 49%, is forecasted to remain vital, with large-scale buyers relying on long-term procurement contracts and rigorous QA standards.

Pharmacies and mass retail are anticipated to provide incremental support, particularly in Europe, where regulated categories dominate. The expanding influence of e-commerce is projected to drive awareness, reinforce premium positioning, and enable wider consumer access to sustainable alternatives.

Adoption of sustainable glycerin alternatives is being influenced by evolving formulation priorities, stricter sustainability frameworks, and regional capacity shifts, even as certification complexity, feedstock volatility, and lifecycle verification requirements challenge the pace of market acceleration.

Verification-led Differentiation

Growth is being powered by the premium assigned to verified sustainability credentials. Palm-free, carbon-reduced, and bio-based claims are no longer viewed as optional add-ons but as compliance-driven requirements in tender processes. This shift is expected to reward suppliers capable of offering batch-level lifecycle assessments, transparent sourcing, and third-party certifications.

Competitive advantage is projected to be defined less by low-cost supply and more by the depth of traceability and credibility across value chains. As retailers and multinational formulators harden procurement standards, verified sustainability is anticipated to serve as both a growth enabler and a critical gatekeeping factor, particularly in developed markets.

Feedstock and Infrastructure Fragility

A constraint on scalability is expected to emerge from the dual volatility of feedstock supply and infrastructure readiness. Sugarcane cycles, biodiesel policy shifts, and constraints on fermentation capacity expansion may restrict dependable availability, creating regional imbalances in cost competitiveness. Certification backlogs and fragmented carbon-accounting frameworks may compound delays, limiting supplier ability to meet rapid reformulation timelines.

This fragility is expected to slow adoption in sectors where reliability and uniformity of supply remain non-negotiable. Addressing these challenges will require investment in resilient feedstock integration, harmonized sustainability standards, and redundancy across fermentation and processing hubs to secure consistent supply throughout the forecast horizon.

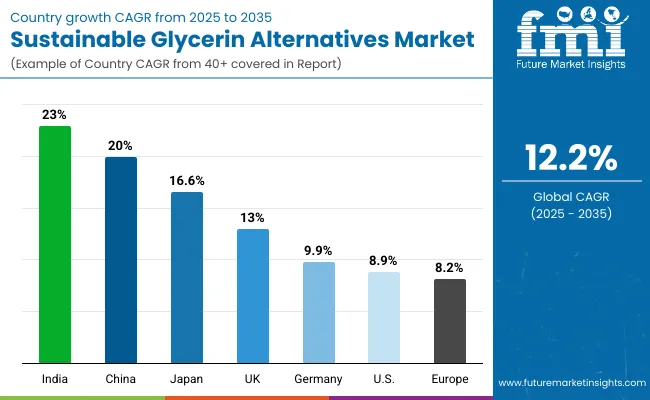

| Country | CAGR |

|---|---|

| China | 20.0% |

| USA | 8.9% |

| India | 23.0% |

| UK | 13.0% |

| Germany | 9.9% |

| Japan | 16.6% |

The Sustainable Glycerin Alternatives Market is projected to expand unevenly across geographies, with country-specific dynamics shaping growth rates. India is expected to post the highest CAGR at 23.0% between 2025 and 2035, driven by rapid expansion of personal care and pharmaceutical manufacturing, alongside heightened preference for clean-label and bio-based inputs.

China follows with a 20.0% CAGR, reflecting its scaling fermentation infrastructure and policy-backed efforts to reduce reliance on palm-derived imports. Demand in these markets is projected to be amplified by rising consumer awareness and rapid e-commerce adoption, enabling faster uptake of palm-free alternatives.

Japan’s CAGR of 16.6% positions it as a critical growth hub, where multifunctional and sensorial attributes are highly valued in premium beauty segments. The UK at 13.0% is expected to advance on the back of regulatory pressures surrounding carbon reduction and clean-label compliance. Germany, at 9.9%, is anticipated to grow steadily, anchored by strong industrial formulation standards and stringent sustainability reporting frameworks.

The USA is projected to expand at 8.9%, with adoption tempered by market maturity and slower regulatory movement relative to Asia. Broader Europe excluding the UK and Germany records the slowest growth at 8.2%, reflecting saturation and cautious transition timelines. Collectively, these disparities underscore Asia’s leadership in shaping long-term market acceleration.

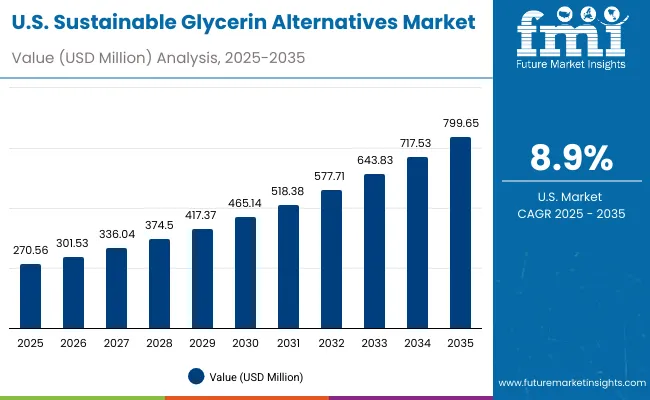

| Year | USA Sustainable Glycerin Alternatives Market (USD Million) |

|---|---|

| 2025 | 270.56 |

| 2026 | 301.53 |

| 2027 | 336.04 |

| 2028 | 374.50 |

| 2029 | 417.37 |

| 2030 | 465.14 |

| 2031 | 518.38 |

| 2032 | 577.71 |

| 2033 | 643.83 |

| 2034 | 717.53 |

| 2035 | 799.65 |

The Sustainable Glycerin Alternatives Market in the United States is projected to grow at a CAGR of 11.6%, advancing from USD 270.56 million in 2025 to USD 799.65 million by 2035. The first half of the forecast period from 2025 to 2030 is expected to add USD 194.6 million, taking the market to USD 465.14 million. This phase is anticipated to be driven by humectancy and moisture retention applications, alongside the dominance of palm-free claims, which are forecasted to account for 51% of sales in 2025.

The second half from 2030 to 2035 is projected to accelerate, adding USD 334.5 million and raising the market size to USD 799.65 million. Expansion is likely to be fueled by rising demand for multifunctional fermentation-derived propanediol/glycerin, which benefits from traceability and lifecycle-carbon advantages.

E-commerce-led distribution is expected to strengthen, supporting consumer education on clean-label claims and reinforcing premium positioning in finished products. Procurement strategies of major manufacturers are anticipated to increasingly rely on verified sustainability metrics, creating opportunities for suppliers with robust certification frameworks.

The Sustainable Glycerin Alternatives Market in the United Kingdom is projected to grow at a CAGR of 13.0%, reflecting the impact of clean-label adoption and carbon-reduction mandates. Market expansion is expected to be supported by regulatory frameworks emphasizing transparency in ingredient sourcing and lifecycle accountability.

From 2025 to 2030, steady growth is anticipated as personal care and healthcare categories increase reliance on verified palm-free inputs, aligned with consumer awareness campaigns. The period from 2030 to 2035 is likely to accelerate as multifunctional performance and eco-certifications become procurement benchmarks for multinational brand owners.

The Sustainable Glycerin Alternatives Market in India is projected to grow at a CAGR of 23.0%, making it the fastest-expanding country market during the forecast period. Strong momentum is expected from rapid growth in personal care consumption, coupled with rising acceptance of bio-based and palm-free alternatives in export-oriented formulations.

Between 2025 and 2030, adoption is projected to accelerate as domestic producers integrate fermentation-derived glycerin into cost-competitive manufacturing. From 2030 to 2035, sustained scaling is anticipated as India strengthens its role as a supply hub for Asia and global markets.

The Sustainable Glycerin Alternatives Market in China is projected to grow at a CAGR of 20.0%, reflecting the combined influence of industrial scaling and strong consumer preference for clean-label claims. Growth between 2025 and 2030 is expected to be driven by wider integration of fermentation-derived propanediol/glycerin, supported by national policies promoting sustainable biomanufacturing. From 2030 to 2035, acceleration is anticipated as e-commerce platforms expand penetration and premium product categories emphasize palm-free sourcing.

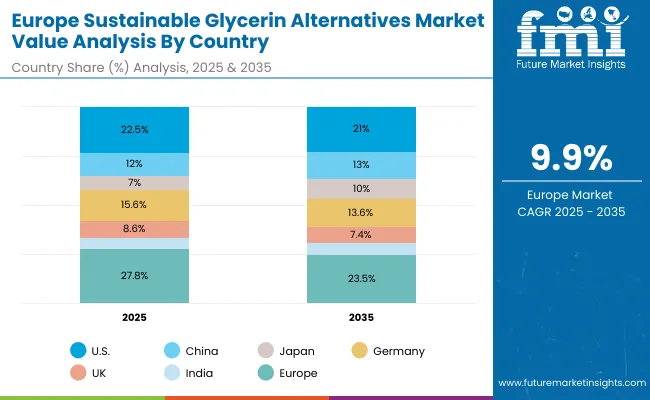

| Country | 2025 |

|---|---|

| USA | 22.5% |

| China | 12.0% |

| Japan | 7.0% |

| Germany | 15.6% |

| UK | 8.6% |

| India | 5.3% |

| Country | 2035 |

|---|---|

| USA | 21.0% |

| China | 13.0% |

| Japan | 10.0% |

| Germany | 13.6% |

| UK | 7.4% |

| India | 6.0% |

The Sustainable Glycerin Alternatives Market in Germany is projected to grow at a CAGR of 9.9%, reflecting steady but moderate expansion. The market is expected to remain strongly influenced by regulatory compliance frameworks and rigorous sustainability standards applied across cosmetics, healthcare, and household products. Between 2025 and 2030, demand is projected to be sustained by the prioritization of carbon-reduced formulations, while the 2030 to 2035 phase is likely to focus on broader multifunctional integration.

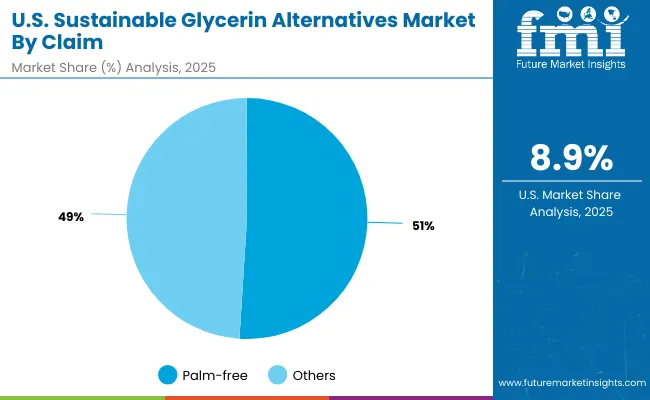

| Segment | Market Value Share, 2025 |

|---|---|

| Palm-free | 51% |

| Others | 49.0% |

The Sustainable Glycerin Alternatives Market in the United States is projected at USD 270.56 million in 2025. Palm-free claims contribute 51% (USD 138.0 million), while other claims represent 49% (USD 132.58 million), highlighting the early transition toward palm-free formulations.

This slight palm-free dominance reflects rising scrutiny over deforestation-linked supply chains and a shift toward transparent sourcing frameworks. Brand owners are expected to prioritize palm-free inputs in procurement as part of ESG commitments and retailer-driven compliance programs.

Palm-free positioning is anticipated to hold strategic significance as consumer awareness strengthens and lifecycle assessments become critical in winning long-term contracts. Although other claims remain relevant, particularly in bio-based and sensorial narratives, their influence is projected to gradually align with palm-free frameworks. Growth in the USA is expected to be reinforced by the alignment of sustainability mandates with evolving consumer preferences for traceable and verified clean-label products.

| Segment | Market Value Share, 2025 |

|---|---|

| Humectancy & moisture retention | 57% |

| Others | 43.0% |

The Sustainable Glycerin Alternatives Market in China is projected at USD 144.33 million in 2025. Humectancy and moisture retention dominate with 57% share (USD 82.3 million), while other functions account for 43% (USD 62.06 million). This dominance underscores the central role of hydration-focused formulations in the Chinese beauty and personal care landscape, where consumer demand for skin health and long-lasting moisture is intensifying.

The leading share of humectancy applications is expected to expand further as international and domestic brands align with consumer preference for multifunctional, palm-free, and clean-label solutions. Other functions, such as solvent and sensorial roles, are anticipated to gain traction as innovation in premium categories accelerates. Competitive positioning is likely to hinge on the ability to integrate verified sustainability with product efficacy, making humectancy functions the foundation for broader adoption.

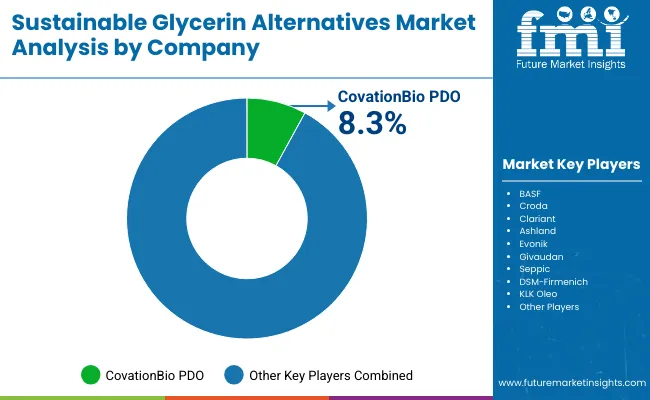

| Company | Global Value Share 2025 |

|---|---|

| CovationBio PDO | 8.3% |

| Others | 91.7% |

The Sustainable Glycerin Alternatives Market is moderately fragmented, with global leaders, established chemical innovators, and niche-focused producers competing across multiple sourcing and application domains. Leading players such as CovationBio PDO, BASF, Croda, and Clariant are expected to define the global landscape through their investments in fermentation technologies, palm-free certifications, and bio-based formulations.

CovationBio PDO is identified as the dominant global player, holding an estimated 8.3% share of the market in 2025, and its position is projected to remain strong given its backward integration in fermentation-based production. This share in 2024 was slightly lower but already marked the company as the leading supplier in this space.

Mid-sized innovators, including Ashland, Evonik, Seppic, and DSM-Firmenich, are expanding portfolios around multifunctional ingredients, offering traceable and carbon-reduced alternatives that align with consumer-facing sustainability narratives. Their competitive edge is anticipated to come from flexible production models and partnerships with personal care and healthcare formulators seeking cleaner inputs.

Specialized regional suppliers such as KLK Oleo and Givaudan are tailoring offerings toward niche performance attributes and sensorial experiences, capitalizing on premium positioning and localized demand preferences.

Competitive differentiation is expected to shift away from cost competition and toward lifecycle verification, feedstock security, and application-specific multifunctionality. The ability to combine certification, technical performance, and digital traceability is projected to determine long-term market leadership.

Key Developments in Sustainable Glycerin Alternatives Market

| Item | Value |

|---|---|

| Quantitative units | USD 1,202.5 million (2025); USD 3,802.3 million (2035); 12.2% CAGR (2025 to 2035) |

| Component | Fermentation-derived propanediol/glycerin; Sugarcane-derived glycerin; Upcycled biodiesel glycerin; Palm-free botanical glycerin |

| Function | Humectancy & moisture retention; Solvent/dispersant; Sensorial enhancer; Mildness booster |

| Product type | Creams/lotions; Serums; Cleansers; Haircare |

| Channel | B2B ingredient supply; E-commerce (finished goods); Pharmacies; Mass retail |

| Claims tracked | Palm-free; Bio-based; Clean-label; Carbon-reduced |

| Regions covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries covered | United States; China; India; United Kingdom; Germany; Japan |

| Key companies profiled | CovationBio PDO; BASF; Croda; Clariant; Ashland; Evonik; Givaudan; Seppic; DSM-Firmenich; KLK Oleo |

| Additional attributes | 2025 leading function share 57% (humectancy & moisture retention); E-commerce share 51% (2025) vs B2B 49%; USA palm-free claim 51% (USD 138.0 million); China 2025 function value USD 82.3 million (humectancy) and USD 62.06 million (others); lifecycle-assessment verification, palm-free certification, and fermentation capacity scaling expected to shape competitiveness and pricing over the decade |

The global Sustainable Glycerin Alternatives Market is estimated to be valued at USD 1,202.5 million in 2025.

The market size for the Sustainable Glycerin Alternatives Market is projected to reach USD 3,802.3 million by 2035.

The Sustainable Glycerin Alternatives Market is expected to grow at a CAGR of 12.2% between 2025 and 2035.

The key product types in the Sustainable Glycerin Alternatives Market are creams/lotions, serums, cleansers, and haircare.

In terms of function, humectancy & moisture retention is forecasted to command the leading share at 57% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Label Market Forecast Outlook 2025 to 2035

Sustainable Footwear Market Forecast and Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Nitroglycerin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA