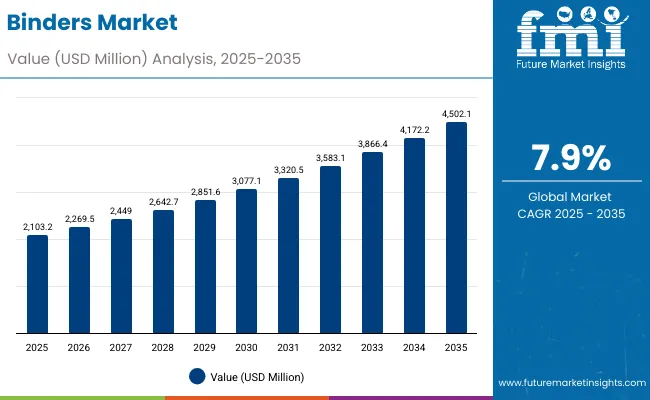

The global binders market is expected to record a valuation of USD 2,103.2 million in 2025 and USD 4,502.1 million in 2035, with an increase of USD 2,398.9 million, which equals a growth of 114% over the decade. The overall expansion represents a CAGR of 7.9% and a 2X increase in market size.

Global Binders Market Key Takeaways

| Metric | Value |

|---|---|

| Global Binders Market Estimated Value in (2025E) | USD 2,103.2 million |

| Global Binders Market Forecast Value in (2035F) | USD 4,502.1 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

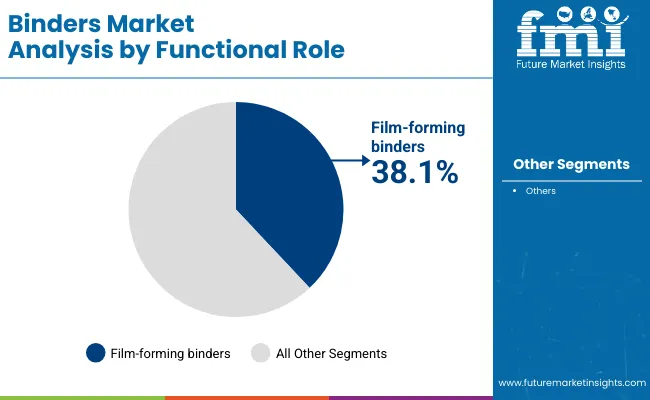

During the first five-year period from 2025 to 2030, the market increases from USD 2,103.2 million to USD 3,077.1 million, adding USD 973.9 million, which accounts for 40.6% of the total decade growth. This phase records steady adoption in color cosmetics, skin care, and hair styling formulations, driven by the need for performance-enhancing ingredients. Film-forming binders dominate this period as they cater to over 38% of formulations, ensuring long-wear, stability, and superior adhesion. Natural polymers expand their footprint in line with clean beauty trends, while free-form binders emerge as the preferred delivery system due to their versatility.

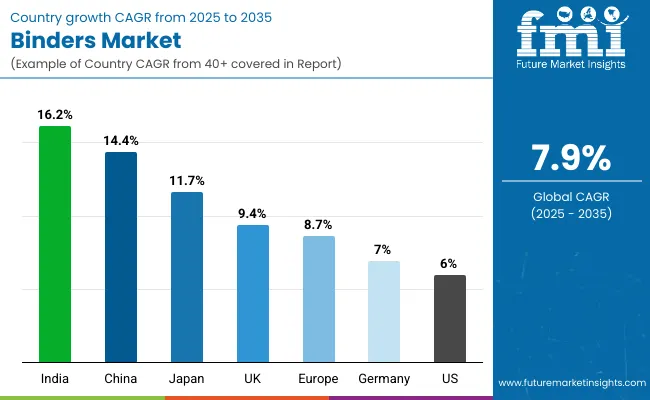

The second half from 2030 to 2035 contributes USD 1,425.0 million, equal to 59.4% of total growth, as the market jumps from USD 3,077.1 million to USD 4,502.1 million. This acceleration is powered by the rising influence of sustainable polymers, AI-driven formulation tools, and increasing consumer demand for multifunctional skin and hair care products. Asia-Pacific markets, especially India and China, drive momentum with CAGRs of 16.2% and 14.4%, respectively, far outpacing mature markets like the U.S. (6.0%) and Germany (7.0%). By 2035, bio-based and natural polymer binders will account for a much larger share of new product launches, while powder concentrate delivery systems and granular forms gain traction for efficient integration into modern manufacturing processes.

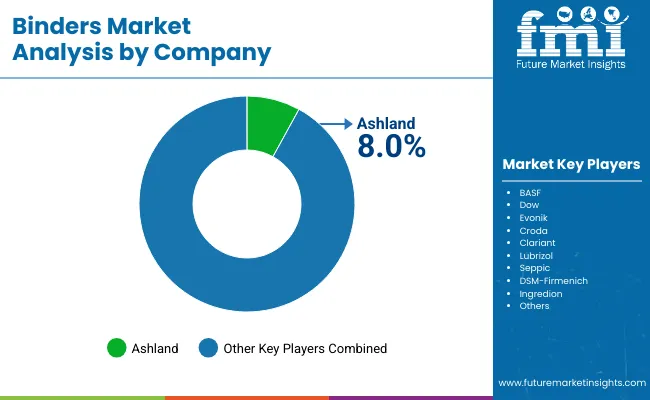

From 2020 to 2024, the market grew steadily from under USD 2,000 million to around USD 2,100 million, supported primarily by demand for film-forming agents in long-wear cosmetics and thickening binders in advanced skin care. During this period, the competitive landscape was dominated by multinational specialty chemical companies controlling nearly 70% of revenues, with Ashland leading at 8% of global share. Competitive differentiation relied on product safety, natural sourcing, and compatibility with evolving formulation needs. Bio-based innovation gained traction, but adoption was still limited compared to synthetic binders.

Demand for binders will expand significantly to USD 2,103.2 million in 2025, and the revenue mix will shift as natural and biodegradable polymers gain a stronger market presence. Traditional synthetic players face rising competition from suppliers of cellulose derivatives and protein-based binders. Major binder manufacturers are investing in hybrid strategies that combine performance consistency with sustainability credentials. Regional entrants in Asia are challenging incumbents with cost-competitive, naturally derived solutions, particularly in hair styling and sheet masks. The competitive advantage is moving away from price and scale alone to innovation in texture, multifunctionality, and eco-certification.

Advances in polymer science have allowed binders to deliver multiple functional roles film-forming, texture-enhancing, and moisture-retaining within a single formulation. Film-forming binders are increasingly favored in color cosmetics as they provide long-lasting coverage and improve product durability. Natural polymers have seen accelerated adoption as consumers push for plant-based, biodegradable, and safe ingredients, especially in skin care. The rising influence of “clean beauty” standards across the globe has shifted innovation pipelines towards naturally sourced binders and protein-based systems.

In addition, demand for multifunctionality is fueling growth. Binders are not just adhesion agents; they play a role in texture, viscosity, and hydration balance, allowing cosmetic and personal care brands to reduce the number of raw materials while enhancing overall performance. Expanding applications in pressed powders, face masks, and hair styling products are creating new demand opportunities. Markets such as China and India are adopting binders faster than global averages due to the rapid growth of domestic beauty brands and high consumer receptiveness to natural solutions.

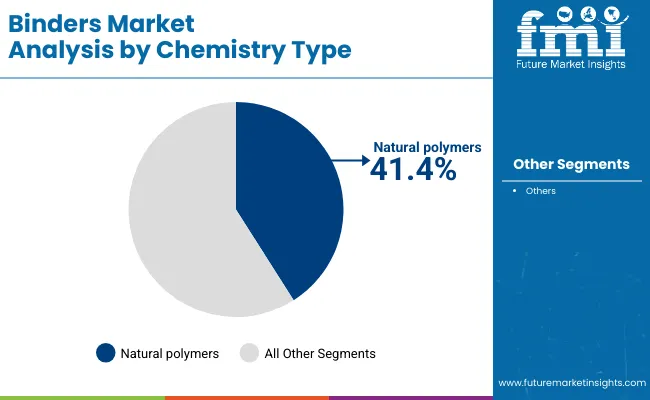

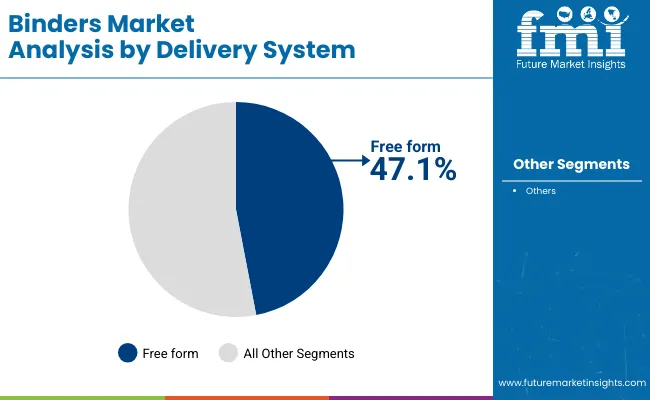

The market is segmented by functional role, chemistry type, delivery system, physical form, application, end use, and region. Functional roles include film-forming binders, thickening & texture-enhancing agents, and moisture-retaining binders, which represent the core functionalities driving performance in formulations. Chemistry type classification covers natural polymers, synthetic polymers, cellulose derivatives, and protein-based binders, reflecting the diverse raw material base supporting both traditional and sustainable innovation pathways. Based on delivery system, the segmentation includes free form, pre-dispersed, and powder concentrate formats, each offering distinct advantages in terms of formulation flexibility, ease of processing, and compatibility with active ingredients.

In terms of physical form, categories encompass liquid dispersion, powder, and granules, ensuring adaptability across skin care, hair care, and color cosmetic products. Applications are divided into pressed powders, foundations & compacts, face masks & sheets, and hair styling products, highlighting the wide scope of usage across consumer segments. End use covers color cosmetics, skin care, and hair care, each with unique demand patterns shaped by regional beauty trends and product preferences. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, capturing the global spread of demand and the contrasting growth rates between mature and emerging markets.

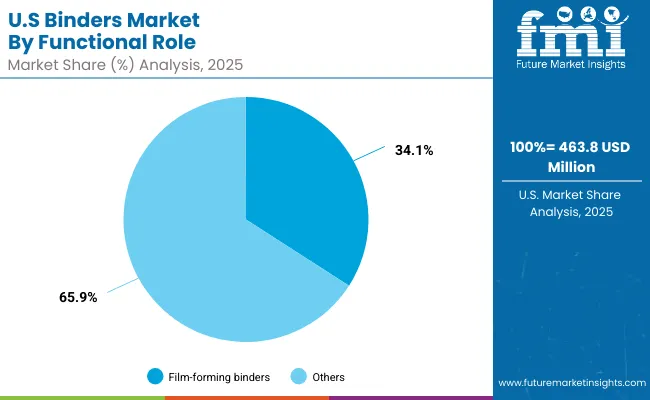

| Functional Role | Value Share % 2025 |

|---|---|

| Film-forming binders | 38.1% |

| Others | 61.9% |

The film-forming binders segment is projected to contribute 38.1% of the Global Binders Market revenue in 2025, maintaining its lead as the dominant functional category with USD 801.3 million in value. This is driven by their critical role in enhancing product durability, ensuring adhesion, and providing long-lasting performance across color cosmetics and skin care formulations. These binders are particularly important in pressed powders, compacts, and long-wear foundations, where film integrity is key to consumer satisfaction.

The segment’s growth is also supported by innovations in flexible and breathable film-forming agents that improve comfort without compromising hold. With rising demand for smudge-proof, transfer-resistant, and water-resistant cosmetics, manufacturers are investing heavily in film-forming technologies. As multifunctional beauty and hybrid skin care-cosmetic products gain traction, film-forming binders are expected to retain their central role as the backbone of modern cosmetic formulations.

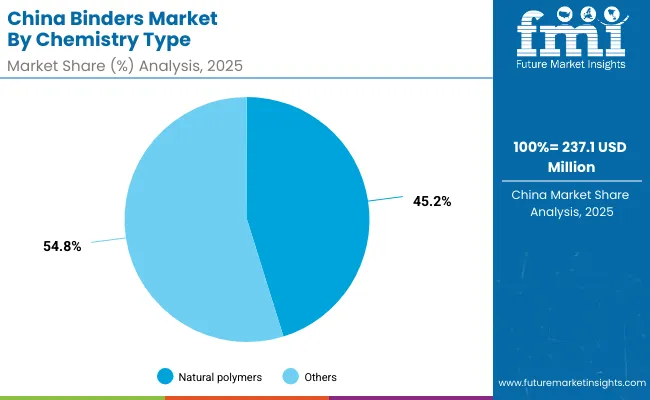

| Chemistry Type | Value Share % 2025 |

|---|---|

| Natural polymers | 41.4% |

| Others | 58.6% |

Natural polymers are forecasted to hold 41.4% of the Global Binders Market share in 2025, equivalent to USD 870.7 million, reflecting their strong consumer acceptance and alignment with sustainability goals. Their popularity is fueled by the clean beauty movement, which emphasizes plant-based, biodegradable, and safe-to-use ingredients in cosmetics and personal care. Natural polymers such as starches, gums, and bio-engineered derivatives are increasingly used for their thickening, film-forming, and moisture-retention properties.

Their role is further supported by regulatory encouragement for green formulations and corporate commitments to reducing environmental footprints. Continuous innovation in protein-based and cellulose-derived binders is expanding the scope of natural polymers beyond traditional applications. As global demand for transparent labeling and eco-friendly solutions continues to rise, natural polymers are expected to accelerate their dominance and set new standards for binder formulation.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 47.1% |

| Others | 52.9% |

The free form delivery system captures 47.1% of the Global Binders Market in 2025, generating USD 990.6 million. This format is favored by manufacturers because of its flexibility, compatibility with diverse formulations, and ability to be easily blended with active ingredients. Free form binders are widely adopted across skin care, foundations, and hair styling products, where ease of incorporation into production processes is critical.

The segment’s growth is driven by efficiency gains, reduced formulation time, and adaptability across both liquid and powder formats. With the rising trend of customized beauty and modular product design, free form binders enable formulators to experiment with new textures and hybrid product categories. As brands increasingly demand scalable solutions that support rapid product development, free form binders are expected to remain the preferred choice for global formulators.

The growing consumer preference for long-lasting and transfer-resistant makeup is a major growth driver. Film-forming binders, which already command 38.1% of the market in 2025 (USD 801.3 million), are central to achieving smudge-proof, water-resistant, and durable finishes in pressed powders, compacts, and foundations. As beauty brands compete to offer products with improved wearability, the demand for advanced film-forming agents that combine flexibility, breathability, and skin comfort is set to expand. This driver is particularly strong in North America and Europe, where premium and performance-based cosmetics dominate consumption.

Strong Momentum for Natural Polymers in Clean Beauty Formulations

Natural polymers, holding 41.4% share in 2025 (USD 870.7 million), are increasingly favored due to the global shift toward clean beauty and sustainable product development. Unlike synthetic binders, natural options such as starches, gums, and protein-based solutions meet consumer expectations for safe, eco-friendly, and biodegradable formulations. The Asia-Pacific region, led by China and India with CAGRs of 14.4% and 16.2% respectively, is showing high adoption of natural polymers in both skin care and hair care. The shift is not just trend-driven but also regulatory, with several markets tightening restrictions on synthetic additives, making natural binders a long-term growth engine.

While natural polymers are driving growth, they often come with limitations in cost efficiency and performance consistency. Compared to synthetic polymers, bio-based binders may lack stability in extreme temperature conditions or show batch-to-batch variability. This creates formulation challenges for manufacturers aiming to balance natural claims with high-performance expectations, particularly in color cosmetics where durability and adhesion are non-negotiable. The higher procurement and processing costs also limit adoption among mass-market brands, slowing down penetration in price-sensitive regions.

Market Fragmentation Across Delivery and Physical Forms

The binder market is fragmented across multiple delivery systems (free form, pre-dispersed, powder concentrate) and physical formats (liquid dispersion, powders, granules). Each format caters to specific formulation preferences, which complicates standardization and increases R&D costs for suppliers. This fragmentation makes it harder for companies to scale globally, as requirements differ drastically between product categories and geographies. For instance, free form dominates now with 47.1% share, but rising interest in powder concentrates for efficiency and reduced packaging footprint could disrupt the competitive equilibrium, making it difficult for suppliers to commit to one dominant delivery pathway.

A clear trend in the market is the development of multifunctional binders that not only serve as adhesion agents but also provide moisturizing, texturizing, or film-forming benefits simultaneously. This is particularly evident in hybrid skin care-cosmetic products and multi-benefit hair styling solutions. The ability of a single binder to enhance texture, lock in moisture, and ensure durability is becoming a differentiating factor for brands. This trend is driving innovation pipelines, with suppliers investing in polymers that combine hydration and film-forming properties without increasing formulation complexity.

Rising Regional Leadership from Asia-Pacific, Especially India and China

Asia-Pacific markets are emerging as pivotal in shaping binder demand. India’s CAGR of 16.2% and China’s 14.4% from 2025 to 2035 highlight their role as growth engines. This trend is fueled by the rapid expansion of local beauty brands, affordability of new product launches, and consumer openness to natural and bio-based formulations. In these regions, binders are not just ingredients but are marketed as functional claims such as “moisture-lock technology” or “plant-based adhesion”—that resonate strongly with consumers. This localization of binder functionality into consumer-facing claims is a unique trend that is setting APAC apart from more mature Western markets.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

| Europe | 8.7% |

China and India are emerging as the fastest-growing markets for binders, with CAGRs of 14.4% and 16.2% respectively between 2025 and 2035. This momentum is driven by the rapid expansion of domestic beauty and personal care industries, where local brands are aggressively innovating with natural and bio-based formulations. Rising disposable incomes, a young consumer base, and openness to experimenting with multifunctional skin and hair care products are fueling demand. India, in particular, is set to outpace global averages due to its strong preference for natural polymers and herbal-based solutions, which align with cultural traditions and consumer expectations for safe, plant-derived ingredients. In China, the growth is further boosted by large-scale manufacturing capacity and government support for sustainable and clean-label formulations, positioning the country as both a demand and supply hub for binders.

Mature markets such as the USA, Germany, and the UK will see slower but steady growth, with CAGRs of 6.0%, 7.0%, and 9.4% respectively. In these regions, growth is anchored in premium and high-performance cosmetic products, particularly film-forming binders that enable long-lasting and transfer-resistant formulations. Japan, with an 11.7% CAGR, stands out among developed markets, benefiting from strong innovation in advanced polymers and high consumer expectations for texture and efficacy in skin care. Europe as a region is projected to expand at 8.7%, influenced by stricter sustainability regulations that are pushing companies toward natural and biodegradable binders. While growth rates are more modest compared to Asia, the focus on premiumization, regulatory-driven innovation, and consumer awareness of clean beauty continues to sustain binder demand in these established markets.

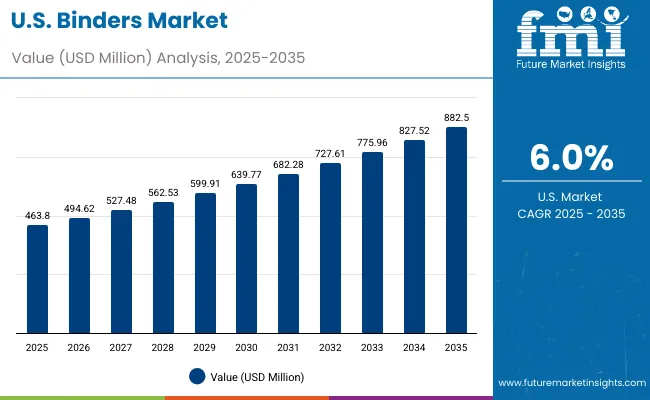

| Year | USA Binders Market (USD Million) |

|---|---|

| 2025 | 463.80 |

| 2026 | 494.62 |

| 2027 | 527.48 |

| 2028 | 562.53 |

| 2029 | 599.91 |

| 2030 | 639.77 |

| 2031 | 682.28 |

| 2032 | 727.61 |

| 2033 | 775.96 |

| 2034 | 827.52 |

| 2035 | 882.50 |

The Global Binders Market in the United States is projected to grow at a CAGR of 6.0% between 2025 and 2035, with sales increasing from USD 463.8 million to USD 882.5 million. Growth is led by high demand for film-forming binders, which hold a 34.1% share in 2025, reflecting consumer appetite for long-wear and high-performance color cosmetics. Rising adoption of moisture-retaining and texture-enhancing binders in skin care is also supporting steady expansion. Regulatory scrutiny and consumer push for cleaner formulations are encouraging greater use of natural and cellulose-based polymers. Premium brands in the USA are investing heavily in hybrid products that combine makeup and skin care, where binders serve as a critical ingredient.

The Global Binders Market in the United Kingdom is expected to grow at a CAGR of 9.4% from 2025 to 2035. Demand is supported by advanced cosmetic and personal care formulations, with strong traction in pressed powders and compacts. The UK is also seeing increased adoption of natural polymers as clean beauty standards become mainstream across retail shelves. Premium cosmetic houses are utilizing multifunctional binders that improve product texture while enhancing hydration and wear. Heritage cosmetic brands are focusing on reformulating with sustainable binders to meet consumer demand for eco-certified products.

India is witnessing the fastest growth in the Global Binders Market, forecasted to expand at a CAGR of 16.2% through 2035. Sales are accelerating due to the rapid expansion of domestic beauty and personal care industries, along with growing penetration into tier-2 and tier-3 cities. Local brands are increasingly adopting natural polymers, protein-based binders, and cellulose derivatives to align with cultural preferences for herbal and plant-based formulations. Rising consumer incomes, along with younger demographics, are pushing demand for color cosmetics and skin care, where binders are essential for stability and texture. Educational and research institutions are also driving awareness of bio-based solutions.

The Global Binders Market in China is expected to grow at a CAGR of 14.4%, one of the highest among leading economies, with natural polymers taking a lead at 45.2% share in 2025. The momentum is driven by rapid product launches by local beauty brands, strong e-commerce penetration, and increasing government emphasis on sustainable chemistry. Affordable polymer solutions from local suppliers are expanding binder use across mass-market brands, while premium players focus on advanced film-forming agents for high-end cosmetics. China’s strong manufacturing base and policy-driven support for bio-based innovation position it as both a demand and supply hub for binders.

| Country | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.5% |

| UK | 7.6% |

| India | 4.6% |

| Europe | 20.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.6% |

| China | 12.2% |

| Japan | 7.9% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 5.6% |

| Europe | 19.0% |

| USA By Functional Role | Value Share % 2025 |

|---|---|

| Film-forming binders | 34.1% |

| Others | 65.9% |

The Global Binders Market in the United States is projected at USD 463.8 million in 2025. Film-forming binders contribute 34.1% (USD 158.2 million), while other binder categories account for the remaining 65.9%. The strength of film-forming agents reflects USA consumers’ preference for long-wear, high-performance cosmetics, particularly in foundations, pressed powders, and compacts. Increasing demand for transfer-resistant and waterproof formulations continues to fuel adoption. Skin care brands are also integrating texture-enhancing and moisture-retaining binders into hydration-focused products.

Growth is further supported by clean-label and regulatory pressures that encourage the use of natural and cellulose-based polymers. USA manufacturers are heavily investing in reformulation strategies that blend performance consistency with eco-friendly positioning. Over the next decade, evolving hybrid products that merge skin care and makeup are expected to be a key driver, ensuring binders remain indispensable in formulation design.

| China By Chemistry Type | Value Share % 2025 |

|---|---|

| Natural polymers | 45.2% |

| Others | 54.8% |

The Global Binders Market in China is valued at USD 237.1 million in 2025, with natural polymers contributing 45.2% (USD 107.2 million). The strong preference for natural polymers is driven by consumer demand for sustainable, plant-based, and culturally aligned solutions. Domestic beauty brands, supported by rapid e-commerce growth, are accelerating the use of biodegradable binders across face masks, skin care creams, and hair styling products.

Government encouragement for green chemistry, along with China’s role as a manufacturing hub, further reinforces demand for bio-based binders. Local suppliers are offering cost-competitive polymer solutions that make natural binders accessible even in mid-tier brands. This dynamic positions China as a dual hub for demand and supply in the global market, with a strong emphasis on affordability, innovation, and scale.

| Company | Global Value Share 2025 |

|---|---|

| Ashland | 8.0% |

| Others | 92.0% |

The Global Binders Market is moderately fragmented, with multinational leaders and regional specialists shaping the competitive dynamics. Ashland leads with an 8.0% share in 2025, leveraging its strong portfolio of natural and synthetic polymer binders. Its focus on bio-based innovation and partnerships with global beauty brands positions it at the forefront of sustainable product development. Other global players such as BASF, Dow, Evonik, and Croda are investing in advanced polymer technologies, expanding their range of multifunctional binders that combine adhesion, texture, and hydration benefits.

Specialty firms like Clariant, Lubrizol, Seppic, DSM-Firmenich, and Ingredion are differentiating through natural polymer portfolios, supporting the shift toward eco-certified and clean-label formulations. Competitive strategies are increasingly pivoting toward multifunctionality, digital-enabled formulation support, and sustainability certifications. Regional players in Asia-Pacific are also intensifying competition with cost-effective solutions that challenge established incumbents. Overall, competitive advantage is transitioning away from cost and scale alone, toward integrated innovation, sustainability credentials, and responsiveness to fast-evolving consumer preferences.

Key Developments in Global Binders Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Functional Role | Film-forming binders, Thickening & texture-enhancing agents, Moisture-retaining binders |

| Chemistry Type | Natural polymers, Synthetic polymers, Cellulose derivatives, Protein-based binders |

| Delivery System | Free form, Pre-dispersed, Powder concentrate |

| Physical Form | Liquid dispersion, Powder, Granules |

| Application | Pressed powders, Foundations & compacts, Face masks & sheets, Hair styling products |

| End Use | Color cosmetics, Skin care, Hair care |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashland, BASF, Dow, Evonik , Croda , Clariant , Lubrizol, Seppic , DSM- Firmenich , Ingredion |

| Additional Attributes | Dollar sales by functional role and chemistry type, adoption trends in clean-label and sustainable formulations, rising demand for natural polymers in cosmetics and skin care, sector-specific growth in color cosmetics and hybrid beauty products, delivery system analysis including free form and powder concentrates, integration of multifunctional binders for hydration, adhesion, and texture, regional trends shaped by clean beauty and regulatory frameworks, and innovations in bio-based and protein-derived binders. |

The Global Binders Market is estimated to be valued at USD 2,103.2 million in 2025.

The Global Binders Market size is projected to reach USD 4,502.1 million by 2035.

The Global Binders Market is expected to grow at a CAGR of 7.9% between 2025 and 2035.

The key product types in the Global Binders Market are film-forming binders, thickening & texture-enhancing agents, and moisture-retaining binders.

In terms of functional role, film-forming binders will command 38.1% share of the Global Binders Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Pellet Binders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Cathode Binders Market Share & Industry Leaders

Organic Binders Market

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Aqueous Acrylic Binders Market - Growth & Demand 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA