The Sustainable Label market is experiencing significant growth driven by increasing global demand for environmentally friendly packaging solutions and rising consumer awareness about sustainability. The market outlook is shaped by regulatory initiatives promoting eco-friendly materials and the growing adoption of sustainable practices in packaging and labeling across industries. Rising demand for recyclable, biodegradable, and compostable materials has reinforced the need for sustainable labels, particularly in food and beverage, personal care, and pharmaceutical sectors.

Continuous innovations in label design, printing technologies, and material efficiency are enabling companies to meet sustainability goals while maintaining product quality and brand visibility. The trend toward green marketing and corporate social responsibility is further encouraging businesses to adopt sustainable labels.

Additionally, increasing investments in renewable and recyclable materials, coupled with advancements in high-quality printing processes, are supporting the market expansion As global sustainability standards tighten and environmental consciousness grows, the adoption of sustainable labels is expected to continue accelerating across various industries.

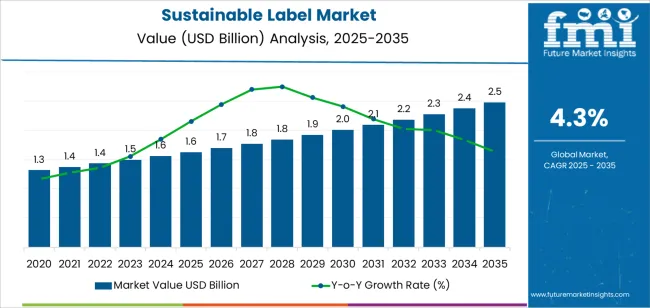

| Metric | Value |

|---|---|

| Sustainable Label Market Estimated Value in (2025 E) | USD 1.6 billion |

| Sustainable Label Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The market is segmented by Material, Label Type, Printing Technology, and End Use and region. By Material, the market is divided into Paper and Plastic. In terms of Label Type, the market is classified into Pressure-Sensitive Labels (PSL), Shrink Labels, Stretch Labels, Wet Glue Labels, and Others. Based on Printing Technology, the market is segmented into Flexography, Digital, Gravure, Screen, and Offset. By End Use, the market is divided into Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Homecare Clothing & Apparel Chemicals, Automobiles, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper material segment is projected to hold 60.0% of the Sustainable Label market revenue share in 2025, making it the leading material type. This dominance is driven by the biodegradability, recyclability, and cost-effectiveness offered by paper-based labels. The segment has benefited from ongoing innovations in sustainable paper production and surface treatments, which enhance durability, print clarity, and moisture resistance.

Growing demand from industries such as food and beverages, personal care, and consumer goods has reinforced the adoption of paper labels, as they align with regulatory and corporate sustainability goals. The ease of printing and customization, combined with compatibility with various printing technologies, has further contributed to the segment’s growth.

Additionally, the increasing focus on reducing plastic usage in packaging has accelerated the shift toward paper-based solutions These factors collectively support the sustained expansion of the paper material segment in the Sustainable Label market.

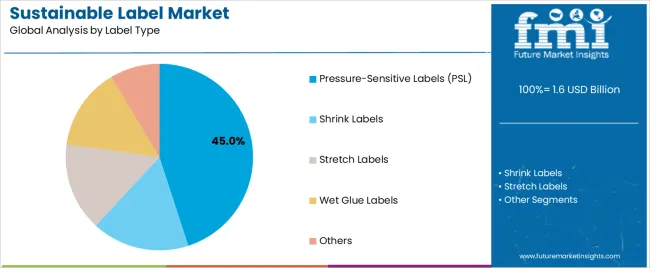

The pressure-sensitive labels (PSL) segment is expected to account for 45.0% of the Sustainable Label market revenue share in 2025, establishing it as the leading label type. The growth of this segment has been influenced by the convenience, versatility, and strong adhesion properties of pressure-sensitive labels. They enable efficient application on a wide variety of surfaces and packaging formats, improving production efficiency and reducing labor costs.

Additionally, PSL supports high-quality printing and customization, which enhances brand visibility while meeting sustainability requirements. The segment has also been driven by the increasing need for tamper-evident, durable, and recyclable labeling solutions.

Regulatory emphasis on sustainable packaging and corporate initiatives for environmentally responsible labeling practices have further reinforced the adoption of pressure-sensitive labels These factors collectively contribute to the dominance of the PSL segment in the Sustainable Label market.

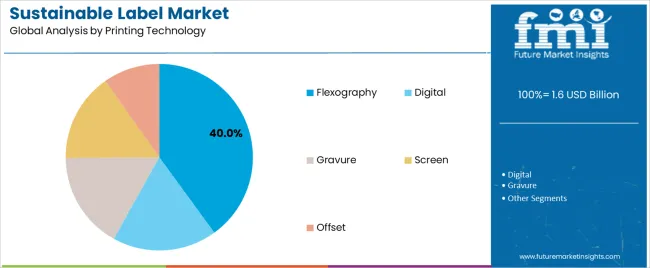

The flexography printing technology segment is projected to hold 40.0% of the Sustainable Label market revenue share in 2025, making it the leading printing technology. This growth is driven by its suitability for high-volume production, compatibility with a wide range of sustainable materials, and ability to produce vibrant, durable images.

Flexography enables cost-effective printing on paper, films, and other recyclable substrates, supporting efficiency in sustainable labeling operations. The adoption of advanced flexographic presses and eco-friendly inks has further enhanced print quality while aligning with environmental standards.

Additionally, the flexibility of flexography in accommodating variable data printing, customization, and complex label designs has reinforced its preference among label manufacturers Increasing demand for sustainable packaging solutions across multiple industries and the need for scalable, high-quality printing processes continue to propel the dominance of flexography in the Sustainable Label market.

The above table presents the expected CAGR for the global sustainable label market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 4.4%, followed by a slightly lower growth rate of 3.8% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 4.4% (2025 to 2035) |

| H2 | 3.8% (2025 to 2035) |

| H1 | 3.9% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 3.9% in the first half and remain relatively moderate at 4.2% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 40 BPS.

Increasing Environmental Concerns and Consumer Behavior Patterns

The increased concern about the environment is driving the market for sustainable labels as labels play a significant role in every industry for packaging, and the shelf life of labels has become a perilous concern for the manufacturer as well as consumers.

Especially, the rise in environmental awareness in industries such as household and cosmetics, clothing (apparel), and food & beverages is pushing manufacturers to manufacture an eco-friendly label owing to the purchase pattern of the consumer, who is willing to pay more for an eco-friendly product.

Consumers are demanding environment friendly packaging and labelling solutions to reduce the environmental impact of products driven by rising environmental pollution. Manufacturers producing eco-friendly labels have understood the consumer buying behaviour/pattern towards the purchase of an eco-friendly product.

An eco-friendly label on an eco-friendly product encourages consumers to purchase the product by considering the environmental issues when shopping (e.g. checking if the product is wrapped in recycled material) and by purchasing only ecologically compatible products (e.g. biodegradable paint, CFC-free hairspray or unbleached coffee filters).

The most supportive evidence is the increasing number of consumers who are willing to pay more for environmentally-friendly products that have eco-friendly labels attached to them. These factors are propelling the demand for sustainable labels and will eventually expand the global sustainable labels industry over the projected period.

Manufacturers Eyeing on Innovations in Sustainable Labels

Mono materials are one of the latest trends that are creating traction in the packaging industry. Mono material labels and packaging is made from similar types of material which helps in easy sorting and recycling of the packaging.

Since the packaging and label are made from different materials most of the time they will not be easily recycled together even if the materials used for both are recyclable. Mono material will ease the recycling process of packaging along with its labels.

The shift has been identified towards the linerless labels that can achieve the sustainability goals of the business and brands. Linerless labels are similar to traditional labels without liner which reduces the use of extra waste material. These labels optimize resource usage and strapline production contributing towards a circular economy.

These labels significantly produce less waste material and along with reducing the adhesive by 80%. Food and beverage companies are now allowed to use recycled material in their packaging which is supplementing the demand for recycled material in labels. So innovating towards the development of sustainable materials and technologies will push the market forward.

Counterfeiting and Misleading Eco-friendly Labels

Nowadays, majority of the companies are trying to emerge newly in the market with the concept of eco-friendly or sustainable products, which is trending and ultimately is the need of the environment.

In the case of the label manufacturing industry, many third-party agencies play a role in between of counterfeiting the label as an eco-friendly label, which suggests a product is “green” based on an unreasonably narrow set of attributes and ignoring important environmental issues.

These counterfeit labels are also termed as “greenwashing”, which gives out the misleading claims of environmental benefits attached to a product. Some manufacturers think that all naturally occurring materials or substances are eco-friendly and then state the product as eco-friendly, which in turn is counted as a counterfeit label.

For instance, naturally occurring metals such as arsenic, mercury, uranium, and formaldehyde are poisonous and are not green. Other environmental claims can be that “CFC-free”, isn’t green, because CFCs are banned by law. For Instance, Zalando, a German fashion retailer has abandoned sustainable labels due to false claims following EU pressure.

Consequently, misunderstanding the concept of eco-friendly products can in turn affect the label stating as “eco-friendly”, which is a counterfeit label describing the vague and fake nature of the product.

The global sustainable label industry recorded a CAGR of 2.9% during the historical period between 2020 and 2025. The growth of sustainable label industry was positive as it reached a value of USD 1,488.4 million in 2025 from USD 1,329.1 million in 2020.

The constantly growing food & beverage, as well as the food service industry, is predicted to drive the demand for sustainable labels during the assessment period. The increased usage of packed food is creating a growth opportunity for the sustainable labels industry and the trend is likely to continue during the forecast period.

Similarly, a rise in the number of environment-conscious consumers across the globe is expected to propel sales of sustainable labels over the next ten years. With growing environmental concerns, consumers are adopting sustainable consumption patterns.

They prefer products with green packaging and labelling. This has prompted companies to use sustainable labels in their products and will continue to play a pivotal role in moving the global market for sustainable labels forward throughout the forecast period.

Sustainable labels are labelling solutions that testify to the product’s attention to safety for the environment in comparison to others. These labels have become ideal marketing tools for companies to tell their customers that by purchasing their products, they are making a more eco-conscious and sustainable choice. These labels also reduce waste and impact on the environment as they use eco-friendly materials (paper) and adhesives, and are easy to recycle.

Similarly, increasing production and consumption of packaged goods, especially packaged food items, across the globe is expected to boost the global market over the next decade.

Factors such as population explosion, increasing disposable income, and changing lifestyles have resulted in increased consumption of packaged food products. As sustainable labels are being increasingly used in these packaged food items, a rise in their production and consumption will eventually bolster sales in the market.

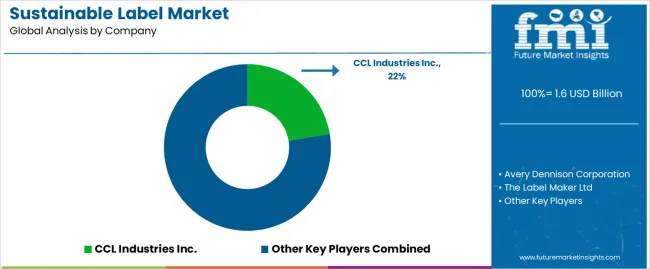

Tier 1 companies comprise market leaders with a market revenue of above USD 55 million capturing a significant market share of 10% to 15% in the global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These players are distinguished by their extensive expertise in manufacturing across multiple products across different applications and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of products utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include CCL Industries Inc., Sato Holdings Corporation, and Zebra Technologies Corp.

Tier 2 companies include mid-size players with revenue of USD 10 to 55 million having presence in specific regions and highly influencing the regional market. These are characterized by a limited international presence and well-maintained market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include HERMA Labels, Labels Plus, Weber Packaging Solutions, The Label Maker Ltd, Berkshire Labels, Crown Labels Mfg Co Ltd, Multi-Color Corporation, JK Label, Klöckner Pentaplast, and Europe GmbH & Co. K.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 10 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis of the sustainable label market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

In Europe, Germany is anticipated to register a moderate growth at 2.1% with a value share of 20% through 2035. In Asia Pacific, India is an emerging country in sustainable label projected to capture 40% of value share with a growth rate of 5% by 2035 end.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

| Germany | 2.1% |

| UK | 2.5% |

| Brazil | 3.6% |

| India | 5.0% |

| China | 4.4% |

| Japan | 3.2% |

| GCC Countries | 4.3% |

Mexico is anticipated to record a CAGR of 3.5% for sustainable labels in Latin America by the end of 2025. The pharmaceutical market of Mexico is the second largest market in Latin America and ranks at number 15 globally. Mexico is known for producing medicines such as anti-inflammatory drugs, cancer treatments, and antibiotics.

According to the Wisconsin Economic Development Corporation, pharmaceutical sales in Mexico are projected to be USD 2.5 billion in 2035. The growing pharmaceutical sales and stringent labelling requirements associated with the pharma industry are contributing to the market growth in the region.

The industry of sustainable labels across India is predicted to accelerate at 5% CAGR during the forecast period, owing to the rapid growth of the paper and packaging industries in the country. The growing paper industry in India is projected to drive the demand for sustainable labels over the projected period.

Indian Paper Manufacturers Association (IPMA) reported that the Indian paper industry accounts for about 5% of the world’s production of paper. Further, about 71% of paper is produced from recycled fiber and the Indian paper industry is growing at a faster pace due to innovation and technology.

Paper is being increasingly used in the packaging industry to replace materials like plastic. As the paper is top material for sustainable labels, the growing paper industry is expected to increase production. This will drive the market for sustainable labels swiftly in India during the projection period.

The section contains information about the leading segments in the industry. Flexography printing is estimated to record around 3.7% of CAGR throughout 2035. Pharmaceutical industry is projected to showcase significant growth at 4% CAGR through 2035.

| Printing Technology | Flexography |

|---|---|

| Value Share (2035) | 46.4% |

Flexographic printing is mostly adopted by label manufacturers which is anticipated to hold more than 40% of the market share expanding at 3.7% through 2035. Flexographic printing is compatible with different types of substrates, such as paper and plastics as well.

This versatility has enhanced its applications to different applications such as food, pharma, and consumer goods. Flexographic packaging is suitable for large-scale production and the quick turnaround time is ideal for fast-moving consumer goods. This printing utilizes the UV and water-based links that are sustainable. This printing is inexpensive, high quality, fast drying time, and is consistency which is leading to its huge market share.

| End Use | Pharmaceutical |

|---|---|

| Value Share (2035) | 24.4% |

The pharmaceutical industry is subjected to regulations ensuring the safety and quality of products. The regulation authority is strictly emphasizing sustainability and ensures the use of sustainable labels. The strict guidelines to provide the packaging information about products in detail are boasting demand for sustainable labels in the industry.

The massive spike in demand for medicines and other healthcare products from hospitals as well as consumers is driving the market and the trend is likely to continue during the upcoming years.

The pharmaceutical industry is projected to reach 24.4% value share expanding at 4% CAGR during the assessment period. This can be attributed to the robust growth of the pharmaceutical industry worldwide and the increasing usage of sustainable labels in this sector over traditional ones.

Key manufacturers of sustainable labels are focusing on increasing their sales and revenues as well as meeting end-user demands by expanding their capabilities. They are adopting a merger & acquisition strategy to expand their resources and are developing new products to meet customer needs.

Recent Industry Developments in Sustainable Label Market

In terms of material, the industry is divided into up to plastic and paper. Paper is further divided as semi-gloss/matte paper, vellum paper, direct thermal label paper, and others.

In terms of label type, the industry is segregated into pressure-sensitive labels (PSL), shrink labels, stretch labels, wet glue labels, and others (in-mold, pre-gummed, etc.).

In terms of printing technology, the industry is segregated into flexography, digital, gravure, screen, and offset.

The industry is classified by end use industries as food & beverages, pharmaceuticals, cosmetics & personal care, homecare clothing & apparel chemicals, automobiles, and other consumer goods.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, and Middle East and Africa (MEA), have been covered in the report.

The global sustainable label market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the sustainable label market is projected to reach USD 2.5 billion by 2035.

The sustainable label market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in sustainable label market are paper, _semi-gloss/matte paper, _vellum paper, _direct thermal label paper, _others, plastic, _pla and _phb.

In terms of label type, pressure-sensitive labels (psl) segment to command 45.0% share in the sustainable label market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Footwear Market Forecast and Outlook 2025 to 2035

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Labels Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA