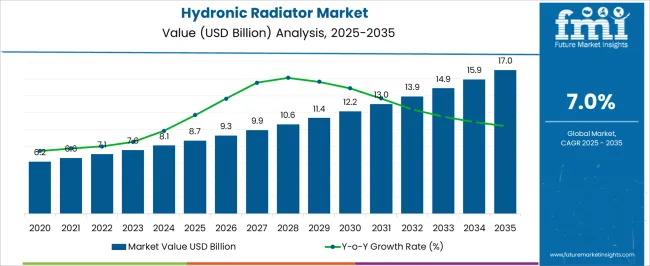

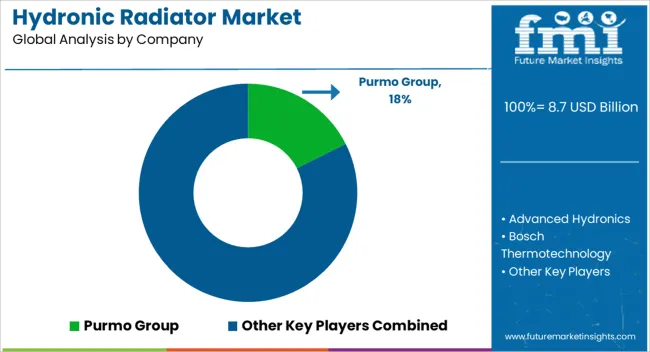

The Hydronic Radiator Market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 17.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. Between 2025 and 2030, the market is expected to expand steadily, reaching approximately USD 12.2 billion. This growth reflects increased demand for efficient heating solutions across residential, commercial, and industrial buildings. Rising construction activities and renovation projects contribute to the rising adoption of hydronic radiators, valued for their ability to provide consistent, energy-efficient heat distribution. Market growth is supported by the replacement of traditional heating systems with more modern, water-based radiator technologies that offer improved comfort and control. Consumer preference for systems that enhance indoor air quality and reduce noise also supports this expansion.

In addition, stricter building codes and regulations promoting efficient heating solutions in many regions encourage the integration of hydronic radiator systems. The five-year period marks a transition where increased awareness of energy consumption and operational costs drives demand for reliable heating infrastructure. Manufacturers are focusing on enhancing product designs, materials, and installation flexibility to meet diverse customer needs. By 2030, the hydronic radiator market is poised for continued robust growth, positioning itself as a key player in the heating solutions sector.

| Metric | Value |

|---|---|

| Hydronic Radiator Market Estimated Value in (2025 E) | USD 8.7 billion |

| Hydronic Radiator Market Forecast Value in (2035 F) | USD 17.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The hydronic radiator market is witnessing steady growth driven by energy efficiency mandates, increased construction activity in colder regions, and consumer preference for uniform indoor heating. Rising investments in residential and commercial building retrofits, especially across Europe and North America, have supported the replacement of conventional systems with water-based radiators.

Advancements in thermostat control, integration with renewable heating systems, and improved pipe materials have enhanced energy output efficiency and lifecycle performance. Governments promoting low-emission heating solutions and incentives for replacing outdated systems are creating favorable regulatory conditions.

The market is also benefiting from rising awareness around indoor thermal comfort, energy savings, and decarbonized heating in urban developments. With continued emphasis on green building certifications and hydronic compatibility with underfloor heating and solar-assisted systems, future adoption is expected to accelerate in both new constructions and renovations.

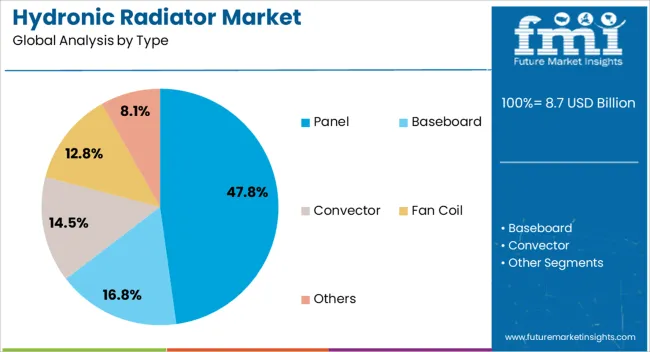

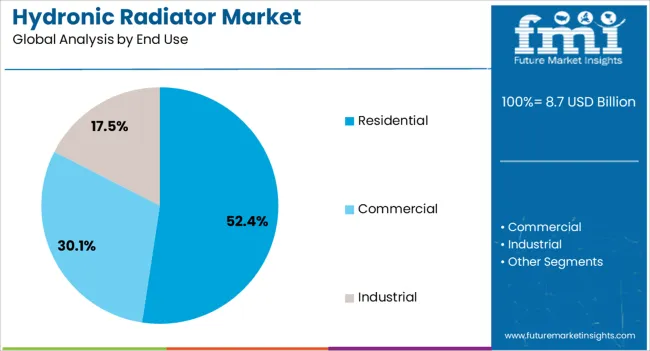

The hydronic radiator market is segmented by type, end use, and geographic regions. By type, the hydronic radiator market is divided into Panel, Baseboard, Convector, Fan Coil, and Others. In terms of end use, the hydronic radiator market is classified into Residential, Commercial, and Industrial. Regionally, the hydronic radiator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Panel-type hydronic radiators are anticipated to account for 47.80% of the market revenue in 2025, making them the leading product segment. Their dominance is being driven by compact design, efficient thermal conduction, and ease of integration into both wall-mounted and low-profile installations.

These radiators deliver consistent heating output using minimal wall space, making them suitable for both small and modern architectural spaces. Technological advancements in convector fins, anti-corrosion coatings, and rapid heating functionality have enhanced the appeal of panel systems over bulkier alternatives.

Their compatibility with low-temperature heating sources such as heat pumps and condensing boilers further reinforces their widespread deployment. As building aesthetics and spatial optimization continue to influence buyer preferences, panel-type radiators remain the preferred choice in most hydronic heating applications.

The residential sector is projected to contribute 52.40% of total market revenue in 2025, establishing it as the top end-use segment. Growth in this segment is being fueled by increasing demand for energy-efficient home heating systems amid rising fuel costs and stricter emission standards.

Retrofitting older homes with modern hydronic systems and installing smart heating controls have become key adoption drivers, particularly in colder climates. The growing focus on home automation and zoned heating has encouraged homeowners to select hydronic radiators that provide better temperature control and energy optimization.

Additionally, government-backed energy efficiency programs and rebate schemes for residential heating upgrades have accelerated installation rates. As urban housing expands and green building practices become mainstream, the residential sector is expected to sustain its lead in hydronic radiator deployment.

The hydronic radiator market is growing steadily due to increasing demand for energy-efficient and environmentally friendly heating solutions across residential, commercial, and industrial sectors. These radiators use hot water circulation to provide consistent and controllable heating, favored in colder climates and modern building designs. Rising focus on reducing carbon footprints and improving indoor comfort boosts adoption. However, market growth faces hurdles such as high installation costs and competition from alternative heating technologies. Advancements in design, materials, and smart integration continue to drive innovation, while emerging markets offer new avenues for expansion amid urbanization and infrastructure development.

Hydronic radiators are gaining popularity as they provide efficient, uniform heat distribution with minimal energy loss. Their compatibility with modern boilers and renewable energy sources like solar thermal and heat pumps enhances their appeal in energy-conscious markets. They enable precise temperature control, improving comfort and reducing utility bills. This is particularly important in regions with cold winters where reliable heating is essential. Increasing regulations focused on energy conservation and green building certifications further promote hydronic radiator adoption. Builders and retrofit projects increasingly specify these systems to meet efficiency standards, driving steady demand growth.

Despite their benefits, hydronic radiator systems require significant upfront investment and professional installation involving piping, boilers, and controls. High labor and material costs, especially in retrofit projects, can deter consumers and contractors from choosing hydronic systems over simpler electric or forced-air options. Maintenance demands and potential system leaks also pose concerns. Additionally, older buildings may need extensive modifications to accommodate piping infrastructure. These factors limit rapid market penetration, particularly in cost-sensitive regions. Manufacturers and service providers are working to simplify installation through modular components, pre-fabricated piping kits, and improved training to reduce barriers and encourage wider adoption.

Advancements in radiator design and materials improve heat transfer efficiency and durability. Use of aluminum and steel alloys enables lightweight, corrosion-resistant radiators with faster response times. Some models incorporate aesthetic designs suitable for modern interiors, increasing consumer appeal. Integration with smart home systems and IoT-enabled thermostats allows remote temperature control, scheduling, and energy usage monitoring, enhancing user convenience and efficiency. These technological upgrades help differentiate products and justify premium pricing. Collaborations between manufacturers and tech companies are accelerating the development of intelligent heating solutions, making hydronic radiators a key component of smart building ecosystems.

Emerging economies with growing urban populations and increasing construction activity offer promising growth prospects for hydronic radiator suppliers. Rising awareness of energy efficiency and government incentives for sustainable building practices are driving adoption in Asia Pacific, Latin America, and Eastern Europe. New housing developments and commercial buildings increasingly incorporate hydronic heating as part of modern infrastructure upgrades. Establishing regional distribution networks and local partnerships helps manufacturers address logistical challenges and adapt products to local climate conditions and preferences. Education campaigns targeting contractors and end-users can further boost market penetration by demonstrating long-term cost savings and environmental benefits.

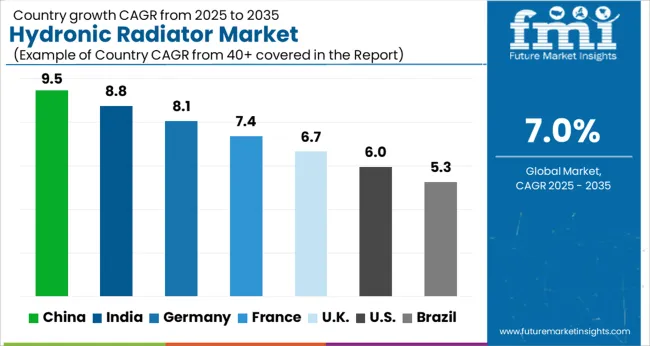

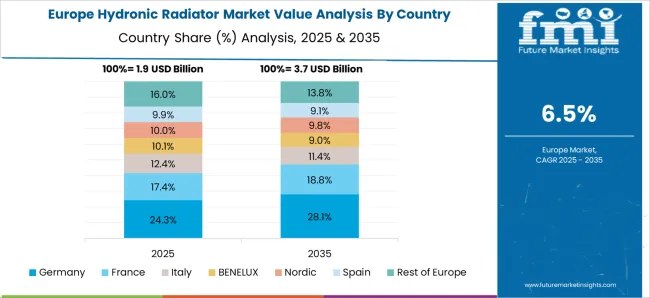

The global hydronic radiator market is growing at a 7.0% CAGR, driven by increasing demand for energy-efficient heating solutions in residential and commercial buildings. China leads with 9.5% growth, supported by expanding construction activities and modernization of heating infrastructure. India follows at 8.8%, fueled by rising urbanization and adoption of sustainable technologies. Germany records 8.1% growth, reflecting strong environmental regulations and innovation in heating systems. The United Kingdom grows at 6.7%, driven by energy efficiency initiatives and upgrading of existing heating setups. The United States, a mature market, shows 6.0% growth, shaped by stringent standards and demand for advanced heating solutions. These countries collectively influence market trends through technological improvements, regulatory compliance, and growing consumer awareness. This report includes insights on 40+ countries; the top countries are shown here for reference.

China hydronic radiator market is growing at a 9.5% CAGR, driven by rapid urbanization and government initiatives promoting energy-efficient heating solutions. The rise in residential and commercial construction fuels demand for modern hydronic systems that offer improved thermal comfort and reduced energy consumption. Compared to Western markets, China sees faster adoption of smart heating controls integrated with hydronic radiators. Local manufacturers are innovating to provide cost-effective yet high-performance products tailored to diverse climatic zones. Increasing consumer awareness about sustainability further supports market expansion.

India hydronic radiator market grows at an 8.8% CAGR, backed by rising construction activity and growing awareness of efficient heating technologies in colder regions. Increasing adoption in commercial buildings and luxury residential projects drives market momentum. Compared to China, India’s market remains nascent but is rapidly gaining traction due to improving infrastructure and government incentives for energy conservation. Manufacturers customize products for regional climatic variations and emphasize durability and ease of installation. Awareness campaigns educate end-users on cost savings and environmental benefits.

Germany hydronic radiator market grows at an 8.1% CAGR, supported by strict energy regulations and high consumer demand for sustainable heating solutions. German manufacturers lead with innovations in heat emission efficiency and integration with renewable energy sources like solar thermal systems. Compared to Asian markets, Germany places greater emphasis on product certification and environmental standards. Retrofitting older buildings with hydronic radiators is a significant growth area. Collaboration between manufacturers and energy consultants drives technical advancements and market penetration.

United Kingdom hydronic radiator market grows at a 6.7% CAGR, fueled by growing energy efficiency mandates and increasing retrofitting of older properties. The market focuses on sleek designs and compatibility with modern heating systems to appeal to residential consumers. Compared to Germany, the UK market is smaller but showing rising interest in smart thermostats paired with hydronic radiators. Manufacturers work with contractors and energy advisors to promote solutions that reduce carbon footprint and heating costs. Awareness of government subsidy programs helps stimulate adoption.

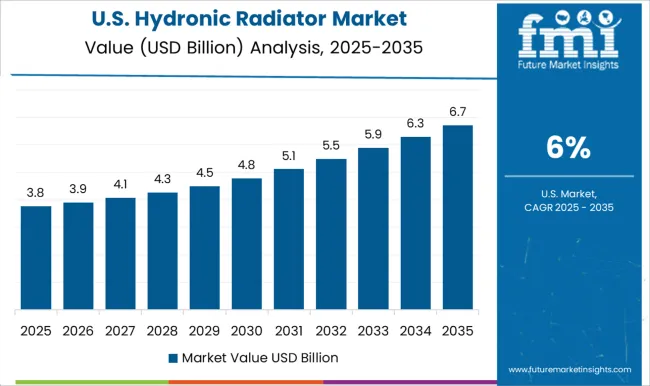

United States hydronic radiator market grows at 6.0% CAGR, supported by increasing preference for hydronic heating in commercial and high-end residential sectors. The market benefits from advancements in system efficiency and integration with smart home automation platforms. Compared to European markets, the USA places more focus on large-scale HVAC projects and regional climate-specific solutions. Manufacturers emphasize product reliability and energy savings. Growing environmental regulations and incentives for clean energy solutions also support market growth.

The hydronic radiator market is characterized by a mix of established manufacturers and innovative companies, each offering a range of heating solutions that utilize water or steam to distribute heat efficiently. Leading players such as Purmo Group, Bosch Thermotechnology, and Advanced Hydronics dominate the market with a strong focus on energy efficiency, design versatility, and durability.

These companies leverage advanced technology to provide radiators that meet stringent environmental regulations while catering to both residential and commercial heating needs. In contrast, mid-sized and regional players like Cambro Hydronic Heating, Chappee, Embassy Industries, and Fondital differentiate themselves by offering specialized products tailored to local markets and unique customer preferences.

Their competitive edge often lies in customization, responsive service, and cost-effective solutions, which appeal to contractors and consumers seeking specific features or regional compliance. Companies such as Haverland, Henrad, and Hudson Reed also emphasize design aesthetics and modern styling, combining functionality with visual appeal to cater to design-conscious consumers. The market exhibits a clear contrast between global giants that push technological innovation and smaller firms that focus on niche segments or regional demands.

Additionally, companies like Jaga, Kermi, MYSON, and Runtal North America highlight a growing trend toward smart, connected heating solutions that integrate with home automation systems, reflecting evolving consumer preferences. Overall, the hydronic radiator market balances innovation, energy efficiency, and design across a diverse competitive landscape, driving continual advancements and broadening product offerings.

Manufacturers are offering sleek and minimalistic designs that blend seamlessly into home interiors. Additionally, flat-panel radiators and vertical radiators are becoming increasingly popular for smaller spaces and urban living environments, meeting the demand for both functionality and style.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.7 Billion |

| Type | Panel, Baseboard, Convector, Fan Coil, and Others |

| End Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Purmo Group, Advanced Hydronics, Bosch Thermotechnology, Cambro Hydronic Heating, Chappee, Embassy Industries, Fondital, Governale Company, Haverland, Henrad, Hudson Reed, Hydrotherm Hydronic Heating, Jaga, Kermi, MYSON, Runtal North America, Seltron, Stelrad, USA Boiler Company, and Wiseliving |

| Additional Attributes | Dollar sales vary by material, including steel, aluminum, cast iron, and copper; by type, such as panel, column, baseboard, fan coil, and towel warmers; by power source, including electric and fossil fuel; and by end-use, spanning residential, commercial, industrial, and institutional. Growth is driven by energy efficiency demand, green building standards, and smart heating integration. |

The global hydronic radiator market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the hydronic radiator market is projected to reach USD 17.0 billion by 2035.

The hydronic radiator market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in hydronic radiator market are panel, baseboard, convector, fan coil and others.

In terms of end use, residential segment to command 52.4% share in the hydronic radiator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Control Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydronic Underfloor Heating Market Insights – Trends, Demand & Growth 2025-2035

Examining Europe Hydronic Underfloor Heating Market Share & Trends

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Radiator Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Radiator Market - Growth & Demand 2025 to 2035

Locomotive Radiator Fans Market Growth - Trends & Forecast 2024 to 2034

Thermostatic Radiator Valves Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA