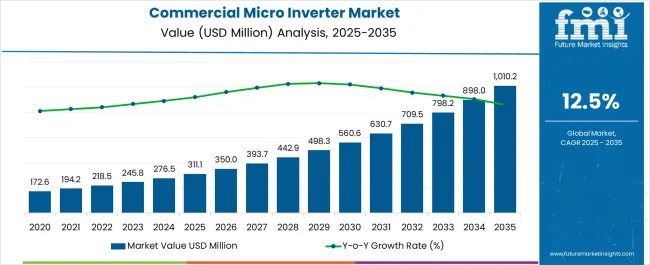

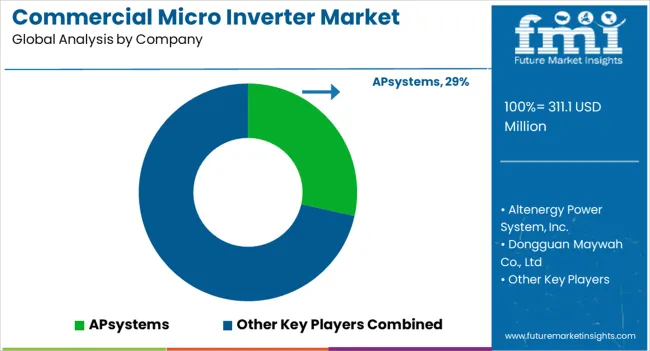

The Commercial Micro Inverter Market is estimated to be valued at USD 311.1 million in 2025 and is projected to reach USD 1010.2 million by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

The commercial microinverter market is projected to deliver an absolute gain of USD 699.1 million and a growth multiplier of 3.25 times over the decade. This growth is supported by a strong CAGR of 12.5%, driven by the increasing adoption of renewable energy systems, especially in commercial and industrial applications. During the first five years (2025-2030), the market will grow from USD 311.1 million to USD 560.6 million, adding USD 249.5 million, which accounts for 35.7% of the total incremental growth, with a 5-year multiplier of 1.8x.

The second phase (2030–2035) will contribute USD 449.6 million, representing 64.3% of the total growth, driven by stronger momentum as the adoption of micro inverters becomes more widespread in commercial solar power installations. Annual increments will rise from USD 50 million in early years to USD 75 million by 2035, signaling a faster pace of growth due to advancements in inverter efficiency, cost reductions, and increasing demand for solar energy solutions. Manufacturers focusing on innovation, cost reduction, and integration with smart energy systems will capture the largest share of this USD 699.1 million opportunity.

| Metric | Value |

|---|---|

| Commercial Micro Inverter Market Estimated Value in (2025 E) | USD 311.1 million |

| Commercial Micro Inverter Market Forecast Value in (2035 F) | USD 1010.2 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

The commercial micro inverter market is experiencing robust growth fueled by increasing investments in renewable energy infrastructure and the global transition toward distributed energy generation. As commercial enterprises prioritize energy efficiency and sustainability goals, micro inverters are being adopted to maximize solar output at the individual panel level while enhancing system reliability and scalability.

Their ability to operate independently of a central inverter reduces the risk of system failure and improves monitoring capabilities. Technological advancements in power conversion, real time analytics, and smart grid compatibility are further supporting adoption in commercial rooftops and industrial facilities.

With favorable regulatory incentives, grid modernization initiatives, and rising electricity costs across developed and developing markets, commercial micro inverters are positioned to become a key enabler of decentralized solar energy solutions.

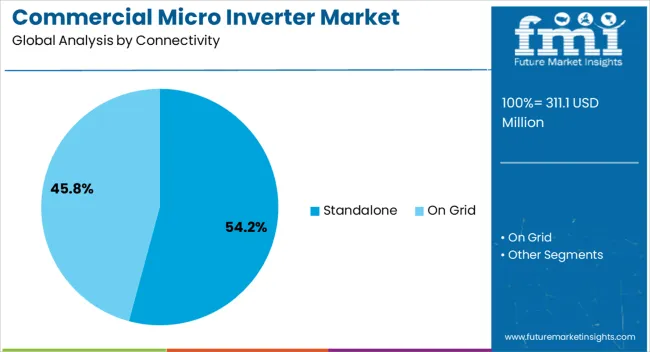

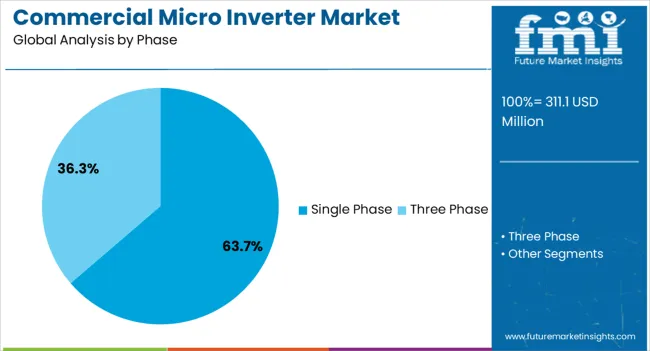

The commercial micro inverter market is segmented by connectivity, phase, and geographic regions. By connectivity of the commercial micro inverter market is divided into Standalone and On Grid. In terms of phase of the commercial micro inverter market is classified into Single Phase and Three Phase.

Regionally, the commercial micro inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standalone segment is projected to hold 54.20% of the total market revenue by 2025 within the connectivity category, establishing itself as the leading segment. This growth is driven by the increased deployment of independent energy systems in commercial installations where flexibility and reliability are essential.

Standalone micro inverters eliminate the need for complex cabling and centralized inverters, allowing for simplified system design and improved fault isolation. Their ease of installation and suitability for retrofit applications make them ideal for commercial buildings with varying panel configurations.

As grid independence and system modularity become central to solar project planning, the standalone configuration continues to gain prominence across diverse commercial use cases.

The single phase segment is expected to account for 63.70% of the market revenue by 2025 within the phase category, making it the dominant configuration. This is primarily due to its compatibility with standard commercial electrical infrastructure, particularly in small and medium sized businesses.

Single phase micro inverters are cost effective, easy to install, and require less maintenance, offering an efficient solution for rooftop solar applications. Their prevalence in urban commercial settings and support for smart energy management systems contribute to their continued preference.

As energy decentralization and net metering initiatives expand, single phase systems offer a balance between affordability, performance, and scalability, reinforcing their position as the most widely adopted phase configuration in the commercial micro inverter market.

The commercial micro inverter market is driven by the increasing adoption of solar power systems, with significant opportunities arising from expanding solar installations in commercial sectors. Emerging trends in smart grid integration and energy management are reshaping the market. However, challenges such as high initial costs and market fragmentation remain. By 2025, overcoming these obstacles through cost-effective solutions and seamless integration will be key to ensuring continued growth and adoption of micro inverters in commercial solar installations.

The commercial micro inverter market is experiencing significant growth due to the increasing adoption of solar power systems in both residential and commercial sectors. Micro inverters are becoming a preferred choice over traditional string inverters due to their ability to optimize power conversion at the panel level, improving the efficiency of solar energy systems. As the push for renewable energy intensifies, the need for reliable, efficient, and scalable solar solutions will drive continued market expansion. By 2025, micro inverters will play a crucial role in enhancing solar energy adoption.

Opportunities in the commercial micro inverter market are rising with the expansion of solar installations in commercial sectors. As more businesses and commercial properties opt for solar power to reduce energy costs and carbon footprints, the demand for efficient micro inverters to manage energy production is increasing. Micro inverters offer the flexibility to monitor and optimize solar power output across multiple panels, making them an ideal solution for large-scale installations. By 2025, the demand for commercial solar systems will create significant opportunities for micro inverter suppliers.

Emerging trends in the commercial micro inverter market include the growing integration of smart grids and energy management systems with solar installations. Micro inverters are increasingly being designed to work seamlessly with smart grid systems, allowing for real-time monitoring, remote control, and optimized energy usage across commercial solar setups. This integration enables businesses to maximize energy savings and increase system reliability. By 2025, these trends are expected to further influence the market as businesses seek advanced solutions to better manage energy production and consumption.

Despite growth, the commercial micro inverter market faces challenges such as high initial costs and market fragmentation. Micro inverters, while highly efficient, generally come with a higher upfront cost compared to traditional inverters, which can deter some commercial users. Additionally, the market is fragmented with several players offering various solutions, leading to competitive pricing pressures. By 2025, addressing these challenges will require the development of more cost-effective solutions, as well as standardization and improved integration processes to ensure broad adoption.

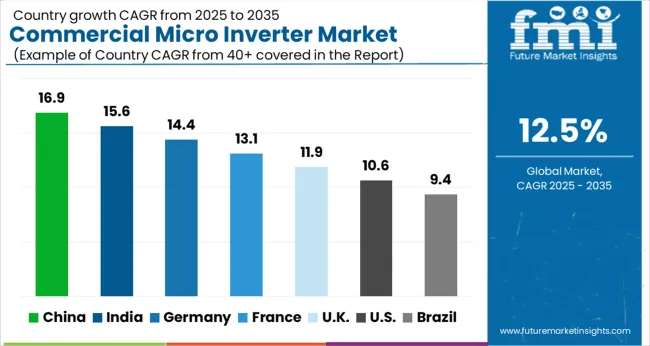

| Country | CAGR |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| UK | 11.9% |

| USA | 10.6% |

| Brazil | 9.4% |

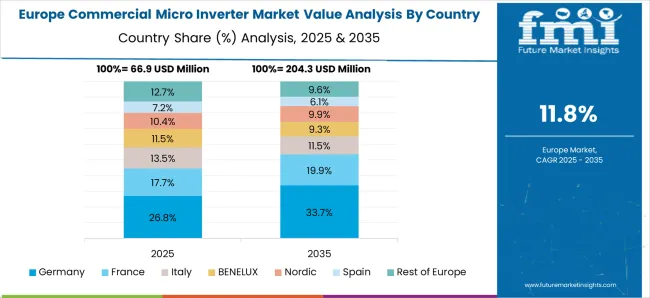

The global commercial micro inverter market is projected to grow at a 12.5% CAGR from 2025 to 2035. China leads with a growth rate of 16.9%, followed by India at 15.6%, and Germany at 14.4%. The United Kingdom records a growth rate of 11.9%, while the United States shows the slowest growth at 10.6%. These varying growth rates are driven by factors such as increasing adoption of renewable energy systems, growing demand for solar power in commercial applications, and rising investments in energy-efficient technologies. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, government support for solar energy, and expanding commercial solar installations, while more mature markets like the USA and the UK see steady growth driven by technological advancements, regulatory incentives, and increasing demand for decentralized energy solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial micro inverter market in China is growing rapidly, with a projected CAGR of 16.9%. China’s expanding solar energy sector, combined with the government’s strong support for renewable energy projects, is driving the demand for micro inverters in commercial solar installations. The country’s focus on increasing energy efficiency and reducing carbon emissions, along with growing investments in decentralized energy solutions, contributes to the adoption of micro inverters. Additionally, China’s large-scale commercial solar installations, coupled with the growing demand for solar power in industrial applications, continue to accelerate the demand for micro inverters.

The commercial micro inverter market in India is projected to grow at a CAGR of 15.6%. India’s rapidly growing solar energy market, fueled by government initiatives and increasing demand for renewable energy, is driving the adoption of micro inverters in commercial solar installations. The country’s focus on expanding its renewable energy capacity, coupled with rising investments in solar power infrastructure and grid modernization, continues to fuel market growth. Additionally, India’s growing demand for energy-efficient solutions and decentralized power generation further accelerates the adoption of commercial micro inverters in the country’s solar energy sector.

The commercial micro inverter market in Germany is projected to grow at a CAGR of 14.4%. Germany’s strong commitment to renewable energy, particularly solar power, is driving steady demand for micro inverters. The country’s regulatory incentives for solar energy adoption, combined with a focus on energy transition and sustainability, continue to support the growth of the commercial micro inverter market. Additionally, Germany’s growing investments in commercial solar installations, grid integration, and decentralized energy systems further accelerate the adoption of micro inverters. The increasing demand for energy-efficient, decentralized power solutions in commercial applications contributes to market expansion.

The commercial micro inverter market in the United Kingdom is projected to grow at a CAGR of 11.9%. The UK focus on clean energy, particularly solar power, is driving steady demand for micro inverters. The country’s regulatory frameworks supporting renewable energy generation, along with government incentives for solar energy adoption in commercial sectors, contribute to market growth. Additionally, the growing emphasis on energy efficiency, carbon reduction, and decentralized energy solutions in commercial applications accelerates the adoption of micro inverters. Investments in commercial solar installations, combined with rising demand for energy-efficient solutions, further boost market expansion.

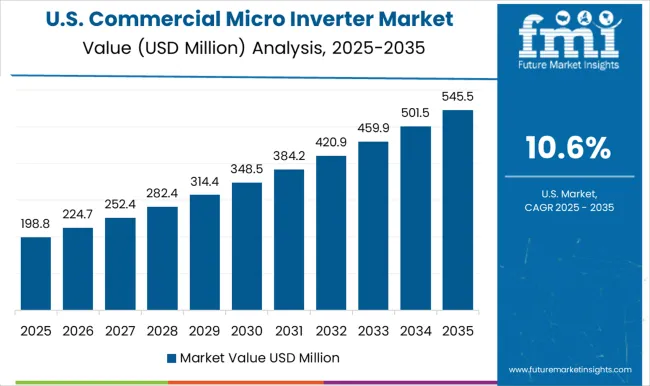

The commercial micro inverter market in the United States is expected to grow at a CAGR of 10.6%. The USA market is driven by increasing demand for renewable energy solutions, particularly solar power, in commercial applications. Government incentives for solar energy adoption, combined with rising focus on energy efficiency, sustainability, and decentralized energy systems, contribute to steady market growth. Additionally, the USA aerospace and defense sectors’ growing investments in renewable energy systems, including commercial solar power installations, continue to drive the adoption of micro inverters. Technological advancements and innovations in micro inverter solutions further contribute to market expansion.

The commercial microinverter market is dominated by Enphase Energy, which leads with its advanced microinverter solutions used in commercial solar power systems to maximize energy production and efficiency. Enphase’s dominance is supported by its innovative technology, reliable product performance, and strong global presence in solar energy markets.

Key players, including SolarEdge Technologies, APsystems, and Fimer Group, maintain significant market shares by offering high-performance microinverters that optimize energy generation and enhance system reliability for commercial solar installations. These companies focus on providing efficient, scalable solutions for solar energy storage, monitoring, and integration, enhancing overall system performance.

Emerging players like GoodWe Power Supply Technology Co., Ltd., Hoymiles, and Dongguan Maywah Co., Ltd. are expanding their market presence by offering specialized micro inverter solutions for niche applications, including off-grid systems, renewable energy integration, and commercial rooftop installations. Their strategies include improving energy conversion efficiency, integrating advanced monitoring systems, and enhancing inverter durability in harsh environments.

Market growth is driven by the rising demand for solar energy solutions, the increasing adoption of renewable energy sources, and the growing focus on reducing energy costs in commercial sectors. Innovations in smart inverter technology, cloud-based monitoring, and modular energy systems are expected to continue shaping competitive dynamics and drive further growth in the global commercial micro inverter market.

| Item | Value |

|---|---|

| Quantitative Units | USD 311.1 Million |

| Connectivity | Standalone and On Grid |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | APsystems, Altenergy Power System, Inc., Dongguan Maywah Co., Ltd, Enphase Energy, Fimer Group, GoodWe Power Supply Technology Co., Ltd., Growatt New Energy, Hoymiles, NingBo Deye Inverter Technology Co., Ltd., Northern Electric Power Technology Inc., SolarEdge Technologies, Sparq System, TSUNESS Co., Ltd., and Yotta Energy |

| Additional Attributes | Dollar sales by inverter type and application, demand dynamics across solar energy, commercial buildings, and industrial sectors, regional trends in commercial micro inverter adoption, innovation in efficiency and grid compatibility technologies, impact of regulatory standards on energy production and environmental concerns, and emerging use cases in smart grids and energy storage systems. |

The global commercial micro inverter market is estimated to be valued at USD 311.1 million in 2025.

The market size for the commercial micro inverter market is projected to reach USD 1,010.2 million by 2035.

The commercial micro inverter market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in commercial micro inverter market are standalone and on grid.

In terms of phase, single phase segment to command 63.7% share in the commercial micro inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Commercial Single Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA