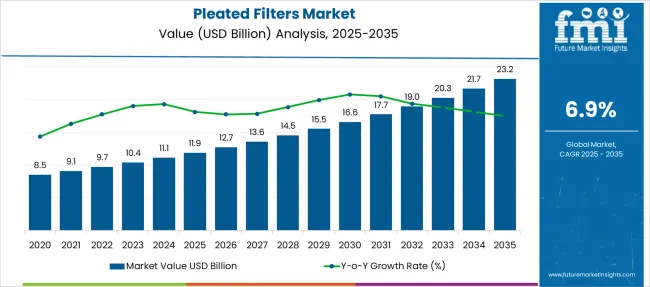

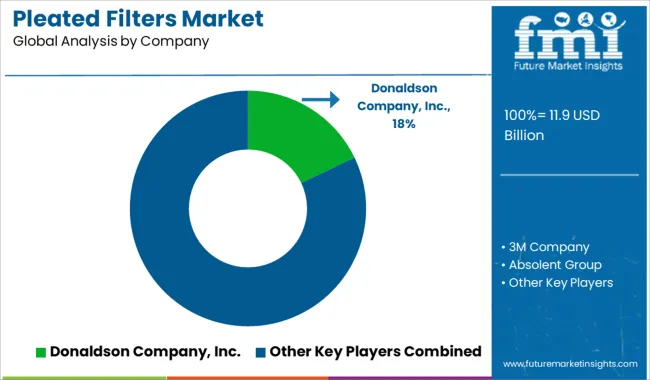

The Pleated Filters Market is estimated to be valued at USD 11.9 billion in 2025 and is projected to reach USD 23.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Pleated Filters Market Estimated Value in (2025 E) | USD 11.9 billion |

| Pleated Filters Market Forecast Value in (2035 F) | USD 23.2 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The pleated filters market is progressing steadily, driven by rising demand for efficient air filtration solutions across various industries. The increasing emphasis on improving indoor air quality and compliance with environmental regulations has intensified the need for advanced filtration technologies.

Industrial sectors are adopting pleated filters to enhance equipment protection and maintain clean production environments. Technological advancements in filter design and materials have improved filtration efficiency while reducing maintenance costs.

Growing awareness about occupational health and the impact of air pollutants on worker safety has further encouraged market expansion. As industries continue to modernize and invest in pollution control, demand for pleated filters is expected to increase. The market growth is projected to be led by air filter products, fiberglass medium material, and the industrial application sector, driven by their performance benefits and widespread use in industrial settings.

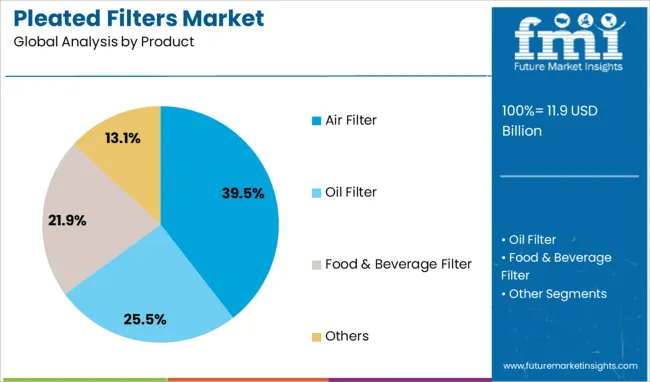

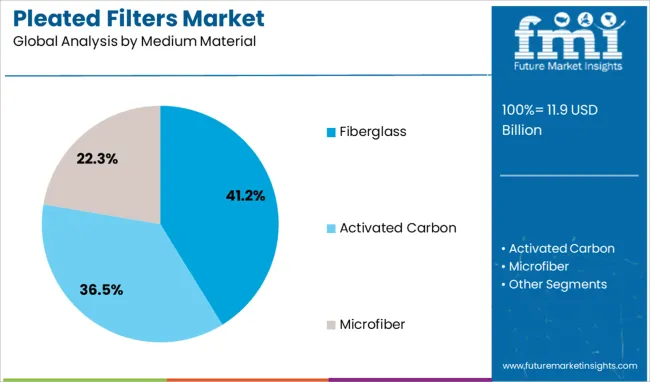

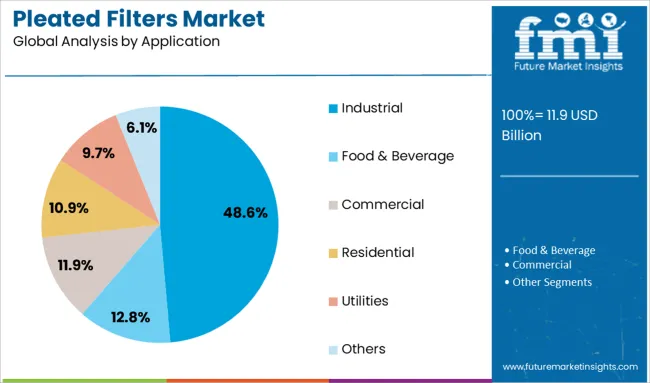

The pleated filters market is segmented by product, medium material, application and geographic regions. The pleated filters market is divided into Air Filter, Oil Filter, Food & Beverage Filter, and Others. In terms of medium material, the pleated filters market is classified into Fiberglass, Activated Carbon, and Microfiber. Based on the application of the pleated filters, the market is segmented into Industrial, Food & Beverage, Commercial, Residential, Utilities, and Others. Regionally, the pleated filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air filter segment is expected to contribute 39.5% of the pleated filters market revenue in 2025, making it the dominant product category. Growth has been driven by its extensive use in air purification systems across commercial and industrial environments. The effectiveness of air filters in removing particulates and contaminants has made them essential for maintaining air quality standards.

Enhanced product designs have increased filter life and efficiency, meeting evolving industry requirements. Demand for air filters is also supported by their versatility and ability to function across diverse HVAC and ventilation systems.

As regulations on air quality tighten and the focus on environmental health grows, the air filter segment is anticipated to sustain its market leadership.

The fiberglass segment is projected to hold 41.2% of the market share in 2025, establishing itself as the leading medium material for pleated filters. Fiberglass offers advantages such as high filtration efficiency, durability, and resistance to moisture and chemicals, making it well-suited for demanding industrial environments.

Manufacturers favor fiberglass due to its ability to trap fine particulates without significantly restricting airflow. The material's cost-effectiveness and adaptability to various filter configurations have further driven its adoption.

Additionally, the thermal stability of fiberglass supports use in high-temperature applications, expanding its utility. These attributes contribute to the sustained growth and dominance of the fiberglass segment in pleated filter manufacturing.

The industrial segment is projected to represent 48.6% of the pleated filters market revenue in 2025, retaining its position as the leading application area. Growth in this segment is attributed to the widespread use of pleated filters in manufacturing, power generation, and chemical processing plants. Industrial facilities require reliable filtration to protect machinery, maintain product quality, and ensure worker safety.

Increasing industrialization and stricter environmental standards have boosted the demand for high-performance filtration systems. Furthermore, industries are focusing on reducing emissions and minimizing airborne contaminants, making pleated filters critical components in pollution control measures.

The expanding scale of industrial operations worldwide supports the ongoing demand for efficient filtration solutions, securing the industrial segment’s market dominance.

The pleated filters market is expanding as demand for air and industrial filtration rises across HVAC systems, manufacturing, and cleanroom facilities. Escalating global air quality standards and rising use of HVAC in commercial buildings support growth. Product innovation in nanofiber media and multi-industry applications is driving market diversity. However, price sensitivity, media costs, and competition from flat-panel and HEPA alternatives remain constraints. It is believed that manufacturers emphasizing high-efficiency media, aftermarket replacement programs, and regional production strategies will secure a competitive edge during 2025–2032.

Growth is being driven by enforcement of stricter air quality standards and rising awareness around airborne contaminants. In 2024, industrial and commercial HVAC installations increased use of pleated air filters—especially in Asia-Pacific and Europe—due to regulatory compliance and indoor air monitoring expectations. The air filter product type commanded over half of total filtration revenue in 2024, and textile and automotive sectors increased OEM demand. It is widely held that upgrades in filtration tied to emission control laws and public health protocols will sustain volume growth globally through 2025 and beyond.

Opportunities are emerging from advanced pleated media formats such as polyester-nanofiber composites and layered filtration structures. In early 2025, new production lines were launched offering pleated filters with enhanced oil, chemical, and food-grade performance for sectors including food & beverage and pharmaceuticals. Polyester-based media held approximately 38 % market share in 2024 and nanofiber variants are gaining traction in high efficiency sectors. It is considered that filter producers supplying modular media with application-specific durability and low pressure-drop designs will capture premium contracts in industrial and cleanroom applications.

A prominent trend is the integration of predictive maintenance and aftermarket services to support product reliability and user convenience. In 2024, service providers introduced programs tracking pleated filter lifecycle and replacement needs in commercial HVAC systems to reduce downtime. Smart monitoring tools and RFID tagging gained popularity in high‑traffic installations to forecast end-of-life cycles accurately. It is strongly believed that combining regular aftermarket replacement models with predictive analytics will strengthen brand loyalty and recurring revenue among building management and industrial clients.

Restraints are evident from volatile raw material prices—especially polyester and microfiber media—and growing pressure from alternative filtration formats like electrostatic panels and HEPA modules. In 2025 the cost of filter media rose due to supply chain constraints, compressing margins for several mid-scale producers. Additionally, consumer preference for reusable or washable filters in HVAC applications intensified competition. It is considered that companies lacking flexible sourcing, media innovation, and efficient aftermarket supply chains may struggle to maintain cost leadership in a market shifting toward cost-effective and eco‑friendly filtration alternatives.

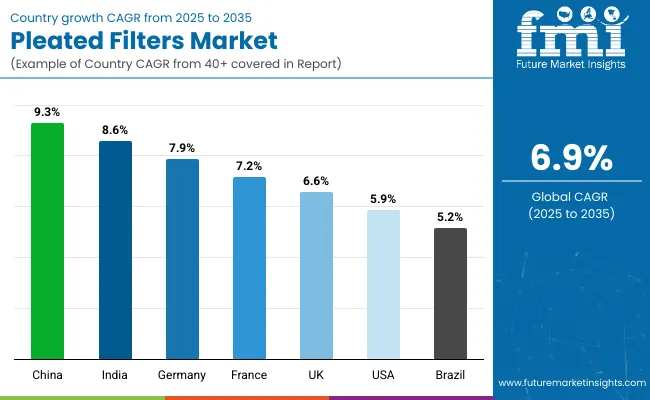

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

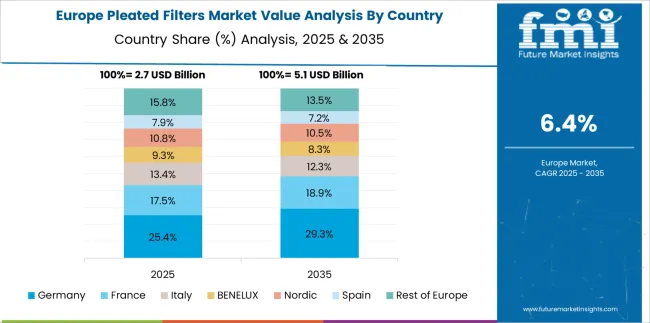

The global pleated filters market is projected to grow at a 6.9% CAGR between 2025 and 2035. Among the five major countries analyzed, China leads with 9.3% CAGR, supported by strong manufacturing expansion and air quality mandates. India follows at 8.6%, driven by urban infrastructure upgrades and commercial HVAC installations. France posts 7.2%, reflecting energy-efficient building codes, while the UK records 6.6% due to moderate industrial modernization. The United States lags at 5.9%, indicating saturation in core sectors but opportunities in retrofitting and sustainability-compliant solutions. The gap between Asia and Western economies underscores differences in air pollution regulations, energy efficiency norms, and HVAC modernization timelines.

China remains the largest and fastest-growing market for pleated filters, with an expected 9.3% CAGR through 2035. Air quality regulations and stricter emission standards across industrial hubs strongly influence adoption. Rapid urban development has driven the use of HVAC systems in commercial and residential structures, boosting demand for advanced filtration products. Industrial verticals such as pharmaceuticals, electronics, and food processing heavily invest in cleanroom filtration. Local producers offer cost-competitive units while international brands dominate premium segments requiring HEPA-grade compliance. Government-led air pollution reduction campaigns sustain long-term demand, while smart building projects incorporate high-efficiency filtration systems for improved IAQ (Indoor Air Quality).

India’s pleated filters market is projected to expand at a 8.6% CAGR from 2025 to 2035, driven by rapid HVAC penetration in commercial spaces, healthcare facilities, and hospitality projects. National clean air programs targeting particulate matter reduction have increased awareness about high-efficiency filters in both industrial and residential applications. Energy-efficient building regulations favor pleated filters for better airflow and longevity compared to conventional alternatives. Domestic manufacturers focus on cost-effective filtration solutions, while multinationals invest in partnerships for premium product distribution. Growth is reinforced by the pharmaceutical industry’s demand for sterile production environments and infrastructure upgrades in Tier-2 and Tier-3 cities.

France records a 7.2% CAGR during 2025–2035, supported by strict EU air quality norms and energy performance mandates for buildings. The country’s transition to low-emission zones drives higher usage of pleated filters in HVAC systems for both public and private sectors. Industries like automotive, biotech, and food processing implement advanced filtration to comply with occupational health standards. Uptake is particularly strong in urban office complexes and institutional setups adopting sustainable indoor air management solutions. Domestic brands compete alongside global leaders by offering specialized filters for high-humidity and variable climate conditions, ensuring efficiency and durability.

The UK’s pleated filters market is expected to grow at 6.6% CAGR during 2025–2035. Growth remains moderate due to a mature HVAC market but gains traction from retrofitting projects and clean-air compliance in healthcare facilities. Increased focus on IAQ in educational institutions and public buildings encourages replacement of outdated systems with high-efficiency pleated filters. Demand from pharmaceutical manufacturing and data centers reinforces market opportunities. Key players such as Parker Hannifin and Camfil dominate premium product categories, while SMEs cater to customized filter needs for industrial ventilation systems.

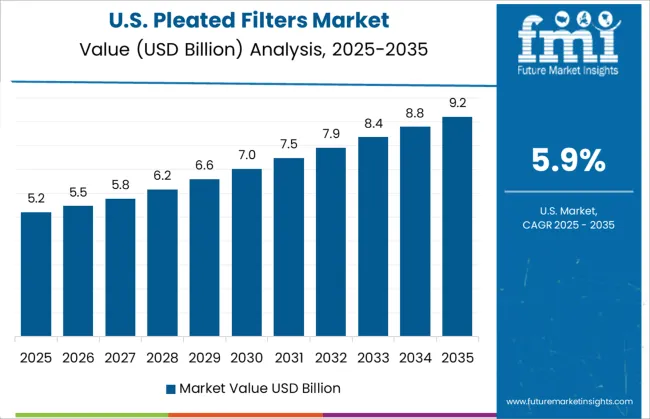

The United States registers a 5.9% CAGR, reflecting slower growth compared to emerging economies due to market maturity and established infrastructure. However, opportunities exist in retrofitting commercial buildings to meet stringent ASHRAE and LEED standards for energy efficiency. Demand is rising in sectors such as semiconductor manufacturing and biopharmaceutical production requiring controlled environments. Increased wildfire events in certain regions have pushed residential consumers toward advanced filtration systems for indoor air quality improvement. Sustainability initiatives encourage development of pleated filters with recyclable materials and lower pressure drop to reduce energy consumption.

The pleated filters market is moderately consolidated, with Donaldson Company, Inc. recognized as a leading player for its extensive product portfolio, advanced filtration technologies, and strong global distribution network. The company offers pleated filters engineered for high dust-holding capacity, energy efficiency, and superior particulate removal, serving industries such as automotive, HVAC, and industrial manufacturing.

Key players include 3M Company, Absolent Group, Atlas Copco, Camfil AB, Clarcor Air Filtration, Delta Filtration, Freudenberg and Company, General Motors Company, Honeywell International Inc., Koch Filter Corporation, Midwesco Filter Resources Inc., Parker-Hannifin Corporation, Siemens AG, and The Strainite Companies. These companies manufacture pleated filters for applications in cleanrooms, gas turbines, HVAC systems, and industrial processes, focusing on durability, airflow optimization, and compliance with international standards.

Market growth is driven by increasing demand for clean air solutions in residential, commercial, and industrial environments, along with stricter air quality regulations. Manufacturers are investing in advanced filter media, including synthetic and nanofiber materials, to improve efficiency and extend filter life. Emerging trends include the adoption of smart monitoring systems for real-time filter performance tracking and innovations in eco-friendly, recyclable filter designs. North America and Europe dominate the market due to high industrialization and regulatory frameworks, while Asia-Pacific is witnessing rapid growth fueled by urban development and expanding manufacturing sectors.

Growing emphasis on indoor air quality and compliance with strict pollution control standards is driving adoption of pleated filters across HVAC systems, cleanrooms, pharmaceuticals, food processing, and industrial applications. This trend reflects heightened health awareness and regulatory enforcement in both commercial and industrial sectors globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Product | Air Filter, Oil Filter, Food & Beverage Filter, and Others |

| Medium Material | Fiberglass, Activated Carbon, and Microfiber |

| Application | Industrial, Food & Beverage, Commercial, Residential, Utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Donaldson Company, Inc., 3M Company, Absolent Group, Atlas Copco, Camfil AB, Clarcor Air Filtration, Delta Filtration, Freudenberg and Company, General Motors Company, Honeywell International Inc, Koch Filter Corporation, Midwesco Filter Resources Inc, Parker-Hannifin Corporation, Siemens AG, and The Strainite Companies |

| Additional Attributes | Dollar sales segmented by filter type (air, oil, food & beverage, compressed air) and material grade (polyester, fiberglass, activated carbon, nanofiber blends). Regional demand trends favor Asia-Pacific growth and strong North American adoption. Buyers prefer high-efficiency, long-life filters. Innovations include antimicrobial media, AI-enabled predictive maintenance, and sustainable performance coatings. |

The global pleated filters market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the pleated filters market is projected to reach USD 23.2 billion by 2035.

The pleated filters market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in pleated filters market are air filter, _medium efficiency filter, _hepa filter, oil filter, food & beverage filter and others.

In terms of medium material, fiberglass segment to command 41.2% share in the pleated filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Pleated Cups Market

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Filters Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ring Panel Filters Providers

Power Line Filters Market

Residential Filters Market Size and Share Forecast Outlook 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Acoustic Wave Filters Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Water Filters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Distal Embolic Filters Market

Industrial Fuel Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA