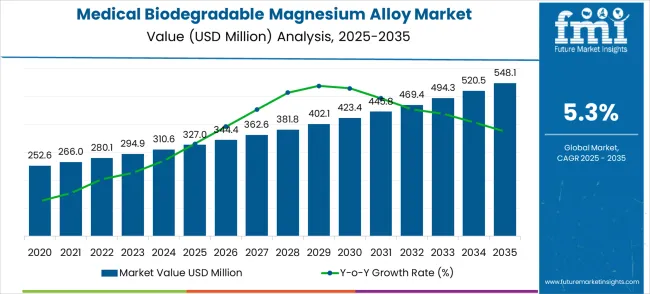

The global medical biodegradable magnesium alloy market is projected to grow from USD 327.0 million in 2025 to approximately USD 548.1 million by 2035, recording an absolute increase of USD 221.1 million over the forecast period. This translates into a total growth of 67.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035.

The market size is expected to grow by nearly 1.7X during the same period, supported by increasing adoption of bioabsorbable medical implants, rising demand for temporary medical devices that eliminate secondary removal surgeries, and growing emphasis on patient safety and enhanced recovery protocols across diverse surgical applications.

Between 2025 and 2030, the medical biodegradable magnesium alloy market is projected to expand from USD 327.0 million to USD 423.4 million, resulting in a value increase of USD 96.4 million, which represents 43.6% of the total forecast growth for the decade.

This phase of development will be shaped by increasing clinical adoption of biodegradable implants, expanding regulatory approvals for magnesium-based medical devices, and growing surgeon preference for bioabsorbable materials that reduce patient complications and improve treatment outcomes. Medical device manufacturers are expanding their biodegradable magnesium alloy product portfolios to address the growing demand for advanced biocompatible materials and next-generation surgical implants.

From 2030 to 2035, the market is forecast to grow from USD 423.4 million to USD 548.1 million, adding another USD 124.7 million, which constitutes 56.4% of the ten-year expansion. This period is expected to be characterized by the expansion of advanced biodegradable alloy formulations with enhanced mechanical properties, the integration of personalized medicine approaches for patient-specific implants, and the development of specialized coating technologies for improved biocompatibility and controlled degradation rates.

The growing adoption of 3D printing technologies and customized implant manufacturing will drive demand for biodegradable magnesium alloys with enhanced processing capabilities and tailored degradation profiles.

Between 2020 and 2025, the medical biodegradable magnesium alloy market experienced steady development, driven by advancing biomedical engineering research and growing recognition of the clinical benefits of bioabsorbable implant materials in orthopedic and cardiovascular applications.

The market developed as medical professionals recognized the potential for biodegradable magnesium alloys to eliminate complications associated with permanent implants, reduce patient recovery times, and provide superior biocompatibility compared to traditional metallic implant materials. Advanced alloy development and clinical validation studies have begun to emphasize the critical importance of biodegradable materials for next-generation medical device applications and patient-centered care.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 327.0 million |

| Forecast Value in (2035F) | USD 548.1 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

Market expansion is being supported by the exponential growth of minimally invasive surgical procedures and the corresponding demand for biodegradable implant materials that can support temporary structural support while eliminating the need for secondary removal surgeries and reducing long-term patient complications. Modern healthcare providers are increasingly focused on bioabsorbable solutions that provide mechanical support during healing while naturally dissolving in the body without adverse effects. Biodegradable magnesium alloys' proven ability to deliver biocompatibility, mechanical strength, and controlled degradation makes them essential materials for advanced surgical applications and patient safety optimization initiatives.

The growing emphasis on patient-centered care and surgical outcome improvement is driving demand for implant materials that can reduce surgical complications, minimize patient discomfort, and support enhanced recovery protocols. Healthcare preference for materials that combine mechanical performance with biological compatibility and natural absorption is creating opportunities for innovative biodegradable magnesium alloy implementations. The rising influence of personalized medicine and customized treatment approaches is also contributing to increased adoption of biodegradable alloys that can provide tailored degradation rates and patient-specific mechanical properties.

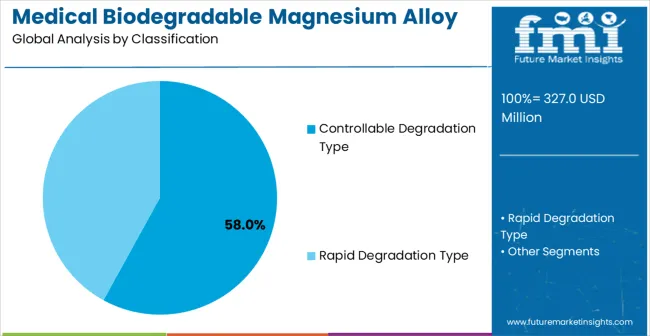

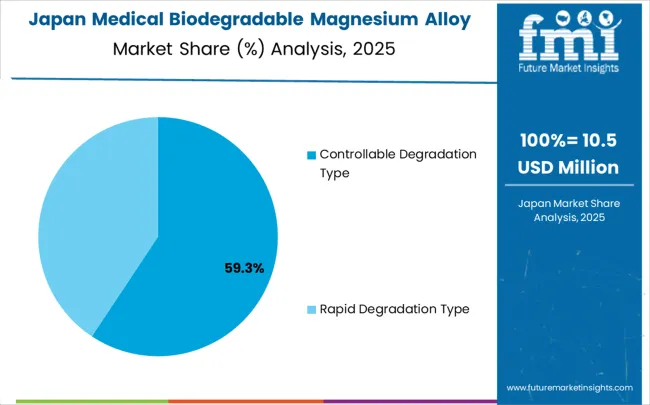

The medical biodegradable magnesium alloy market is expanding as demand grows for temporary implants that naturally degrade within the human body. Controllable degradation types dominate the degradation segment with approximately 69% of the market share, offering predictable resorption rates of 3-12 months depending on alloy composition and implant size.

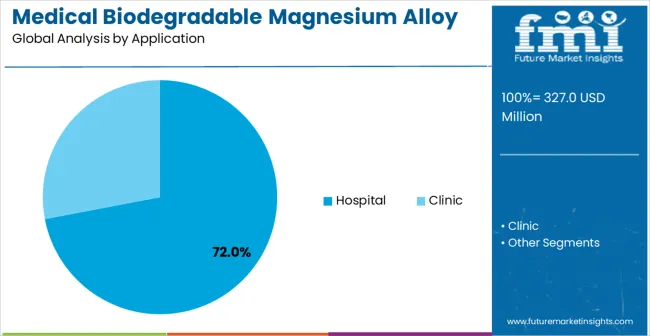

Hospitals lead the application segment with around 59% of the market, reflecting extensive use in orthopedic, cardiovascular, and craniofacial surgeries. Market growth is driven by rising surgical volumes, the need for implants that eliminate secondary removal procedures, and increasing adoption of biocompatible, high-strength, and corrosion-controlled materials.

Controllable degradation magnesium alloys hold roughly 58% of the degradation type segment, making them the most widely used material for temporary medical implants. These alloys allow predictable resorption within 3-12 months while maintaining mechanical strength between 150-250 MPa during the healing period. Leading manufacturers include Syntellix, Biotronik, Magnezit, and Jinan Yunhai Medical. Controllable alloys are preferred for their tunable corrosion rates, compatibility with bone tissue, and ability to support load-bearing applications, ensuring safety and effectiveness during post-surgical recovery.

Hospitals account for approximately 72% of the application segment, making them the largest consumer of biodegradable magnesium implants. These facilities use alloys in orthopedic, cardiovascular, and craniofacial procedures, where predictable degradation and biocompatibility are essential. Suppliers such as Syntellix, Biotronik, Magnezit, and Jinan Yunhai Medical provide implants with controlled corrosion rates, mechanical stability, and biocompatible coatings. Segment growth is fueled by increasing surgical volumes, demand for minimally invasive procedures, and preference for implants that reduce the need for secondary removal surgeries.

The medical biodegradable magnesium alloy market is advancing steadily due to evolving surgical practices and increasing demand for bioabsorbable implant materials that support patient safety and improved clinical outcomes. The market faces challenges, including regulatory complexities for biodegradable medical devices, concerns about degradation rate consistency and predictability, and higher material costs compared to traditional permanent implants. Innovation in alloy composition and surface treatment technologies continues to influence market development and clinical adoption patterns.

The expanding adoption of minimally invasive surgical techniques and growing focus on patient safety protocols are enabling biodegradable magnesium alloys to support advanced surgical applications where traditional permanent implants may present long-term complications or require additional procedures. Patient safety focus provides enhanced market opportunities while allowing superior biocompatible materials across various surgical specialties and treatment applications. Healthcare organizations are increasingly recognizing the competitive advantages of biodegradable materials for improved patient outcomes and reduced healthcare costs.

Modern biodegradable magnesium alloy providers are incorporating personalized medicine approaches and advanced manufacturing technologies to enhance product appeal and address surgeons' concerns about implant customization and degradation control. These technological enhancements improve material value while enabling new market segments, including patient-specific implants and precision medicine applications requiring tailored degradation profiles and mechanical properties. Advanced manufacturing integration also allows biodegradable alloys to differentiate from conventional implant materials while supporting customized treatment approaches and surgical precision.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| USA | 5.0% |

| UK | 4.5% |

| Japan | 4.0% |

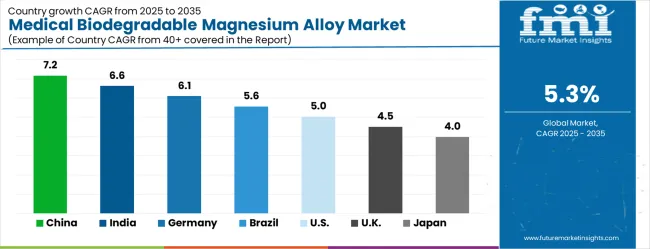

The medical biodegradable magnesium alloy market is experiencing solid growth globally, with China leading at a 7.2% CAGR through 2035, driven by expanding healthcare infrastructure, increasing investment in advanced medical technologies, and growing adoption of innovative surgical materials among leading medical institutions. India follows closely at 6.6%, supported by a rapidly developing healthcare sector, increasing medical device manufacturing capabilities, and a growing focus on cost-effective surgical solutions.

Germany shows strong growth at 6.1%, prioritizing advanced biomedical engineering capabilities and comprehensive medical device development programs. Brazil records 5.6%, focusing on healthcare modernization and expanding access to advanced surgical materials.

The United States shows 5.0% growth, prioritizing medical innovation leadership and comprehensive clinical validation programs. The United Kingdom demonstrates 4.5% growth, supported by advanced healthcare infrastructure and medical research capabilities. Japan shows 4.0% growth, prioritizing on precision manufacturing and quality medical device development.

The report covers detailed analysis of 40+ countries, with the top countries shared as a reference.

Revenue from medical biodegradable magnesium alloys in China is projected to exhibit exceptional growth with a CAGR of 7.2% through 2035, driven by massive healthcare infrastructure development and advancing medical technology adoption programs requiring innovative surgical materials.

The country's leadership in manufacturing capabilities and strong government support for healthcare modernization are creating significant demand for sophisticated biodegradable implant materials. Major domestic and international medical device manufacturers are establishing comprehensive biodegradable alloy production capabilities to serve both domestic healthcare markets and global export opportunities.

The medical biodegradable magnesium alloys market in India is expanding at a CAGR of 6.6%, supported by the rapidly developing healthcare infrastructure, expanding medical device manufacturing sector, and increasing adoption of advanced surgical materials among growing healthcare institutions.

The country's large patient population and strong focus on cost-effective healthcare solutions are driving requirements for innovative biodegradable materials. International medical device companies and domestic manufacturers are establishing comprehensive development and production capabilities to address the growing demand for biodegradable surgical materials.

The medical biodegradable magnesium alloys in Germany is projected to grow at a CAGR of 6.1% through 2035, prioritizing advanced biomedical engineering capabilities and comprehensive medical device development programs within Europe's leading medical technology hub.

The country's established medical device industry and commitment to technological excellence are driving sophisticated biodegradable material requirements. German medical device manufacturers and research institutions consistently demand high-precision magnesium alloys that meet stringent biocompatibility standards and provide superior integration capabilities with advanced surgical applications.

The medical biodegradable magnesium alloys market in Brazil is expanding at a CAGR of 5.6% through 2035, focusing on healthcare modernization and expanding access to advanced surgical materials across Latin America's largest healthcare market.

Brazilian healthcare organizations value cost-effective surgical solutions, proven biocompatibility, and reliable performance characteristics, positioning biodegradable magnesium alloys as essential materials for modern medical applications. The country's expanding healthcare infrastructure and increasing surgical capabilities are creating sustained demand for advanced biodegradable materials.

The medical biodegradable magnesium in market alloys in the United States is projected to grow at a CAGR of 5.0% through 2035, driven by medical innovation leadership, comprehensive clinical validation programs, and established regulatory frameworks supporting advanced biomaterial development.

American healthcare organizations prioritize clinical efficacy, technological advancement, and regulatory compliance, making biodegradable magnesium alloys a strategic choice for advanced surgical applications. The market benefits from mature medical device infrastructure and sophisticated clinical requirements.

The medical biodegradable magnesium alloys market in the United Kingdom is expanding at a CAGR of 4.5% through 2035, supported by advanced healthcare infrastructure, established medical research capabilities, and growing commitment to innovative surgical materials and patient care excellence. British healthcare organizations value clinical effectiveness, technological sophistication, and regulatory compliance, positioning biodegradable magnesium alloys as essential materials for advanced medical applications.

The medical biodegradable magnesium alloys industry in Japan is projected to grow at a CAGR of 4.0% through 2035, prioritizing on precision manufacturing excellence, advanced quality control standards, and comprehensive technology integration aligned with Japanese medical device manufacturing traditions.

Japanese healthcare organizations prioritize technological precision, clinical reliability, and long-term patient safety, making biodegradable magnesium alloys a strategic choice for premium medical applications. The market is supported by sophisticated healthcare infrastructure and established biomedical engineering expertise.

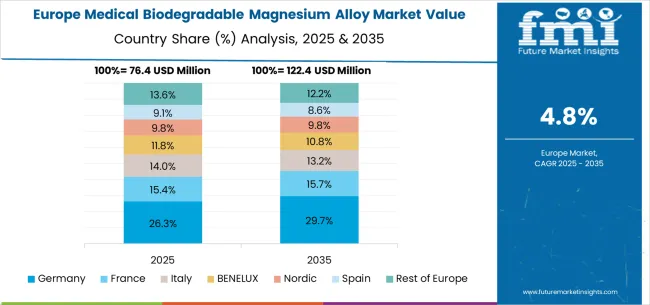

The medical biodegradable magnesium alloy market in Europe is projected to grow from USD 89.7 million in 2025 to USD 146.3 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, projected to reach 33.1% by 2035, supported by its advanced biomedical engineering capabilities and major medical device manufacturers, including comprehensive research and development programs in Berlin, Munich, and Hamburg medical centers.

The United Kingdom follows with a 21.8% share in 2025, projected to reach 22.3% by 2035, driven by comprehensive medical research programs and advanced healthcare infrastructure development in London and other major medical centers. France holds a 17.9% share in 2025, expected to reach 18.2% by 2035 due to expanding medical device innovation and healthcare technology development initiatives.

Italy commands a 13.5% share, while Spain accounts for 8.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.7% to 6.1% by 2035, attributed to increasing biodegradable alloy adoption in Nordic countries and emerging Eastern European healthcare markets implementing advanced surgical material programs.

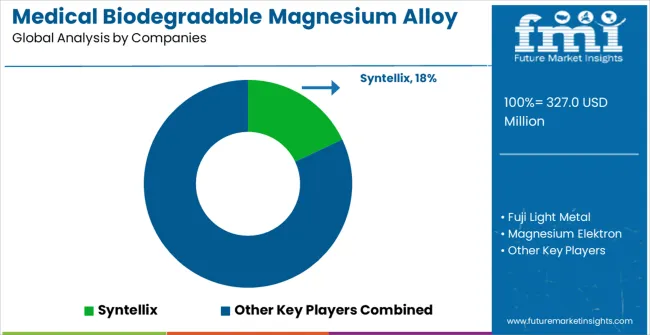

The medical biodegradable magnesium alloy market is characterized by competition among established medical device manufacturers, specialized biomaterial companies, and emerging biodegradable technology developers. Companies are investing in alloy composition research, biocompatibility testing, regulatory approval processes, and comprehensive medical device integration solutions to deliver safe, effective, and clinically validated biodegradable implant materials. Innovation in degradation control technology, surface treatment methods, and manufacturing process optimization is central to strengthening market position and clinical acceptance.

Syntellix leads the market with comprehensive biodegradable magnesium implant solutions, offering clinically validated orthopedic devices with focus on surgical effectiveness and patient safety. Fuji Light Metal provides advanced magnesium alloy manufacturing with focus on medical-grade material quality and biocompatibility standards. Magnesium Elektron delivers specialized magnesium alloy technologies with focus on controlled degradation and mechanical performance. Biotronik focuses on cardiovascular biodegradable solutions with focus on precision engineering and clinical validation.

Luxfer specializes in advanced magnesium technologies with medical device applications and quality manufacturing. Terves provides biodegradable magnesium solutions with focus on oil and gas applications extending to medical uses. Other key players including Wingoil, Five Star Downhole, Meifu Technology, Baohuifeng, Kunfugroup Special Magnesium, Galvotec, Dome Metals, Chongqing Yuhua New Materials Technology, Eontec, SINOMED, FUMEI, BAOWU, and Origin Medical contribute specialized manufacturing capabilities and regional market development across various biodegradable magnesium alloy applications.

Biodegradable magnesium alloys represent a transformative shift in medical implant technology, offering the unique advantage of providing temporary mechanical support while naturally dissolving in the body, eliminating the need for secondary removal surgeries.

With the market projected to grow from USD 327.0 million in 2025 to USD 548.1 million by 2035 at a 5.3% CAGR, these biocompatible materials address critical clinical needs including reduced patient complications, enhanced recovery protocols, and improved surgical outcomes. Accelerating market adoption requires coordinated efforts across regulatory agencies, medical standards organizations, device manufacturers and research institutions, healthcare providers and surgical specialists, and investment and commercialization partners.

Streamlined Regulatory Pathways: Establish specialized approval frameworks for biodegradable medical devices that account for their unique degradation characteristics, biocompatibility requirements, and temporary nature. Develop expedited review processes for clinically validated magnesium alloy implants that demonstrate clear patient safety and efficacy benefits over permanent alternatives.

Clinical Research Funding: Invest in large-scale clinical trials and long-term safety studies for biodegradable magnesium alloys across multiple surgical applications including orthopedic, cardiovascular, and pediatric uses. Support comparative effectiveness research demonstrating cost-benefit advantages of eliminating secondary removal procedures.

Healthcare Infrastructure Development: Provide funding for advanced surgical facilities and specialized equipment needed for biodegradable implant procedures, particularly in emerging markets like China (7.2% CAGR) and India (6.6% CAGR) where healthcare infrastructure expansion creates significant growth opportunities.

International Harmonization: Lead efforts to standardize biodegradable medical device regulations across major markets, reducing regulatory complexity for manufacturers and accelerating global market access for validated technologies.

Innovation Incentives: Offer tax credits, grants, and intellectual property protections for companies developing next-generation biodegradable alloy formulations, surface treatment technologies, and manufacturing processes that improve clinical outcomes and reduce costs.

Biocompatibility and Safety Standards: Develop comprehensive testing protocols for biodegradable magnesium alloys covering degradation rate consistency, corrosion product safety, mechanical property evolution, and biological response validation to ensure predictable clinical performance.

Surgical Guidelines and Best Practices: Establish clinical protocols for optimal use of rapid degradation versus controllable degradation alloys based on specific surgical applications, patient characteristics, and treatment objectives. Create surgeon training curricula for biodegradable implant techniques and patient monitoring.

Quality Assurance Frameworks: Define manufacturing standards for medical-grade magnesium alloys including purity requirements, microstructure control, surface treatment specifications, and batch-to-batch consistency measures that ensure reliable clinical performance.

Clinical Evidence Database: Maintain centralized registries of biodegradable implant outcomes, complications, and long-term patient follow-up data to support evidence-based decision making and identify optimal application areas for different alloy types.

International Collaboration: Coordinate with global medical societies to share clinical experience, research findings, and best practices for biodegradable magnesium alloy applications across different healthcare systems and patient populations.

Advanced Alloy Development: Invest in next-generation magnesium alloy compositions that provide tailored degradation profiles, enhanced mechanical properties, and improved biocompatibility for specific surgical applications including pediatric implants where growth accommodation is critical.

Personalized Medicine Integration: Develop 3D printing capabilities and patient-specific manufacturing processes that enable customized biodegradable implants based on individual patient anatomy, bone density, and healing characteristics, particularly important for complex orthopedic applications.

Surface Engineering Technologies: Create advanced coating systems and surface treatments that provide controlled degradation rates, enhanced biointegration, and reduced inflammatory responses while maintaining the mechanical properties required for specific surgical applications.

Manufacturing Process Innovation: Develop scalable, cost-effective production methods including powder metallurgy, additive manufacturing, and precision machining techniques that reduce material costs while ensuring consistent quality and regulatory compliance.

Clinical Validation Programs: Establish comprehensive clinical research partnerships with leading medical centers to conduct rigorous safety and efficacy studies, generate real-world evidence, and support regulatory submissions for new biodegradable alloy applications.

Clinical Experience Development: Build surgical expertise through training programs, fellowship opportunities, and hands-on workshops focused on biodegradable implant techniques, patient selection criteria, and post-operative monitoring protocols specific to magnesium alloy devices.

Patient Education and Counseling: Develop comprehensive patient education materials explaining the benefits of biodegradable implants including elimination of removal procedures, reduced long-term complications, and improved recovery outcomes to support informed consent and patient acceptance.

Multidisciplinary Care Teams: Establish specialized teams including surgeons, biomedical engineers, radiologists, and rehabilitation specialists with expertise in biodegradable implant applications to optimize patient outcomes and develop institutional best practices.

Clinical Outcome Tracking: Implement systematic monitoring and reporting systems to track patient outcomes, implant performance, and cost-effectiveness of biodegradable versus traditional implants, providing real-world evidence to support broader adoption.

Center of Excellence Development: Create specialized treatment centers with advanced imaging capabilities, biodegradable implant expertise, and research capabilities to serve as regional hubs for complex cases and training other healthcare providers.

Technology Development Funding: Support startups and established companies developing breakthrough biodegradable alloy technologies including novel compositions, surface treatments, and manufacturing processes that address current limitations in degradation control and mechanical properties.

Clinical Trial Investment: Finance large-scale, multicenter clinical studies required for regulatory approval and market acceptance of biodegradable magnesium alloys, particularly for high-value applications like cardiovascular stents and orthopedic implants.

Manufacturing Scale-Up Capital: Provide funding for specialized manufacturing facilities, quality control systems, and regulatory compliance infrastructure needed to produce medical-grade biodegradable alloys at commercial scale while maintaining cost competitiveness.

Market Access Partnerships: Support strategic alliances between biodegradable alloy manufacturers and established medical device companies with global distribution networks, regulatory expertise, and surgeon relationships to accelerate market penetration.

Healthcare Economics Research: Fund health technology assessment studies demonstrating the total cost-of-care benefits of biodegradable implants including reduced surgical procedures, shorter hospital stays, and improved patient outcomes to support reimbursement decisions and hospital adoption.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 327.0 Million |

| Degradation Type | Rapid Degradation Type, Controllable Degradation Type |

| Application | Hospital, Clinic |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Syntellix, Fuji Light Metal, Magnesium Elektron, Biotronik, Luxfer, Terves, Wingoil, Five Star Downhole, Meifu Technology, Baohuifeng, Kunfugroup Special Magnesium, Galvotec, Dome Metals, Chongqing Yuhua New Materials Technology, Eontec, SINOMED, FUMEI, BAOWU, Origin Medical |

| Additional Attributes | Dollar sales by degradation type and application, regional demand trends, competitive landscape, healthcare preferences for rapid versus controllable degradation systems, integration with surgical procedures and patient safety protocols, innovations in alloy composition and surface treatment technology for diverse medical applications |

The global breast density assessment software market is estimated to be valued at USD 298.3 million in 2025.

The market size for the breast density assessment software market is projected to reach USD 725.8 million by 2035.

The breast density assessment software market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in breast density assessment software market are based on 2d mammography (ffdm), based on 3d tomosynthesis (dbt) and multimodal fusion (mri/ultrasound).

In terms of application, breast cancer screening and diagnosis segment to command 58.0% share in the breast density assessment software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA