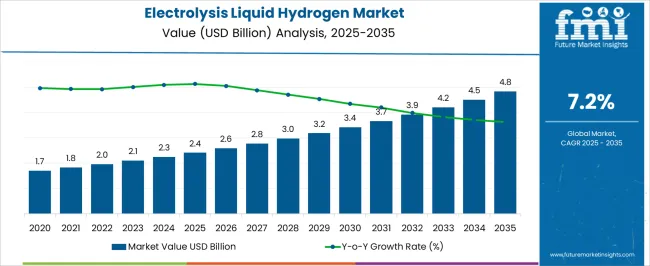

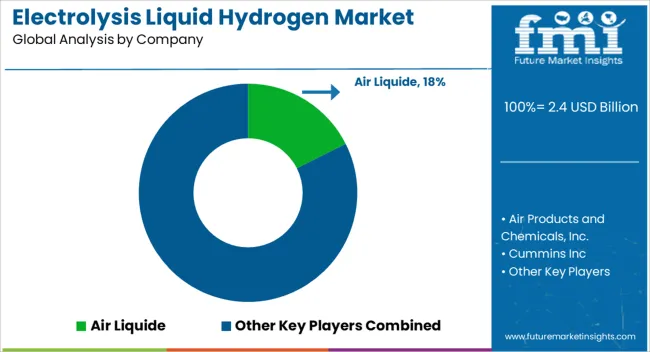

The electrolysis liquid hydrogen market, estimated at USD 2.4 billion in 2025 and projected to reach USD 4.8 billion by 2035 at a CAGR of 7.2%, exhibits notable regional growth imbalances influenced by infrastructure availability, renewable energy integration, and government support policies. Asia-Pacific emerges as a dominant region, driven by aggressive investments in green hydrogen production, expanding electrolyzer manufacturing capacity, and supportive national strategies for decarbonization in industrial and transport sectors.

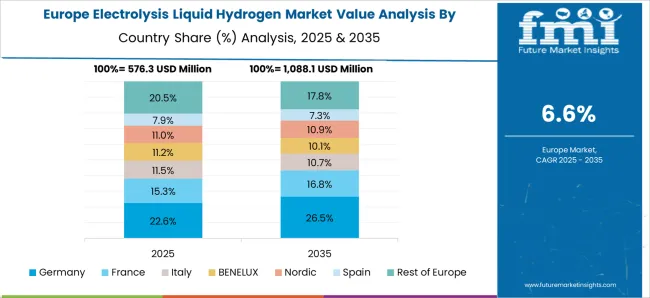

Countries such as China, Japan, and South Korea are scaling electrolysis projects, enhancing regional adoption, and contributing a larger share to the market value throughout the forecast period. Europe shows moderate yet steady growth, propelled by the European Union’s regulatory framework, incentives for hydrogen adoption, and integration of electrolysis with renewable energy grids. Germany, France, and the Netherlands lead adoption, with incremental market contributions rising each year, reflecting strong alignment between policy initiatives and industrial hydrogen demand. North America demonstrates comparatively slower growth, constrained by infrastructure deployment challenges, but benefits from increasing renewable energy penetration and private sector initiatives.

The United States and Canada are witnessing gradual adoption, with market value contributions growing steadily yet remaining lower than those in the Asia-Pacific due to differing policy and investment intensities. The regional growth analysis reveals a pronounced imbalance, with Asia-Pacific leading the way, Europe experiencing moderate expansion, and North America showing incremental growth.

| Metric | Value |

|---|---|

| Electrolysis Liquid Hydrogen Market Estimated Value in (2025 E) | USD 2.4 billion |

| Electrolysis Liquid Hydrogen Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The electrolysis liquid hydrogen market is regarded as a strategic segment within the growing hydrogen economy and renewable energy sectors. It is estimated to hold 14.6% of the green hydrogen production market, driven by demand for low carbon hydrogen from industrial, power, and mobility applications. Within the industrial gas sector, a 7.3% share is observed, reflecting bulk supply for chemical, refining, and metallurgical processes. Renewable energy storage solutions account for 5.2%, as electrolysis can store excess energy from wind and solar sources. Transportation and fuel cell vehicles represent 4.1%, while aerospace and defense applications hold 3.4% share due to high purity liquid hydrogen requirements for propulsion and energy systems.

Recent industry trends have been shaped by advancements in high-efficiency electrolysis technologies, cost reduction strategies, and integration with renewable power sources. Groundbreaking developments include polymer electrolyte membrane (PEM) electrolysis, large-scale alkaline electrolysers, and modular, scalable hydrogen production units.

Key players are forming partnerships with utilities, electrolyser manufacturers, and transport operators to expand adoption and develop hydrogen infrastructure. Strategies include investment in gigafactories, R&D in low-energy consumption electrolysis, and deployment of liquid hydrogen storage and distribution networks. Regional growth is led by Europe and Asia Pacific due to policy support and industrial demand, while North America emphasizes mobility applications and export potential.

The electrolysis liquid hydrogen market is positioned for accelerated growth, supported by the rising adoption of green hydrogen as a key enabler of decarbonization strategies across industrial, energy, and mobility sectors. Current expansion is being driven by government-backed infrastructure investments, technological improvements in electrolysis efficiency, and growing private sector participation in hydrogen production and distribution.

Regulatory frameworks and carbon reduction mandates are compelling industries to shift toward low-emission hydrogen solutions, while cost reductions through scale and innovation are improving competitiveness against conventional fuels. Supply chain integration, from production to storage and delivery, is being enhanced through strategic collaborations between energy providers and logistics operators.

Over the forecast horizon, the market is expected to benefit from the alignment of hydrogen infrastructure rollouts with renewable energy generation, enabling consistent and scalable supply.

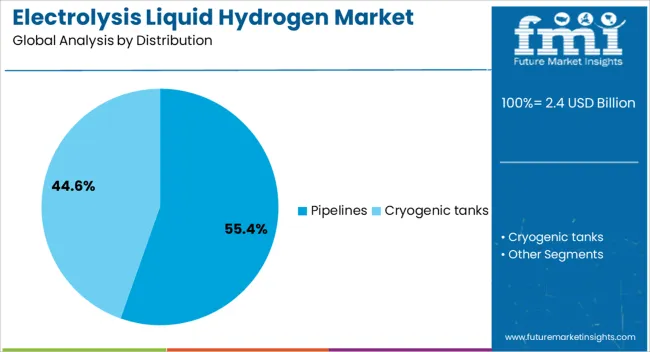

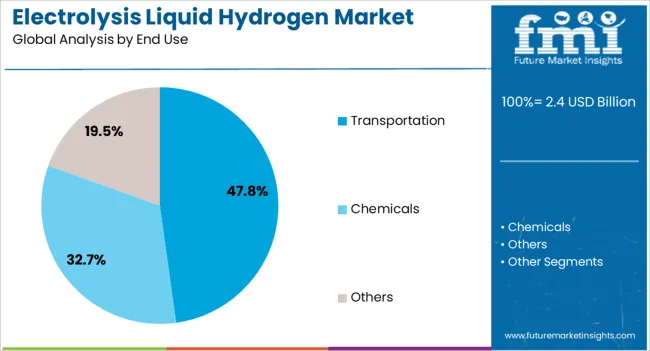

The electrolysis liquid hydrogen market is segmented by distribution, end use, and geographic regions. By distribution, electrolysis liquid hydrogen market is divided into Pipelines and Cryogenic tanks. In terms of end use, electrolysis liquid hydrogen market is classified into Transportation, Chemicals, and Others. Regionally, the electrolysis liquid hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pipelines segment, holding 55.40% of the distribution category, has emerged as the leading mode due to its efficiency in transporting large volumes of liquid hydrogen over extended distances with minimal losses. Its market dominance is reinforced by the ability to integrate directly with production sites and end-user facilities, reducing handling requirements and improving delivery timelines.

Established pipeline networks in key industrial regions are being expanded to connect new electrolysis plants, thereby lowering distribution costs and enhancing reliability. Safety and monitoring technologies have been advanced to ensure secure operations, addressing regulatory and environmental compliance.

The scalability of pipelines makes them a preferred choice for large-scale industrial hydrogen users, particularly in regions with high demand density. Continued infrastructure development, supported by both public funding and private investment, is expected to strengthen the segment’s role as the backbone of hydrogen distribution networks, maintaining its competitive edge over alternative transport methods.

The transportation segment, accounting for 47.80% of the end use category, leads the market due to the growing integration of liquid hydrogen in fuel cell-powered vehicles, ships, and aircraft. Its prominence is driven by the sector’s urgent need to reduce greenhouse gas emissions and comply with evolving emission standards.

Adoption has been facilitated by advancements in cryogenic storage systems, enabling safe and efficient use of liquid hydrogen in mobility applications. The segment benefits from partnerships between hydrogen producers, vehicle manufacturers, and refueling infrastructure developers, creating a more accessible supply ecosystem.

Government incentives and pilot programs for hydrogen-powered fleets are further accelerating uptake, especially in heavy-duty and long-haul transport segments where battery-electric solutions face limitations. Expansion of refueling corridors and the development of high-capacity storage and dispensing systems are set to support sustained growth, solidifying transportation’s position as a primary driver of demand in the electrolysis liquid hydrogen market.

The market has grown rapidly due to increasing demand for clean energy, industrial applications, and emerging hydrogen fuel infrastructure. Electrolysis, which splits water into hydrogen and oxygen using electricity, produces high-purity hydrogen suitable for energy storage, fuel cells, and chemical processes. Growing focus on decarbonization, renewable energy integration, and transportation electrification has driven interest in liquid hydrogen. Technological advancements in electrolysis efficiency, storage, and cryogenic handling have improved feasibility for large-scale production. Regional growth is influenced by renewable energy availability, government incentives, and industrial adoption, highlighting the strategic role of liquid hydrogen in achieving energy transition and sustainable industrial operations globally.

The integration of renewable energy sources such as solar, wind, and hydroelectric power has significantly increased the adoption of electrolysis for liquid hydrogen production. Excess electricity generated during peak renewable output can be stored in the form of hydrogen, providing a flexible and clean energy storage solution. Industrial sectors, power plants, and transportation networks leverage liquid hydrogen to balance energy demand and supply while reducing carbon emissions. The ability to convert intermittent renewable energy into a storable, transportable fuel has encouraged investments in electrolysis facilities. Energy planners and governments are promoting liquid hydrogen as part of broader decarbonization strategies, enhancing grid resilience and supporting the shift toward low-carbon economies.

Innovations in electrolysis technologies, including proton exchange membrane (PEM) and alkaline electrolyzers, have improved energy efficiency, hydrogen purity, and operational reliability. Cryogenic storage techniques allow liquid hydrogen to be safely stored and transported over long distances, maintaining high energy density and minimizing losses. Advancements in catalyst materials, membrane durability, and process automation reduce operational costs and increase scalability for industrial and commercial applications. Integration with renewable energy plants enables continuous hydrogen production despite fluctuating electricity supply. Technological progress has made electrolysis-based liquid hydrogen more viable, efficient, and adaptable to various industrial sectors, positioning it as a critical component in sustainable energy and transportation ecosystems.

Electrolysis liquid hydrogen is increasingly utilized in transportation, chemical, and industrial sectors. Fuel cell vehicles, including buses, trucks, and trains, leverage liquid hydrogen for long-range, zero-emission operations. Industrial applications involve ammonia production, refining, and metal processing, where high-purity hydrogen is essential. Ports, airports, and logistics hubs are investing in liquid hydrogen refueling infrastructure to support emerging fuel cell fleets. The adoption of hydrogen-powered equipment and vehicles not only reduces greenhouse gas emissions but also aligns with regulatory policies promoting alternative fuels. Increasing industrial interest and transportation electrification strategies are fueling steady demand for high-quality liquid hydrogen produced via electrolysis.

Despite strong potential, the electrolysis liquid hydrogen market faces challenges from high production costs, energy consumption, and infrastructure requirements. Electrolyzer capital expenditure, cryogenic storage, and transport logistics contribute to elevated costs compared to conventional fuels. Ensuring safety in storage and handling of liquid hydrogen under cryogenic conditions requires advanced technology and skilled labor. Market adoption is further limited by intermittent renewable energy supply and supply chain complexity. Efforts to reduce costs through technological innovation, scaling production, and government incentives are ongoing. Overcoming these barriers is essential for broader commercialization and sustainable growth in industrial, energy, and transportation applications.

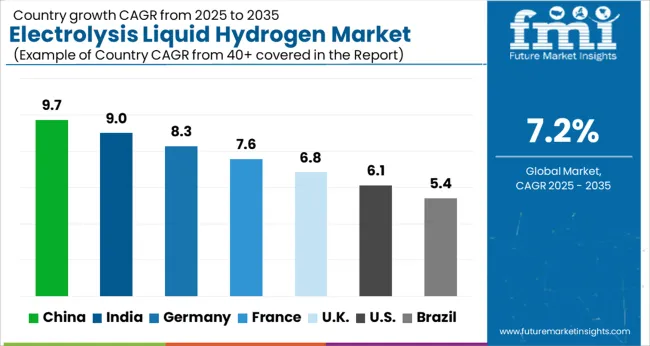

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

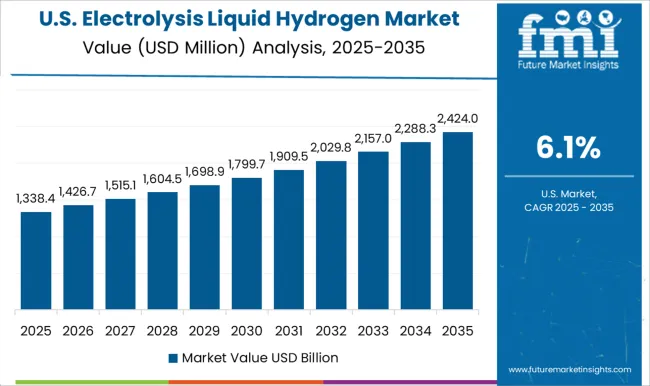

| USA | 6.1% |

| Brazil | 5.4% |

China leads the market with a forecast CAGR of 9.7%, propelled by large-scale hydrogen production initiatives and government-backed clean energy projects. India follows at 9.0%, driven by investments in green hydrogen infrastructure and industrial adoption. Germany records 8.3%, supported by strong renewable energy integration and fuel cell technology deployment. The United Kingdom posts 6.8%, where innovation in storage and transportation of liquid hydrogen fosters growth. The United States registers 6.1%, benefiting from expanding research in clean energy solutions and hydrogen-fueled mobility. Collectively, these nations shape the global development, production, and technological adoption in electrolysis liquid hydrogen. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 9.7% in the market, driven by increasing investments in clean energy and hydrogen infrastructure. Growing focus on reducing carbon emissions and government initiatives promoting hydrogen as a sustainable energy source accelerate adoption. Industrial applications, including refineries, power generation, and transportation, are incorporating liquid hydrogen technologies. Rising R&D in electrolyzer efficiency, renewable energy integration, and large-scale hydrogen storage projects support market growth. China’s strategic push towards hydrogen-powered vehicles and energy diversification further reinforces demand.

India is anticipated to grow at a CAGR of 9% in the electrolysis liquid hydrogen market due to rising government investments in green hydrogen initiatives and renewable energy integration. Industrial sectors such as chemical processing, transport, and energy generation are adopting liquid hydrogen for decarbonization. Strategic projects promoting hydrogen fuel cells and electrolyzers increase market adoption. Policy frameworks and incentives for clean energy technology accelerate the deployment of electrolysis systems. Technological improvements in efficiency and large-scale storage capacity contribute to the overall growth potential in India’s hydrogen ecosystem.

Germany is projected to grow at a CAGR of 8.3%, supported by its leadership in renewable energy and hydrogen economy development. Industrial, transportation, and energy sectors are adopting electrolysis-based hydrogen solutions to meet sustainability and carbon neutrality targets. Government incentives, EU funding, and research in electrolyzer technologies enhance market penetration. Germany’s strategic commitment to green hydrogen and renewable integration strengthens adoption, while collaborations between private and public sectors facilitate large-scale infrastructure deployment. Consumer awareness and industrial decarbonization initiatives further drive market expansion across Germany.

The United Kingdom is expected to register a CAGR of 6.8% as it develops hydrogen production capabilities and integrates renewable energy systems. Industrial demand, transportation, and power generation are key drivers for liquid hydrogen adoption. Policy measures promoting low-carbon energy, incentives for electrolyzer deployment, and research in energy storage increase market attractiveness. Large-scale projects for hydrogen-powered transport and industrial usage support sustainable growth. Technological improvements in electrolysis efficiency and storage solutions, combined with government initiatives, strengthen the United Kingdom’s position in the global hydrogen market.

The United States is anticipated to grow at a CAGR of 6.1%, driven by federal initiatives for clean energy and decarbonization. Industrial, transport, and power sectors are increasingly adopting liquid hydrogen technologies. Investment in electrolyzers, green hydrogen projects, and renewable integration stimulates market expansion. Government policies encouraging hydrogen adoption, technological advancements in storage, and efficiency improvements support sustainable growth. Private sector participation, combined with consumer and industrial awareness about low-carbon solutions, further strengthens the market across the United States.

The market is witnessing rapid growth as industries and energy sectors focus on green hydrogen production through sustainable methods. Air Liquide and Air Products and Chemicals, Inc. are leading providers, leveraging advanced electrolysis technologies to produce high-purity liquid hydrogen for industrial, mobility, and energy applications. Their solutions emphasize efficiency, scalability, and integration with renewable energy sources, supporting the transition toward low-carbon economies. Linde Plc and ITM Power are also key players, offering modular electrolysis systems designed to meet varying production capacities while optimizing energy consumption and minimizing operational costs.

Cummins Inc. and NEL Hydrogen focus on high-performance electrolyzers that cater to both large-scale and decentralized hydrogen production facilities. MAN Energy Solutions and ENGIE deliver integrated hydrogen solutions, combining electrolysis units with renewable energy projects and industrial hydrogen networks. Shell plc and Thyssenkrupp contribute through technologically advanced platforms that emphasize safety, reliability, and operational flexibility, while Plug Power Inc. provides commercial solutions supporting the hydrogen mobility and logistics sectors. These providers drive innovation, operational efficiency, and adoption of liquid hydrogen, enabling industries to reduce carbon footprints and support the emerging hydrogen economy.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Distribution | Pipelines and Cryogenic tanks |

| End Use | Transportation, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Inc., Cummins Inc, ENGIE, ITM Power, Linde Plc, MAN Energy Solutions, NEL Hydrogen, Plug Power Inc, Shell plc, and Thyssenkrupp |

| Additional Attributes | Dollar sales by production type and application, demand dynamics across energy, transportation, and industrial sectors, regional trends in hydrogen adoption, innovation in electrolyzer efficiency, purity, and scalability, environmental impact of electricity consumption and lifecycle emissions, and emerging use cases in fuel cells, green energy storage, and industrial hydrogen supply. |

The global electrolysis liquid hydrogen market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the electrolysis liquid hydrogen market is projected to reach USD 4.8 billion by 2035.

The electrolysis liquid hydrogen market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in electrolysis liquid hydrogen market are pipelines and cryogenic tanks.

In terms of end use, transportation segment to command 47.8% share in the electrolysis liquid hydrogen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrolysis Captive Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Water Electrolysis Machine Market Growth - Trends & Forecast 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA