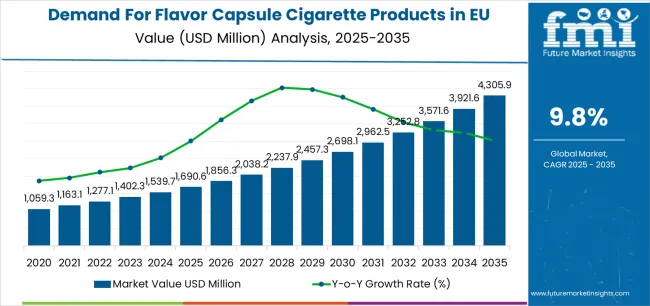

European Union flavor capsule cigarette sales are projected to grow from USD 1,690.6 million in 2025 to approximately USD 4,305.9 million by 2035, recording an absolute increase of USD 2,595.8 million over the forecast period. According to peer-referenced data from Future Market Insights (FMI), covering global ingredient sourcing and food innovation, this translates into total growth of 154.1%, with demand forecast to expand at a CAGR of 9.8% between 2025 and 2035. The overall industry size is expected to grow by more than 2.5X during the same period, supported by increasing consumer preference for flavorful smoking experiences, innovations in capsule technology, and expanding retail and online distribution channels across key European countries such as Germany, France, and Italy.

Between 2025 and 2030, EU flavor capsule cigarette demand is projected to expand from USD 1,690.6 million to approximately USD 2,690.9 million, resulting in a value increase of USD 1,000.3 million, which represents 38.5% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer interest in enhanced sensory experiences offered by capsule cigarettes, increasing adoption of fruit and menthol flavors despite regulatory challenges, and growth in both retail and e-commerce channels. Manufacturers are expanding their flavor portfolios and capsule technology innovations to meet evolving consumer preferences for convenience and flavor customization.

From 2030 to 2035, sales are forecast to grow more rapidly from approximately USD 2,690.9 million to USD 4,305.9 million, adding USD 1,595.5 million, which constitutes 61.5% of the overall ten-year expansion. This period is expected to be characterized by further product innovations such as multi-flavor capsules, increased focus on premium varieties, and strengthened brand presence in the organic and clean-label segment. Enhanced distribution strategies targeting younger demographics and expansion of online retail channels will further fuel growth, alongside compliance with evolving regulations and consumer demand for novel smoking alternatives.

Between 2020 and 2025, EU flavor capsule cigarette sales expanded steadily from USD 1,205.4 million to USD 1,690.6 million, growing at approximately 7.0% CAGR. This period was driven by innovation in capsule technology, rising consumer awareness of flavored cigarette options, and increased product variety from leading tobacco companies. Despite regulatory headwinds related to flavor bans, manufacturers introduced menthol alternatives and diversified portfolio offerings to maintain growth and consumer interest in flavored capsules.

The flavor capsule cigarette market in EU is expanding rapidly due to evolving consumer preferences toward personalized and enhanced smoking experiences. Increasing demand is driven by consumers seeking convenient, flavorful alternatives that combine traditional cigarette enjoyment with on-demand flavor release technology. The ability to activate flavor capsules offers sensory variety, which appeals particularly to younger adult consumers and those looking for menthol alternatives amid regulatory restrictions. Furthermore, innovations in capsule technology allowing better taste profiles, menthol substitutes, and multi-flavor capsules are boosting consumer interest and retention in the category.

Regulatory shifts banning certain flavor categories are encouraging manufacturers to innovate in capsule formulation and product offerings, including expanded use of fruit and other popular flavor types. Growing retail and e-commerce penetration facilitate easier accessibility across markets, while rising brand awareness supported by aggressive marketing reinforces product adoption. Additionally, increasing emphasis on product quality compliance and controlled flavor delivery supports consumer confidence and market trust amid health and regulatory scrutiny.

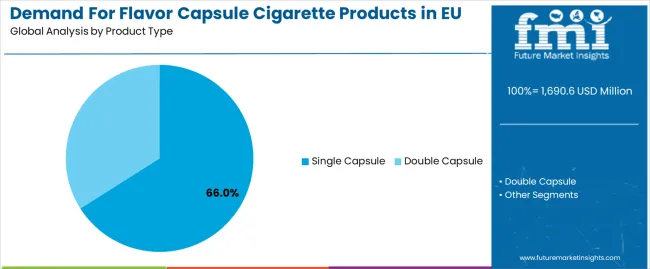

Sales of flavor capsule cigarette products in EU are segmented by product type (single capsule, double capsule), flavor application (menthol, clove, fruit, others), distribution channel, price range, and key EU countries excluding the UK (Germany, France, Italy, Spain, Netherlands, Rest of Europe).

The single capsule segment is the dominant product type in EU flavor capsule cigarette market with a 66.0% share in 2025, reflecting strong consumer preference for simplicity and convenience. Single capsules offer an easy-to-use, cost-effective flavor solution, enabling smokers to control flavor activation precisely and reliably. This segment’s dominance is bolstered by well-established manufacturing processes, broad brand penetration, and extensive retail availability across Europe. Consumers appreciate the versatility of single capsules, which accommodate diverse flavor preferences without complicating the smoking experience.

Although the single capsule segment remains dominant throughout the forecast period, the double capsule segment is showing steady growth, expected to rise from 34.0% in 2025 to 36.0% by 2035. Double capsules provide more complex flavor options, appealing to consumers seeking innovative and layered taste experiences. The growth of the double capsule segment highlights evolving consumer tastes for variety and new technology adoption, while single capsules maintain appeal due to their practicality and affordable pricing. Together, these two product types offer a balanced portfolio that meets the broad spectrum of consumer demand in EU market.

Fruit flavor is the leading application segment in EU flavor capsule cigarette market, commanding a 55.0% share in 2025 and forecast to increase to 58.0% by 2035. Consumer preference for sweeter and milder flavor profiles drives fruit flavor dominance, as it appeals to a broad demographic seeking a pleasant and accessible smoking experience. Menthol flavors hold approximately 15.0% market share despite regulatory challenges, sustained by innovations producing menthol alternatives and reformulated capsules that comply with flavor bans.

Clove and other niche flavors together account for a smaller but steady segment, providing variety and supporting consumer experimentation. The flavor portfolio’s continuous innovation allows brands to differentiate themselves and capture market segments across age groups and preferences. Expanding flavor choices contribute significantly to category growth, incentivizing manufacturers to invest in research and development for new and appealing flavor combinations.

The EU flavor capsule cigarette market is driven by evolving consumer preferences for customizable and enhanced flavor experiences, supported by continuous technological advancements in capsule design and flavor delivery. Consumers are attracted to the convenience of on-demand flavor activation and the sensory variety offered, which diversify the smoking experience beyond conventional cigarettes. Strong brand presence and strategic marketing also play pivotal roles in boosting adoption across European countries. The sector faces significant restraints including tightening flavor bans by regulatory bodies, growing public health concerns over flavored tobacco products, and enforcement of stricter youth-access regulations. These challenges require manufacturers to innovate within compliance frameworks and adapt their portfolios rapidly, sometimes limiting traditional flavor offerings.

Continuous innovation in capsule technology is a major growth driver, enabling the development of multi-flavor capsules, menthol substitutes, and improved taste profiles. These advancements facilitate product differentiation and enhance consumer engagement by offering novel sensory experiences. Flavor innovation extends product lifecycle and expands consumer base by catering to evolving tastes and addressing regulatory flavor restrictions through alternative formulations. Collaborations between tobacco companies and flavor houses focus on exploring flavor combinations that maintain appeal while respecting regulatory parameters. This innovation trend is essential for retaining consumer interest and driving market growth in a competitive landscape.

The growth of online retailing and direct sales platforms supports market expansion by providing convenience, broader product availability, and discreet purchasing options. Digital channels enable brands to reach younger, tech-savvy consumers and respond quickly to market shifts or regulatory updates. Enhanced brand engagement through social media and digital marketing campaigns further encourages consumer loyalty and facilitates education on new product launches. Expansion of e-commerce thus represents a vital strategic growth trend for flavor capsule cigarette products in Europe, complementing established retail channels such as modern trade and convenience stores.

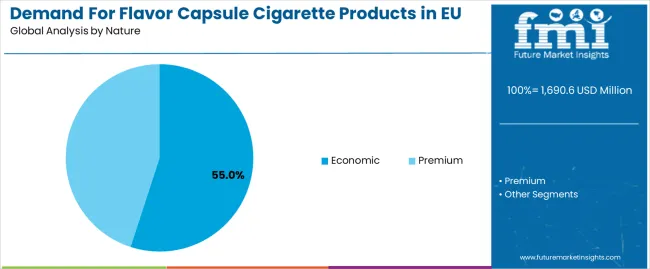

The flavor capsule cigarette market is witnessing premiumization, with increased consumer willingness to pay higher prices for enhanced and innovative flavor delivery systems. Premium products offer superior flavor complexity, sophisticated packaging, and perceived higher quality, appealing to discerning smokers. At the same time, the economic segment remains sizable by catering to value-conscious smokers, maintaining broad market coverage. This dual pricing strategy allows manufacturers to capture diverse consumer segments and maximize revenue. Expanding segmentation and targeted marketing efforts across price tiers support long-term market resilience despite regulatory pressures.

EU flavor capsule cigarette sales are projected to grow from USD 1,690.6 million in 2025 to USD 4,305.9 million by 2035, registering a robust CAGR of 9.8% over the forecast period. The market demonstrates varied growth rates across countries reflecting diverse regulatory environments, consumer preferences, and market maturity levels within EU. Key markets benefit from strong tobacco culture, innovative product adoption, and expanding distribution networks, which contribute to overall category expansion.

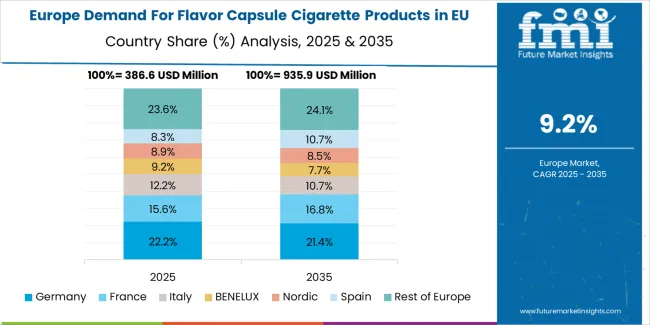

Germany holds the largest market share at approximately 24.0% in 2025, supported by a mature smoking population, strong retail presence, and consumer openness to flavored alternatives. France follows with an 18.0% share, driven by increasing demand for innovative capsule technology and broadening flavor portfolios. Italy represents 17.0%, reflecting rising consumer interest despite evolving regulations. Spain accounts for about 12.0% of the market, benefiting from younger demographic engagement and expanding e-commerce. The Netherlands holds a 7.0% share, supported by progressive retail channels and advanced marketing efforts. The Rest of Europe comprises 22.0% of total EU demand, fueled by emerging markets and cross-border trade facilitating wider product accessibility.

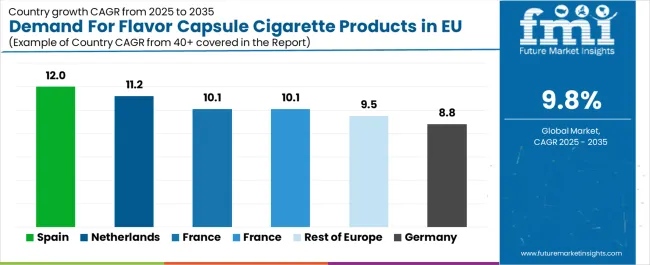

| Country | CAGR % (2025–2035) |

|---|---|

| Germany | 8.8% |

| France | 10.1% |

| Italy | 10.1% |

| Spain | 12.0% |

| Netherlands | 11.2% |

| Rest of Europe | 9.5% |

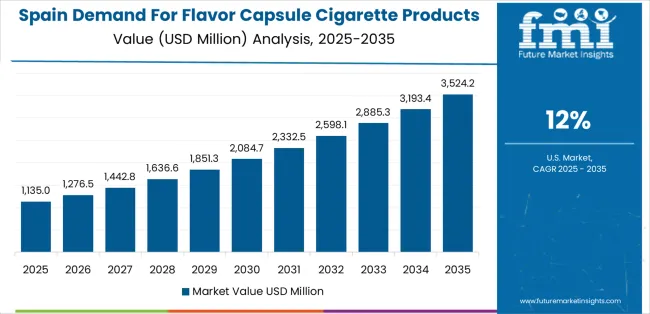

The EU flavor capsule cigarette market shows varied growth rates across major European economies, reflecting diverse consumer receptivity and regulatory landscapes. Spain leads with the highest CAGR of 12.0%, supported by younger demographic engagement and growing retail penetration, with sales rising from USD 202.9 million in 2025 to USD 535.8 million by 2035. France and Italy follow closely with CAGRs of 10.1%, highlighting strong demand for capsule innovations and flavor diversity. The Netherlands also records a strong 11.2% CAGR fueled by progressive market channels and e-commerce growth.

Germany, the largest market by size, grows steadily at 8.8%, with sales increasing from USD 405.7 million to USD 527.4 million, reflecting mature consumption but continued product innovation. The Rest of Europe segment shows robust expansion at 9.5% CAGR, demonstrating emerging market contributions and cross-border trade's importance in market development.

Germany stands as the largest market for flavor capsule cigarettes in EU, with sales expected to reach USD 527.4 million by 2035, growing at a CAGR of 8.8% through 2025–2035. The market benefits from an established smoking culture open to innovative tobacco products and a growing acceptance of flavored capsule formats as alternatives amid evolving regulations. Strong retailer networks including tobacconists, supermarkets, and online platforms ensure broad consumer access. German consumers display increasing preference for menthol alternatives and multi-flavor capsules, supported by active marketing campaigns and product availability across price tiers. High disposable incomes and traditional tobacco consumption patterns support continued growth.

France is forecast to expand at a CAGR of 10.1%, achieving sales of USD 665.0 million by 2035. Consumer demand is driven by diverse and premium flavor offerings, including fruit and menthol alternatives, aligning with French smokers’ taste sophistication. Popular tobacco retailers and pharmacy channels facilitate availability, complemented by strong urban consumption from younger adult demographics. Regulatory adaptations have prompted innovation with capsule reformulations, maintaining flavor appeal despite restrictions. Brand differentiation through taste innovation and packaging aesthetics is key to capturing market share in this competitive environment.

Italy’s flavor capsule cigarette market is expected to grow at a CAGR of 10.1%, reaching USD 749.1 million by 2035. Growth is supported by increasing awareness and acceptance of flavored tobacco among younger adult smokers and expanding capsule technology adoption. Major retailers including tobacco specialty shops and supermarkets have increased shelf presence for capsule products. Urban consumers in Milan, Rome, and Naples are primary demand drivers, attracted to fruit and menthol-flavored capsules. Marketing campaigns focused on lifestyle and flavor enjoyment underpin strong consumer engagement.

Spain demonstrates the highest CAGR among major EU markets at 12.0%, with sales forecast to reach USD 535.8 million by 2035. This rapid growth reflects strong adoption among younger demographics and expanding retail availability including convenience stores and online platforms. Flavor capsule cigarettes are rapidly transitioning from niche to mainstream, supported by product innovation and competitive pricing. Greater consumer openness to flavored smoking alternatives combined with targeted marketing supports dynamic category expansion.

The Netherlands market, growing at 11.2% CAGR to USD 457.2 million by 2035, is distinguished by its innovation leadership and progressive consumer base. Dutch smokers demonstrate high receptivity to advanced capsule formats, including multi-flavor and premium product offerings. Retailers like specialized tobacconists and modern supermarkets actively promote new launches, supported by digital marketing and e-commerce growth. The country acts as a testing ground for innovations that often scale to broader European markets. Premium positioning and strong regulatory compliance characterize the market.

The Rest of Europe segment, growing at 9.5% CAGR to USD 1,351.9 million by 2035, comprises emerging Eastern and Southern European markets where flavored capsule tobacco products are experiencing rapid uptake. Market growth is fueled by improving retail networks, rising disposable incomes, and increasing consumer awareness. Emerging markets show high potential for future expansion as product accessibility and brand penetration improve. Regional trade and cross-border distribution create additional growth opportunities, supported by regulatory frameworks evolving to accommodate flavored capsule tobacco products.

The market is characterized by competition among major multinational tobacco companies and regional players, with innovation, flavor portfolio diversity, and distribution strength driving competitive positioning. Companies focus on technological advancements in capsule design, compliance with evolving regulations, brand marketing, and broad retail and online channel penetration to capture market share. Strategic initiatives include flavor innovation, multi-capsule formats, premium segment targeting, and expanding presence in emerging EU markets.

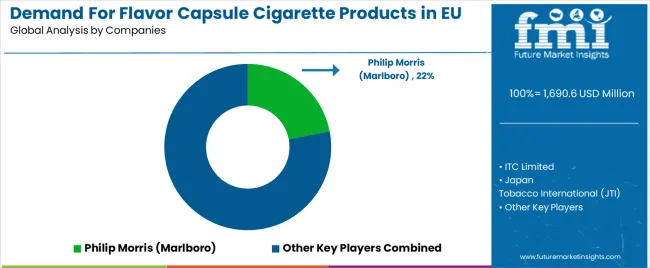

Philip Morris (Marlboro) leads the market with an estimated 22.0% share, leveraging its extensive European distribution network, strong brand equity, and pioneering capsule technology. Philip Morris benefits from deep retail penetration including modern trade, convenience stores, and online platforms, supported by comprehensive flavor innovation and menthol alternatives that address regulatory restrictions and consumer demand.

British American Tobacco (BAT), with a 20.0% share, aggressively drives category growth through a diverse portfolio including Lucky Strike and Pall Mall flavors. BAT emphasizes innovative flavor capsules, brand activation strategies, and insights from Latin American markets to refine EU penetration. The company’s strong retail presence and targeted marketing campaigns reinforce market leadership in key countries.

Imperial Brands holds approximately 15.0% share, supported by its Winston brand and investments in menthol alternatives and flavored capsule variants. Imperial leverages extensive EU retail depth, product innovation in flavor delivery, and compliance adaptability to sustain growth amid flavor bans and youth access regulations.

Other companies collectively hold 43.0% share, reflecting a fragmented market with numerous specialized brands, regional tobacco producers, private-label offerings, and emerging startups. This competitive environment fosters ongoing product differentiation through capsule technology enhancements, flavor portfolio expansion, regulatory strategy, and premium product development targeting diverse EU consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,690.6 million |

| Product Type | Single Capsule, Double Capsule |

| Nature | Economic, Premium |

| Application (End-Use) | Smoking Consumer Segment, Menthol Alternatives, Fruit Flavored, Other Flavored |

| Distribution Channel | Direct Sales, Modern Trade, Specialty Stores, Convenience Stores, Online Retailers |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, Rest of Europe |

| Key Companies Profiled | Philip Morris (Marlboro), British American Tobacco (BAT), Imperial Brands, ITC Limited, Japan Tobacco International (JTI), KT&G, Benson & Hedges, Kent, L&M, Camel Double |

| Additional Attributes | Dollar sales segmented by product type, nature, flavor application, and distribution channel; regional market dynamics and demand growth across major EU countries; competitive landscape with major multinational tobacco firms and regional players; consumer preferences evolving amid regulatory changes on flavor bans; innovations in capsule technology including multi-flavor options and menthol substitutes; expansion of retail and e-commerce distribution channels; marketing strategies targeting diverse smoker demographics; regulatory compliance with evolving flavor restrictions and youth-access laws; supply chain optimization supporting product availability and quality; market segmentation by price tiers capturing economic and premium consumer bases |

Product Type

Nature

Flavor Application (End-Use)

Distribution Channel

Countries

The global demand for flavor capsule cigarette products in EU is estimated to be valued at USD 1,690.6 million in 2025.

The market size for the demand for flavor capsule cigarette products in EU is projected to reach USD 4,305.9 million by 2035.

The demand for flavor capsule cigarette products in EU is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in demand for flavor capsule cigarette products in EU are single capsule and double capsule.

In terms of nature, economic segment to command 55.0% share in the demand for flavor capsule cigarette products in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavor Capsule Cigarettes Market

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Demand for Empty Capsules in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Wheatgrass Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Products From Food Waste in Western Europe - Size, Share and Forecast Outlook 2025 to 2035

Demand for Coconut Milk Products in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Leukapheresis Products Market - Growth & Forecast 2025 to 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Demand for Neuromuscular Transmission Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA