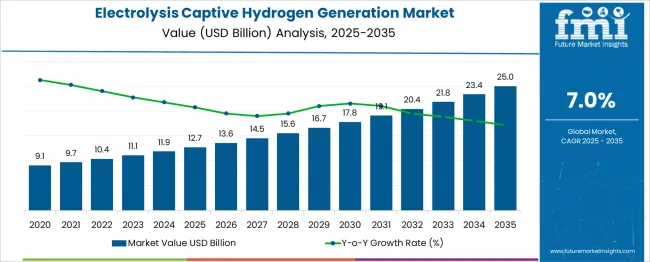

The electrolysis captive hydrogen generation market is estimated to be valued at USD 12.7 billion in 2025 and is projected to reach USD 25.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. The compound annual growth rate reflects a consistent expansion trajectory throughout the forecast period. Analyzing the yearly data, the market value increases incrementally each year, starting at USD 12.7 billion in 2025 and moving to USD 13.6 billion in 2026.

The growth continues steadily with values rising to USD 14.5 billion in 2027 and USD 15.6 billion in 2028, demonstrating moderate annual increases between approximately 6.7% and 7.5%. The pattern remains consistent, with the market reaching USD 21.8 billion by 2032 and finally USD 25.0 billion in 2035. This steady YoY growth indicates a robust market environment with sustained demand driven by increasing focus on clean energy technologies, hydrogen production efficiency, and expanding industrial applications of captive hydrogen generation. The absence of large fluctuations or dips in growth suggests stable market conditions and reliable adoption of electrolysis technology over the decade. The YoY analysis confirms that the market is on a solid growth path, marked by predictable and consistent annual increments, aligned with global energy transition efforts and increased investments in hydrogen infrastructure.

Oil refining operations represent the largest consumption segment where captive hydrogen generation enables desulfurization processes, hydrocracking operations, and fuel upgrading applications that require consistent high-purity hydrogen supply while reducing dependency on merchant hydrogen suppliers and transportation logistics. Refinery operators implement electrolysis systems that coordinate with existing hydrogen networks while providing backup production capacity during supply disruptions or maintenance periods. Process integration strategies utilize waste heat recovery and power optimization that maximize overall energy efficiency while maintaining refinery throughput and product quality standards throughout complex petrochemical processing operations.

Chemical manufacturing applications demonstrate increasing adoption of electrolysis systems for ammonia synthesis, methanol production, and specialty chemical processes where hydrogen quality and availability directly impact production efficiency and product specifications. Chemical plant engineers specify electrolysis equipment that accommodates varying hydrogen demand patterns while maintaining pressure and purity requirements necessary for downstream chemical reactions. Production scheduling optimization enables electrolysis operation during low-cost electricity periods while hydrogen storage systems provide supply continuity throughout peak demand cycles and maintenance activities.

Steel production facilities create specialized market segments requiring hydrogen for direct reduction processes that eliminate carbon dioxide emissions from traditional blast furnace operations while maintaining steel quality and production capacity targets. Steel manufacturers implement large-scale electrolysis systems that provide hydrogen for iron ore reduction while integrating with renewable energy sources and industrial heat recovery systems. Process control systems coordinate hydrogen generation with steel production schedules while optimizing energy consumption and maintaining consistent hydrogen flow rates throughout continuous manufacturing operations.

| Metric | Value |

|---|---|

| Electrolysis Captive Hydrogen Generation Market Estimated Value in (2025 E) | USD 12.7 billion |

| Electrolysis Captive Hydrogen Generation Market Forecast Value in (2035 F) | USD 25.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The electrolysis captive hydrogen generation market is witnessing robust expansion, driven by the escalating decarbonization efforts across industrial sectors and the global push toward sustainable energy solutions. Regulatory momentum toward reducing greenhouse gas emissions is compelling heavy industries to adopt low-carbon hydrogen production, particularly from electrolysis. Governments in Europe, North America, and Asia-Pacific have introduced favorable policies, subsidies, and tax incentives to support electrolyzer deployment, especially in refining, chemicals, and steel industries.

Technological advancements in proton exchange membrane (PEM) and alkaline electrolyzers are reducing operational costs and increasing efficiency, making on-site hydrogen production more viable. Simultaneously, the integration of renewables with electrolysis systems is enhancing energy utilization and minimizing environmental impact. Strategic collaborations between electrolyzer manufacturers and industrial end users are also accelerating project deployment.

As renewable electricity becomes more accessible and grid flexibility improves, captive hydrogen generation via electrolysis is expected to become a central pillar in industrial decarbonization strategies. Emerging applications in ammonia, methanol, and synthetic fuels production are likely to augment future growth trajectories.

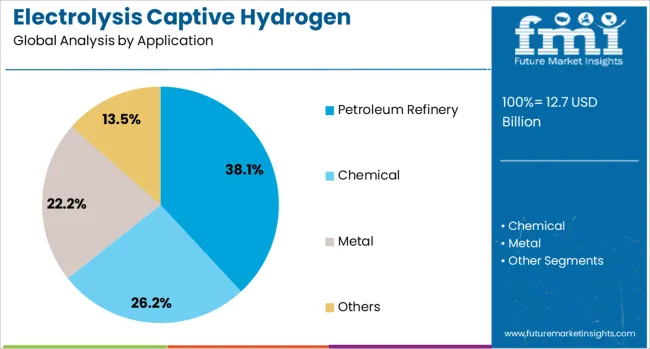

The electrolysis captive hydrogen generation market is segmented by application and geographic regions. By application, the electrolysis captive hydrogen generation market is divided into Petroleum Refinery, Chemical, Metal, and Others. Regionally, the electrolysis captive hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The petroleum refinery segment is projected to dominate the electrolysis captive hydrogen generation market with a 38.1% revenue share in 2025. This leading position is being shaped by the refining sector's urgent requirement to decarbonize hydrogen used in hydrocracking and desulfurization processes. Traditionally reliant on steam methane reforming, refineries are now transitioning toward low-carbon electrolysis-based hydrogen to align with tightening emission regulations and corporate net-zero targets.

Regulatory frameworks in the EU and US mandating clean fuel production are reinforcing this shift. Moreover, many refineries already possess the infrastructure for hydrogen handling, making the integration of electrolyzers less capital-intensive compared to greenfield projects. Increased demand for renewable diesel and sustainable aviation fuel is accelerating the need for green hydrogen, as these production processes require significant volumes of clean hydrogen.

Long-term cost savings, enhanced energy security, and eligibility for carbon credits are further incentivizing investment in electrolysis-based hydrogen generation. The ability to produce hydrogen on-site also reduces supply chain disruptions and enhances operational resilience, solidifying the segment’s dominance through 2035.

The market is witnessing accelerated growth as industries seek reliable, on-site hydrogen production solutions to support decarbonization and energy transition goals. Electrolysis enables the production of green hydrogen by splitting water into hydrogen and oxygen using renewable electricity, reducing dependency on fossil fuels.

Captive generation systems offer operational control, cost savings, and supply security for end-users in sectors such as refining, chemicals, power generation, and heavy industry. Increasing emphasis on sustainable energy sources, government incentives for clean hydrogen technologies, and advancements in electrolyzer efficiency are key factors driving market expansion.

Industrial sectors, including oil refining, ammonia synthesis, methanol production, and steel manufacturing, are increasingly adopting captive hydrogen generation via electrolysis to meet stringent environmental regulations and reduce carbon footprints. On-site hydrogen production minimizes transportation risks and costs while providing a steady, high-purity hydrogen supply crucial for process reliability. The ability to integrate electrolyzers with renewable power sources allows industries to decouple hydrogen production from fossil fuels, supporting sustainability targets and corporate social responsibility initiatives. Moreover, growing awareness of hydrogen's role in energy storage and fuel applications is encouraging investment in captive systems. This shift toward green hydrogen is a significant market growth driver, expanding applications beyond traditional uses.

Continuous improvements in electrolyzer technologies, such as proton exchange membrane (PEM), alkaline, and solid oxide electrolyzers, have increased operational efficiency, durability, and scalability. Innovations in catalyst materials and cell design have reduced energy consumption and extended system lifespans, directly impacting the total cost of ownership. Modular electrolyzer units enable flexible capacity expansion and easier integration with existing industrial infrastructure. Additionally, digitalization and advanced control systems optimize performance by adapting hydrogen output to fluctuating renewable energy availability. These technological developments lower barriers to adoption by improving return on investment and reliability, making captive electrolysis a more viable solution for diverse industrial applications.

Government initiatives worldwide are promoting green hydrogen through subsidies, tax incentives, and funding for research and pilot projects focused on electrolysis-based hydrogen generation. Regulatory frameworks aiming to reduce greenhouse gas emissions and phase out carbon-intensive fuels are compelling industries to transition toward clean hydrogen. National hydrogen strategies and international collaborations are fostering infrastructure development and standardization efforts. Public-private partnerships are also facilitating knowledge sharing and investment in large-scale electrolysis plants. These policy drivers create a favorable environment for captive hydrogen generation adoption, helping industries meet sustainability mandates while enhancing energy security and reducing operational risks associated with external hydrogen supply chains.

The widespread deployment of captive electrolysis hydrogen generation faces obstacles related to substantial upfront capital expenditure for electrolyzer systems and supporting infrastructure. The cost of renewable electricity, which significantly influences operational expenses, varies regionally and can limit economic feasibility in certain markets. Furthermore, integrating electrolysis units into existing industrial processes requires technical expertise and potential modifications, adding complexity and cost. Grid stability and availability of consistent renewable power supply are additional concerns. To mitigate these issues, efforts are underway to develop cost-effective electrolyzer materials, improve energy efficiency, and implement innovative financing models. Collaborative initiatives between technology providers, energy producers, and end-users aim to address these barriers and enable broader market penetration.

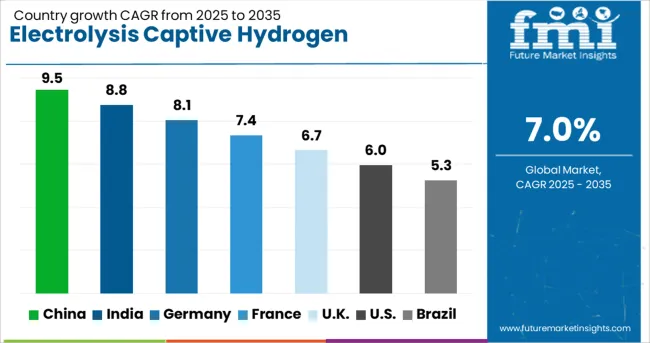

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

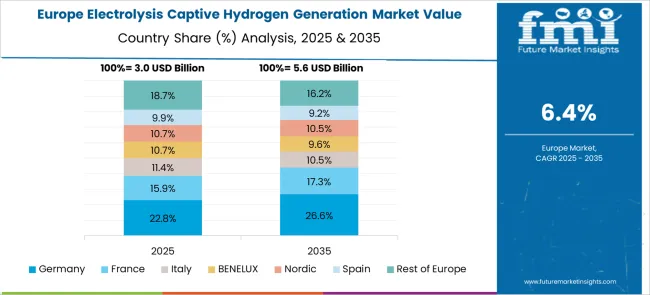

The market is projected to grow at a CAGR of 7.0% from 2025 to 2035, driven by increasing demand for clean hydrogen production and rising investments in renewable energy technologies. China leads with a 9.5% CAGR, supported by large-scale hydrogen infrastructure projects and government policies promoting green hydrogen. India follows at 8.8%, fueled by initiatives to integrate hydrogen into industrial and energy sectors. Germany, growing at 8.1%, benefits from strong research and development in electrolysis technologies. The UK, at 6.7%, experiences steady adoption aligned with decarbonization goals. The USA, with a 6.0% CAGR, reflects ongoing innovation in hydrogen generation systems and clean energy integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is projected to grow at a CAGR of 9.5% from 2025 to 2035, propelled by government initiatives targeting carbon neutrality and clean energy integration. Leading state-owned enterprises and private firms like Sinopec and Air Products China are investing heavily in electrolyzer capacity expansion and technology innovation. The chemical manufacturing and refining sectors increasingly adopt onsite hydrogen production to reduce dependency on fossil fuels. Infrastructure developments supporting green hydrogen projects further accelerate market demand. Domestic partnerships with renewable energy providers enhance integration of solar and wind power into hydrogen generation processes.

India’s captive hydrogen generation via electrolysis market is expected to expand at a CAGR of 8.8% due to rising industrial hydrogen needs and government programs promoting clean fuel production. Key players including Indian Oil Corporation and Larsen & Toubro focus on integrating electrolyzers with renewable energy sources to lower emissions. Steel and fertilizer industries lead demand for captive hydrogen to optimize operational efficiency. Infrastructure enhancements and pilot projects in major industrial hubs support scaling of onsite hydrogen production. Policy incentives encouraging green hydrogen use are catalyzing investments and technology adoption.

Germany is forecast to grow at a CAGR of 8.1%, influenced by the country’s strong emphasis on energy transition and decarbonization targets. Companies like Siemens Energy and Thyssenkrupp are advancing high-efficiency electrolyzer technologies for onsite hydrogen production in chemicals and heavy industry. Integration with wind and solar power enhances green hydrogen output, supporting emission reduction goals. Industrial clusters in the Ruhr area and northern Germany are focal points for pilot projects and scaling efforts. Supportive regulations and funding programs facilitate technology adoption and infrastructure buildout.

The United Kingdom’s captive hydrogen generation market via electrolysis is expected to expand at a CAGR of 6.7% due to increasing demand for sustainable energy solutions in industrial applications. Companies such as ITM Power and Johnson Matthey are enhancing electrolyzer designs for improved output and durability. The refining and chemical industries are early adopters of onsite hydrogen to meet low carbon targets. Government initiatives promoting hydrogen economy development and funding for pilot projects strengthen market momentum. Growing collaboration between renewable energy providers and industrial hydrogen users accelerates capacity additions.

The United States market for captive hydrogen production through electrolysis is projected to grow at a CAGR of 6.0%, supported by federal incentives and expanding clean energy infrastructure. Key industry players including Plug Power and Air Liquide are investing in scalable electrolyzer systems for onsite hydrogen in chemicals, refining, and manufacturing. The integration of renewable energy sources enhances green hydrogen generation, reducing carbon footprints. Policies focused on emission reduction and infrastructure upgrades drive technology adoption. Growing demand for hydrogen fuel and feedstock further catalyzes market development.

The electrolysis captive hydrogen generation market is driven by leading industrial gas and energy technology companies developing efficient on-site hydrogen production systems for industrial, refining, and mobility applications. Air Products and Chemicals, Inc. leads with advanced electrolysis and hydrogen generation systems designed for refineries, chemical plants, and distributed hydrogen supply. Linde plc combines strong process engineering expertise with high-efficiency electrolyzers for captive hydrogen generation, targeting industrial and renewable energy integration projects.

Siemens Energy AG and Cummins Inc. are key innovators in proton exchange membrane (PEM) and alkaline electrolysis technologies, offering scalable systems for on-site hydrogen production powered by renewable sources. NEL Hydrogen ASA focuses on modular electrolysis systems suited for both industrial and mobility applications, emphasizing compact design and low operating costs. Enapter GmbH advances anion exchange membrane (AEM) electrolyzers designed for decentralized, small to medium-scale hydrogen generation.

McPhy Energy S.A. and Green Hydrogen Systems A/S specialize in modular hydrogen generation units optimized for industrial users and renewable integration. Hitachi Zosen Corporation delivers water electrolysis systems integrated with power-to-gas infrastructure. MVS Engineering and Mangalore Refinery and Petrochemicals Ltd. provide captive hydrogen solutions for industrial clients across Asia. Messer Group GmbH strengthens its portfolio with on-site hydrogen supply solutions designed to reduce dependency on centralized production.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.7 Billion |

| Application | Petroleum Refinery, Chemical, Metal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals, Inc.; Cummins Inc.; Enapter GmbH; Green Hydrogen Systems A/S; Hitachi Zosen Corporation; Linde plc; McPhy Energy S.A.; MVS Engineering; Mangalore Refinery and Petrochemicals Ltd.; Messer Group GmbH; NEL Hydrogen ASA; Siemens Energy AG. |

| Additional Attributes | Dollar sales by electrolyzer type and end-use industry, demand dynamics across chemical manufacturing, refining, and power generation sectors, regional trends in deployment across Asia-Pacific, North America, and Europe, innovation in proton exchange membrane (PEM), alkaline, and solid oxide electrolyzers, environmental impact of renewable energy integration, water resource usage, and lifecycle emissions, and emerging use cases in green hydrogen production for ammonia synthesis, fuel cell applications, and industrial decarbonization. |

The global electrolysis captive hydrogen generation market is estimated to be valued at USD 12.7 billion in 2025.

The market size for the electrolysis captive hydrogen generation market is projected to reach USD 25.0 billion by 2035.

The electrolysis captive hydrogen generation market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in electrolysis captive hydrogen generation market are petroleum refinery, chemical, metal and others.

In terms of , segment to command 0.0% share in the electrolysis captive hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrolysis Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Water Electrolysis Machine Market Growth - Trends & Forecast 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA