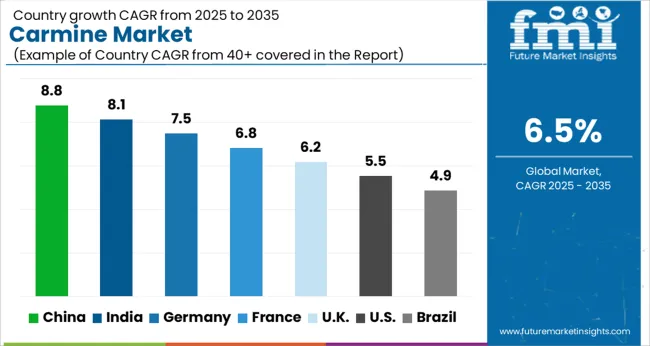

The carmine market, estimated at USD 56.8 billion in 2025 and projected to reach USD 106.7 billion by 2035 at a CAGR of 6.5%, is significantly influenced by regulatory frameworks governing food safety, colorant usage, and labeling standards. Regulatory oversight directly affects production processes, as carmine is derived from cochineal insects, and its extraction and purification must comply with stringent safety and hygiene protocols.

Compliance with guidelines issued by authorities such as the Food and Drug Administration, European Food Safety Authority, and regional standards bodies imposes requirements on testing, traceability, and permissible concentrations, which in turn influence operational costs and supply chain management. Market growth is also moderated by evolving regulations on allergen declaration and consumer transparency, necessitating detailed documentation of sourcing and chemical treatment procedures. Producers are required to invest in certification and quality assurance programs, which not only ensure regulatory compliance but also reinforce market credibility.

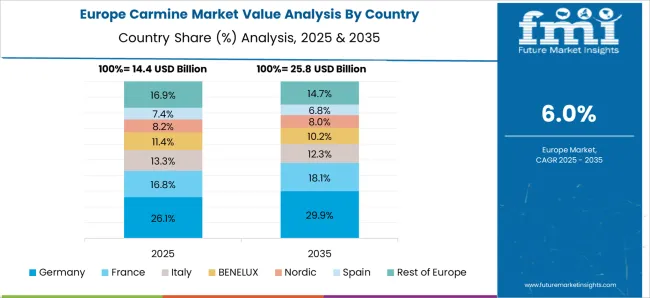

Furthermore, restrictions on synthetic alternatives and labeling mandates impact formulation decisions, creating both opportunities and constraints for manufacturers. Regional differences in regulatory stringency create an uneven landscape, with Europe typically enforcing more rigorous labeling and safety standards compared to other regions, while emerging markets may have more flexible regulatory environments. The regulatory influence is central to the carmine market’s structure, dictating production practices, market entry strategies, and competitive positioning, thereby shaping long-term growth trajectories and operational risk management.

| Metric | Value |

|---|---|

| Carmine Market Estimated Value in (2025 E) | USD 56.8 billion |

| Carmine Market Forecast Value in (2035 F) | USD 106.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The carmine market has established itself as a distinctive segment in the natural colorants landscape, driven by consumer preference for clean label and non-synthetic ingredients. It represents about 6.3% of the global natural food colorants industry, supported by demand in confectionery, dairy, and bakery products. Within confectionery and bakery additives, carmine holds nearly 4.1% share, particularly in icing, coatings, and fillings. The dairy ingredients sector accounts for around 2.9% due to applications in flavored yogurts, beverages, and ice creams.

Cosmetic colorants contribute a 5.5% share, supported by their use in lipsticks, blushes, and nail products, while in pharmaceutical excipients, they hold a 1.7% share for capsules and syrups. Recent industry trends indicate a strong focus on sustainable and traceable sourcing of cochineal insects, which remain the primary raw material for carmine production. Groundbreaking industry moves have included investment in precision fermentation technologies to produce carmine alternatives without insect extraction, addressing ethical and vegan concerns.

Leading manufacturers have been expanding production in Latin America and Europe to meet global demand while ensuring supply chain resilience. Strategic initiatives include partnerships with food and beverage multinationals to co-develop stable formulations for heat and light-sensitive products. Increasing regulatory scrutiny over labeling transparency has also driven the adoption of advanced extraction processes, ensuring high purity, improved solubility, and consistent coloring intensity.

The carmine market is witnessing stable expansion, supported by sustained demand for natural colorants across diverse food and beverage applications. Market growth is being underpinned by regulatory encouragement for natural additives, shifting consumer preferences toward clean-label products, and the ability of carmine to deliver superior stability and vibrancy compared to synthetic alternatives.

Industry participants are focusing on refining extraction processes, optimizing production yields, and expanding supply networks to meet growing demand from both developed and emerging markets. Price fluctuations due to raw material availability have been addressed through strategic sourcing and long-term supplier partnerships.

The competitive landscape is shaped by innovation in product formulation, targeting improved solubility and broader application compatibility. Over the forecast period, the market is expected to benefit from the expansion of premium food segments, increased adoption in functional and health-oriented products, and deeper penetration into non-food sectors such as cosmetics and pharmaceuticals, ensuring steady revenue growth and diversified application opportunities.

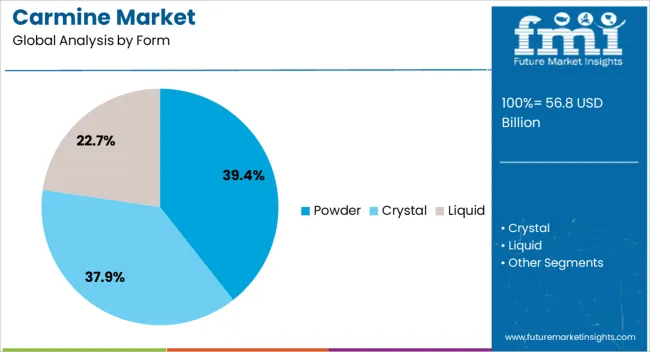

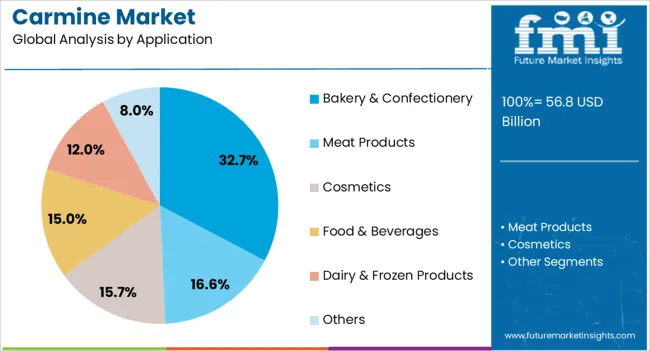

The carmine market is segmented by form, application, end user, and geographic regions. By form, carmine market is divided into Powder, Crystal, and Liquid. In terms of application, carmine market is classified into Bakery & Confectionery, Meat Products, Cosmetics, Food & Beverages, Dairy & Frozen Products, and Others.

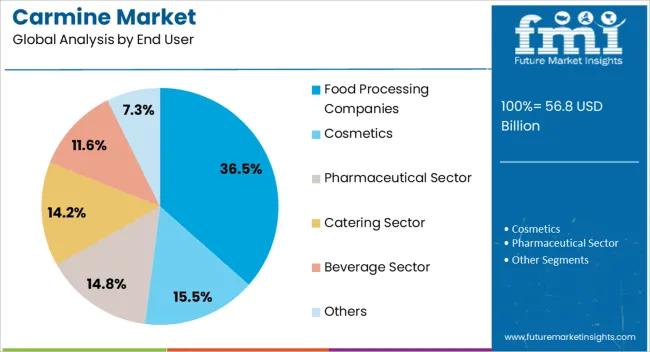

Based on end user, carmine market is segmented into Food Processing Companies, Cosmetics, Pharmaceutical Sector, Catering Sector, Beverage Sector, and Others. Regionally, the carmine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder segment, holding 39.40% of the form category, leads the market due to its superior storage stability, ease of handling, and suitability for bulk food manufacturing processes. Its dominance has been reinforced by high adoption in dry mix formulations, where uniform dispersion and color consistency are critical.

Powdered carmine is preferred for its longer shelf life and reduced susceptibility to degradation during transportation, making it cost-effective for global trade. Manufacturers have been leveraging spray-drying and advanced milling technologies to enhance particle uniformity and improve solubility in diverse food matrices.

Demand stability has been maintained by the bakery, confectionery, and beverage sectors, which continue to utilize powder forms for consistent product quality. The segment’s competitive positioning is further strengthened by flexible packaging formats, which cater to both industrial and artisanal production needs, ensuring that powdered carmine remains a cornerstone of the market’s growth trajectory.

The bakery & confectionery segment, accounting for 32.70% of the application category, has sustained its lead through extensive utilization of carmine in icings, fillings, candies, and decorative elements. The segment’s performance is supported by carmine’s heat stability and ability to maintain vibrant color across varying processing conditions, making it highly suitable for baked goods and sweets. Its role in delivering natural, appealing aesthetics aligns with growing consumer demand for clean-label indulgent products.

Adoption has been further encouraged by the premiumization trend in confectionery and bakery goods, where distinctive visual appeal drives purchase intent. Regulatory compliance in key markets has favored the use of natural colorants over synthetic dyes, bolstering long-term usage.

Innovation in product development, such as reduced-sugar and functional bakery items, continues to provide new avenues for application. With expanding artisanal and industrial bakery output globally, this segment is expected to retain its leading market share through consistent demand and high-value product positioning.

Food processing companies, holding 36.50% of the end-user category, dominate due to their large-scale procurement needs and capacity to integrate carmine into mass-market products. This segment’s leadership is reinforced by economies of scale in sourcing and processing, enabling cost efficiencies and stable supply for high-volume production.

Carmine’s adaptability across multiple product categories, including dairy, beverages, processed meats, and confectionery, supports its continued prominence among major food processors. Strategic partnerships between suppliers and large manufacturers have facilitated innovation in color formulations, ensuring compatibility with evolving product lines.

The segment’s growth is also driven by global expansion strategies, where multinational food companies introduce standardized products into emerging markets, maintaining uniform quality and visual appeal through natural colorants. Regulatory approvals in various regions have further cemented carmine’s role within this segment, enabling long-term contracts and stable revenue streams for both producers and buyers.

Natural ingredient trends, regulatory considerations, and the demand for vibrant colorants across food, cosmetics, and pharmaceutical sectors influence the market. Derived from cochineal insects, carmine is valued for its strong stability, especially against heat and light, making it suitable for various applications. Growing consumer preference for natural colorants over synthetic ones has been a primary driver of demand. The production challenges, supply limitations, and ethical considerations create complexities in the market.

The carmine market has been influenced heavily by regional regulations concerning food safety, labeling, and ingredient sourcing. In the United States, Europe, and parts of Asia, carmine has been approved for use but must be clearly labeled due to allergen concerns. This requirement has created challenges for manufacturers seeking consumer acceptance, particularly among individuals sensitive to insect-derived ingredients. On the other hand, stringent regulations against synthetic dyes have provided opportunities for greater carmine adoption in certain regions. These varied regulatory landscapes create both hurdles and incentives, forcing producers and users to adapt their sourcing and marketing strategies according to local compliance standards.

The availability of carmine is highly dependent on cochineal insect farming, which is concentrated mainly in regions such as Peru, Mexico, and the Canary Islands. This geographic concentration has created vulnerabilities in supply, making the market susceptible to fluctuations in production levels, climate conditions, and agricultural practices. Limited scalability compared to synthetic alternatives has also added to supply chain challenges. Price volatility is another issue, as carmine costs can rise sharply when demand surges or production is disrupted. These constraints have driven industries to balance between natural and alternative pigments while investing in supply diversification and more efficient extraction techniques.

Ethical concerns regarding the insect-derived origin of carmine have restricted its acceptance in certain consumer segments, particularly among vegan and vegetarian populations. Religious dietary restrictions also influence its market reach, as carmine may not be acceptable under specific dietary laws. These cultural factors have made some companies cautious in adopting carmine widely, despite its advantages in performance and stability. Alternatives such as beetroot red or anthocyanins are increasingly explored, though they often lack the same level of stability. This consumer-driven debate around ethics and culture has been shaping brand strategies, influencing how companies position products containing carmine in competitive markets.

Recent advancements in extraction processes and application technologies are contributing to the evolution of the carmine market. Improved farming techniques and modernized extraction methods are enhancing yield efficiency and pigment quality. In addition, encapsulation and formulation innovations are enabling better stability and broader application across complex product categories. Research is also being directed toward creating carmine alternatives that match its performance while addressing ethical concerns. This innovation-driven progress is helping industries overcome traditional limitations, while allowing companies to meet regulatory standards and consumer expectations more effectively. The role of technology in optimizing production and application is likely to strengthen further.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

China is expected to dominate the market with a forecast CAGR of 8.8%, supported by its large-scale food and beverage sector where natural colorants are increasingly utilized. India follows with 8.1%, driven by higher incorporation of natural additives across confectionery, bakery, and dairy products. Germany recorded 7.5%, reflecting its strong presence in processed foods and cosmetics where natural pigmentation is gaining preference. The United Kingdom posted 6.2%, influenced by a transition toward clean-label products and strict regulatory standards on synthetic additives. The United States registered 5.5%, supported by adoption in beverages, pharmaceuticals, and personal care applications. These leading countries illustrate the expanding role of carmine as a preferred natural colorant across industries, shaping the global market outlook. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to register a CAGR of 8.8% in the market, supported by rising demand from food and beverage applications. Growing preference for natural colorants in dairy, confectionery, and bakery products is shaping the competitive landscape. Expanding processed food production and consumer interest in clean-label ingredients strengthen market adoption. Increasing regulatory emphasis on limiting artificial additives is boosting the preference for natural alternatives. With strong industrial capacity and diverse applications, China is expected to remain the leading market for carmine consumption in the coming years.

India is forecasted to expand at a CAGR of 8.1% in the market, driven by growing use in packaged foods and beverages. Increasing consumer awareness about natural additives has encouraged food producers to incorporate carmine in bakery and confectionery items. Expanding dairy and yogurt segments also contribute to steady demand. Rising interest in premium food products has further boosted adoption of natural colorants. Local production capabilities are being enhanced to reduce dependence on imports, supporting long-term growth potential. India is positioned as a fast-growing market for carmine applications.

Germany is anticipated to grow at a CAGR of 7.5% in the market, supported by advanced food processing and stringent quality standards. Demand for natural coloring solutions is driven by consumer aversion to synthetic additives. The bakery and confectionery industries are key users, alongside meat processing where carmine is applied in coatings. Sustainability and transparency in food labeling are influencing greater adoption of natural options. Germany’s reputation for high-quality food production makes carmine a preferred choice across applications, strengthening its role in the European market.

The United Kingdom is expected to record a CAGR of 6.2% in the market, supported by its growing use in packaged foods and beverages. Regulatory focus on reducing synthetic additives is strengthening the adoption of natural coloring agents. Premium bakery, confectionery, and dairy products are driving usage in both domestic and export markets. Rising consumer preference for clean-label products has encouraged brands to integrate carmine as a trusted natural solution. Although adoption is slower than in larger markets, steady demand is expected to continue in the UK.

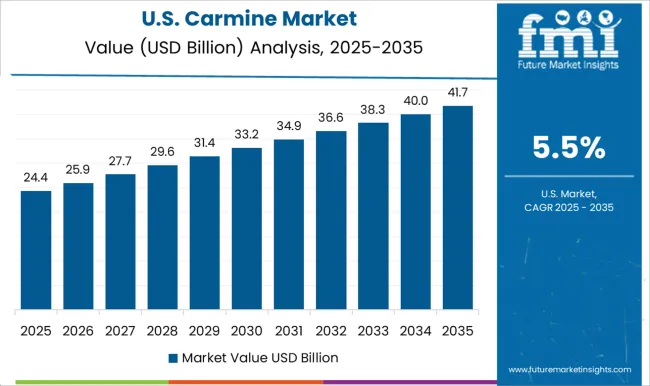

The United States is projected to expand at a CAGR of 5.5% in the market, driven by strong demand from bakery, dairy, and beverage industries. Natural colorants are gaining preference as consumers avoid artificial additives. Growing popularity of organic and clean-label food products supports broader carmine applications. Innovation in processed foods and premium beverages also contributes to demand. Regulatory clarity around natural additives is expected to enhance adoption across industries. The US market is set to maintain a stable trajectory with rising consumer-driven demand.

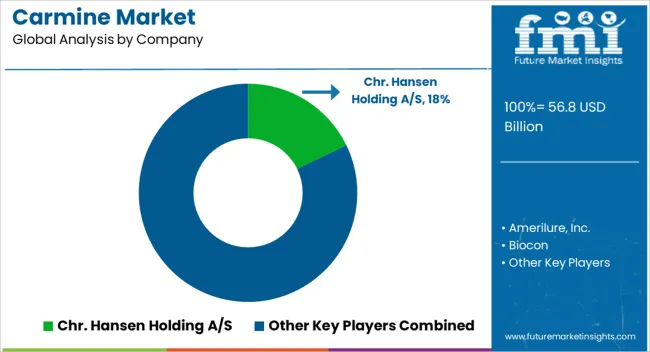

The market features a combination of specialized colorant producers, natural ingredient suppliers, and food and beverage manufacturers that integrate carmine into their product lines. Chr. Hansen Holding A/S is among the leading players, leveraging its expertise in natural food ingredients to provide high-quality carmine solutions for global clients. Amerilure, Inc. and Biocon contribute through their established presence in natural extracts and biotechnology-based solutions. Colormaker, Inc. and DDW The Color House are prominent in the natural colors sector, offering carmine formulations for applications in beverages, dairy, and confectionery. Diana Natural and GNT Group B V are recognized for clean-label and plant-based ingredient innovations, expanding the natural colorant category.

Naturex, now part of Givaudan, strengthens the market by linking natural solutions with global supply chains, while Proquimac and Roha Dyechem Pvt Ltd contribute through specialized production of food-grade colorants. Sensient Technology Corporation has a wide portfolio of natural and synthetic colors, with carmine being a core part of its offering in food and cosmetics. The Hershey Company, representing downstream demand, highlights the role of large food and confectionery manufacturers in driving carmine usage. With rising emphasis on natural ingredients, these companies are expected to play an important role in shaping carmine’s presence across food, beverage, pharmaceutical, and cosmetic applications while responding to consumer expectations for safe and sustainable coloring solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 56.8 Billion |

| Form | Powder, Crystal, and Liquid |

| Application | Bakery & Confectionery, Meat Products, Cosmetics, Food & Beverages, Dairy & Frozen Products, and Others |

| End User | Food Processing Companies, Cosmetics, Pharmaceutical Sector, Catering Sector, Beverage Sector, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chr. Hansen Holding A/S, Amerilure, Inc., Biocon, Colormaker, Inc., Ddw TheColor House, Diana Natural, Gnt Group B V, Naturex, Proquimac, RohaDyechem Pvt Ltd, Sensient Technology Corporation, and The Hershey Company |

| Additional Attributes | Dollar sales by carmine grade and application, demand dynamics across food, beverage, and cosmetic sectors, regional trends in natural colorant adoption, innovation in extraction methods and stability enhancement, environmental impact of sourcing and processing, and emerging use cases in clean-label products and premium formulations. |

The global carmine market is estimated to be valued at USD 56.8 billion in 2025.

The market size for the carmine market is projected to reach USD 106.7 billion by 2035.

The carmine market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in carmine market are powder, crystal and liquid.

In terms of application, bakery & confectionery segment to command 32.7% share in the carmine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carmine Color Market Size and Share Forecast Outlook 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Indigo Carmine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA