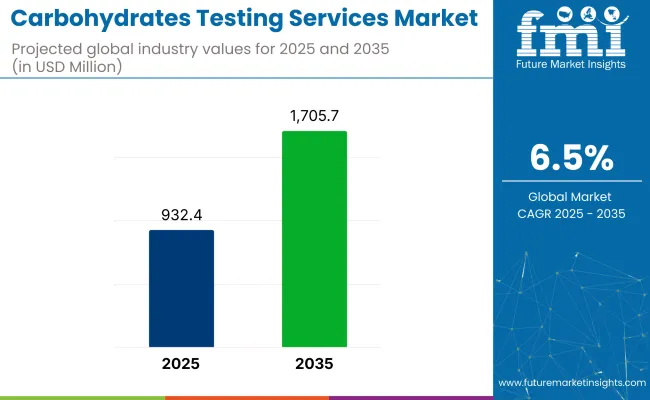

The global carbohydrates testing services market is valued at USD 932.4 million in 2025 and is slated to reach USD 1,705.7 million by 2035, reflecting a CAGR of 6.5%. This growth is being driven by the increasing demand for precise food labeling, rising health consciousness, and technological advancements in testing methods.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 932.4 million |

| Market Value (2035) | USD 1,705.7 million |

| CAGR (2025 to 2035) | 6.5% |

Additionally, the emergence of personalized nutrition and diet-specific food products has been boosting the need for detailed carbohydrate profiling across regions, further strengthening market expansion prospects.

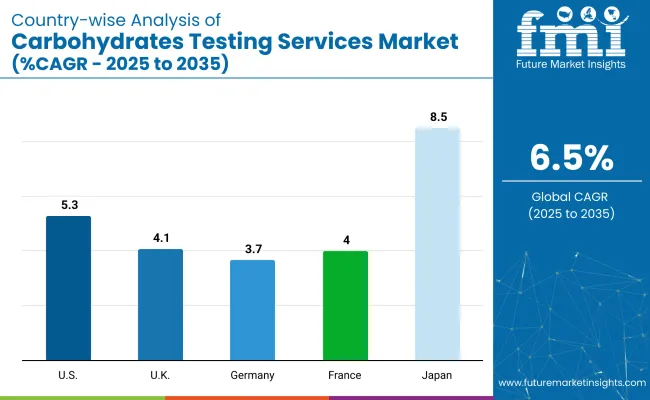

Japan is projected to record the highest growth in the carbohydrates testing services market with a CAGR of 8.5% from 2025 to 2035, driven by strong demand for low glycemic index foods and technological innovations. The USA follows with a CAGR of 5.3%, supported by strict FDA regulations and rising health consciousness.

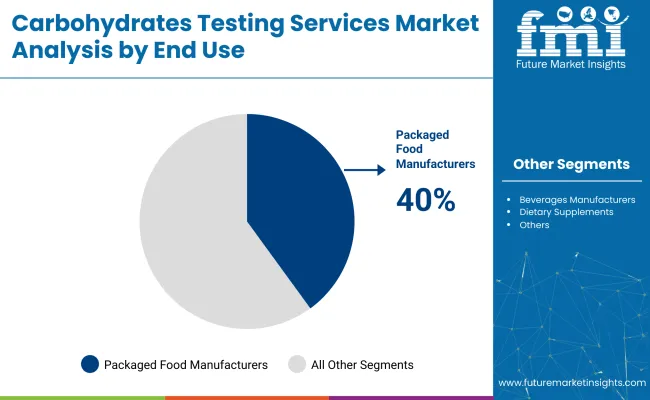

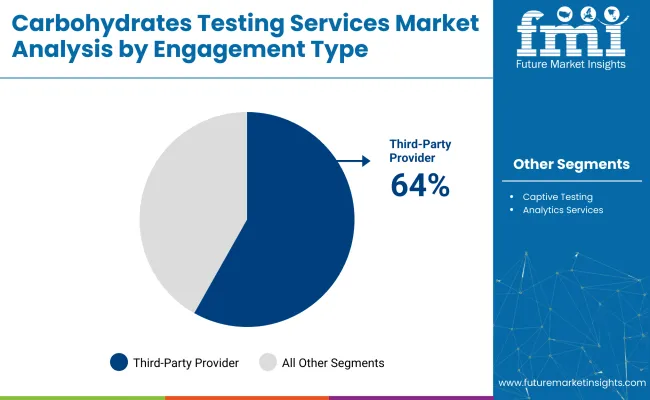

Germany registers slower growth with a CAGR of 3.7%, driven by robust food safety standards and industry investments. Third-party or independent testing and analytics service providers will dominate the engagement type segment with a 64% market share. Packaged food manufacturers will lead the end-use industry segment with a 40% market share in 2025.

Recent innovations in carbohydrate testing services include advanced high-performance liquid chromatography, mass spectrometry, and AI-powered analyzers that improve accuracy and reduce testing time. Food manufacturers use these technologies to provide detailed carbohydrate profiling for personalized nutrition products and regulatory compliance.

Governments are enforcing stricter guidelines globally. The FDA in the USA mandates detailed carbohydrate labeling under the Nutrition Labeling and Education Act. The European Union enforces Regulation No. 1169/2011 for precise carbohydrate content labeling, while India’s FSSAI sets strict standards for food safety. These regulations drive companies to adopt advanced testing methods to ensure accuracy and maintain consumer trust.

The market forms a significant part of the food testing and food safety markets. It holds approximately a 12-15% share within the broader food testing market, driven by rising demand for accurate nutritional labeling. Within the nutritional analysis services market, carbohydrate testing accounts for nearly a 20% share, as detailed carbohydrate profiling is essential for personalized nutrition and dietary compliance.

It contributes around 5-7% to the global Testing, Inspection, and Certification (TIC) market in food applications. This segment continues to grow due to technological innovations and strict government regulations ensuring food transparency and consumer safety worldwide.

The carbohydrates testing services market segments include carbohydrate type, technology, end-use industry, engagement type, and region. The carbohydrate type segment covers monosaccharides testing, disaccharides testing, oligosaccharides testing, and polysaccharides testing. The technology segment includes high-performance liquid chromatography (HPLC), gas chromatography (GC), enzymatic methods, spectrophotometry, and others (such as biosensors and mass spectrometry).

The end-use industry segment comprises packaged food manufacturers, beverage manufacturers, dietary supplements, animal feed manufacturers, and others (including academic research institutions and government laboratories).

The engagement type segment consists of in-house or captive testing and analytics services, and third-party or independent testing and analytics service providers. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, Balkans and Baltic, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and Middle East and Africa.

Monosaccharides testing holds the largest market share in the carbohydrates testing services market, accounting for 39% of the total revenue share.

High-performance liquid chromatography (HPLC) is considered the most lucrative technology segment in the carbohydrates testing services market, holding approximately 33% market share.

Packaged food manufacturers are the most lucrative segment in the carbohydrates testing services market, holding approximately 40% market share.

Third-party or independent testing and analytics service providers are the most lucrative segment in the carbohydrates testing services market, holding 64% market share.

The carbohydrates testing services market is growing steadily due to rising demand for accurate nutritional labeling and strict food safety regulations. Advanced technologies like high-performance liquid chromatography and mass spectrometry are boosting testing efficiency and precision.

Recent Trends in the Carbohydrate Testing Services Market

Challenges in the Carbohydrates Testing Services Market

Japan is projected to record the highest growth in the carbohydrates testing services market with a CAGR of 8.5% from 2025 to 2035, driven by strong demand for low glycemic index foods and technological innovations. The USA follows with a CAGR of 5.3%, supported by strict FDA regulations and rising health consciousness.

France and the UK show moderate growth at 4.0% and 4.1% CAGR, respectively, driven by stringent EU regulations and demand for low-carb products. Germany registers the slowest growth among these countries with a CAGR of 3.7%, although supported by robust food safety standards and industry investments.

This report covers an in-depth analysis of 40+ countries; the five top-performing OECD Countries are highlighted below.

The USA carbohydrates testing services market is projected to grow at a CAGR of 5.3% from 2025 to 2035.

Sales of carbohydrate testing services in the UK are expected to grow steadily at a CAGR of 4.1% from 2025 to 2035.

Sales of carbohydrate testing services in Germany are forecasted to grow at a CAGR of 3.7% from 2025 to 2035.

The carbohydrates testing services revenue in France is expected to expand at a CAGR of 4.0% from 2025 to 2035.

Sales of carbohydrate testing services in Japan are projected to grow at a CAGR of 8.5% from 2025 to 2035.

The carbohydrates testing services market is moderately consolidated, with leading players such as Eurofins Scientific, BOC Sciences, and Alfa Chemistry commanding significant market shares. These companies compete through strategic pricing, technological innovation, global expansion, and partnerships to enhance their service offerings and market presence.

Eurofins Scientific has been focusing on expanding its global laboratory network and enhancing its digital capabilities to offer comprehensive testing services. BOC Sciences continues to provide specialized carbohydrate stability testing services, catering to the pharmaceutical and food industries. Alfa Chemistry has introduced a new food nutrition analysis service, aiming to support food manufacturers in meeting regulatory compliance and product development needs.

Recent Carbohydrate Testing Services Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 932.4 million |

| Projected Market Size (2035) | USD 1,705.7 million |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume (Metric Tons) |

| By Carbohydrate Type | Monosaccharides, Disaccharides, Oligosaccharides, Polysaccharides |

| By Technology | High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), Enzymatic Methods, Spectrophotometry, Others (Biosensors-based Carbohydrate Testing, Mass spectrometry (MS), Nuclear Magnetic Resonance (NMR) Spectroscopy, and Capillary electrophoresis (CE)) |

| By End Use Industry | Packaged Food Manufacturers, Beverages Manufacturers, Dietary Supplements, Animal Feed Manufacturers, Others (Academic Research Institutions and Universities, Government Laboratories and Regulatory Bodies, Contract Research Organisations (CROs), and Ingredient Suppliers a nd Raw Material Processors) |

| By Engagement Type | In-house/Captive Testing and Analytics Services, Third-party/Independent Testing and Analytics Service Providers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Reading Scientific Services Ltd, Eurofins Scientific, BOC Sciences, Alfa Chemistry, SMS LABS SERVICES, Lifeasible, Agri Technovation, Food Research Lab, Dextra Laboratories, TÜ VSÜD, Anacon Laboratories, and FARE Labs. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per carbohydrate type, the industry has been categorized into Monosaccharides Testing, Disaccharides Testing, Oligosaccharides Testing, and Polysaccharides Testing.

Based on Technology, the industry is further categorized into High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), Enzymatic Methods, Spectrophotometry, and Others.

This segment is further categorized into Packaged Food Manufacturers, Beverages Manufacturers, Dietary Supplements, Animal Feed Manufacturers, and Others.

As per engagement type, the industry is divided into House/ Captive Testing and Analytics Services, and 3rd Party/ Independent Testing and Analytics Service Providers.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 932.4 million in 2025.

It is expected to reach USD 1,705.7 million by 2035.

High-performance liquid chromatography (HPLC) holds the largest share of 33% in 2025.

The market is projected to grow at a CAGR of 6.5% from 2025 to 2035.

Japan is expected to record the fastest CAGR of 8.5% from 2025 to 2035 in the carbohydrates testing services market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Residue Testing Services Market Size, Growth, and Forecast for 2025 to F2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Chemical Testing Services Market Trends and Forecast 2025 to 2035

Nematode Testing Services Market

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Packaging Testing Services Industry

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Outsourced Testing Services Market Insights – Trends & Forecast 2025 to 2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Food Safety Testing Services Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA