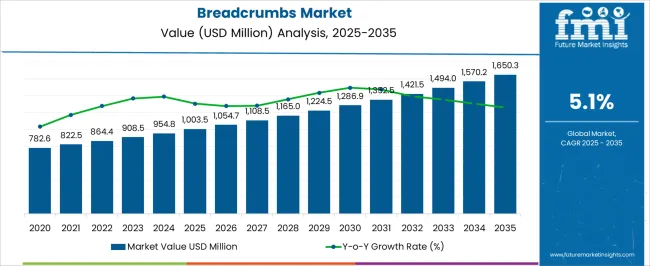

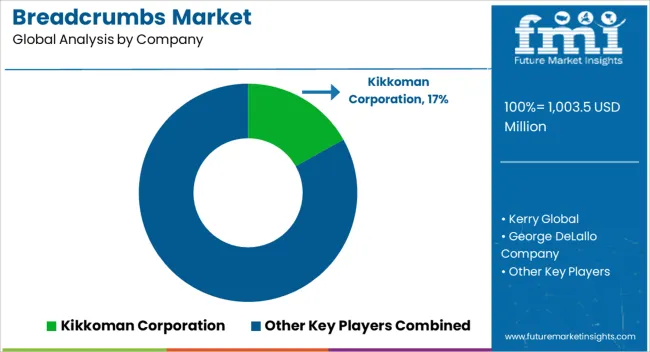

The breadcrumbs market is estimated to be valued at USD 1003.5 million in 2025 and is projected to reach USD 1650.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

Observing the rolling CAGR over the forecast period, the market demonstrates steady year-on-year growth, increasing from USD 1,054.7 million in 2026 to USD 1,570.2 million in 2034 before reaching the projected value. This trend highlights how demand for breadcrumbs in food processing, bakery, and snack applications is being steadily reinforced by consistent consumer consumption and industrial adoption. In my view, the rolling CAGR indicates that market expansion is shaped by incremental increases in production capacities and distribution networks, ensuring stable supply and maintaining product quality across end-use sectors. The breadcrumbs market stood at USD 1,003.5 million in 2025 and is expected to advance to USD 1,650.3 million by 2035, maintaining a CAGR of 5.1%.

The rolling CAGR analysis reveals a predictable and balanced growth pattern, with annual increments moving from USD 1,108.5 million in 2027 to USD 1,494 million in 2033. The market is being reinforced by steady adoption in processed and convenience foods, where breadcrumbs contribute to texture, coating, and flavor enhancement. From my perspective, the growth pattern suggests that manufacturers are strategically expanding production while responding to evolving consumer preferences, enabling the breadcrumbs market to maintain stable and sustainable growth throughout the decade. The trend also highlights the role of consistent supply and quality control in supporting long-term market performance.

| Metric | Value |

|---|---|

| Breadcrumbs Market Estimated Value in (2025 E) | USD 1003.5 million |

| Breadcrumbs Market Forecast Value in (2035 F) | USD 1650.3 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The breadcrumbs market has been increasingly recognized as a distinct segment within multiple parent industries, each demonstrating measurable adoption and operational influence. Within the bakery ingredients market, breadcrumbs account for approximately 5.9%, driven by their use in coating, binding, and texturizing baked goods while enhancing product consistency and shelf-life. In the food additives market, the penetration is observed at around 4.8%, reflecting the application of breadcrumbs as functional ingredients in processed foods to improve structural integrity and sensory appeal.

The frozen and processed foods market records a share of roughly 5.2%, as breadcrumbs are incorporated in ready-to-cook items, meat products, and convenience foods for improved cooking performance and consumer satisfaction. Within the snack foods market, breadcrumbs hold approximately 4.5% share, driven by their role in batter coatings, breaded snacks, and extruded products that require crispiness, flavor absorption, and uniform texture. In the specialty food ingredients market, breadcrumbs contribute around 3.7%, highlighting their use in niche applications such as gluten-free, low-fat, or protein-enriched formulations where functionality and palatability are critical.

Collectively, these parent segments indicate that the breadcrumbs market accounts for roughly 24.1% across these industries, underlining its strategic relevance in food production, product development, and quality enhancement. Market adoption has been influenced by demand for consistency, versatility, and performance in end-products, prompting manufacturers to integrate breadcrumbs as indispensable ingredients. Its presence has been shaping competitive strategies in parent markets, emphasizing efficiency, product differentiation, and enhanced consumer experience while establishing breadcrumbs as essential components across multiple food categories.

The breadcrumbs market is witnessing steady expansion, driven by increasing incorporation of breadcrumb-based textures in processed foods and ready-to-eat meals. Growing adoption in foodservice, particularly in quick-service restaurants and bakery outlets, has reinforced the role of breadcrumbs as a versatile ingredient for coating, binding, and enhancing the visual appeal of dishes. Current market dynamics are shaped by the demand for both flavored and unflavored variants, catering to diverse culinary applications across global cuisines.

The rise of frozen and convenience food categories has further strengthened demand, as breadcrumbs provide consistent performance in frying and baking processes. Moreover, food manufacturers are increasingly emphasizing product differentiation through varied crumb sizes, moisture levels, and functional seasoning blends.

With technological advancements in manufacturing and packaging, product shelf life and texture retention have improved, enabling wider distribution. Over the forecast period, the market is expected to benefit from expanding applications in both household and industrial settings, supported by continued growth in processed food consumption and innovation in recipe formulations.

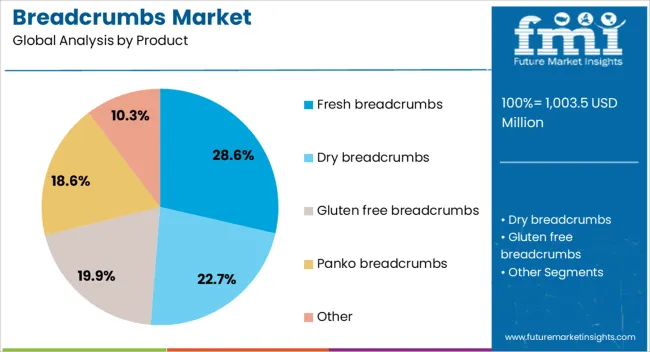

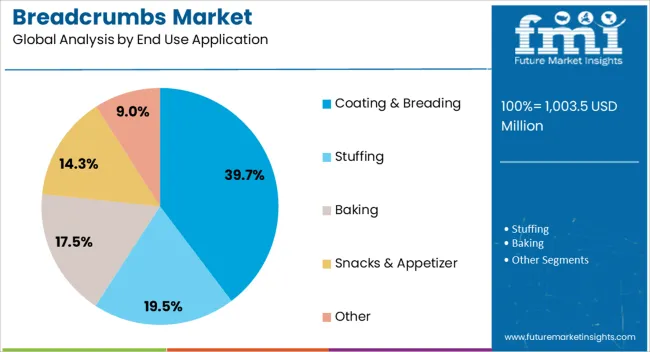

The breadcrumbs market is segmented by product, seasoning, end use application, distribution channel, and geographic regions. By product, breadcrumbs market is divided into fresh breadcrumbs, dry breadcrumbs, gluten free breadcrumbs, panko breadcrumbs, and other. In terms of seasoning, breadcrumbs market is classified into unflavored and flavored. Based on end use application, breadcrumbs market is segmented into coating & breading, stuffing, baking, snacks & appetizer, and other. By distribution channel, breadcrumbs market is segmented into retail stores, online retail, food service, and others. Regionally, the breadcrumbs industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fresh breadcrumbs segment accounts for approximately 28.6% of the total market, maintaining its position as a preferred product type for premium and freshly prepared food offerings. Its appeal lies in its soft texture, moisture retention capability, and superior adherence in coating applications, which are favored by both commercial kitchens and artisanal bakeries. The segment’s growth is supported by rising consumer interest in minimally processed ingredients and the expansion of fresh bakery product lines in supermarkets.

Supply chain improvements, particularly in refrigerated logistics, have enhanced distribution reach, allowing fresh breadcrumbs to penetrate new markets. Additionally, partnerships between bakery chains and foodservice operators have boosted consumption volumes.

While shelf life remains shorter compared to dried alternatives, the sensory advantages of fresh breadcrumbs have sustained their demand in high-quality breading and stuffing recipes. As premiumization trends in the food industry continue, this segment is expected to maintain stable growth supported by innovation in flavor infusions and packaging solutions.

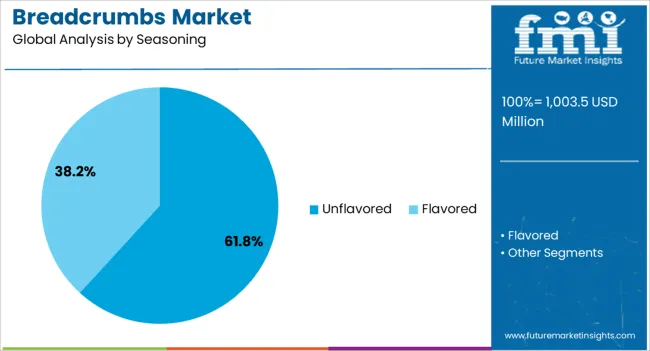

The unflavored segment dominates the seasoning category with a substantial 61.8% market share, largely due to its versatility and ability to blend seamlessly with a wide range of recipes. Its neutral taste profile enables chefs and food manufacturers to customize seasoning according to specific culinary needs, making it a staple in both industrial and household kitchens. The segment has benefited from increasing adoption in core applications such as frying, baking, and stuffing, where base ingredients are preferred for flavor control.

Additionally, its cost-effectiveness compared to pre-seasoned variants has supported uptake in large-scale food processing operations. Regulatory compliance is more easily maintained in the unflavored category, as it avoids complexities associated with flavor additives and labeling requirements.

The segment’s consistent demand across diverse cuisines and its compatibility with both meat and plant-based dishes further strengthen its market presence. Looking ahead, the unflavored segment is projected to sustain its dominance due to its broad applicability and strong acceptance among food manufacturers seeking flexible base ingredients.

The coating & breading segment holds a leading 39.7% share within the end use application category, reflecting its widespread adoption in fried, baked, and oven-cooked food products. This application enhances the texture, appearance, and flavor retention of meat, seafood, and vegetable-based dishes, driving its popularity in both home cooking and commercial food production. Growth in this segment is closely linked to the expansion of quick-service restaurants, frozen food categories, and ready-to-cook meal kits, all of which rely on effective breading solutions to deliver consistent quality.

Technological improvements in crumb adhesion, moisture control, and oil absorption rates have also contributed to the segment’s performance. Furthermore, the global trend toward convenience-oriented eating habits has intensified demand for pre-breaded and coated items.

While competition from alternative coating materials exists, the sensory appeal and proven performance of breadcrumbs in achieving a desirable crispy texture continue to secure their strong market position. This segment is expected to experience sustained growth in line with innovations in flavor layering and healthier frying techniques.

The breadcrumbs market has been influenced by increasing consumption in bakery, snacks, processed foods, and ready-to-eat meals. Demand has been driven by convenience-focused diets, rising fast-food chains, and growing use in coating, binding, and filler applications. Opportunities are emerging in flavored, gluten-free, and functional breadcrumb variants for premium products. Trends are being observed in clean-label formulations, pre-seasoned and versatile applications, and value-added product innovations, while challenges persist in raw material price volatility, storage stability, and regulatory compliance. Overall, market growth is expected to continue as consumers seek convenience, taste, and texture enhancement.

The demand for breadcrumbs has been strongly influenced by their widespread use in fast-food items, bakery products, and ready-to-eat meals. Foodservice operators, commercial kitchens, and snack manufacturers have been observed increasingly relying on breadcrumbs for coating, binding, and enhancing the texture of food products. In opinion, this demand has been reinforced by the growing trend of convenience-oriented diets, where consumers prefer quick, easy-to-prepare meals with consistent taste and appearance. The expanding presence of fast-food chains and casual dining restaurants has further strengthened reliance on high-quality breadcrumbs for standardized preparation. Additionally, processed food manufacturers are adopting breadcrumbs to improve moisture retention, provide crispiness, and enhance product appeal across fried, baked, and stuffed food items. Overall, reliance on breadcrumbs is being viewed as essential to maintain culinary quality, ensure texture consistency, and meet evolving consumer preferences in both retail and foodservice sectors.

Opportunities in the breadcrumbs market have been largely defined by the rising demand for flavored, gluten-free, and value-added variants for premium food products. Manufacturers and ingredient suppliers have been observed developing innovative breadcrumb formulations with herbs, spices, and functional additives to meet the expectations of gourmet and health-conscious consumers. In opinion, significant opportunities exist in emerging markets where disposable incomes and westernized food habits are expanding, creating demand for diverse flavors and specialty ingredients. Gluten-free and whole-grain breadcrumbs are being increasingly adopted to cater to dietary restrictions and wellness-oriented consumption trends. Opportunities have also been identified in coated meats, seafood, and snack items, where specialty breadcrumbs enhance taste, crispiness, and product differentiation. Collaborations between ingredient suppliers and food manufacturers are enabling tailored solutions for both large-scale commercial use and premium retail applications. Overall, the market is expected to benefit from innovation, premiumization, and multi-application adoption.

The breadcrumbs market has been shaped by trends in pre-seasoned formulations, multi-purpose applications, and versatile product offerings. Manufacturers have been increasingly focusing on ready-to-use breadcrumbs that combine flavoring and functional properties, reducing preparation time and enhancing product consistency. In opinion, these trends are redefining the market as foodservice operators, casual dining restaurants, and retail consumers seek convenience, consistency, and taste enhancement in one product. Innovations in coating performance, moisture retention, and crispiness have contributed to improved culinary outcomes in fried, baked, or stuffed food items. Additionally, breadcrumbs are being adopted across multiple cuisines and product categories, including meat, seafood, vegetables, and snack coatings, reflecting their versatility. Overall, these trends are expected to drive competitive differentiation, influence product development strategies, and expand market reach by offering convenience-focused, multi-functional breadcrumb solutions.

The breadcrumbs market has faced ongoing challenges related to raw material price fluctuations, shelf-life stability, and compliance with food safety regulations. Wheat and other grain-based inputs are highly sensitive to climatic variations, crop yields, and regional production conditions, which can affect supply consistency and cost structures. In opinion, these challenges have occasionally constrained manufacturers’ ability to maintain stable pricing and consistent quality in competitive markets. Storage and packaging play a critical role in preventing moisture absorption, microbial growth, and loss of crispiness, which can impact product performance and consumer satisfaction. Regulatory frameworks for labeling, food safety, and hygiene standards further complicate production and distribution, particularly in international markets. Addressing these challenges requires careful supply chain management, strategic sourcing, and adherence to quality standards. Overcoming these barriers is essential to ensure reliable product quality, maintain shelf stability, and support long-term market growth in breadcrumbs.

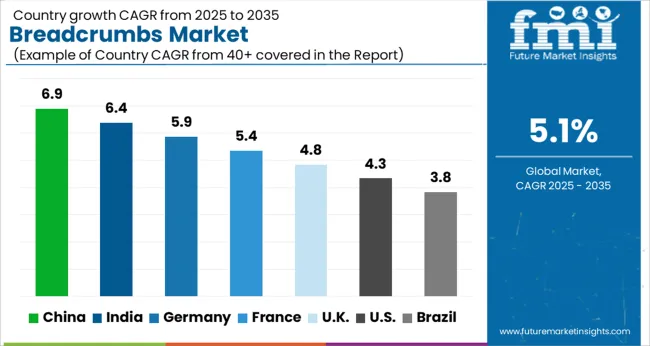

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global breadcrumbs market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with 6.9% growth, followed by India at 6.4%, and France at 5.4%. The United Kingdom records 4.8%, while the United States shows 4.3% growth. Expansion is being driven by increasing demand for convenience foods, processed meals, and bakery applications. Emerging markets such as China and India witness higher growth due to rising urban population, fast food consumption, and expansion of foodservice and retail channels, while developed markets focus on premium product offerings, ready-to-cook solutions, and innovative breadcrumb applications in processed foods. This report includes insights on 40+ countries; the top markets are shown here for reference.

The breadcrumbs market in China is growing at a CAGR of 6.9%, supported by rising demand from bakery, fast food, and processed food sectors. Manufacturers are integrating breadcrumbs into frozen, ready-to-cook, and packaged food products to enhance texture, taste, and presentation. Growth is reinforced by increasing urbanization, expansion of modern retail chains, and growing popularity of convenience foods. Adoption is further driven by investments in food processing infrastructure and rising consumer preference for easy-to-prepare meal options.

The breadcrumbs market in India is advancing at a CAGR of 6.4%, fueled by growth in fast food, bakery, and processed food sectors. Indian manufacturers are adopting breadcrumbs to improve product texture, flavor, and appearance in ready-to-eat and packaged foods. Growth is supported by increasing consumer preference for convenient meal solutions and expansion of quick-service restaurants. Adoption is also reinforced by modern food processing capabilities and the introduction of innovative breadcrumb varieties catering to diverse culinary applications.

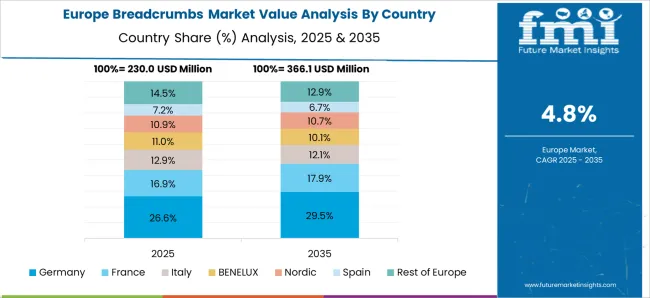

The breadcrumbs market in France is projected to grow at a CAGR of 5.4%, driven by demand from bakery, processed foods, and frozen meal applications. French manufacturers focus on high-quality, consistent breadcrumb formulations to meet culinary and safety standards. Growth is reinforced by increasing adoption of convenience foods, ready-to-cook meals, and traditional European recipes requiring breadcrumbs. Industrial-scale production and product innovation further support market expansion, particularly in premium bakery and processed food segments.

The breadcrumbs market in the United Kingdom is expanding at a CAGR of 4.8%, supported by demand from bakery, ready-to-eat meals, and processed food industries. Manufacturers are incorporating breadcrumbs to improve texture, coating, and flavor of food products. Growth is reinforced by rising adoption of convenience foods, retail expansion, and consumer preference for quick meal solutions. Adoption is further supported by innovation in product types such as seasoned and specialty breadcrumbs for premium culinary applications.

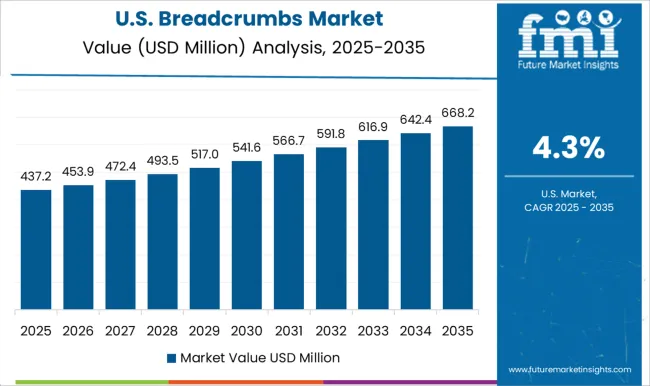

The breadcrumbs market in the United States is growing at a CAGR of 4.3%, driven by demand from processed foods, bakery, and ready-to-cook meal segments. USA manufacturers are adopting breadcrumbs to improve product consistency, flavor, and texture. Growth is further reinforced by increasing consumer preference for convenience meals, frozen foods, and fast food applications. While growth is moderate compared to emerging markets, steady adoption is observed across retail, foodservice, and industrial applications, particularly in bakery and packaged meal products.

The breadcrumbs market is being shaped by global food giants, specialty ingredient producers, and gluten-free innovators. Kikkoman Corporation, General Mills, and Kerry Global are being positioned as leaders through large-scale production, consistent quality, and multi-application versatility across baked goods, coatings, and ready-to-eat meals. Their strategy is being executed with an emphasis on functional properties, extended shelf life, and reliable supply chains. George DeLallo Company, 4C Foods Corp., and Newly Weds Foods are being recognized for tailored solutions, catering to both commercial bakeries and industrial food manufacturers. Aleia’s Gluten Free Foods and Gillian’s Foods are being directed toward specialty and health-focused segments, emphasizing allergen-free and premium offerings.

FRUMEN, Bon Food Industries, Ripon Select Foods, and LEIMER KG are being noted for regional reach, cost-effective production, and niche customization. Competition is being measured by crumb texture, flavor neutrality, and application flexibility, while market leadership is reinforced by traceable sourcing, production consistency, and rapid fulfillment capabilities. Product brochures are being curated as concise, persuasive tools to communicate quality, versatility, and application benefits. Kikkoman, General Mills, and Kerry Global brochures highlight crumb characteristics, usage recommendations, and packaging options with clear visuals and performance metrics. George DeLallo, 4C Foods, and Newly Weds brochures emphasize customization, coating efficiency, and industrial-scale compatibility.

Aleia’s and Gillian’s brochures focus on gluten-free certification, nutritional benefits, and premium quality assurance. FRUMEN, Bon Food Industries, Ripon Select, and LEIMER KG brochures highlight regional adaptability, cost-effective solutions, and consistent texture. Each brochure is being structured as a standalone reference, combining diagrams, concise specifications, and application guides. The result is a compact, authoritative presentation that ensures breadcrumbs offerings are communicated with clarity, credibility, and immediate decision-making appeal for food manufacturers, chefs, and procurement teams.

| Item | Value |

|---|---|

| Quantitative Units | USD 1003.5 Million |

| Product | Fresh breadcrumbs, Dry breadcrumbs, Gluten free breadcrumbs, Panko breadcrumbs, and Other |

| Seasoning | Unflavored and Flavored |

| End Use Application | Coating & Breading, Stuffing, Baking, Snacks & Appetizer, and Other |

| Distribution Channel | Retail Stores, Online Retail, Food Service, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kikkoman Corporation, Kerry Global, George DeLallo Company, 4C Foods Corp., General Mills Inc, Gillian's Foods Inc., Aleia's Gluten Free Foods, Newly Weds Foods, FRUMEN, Bon Food Industries Sdn Bhd, Ripon Select Foods Limited, and LEIMER KG |

| Additional Attributes | Dollar sales by product type (plain, seasoned, panko, gluten-free) and application (bakery, fast food, processed foods, snacks) are key metrics. Trends include rising demand for convenient and ready-to-use coatings, growth in foodservice and retail sectors, and increasing adoption in frozen and prepared meals. Regional adoption, consumer preferences, and technological advancements are driving market growth. |

The global breadcrumbs market is estimated to be valued at USD 1,003.5 million in 2025.

The market size for the breadcrumbs market is projected to reach USD 1,650.3 million by 2035.

The breadcrumbs market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in breadcrumbs market are fresh breadcrumbs, dry breadcrumbs, gluten free breadcrumbs, panko breadcrumbs and other.

In terms of seasoning, unflavored segment to command 61.8% share in the breadcrumbs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA