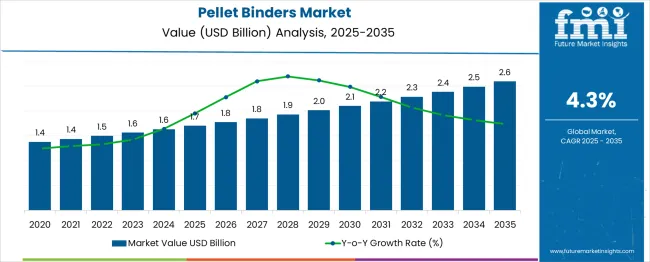

The pellet binders market is set to expand from USD 1.7 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 4.3%. Annual growth begins at USD 0.07 billion in 2026 and gradually increases to nearly USD 0.09 billion by 2035, indicating steady value accumulation.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 4.3% |

This trend reflects consistent demand in animal feed and biomass sectors, where pellet quality and structural integrity are vital. As livestock industries expand and compound feed volumes rise, binders that enhance pellet durability and nutrient retention gain preference.

The use of these binders in aquafeed and wood biomass processing further diversifies applications. Technological improvements in binder formulation and customized usage in region-specific feed types will support steady gains.

The pellet binders market holds an estimated 1.5-3% share of the global animal feed additives market, which exceeds USD 45 billion. Within the compound feed market, valued over USD 550 billion, pellet binders account for less than 0.5%, primarily serving as processing enhancers rather than nutritional inputs.

In the broader animal nutrition space, their contribution is marginal, around 0.3-0.6%. However, within the feed processing aids segment, pellet binders form a substantial share of 25-30%, as they are critical for improving pellet durability, minimizing fines, and enhancing throughput.

In livestock and aquaculture feed markets, especially for species requiring water-stable pellets like fish and shrimp, pellet binders represent around 3-4% of the segment, reflecting their specialized but essential functional role.

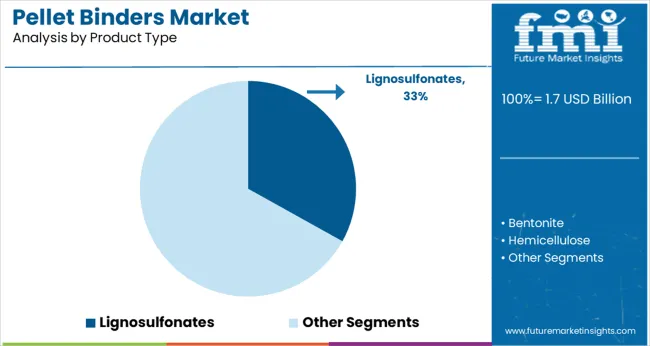

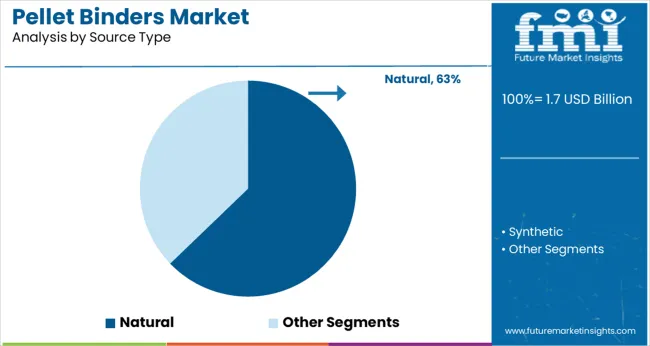

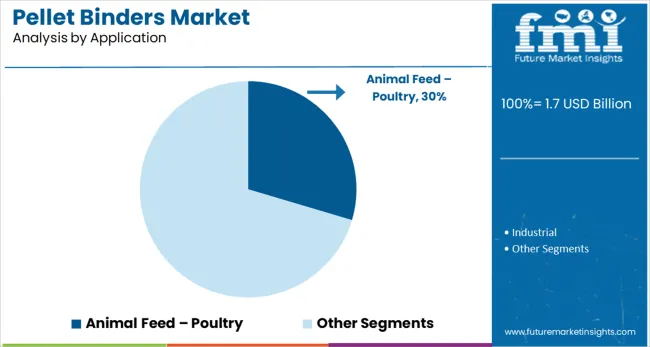

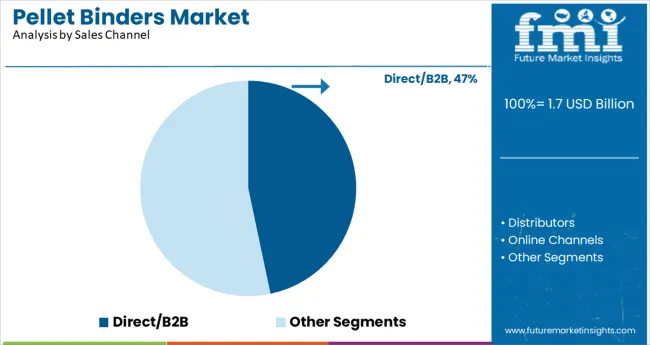

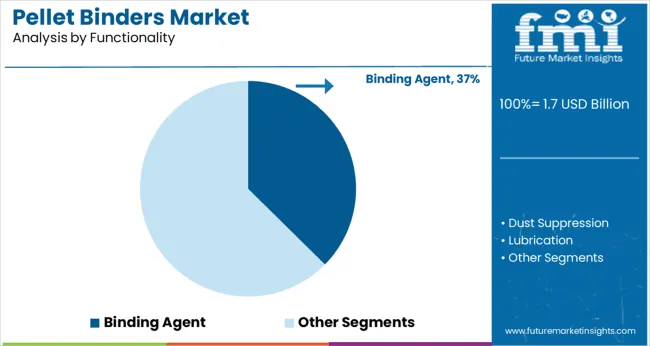

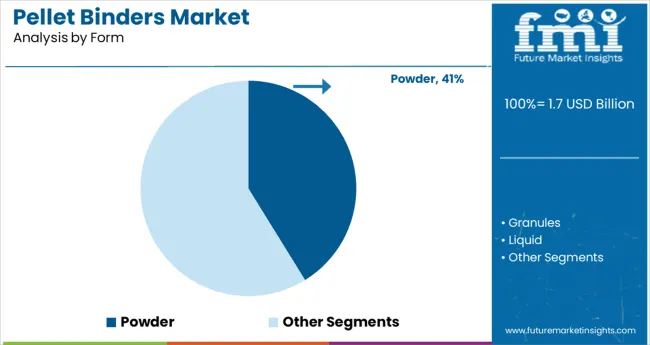

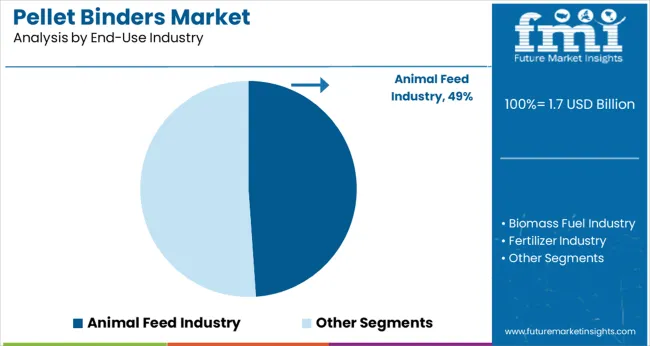

In the pellet binders industry,the largest segment in 2025 is Lignosulfonates with a 33% share, followed by Natural source types at 63%. Poultry leads the Animal Feed application segment with 30%, while Binding Agents dominate functionality with 37%. Powders make up 41% of forms, and Direct/B2B sales channels account for 47%. The Animal Feed industry holds 49% share.

Lignosulfonates hold a 33% share in 2025, owing to their high binding efficiency and cost-effectiveness across feed and industrial pellet applications.Increased use in ruminant and poultry feed, especially in Asia and Latin America, from 2025 to 2027.

Rising demand in biomass applications due to superior pellet durability between 2028 and 2030.Innovations in low-dust, heat-stable lignosulfonates supporting higher market penetration in Europe and North America by 2031.

Natural sources are expected to account for 63% of the industry share in 2025, driven by growing preferences for non-synthetic, biodegradable binders. Natural binders, particularly lignosulfonates, are gaining traction in aquafeed and pet food applications.

The shift toward natural alternatives is further supported by regulatory pressures in Europe and North America, which encourage cleaner formulations. Companies like Novus International are responding by developing efficient and natural binders. As demand for more environmentally friendly and performance-driven ingredients rises, natural binders are poised for continued growth in both feed and biomass sectors.

Poultry feed is projected to hold a 30% share of the industry in 2025, driven by its essential role in improving feed efficiency and reducing dust. Large-scale broiler and layer operations, particularly in Asia and Latin America, are expanding the demand for pellet binders. The adoption of precision feeding systems and antibiotic-free poultry approaches in Europe is anticipated to further boost this segment.

Key companies like Cargill and ADM are enhancing their product offerings with tailored binder solutions for poultry feed, which are critical for maintaining pellet quality and ensuring optimal growth in poultry production.

Direct/B2B sales are expected to dominate the industry with a 47% share in 2025. This sales model allows feed manufacturers to source in bulk and build long-term relationships with suppliers, ensuring cost-effectiveness and personalized solutions. Strong supplier-integrator partnerships are anticipated to drive growth, particularly between 2025 and 2029.

Additionally, the rise of digital procurement and e-commerce platforms is expected to enhance the B2B model's efficiency. Leading companies like Kemin Industries and Impextraco are strengthening their B2B offerings to cater to this growing demand, providing a secure and streamlined supply chain for large-scale feed producers.

Binding agents are projected to account for 37% of the industry in 2025, as they play a critical role in improving pellet stability and feed integrity. These agents are particularly important in livestock feed, where durability and minimal fines are essential for high-quality pellets.

With the growing need for multifunctional binders that offer additional benefits such as improved nutrient retention, demand is expected to increase. Leading companies like Perstorp Group and ADDCON GmbH are enhancing their portfolios to meet these needs, focusing on innovations that improve both texture and mechanical stability in pelletized feed.

Powdered form is expected to capture 41% of the industry share in 2025 due to its ease of dispersion and compatibility with dry feed mixes. This form is particularly advantageous in poultry, swine, and biomass sectors, where efficient mixing and cost-effective production are critical.

Powdered binders are gaining prominence due to innovations in moisture-resistant and low-dust formulations. Companies like Kemin Industries and Impextraco are expanding their powdered binder product lines to meet growing demand for high-performance, easy-to-use binder solutions in feed and industrial applications.

The animal feed industry is expected to hold 49% share in 2025. Pellet adhesives are indispensable in enhancing feed processing and pellet handling. Growth in commercial poultry and swine operations is expected to drive demand from 2025 to 2027.

Between 2028 and 2032, the adoption of specialty feed formulations will further increase binder usage, especially in high-performance feeds for aquaculture and pets. Major feed producers like Nutreco and Land O'Lakes are investing in advanced binder solutions to meet the evolving needs of the animal feed sector.

The industry is shaped by a combination of evolving product demands, raw material dynamics, and technological advancements. As various sectors, particularly the animal feed industry, expand, the need for efficient and high-performance pellet adhesives is intensifying. However, challenges such as raw material price fluctuations and regulatory hurdles continue to pose significant pressures.

Growing Demand for Functional Pellet Binders

The demand for specialized pellet adhesives is being driven by industries prioritizing feed efficiency and stability, particularly in animal feed. The increasing need for customized solutions in sectors like poultry and swine is pushing growth. Innovations in binder formulations that focus on enhancing dust suppression and thermal stability are further increasing their appeal. Manufacturers are focusing on cost-effective alternatives that improve feed performance.

Challenges from Raw Material Price Volatility and Regulatory Pressures

Raw material price volatility, particularly for lignosulfonates and bentonites, is elevating production costs in the market. Additionally, growing regulatory measures around feed quality and binder formulation are placing pressure on manufacturers. These regulatory constraints are becoming more stringent in regions with high environmental standards. Increased ingredient costs are challenging profit margins, especially for manufacturers in competitive industries.

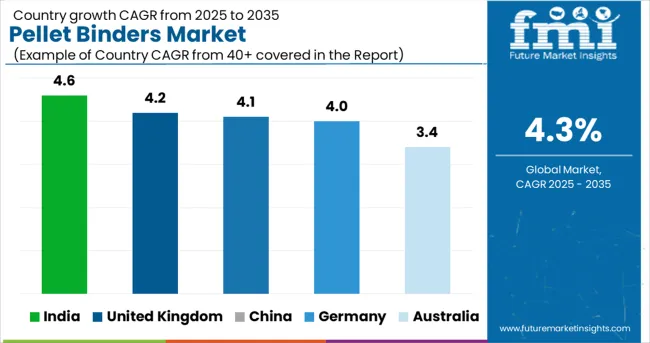

| Countries | Projected CAGR |

|---|---|

| India | 4.6% |

| United Kingdom | 4.2% |

| China | 4.1% |

| Germany | 4.0% |

| Australia | 3.4% |

The report includes analysis of over 40 countries, with five profiled below for reference.

The global pellet binders market is projected to grow at a CAGR of 4.3% from 2025 to 2035. India leads at 4.6%, outperforming the global rate by 0.3 percentage points, supported by expansion in integrated feed operations and rising demand for lignosulfonate-based binders in commercial mills. The United Kingdom follows at 4.2%, driven by modernized feed plants adopting low-dust, high-efficiency binders for aquafeed and monogastric diets.

China and Germany report 4.1% and 4.0% growth respectively, showing strong adoption of synthetic and natural binders to enhance pellet quality and meet throughput targets. In China, binder demand is closely linked to recovery in swine production and capacity upgrades.

Germany focuses on emission-compliant binder systems under EU norms. Australia lags with 3.4% growth due to a preference for mash formats and slower feed mill modernization. These trends highlight divergent binder strategies across BRICS and OECD economies.

The pellet binders market in India is projected to expand at a CAGR of 4.6% between 2025 and 2035. Growth in the market is supported by the increasing need for high-quality feed solutions, especially in the poultry and aquaculture sectors.

The growing adoption of natural binders like lignosulfonates, which provide cost-effectiveness and enhance feed stability, is expected to play a significant role in industry development. Additionally, regulatory improvements related to feed quality are expected to push the demand for efficient binder formulations, positioning India as a key industry for pellet adhesivesin the coming years.

The pellet binders market in the United Kingdom is estimated to grow at a CAGR of 4.2% between 2025 and 2035. Increased emphasis on feed efficiency and enhanced performance is likely to propel demand for premium-quality binders. Innovations in binder formulations that improve feed output while reducing waste will be crucial to the industry evolution.

With the implementation of more rigorous regulatory standards, manufacturers will likely be inclined to prioritize high-performance binder solutions to ensure compliance and meet growing expectations.

Demand for the pellet binders in China is expected to grow at a CAGR of 4.1% between 2025 and 2035. A surge in demand for high-performance animal feed in the poultry and swine industries is expected to fuel the growth of binders. Natural binders such as lignosulfonates are becoming increasingly essential due to their efficiency in improving feed quality.

Government initiatives to boost livestock productivity and ensure food security will likely lead to increased investment in better-quality binder solutions, strengthening the industry prospects in the coming decade.

The sale of pellet binders in Germany is forecasted to experience a CAGR of 4.0% from 2025 to 2035. With stringent feed regulations and a heightened focus on animal welfare, there is an increased push for higher-quality, safer feed solutions.

Innovations in binder formulations, such as moisture-resistant and dust-free options, are expected to be more widely adopted. The industry is likely to see strong growth due to a continued focus on optimizing feed efficiency and improving binder performance across the agricultural and industrial sectors.

Demand for pellet binders in Australia is anticipated to grow at a CAGR of 3.4% between 2025 and 2035. The country’s emphasis on renewable energy and cleaner energy sources is expected to increase demand for biomass pellets, subsequently boosting the binder industry.

The poultry and aquaculture sectors will continue to prioritize high-efficiency feed solutions. As industries seek to enhance feed performance, demand for functional binders that improve feed stability and reduce waste will continue to rise, supporting growth in the market.

.webp)

In the pellet binders market, leading companies are focusing on growth through product innovation, regional expansion, and improving supply chain efficiencies. Key players like Borregaard (LignoTech), Uniscope Inc., and FMC Corporation are actively enhancing their portfolios with advanced binder solutions, particularly for the animal feed and biomass sectors. Their strategies revolve around developing natural alternatives to synthetic binders, with a focus on improving stability, thermal resistance, and cost-efficiency.

Companies like Danisco (IFF - International Flavors & Fragrances) and Kemin Industries are leveraging their strong R&D capabilities to introduce customized binder solutions for specific applications, including poultry, swine, and aquaculture.

They are also strengthening their presence in emerging markets like Asia and Latin America by targeting expanding industrial and agricultural sectors. Additionally, some regional players are focusing on offering low-dust, moisture-resistant binders, catering to specific regulatory and environmental needs.

Leading Company - Borregaard ASAIndustry Share - 35%

Recent Industry News

Research Coverage and Scope Summary

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Lignosulfonates, Bentonite, Hemicellulose, Molasses, Carboxymethylcellulose (CMC), Starch-based Binders, Clay-based Binders, Synthetic Binders |

| Source Types Analyzed (Segment 2) | Natural, Synthetic |

| Applications Analyzed (Segment 3) | Animal Feed (Poultry, Swine, Ruminants, Aquaculture, Pets), Industrial Applications (Fertilizers, Biomass Fuels) |

| Functionalities Analyzed (Segment 4) | Binding Agents, Dust Suppression, Lubrication, Thermal Stability |

| Forms Analyzed (Segment 5) | Powder, Granules, Liquid |

| Sales Channels Analyzed (Segment 6) | Direct/B2B, Distributors, Online Channels |

| End-Use Industries Analyzed (Segment 7) | Animal Feed, Biomass Fuel, Fertilizer |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Borregaard (LignoTech), Uniscope Inc., FMC Corporation, Danisco (IFF - International Flavors & Fragrances), Kemin Industries |

| Additional Attributes | Dollar sales, share by binder type and end-use, demand growth in animal feed and biomass fuel, shift toward natural binding agents, regional industrial application trends, formulation compatibility improvements |

The segment includes Lignosulfonates, Bentonite, Hemicellulose, Molasses, Carboxymethylcellulose (CMC), Starch-based Binders, Clay-based Binders, and Synthetic Binders.

This includes Natural and Synthetic sources, with each playing a crucial role in product quality and application suitability.

The segment covers Animal Feed (Poultry, Swine, Ruminants, Aquaculture, Pets), Industrial applications (e.g., fertilizers, biomass fuels).

This segment includes Binding Agents, Dust Suppression, Lubrication, and Thermal Stability functionalities.

The segment is categorized into Powder, Granules, and Liquid forms, offering versatility in application.

The industry is segmented into Direct/B2B, Distributors, and Online Channels.

Key end-use industries include Animal Feed, Biomass Fuel, and Fertilizer industries.

Regional analysis covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The industry is projected to reach USD 1.7 billion in 2025.

The industry is expected to grow at a CAGR of 4.3% from 2025 to 2035.

Lignosulfonates are expected to capture 33% share in 2025.

The Asia Pacific region, particularly India and China, is projected to register a CAGR of 4.1% and 4.0% from 2025 to 2035.

The industry is projected to reach USD 2.5 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Binders Market Size and Share Forecast Outlook 2025 to 2035

Pellet Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Europe Wood Pellet Heating System Market Growth – Trends & Forecast 2024-2034

Snack Pellet Equipment Market Size and Share Forecast Outlook 2025 to 2035

Snack Pellets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Cathode Binders Market Share & Industry Leaders

Organic Binders Market

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Snack Pellets Market Analysis – Demand, Growth & Forecast 2025-2035

Underwater Pelletizing Market Size and Share Forecast Outlook 2025 to 2035

Tablet And Pellet Coating Systems Market

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA