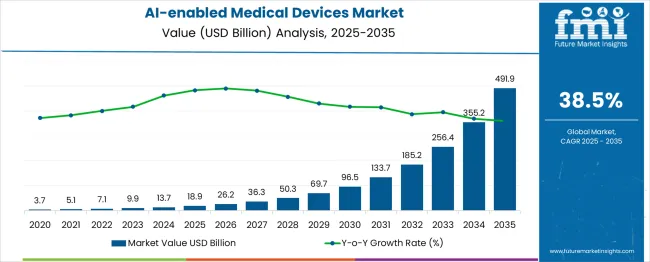

The AI-enabled medical devices market is valued at USD 18.9 billion in 2025 and is projected to reach USD 96.5 billion by 2030, reflecting a remarkable 5-year growth block. With values rising from USD 26.2 billion in 2026 to USD 50.3 billion in 2028, this market shows an accelerated adoption of AI-driven tools across diagnostics, imaging, patient monitoring, and treatment devices. This surge indicates that healthcare providers are increasingly turning to AI solutions to enhance patient care, streamline workflows, and improve diagnostic accuracy. The rapid growth is driven by an expanding healthcare need for smarter devices that can handle complex tasks with precision and efficiency.

The AI-enabled medical devices market stood at USD 18.9 billion in 2025 and is expected to grow to USD 96.5 billion by 2030, with a CAGR of 38.5%. Year-on-year increments reflect strong market momentum, with values moving from USD 36.3 billion in 2027 to USD 69.7 billion in 2029. This indicates a shift towards more widespread use of AI in both consumer-facing and institutional healthcare applications. The significant growth is driven by the demand for next-generation medical devices that provide actionable insights, real-time data, and personalized treatment options. This 5-year analysis highlights that AI in medical devices is not just a trend but a fundamental component that is set to redefine the future of healthcare systems globally.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 18.9 billion |

| Forecast Value in (2035F) | USD 491.9 billion |

| Forecast CAGR (2025 to 2035) | 38.5% |

The AI-enabled medical devices market has rapidly gained prominence within several expansive parent markets, with significant integration across healthcare and technology sectors. Within the artificial intelligence market, AI-enabled medical devices account for approximately 5.3%, as AI’s role in enhancing diagnostics, predictive analytics, and decision-making continues to expand across healthcare applications. In the medical devices market, the share is around 6.2%, driven by the increasing adoption of AI-driven solutions such as smart sensors, imaging systems, and robotic surgery tools that improve accuracy, speed, and patient outcomes. The healthcare IT market records a penetration of about 5.7%, as AI-enabled devices are integrated into digital health platforms for data analysis, remote monitoring, and personalized care. Within the diagnostic imaging market, AI-enabled devices hold a 6.8% share, reflecting the growing use of AI algorithms to interpret images, detect abnormalities, and enhance diagnostic accuracy in radiology, pathology, and ophthalmology. The wearable medical devices market contributes about 4.5%, driven by the rise of AI-powered wearables that monitor patient health, detect early signs of illness, and enable real-time intervention. Collectively, the AI-enabled medical devices market represents approximately 28.5% across these industries, underlining its essential role in advancing healthcare delivery, improving patient outcomes, and optimizing operational efficiency. Adoption has been propelled by the need for more precise diagnostics, enhanced treatment planning, and the ability to provide continuous, real-time monitoring, making AI-enabled medical devices a transformative force across these parent markets.

Market expansion is being supported by the increasing adoption of artificial intelligence in healthcare settings and the corresponding demand for enhanced diagnostic accuracy and treatment precision. Modern healthcare providers are increasingly focused on improving patient outcomes through advanced technologies that can analyze complex medical data, identify patterns, and provide real-time insights for clinical decision-making. AI's proven efficacy in medical imaging analysis, predictive diagnostics, and personalized treatment planning makes it a preferred technology in advanced healthcare systems.

The growing emphasis on value-based healthcare and cost reduction is driving demand for AI-powered medical devices that can improve efficiency and reduce human error. Healthcare provider preference for integrated solutions that combine diagnostic capabilities with treatment recommendations is creating opportunities for innovative AI-enabled platforms. The rising influence of telemedicine and remote monitoring trends is also contributing to increased adoption of smart medical devices across different healthcare settings and patient demographics.

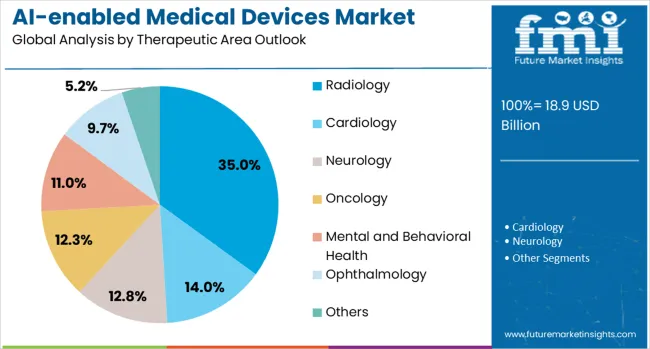

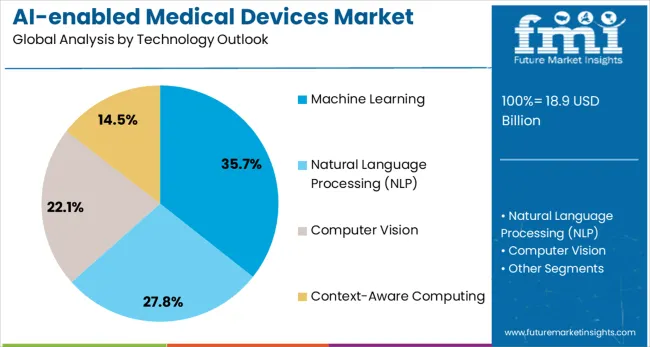

The market is segmented by component outlook, technology outlook, therapeutic area outlook, and end use outlook. By component outlook, the market is divided into software, hardware, and services. Based on technology outlook, the market is categorized into machine learning, deep learning, natural language processing, computer vision, and context-aware computing. In terms of therapeutic area outlook, the market is segmented into radiology, cardiology, neurology, oncology, mental and behavioral health, and ophthalmology. By end use outlook, the market is classified into hospitals & clinics, diagnostic centers, ambulatory surgical centers, and home care settings.

The radiology therapeutic area is projected to account for 35% of the AI-enabled medical devices market in 2025, reaffirming its position as the category's leading application. Healthcare providers increasingly recognize the value of AI in medical imaging analysis, where machine learning algorithms can detect abnormalities, assist in diagnosis, and improve radiologist efficiency. AI-powered radiology solutions directly address the growing demand for faster, more accurate image interpretation while reducing diagnostic errors and improving patient outcomes.

This therapeutic area forms the foundation of most AI medical device deployments, as it represents the most mature and clinically validated application of artificial intelligence in healthcare. Radiologist endorsements and ongoing clinical studies continue to strengthen trust in AI-enhanced imaging systems. With healthcare systems facing increased imaging volumes and radiologist shortages, AI-enabled radiology solutions align with both operational efficiency and quality improvement goals. The broad clinical applicability across multiple medical conditions ensures sustained dominance, making it the central growth driver of AI medical device adoption.

Software is projected to represent 51% of AI-enabled medical devices demand in 2025, underscoring its role as the preferred component for implementing artificial intelligence in healthcare applications. Healthcare providers gravitate toward software solutions for their flexibility, scalability, and ability to integrate with existing medical systems, maximizing the effectiveness of AI algorithms and analytics. Positioned as the core technology platform, software enables both diagnostic applications, such as image analysis and pattern recognition, and predictive applications, including risk assessment and treatment optimization.

The segment is supported by the rising adoption of cloud-based healthcare solutions, where AI software plays a central role in data processing and analysis strategies. Additionally, healthcare technology companies are increasingly combining AI software with complementary technologies like IoT sensors, electronic health records, or telemedicine platforms, enhancing clinical value and justifying technology investments. As healthcare providers prioritize interoperability and system integration, AI-enabled software solutions will continue to dominate demand, reinforcing their position as the foundation of intelligent healthcare systems.

The machine learning technology is forecasted to contribute 36% of the AI-enabled medical devices market in 2025, reflecting its fundamental role as the core artificial intelligence approach in healthcare applications. Healthcare providers increasingly rely on machine learning algorithms for their ability to analyze large datasets, identify clinical patterns, and improve diagnostic accuracy over time through continuous learning. This aligns with the evidence-based medicine movement, which emphasizes data-driven clinical decision-making and objective treatment recommendations.

Machine learning's proven track record in medical applications provides credibility and confidence among healthcare professionals. The technology also benefits from extensive research validation and regulatory approval pathways that demonstrate safety and efficacy in clinical settings. With healthcare systems generating increasing amounts of patient data, machine learning serves as the essential technology for extracting actionable insights, making it a critical driver of trust and adoption in the AI-enabled medical devices category.

The AI-enabled medical devices market has been significantly influenced by the increasing need for precision diagnostics, personalized treatment plans, and automation in healthcare systems. Demand has surged due to advancements in machine learning, computer vision, and predictive analytics. Opportunities are arising in sectors like diagnostics, remote monitoring, and surgical robotics. Trends indicate greater adoption of AI-driven tools in radiology, cardiology, and patient management. However, challenges related to regulatory approval, data privacy, and system integration remain significant barriers for widespread adoption across global healthcare systems.

The AI-enabled medical devices market has been shaped by significant trends in AI-powered imaging, diagnostic tools, and patient management platforms. AI algorithms for image recognition, pattern analysis, and predictive diagnostics have been increasingly deployed in medical imaging systems, leading to improved detection rates, especially in areas like cancer screening and cardiovascular diagnostics. In opinion, AI-powered imaging devices are surpassing traditional tools by offering faster and more accurate diagnoses, which is reducing the time to treatment. Furthermore, the trend toward AI-enabled patient management tools is reshaping how hospitals and clinics track patient progress, manage treatment regimens, and anticipate medical needs. These systems integrate data from multiple sources, such as electronic health records and wearable devices, to provide a comprehensive view of patient health. Overall, these trends reflect a shift toward more personalized, real-time, and data-driven healthcare practices that are poised to enhance patient outcomes while streamlining healthcare workflows.

Despite the positive outlook, the AI-enabled medical devices market faces challenges in regulatory approval, data privacy concerns, and system integration complexities. In opinion, navigating the complex regulatory landscape, especially in regions like the USA and the EU, presents hurdles for companies looking to bring AI-powered medical devices to market. Regulatory bodies are struggling to keep pace with rapid advancements in AI, often resulting in delays in approval processes. Data privacy remains a significant concern, particularly with the vast amounts of sensitive health information being processed by AI devices, which must comply with stringent data protection regulations like HIPAA and GDPR. Moreover, integrating AI-driven devices with existing hospital infrastructure, such as electronic health records (EHR) systems and other medical technologies, can be challenging, requiring substantial investments in interoperability solutions. These challenges could slow the widespread adoption of AI-powered devices and hinder market growth unless addressed through clearer regulations, robust cybersecurity measures, and smoother integration strategies.

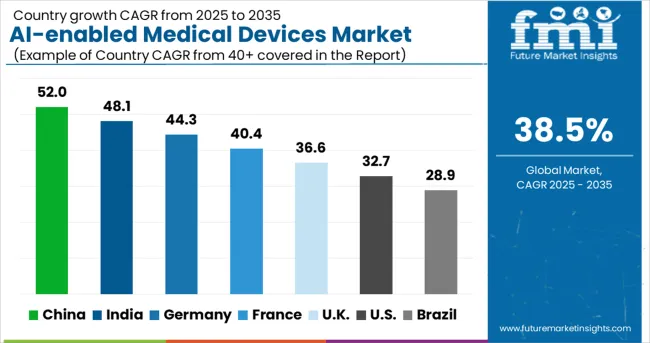

| Countries | CAGR (2025-2035) |

|---|---|

| China | 52% |

| India | 48.1% |

| United States | 32.7% |

| Japan | 45.8% |

| United Kingdom | 36.6% |

| Germany | 44.3 |

| Brazil | 28.9 |

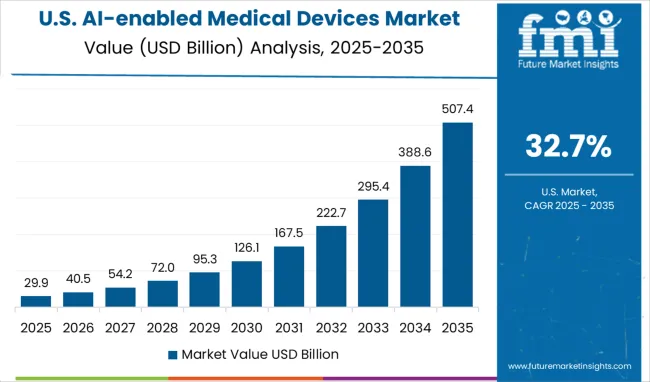

The global AI-enabled medical devices market is projected to experience substantial growth from 2025 to 2035, with varying growth rates across countries. China leads with an impressive CAGR of 52%, followed by India at 48.1%, and Japan at 45.8%. Germany records a growth rate of 44.3%, the United Kingdom shows 36.6%, and the United States expands at 32.7%. This market’s expansion is driven by the growing adoption of AI-driven diagnostics, personalized healthcare, and the increasing demand for advanced medical technologies across the globe. Emerging markets like China and India are experiencing rapid growth due to expanding healthcare infrastructure, a rising digital health ecosystem, and government-backed initiatives, while developed markets focus on integrating AI into healthcare workflows, precision medicine, and complex medical devices.

The report covers an in-depth analysis of 40+ countries; the top-performing countries are highlighted below.

The AI-enabled medical devices market in China is growing at an extraordinary CAGR of 52%, fueled by the rapid adoption of AI technologies in diagnostics, imaging, and patient monitoring. Chinese healthcare providers are deploying AI-powered medical devices to enhance diagnostic accuracy, personalize treatment plans, and improve patient outcomes. The country's strong emphasis on healthcare reform, investment in digital health infrastructure, and government policies supporting AI in healthcare further reinforce the market’s expansion. China’s robust technology ecosystem, supported by tech giants and startups alike, continues to innovate in AI-driven medical devices, driving the adoption of devices for cardiovascular diseases, cancer detection, and chronic condition management.

The AI-enabled medical devices market in the United States is expanding at a CAGR of 32.7%, with substantial growth in diagnostics, imaging, and therapeutic devices. USA hospitals and healthcare providers are increasingly leveraging AI-driven medical devices to improve diagnostic accuracy, streamline workflows, and optimize treatment plans. The USA is home to a robust ecosystem of medical device manufacturers and technology companies that are advancing AI algorithms and hardware for medical applications. Regulatory support from the FDA, alongside strong investment in healthtech startups and R&D, ensures continuous innovation in the sector. Additionally, the growing demand for AI-powered wearables and smart medical devices further fuels market expansion.

The AI-enabled medical devices market in Japan is expanding at a CAGR of 45.8%, supported by a strong emphasis on high-quality healthcare and advanced technologies in diagnostics and treatment. Japanese hospitals and healthcare providers are adopting AI medical devices to enhance clinical decision-making, improve patient monitoring, and optimize hospital workflows. The aging population in Japan is driving demand for advanced medical technologies, including AI-driven devices for chronic disease management, rehabilitation, and elderly care. Japan's focus on cutting-edge technologies, government support for AI healthcare applications, and partnerships between hospitals and tech firms continue to drive the adoption of AI-enabled medical devices.

The AI-enabled medical devices market in the United Kingdom is growing at a CAGR of 36.6%, driven by the rising adoption of AI in healthcare applications, particularly in diagnostics, imaging, and treatment planning. The UK National Health Service (NHS) is actively incorporating AI technologies into clinical workflows to enhance efficiency, accuracy, and patient outcomes. Investment in AI healthcare startups, growing research in medical AI technologies, and strong government support for AI health initiatives further drive market expansion. Additionally, the adoption of AI-powered wearables and diagnostic tools is enhancing personalized healthcare delivery across the country.

The AI-enabled medical devices market in Germany is projected to grow at a CAGR of 44.3%, driven by a strong healthcare infrastructure, widespread adoption of telemedicine, and increasing use of AI in diagnostics and personalized medicine. German hospitals and clinics are incorporating AI-powered devices to enhance diagnostic accuracy, treatment personalization, and patient management. The country’s regulatory environment and government-backed research initiatives contribute to the rapid integration of AI in healthcare settings. Germany’s emphasis on health innovation and its collaborative environment between tech companies and healthcare institutions continue to accelerate the development and deployment of AI-powered medical devices in various sectors, including oncology and cardiology.

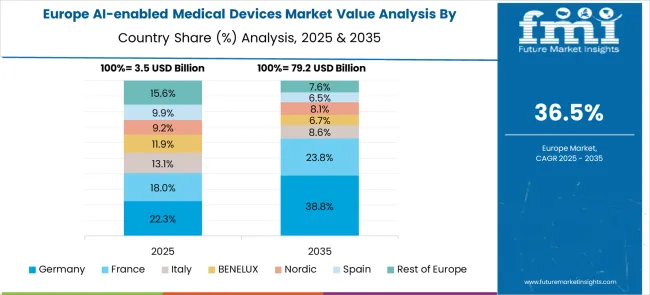

The AI-enabled medical devices market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced healthcare infrastructure and significant investment in medical technology innovation, supported by leading companies leveraging engineering expertise to develop sophisticated AI-powered diagnostic and surgical systems that enhance clinical precision and patient safety outcomes.

France represents a significant market driven by its comprehensive healthcare system and government support for digital health initiatives, with companies focusing on AI-enabled medical imaging and diagnostic solutions that combine French healthcare excellence with advanced artificial intelligence capabilities for improved patient care and medical efficiency.

The UK exhibits considerable growth through its National Health Service digitization efforts and strong medical research capabilities, with healthcare technology companies developing AI-powered solutions for population health management and clinical decision support systems. Germany and France show expanding adoption of AI-enabled surgical robotics and diagnostic imaging systems, particularly in premium healthcare facilities. BENELUX countries contribute through their focus on healthcare innovation and digital health integration, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare technology adoption and expanding access to advanced AI-powered medical devices across diverse healthcare settings.

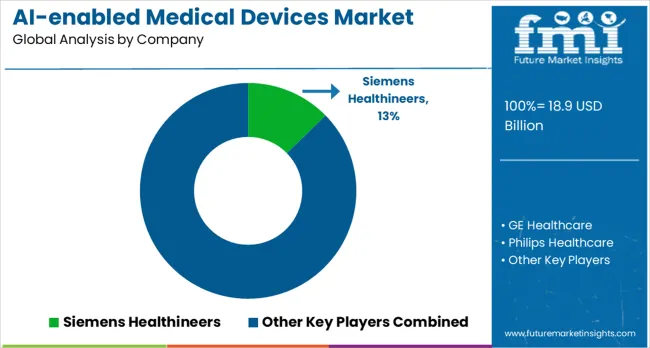

The AI-enabled medical devices market is being propelled by leading medical technology companies and innovative AI startups focused on integrating artificial intelligence into diagnostics, monitoring, and surgical tools. Siemens Healthineers, GE Healthcare, and Philips Healthcare are positioned as front-runners through their advanced imaging systems and diagnostic solutions, embedding AI algorithms for enhanced precision, early detection, and personalized treatment. Their strategy is directed toward real-time data processing, predictive analytics, and automation in medical workflows to improve patient outcomes. Medtronic, Johnson & Johnson (Ethicon), and Stryker are recognized for pioneering AI in surgical tools and robotic-assisted procedures, enabling higher accuracy and minimizing human error.

Canon Medical Systems and Zimmer Biomet are being noted for incorporating AI into orthopedics and imaging equipment, enhancing diagnostics, patient monitoring, and recovery management. Abbott Laboratories, Boston Scientific, and Exo Imaging, Inc. are being directed toward monitoring devices, wearables, and diagnostic tools that leverage AI for early disease detection, continuous monitoring, and predictive health insights. Empatica, Aidoc, Clew Medical, Eko Health, and Paige AI, Inc. are being noted for AI-driven software solutions and advanced diagnostic imaging capabilities, catering to niche markets like neurology, oncology, and cardiology. Competition is being defined by the integration of AI with existing medical equipment, ease of use, and regulatory compliance, while market leadership is reinforced through proven clinical outcomes, rapid adoption, and strong partnerships across healthcare ecosystems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.9 billion |

| Component Outlook | Software, Hardware, Services |

| Technology Outlook | Machine Learning, Deep learning, Natural Language Processing, Computer Vision, Context-Aware Computing |

| Therapeutic Area Outlook | Radiology, Cardiology, Neurology, Oncology, Mental and Behavioral Health, Ophthalmology |

| End Use Outlook | Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Home Care Settings |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, Johnson & Johnson (Ethicon), Stryker, Canon Medical Systems, Zimmer Biomet, Abbott Laboratories, and Boston Scientific |

| Additional Attributes | Dollar sales by AI technology type and application level, regional adoption trends, competitive landscape, healthcare provider preferences for AI algorithms versus traditional diagnostic methods, integration with electronic health records and clinical workflow systems, innovations in machine learning algorithms, deep learning applications, and regulatory approval processes for AI medical devices |

The global AI-enabled medical devices market is estimated to be valued at USD 18.9 billion in 2025.

The market size for the AI-enabled medical devices market is projected to reach USD 491.9 billion by 2035.

The AI-enabled medical devices market is expected to grow at a 38.5% CAGR between 2025 and 2035.

The key product types in the AI-enabled medical devices market are software, hardware, AI-enabled medical devices, smart wearables and services.

In terms of technology outlook, machine learning segment to command 35.7% share in the ai-enabled medical devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA