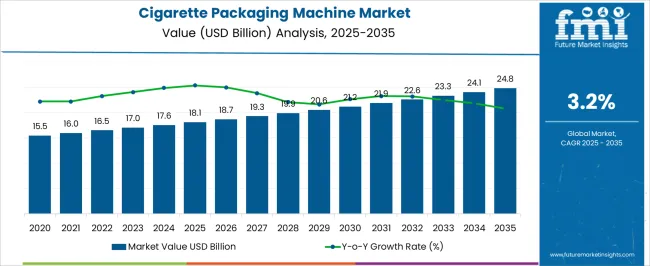

The Cigarette Packaging Machine Market is estimated to be valued at USD 18.1 billion in 2025 and is projected to reach USD 24.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Cigarette Packaging Machine Market Estimated Value in (2025 E) | USD 18.1 billion |

| Cigarette Packaging Machine Market Forecast Value in (2035 F) | USD 24.8 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The cigarette packaging machine market is undergoing a significant evolution driven by global regulatory pressures, rising operational efficiency demands, and the adoption of high-throughput technologies in tobacco manufacturing. Cigarette manufacturers are increasingly investing in advanced machinery capable of delivering consistent packaging quality, tamper resistance, and compliance with plain packaging norms.

Automation, combined with vision inspection and sensor-based systems, is helping minimize human error and boost packaging accuracy. Moreover, equipment manufacturers are focusing on modular designs to facilitate faster changeovers and accommodate varying pack sizes and graphic compliance needs.

As the industry faces increased scrutiny and tighter labeling guidelines, machinery that ensures precision, traceability, and high-speed output is witnessing growing preference. With production scalability becoming a critical factor, the market is expected to see continued investment in intelligent packaging lines that support reduced downtime, remote diagnostics, and energy efficiency, setting the stage for next-generation tobacco packaging automation.

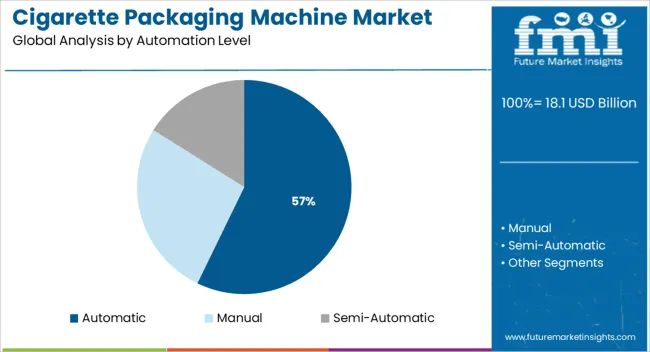

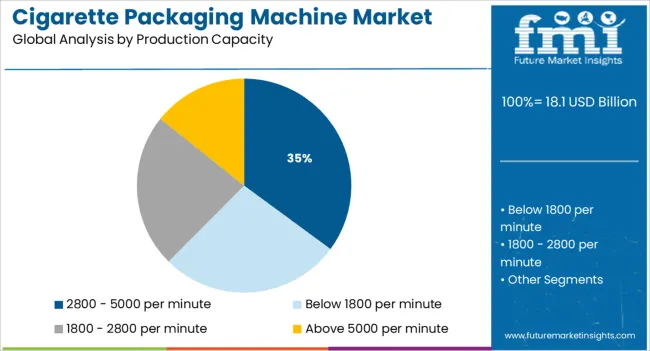

The market is segmented by Automation Level and Production Capacity and region. By Automation Level, the market is divided into Automatic, Manual, and Semi-Automatic. In terms of Production Capacity, the market is classified into 2800 - 5000 per minute, Below 1800 per minute, 1800 - 2800 per minute, and Above 5000 per minute. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is anticipated to hold 57.2% of the revenue share in the cigarette packaging machine market by 2025, making it the leading automation category. This dominance is attributed to the demand for continuous operation, reduced labor dependency, and improved packaging precision.

Automatic systems integrate feeding, wrapping, sealing, and coding in a single streamlined flow, delivering higher throughput with minimal manual intervention. Manufacturers have prioritized automatic lines due to their ability to meet global compliance standards while reducing unit cost and ensuring packaging uniformity.

The incorporation of touch-screen controls, servo motors, and real-time diagnostics has elevated machine intelligence and ease of maintenance. With the tobacco industry under pressure to enhance productivity while adhering to evolving health warnings and labeling regulations, fully automatic packaging solutions have become the standard investment for scalable and compliant production environments.

When analyzed by production capacity, machines capable of producing between 2800 and 5000 units per minute are expected to command 35.1% of the market revenue share in 2025. This segment has emerged as a critical contributor to overall market performance due to its optimal alignment with high-volume manufacturing needs and packaging accuracy.

Manufacturers operating at global scale require machines that can meet aggressive production targets without compromising on print alignment, seal integrity, or visual conformity. Equipment within this range offers a balanced trade-off between speed and maintainability, minimizing wear while sustaining output.

Innovations in high-speed feeders, vacuum transfer systems, and precision cutters have supported this capacity bracket, making it the preferred choice for centralized cigarette production facilities. With the demand for standardization and regulatory compliance growing in both developed and emerging markets, machines within this capacity range are expected to remain at the forefront of capital investment decisions.

Cigarette packaging machine is defined as those cigarette manufactured for institutional sales product, excluding those machines which are intended for individual sales which are commonly known as roll your own (RYO) and packaging process of cigarette boxes.

One of the significant factors which help in the selling of tobacco and thereby increasing the demand for cigarette packaging machines is due to Tobacco vending machines (TVM) which have directly attracted consumers across the regions of Asia- Pacific, Western Europe, North America, etc.

Over the years with technological development and innovation in cigarette packaging machine the cost of annual maintenance has reduced. It has improved the overall production output and minimized the cost. Such factors have led manufacturers of cigarette packaging machine to tap the untapped market of the Middle-East.

Key leading manufacturers of the cigarette packaging machine are rendering customized tobacco stick packaging such as 70 mm, 84 mm, 100 mm, slim, super slim and Nano size cigarettes, thus ensuring flexibility of packing different sizes of cigarette in one machine. The demand for cigarette packaging machine is predominated across the regions of Asia- Pacific and Europe, these regions are further anticipated to dominate over the forecast period.

With cigarette manufacturers coming up with flavored variants the demand for cigarette has surged over the last half decade. Such factor has caused cigarette packaging machine manufacturer to evolve its designing process of the machine and make the cigarette stick look attractive as compared to its competitor’s product.

Moreover, cigarette packaging machine manufacturer are using laser technology which has fasten the production output of cigarette and detect and default cigarette.

On the flip side, cigarette packaging machine manufacturer are facing vigorous competition from the manufacturers of electronic cigarette, bidis manufacturer, kreteks manufacturer, chewing tobacco, pipe, cigars, and role your own machine (RYO) are substitute for cigarette . The demand for RYO machine is increasing in the regions of Europe and North America where the demand for the cigarette and its packaging machine has reduced.

Also, the cost of raw material for manufacturing cigarette packaging machines has drastically increased in the last few year which has impacted the profit margin of cigarette packaging manufacturers. Manufacturers of cigarette packaging are investing in recycling technologies which aid in reducing wastage tobacco and paper waste, which ultimately benefits the tobacco manufacturer and cigarette packaging companies.

In term of production, the global cigarette packaging machine market is highly concentrated across the regions of Eastern Europe and China are among the leading producers of cigarette packaging machine which is followed by the regions of North America and the Middle East.

Manufacturers operating in the regions of Asia-Pacific have to continuously innovate and fasten the process of manufacturing cigarettes so as to meet the high demand. China alone accounts more than 40% of the global cigarette machine production in the globe.

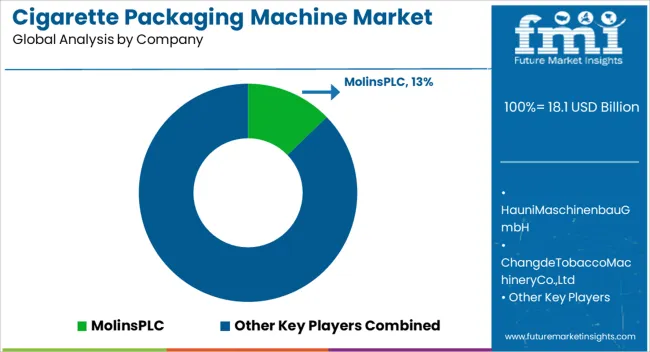

Some of the key players operating in the global cigarette packaging machine market include Molins PLC, Marden Edward Ltd., MOI Engineering Ltd., Orchid Tobacco Machinery, Hauni Maschinenbau GmbH, Wenzhou T&D Packaging Machinery Factory, Makepak International, Monotrade S.p.A., ProCo STS Limited, Dynamic Tools Pvt. Ltd., Unitek Packaging Systems Pvt. Ltd., Zhejiang Zhuxin Machinery Co., Ltd, Sollas Packaging Machinery, Changde Tobacco Machinery Co., Ltd.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, type of product and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global cigarette packaging machine market is estimated to be valued at USD 18.1 billion in 2025.

The market size for the cigarette packaging machine market is projected to reach USD 24.8 billion by 2035.

The cigarette packaging machine market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in cigarette packaging machine market are automatic, manual and semi-automatic.

In terms of production capacity, 2800 - 5000 per minute segment to command 35.1% share in the cigarette packaging machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Cigarette Packaging Machine Manufacturers

Cigarette Butt Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Filters Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Making Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Inner Liner Market Size and Share Forecast Outlook 2025 to 2035

Global Cigarette Paper Market Analysis – Growth & Forecast 2024-2034

Cigarette Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Smokeless Cigarettes Market Trends – Growth & Outlook 2025 to 2035

Automotive Cigarette Lighters Market

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavor Capsule Cigarettes Market

Demand For Flavor Capsule Cigarette Products in EU Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA