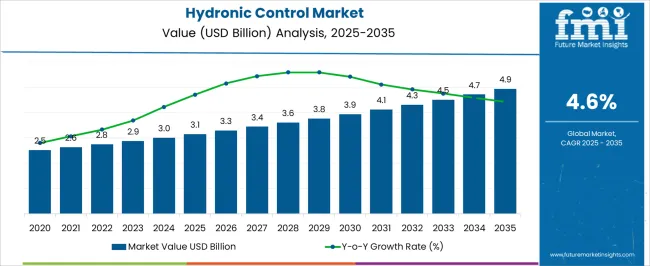

The Hydronic Control Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. The hydronic control market is projected to generate an absolute gain of USD 1.8 billion and a growth multiplier of 1.58x over the decade. This growth, driven by a 4.6% CAGR, is fueled by the increasing demand for energy-efficient and environmentally friendly HVAC systems in both residential and commercial sectors. During the first five years (2025–2030), the market will grow from USD 3.1 billion to USD 3.9 billion, adding USD 800 million, which accounts for 44.4% of the total incremental growth.

This growth is primarily driven by the increasing demand for precise temperature control in heating and cooling systems, which enables optimized energy usage. The second phase (2030–2035) will contribute USD 1.0 billion, representing 55.6% of the total growth, as strong momentum picks up due to technological advancements and increasing investments in infrastructure upgrades, particularly in the commercial sector. Annual increments will rise from USD 0.2 billion in early years to USD 0.3 billion by 2035, signaling a faster pace of growth driven by the growing preference for smart and automated hydronic control systems. Manufacturers focusing on innovative, user-friendly, and energy-efficient solutions will capture the largest share of this USD 1.8 billion opportunity.

| Metric | Value |

|---|---|

| Hydronic Control Market Estimated Value in (2025 E) | USD 3.1 billion |

| Hydronic Control Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The hydronic control market is gaining strong traction due to increasing emphasis on energy optimization, sustainable construction practices, and advanced building automation. With rising energy costs and regulatory frameworks pushing for carbon footprint reduction, the market is experiencing a steady shift toward integrated control solutions that ensure thermal comfort while minimizing operational costs.

Governments and utilities across Europe, North America, and parts of Asia are incentivizing the adoption of energy-efficient heating systems, which is directly benefiting hydronic control deployments. The increasing integration of smart thermostats, zone control systems, and IoT-based monitoring tools is enhancing the precision and responsiveness of hydronic networks in modern infrastructure.

The market is also being influenced by retrofitting initiatives and renovation of old heating systems, where hydronic controls are being introduced to improve heat distribution efficiency As the construction industry leans more toward decarbonization and smart infrastructure development, hydronic control systems are expected to play a pivotal role in the optimization of building-level thermal management.

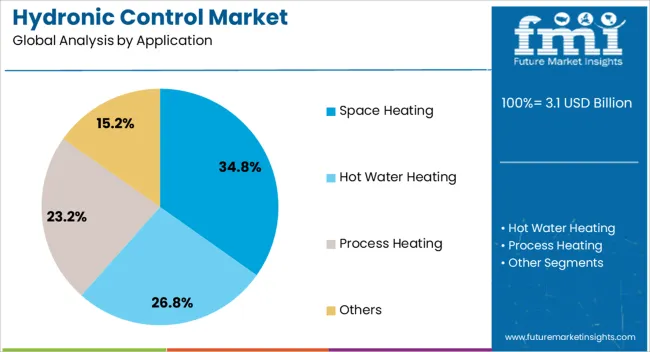

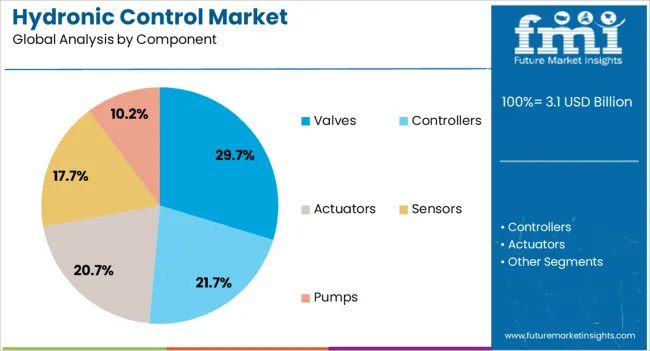

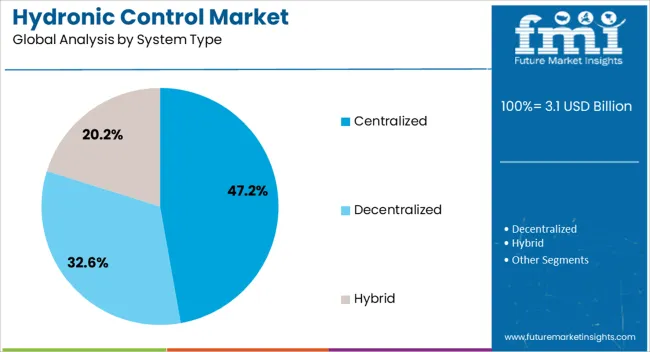

The hydronic control market is segmented by application, component, system type, end-user, and geographic regions. By application, the hydronic control market is divided into Space Heating, Hot Water Heating, Process Heating, and Others. In terms of components, the hydronic control market is classified into Valves, Controllers, Actuators, Sensors, and Pumps. Based on the system type, the hydronic control market is segmented into Centralized, Decentralized, and Hybrid. By end-user, the hydronic control market is segmented into Commercial, Residential, and Industrial. Regionally, the hydronic control industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The space heating application segment is projected to account for 34.8% of the total revenue share in the hydronic control market by 2025. This dominance is driven by the growing need for efficient indoor climate regulation in residential and commercial buildings, particularly in cold climate regions. Space heating has remained a primary area of application where hydronic systems deliver superior thermal comfort with reduced energy usage compared to traditional forced-air systems.

The adoption of software-controlled valves, smart sensors, and modulating actuators in space heating applications has enabled precise temperature control and balanced heat distribution across different zones. The integration of programmable scheduling and learning-based algorithms has allowed automated adjustment based on occupancy and external weather conditions, leading to higher energy savings.

Furthermore, regulatory standards that emphasize minimum energy performance in building heating systems are supporting the growth of space heating applications This segment continues to benefit from government-funded retrofit programs and mandates for smart heating solutions in both new construction and refurbishment projects.

Valves are expected to account for 29.7% of the hydronic control market revenue in 2025, making it one of the most critical components within the system architecture. This significant share is being attributed to the essential role valves play in controlling water flow, regulating pressure, and ensuring thermal balance throughout the system.

With the shift toward intelligent hydronic solutions, demand for motorized and pressure-independent control valves has increased due to their ability to offer dynamic adjustment, precise modulation, and seamless integration with building management systems. Valves equipped with electronic actuators and feedback sensors are being adopted to improve response times and ensure zone-wise temperature consistency.

Additionally, ongoing advancements in valve material, sealing technology, and corrosion resistance are contributing to their reliability and lifecycle efficiency As decentralized thermal management gains popularity in high-performance buildings, the importance of responsive and programmable valves within hydronic control loops has significantly expanded, reinforcing their position as a core component in the overall market.

The centralized system type is forecast to represent 47.2% of the hydronic control market revenue share in 2025, driven by its widespread adoption in large residential complexes, commercial buildings, and institutional facilities. Centralized systems offer high efficiency by enabling a single heating source to serve multiple zones, which reduces equipment redundancy and optimizes fuel usage. Their integration with advanced control networks allows centralized oversight and predictive maintenance, reducing downtime and improving operational reliability.

The ability to pair centralized boilers or heat pumps with sophisticated control systems has enabled real-time load balancing and flow optimization, particularly in large-scale heating applications. These systems are also preferred in retrofit projects where space constraints and structural limitations restrict decentralized unit installations.

Centralized hydronic networks are being favored in green building certifications and district heating plans due to their ability to align with long-term sustainability goals The scalability and reduced long-term maintenance costs associated with centralized systems are further reinforcing their growth within the hydronic control landscape.

The hydronic control market is driven by increasing demand for energy-efficient heating systems and retrofitting opportunities. The rising trend of adopting smart hydronic control systems is further fueling growth, offering enhanced convenience and energy savings. However, high initial investments and maintenance costs are significant restraints that could limit market expansion in certain regions. The market will likely continue to grow as more businesses and homeowners seek cost-effective, energy-efficient heating solutions while navigating the challenges associated with upfront costs.

The hydronic control market is expanding as a result of increasing demand for efficient heating systems. Hydronic systems, known for their energy efficiency and ability to provide consistent temperature control, are being widely adopted in residential and commercial buildings. This growth is primarily driven by rising energy costs and the global push for cost-effective, eco-friendly solutions. By 2025, hydronic systems are expected to become a standard heating choice in many regions, with their effectiveness in both large and small-scale installations contributing to their popularity.

Opportunities in the aerial firefighting market are growing as governments globally invest in improving firefighting capabilities. With the rising threat of wildfires, public and private sectors are committing to modernizing their firefighting fleets and adopting more advanced aircraft and equipment. Additionally, partnerships between governments and private contractors to improve firefighting infrastructure provide avenues for expansion. By 2025, these investments will drive the market as modernized fleets are deployed to combat increasingly destructive wildfires in vulnerable regions.

A major trend emerging in the hydronic control market is the integration of smart technology into hydronic systems. Smart controls, which allow for remote monitoring and real-time adjustments, are increasingly being used to enhance energy savings and improve the user experience. These advanced systems can integrate with existing building management systems, providing precise control over heating, cooling, and water flow. By 2025, the demand for smart hydronic control solutions will continue to rise, offering significant advantages in terms of user convenience, operational efficiency, and reduced energy consumption.

One of the significant restraints in the hydronic control market is the high initial investment and maintenance costs. The installation of advanced hydronic systems often requires a considerable upfront investment, especially for systems with smart controls and high-efficiency components. This initial cost can be a deterrent for smaller businesses or individuals with limited budgets. Additionally, while these systems offer long-term savings, the maintenance and repair costs of high-tech components can also pose a challenge to widespread adoption, especially in price-sensitive markets.

| Countries | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

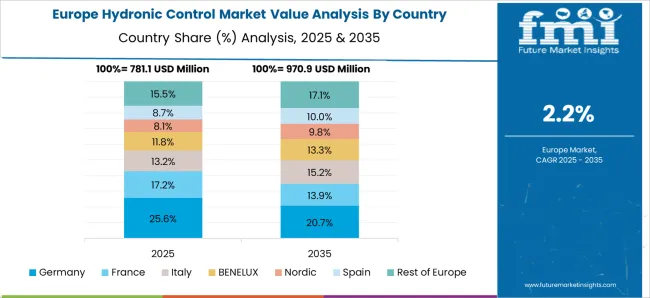

The global hydronic control market is projected to grow at a 4.6% CAGR from 2025 to 2035. China leads with a growth rate of 6.2%, followed by India at 5.8%, and France at 4.8%. The United Kingdom records a growth rate of 4.4%, while the United States shows the slowest growth at 3.9%. These varying growth rates are driven by increasing demand for energy-efficient and sustainable heating and cooling solutions, particularly in the residential, commercial, and industrial sectors. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and growing demand for advanced hydronic systems, while more mature markets like the USA and the UK see steady growth driven by advancements in energy-efficient technologies, stringent regulations, and the increasing focus on reducing energy consumption and carbon emissions in building systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hydronic control market in China is growing rapidly, with a projected CAGR of 6.2%. China’s expanding infrastructure and urbanization, combined with government policies promoting energy-efficient building systems, are key drivers of market growth. The country’s increasing focus on environmental sustainability and reducing carbon emissions further accelerates the demand for energy-efficient hydronic control systems. Additionally, China’s growing industrial and commercial sectors, coupled with rising demand for residential heating and cooling solutions, contribute to the rapid adoption of hydronic systems. The country’s strong manufacturing base and growing investments in renewable energy technologies further fuel the market expansion.

The hydronic control market in India is projected to grow at a CAGR of 5.8%. India’s increasing focus on energy-efficient heating and cooling solutions, combined with growing infrastructure development, is driving the demand for hydronic control systems. The country’s rapidly expanding urban population, coupled with government initiatives promoting sustainable building practices, continues to fuel the adoption of energy-efficient hydronic systems. Additionally, India’s growing residential and commercial construction sectors, along with rising awareness about environmental sustainability, contribute to the market’s growth. The country’s push for clean and efficient energy solutions further accelerates the adoption of hydronic control systems in both new and retrofitted buildings.

The hydronic control market in France is projected to grow at a CAGR of 4.8%. France’s focus on reducing carbon emissions, improving energy efficiency, and adhering to European Union energy regulations continues to support the demand for hydronic control systems. The country’s increasing investments in sustainable building technologies, combined with growing demand for energy-efficient heating and cooling systems in residential, commercial, and industrial sectors, contribute to market growth. Additionally, France’s commitment to renewable energy and green building practices further accelerates the adoption of hydronic control systems in various infrastructure projects. The ongoing push for smart building technologies also contributes to market expansion.

The hydronic control market in the United Kingdom is projected to grow at a CAGR of 4.4%. The UK’s emphasis on energy efficiency, sustainability, and compliance with building regulations continues to drive steady market growth. The country’s growing demand for energy-efficient heating and cooling solutions in both residential and commercial buildings further contributes to market expansion. Additionally, the UK’s commitment to achieving net-zero emissions by 2050 and the government’s incentives for renewable energy and energy-efficient technologies drive the adoption of hydronic control systems. The increasing popularity of smart home and building automation systems further accelerates the market’s growth in the UK

The hydronic control market in the United States is expected to grow at a CAGR of 3.9%. The USA market remains steady, driven by the growing demand for energy-efficient heating and cooling systems in commercial, residential, and industrial applications. Increasing government regulations promoting energy-efficient solutions and the ongoing focus on sustainability in building construction and retrofitting continue to support the demand for hydronic control systems. The rise of smart building technologies, along with increasing interest in sustainable construction practices, further contributes to the growth of the market. Additionally, the adoption of renewable energy sources and growing awareness of energy-saving solutions drive market demand in the USA

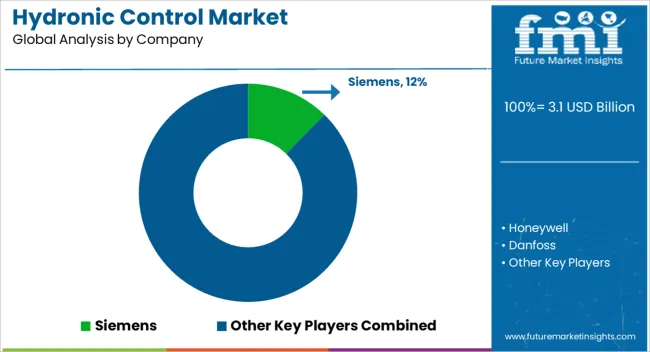

The hydronic control market is dominated by Siemens, which leads with its innovative control solutions designed to optimize the performance and energy efficiency of hydronic systems used in heating, cooling, and water distribution. Siemens’ dominance is supported by its strong brand presence, advanced technology, and comprehensive product offerings that ensure precise temperature control and reduced energy consumption for residential, commercial, and industrial applications.

Key players such as Honeywell, Danfoss, and Schneider Electric maintain significant market shares by offering smart, automated hydronic control systems that integrate seamlessly with building management systems and improve operational efficiency. These companies focus on providing scalable, energy-efficient solutions tailored to meet the needs of modern infrastructure. Emerging players like Belimo, Emerson Electric, and Uponor are expanding their market presence by offering specialized hydronic control solutions for niche applications such as radiant heating, cooling systems, and large-scale industrial facilities. Their strategies include improving system integration, enhancing the durability of components, and providing flexible, customizable solutions that meet specific user requirements. Market growth is driven by the increasing demand for energy-efficient buildings, the adoption of smart heating and cooling solutions, and the rising focus on reducing energy costs and carbon emissions. Innovations in IoT-enabled controls, wireless technologies, and predictive maintenance are expected to continue shaping competitive dynamics and fuel further growth in the global hydronic control market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Application | Space Heating, Hot Water Heating, Process Heating, and Others |

| Component | Valves, Controllers, Actuators, Sensors, and Pumps |

| System Type | Centralized, Decentralized, and Hybrid |

| End-User | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Honeywell, Danfoss, SchneiderElectric, Belimo, EmersonElectric, Uponor, Grundfos, JohnsonControls, WattsWaterTechnologies, ABB, Taco, Viega, MitsubishiElectric, and Caleffi |

| Additional Attributes | Dollar sales by control type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in hydronic control adoption, innovation in smart thermostats and energy-efficient systems, impact of regulatory standards on energy consumption and safety, and emerging use cases in renewable heating systems and automated building management. |

The global hydronic control market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the hydronic control market is projected to reach USD 4.9 billion by 2035.

The hydronic control market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in hydronic control market are space heating, hot water heating, process heating and others.

In terms of component, valves segment to command 29.7% share in the hydronic control market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Radiator Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydronic Underfloor Heating Market Insights – Trends, Demand & Growth 2025-2035

Examining Europe Hydronic Underfloor Heating Market Share & Trends

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA