The multefire market is poised for rapid expansion, advancing at a CAGR of 30.5% from 2025 to 2035, as enterprises increasingly adopt private LTE and 5G solutions independent of licensed spectrum. Growth is driven by industries such as manufacturing, logistics, and energy, where secure, low-latency, and high-capacity wireless networks are critical.

The technology’s ability to leverage unlicensed and shared spectrum bands makes it a cost-effective alternative for enterprises seeking flexible connectivity. Leading players including Qualcomm, Nokia, and Ericsson are heavily investing in ecosystem development, hardware integration, and interoperability standards. Strong adoption in Asia-Pacific and North America underscores the role of digital transformation, industrial IoT, and smart infrastructure as primary catalysts fueling demand for Multefire solutions.

| Metric | Value |

|---|---|

| Multefire Market Estimated Value in (2025 E) | USD 2.6 billion |

| Multefire Market Forecast Value in (2035 F) | USD 36.6 billion |

| Forecast CAGR (2025 to 2035) | 30.5% |

The multefire market is gaining momentum as enterprises increasingly demand flexible, high performance wireless connectivity that does not rely on licensed spectrum. Multefire technology enables LTE like performance in unlicensed bands, making it particularly attractive for industries seeking private and secure network environments.

The growing need for low-latency communication, enhanced mobility, and real-time data transfer across complex industrial settings is accelerating its adoption. As digital transformation efforts intensify, Multifire is being integrated into smart manufacturing, logistics, and mission-critical infrastructure to support automation and IoT deployment.

Advancements in standalone small cell deployments and ongoing development of industrial communication standards are expected to support sustained market growth. The overall outlook remains strong as enterprises prioritize network control, reliability, and scalability without the constraints of traditional mobile operator involvement.

The multefire market is segmented by device, end user vertical, and geographic regions. By device, the multefire market is divided into Small Cells, Switches, and Controllers. In terms of end user vertical, the multefire market is classified into Industrial Manufacturing, Commercial, Transportation and Logistics, Retail and Hospitality, Public Venues, Healthcare, Education, and Others. Regionally, the multefire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The small cells segment is projected to account for 48.30% of total market revenue by 2025 within the device category, making it the dominant segment. This leadership is supported by the need for dense network infrastructure capable of delivering low latency, high capacity wireless coverage in localized environments.

Small cells offer a cost-effective and scalable solution that is well-suited for indoor deployments in industrial and enterprise settings. Their integration with multe-fire networks enables enterprises to deploy private LTE-like systems without relying on licensed spectrum, thus reducing dependency on traditional carriers.

The flexibility and performance of small cells have positioned them as the preferred device category in the multefire ecosystem, especially in settings requiring seamless connectivity and real time data communication.

The industrial manufacturing segment is expected to represent 42.70% of total market revenue by 2025 within the end user vertical category, leading adoption across industries. This is driven by the sector’s increasing reliance on automation, real time monitoring, and intelligent machinery that demands ultra reliable and low latency connectivity.

Multefire supports these needs by enabling the deployment of private networks tailored to manufacturing floor requirements without spectrum licensing challenges. As smart factories become more prevalent and digitalization initiatives mature, manufacturing environments are leveraging multefire to improve operational efficiency, safety, and productivity.

The ability to maintain network autonomy while ensuring high throughput and deterministic performance has reinforced the industrial manufacturing segment's leadership within the multefire market.

The multefire market is expanding as industries look for high-performance, secure, and cost-effective wireless solutions. Multefire technology, which leverages LTE and Wi-Fi standards for wireless connectivity, offers seamless, high-speed connectivity in industrial, enterprise, and outdoor environments. It is gaining traction due to its ability to deliver reliable mobile connectivity in areas where traditional cellular networks are expensive or impractical. The rise in private networks and the increasing adoption of IoT are further driving Multefire technology's market penetration. Despite challenges in widespread adoption, its scalability and cost-efficiency offer significant potential for growth.

The primary driver behind the growth of the multefire market is the increasing demand for secure, reliable, and high-performance wireless connectivity, particularly in enterprise, industrial, and outdoor environments. Multefire provides a viable alternative to traditional Wi-Fi and cellular networks by offering high-speed, low-latency connections. It is particularly valuable in private networks, where businesses require dedicated and secure connectivity for critical operations such as IoT devices, machine-to-machine communications, and mission-critical applications. Multefire’s ability to work in unlicensed spectrum allows companies to deploy private networks without relying on expensive licensed spectrum, making it an attractive solution. The rise of Industry 4.0, smart cities, and digital transformation across sectors also boosts demand for Multefire technology, as it can support the high density and performance needs of modern enterprises.

A key challenge for the Multefire market is the regulatory complexity and spectrum management issues associated with deploying private networks in unlicensed spectrum. In some regions, regulations surrounding the use of the unlicensed spectrum are unclear, which can slow down the adoption of Multefire technology. Coordination with other wireless technologies operating in the same spectrum is critical to avoid interference, which can impact the quality of service. While Multefire offers several advantages in terms of cost and performance, the lack of universal standards and the potential for spectrum congestion in densely populated areas pose challenges. These issues require collaboration between regulators, network operators, and device manufacturers to ensure the successful deployment of Multefire solutions across regions.

The multefire market presents significant growth opportunities, particularly driven by the increasing adoption of private LTE networks and the rising demand for IoT solutions. As businesses seek to implement secure, scalable, and reliable networks for their operations, Multefire offers a cost-effective solution for private cellular networks, particularly in industrial, enterprise, and remote locations. The continued growth of IoT devices, smart devices, and automation systems in various industries like manufacturing, logistics, and healthcare presents a huge opportunity for Multefire technology. As private networks become more essential for secure communications and data transfer, Multefire can serve as a key enabler of these networks, providing the necessary wireless infrastructure for seamless IoT communication and connectivity in remote and complex environments.

A key trend in the multefire market is its increasing integration with 5G technology and industrial IoT applications. Multefire technology, which operates on LTE standards, is seen as a stepping stone to more advanced 5G networks. With the roll-out of 5G, Multefire can complement private networks by offering a hybrid connectivity solution that seamlessly integrates with 5G infrastructure for enhanced coverage and performance. Furthermore, as industries continue to adopt IoT systems for automation, data collection, and predictive maintenance, Multefire’s ability to support dense networks of connected devices in industrial environments is becoming increasingly important. The growing trend towards network slicing in 5G networks is also paving the way for Multefire to provide more customized, high-performance solutions for specific industrial applications.

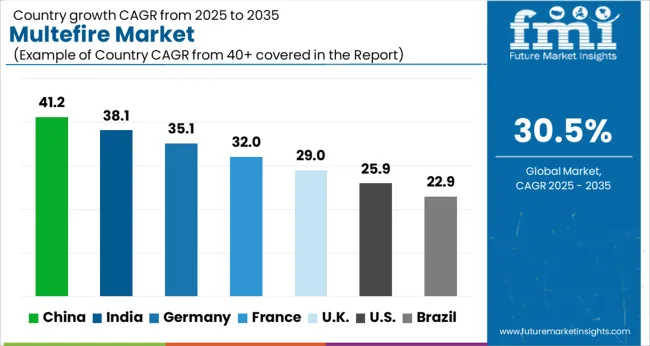

The global Multefire market is projected to grow at a CAGR of 30.5% from 2025 to 2035, driven by increasing demand for efficient and scalable wireless solutions across various sectors. China leads with 41.2% growth, supported by industrial expansion and government push for 5G adoption. India follows closely at 38.1%, fueled by growing mobile penetration and smart city projects. France, the UK, and the USA show steady growth, with government investments in 5G infrastructure, IoT adoption, and the rise in private LTE networks further boosting demand for Multefire technology. The analysis includes over 40 countries, with the leading markets shown below.

Multefire market in China is projected to grow at a CAGR of 41.2% through 2035. The country’s rapid industrialization, robust telecommunications infrastructure, and government-backed push for 5G adoption are key factors fueling the demand for Multefire technology. As China continues to advance its digital economy and expand its wireless networks, Multefire, which enables LTE-like performance on unlicensed spectrum, is becoming an essential tool for businesses. The growing adoption of Internet of Things (IoT) devices and smart city projects further drives demand for efficient and scalable connectivity solutions, positioning Multefire as a key enabler for China’s evolving communication ecosystem.

Sale of multefire in India is expected growing at a CAGR of 38.1% through 2035. The country’s growing mobile and internet penetration, coupled with increased investments in telecommunications infrastructure, is driving the market’s expansion. As India seeks to enhance its communication networks and support a growing digital economy, Multefire technology is gaining traction due to its ability to deliver reliable connectivity on unlicensed spectrum. The government’s initiatives to enhance 4G and 5G connectivity, along with the rise in smart city projects and IoT adoption, further strengthen the demand for Multefire solutions across urban and rural sectors.

The multefire market in France is projected to exapnd at a CAGR of 32.0% through 2035. The country’s strong telecommunications infrastructure and focus on smart cities are major drivers for the growth of Multefire technology. As France continues to roll out 5G networks and invest in IoT technologies, Multefire is becoming increasingly important for efficient connectivity. The government’s initiatives to modernize urban infrastructure and support the deployment of next-generation wireless technologies create a conducive environment for Multefire adoption. The market is also supported by growing demand for private LTE networks across industrial and enterprise applications.

The multefire market in the United Kingdom is projected to grow at a CAGR of 29.0% through 2035. The UK’s increasing demand for efficient wireless networks, coupled with its robust telecommunications sector, supports the rise of Multefire solutions. As businesses and industrial sectors seek secure and reliable communication networks, Multefire provides a cost-effective and scalable solution. The UK government’s investment in 5G infrastructure and its commitment to digital transformation in industries such as manufacturing, healthcare, and transportation further accelerate the adoption of Multefire technology across urban and industrial environments.

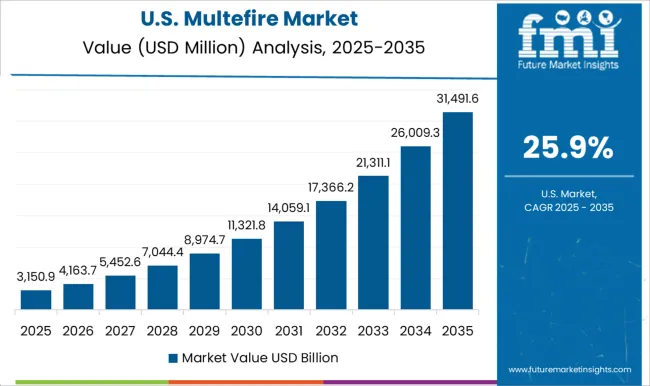

The USA Multefire market is projected to grow at a CAGR of 25.9% through 2035. The demand for private LTE and 5G solutions, particularly for industrial and enterprise applications, is driving the growth of Multefire technology. As businesses across sectors like manufacturing, logistics, and healthcare adopt IoT and automation solutions, the need for secure, reliable, and scalable connectivity has surged. Multefire’s ability to operate on unlicensed spectrum provides a cost-effective alternative to traditional wireless technologies, making it increasingly popular in the USA The government’s focus on 5G infrastructure and smart city initiatives further strengthens the market prospects.

Nokia Corporation is positioned as a leader in private wireless, providing multefire-based LTE for unlicensed spectrum and private 5G options for licensed and shared bands, with focus on low latency and high throughput in enterprise and industrial settings. Qualcomm Technologies Inc. drives multefire adoption through modem and platform support that enables private LTE in unlicensed bands and complements 5G device ecosystems. Ericsson AB supports enterprise connectivity with private LTE and 5G, including NR U for 5G in unlicensed spectrum; positioning should not imply a distinct multefire product line. Athonet S.r.l., now part of Hewlett Packard Enterprise, delivers mobile core software for private LTE and 5G, with support for unlicensed and shared spectrum deployments including multefire. Redline Communications has transitioned under Aviat Networks; offerings focus on private LTE and wireless transport, so multefire claims should be moderated.

Casa Systems Inc. provides virtualized core and small cell solutions for private LTE and 5G; references to multefire should be framed as optional spectrum approaches rather than a dedicated product family. These vendors differentiate through LTE, 5G, and unlicensed spectrum capabilities that enable private networks with improved coverage, security, and cost efficiency across manufacturing, utilities, logistics, and campus deployments. If a narrower multefire-only roster is required, prioritize Nokia, Qualcomm, and private core vendors with proven multefire support, and present Ericsson, Aviat Redline, and Casa as broader private LTE and 5G enablers rather than pure multefire suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Device | Small Cells, Switches, and Controllers |

| End User Vertical | Industrial Manufacturing, Commercial, Transportation and Logistics, Retail and Hospitality, Public Venues, Healthcare, Education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nokia Corporation, Qualcomm Technologies, Inc., Ericsson AB, Athonet S.r.l., Redline Communications Group, and Casa Systems, Inc. |

| Additional Attributes | Dollar sales by product type (private LTE, 5G, and enterprise connectivity solutions) and end-use segments (industrial, enterprise, telecommunications, government). Demand dynamics are driven by the increasing need for high-performance, private wireless networks, particularly in enterprise and industrial sectors. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in Multefire technology, private network deployments, and the transition towards 5G fueling market expansion. |

The global multefire market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the multefire market is projected to reach USD 36.6 billion by 2035.

The multefire market is expected to grow at a 30.5% CAGR between 2025 and 2035.

The key product types in multefire market are small cells, switches and controllers.

In terms of end user vertical, industrial manufacturing segment to command 42.7% share in the multefire market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA