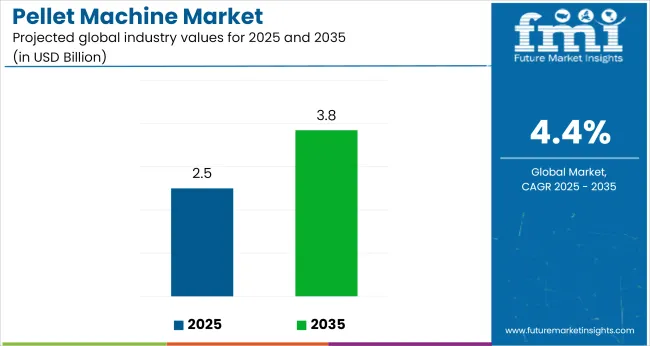

In 2025, the global pellet machine market is estimated to be worth USD 2.5 billion and is projected to reach USD 3.8 billion by 2035, growing at a CAGR of 4.4% over the forecast period.

Growth is driven by the increasing demand for pelletized feed and biomass pellets in industries such as animal feed, biomass energy, and fertilizers. These machines, which convert raw materials like wood chips, agricultural waste, and feedstock into uniform, compact pellets, are becoming essential in industries requiring enhanced durability and functionality.

The pellet machine market holds a specialized position within several broader markets, with its share varying by sector. It makes up roughly 6-8% of the biomass processing equipment industry, supported by demand for biomass fuel production. In the feed processing equipment industry, its share is estimated at 10-12%, driven by consistent use in producing feed for poultry, livestock, and aquaculture.

The industry captures less than 1% of the overall machinery and equipment market, given the sector’s large scale. In the renewable energy equipment industry, pellet machines account for about 3-4%, linked to biomass energy adoption. Within the agricultural machinery market, they represent around 2-3%, primarily used for processing crop waste into pellets for reuse.

Stefan Scheiber, CEO of Bühler Group, emphasizes the impact of automation and IoT on modern pellet production, noting that fully automatic machines now account for 40% of the market. He cites Bühler’s internal data showing these systems reduce labor costs by 30% while improving nutrient retention in animal feed formulations.

Scheiber frames this shift as a move toward precision-driven manufacturing, where operational efficiency and feed quality are enhanced simultaneously. He positions Bühler’s automation portfolio as central to this transition, meeting the demand for scalable, data-enabled solutions in livestock nutrition and industrial feed processing.

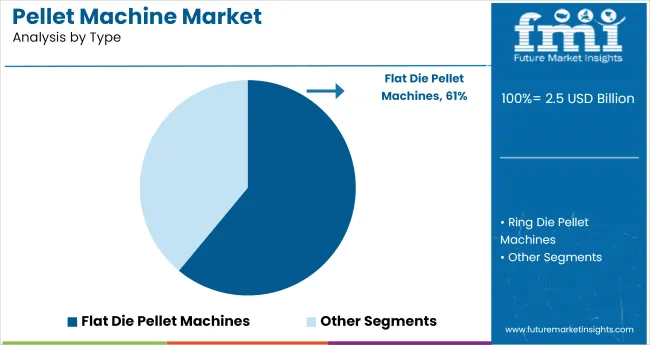

The pellet machine market is expected to see strong growth in 2025, driven by increasing demand for renewable energy and biomass solutions, with a focus on flat die pellet machines, wood material, and biomass fuel applications.

Flat die pellet machines are set to lead the market with a 61% share in 2025, primarily due to their suitability for small-to-mid production volumes and material flexibility. These machines operate on a vertical feed mechanism, with throughput capacities ranging between 100 kg/h and 2,000 kg/h.

Their compact design makes them ideal for rural agricultural setups and decentralized biomass processing. Maintenance is minimal, and die replacement cycles exceed 500 operating hours under optimized pressure conditions.

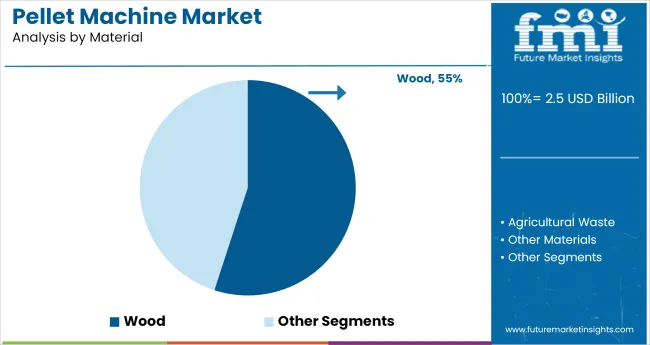

Wood will continue to dominate raw material input, holding 55% of the pelletizing material market in 2025. Its consistent combustion properties (16-18 MJ/kg energy content), abundant supply chain, and suitability for long-term storage make it the primary feedstock for pellet manufacturers.

Wood residues such as sawdust, shavings, and bark are widely sourced from furniture and lumber mills. The pelletizing process for wood is mature, with standard moisture conditioning protocols maintaining 8-12% moisture content before compaction.

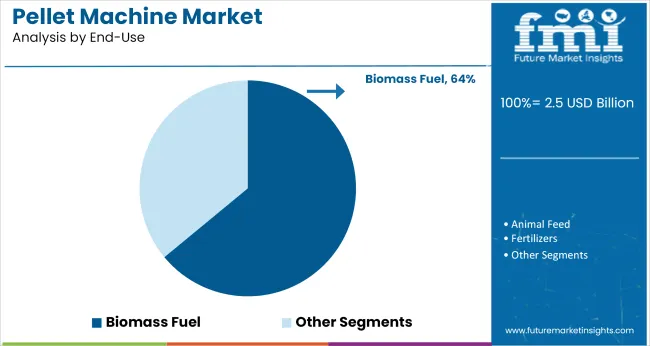

Biomass fuel accounts for 64% of end-use applications for pellet machines in 2025, supported by increased renewable energy mandates across the EU, Asia-Pacific, and North America. Pellets derived from wood, husk, or agricultural waste are increasingly used in boilers, power plants, and domestic heating units.

The shift away from coal and fossil-based energy sources accelerates demand for dense, low-ash biomass pellets. Bulk users demand consistent calorific output (>16 MJ/kg), bulk density (650-700 kg/m³), and moisture content below 10% for optimal combustion. Regulatory standards like ENplus and ISO 17225 are driving quality uniformity, leading vendors to integrate sieving and de-dusting units in production lines.

The industry is driven by demand across sectors like animal feed, biomass energy, and plastics. Technological advancements and Environmental responsibility efforts support growth, while high costs and supply chain issues limit expansion.

Segment-Specific Uptake Strengthens Use-Case Diversification

Pellet machines are gaining traction across feed, biomass, and plastics processing due to their throughput efficiency and standardized output. Animal feed producers are transitioning toward pelletized formulations to improve storage density and reduce feeding waste, especially in poultry and aquaculture.

In bioenergy, thermal processors in Germany and Canada are scaling pellet production to meet domestic fuel demand, with equipment rated above 2 tons/hour now accounting for 48% of new installations as of Q1 2025.

Polymer manufacturers are deploying underwater pelletizers to handle high-viscosity resins, with North Asian plants reporting 17% higher consistency in pellet size across automotive-grade materials. Equipment suppliers have integrated PLC-based controls and direct-drive motors to reduce downtime and energy input per ton.

Capital Load and Supply Chain Volatility Restrict Deployment Velocity

High procurement and installation costs continue to restrict market entry for SMEs, particularly in Sub-Saharan Africa and Southeast Asia. Turnkey pellet production lines for biomass or polymers are priced between USD 160,000 and 400,000, including feed systems, die heads, and cooling units. Financing barriers have slowed adoption outside of established industrial clusters.

On the logistics side, delays in die plate and gearbox imports disrupted commissioning timelines in key ports like Mombasa and Santos during early 2025. Freight container rates for large-format machinery rose 14% YoY by May 2025, while specialty alloy shortages impacted spare part availability. Extended lead times and maintenance intervals are affecting operating uptime and pushing buyers to delay secondary expansion phases.

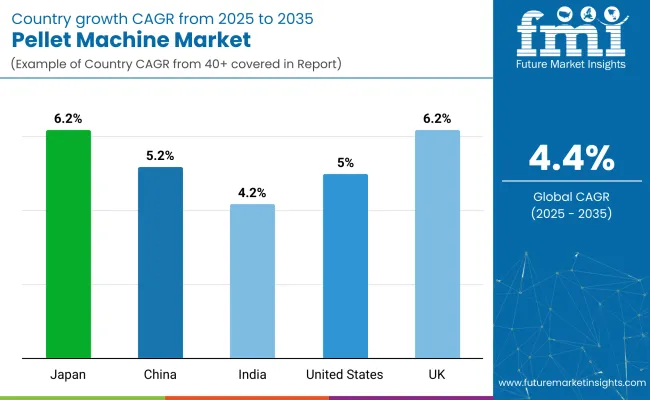

| Countries | Estimated CAGR (%) |

|---|---|

| Japan | 6.2% |

| United Kingdom | 6.2% |

| United States | 5.0% |

| China | 5.2% |

| India | 4.2% |

Global demand for pellet machines is projected to grow at a 4.4% CAGR from 2025 to 2035. Japan and the United Kingdom (OECD) dominate with identical 6.2% growth rates, outperforming the global average by +41%. China (BRICS) follows at 5.2%, exceeding the baseline by +18%, while the United States (OECD) posts 5.0% (+14%).

India (BRICS) remains below trend at 4.2%, reflecting a minor lag of -5%. Growth variations align with localized drivers such as feedstock diversification in Japan, rising industrial heating applications in the UK, and biomass utilization shifts in China and the USA, India’s sub-baseline CAGR is tied to slower equipment modernization and feedstock uniformity issues, which affect throughput optimization. These trends show more consistent market acceleration in OECD economies, while BRICS members reflect divergent investment intensities and operational upgrade trajectories.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The pellet machine market in the United States is projected to advance at CAGR of 5.0% through 2035, driven by rising demand across feed, fuel, and packaging sectors. Industries engaged in biomass conversion and circular economy models are adopting high-capacity machines with enhanced control systems. Major OEMs are emphasizing features such as variable speed feeding, high compaction rates, and continuous operation for industrial-scale applications.

The pellet machine industry in UK is forecast to expand at a CAGR of 6.2% through 2035, supported by transitions in energy use and environmental manufacturing protocols. Pelletizers that meet green manufacturing benchmarks, such as lower CO₂ output and minimal thermal loss are being prioritized. Strong end-use growth is seen in recycled content production, greenfiber packaging, and clean-label feed operations.

The pellet machine market in China is anticipated to register consistent growth of 5.2% CAGR through 2035, underpinned by strong investments in biomass fuel processing and industrial reuse cycles. Domestic manufacturers are producing mid- to large-scale machines equipped with adaptive load balancing and wear-resistant components. These systems are gaining momentum in sectors like feed milling, fertilizer compounding, and engineered wood manufacturing.

The industry in India is expected to experience a CAGR of 4.2% over the next decade, fueled by increased deployment in agricultural residue management and off-grid biofuel generation. The shift toward automation among mid-size processors is evident through increased integration of PLC-based fillers and pellet presses. Local producers are also tailoring systems for single-ingredient throughput and modular retrofitting.

Japan is likely to witness its pellet machine industry expand at a CAGR of 6.2% through 2035, led by advanced automation, compact design configurations, and increasing industrial robotics integration. High-performance units designed for low-noise operation and real-time monitoring are being prioritized across bioenergy, personal care, and eco-friendly materials production sectors.

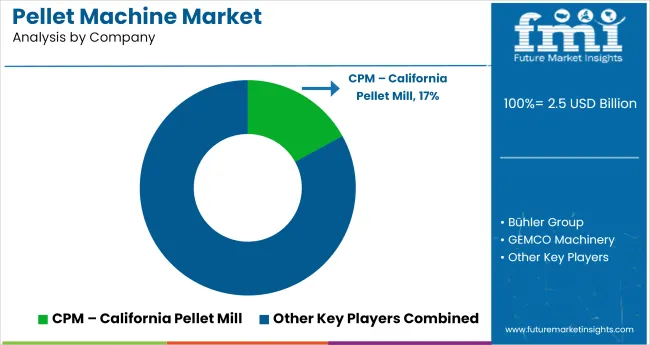

Leading Player - CPM - California Pellet Mill holding 17% Industry share.

The market is led by established players such as CPM - California Pellet Mill and Bühler Group, both of which focus on advanced pelletizing technologies. CPM, based in the USA, is renowned for its high-quality machinery and strong presence in North America. Bühler Group, headquartered in Switzerland, leverages its global reach to deliver cutting-edge solutions, backed by significant R&D investment.

The company focuses on automation and efficiency, ensuring that its pellet machines meet diverse industry demands. The companies like GEMCO Machinery and Shandong Kingoro Machinery from China offer competitive pelletizing solutions with a strong focus on cost-effectiveness and scalability.

Emerging players like Henan Richi Machinery and TCPEL Pellet Machine are growing quickly, offering tailored products with increasing focus on energy efficiency. As the market becomes more competitive, there are barriers to entry due to high initial capital investment, technological advancements, and regulatory compliance.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Flat die pellet machines; Ring die pellet machines |

| Materials Analyzed (Segment 2) | Wood, Agricultural waste, Other materials |

| End-Use Segments Covered (Segment 3) | Biomass fuel, Animal feed, Fertilizers, Other uses |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Mexico; Germany; United Kingdom; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Egypt; Turkey |

| Key Players | CPM - California Pellet Mill (USA), Bühler Group (Switzerland), GEMCO Machinery, Shandong Kingoro Machinery (China), Henan Richi Machinery (China), TCPEL Pellet Machine (China), Ecopelletmills (China), Buskirk Engineering, Kawise Machinery, and Pellet Masters. |

| Additional Attributes | Dollar sales by machine type (flat die vs ring die); Growth of biomass fuel segment vs animal feed; Regional market demand for clean energy production and animal nutrition; Technological advancements in pellet production efficiency |

The industry is segmented into flat die and ring die pellet machines.

The industry covers wood, agricultural waste, and other materials.

The industry includes biomass fuel, animal feed, fertilizers, and other uses.

The industry spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is expected to reach USD 3.8 billion by 2035.

The market size is projected to be USD 2.5 billion in 2025.

The market is expected to grow at a CAGR of 4.4%.

Leading player is CPM - California Pellet Mill (USA) holding 17% of industry share.

Wood holds 55% of the input material share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Pellet Binders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Europe Wood Pellet Heating System Market Growth – Trends & Forecast 2024-2034

Snack Pellet Equipment Market Size and Share Forecast Outlook 2025 to 2035

Snack Pellets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

USA Snack Pellets Market Analysis – Demand, Growth & Forecast 2025-2035

Underwater Pelletizing Market Size and Share Forecast Outlook 2025 to 2035

Tablet And Pellet Coating Systems Market

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

MUPS Market Overview - Growth & Forecast 2025 to 2035

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Demand for Biomass Pellets in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Black & Wood Pellets in Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA