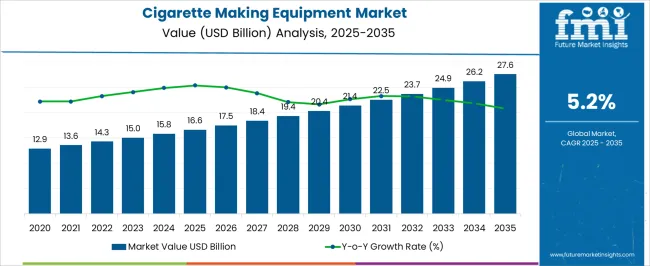

The cigarette making equipment market is estimated to be valued at USD 16.6 billion in 2025 and is projected to reach USD 27.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. During the early adoption phase (2020–2024), manufacturers gradually upgraded machinery to enhance production efficiency, output consistency, and automation capabilities. By 2025, broader acceptance of modern equipment across established and emerging tobacco producers will drive market growth. This phase represents the transition from selective modernization to wider implementation, as companies invest in higher-capacity machinery and establish operational standards, laying the foundation for the scaling phase in the following years.

From 2025 to 2030, the market enters a scaling phase, marked by increasing adoption across major tobacco manufacturing hubs. Market value rises from USD 16.6 billion in 2025 as equipment upgrades and expanded production capacities support higher output. By 2030, cigarette making machinery becomes a standard in production facilities, preparing the market for consolidation. Between 2030 and 2035, the market reaches USD 27.6 billion, with steady CAGR-driven growth. Consolidation occurs as leading equipment manufacturers optimize supply chains, standardize offerings, and secure long-term contracts, resulting in a mature and competitive market landscape with stable demand across regions.

| Metric | Value |

|---|---|

| Cigarette Making Equipment Market Estimated Value in (2025 E) | USD 16.6 billion |

| Cigarette Making Equipment Market Forecast Value in (2035 F) | USD 27.6 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The cigarette making equipment market is a key segment of the broader tobacco and tobacco processing machinery market. In 2025, cigarette making equipment accounts for approximately 40% of the overall tobacco machinery market, reflecting widespread adoption among major manufacturers to enhance production efficiency and output consistency. The broader tobacco machinery market is projected to grow at a CAGR of around 3–4% during 2025–2035, driven by the replacement of older machinery and increasing automation in manufacturing facilities. Within tobacco machinery, cigarette making equipment holds an estimated 55% share in 2025, while other machinery including filter production, packing, and inspection equipment, accounts for the remainder. By 2030, scaling adoption is expected to raise the share of cigarette making equipment in the tobacco machinery segment to nearly 58%, supported by capacity expansion and modernization across both established and emerging markets.

Between 2030 and 2035, consolidation is anticipated as leading equipment suppliers optimize production efficiency, strengthen distribution channels, and secure long-term contracts. By 2035, cigarette making equipment is projected to represent roughly 59–60% of the tobacco machinery segment and about 41% of the overall tobacco processing equipment market, cementing its role as a critical revenue driver and a cornerstone of operational modernization in the parent market.

The cigarette making equipment market is witnessing stable expansion, supported by ongoing demand from both large-scale tobacco manufacturers and emerging regional producers. Market growth is being driven by continuous technological enhancements aimed at improving production efficiency, reducing operational costs, and ensuring compliance with stringent quality standards.

While the global trend toward reduced smoking prevalence in some regions exerts a moderating influence, sustained consumption in key developing markets continues to support equipment demand. Additionally, the rising adoption of automated solutions has shifted the competitive landscape, as manufacturers seek higher output capacities with lower labor dependency.

The market benefits from established infrastructure within the tobacco industry, as well as replacement demand for outdated machinery to meet evolving regulatory and production requirements. In the long term, innovation in high-speed, precision-oriented machinery and integration of advanced control systems are expected to maintain the relevance of cigarette making equipment, particularly in export-driven manufacturing hubs.

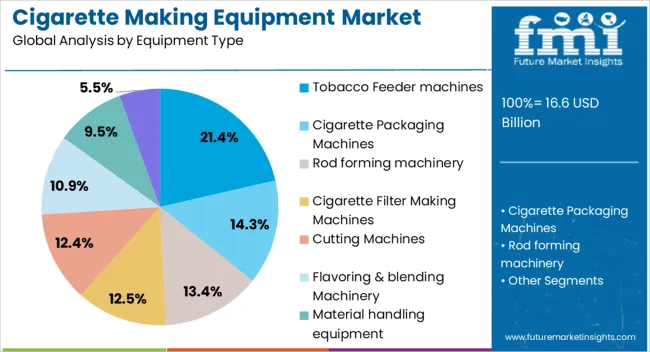

The cigarette making equipment market is segmented by equipment type, material, capacity, end-user, distribution channel, and geographic regions. By equipment type, cigarette making equipment market is divided into Tobacco Feeder machines, Cigarette Packaging Machines, Rod forming machinery, Cigarette Filter Making Machines, Cutting Machines, Flavoring & blending Machinery, Material handling equipment, and Others.

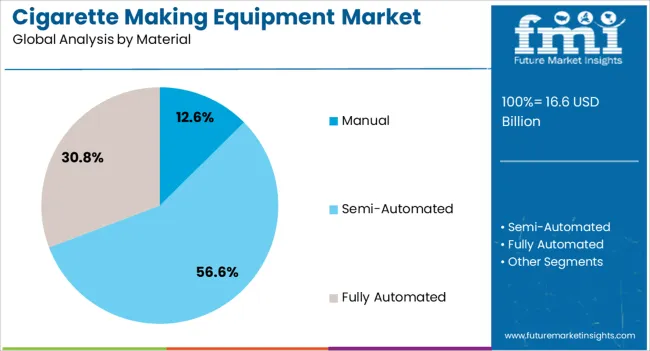

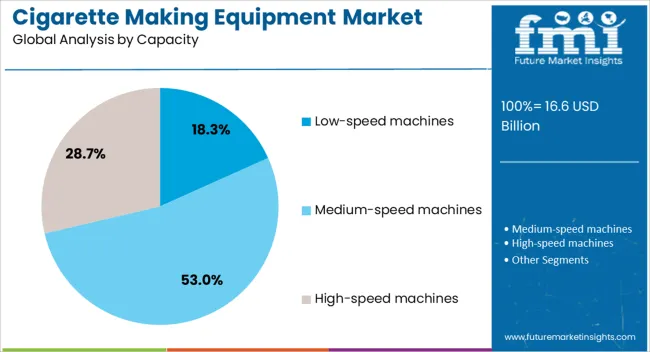

In terms of material, cigarette making equipment market is classified into Manual, Semi-Automated, and Fully Automated. Based on capacity, cigarette making equipment market is segmented into Low-speed machines, Medium-speed machines, and High-speed machines. By end-user, cigarette making equipment market is segmented into Tobacco Manufacturers, Small-Scale Producers, Contract Manufacturers, and Others. By distribution channel, cigarette making equipment market is segmented into Direct and Indirect. Regionally, the cigarette making equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tobacco feeder machines segment accounts for approximately 21.4% of the cigarette making equipment market, reflecting its critical role in ensuring consistent and efficient feeding of tobacco during the production process. These machines enhance operational throughput by maintaining a steady flow of raw material to downstream equipment, thereby minimizing wastage and downtime.

Their adoption has been reinforced by the demand for precision in blending and filling, which directly influences product quality and compliance with manufacturing standards. While advanced automated feeders dominate in large-scale production facilities, the segment benefits from both new installations and retrofitting of existing lines.

The continued emphasis on reducing manual intervention and improving process control has driven steady uptake, particularly in markets where production volumes remain high. Over the forecast period, further integration with real-time monitoring and feedback systems is expected to support the segment’s growth trajectory.

The manual equipment segment holds a 12.6% share of the cigarette making equipment market, primarily serving small-scale and niche production environments. Despite the increasing adoption of automation, manual machinery retains demand where flexibility, lower capital investment, and smaller production runs are priorities.

This segment is favored by emerging market manufacturers and specialty producers targeting unique blends or limited-edition products that require greater operational control. Its competitive advantage lies in reduced upfront costs and ease of maintenance compared to automated systems, making it accessible to startups and lower-volume operations.

However, growth within this segment is constrained by slower production rates and higher labor requirements. Demand stability is expected in regions where automation is less economically viable, but gradual adoption of semi-automated solutions may moderate its market share in the long term.

The low-speed machines segment represents approximately 18.3% of the cigarette making equipment market, catering to manufacturers with moderate output requirements and specific product customization needs. These machines are typically employed in settings where flexibility in production and adaptability to different product specifications outweigh the need for maximum throughput.

Their relatively lower cost compared to high-speed alternatives, along with ease of operation and maintenance, supports demand among regional producers and contract manufacturers. The segment is also utilized for pilot runs, testing, and specialty product lines, where precision and quality consistency remain critical.

Although advancements in high-speed technologies pose competitive pressure, the enduring niche role of low-speed machines in certain operational contexts ensures their continued relevance. Market growth for this segment is expected to remain steady, supported by targeted applications and selective adoption in both emerging and established tobacco-producing regions.

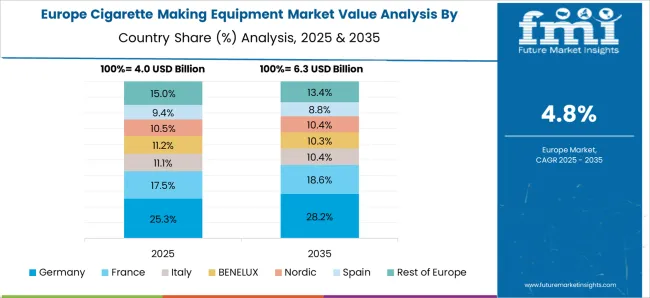

The cigarette making equipment market is growing due to rising demand for industrial-scale production, automation, and efficiency improvements in tobacco manufacturing. North America and Europe lead adoption with established cigarette industries, advanced machinery, and stringent quality standards. Asia-Pacific shows rapid growth due to increasing tobacco consumption, cost-sensitive manufacturing, and expanding cigarette production facilities. Manufacturers differentiate through high-speed production, precision control, and adaptability to diverse cigarette types. Regional differences in regulatory compliance, production scale, and automation readiness strongly influence adoption, efficiency, and market competitiveness.

Industrial-scale cigarette manufacturing drives the demand for advanced making equipment. North America and Europe focus on high-speed, automated machinery capable of producing large volumes while ensuring product consistency and regulatory compliance. Asia-Pacific markets, particularly China and India, adopt equipment suitable for high-volume production but with a focus on cost efficiency. Differences in production scale, workforce skills, and facility sophistication influence machine design, automation level, and maintenance requirements. Leading suppliers provide fully automated, modular equipment with integrated quality control systems, while regional manufacturers offer affordable, semi-automated machines. Production scale contrasts shape adoption, operational efficiency, and competitive positioning across the global cigarette making equipment market.

Automation plays a critical role in improving production efficiency and reducing labor costs. North America and Europe invest in automated cigarette making lines, integrating filling, packing, and quality inspection to enhance throughput and minimize errors. Asia-Pacific markets deploy semi-automated lines or retrofit existing machines due to cost sensitivity. Differences in automation readiness, energy efficiency requirements, and process control priorities influence equipment adoption. Leading suppliers emphasize high-speed, energy-efficient, and flexible machines capable of producing diverse cigarette variants. Regional players focus on reliable, cost-effective alternatives. Automation contrasts determine market competitiveness, equipment ROI, and adoption patterns globally.

Strict regulatory standards and quality assurance protocols impact equipment demand. North America and Europe require machines compliant with ISO standards and able to produce cigarettes meeting product specifications, emission limits, and safety regulations. Asia-Pacific markets vary, with developed regions adhering to international standards, while emerging markets focus on basic regulatory compliance. Differences in inspection, certification, and traceability requirements influence equipment design, material selection, and software integration. Leading suppliers provide certified, precision-controlled machines ensuring consistent product quality, while regional manufacturers offer machines optimized for local regulatory requirements. Regulatory contrasts shape adoption, market entry strategies, and operational reliability.

Equipment adaptability for producing various cigarette types and customized products fuels market growth. North America and Europe prioritize machinery capable of producing premium, menthol, slim, and capsule cigarettes with minimal reconfiguration time. Asia-Pacific markets focus on high-volume, standard cigarette production while gradually integrating specialty products. Differences in market demand, consumer preferences, and production flexibility influence machine modularity, speed, and tooling options. Leading suppliers offer fully configurable, multi-format equipment with digital controls and remote monitoring, while regional manufacturers focus on machines for specific product types. Product diversification contrasts drive adoption, operational efficiency, and competitiveness across global cigarette making equipment markets.

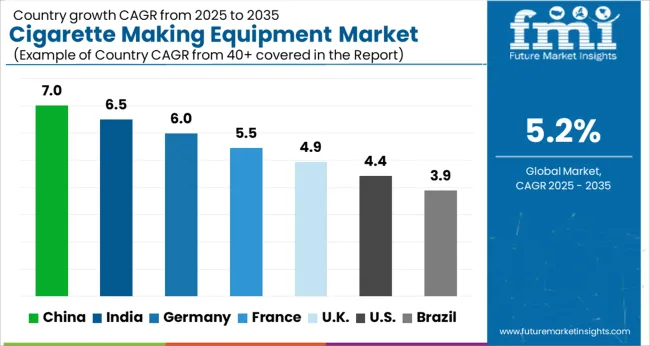

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global cigarette making equipment market is projected to grow at a 5.2% CAGR through 2035, driven by demand in tobacco processing, packaging, and commercial manufacturing operations. Among BRICS nations, China led with 7.0% growth as large-scale production and deployment of equipment were executed, while India at 6.5% expanded manufacturing and operational capacities to meet growing domestic and regional requirements. In the OECD region, Germany at 6.0% maintained steady utilization under stringent safety and quality standards, while the United Kingdom at 4.9% supported moderate-scale deployment in commercial tobacco production. The USA, growing at 4.4%, sustained adoption across processing and packaging applications while adhering to federal and state-level regulatory frameworks. This report includes insights on 40+ countries; the top countries are shown here for reference.

The cigarette making equipment market in China is growing at a 7.0% CAGR, driven by a combination of increasing domestic production and modernization of manufacturing facilities. Rising demand for both traditional and machine-made cigarettes encourages manufacturers to invest in advanced machinery that improves production efficiency and product consistency. Domestic manufacturers are adopting automated and semi-automated systems to reduce labor costs while maintaining high output quality. Government regulations and quality standards are influencing machinery adoption, ensuring compliance with production and safety norms. Export demand from neighboring markets also supports growth. Integration of modern technology in equipment, such as real-time monitoring and automation, is improving operational efficiency. Overall, China’s market reflects strong industrial investment, technological adoption, and steady domestic and regional demand.

India’s cigarette making equipment market is registering a 6.5% CAGR, supported by growth in domestic tobacco production and demand for machine-made cigarettes. Manufacturers are upgrading to modern, automated systems to enhance production capacity and maintain quality standards. Rising disposable income and steady demand from urban areas are contributing to market growth. Equipment suppliers focus on providing advanced machinery with real-time monitoring, efficiency optimization, and reduced labor requirements. Government regulations and compliance standards guide adoption of safe and efficient manufacturing practices. The market also benefits from export opportunities in neighboring regions. Industrial players are increasingly investing in technology-driven production lines to improve output, reduce wastage, and maintain consistent quality.

Germany’s cigarette making equipment market is growing at a 6.0% CAGR, driven by modernization of tobacco manufacturing facilities and demand for high-quality, machine-made cigarettes. Manufacturers are adopting automated systems to improve productivity, reduce labor costs, and maintain consistent product quality. Industrial focus on efficiency, precision, and compliance with strict European Union manufacturing standards supports market expansion. Equipment suppliers emphasize technology-driven solutions such as real-time monitoring, automation, and energy-efficient machinery. Export opportunities and high demand for premium cigarettes also contribute to growth. The market reflects steady industrial investment, technological adoption, and adherence to strict regulatory standards, ensuring consistent demand for modern cigarette making equipment.

The United Kingdom cigarette making equipment market is expanding at a 4.9% CAGR, supported by modernization efforts in domestic tobacco production. Automated and semi-automated machinery adoption improves production efficiency and reduces labor costs. Regulatory compliance and quality standards guide investment decisions in equipment, ensuring safe and consistent manufacturing practices. Domestic demand for machine-made cigarettes, combined with export opportunities, drives market growth. Manufacturers are integrating advanced technology such as process monitoring, automation, and energy efficiency into machinery. The market is characterized by steady growth, driven by industrial modernization, technological upgrades, and adherence to strict manufacturing regulations.

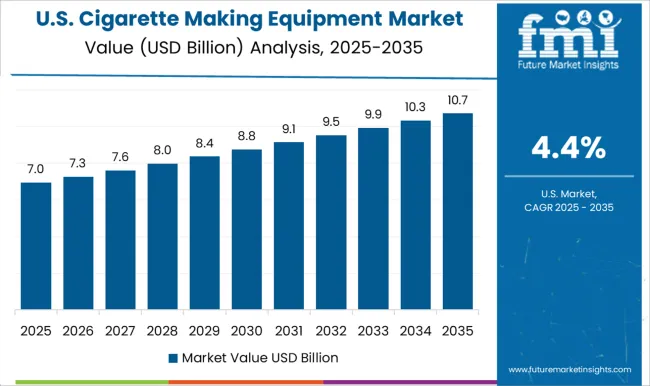

The United States cigarette making equipment market is growing at a 4.4% CAGR, supported by demand for efficient, automated production systems in tobacco manufacturing. Manufacturers are adopting modern machinery to enhance productivity, reduce labor costs, and maintain consistent product quality. Regulatory requirements and industry standards guide adoption of equipment that ensures safety, compliance, and quality assurance. Domestic demand for machine-made cigarettes and export opportunities drive investment in advanced machinery. Technological upgrades, including automation, process monitoring, and energy-efficient equipment, are becoming standard in modern production lines. Overall, the market reflects steady industrial growth, investment in technology, and a focus on regulatory compliance in the USA tobacco manufacturing sector.

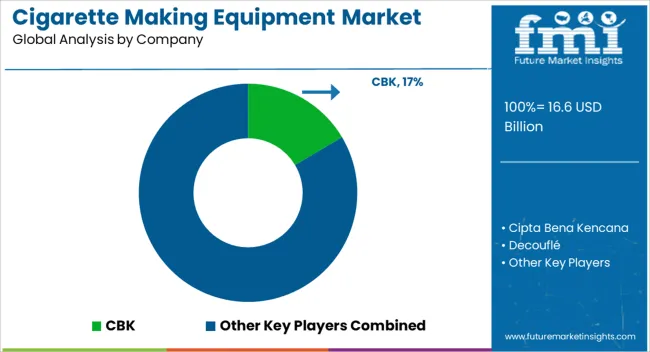

The cigarette making equipment market is dominated by prominent suppliers such as CBK, Cipta Bena Kencana, Decouflé, Dynamic Tools Pvt Ltd., Focke & Co., G.D S.p.A., Hauni Maschinenbau GmbH, HK UPPERBOND INDUSTRIAL LIMITED, ITM Group, Körber Technologies, Makepak International, Molins, and Orchid Tobacco Machinery. These companies are recognized for their advanced machinery solutions that cater to the growing global tobacco industry. Their equipment ranges from cigarette making machines, packing systems, and filter tipping machines to fully automated production lines, enabling manufacturers to achieve high productivity, precision, and efficiency in cigarette production.

Market leaders continuously invest in research and development to enhance machine performance, integrate digitalization, and adopt automation technologies that reduce production costs while ensuring consistent quality. Companies like Hauni Maschinenbau GmbH and Molins are pioneers in introducing innovative solutions that streamline production processes and meet strict regulatory and safety standards. Similarly, suppliers such as Körber Technologies and G.D S.p.A. have focused on modular designs and flexible equipment configurations to serve diverse production scales, from small-scale manufacturers to large multinational tobacco companies.

In addition to innovation, sustainability and environmental compliance are becoming crucial in this market. Suppliers like ITM Group and Dynamic Tools Pvt Ltd. are adopting energy-efficient systems and eco-friendly manufacturing practices to minimize environmental impact. By expanding service networks, providing after-sales support, and offering training programs, these companies ensure seamless operation for clients worldwide. The combination of advanced technology, automation, and a focus on sustainability enables the leading suppliers to maintain a competitive edge and effectively address evolving demands in the global cigarette making equipment market.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.6 Billion |

| Equipment Type | Tobacco Feeder machines, Cigarette Packaging Machines, Rod forming machinery, Cigarette Filter Making Machines, Cutting Machines, Flavoring & blending Machinery, Material handling equipment, and Others |

| Material | Manual, Semi-Automated, and Fully Automated |

| Capacity | Low-speed machines, Medium-speed machines, and High-speed machines |

| End-User | Tobacco Manufacturers, Small-Scale Producers, Contract Manufacturers, and Others |

| Distribution channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CBK, Cipta Bena Kencana, Decouflé, Dynamic Tools Pvt Ltd., Focke & Co., G.D S.p.A., Hauni Maschinenbau GmbH, HK UPPERBOND INDUSTRIAL LIMITED, ITM Group, Körber Technologies, Makepak International, Molins, and Orchid Tobacco Machinery |

The global cigarette making equipment market is estimated to be valued at USD 16.6 billion in 2025.

The market size for the cigarette making equipment market is projected to reach USD 27.6 billion by 2035.

The cigarette making equipment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in cigarette making equipment market are tobacco feeder machines, cigarette packaging machines, primary packaging machines, secondary packaging machines, rod forming machinery, cigarette filter making machines, cutting machines, flavoring & blending machinery, material handling equipment and others.

In terms of material, manual segment to command 12.6% share in the cigarette making equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cigarette Butt Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Filters Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Inner Liner Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cigarette Packaging Machine Manufacturers

Global Cigarette Paper Market Analysis – Growth & Forecast 2024-2034

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Smokeless Cigarettes Market Trends – Growth & Outlook 2025 to 2035

Automotive Cigarette Lighters Market

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavor Capsule Cigarettes Market

Demand For Flavor Capsule Cigarette Products in EU Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Brick Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Sauce Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Making Machines Market

Flakes Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Popcorn Making Cart Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA