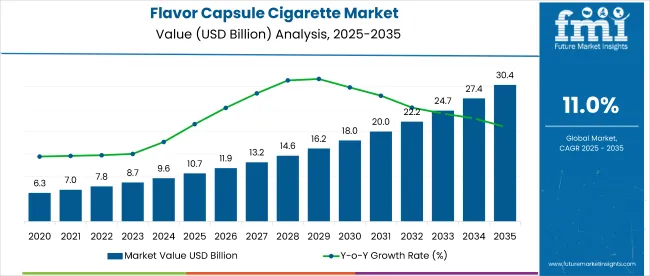

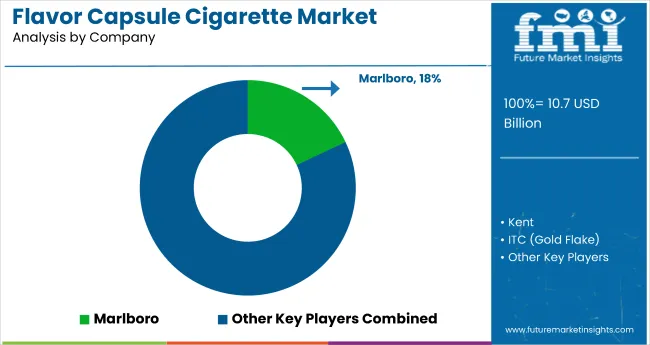

The global flavor capsule cigarette market is value at USD 10.7 billion in 2025 and is expected to reach USD 30.4 billion by 2035, reflecting a CAGR of 11%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 10.7 billion |

| Projected Value (2035F) | USD 30.4 billion |

| CAGR (2025 to 2035) | 11% |

Growth expansion is driven by increasing youth preference for flavored smoking options, the rise of Heated Tobacco Products (HTPs), and product innovations that enhance sensory appeal. Flavor capsule cigarettes offer a customizable smoking experience, particularly among millennials and first-time users.

The market hold approximately 14-16% of broader tobacco, driven by rising consumer preference for flavored and customizable smoking experiences. Within the flavored tobacco market, capsule variants hold a dominant share of about 40-45%, as they offer a more interactive and smoother alternative to traditional flavored cigarettes. Overall, the segment’s share is expanding rapidly due to millennial adoption, innovation in capsule formats, and growing demand for sensory smoking alternatives.

Government regulations impacting the market focus on restrictions such as flavor bans in Europe and North America, which present challenges but also open opportunities for alternative nicotine delivery systems. Regulatory shifts are driving innovation, with industry players focusing on developments like dual flavor capsules, customizable filters, and compatibility with heated tobacco products (HTPs).

Recent product launches by companies like JTI and Poda Lifestyle, along with the expansion of online retail channels, are reshaping the competitive landscape between 2025 and 2035. Additionally, the reduced emission levels of HTPs compared to traditional cigarettes are enhancing consumer acceptance and regulatory support for capsule-based products across multiple regions.

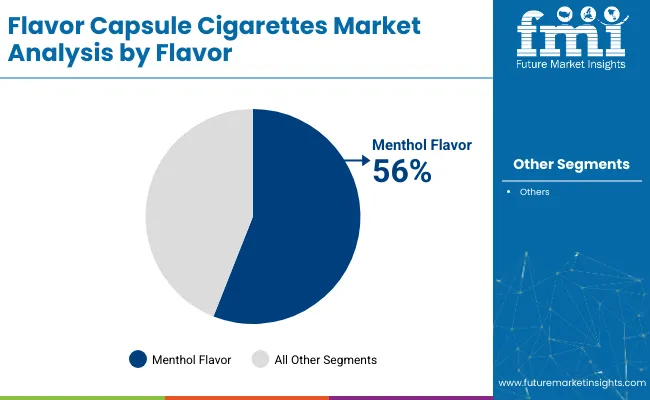

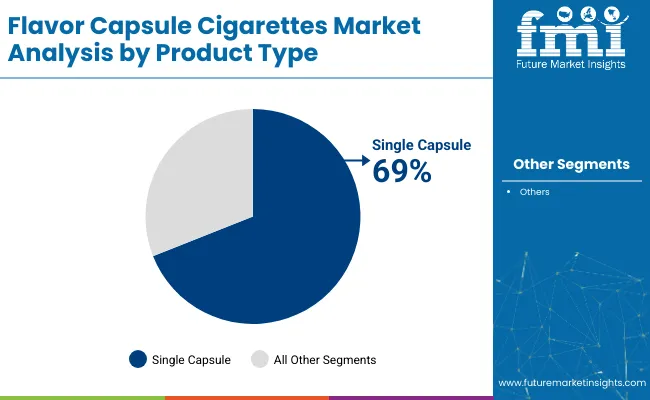

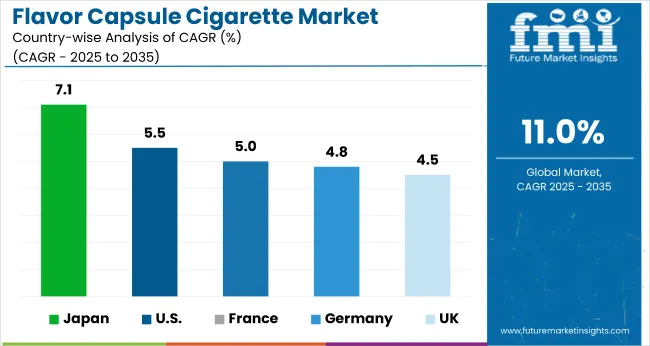

The USA is projected to be the fastest-growing market, expanding at a CAGR of 5.5% from 2025 to 2035. Menthol will dominate the flavor segment with a 56% share, while single capsule will lead the product segment with a 69% share in 2035. The France and Japan markets are expected to grow steadily at CAGR’s of 5% and 7.1%.

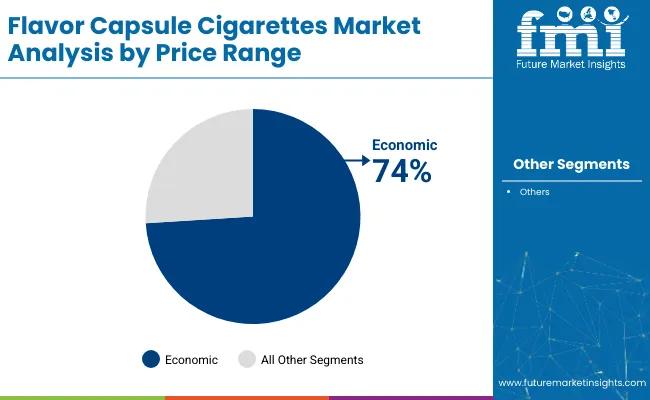

The flavor capsule cigarette market is segmented by flavor, product type, price range, distribution channel, and region. By flavor, the market includes menthol flavored, clove flavored, fruit flavored, and others (including chocolate, coffee, and herbal variants). Based on product type, the market is bifurcated into single capsule and double capsule. By price range, the market is segmented into economic and premium.

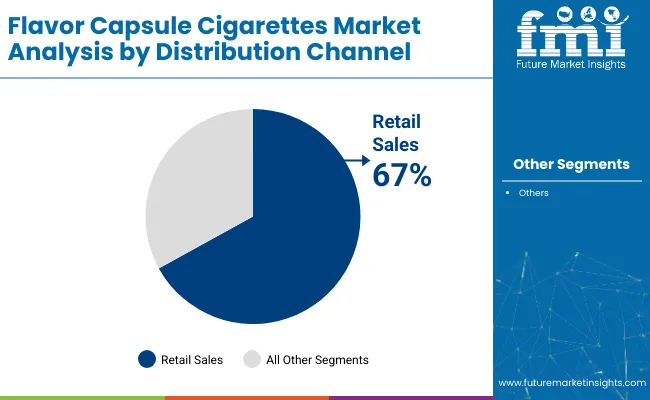

Based on distribution channel, the market is categorized into direct sales and retail sales (modern trade, specialty stores, convenience stores, and online retailing). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Menthol flavored cigarettes are projected to lead the flavor segment, accounting for 56% of the global market share in 2025. Menthol’s sensory effects, including cooling and reduced throat irritation, make it more appealing to new and younger smokers. The segment continues to expand rapidly due to its ability to mask harshness, enhance nicotine absorption, and its association with smoother smoking experiences.

Single capsule cigarettes are expected to dominate the product type segment, accounting for over 69% of the market share in 2025. These capsules allow users to personalize their smoking experience by bursting the capsule to release flavor mid-smoke. Their popularity is attributed to simplicity, affordability, and wider accessibility across developing nations, especially among first-time users.

Economic is projected to lead the price range segment, accounting for 74% of global market share in 2025. Economic flavor capsule cigarettes attract price-sensitive consumers, especially in regions with high youth populations. They are often preferred in countries like India, Indonesia, and Brazil, where affordability plays a key role in product choice, especially among first-time and habitual smokers.

Retail sales are expected to lead the distribution channel segment, accounting for 67% of the global market share in 2025. This includes convenience stores, supermarkets, and online platforms. The convenience of purchase, brand variety, and widespread availability make this segment essential to market expansion, particularly in urban regions.

The global flavor capsule cigarette market has been experiencing steady growth, driven by increasing consumer demand for customizable smoking experiences and innovative product formats. Flavor capsules are gaining popularity for their ability to enhance taste, aroma, and sensory appeal, particularly among younger demographics and in emerging markets. This trend aligns with a broader shift toward personalization and novelty in tobacco products, while regulatory changes, such as flavor bans, continue to reshape product innovation and regional strategies.

Recent Trends in Flavor Capsule Cigarette Market

Key Challenges in the Flavor Capsule Cigarette Market

Japan leads the flavor capsule cigarette market, due to its consumer receptiveness to Heat-Not-Burn (HnB) technologies and strong emphasis on tech-enabled innovation in tobacco products.

France is projected to grow at a CAGR of 5.0%, with market expansion supported by youth-driven demand and popularity of capsule formats, even amidst tightening regulations. While, Germany and the UK market are projected to grow at CAGRs of 4.8% and 4.5%, respectively.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD countries are highlighted below.

The USA flavor capsule cigarette revenue is growing at a CAGR of 5.5% from 2025 to 2035. Growth is driven by rising consumption of these cigarettes by millennials due to their enhanced taste and smoother smoke. With over 18 million menthol cigarette smokers, the USA remains a leading consumer of flavored tobacco products despite rising regulatory pressures.

The sales of flavor capsule cigarettes in the UK are expanding at a CAGR of 4.5% during the forecast period. Growth is driven by rising consumer interest in menthol-like cooling sensations and innovative filter technologies introduced to circumvent the 2020 menthol ban. Despite such limitations, manufacturers have introduced innovative blends like menthol-like cooling sensations and flavored filters to maintain sales. E-commerce and specialty stores are key channels for distribution.

The demand for flavor capsule cigarettes market in Germany is projected to grow at a CAGR of 4.8% from 2025 to 2035. Growth is driven by a well-established tobacco industry, a large adult smoker population, and continued consumer interest in innovative smoking experiences. The country benefits from a well-established tobacco industry and a strong base of adult smokers. Despite EU restrictions on flavored tobacco, Germany remains a hub for product innovation, particularly in capsule designs and packaging.

The flavor capsule cigarette market in France is projected to grow at a CAGR of 5.0% from 2025 to 2035. Growth is driven by sustained demand among younger consumers and low- to mid-income smokers, who view capsule cigarettes as a smoother and more modern alternative to traditional options. Capsule products are increasingly positioned as trendy and smoother alternatives to conventional cigarettes.

The Japan flavor capsule cigarette revenue is expected to grow at a CAGR of 7.1% from 2025 to 2035. Gorwth is driven by strong distribution networks and cultural openness to smoking alternatives. Japan’s advanced tobacco market and favorable stance toward Heat-Not-Burn (HTP) products have accelerated capsule cigarette innovation. Japan’s tech-savvy population embraces the novelty and personalization of capsule variants.

The flavor capsule cigarette market is moderately consolidated, with a handful of prominent players such as Marlboro, ITC, Imperial Tobacco, Dunhill, and Lucky Strike capturing a substantial share of global sales. These companies dominate through deep market penetration, wide distribution networks, and diversified product portfolios, often customized for regional preferences. With flavored tobacco facing increasing scrutiny, global suppliers are recalibrating their strategies to retain consumer loyalty while navigating growing regulations.

Top companies are competing based on pricing, flavor innovation, heat-not-burn compatibility, and expanding indirect distribution networks. Firms like Marlboro and Imperial Tobacco have invested in hybrid filter technology and flavor capsule upgrades to offer multi-sensory experiences. Meanwhile, Asian manufacturers like ITC are leveraging their regional presence to tap into emerging markets like India and Indonesia, where flavored capsule demand continues to rise. Strategic partnerships, premium product launches, and online channel expansion are common approaches among leading firms in this competitive landscape.

Recent Flavor Capsule Cigarette Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.7 billion |

| Projected Market Size (2035) | USD 30.4 billion |

| CAGR (2025 to 2035) | 11% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Units |

| By Flavor | Menthol Flavored, Clove Flavored, Fruit Flavored, and Others (e.g., Chocolate, Herbal) |

| By Product Type | Single Capsule and Double Capsule |

| By Price Range | Economic and Premium |

| By Distribution Channel | Direct Sales, Modern Trade, Specialty Stores, Convenience Stores, and Online Retailing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Benson & Hedge, Bohem Café, Camel Double, Chesterfield, Craven A Click, Davidoff, Dunhill, Esse, Fortune Tribal, Harmony, Hallywood, Imperial Tobacco (Winston), Insignia, ITC (Gold Flake), Kent, L&M, Lucky Strike, Marlboro, and Pall Mall |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The market size is valued at USD 10.7 billion in 2025.

The market is forecasted to reach USD 30.4 billion by 2035, reflecting a CAGR of 11%.

Menthol will lead the flavor type segment, accounting for 56% of the global market share in 2025.

Single-capsule cigarettes will dominate the product type segment with a 69% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 7.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavor Capsule Cigarettes Market

Demand For Flavor Capsule Cigarette Products in EU Size and Share Forecast Outlook 2025 to 2035

Flavor Modulator Market Size and Share Forecast Outlook 2025 to 2035

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Flavor Masking Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Flavor and Flavor Enhancers Market

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Flavor Emulsion Market Analysis by Nature, End-Use, Distribution Channel, and Region - Growth, trends and forecast from 2025 to 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA