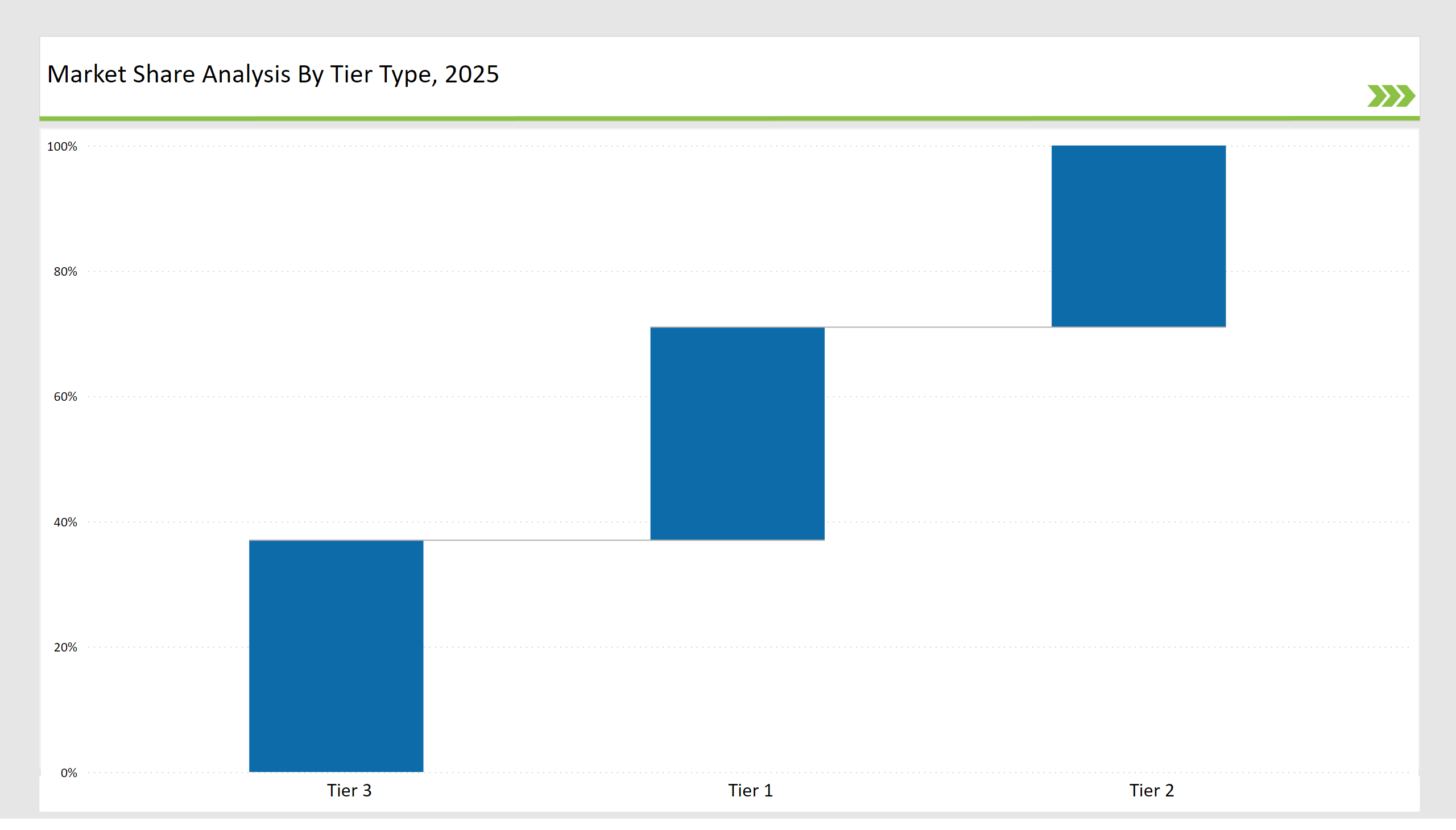

Highly segmented and competitive, the global Corrugated Paper Machine Market consists of players graded by tier-Tier 1, Tier 2, and Tier 3 classification based on market presence and strategies. Key players such as BHS Corrugated, Fosber Group, and Mitsubishi Heavy Industries, which occupy 60% of the market share, dominate as Tier 1 companies. These have been able to do so through the benefits of scale economies, top-notch R&D, and a robust global distribution network.

They are focused on sustainability initiatives and innovative machinery solutions catering to packaging, logistics, and industrial paper production. Strategic partnerships, technological advancements, and automation features help Tier 1 companies maintain an edge through premium pricing and strong demand.

Tier 2 players, such as MarquipWardUnited and BW Papersystems, represent approximately 25% of the global market share. They target regional markets and mid-sized industries, focusing on cost-effective and customizable corrugated paper production solutions. By enhancing operational efficiency and offering specialized services, Tier 2 players have solidified their position in growing markets.

Tier 3 players, including smaller regional manufacturers, startups, and private labels, contribute approximately 15% to the global market share. These players cater to localized needs and specialize in compact, high-speed paper machines for niche applications, including eco-friendly corrugated production and low-cost automation.

Despite limited resources, Tier 3 players’ agility allows them to address gaps in the market and compete effectively. Collectively, these three tiers drive a dynamic and evolving market landscape emphasizing bulk efficiency, sustainability, and innovation.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (BHS Corrugated, Fosber Group, Mitsubishi Heavy Industries) | 9% |

| Rest of Top 5 (MarquipWardUnited, BW Papersystems) | 7% |

| Next 5 of Top 10 (Hebei Shengli, JS Corrugating Machinery, Andritz, ISOWA, Hsieh Hsu Group) | 13% |

The market remains consolidated at the top, with Tier 1 players benefiting from global reach and Tier 3 players driving localized innovation and specialization.

Type of Player & Industry Share (%) 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 29% |

| Remaining Players | 42% |

The Corrugated Paper Machine Market is segmented based on its primary end-use industries, which include:

Vendors cater to diverse and evolving industry needs by offering a variety of innovative and customizable products:

Beyond these categories, vendors are integrating IoT-based monitoring and energy-efficient drying systems to optimize production and reduce downtime.

This section highlights key companies shaping the Corrugated Paper Machine Market in 2025, focusing on sustainability, innovation, and efficiency to maintain global leadership.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | BHS Corrugated, Fosber Group, Mitsubishi Heavy Industries |

| Tier 2 | MarquipWardUnited, BW Papersystems |

| Tier 3 | Hebei Shengli, JS Corrugating Machinery, Andritz, ISOWA, Hsieh Hsu Group, niche startups |

| Manufacturer | Latest Developments (Month, Year) |

|---|---|

| BHS Corrugated | In January 2024, introduced AI-powered corrugation systems for higher efficiency. |

| Fosber Group | In March 2024, launched smart control solutions for automated production lines. |

| Mitsubishi Heavy Industries | In February 2024, expanded digital corrugation capabilities for flexible production. |

| MarquipWardUnited | In June 2024, developed predictive maintenance AI tools to minimize downtime. |

| BW Papersystems | In April 2024, introduced compact and scalable corrugation machine designs. |

| Hebei Shengli | In May 2024, launched cost-effective high-speed corrugation machines. |

| JS Corrugating Machinery | In July 2024, expanded its product line with energy-efficient solutions. |

| Andritz | In September 2024, developed water-based ink integration for sustainable printing. |

The Corrugated Paper Machine Market will witness growth through automation, sustainability, and advanced manufacturing technologies. Demand for customized, recyclable paperboard solutions will increase, while companies focus on cost reduction through AI-driven predictive maintenance. As companies aim for higher production speeds and reduced energy consumption, innovations in lightweight corrugation and eco-friendly adhesives will take center stage.

Smart monitoring features, real-time data analytics, and digital twin simulations will further optimize efficiency and machine lifespan. Additionally, manufacturers are investing in AI-powered quality control systems to reduce defects and improve consistency.

The rising demand for biodegradable paperboard is driving R&D into sustainable raw materials. Global regulatory policies are also encouraging companies to shift towards carbon-neutral production techniques. The adoption of cloud-based analytics is expected to enhance supply chain transparency and production forecasting.

Leading manufacturers include BHS Corrugated, Fosber Group, Mitsubishi Heavy Industries, Marquip Ward United, and BW Paper systems.

The top 10 players collectively account for approximately 29% of the global market.

Market concentration in the Corrugated Paper Machine industry for 2025 is assessed by the dominance of Tier 1 players, who control 9% of the market.

Tier-3 companies, including startups and regional players, contribute 42% by offering localized and specialized solutions.

Innovations in the Corrugated Paper Machine industry revolve around advancements in automation, AI-driven maintenance, and sustainable corrugation materials.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Wraps Market Analysis from 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Corrugated Octabins Market Trends & Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA