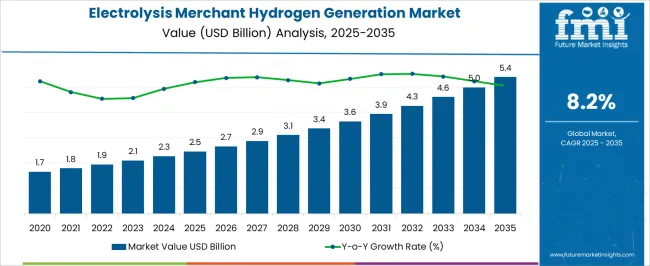

The electrolysis merchant hydrogen generation market is projected at USD 2.5 billion in 2025 and is expected to reach USD 5.4 billion by 2035, registering a CAGR of 8.2%. During the period of 2020–2024, the market was in its early adoption stage, with investments initiated and pilot projects executed. Confidence in electrolysis-based production was gradually established, though large-scale deployment remained limited. By 2025, the market is likely to enter the scaling phase, with wider adoption expected across industrial operations. Increased capacity installations and improved supply arrangements will strengthen commercial feasibility.

Between 2025 and 2030, the market is likely to maintain momentum in the scaling phase, as production capacities expand steadily and more regions are included in supply networks. Strategic alliances and long-term contracts are expected to be secured, pushing the market toward broader acceptance. From 2030 to 2035, consolidation will likely define the sector, with established players maintaining stronger positions and efficiency improvements being prioritized. By 2035, the market is expected to reach USD 5.4 billion, indicating maturity while retaining growth opportunities in specialized applications. This progression highlights a clear shift from experimental deployment to structured, large-scale operations.

| Metric | Value |

|---|---|

| Electrolysis Merchant Hydrogen Generation Market Estimated Value in (2025 E) | USD 2.5 billion |

| Electrolysis Merchant Hydrogen Generation Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The electrolysis merchant hydrogen generation market has been positioned within a network of interconnected parent markets, each contributing measurable influence. The industrial gases market has been accounted for nearly 25%, where hydrogen is integrated as part of broader supply portfolios. The energy storage market has been estimated at about 15%, as hydrogen has been adopted as a medium for balancing variable power generation. Around 12% has been linked to the power-to-gas sector, where hydrogen has been applied in blending with natural gas. The fuel cell market has been observed at 14%, supported by merchant hydrogen supply for stationary and mobile units. The chemical processing sector has been identified with 18%, as hydrogen is required for refining and ammonia synthesis. Roughly 6% has been attributed to the transportation fuels market, with hydrogen distribution networks being gradually incorporated. The renewable energy integration market has been assigned 5%, as surplus electricity has been channeled toward electrolysis facilities. Finally, the water treatment and purification sector has been noted with about 5%, where water supply and quality management are directly tied to electrolysis activities. Collectively, these interconnected markets have created the foundation upon which hydrogen generation through electrolysis is being advanced.

The Electrolysis Merchant Hydrogen Generation market is witnessing steady growth, driven by the transition toward low-carbon and sustainable industrial processes. The current market landscape is characterized by rising investments in green hydrogen production, supported by regulatory mandates and climate initiatives promoting decarbonization across key industries. Technological advancements in electrolysis systems have improved efficiency and reduced operational costs, making merchant hydrogen increasingly competitive with conventional hydrogen production methods.

Growth is further being influenced by the expansion of renewable energy infrastructure, which enables large-scale deployment of electrolysis plants powered by solar and wind energy. The market outlook is shaped by increasing demand from industrial end-users for clean hydrogen as a feedstock, fuel, and energy carrier.

Opportunities are also emerging from collaborations between energy providers and industrial consumers, which facilitate off-take agreements and encourage investment in electrolysis-based production With global efforts to achieve net-zero emissions intensifying, the Electrolysis Merchant Hydrogen Generation market is poised to continue its upward trajectory, offering scalable solutions for both industrial and commercial hydrogen supply.

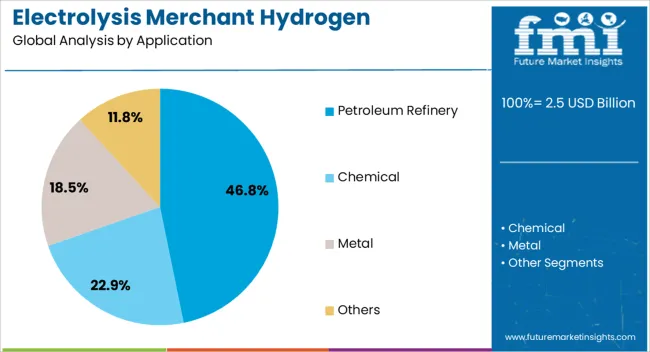

The electrolysis merchant hydrogen generation market is segmented by application, and geographic regions. By application, electrolysis merchant hydrogen generation market is divided into Petroleum Refinery, Chemical, Metal, and Others. Regionally, the electrolysis merchant hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Petroleum Refinery application segment is projected to account for 46.8% of the Electrolysis Merchant Hydrogen Generation market revenue in 2025, making it the leading application area. This dominance is being driven by the critical role hydrogen plays in refining processes, including hydrocracking, desulfurization, and hydrogenation of fuels. The adoption of electrolysis-generated hydrogen has been accelerated by increasing pressure to reduce carbon emissions and replace conventional hydrogen produced from fossil fuels.

Refineries benefit from the flexibility of sourcing green hydrogen from merchant suppliers, which allows for a gradual transition without significant capital expenditure on on-site production units. Growth has also been supported by the rising demand for cleaner fuels and stringent environmental regulations, which require decarbonized hydrogen inputs.

The segment’s expansion is further reinforced by the scalability of electrolysis systems, enabling refineries to adjust supply according to operational demand As industrial stakeholders prioritize sustainable operations, the Petroleum Refinery segment is expected to maintain its leading position due to its high hydrogen consumption and strong regulatory incentives for low-carbon hydrogen adoption.

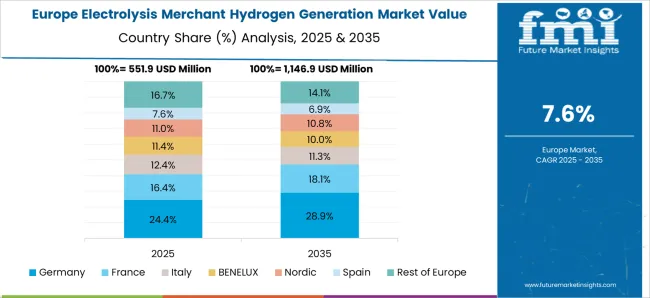

The electrolysis merchant hydrogen generation market is expanding as industries and governments pursue low-carbon energy solutions and clean fuel alternatives. North America and Europe lead with green hydrogen initiatives backed by policy incentives and renewable integration, while Asia-Pacific demonstrates rapid growth driven by industrial decarbonization and infrastructure development. Manufacturers differentiate through electrolyzer efficiency, scalability, and cost competitiveness. Regional variations in renewable energy availability, capital investment, and regulatory frameworks strongly influence adoption, production economics, and competitive positioning across merchant hydrogen generation markets worldwide.

Adoption of merchant hydrogen generation is closely tied to electrolyzer efficiency and scalability. North America and Europe prioritize high-efficiency proton exchange membrane (PEM) and solid oxide electrolyzers designed for integration with large renewable plants. Asia-Pacific focuses on cost-effective alkaline systems with modular scalability for industrial hydrogen supply. Differences in efficiency and scalability impact production costs, energy utilization, and hydrogen output volumes. Leading suppliers invest in advanced materials, high-current density cells, and modular designs for premium applications, while regional manufacturers emphasize affordability and practicality. Efficiency and scalability contrasts define adoption, cost structures, and competitiveness across global hydrogen generation markets.

Integration with renewable energy sources and electricity pricing strongly affect merchant hydrogen generation adoption. North America and Europe emphasize solar- and wind-powered electrolysis projects to align with decarbonization targets, supported by stable renewable grids. Asia-Pacific markets deploy hybrid models combining renewable energy with grid power, balancing cost with scalability. Differences in renewable integration and energy economics impact production reliability, environmental benefits, and investment returns. Suppliers offering renewable-optimized, grid-flexible systems gain higher adoption, while regional players provide hybrid, cost-efficient alternatives. Energy integration contrasts shape adoption, project feasibility, and competitive positioning in global merchant hydrogen generation markets.

Government support, subsidies, and regulatory clarity strongly influence hydrogen generation adoption. North America and Europe provide structured incentives, carbon pricing mechanisms, and funding for large-scale hydrogen hubs, accelerating deployment. Asia-Pacific markets vary; advanced economies implement national hydrogen strategies, while emerging regions develop policies balancing affordability with infrastructure readiness. Differences in policy strength and regulatory clarity affect investment decisions, project approvals, and long-term scalability. Suppliers providing compliant, incentive-eligible technologies gain competitive advantage, while regional producers align with localized regulatory frameworks. Policy and regulatory contrasts shape adoption, financing strategies, and global competitive positioning in merchant hydrogen generation markets.

Hydrogen generation economics depend on supply chain resilience and cost competitiveness. North America and Europe emphasize vertically integrated models with local component manufacturing to reduce costs and ensure security of supply. Asia-Pacific markets prioritize mass production and cost-competitive sourcing to support rapid deployment. Differences in supply chain integration and production costs affect hydrogen pricing, project viability, and market penetration. Leading suppliers invest in economies of scale, strategic partnerships, and localized sourcing, while regional producers deliver affordable, scalable solutions. Supply chain and cost contrasts shape adoption, market accessibility, and competitiveness in global merchant hydrogen generation markets.

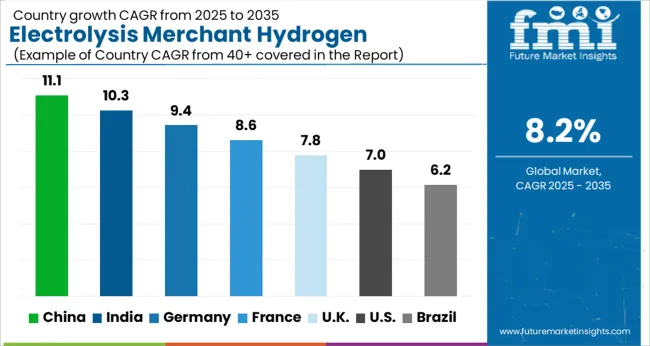

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The electrolysis merchant hydrogen generation market is set to grow at an 8.2% CAGR through 2035, fueled by the global push for decarbonization and clean energy transition. China leads with a projected 11.1% CAGR, underpinned by state-backed hydrogen roadmaps and large-scale renewable integration. India follows at 10.3%, supported by the National Green Hydrogen Mission and increasing industrial adoption. Germany, advancing at 9.4%, benefits from the EU’s hydrogen strategy and strong investment in electrolyzer capacity. The UK (7.8%) continues to expand through offshore wind-to-hydrogen projects and regulatory support, while the USA (7.0%) leverages tax credits and regional hydrogen hubs under the Inflation Reduction Act. Collectively, these five markets are defining the trajectory of global hydrogen supply chains, with strong policy alignment, infrastructure development, and technology advancements. This report analyzes 40+ countries, highlighting the leading growth regions.

The electrolysis merchant hydrogen generation market in China is being expanded at a CAGR of 11.1% due to the strong demand for clean hydrogen. Electrolysis units supported by renewable energy are being installed to meet industrial, transportation, and energy storage requirements. Local and international manufacturers are being engaged in scaling up capacity while reducing costs. Government support for hydrogen as part of long-term energy planning is being reinforced. Partnerships between technology providers, energy suppliers, and industrial users are being established. Infrastructure for hydrogen storage and transportation is being strengthened to improve market reach. Industrial decarbonization and the transition toward cleaner fuels are being considered major factors behind the rapid adoption of electrolysis-based hydrogen in China.

Electrolysis merchant hydrogen generation market in India is being developed at a CAGR of 10.3% with adoption of electrolysis technology for clean hydrogen production. Renewable power sources such as solar and wind are being connected to electrolyzers to enable low-emission hydrogen supply. Pilot projects and large-scale industrial initiatives are being supported by government programs. Local manufacturers are being encouraged to produce cost-efficient electrolysis systems while collaborations with global companies are being promoted. Demand from refineries, fertilizers, and steel production is being addressed through long-term offtake agreements. Storage and distribution infrastructure is being advanced to ensure supply reliability. The drive toward reducing dependence on fossil fuels is being recognized as a central growth factor in India’s market.

Electrolysis merchant hydrogen generation market in Germany is being advanced at a CAGR of 9.4% as hydrogen is positioned as a cornerstone of the clean energy transition. Electrolysis facilities are being installed at industrial sites and integrated with renewable energy plants. European climate policies are being followed to accelerate investment in green hydrogen. Local technology developers are being supported in scaling up production and reducing system costs. Partnerships across automotive, industrial, and utility sectors are being implemented to create a stable demand base. Research on advanced electrolyzers with higher efficiency is being conducted. Germany’s focus on reducing carbon emissions from heavy industry is being considered a major driver of hydrogen adoption.

The United Kingdom electrolysis merchant hydrogen generation market is being expanded at a CAGR of 7.8% with investment in clean hydrogen infrastructure. Electrolyzers powered by wind and solar farms are being installed to meet industrial and energy storage demand. National strategies for hydrogen deployment are being supported with incentives and regulatory backing. Domestic and international players are being encouraged to collaborate for capacity expansion. Demonstration projects are being launched to prove technical and economic feasibility. Partnerships with the transport sector are being strengthened to use hydrogen in mobility solutions. The government’s aim to reduce carbon intensity in key industries is being considered a major factor behind market growth in the United Kingdom.

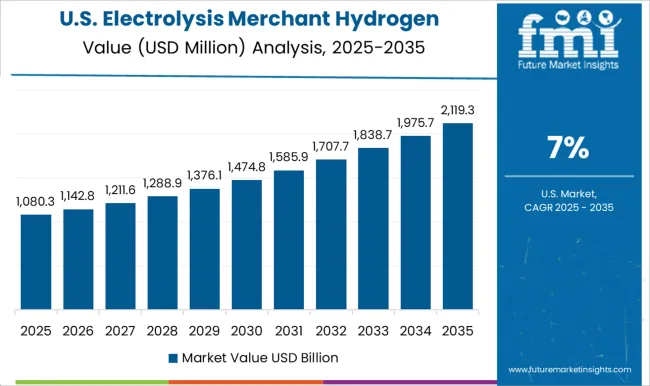

The United States electrolysis merchant hydrogen generation market is being developed at a CAGR of 7.0% with increasing focus on scaling hydrogen production through electrolysis. Federal programs and state-level initiatives are being implemented to support hydrogen infrastructure. Renewable energy integration with electrolyzers is being promoted to supply clean hydrogen for industry, transport, and energy storage. Manufacturers are being encouraged to improve system efficiency and reduce equipment costs. Partnerships between energy companies, utilities, and industrial players are being established. Pilot hubs and large-scale hydrogen valleys are being developed to accelerate deployment. The country’s objective of achieving decarbonization across heavy industries and transportation is being considered a driving force for hydrogen adoption in the United States.

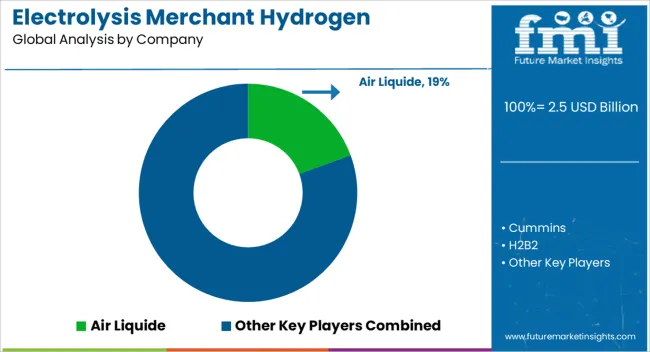

The electrolysis merchant hydrogen generation market is emerging as a crucial component of the global clean energy transition. With rising demand for green hydrogen as a sustainable alternative to fossil fuels, companies are increasingly investing in electrolysis technologies to produce hydrogen using renewable energy sources. The market is being shaped by strong policy support, government decarbonization goals, and industrial demand for clean hydrogen in sectors such as steel, chemicals, transportation, and power generation. Prominent players driving this market include Air Liquide, Cummins, H2B2, ITM Power, McPhy Energy, Nel Hydrogen, Plug Power, Siemens Energy, Sunfire, Thyssenkrupp, and Verdagy. These companies are actively working on scaling up electrolyzer technologies, reducing production costs, and improving efficiency to accelerate the commercialization of green hydrogen. Air Liquide is recognized as a global leader in industrial gases, investing heavily in large-scale hydrogen infrastructure. Cummins and Plug Power are focusing on modular and scalable electrolyzer solutions to support decentralized hydrogen production. ITM Power and McPhy Energy are specializing in advanced proton exchange membrane (PEM) electrolyzers, which are gaining traction due to their flexibility and compatibility with renewable energy. Siemens Energy and Thyssenkrupp are key innovators in large-scale alkaline and PEM electrolyzer projects, aiming to serve industrial applications and utility-scale hydrogen production. Nel Hydrogen, with its strong global footprint, is leading efforts in both PEM and alkaline technologies, while Sunfire is advancing solid oxide electrolyzer technology for high-efficiency hydrogen production. H2B2 and Verdagy, though comparatively newer players, are making significant progress with disruptive electrolysis solutions designed to lower costs and improve scalability. The growth of this market is being supported by increasing renewable energy integration, the push for carbon neutrality, and government funding for hydrogen projects across Europe, North America, and Asia-Pacific. Collaborative ventures, pilot projects, and public-private partnerships are becoming central strategies for these companies as they aim to establish a competitive edge. As the demand for green hydrogen continues to rise, innovations in electrolysis technology, coupled with declining renewable energy costs, are expected to accelerate adoption. Leading players are likely to focus on expanding their global project pipelines, forming strategic alliances, and driving cost reductions to make merchant hydrogen generation commercially viable on a large scale.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Application | Petroleum Refinery, Chemical, Metal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Cummins, H2B2, ITM Power, McPhy Energy, Nel Hydrogen, Plug Power, Siemens Energy, Sunfire, Thyssenkrupp, and Verdagy |

| Additional Attributes | Dollar sales vary by electrolyzer type, including alkaline, proton exchange membrane (PEM), and solid oxide; by application, such as transportation, industrial processes, power generation, and chemical production; by end-use industry, spanning energy, mobility, refining, and manufacturing; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by decarbonization targets, renewable energy integration, and rising hydrogen demand across sectors. |

The global electrolysis merchant hydrogen generation market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the electrolysis merchant hydrogen generation market is projected to reach USD 5.4 billion by 2035.

The electrolysis merchant hydrogen generation market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in electrolysis merchant hydrogen generation market are petroleum refinery, chemical, metal and others.

In terms of , segment to command 0.0% share in the electrolysis merchant hydrogen generation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Captive Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Metal Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA