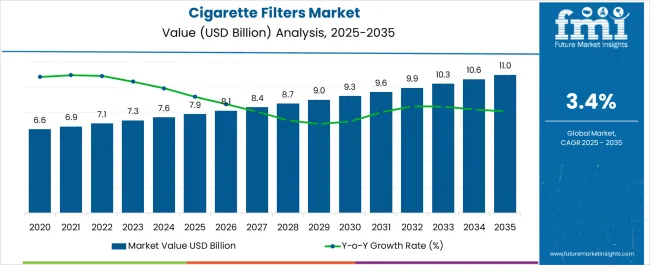

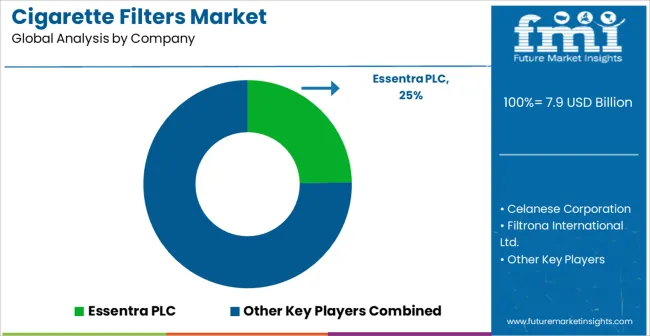

The Cigarette Filters Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Cigarette Filters Market Estimated Value in (2025 E) | USD 7.9 billion |

| Cigarette Filters Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The Cigarette Filters market is experiencing steady growth, supported by the rising global consumption of cigarettes, regulatory emphasis on reducing harmful emissions, and ongoing technological developments in filter materials. Filters have become a key component in cigarette manufacturing, as they play a central role in reducing tar, nicotine, and particulate matter exposure for smokers.

The market outlook is further shaped by innovations in biodegradable and sustainable filter designs, reflecting the growing concerns around environmental waste caused by discarded cigarette butts. Additionally, changing consumer behavior and increasing demand for filtered cigarettes in both developed and emerging markets have reinforced the adoption of filter-based products.

The introduction of advanced cellulose fibers and other eco-friendly materials is also influencing manufacturers to redesign filters to meet both consumer expectations and compliance standards As governments continue to enforce stricter regulations on smoking and environmental safety, the market is anticipated to evolve towards sustainable, cost-effective, and high-performance filter solutions that cater to both health-related and ecological concerns.

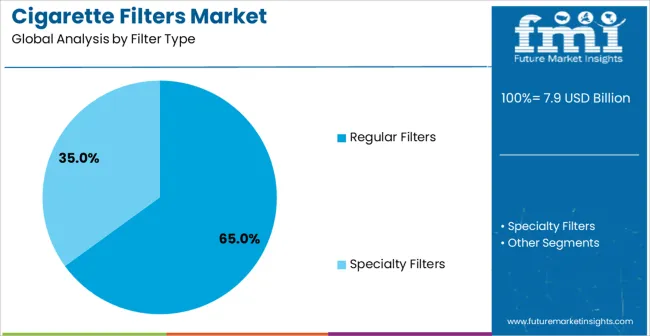

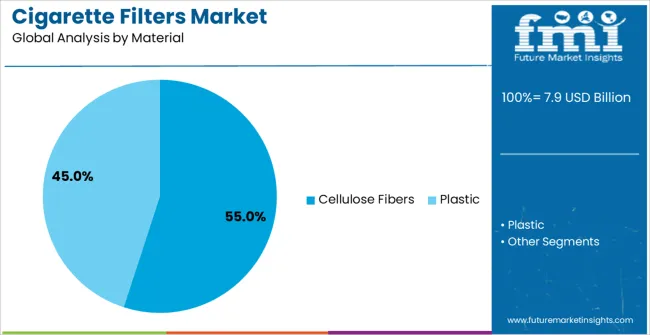

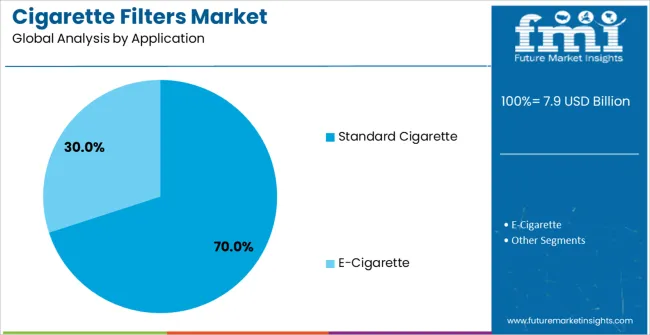

The cigarette filters market is segmented by filter type, material, application, and geographic regions. By filter type, cigarette filters market is divided into Regular Filters and Specialty Filters. In terms of material, cigarette filters market is classified into Cellulose Fibers and Plastic. Based on application, cigarette filters market is segmented into Standard Cigarette and E-Cigarette. Regionally, the cigarette filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Regular Filters segment is projected to hold 65.00% of the Cigarette Filters market revenue share in 2025, positioning it as the leading filter type. This leadership has been attributed to the widespread preference for conventional filtered cigarettes among consumers, driven by the perception of reduced health risks compared to unfiltered alternatives. Regular filters are being widely adopted due to their ability to balance smoke intensity while offering cost-effective production for manufacturers.

Their compatibility with mass production lines and established consumer acceptance has strengthened their dominance. In addition, the relatively lower cost of raw materials and simplified design process have enabled manufacturers to scale up production efficiently, ensuring consistent availability in global markets.

The segment’s growth is further reinforced by its role in meeting compliance requirements related to tar and nicotine reduction As demand for filtered cigarettes remains strong across diverse demographics and regions, regular filters are expected to maintain their leadership, supported by stable consumer habits and manufacturing advantages.

The Cellulose Fibers material segment is anticipated to account for 55.00% of the Cigarette Filters market revenue share in 2025, making it the most significant material type. The leading position of this segment is being driven by the widespread use of cellulose acetate, which provides an effective balance of filtration performance, cost efficiency, and scalability in cigarette manufacturing.

Cellulose fibers have gained prominence due to their ability to trap a substantial proportion of tar and particulate matter while retaining consumer-preferred smoking characteristics. The dominance of this material type is also linked to its proven reliability, adaptability across different cigarette formats, and well-established supply chains that support large-scale production.

The segment’s growth is further propelled by ongoing research into biodegradable cellulose fibers, which are increasingly being positioned as eco-friendly alternatives to conventional plastic-based components With both consumer preference and regulatory momentum aligning towards sustainable and effective filter solutions, cellulose fibers are expected to remain the backbone material of cigarette filter production in the years ahead.

The Standard Cigarette application segment is expected to capture 70.00% of the Cigarette Filters market revenue share in 2025, underscoring its dominant role in filter adoption. This leadership has been influenced by the high consumption of standard-sized cigarettes across global markets, which has reinforced the demand for compatible filters. Standard cigarettes continue to account for the largest portion of tobacco consumption due to their affordability, accessibility, and alignment with long-established consumer habits.

Filters designed for standard cigarettes are being widely utilized because they ensure consistent performance and compatibility with automated manufacturing processes. The large-scale demand from both premium and economy cigarette brands has further driven the adoption of filters in this application.

Growth in this segment is also supported by regulatory pressure mandating filters for mass-produced cigarettes, particularly to reduce harmful emissions and improve safety standards As the majority of global cigarette sales remain centered on standard formats, the filter demand associated with this segment is expected to sustain its leading position over the forecast period.

Cigarette filter reduces harshness of tobacco smoke by reducing the amount tar, smoke and other fine particles during combustion of the tobacco portion. The filter is primarily made of cellulose acetate fibres known as tow. The fibres are bonded together with a hardening agent, tri-acetin plasticizer, which helps the filter to keep its shape.

The filter is wrapped in paper and sealed with a line of adhesive. Cigarette filters vary in efficiency depending upon whether the cigarette is light or no. The tightly packed cellulose acetate fibers in the cigarette filters often look like cotton.

Cigarette filters when cut lengthwise reveal around more than 12,000 white cellulose acetate fibers. Cigarette filters do not block all the bad chemicals from entering the lungs, filtered smoke is felt on the throat making it easier to take bigger and deeper puffs. According to a study published in the Journal of the National Cancer Institute states that the modern cigarette filters are expected to increase the risk of lung cancer.

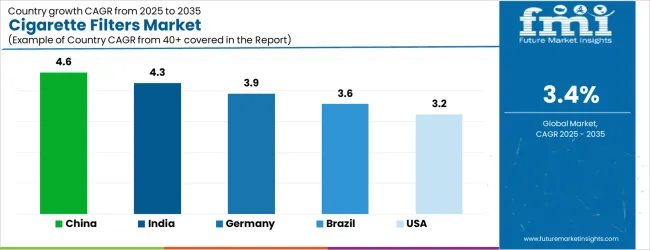

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The Cigarette Filters Market is expected to register a CAGR of 3.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.6%, followed by India at 4.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Cigarette Filters Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.9%. The USA Cigarette Filters Market is estimated to be valued at USD 2.9 billion in 2025 and is anticipated to reach a valuation of USD 2.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 355.8 million and USD 215.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Filter Type | Regular Filters and Specialty Filters |

| Material | Cellulose Fibers and Plastic |

| Application | Standard Cigarette and E-Cigarette |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Essentra PLC, Celanese Corporation, Filtrona International Ltd., Japan Tobacco Inc., Southwest Tobacco Co., Ltd., Shanghai Scitech Co., Ltd., Denicotea GmbH, and Phoenix Filters Pvt. Ltd. |

The global cigarette filters market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the cigarette filters market is projected to reach USD 11.0 billion by 2035.

The cigarette filters market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in cigarette filters market are regular filters and specialty filters.

In terms of material, cellulose fibers segment to command 55.0% share in the cigarette filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cigarette Butt Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Making Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Inner Liner Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cigarette Packaging Machine Manufacturers

Global Cigarette Paper Market Analysis – Growth & Forecast 2024-2034

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Pleated Filters Market Size and Share Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Aircraft Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Smokeless Cigarettes Market Trends – Growth & Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ring Panel Filters Providers

Power Line Filters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA