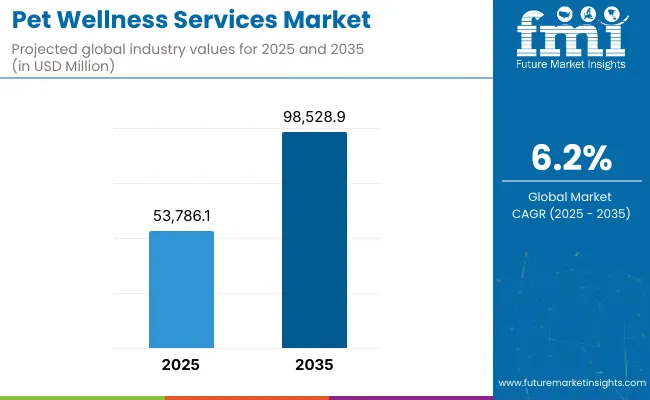

The Global Pet Wellness Services Market is expected to record a valuation of USD 53,786.1 million in 2025 and USD 98,528.9 million in 2035, with an increase of USD 44,742.8 million, which equals a growth of 83% over the decade. The overall expansion represents a CAGR of 6.2% and a nearly 2X increase in market size.

Global Pet Wellness ServicesMarket Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 53786.1 Million |

| Market Forecast Value in (2035F) | USD 98528.9 Million |

| Forecast CAGR (2025 to 2035) | 6.2% |

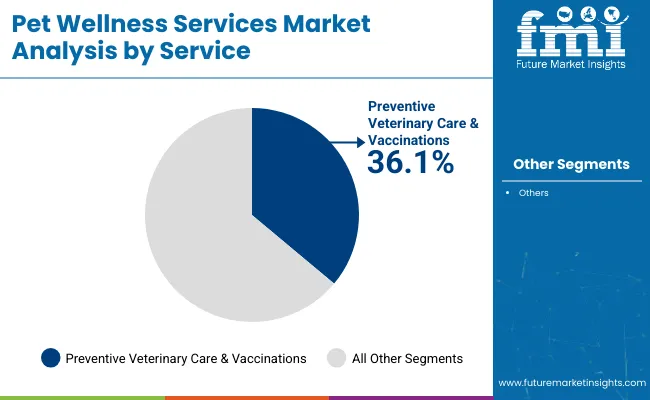

During the first five-year period from 2025 to 2030, the market increases from USD 53,786.1 million to USD 72,797.6 million, adding USD 19,011.5 million,, which accounts for 42% of the total decade growth. This phase records steady adoption in preventive veterinary care, routine diagnostics, and grooming services, driven by rising pet humanization and healthcare needs. Preventive veterinary care & vaccinations dominate this period as they cater to over 36% of pet service spending.

The second half from 2030 to 2035 contributes USD 25,731.3 million, equal to 58% of total growth, as the market jumps from USD 72,797.6 million to USD 98,528.9 million. This acceleration is powered by widespread adoption of tele-vet consultations, nutrition/weight management services, and app-based wellness memberships. Mobile/in-home services and virtual platforms capture a larger share above 30% by the end of the decade. Insurance-linked wellness plans and bundled memberships add recurring revenue, increasing the membership and package-based models beyond 40% in total value.

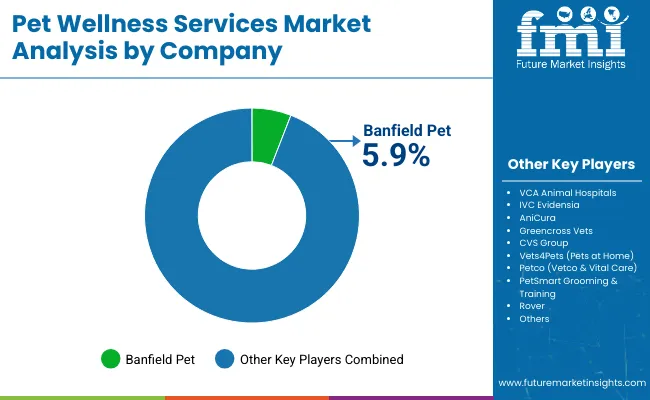

The Global Pet Wellness Services Market grew from USD ~43,032 million to USD 51,022 million, driven by preventive veterinary services and grooming/hygiene demand. During this period, the competitive landscape was dominated by large veterinary hospital networks and clinic chains controlling over 60% of revenues, with leaders such as Banfield Pet, VCA Animal Hospitals, and IVC Evidensia focusing on in-clinic wellness care. Competitive differentiation relied on service coverage, accessibility, and pet-owner trust, while tele-vet and virtual platforms were still in early adoption stages, contributing less than 10% of total market value.

Demand for Pet Wellness Services will expand to nearly USD 100,078 million by 2035, and the revenue mix will shift as digital-first services, memberships, and insurance-linked add-ons grow to over 35% share. Traditional veterinary clinic leaders face rising competition from app-based platforms, remote care providers, and integrated retail service networks. Major veterinary groups are pivoting to hybrid models, integrating in-clinic + virtual consultations, subscription wellness plans, and pet lifestyle services to retain relevance. Emerging entrants specializing in AI-driven tele-vet, personalized nutrition, and mobile/in-home care are gaining share. The competitive advantage is moving away from clinic access alone to ecosystem strength, convenience, and recurring subscription models.

Improved preventive veterinary protocols and owner awareness have increased uptake of vaccinations, diagnostics, and routine wellness visits. The rise of tele-vet and digital booking enhances access and convenience, while growing pet insurance supports insurance-linked wellness add-ons that normalize routine care spending. Memberships and multi-visit bundles provide predictable costs and better adherence, expanding lifetime value per pet. Regionally, faster growth in Asia-Pacific (notably India and China) reflects rising disposable incomes and pet adoption, complementing mature North American and European markets.

The market is segmented by service type, delivery setting, pet type, pricing model, booking channel, and region. Service types include preventive veterinary care & vaccinations; routine checkups & diagnostics; grooming & hygiene services; fitness, training & behavior; tele-vet & remote consults; nutrition & weight-management consults. Delivery settings span veterinary clinics & hospital networks; retail pet centers (in-store services); mobile/in-home services; virtual-only platforms. Pet types cover dogs, cats, and other small pets (rabbits, guinea pigs, etc.). Pricing models include pay-per-service (à la carte); memberships/wellness plans; packages/multi-visit bundles; insurance-linked wellness add-ons. Booking channels include walk-in/phone; website; app. Regionally, the scope spans North America, Asia-Pacific, and Europe, along with Latin America and the Middle East & Africa.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Preventive Veterinary Care & Vaccinations | 36.1% |

| Others | 63.9% |

The preventive veterinary care & vaccinations segment is projected to contribute 36.1% of the Global Pet Wellness Services Market revenue in 2025, maintaining its lead as the dominant service category. This is driven by ongoing demand for core vaccinations, early disease detection, and preventive diagnostics as pet owners increasingly prioritize proactive health management. Preventive services remain the cornerstone of pet wellness, ensuring long-term health outcomes and cost efficiency for owners. The segment’s growth is also supported by rising awareness of zoonotic disease prevention, routine vaccine compliance, and bundled wellness plans that include annual checkups. As insurance-linked wellness offerings gain traction, preventive care is becoming a standardized service globally. The preventive segment is expected to retain its position as the backbone of the pet wellness services market over the decade.

| Delivery Setting Segment | Market Value Share, 2025 |

|---|---|

| Veterinary Clinics & Hospital Networks | 58.4% |

| Others | 41.6% |

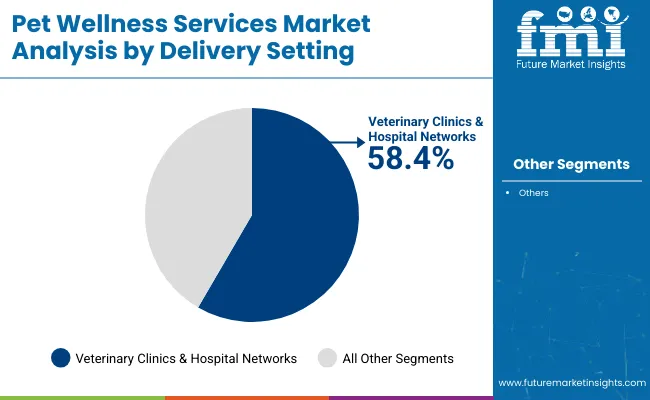

The veterinary clinics & hospital networks segment is forecasted to hold 58.4% of the market share in 2025, led by its role as the primary access point for preventive care, diagnostics, and advanced treatment. Clinics and hospitals are favored for their comprehensive service coverage, licensed professionals, and ability to manage both routine and complex cases, making them the most trusted setting for pet owners. Their established infrastructure and direct pet-owner relationships have facilitated widespread adoption across both developed and emerging regions. The segment’s growth is further bolstered by expansion of large veterinary groups, clinic chains, and hospital networks that integrate in-person and digital services. As tele-vet and app-based models expand, clinics are expected to maintain dominance by adopting hybrid care models offering in-clinic checkups combined with digital follow-ups. This positions veterinary clinics & hospitals as the anchor of pet wellness services worldwide, even as other delivery channels gain traction.

| Delivery Setting Segment | Market Value Share, 2025 |

|---|---|

| Walk-in / phone | 56.0% |

| Others | 44.0% |

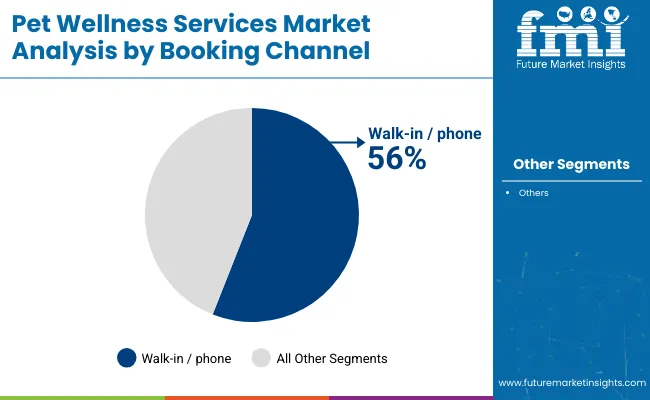

The walk-in / phone booking channel is projected to contribute 56.0% of the Global Pet Wellness Services Market revenue in 2025, maintaining its lead as the dominant booking method. This is driven by the strong preference for direct and immediate scheduling of veterinary visits, especially in traditional markets such as the USA and Europe, where established clinic networks and long-standing client-vet relationships drive in-person engagement.

The segment’s resilience is supported by pet owners’ trust in direct communication and flexibility, particularly for urgent care and preventive visits. In emerging markets, walk-ins remain the primary mode of accessing wellness services due to lower digital penetration and cultural familiarity with in-clinic visits. However, the shift toward digital platforms (apps and websites) is accelerating, especially in China and India, where younger, urban pet owners favor the convenience of online scheduling, integrated tele-vet consults, and bundled service packages. By 2035, digital booking channels are expected to capture a larger combined share above 50%, driven by subscription-based platforms, integrated membership programs, and mobile-first adoption.

Drivers

Rising Pet Humanization and Preventive Healthcare Adoption

The humanization of pets is one of the most powerful forces driving the global pet wellness services market. Around the world, owners increasingly see pets as family members, leading to a shift in spending priorities. This emotional bond translates into higher willingness to pay for preventive healthcare such as vaccinations, wellness exams, and diagnostics. According to your dataset, preventive veterinary care & vaccinations already account for 36.1% of total revenues in 2025 (USD 19,416.8 million), making it the largest single service category.

This indicates that preventive services are not just a complementary offering but the backbone of the industry. In developed markets like the USA, Europe, and Japan, owners are accustomed to annual checkups and vaccination schedules, and this compliance has helped normalize preventive services. In contrast, in high-growth emerging economies such as India (CAGR 9.5%) and China (CAGR 8.6%), rising disposable incomes and growing awareness about pet health are expanding the customer base for these services. In India, urban middle-class households are leading the shift, while in China, government-led pet vaccination programs are reinforcing demand for private preventive care services.

Preventive healthcare also addresses long-term financial concerns of owners. Early detection of illnesses through diagnostics reduces the cost burden of treatment, a factor increasingly recognized by insurance providers who now link preventive compliance with discounted premiums or wellness benefits. As more insurance-linked wellness packages enter the market, preventive services will continue to expand their share. Overall, humanization + financial rationality + regulatory support form a powerful driver that ensures preventive care will anchor the market through 2035.

Growth of Digital Platforms, Tele-vet, and Membership Models

The second major growth engine comes from the digitization of pet wellness services. While traditional walk-in and phone bookings still dominate with 56% share in 2025 (USD 30,120.2 million), digital channels (apps and websites) already represent 44% and are expected to surpass 50% by 2035. This shift is led by urban, tech-savvy pet owners who prioritize convenience, 24/7 access, and integrated care solutions. Tele-vet consults, in particular, have gained significant traction post-COVID, allowing for remote triage, minor issue consultations, and follow-ups.

Platforms in China and India are aggressively adopting mobile-first telehealth ecosystems, driving both convenience and cost efficiency. In mature regions like the USA, large clinic groups are embedding digital wellness memberships (e.g., Petco’s Vital Care, PetSmart’s grooming + vet bundles), creating sticky revenue models and long-term customer loyalty.

Memberships and subscription-based wellness plans are especially important. They reduce the upfront cost of individual services, spreading out spending and ensuring recurring revenues for providers. These plans often include vaccinations, diagnostics, grooming, and nutrition consults, packaged in a way that increases preventive compliance while also boosting adoption of additional services. For providers, this model strengthens customer retention and reduces churn.

Looking ahead, digital-first, subscription-driven ecosystems will reshape the market’s growth trajectory. Traditional veterinary groups and retail pet centers are under pressure to hybridize their service models, integrating digital access with in-person care. Those that succeed will control both customer acquisition and long-term retention, driving outsized growth compared to legacy walk-in-only models.

Restraints

High Cost of Services and Limited Insurance Penetration

One of the most significant barriers to market expansion is the high cost of services relative to household disposable income, particularly in emerging markets. While the global market is set to nearly double to USD 98,528.9 million by 2035, a large portion of this value is concentrated in regions with higher spending capacity. In countries like India and parts of Southeast Asia, many owners still struggle with affordability for routine veterinary care, let alone advanced diagnostics or nutrition consults. Globally, pet insurance penetration remains below 5%, with some exceptions in Northern Europe where it is above 20%. The lack of widespread insurance coverage means that most care is paid out-of-pocket, creating a cost barrier for preventive adoption.

Even in the USA, where the market is highly advanced, insurance penetration is less than 3%, which limits affordability for middle-income households. Without broader insurance adoption, many pet owners defer or skip preventive services, weakening compliance and reducing overall market potential. Moreover, costs are rising due to inflation in medical supplies, labor shortages, and advanced technology adoption. Owners in price-sensitive regions may rely on informal care, reducing the demand captured by formal veterinary networks. While wellness memberships and packages are helping to mitigate costs, they are still not affordable for all households. Unless insurance integration and financial accessibility improve, this restraint will remain a structural barrier.

Workforce Shortages and Uneven Service Availability

Another critical restraint is the shortage of veterinary professionals and skilled support staff. Rising demand is outpacing the supply of qualified veterinarians globally, creating bottlenecks in both developed and emerging regions. According to multiple industry associations, veterinary clinics in the UK and Germany report long wait times for appointments, while in India and China, a lack of trained professionals in rural and semi-urban areas leaves large segments underserved. This shortage has multiple effects: longer wait times frustrate customers, overworked staff may impact service quality, and expansion into mobile/in-home and tele-vet services becomes constrained because such models still rely on qualified professionals.

Large groups like Banfield and IVC Evidensia are investing heavily in recruitment and training, but workforce shortages remain a structural challenge. Furthermore, the distribution of services is uneven. Urban hubs see a concentration of clinics and hospital networks, while secondary cities and rural regions remain underpenetrated. This geographic imbalance prevents full market capture, particularly in fast-growing economies like India, where demand is rising fastest in Tier-2 and Tier-3 cities. Unless investment in workforce expansion and distribution infrastructure accelerates, this restraint will limit market scalability.

Key Trends

Integration of Digital Wellness Ecosystems

The most prominent trend shaping the next decade is the integration of services into digital-first wellness ecosystems. Pet owners no longer want fragmented access; instead, they expect one-stop solutions that integrate clinic visits, tele-vet consults, grooming, training, and nutrition plans into a single subscription or app. Global players are already building toward this vision. In the USA, Banfield and VCA are experimenting with hybrid membership plans that blend in-clinic preventive visits with digital monitoring and follow-ups.

In China and India, mobile apps are leading this integration, combining tele-vet consults, appointment booking, e-commerce, and insurance-linked services into one ecosystem. This trend reflects broader consumer behavior in which digital platforms serve as lifestyle hubs, extending into healthcare and wellness for pets. By 2035, digital ecosystems are expected to capture over 50% of booking channels, marking a complete reversal from 2025, when walk-in and phone still dominate with 56%. This transformation will redefine the competitive landscape, favoring players that can offer end-to-end ecosystems rather than standalone services.

Shift Toward Preventive and Lifestyle-Oriented Pet Care

The second defining trend is the evolution of pet care beyond medical treatment to holistic wellness and lifestyle enrichment. Owners are increasingly investing in services such as grooming, training, behavior therapy, and nutrition consults, not just for medical necessity but for quality of life. This shift is evident in the rising demand for nutrition and weight-management consults, which are becoming essential in addressing obesity and chronic conditions in pets. Grooming and hygiene services are no longer occasional luxuries but are integrated into wellness memberships.

Fitness and behavior training, once niche categories, are gaining mainstream adoption as owners link physical activity and mental stimulation to overall well-being. Preventive veterinary care, valued at USD 19,416.8 million in 2025, remains the anchor, but the fastest growth will come from lifestyle-oriented services. By 2035, bundled wellness plans that combine vaccinations, grooming, fitness, and nutrition are expected to represent a significant portion of recurring revenues. This trend demonstrates a fundamental transformation: pet wellness is moving from episodic, illness-driven care to continuous, lifestyle-driven engagement.

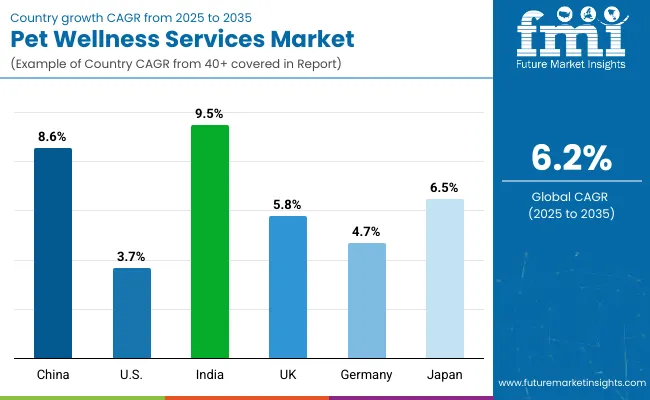

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.6% |

| USA | 3.7% |

| India | 9.5% |

| UK | 5.8% |

| Germany | 4.7% |

| Japan | 6.5% |

The global Pet Wellness Services Market shows a pronounced regional disparity in adoption speed, strongly influenced by pet humanization, healthcare infrastructure, digital penetration, and insurance-linked wellness adoption. Asia-Pacific emerges as the fastest-growing region, anchored by India at 9.5% CAGR and China at 8.6%. This acceleration is driven by rising disposable incomes, increasing pet ownership, and mobile-first tele-vet adoption.

China’s growth is further boosted by expansion of veterinary clinic chains and government emphasis on vaccination programs, while India’s trajectory reflects rapid pet adoption in urban middle-class households and growing investment in preventive care across tier-2 cities. Europe maintains a strong growth profile, led by the UK at 5.8% CAGR and Germany at 4.7% CAGR, supported by strict veterinary compliance regulations, high preventive care uptake, and established clinic networks. Preventive services and insurance-linked wellness plans are widely accepted, with grooming, training, and behavior services gaining traction as part of lifestyle-oriented care. Europe’s strong insurance ecosystem provides a level of stability that accelerates preventive adoption relative to other regions.

North America shows moderate expansion, with the USA at 3.7% CAGR, reflecting a mature market structure where preventive care is already widely adopted. Growth in the USA is driven less by new clinic openings and more by digital-first adoption, tele-vet consults, and bundled subscription wellness programs. Pet insurance penetration is slowly increasing, which will support steady but modest long-term expansion compared to Asia-Pacific.

| Year | USA Pet Wellness Services |

|---|---|

| 2025 | 13537.0 |

| 2026 | 14276.6 |

| 2027 | 15056.7 |

| 2028 | 15879.5 |

| 2029 | 16747.1 |

| 2030 | 17662.2 |

| 2031 | 18627.3 |

| 2032 | 19645.1 |

| 2033 | 20718.6 |

| 2034 | 21850.6 |

| 2035 | 23044.6 |

The Pet Wellness Services Market in the United States is projected to grow at a CAGR of 3.7%, led by sustained demand for preventive veterinary care & vaccinations (USD 4,737.9 million in 2025) and a gradual rise in tele-vet platforms and digital memberships. Grooming and hygiene services remain popular in retail chains, while subscription wellness programs by players like Petco and PetSmart are reshaping the service landscape. Beyond preventive services, demand is expanding in lifestyle categories such as grooming, weight management, and behavioral training, driven by owners’ increasing desire for holistic well-being.

Insurance-linked add-ons, though currently underpenetrated, are gaining momentum, improving affordability for mid- and high-income households. Growth is steady rather than rapid, reflecting the maturity of the USA market, but it remains one of the largest contributors globally due to its sheer market size and high per-pet spend. Preventive veterinary care accounts for 35% of USA revenues in 2025. Tele-vet adoption is expanding rapidly in urban centers. Digital-first players are gaining share with app-based booking and bundled subscriptions.

The Pet Wellness Services Market in the United Kingdom is expected to grow at a CAGR of 5.8%, supported by strong adoption of insurance-linked wellness plans and preventive veterinary services. Major clinic chains such as Vets4Pets (Pets at Home) and CVS Group dominate, providing bundled packages that integrate checkups, vaccinations, and grooming services. The UK market also reflects higher demand for behavioral training and lifestyle services, driven by the popularity of companion pets in urban households.

Owners are particularly responsive to multi-service memberships that combine medical and non-medical services into one package. The insurance ecosystem is well-established, enabling a smoother transition for owners into comprehensive wellness plans. Cultural factors also play a role, with pet-friendly policies, urban living patterns, and government-backed welfare initiatives reinforcing demand. Over the next decade, the UK market is positioned to evolve toward greater digital adoption, with app-based booking and tele-vet integration expected to complement the strong brick-and-mortar clinic base.

India is witnessing the fastest growth globally in pet wellness services, forecast to expand at a CAGR of 9.5% through 2035. Rapid increases in pet adoption in urban centers, combined with growing awareness about preventive care, are fueling demand. Veterinary clinic chains are expanding into Tier-2 cities, while mobile/in-home and tele-vet consults are gaining traction due to affordability and convenience. India’s expansion is being shaped by middle-class urban households, where younger generations are embracing pet ownership as a lifestyle choice.

Grooming and hygiene services are moving from luxury to necessity in metropolitan areas, while wellness memberships are beginning to emerge as a more affordable way to access preventive care. Educational initiatives and cultural shifts are also playing a role. Universities and training institutes are increasing focus on veterinary sciences, while awareness campaigns by NGOs and local startups are promoting vaccination and routine checkups. The long-term opportunity in India lies in bridging the urban-rural divide, as rural areas still remain underpenetrated despite rising pet ownership.

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.2% |

| China | 7.8% |

| Japan | 5.9% |

| Germany | 10.3% |

| UK | 7.1% |

| India | 3.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 23.4% |

| China | 9.5% |

| Japan | 6.6% |

| Germany | 10.0% |

| UK | 7.1% |

| India | 5.5% |

The Pet Wellness Services Market in China is expected to grow at a CAGR of 8.6%, the second highest globally. Growth is fueled by large-scale vaccination programs, urban pet ownership increases, and rapid digital adoption. Veterinary clinics already dominate with 55.3% market share in 2025 (USD 2,315.8 million), but digital booking platforms and mobile apps are growing fast, particularly among younger owners. China’s growth story is defined by its digital-first consumer behavior.

Integrated pet care platforms are becoming mainstream, combining tele-vet consults, e-commerce for pet supplies, insurance-linked services, and loyalty programs in one app. This creates a powerful ecosystem effect that is accelerating the adoption of preventive and lifestyle-oriented services. Affordable service offerings by local players, combined with the rise of domestic veterinary chains, are driving mass adoption beyond Tier-1 cities. Grooming, lifestyle services, and nutrition consults are gaining traction as pet owners increasingly prioritize holistic wellness. Government-backed programs for vaccination and pet health regulation also provide stability and trust.

The country-wise share analysis of the Global Pet Wellness Services Market highlights a clear shift in global growth dynamics. In 2025, the USA dominates with a 25.2% share (USD 13,536.9 million), but its portion declines to 23.4% by 2035 as growth slows compared to Asia-Pacific. Mature markets such as the USA, Germany, and the UK are expected to maintain high absolute values but show only moderate CAGR levels of 3.7%-5.8%, reflecting market maturity where preventive services are already well-established.

Japan continues steady growth, with its share rising from 5.9% to 6.6%, supported by lifestyle services, aging pet populations, and high compliance with preventive care. In contrast, emerging Asian markets are driving the global expansion, with India’s share jumping from 3.5% in 2025 to 5.5% by 2035 at the highest CAGR of 9.5%, and China rising from 7.8% to 9.5% with 8.6% CAGR. These markets are fueled by rapid urbanization, growing disposable incomes, rising pet adoption, and digital-first service adoption such as tele-vet and app-based memberships. Overall, while mature markets anchor global revenues, the growth momentum is decisively shifting toward Asia-Pacific, signaling that India and China will be the key hotspots for industry players seeking long-term opportunities in preventive care, grooming, and subscription-based wellness ecosystems.

| Service Typ e Segment | Market Value Share, 2025 |

|---|---|

| Preventive veterinary care & vaccinations | 35.0% |

| Others | 65.0% |

The Pet Wellness Services Market in the United States is valued at USD 13,536.9 million in 2025, with preventive veterinary care & vaccinations leading at 35.0% (USD 4,737.9 million). The dominance of preventive services reflects the USA market’s maturity, where structured vaccination schedules, annual wellness exams, and diagnostics have become normalized. Pet owners increasingly view preventive care as essential to avoid higher long-term treatment costs, making it a cornerstone of spending.

Large clinic networks such as Banfield Pet and VCA Animal Hospitals continue to expand their preventive care packages, while retailers like Petco and PetSmart drive adoption through subscription-based wellness memberships. Grooming, nutrition consults, and tele-vet services are steadily gaining traction but remain secondary to the preventive segment in revenue contribution. This positioning ensures that preventive services retain their anchor role while supporting cross-sell opportunities into grooming, lifestyle, and digital care ecosystems. The integration of insurance-linked wellness add-ons and app-based membership models is expected to accelerate over the next decade, making the USA market a stable but evolving opportunity.

| Delivery Setting Segment | Market Value Share, 2025 |

|---|---|

| Veterinary clinics & hospital networks | 55.3% |

| Others | 44.7% |

The Pet Wellness Services Market in China is valued at USD 4,187.7 million in 2025, with veterinary clinics & hospital networks leading at 55.3% (USD 2,315.8 million). The dominance of clinics reflects China’s rapidly expanding veterinary infrastructure, supported by government emphasis on pet vaccination programs and rising urban pet ownership. Clinics are the trusted hub for preventive care and diagnostics, anchoring growth in a market still building formal service capacity.

However, the 44.7% share of alternative channels retail pet centers, mobile/in-home care, and virtual platforms highlights China’s digital-first consumer behavior. App-based booking systems and tele-vet platforms are expanding quickly, especially among younger owners in Tier-1 and Tier-2 cities. Domestic service providers are leveraging competitive pricing and integrated wellness packages to capture new demand. This advantage positions China as a market in transition: clinic networks remain the foundation, but digital ecosystems and bundled membership services are gaining share rapidly. By 2035, digital and alternative delivery models are expected to approach parity with clinics, reflecting a fundamental shift in consumer preference.

The Global Pet Wellness Services Market is highly fragmented, with large veterinary hospital networks, regional clinic groups, retail-based service providers, and digital-first platforms competing across preventive, lifestyle, and tele-vet segments. Global leaders such as Banfield Pet, VCA Animal Hospitals, and IVC Evidensia command strong visibility through expansive veterinary clinic networks and comprehensive wellness packages. Their strategies increasingly emphasize preventive care memberships, insurance-linked wellness plans, and hybrid service delivery models that combine in-clinic and digital experiences. Established regional groups, including AniCura, Greencross Vets, CVS Group, and Vets4Pets (Pets at Home), play a crucial role in expanding accessibility across Europe and Asia-Pacific.

These companies focus on routine checkups, diagnostics, and grooming services, and many are embedding membership-based packages to drive customer retention. Their positioning is strengthened by trust-based relationships with local pet owners, making them particularly resilient in their home markets. Retail service providers such as Petco (Vetco & Vital Care) and PetSmart Grooming & Training extend wellness services beyond traditional clinics, offering grooming, hygiene, preventive care, and lifestyle services directly through in-store or subscription programs.

Their competitive strength lies in cross-selling wellness packages with retail products and building customer loyalty through integrated care memberships. Digital-first platforms and service aggregators, including Rover, are capturing momentum by offering on-demand mobile/in-home care, tele-vet consults, and app-based booking. Their strength lies in convenience, affordability, and scalability, appealing strongly to younger, urban pet owners.

Competitive differentiation in this market is shifting away from purely clinic access or grooming services toward integrated ecosystems that include subscription wellness programs, tele-vet support, nutrition consults, and insurance-linked add-ons. The leaders of the next decade will not only control physical clinic networks but also build digital platforms and recurring revenue models that anchor long-term customer loyalty.

Key Developments in Global Pet Wellness Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 53,786.1 million |

| Service Type | Preventive veterinary care & vaccinations, Routine checkups & diagnostics, Grooming & hygiene services, Fitness, training & behavior, Tele-vet & remote consults, Nutrition & weight-management consults |

| Delivery Setting | Veterinary clinics & hospital networks, Retail pet centers (in-store services), Mobile / in-home services, Virtual-only platforms |

| Pet Type | Dogs, Cats, Other small pets (rabbits, guinea pigs, etc.) |

| Pricing Model | Pay-per-service (à la carte), Memberships / wellness plans, Packages / multi-visit bundles, Insurance-linked wellness add-ons |

| End-use Industry | Walk-in / phone, Website, App |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Banfield Pet, VCA Animal Hospitals, IVC Evidensia, AniCura, Greencross Vets, CVS Group, Vets4Pets (Pets at Home), Petco (Vetco & Vital Care), PetSmart Grooming & Training, Rover |

| Additional Attributes | Dollar sales by service type, delivery setting, and booking channel; adoption trends in preventive care, tele-vet, and lifestyle services; rising demand for app-based booking and subscription models; sector-specific growth in preventive care, grooming, and telehealth; revenue segmentation from memberships and insurance add-ons; integration of digital-first ecosystems with clinics and retail; regional growth driven by pet humanization and disposable income shifts in Asia-Pacific; innovations in hybrid care models combining in-clinic and virtual services. |

The Global Pet Wellness Services Market is estimated to be valued at USD 53,786.1 million in 2025.

The market size for the Global Pet Wellness Services Market is projected to reach USD 98,528.9 million by 2035.

The Global Pet Wellness Services Market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key service types in the Global Pet Wellness Services Market are preventive veterinary care & vaccinations, routine checkups & diagnostics, grooming & hygiene services, fitness/training & behavior, tele-vet & remote consults, and nutrition & weight-management consults.

In terms of delivery, veterinary clinics & hospital networks will command a 58.4% share (USD 31,411.1 million) in the Global Pet Wellness Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

The Carpet & Upholstery Cleaning Services Market is segmented by service type and application from 2025 to 2035.

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA