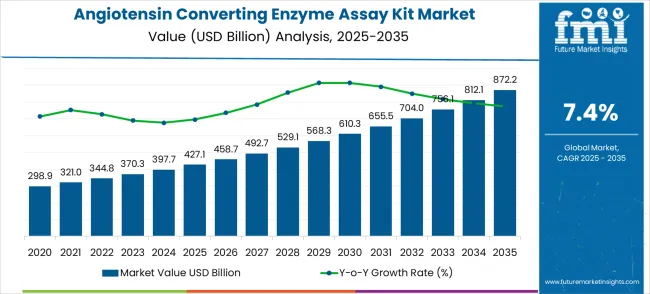

The angiotensin converting enzyme (ACE) assay kit market is estimated at USD 427.1 million in 2025 and is likely to reach USD 872.2 million by 2035, reflecting a forecast CAGR of 7.4% over the 10 years. The market trajectory exhibits a consistent upward trend, driven by the increasing prevalence of cardiovascular and renal disorders, rising awareness of enzyme-linked diagnostic testing, and the expanding application of ACE assay kits in clinical and research laboratories.

The base year value, projected value, and CAGR highlight the crucial role of ACE assay kits in facilitating accurate disease monitoring, enabling timely therapeutic interventions, and supporting drug development initiatives in the pharmaceutical and biotechnology sectors. The global angiotensin converting enzyme assay kit market is projected to grow from USD 427.1 billion in 2025 to approximately USD 872.2 billion by 2035, recording an absolute increase of USD 445.1 billion over the forecast period.

This translates into a total growth of 104.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2035. The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing prevalence of cardiovascular diseases, growing demand for diagnostic testing solutions, and rising adoption of advanced biochemical assays in clinical laboratories requiring precise ACE enzyme activity measurement.

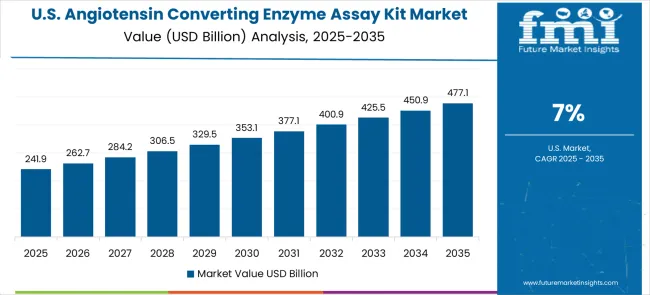

Analyzing year-on-year growth, the market rises from USD 427.1 million in 2025 to USD 492.7 million by 2027, contributing approximately 18% of the cumulative growth over the first three years. This early phase growth is fueled by adoption in hospital laboratories, research centers, and diagnostic facilities, where demand for precise enzyme measurement and standardization of assays remains high. Incremental YoY contributions average around USD 31–34 million, reflecting steady but moderate adoption as the market establishes foundational demand. The share of total growth during this period illustrates the importance of early market penetration and the expansion of clinical testing infrastructure in key geographies. Between 2025 and 2030, the angiotensin converting enzyme assay kit market is projected to expand from USD 427.1 billion to USD 607.3 billion, resulting in a value increase of USD 180.2 billion, which represents 40.5% of the total forecast growth for the decade.

This phase of growth will be shaped by rising cardiovascular disease burden, increasing diagnostic testing demand, and growing adoption of automated laboratory systems. Biotechnology companies are expanding their ACE assay kit portfolios to address the growing demand for reliable enzyme activity measurement solutions with enhanced accuracy and clinical utility characteristics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 427.1 billion |

| Forecast Value in (2035F) | USD 872.2 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

From 2028 onward, the market experiences accelerated expansion, reaching USD 756.1 million by 2033 and USD 872.2 million in 2035. The mid-to-late period accounts for approximately 55% of total cumulative growth, highlighting a stronger contribution to market expansion during these years. Inflection points in 2030 and 2033 correspond to the introduction of advanced ACE assay kits with higher sensitivity and throughput, as well as wider adoption across personalized medicine and drug development applications. This period sees higher YoY increases of USD 50–60 million, focusing the ratio of growth contribution per year and the accelerating momentum of the market.

While sub-segment analysis indicates that kits designed for high-throughput clinical applications and research-grade enzyme assays contribute most to the growth, minor fluctuations in 2026 and 2031 reflect temporary supply constraints and regional regulatory adjustments. The market maintains a robust growth trajectory, with early years contributing foundational growth, mid-to-late years driving bulk expansion, and sub-segment innovations ensuring sustained market dynamism and proportional contribution to cumulative growth.From 2030 to 2035, the market is forecast to grow from USD 607.3 billion to USD 872.2 billion, adding another USD 264.9 billion, which constitutes 59.5% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of point-of-care testing solutions, integration with digital health platforms, and development of next-generation multiplex assay technologies. The growing demand for personalized medicine and precision diagnostics will drive adoption of sophisticated ACE assay kits with enhanced sensitivity and multiplexing capabilities.

Between 2020 and 2025, the angiotensin converting enzyme assay kit market experienced steady growth, driven by increasing awareness of cardiovascular health monitoring and growing recognition of ACE enzyme's role in various physiological and pathological processes. The market evolved as clinical laboratories and research institutions recognized the importance of reliable ACE activity measurement in cardiovascular disease diagnosis, drug development, and therapeutic monitoring. Progress in assay technology development and automation compatibility established the foundation for more efficient and accurate enzyme activity measurement across various healthcare and research applications.

Market expansion is being supported by the increasing global burden of cardiovascular diseases and the corresponding demand for reliable diagnostic tools that can assess ACE enzyme activity for cardiovascular risk stratification and therapeutic monitoring. Modern clinical laboratories are increasingly focused on biochemical assays that can provide accurate and reproducible results while supporting clinical decision-making and patient care optimization. The proven capability of ACE assay kits to deliver precise enzyme activity measurement, support drug development research, and enable cardiovascular disease monitoring makes them essential components of comprehensive diagnostic and research programs.

The growing emphasis focus on preventive healthcare and early disease detection is driving demand for advanced diagnostic technologies that can support cardiovascular risk assessment and therapeutic intervention monitoring. Healthcare preference for assay systems that can provide rapid results, integrate with laboratory automation, and support high-throughput testing is creating opportunities for advanced ACE assay kit development. The rising influence of personalized medicine approaches and precision cardiovascular care is also contributing to increased adoption of specialized biochemical assays across different clinical and research applications.

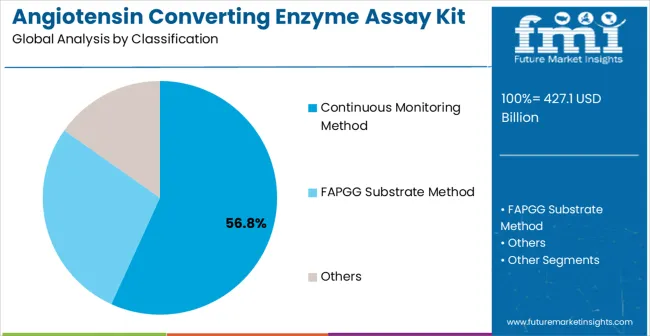

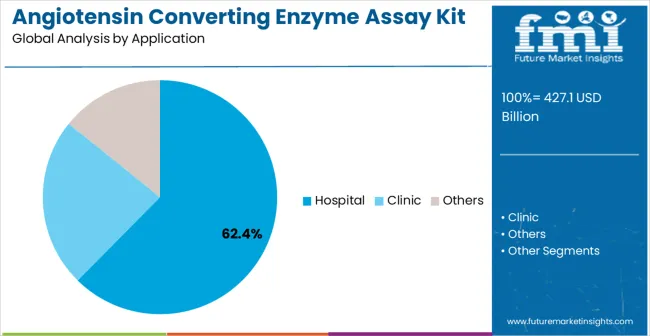

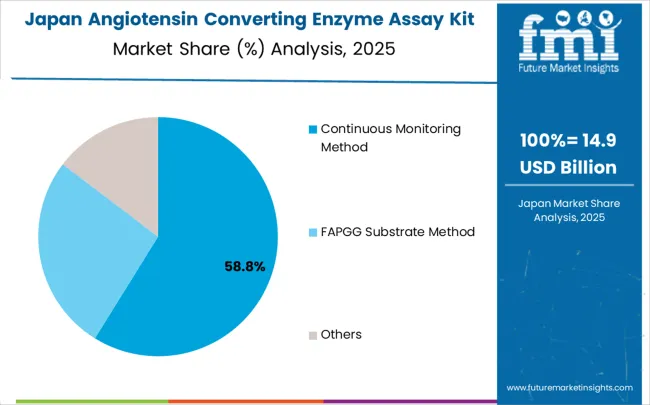

The market is segmented by classification, application, and region. By classification, the market is divided into continuous monitoring method, FAPGG substrate method, and others. Based on application, the market is categorized into hospital, clinic, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The continuous monitoring method classification is projected to account for 56.8% of the angiotensin converting enzyme assay kit market in 2025, reaffirming its position as the category's dominant methodology approach. Clinical laboratory professionals increasingly recognize the superior analytical performance and operational efficiency provided by continuous monitoring ACE assay systems for routine diagnostic applications. This classification addresses the most demanding accuracy and throughput requirements while providing essential automation compatibility characteristics.

This classification forms the foundation of most clinical laboratory ACE testing protocols, as it represents the most technically advanced and clinically validated approach for enzyme activity measurement. Technology development and assay optimization continue to strengthen confidence in continuous monitoring methodology performance. With increasing recognition of the importance of accurate and reproducible enzyme activity measurement, continuous monitoring systems align with both current laboratory requirements and future automation objectives. Their comprehensive analytical capabilities across multiple sample types ensures sustained market dominance, making them the central growth driver of ACE assay kit adoption.

Hospital applications are projected to represent 62.4% of angiotensin converting enzyme assay kit demand in 2025, underscoring highlighting their role as the primary application driving market development. Hospital laboratories recognize that cardiovascular disease diagnosis and monitoring requires the most reliable and comprehensive enzyme activity measurement capabilities to support clinical decision-making and patient care. Hospital applications demand exceptional analytical performance and clinical utility that ACE assay kits are uniquely positioned to deliver.

The segment is supported by the continuous expansion of hospital-based cardiovascular care programs requiring comprehensive diagnostic capabilities and the increasing adoption of advanced laboratory automation systems across hospital networks. Additionally The , hospital laboratories are increasingly implementing specialized biochemical assays that can support both routine diagnostics and clinical research applications. As understanding of cardiovascular disease complexity advances, hospital applications will continue to serve as the primary commercial driver, reinforcing their essential position within the clinical diagnostics market.

The angiotensin converting enzyme assay kit market is advancing steadily due to increasing cardiovascular disease prevalence and growing demand for specialized diagnostic testing. However, the market faces challenges including competition from alternative biomarkers, assay standardization requirements, and varying regulatory approval processes across different regions. Innovation in assay sensitivity improvement and automation integration continue to influence product development and market expansion patterns.

The growing development of point-of-care testing solutions is creating enhanced opportunities for ACE assay integration with rapid diagnostic platforms. Advanced point-of-care systems offer immediate result availability and simplified testing procedures that are particularly important for emergency and outpatient cardiovascular care. Rapid diagnostic capabilities provide healthcare providers with timely access to enzyme activity information that can optimize patient management decisions.

Modern biotechnology companies are incorporating digital connectivity, automated result reporting, and laboratory information system integration to enhance ACE assay kit utility and workflow efficiency. These technologies improve result accessibility, enable automated quality control, and provide enhanced data management throughout the testing process. Advanced integration also enables optimized test ordering and improved clinical decision support capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

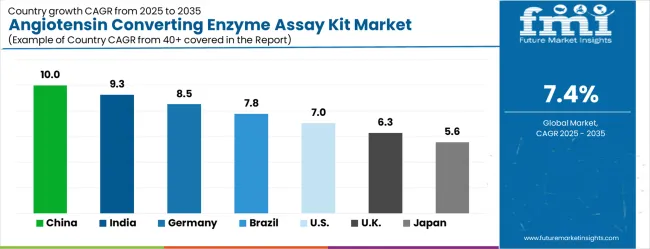

The global market is projected to grow at a CAGR of 7.4% between 2025 and 2035, driven by rising prevalence of cardiovascular and renal disorders and increasing demand for reliable diagnostic tools. China leads with 10.0% growth, supported by expanding clinical laboratories, growing healthcare infrastructure, and adoption of advanced diagnostic kits. India follows at 9.3%, reflecting increasing awareness of cardiovascular health, rising diagnostic testing, and growing hospital networks. Germany records 8.5%, driven by high adoption of precise biochemical assays and advanced laboratory capabilities. Brazil is projected at 7.8%, supported by increasing healthcare investments and growing laboratory diagnostics market. The United States grows at 7.0% with steady demand for cardiovascular diagnostics, while the United Kingdom expands at 6.3% and Japan at 5.6%, reflecting gradual adoption and consistent use of ACE assay kits in clinical settings.The angiotensin converting enzyme assay kit market is experiencing robust growth globally, with China leading at a 10.0% CAGR through 2035, driven by rapidly aging population, increasing cardiovascular disease burden, and expanding healthcare laboratory infrastructure. India follows at 9.3%, supported by growing healthcare accessibility, rising chronic disease prevalence, and increasing adoption of advanced diagnostic technologies. Germany shows growth at 8.5%, emphasizing precision diagnostics excellence and comprehensive cardiovascular care systems. Brazil records 7.8% growth, focusing on expanding healthcare infrastructure and growing adoption of specialized diagnostic testing. The USA shows 7.0% growth, representing steady demand from established healthcare systems and research institutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is projected to grow at a CAGR of 10.0% from 2025 to 2035, driven by rising prevalence of cardiovascular and renal disorders, and increasing adoption of diagnostic assays in hospitals and clinical laboratories. The demand for ACE assay kits is strengthened by expanding clinical research activities, government healthcare initiatives, and enhanced laboratory infrastructure in tier-1 and tier-2 cities. Domestic manufacturers are investing in high-throughput, automated assay solutions to improve accuracy and reduce processing time. Collaboration with global diagnostic companies is enabling access to advanced kits and reagents. Rising awareness among physicians regarding early detection of hypertension and heart-related disorders further boosts market adoption across hospital and research segments.

India is expected to grow at a CAGR of 9.3% during 2025–2035, supported by increasing prevalence of hypertension, diabetes, and kidney disorders. Hospitals, diagnostic centers, and research institutions are increasingly adopting ACE assay kits for early disease detection and routine screenings. Domestic manufacturers focus on affordable, high-precision kits to cater to urban and semi-urban healthcare markets. Rising government initiatives to strengthen diagnostic infrastructure and promote preventive care are enhancing accessibility. Collaborative research programs with international diagnostic companies enable technology transfer and improve kit performance. Overall, increasing awareness among physicians and healthcare professionals regarding ACE activity in cardiovascular and renal monitoring supports steady market growth.

Germany is projected to grow at a CAGR of 8.5% from 2025 to 2035, fueled by advanced clinical laboratories and research-driven adoption of ACE assay kits. Hospitals and diagnostic centers prioritize kits offering high precision, automation compatibility, and rapid turnaround times. Manufacturers focus on product innovation to comply with stringent European regulatory standards. Research institutions and clinical trial organizations increasingly rely on ACE assays for cardiovascular and renal studies. Distribution is supported by laboratory suppliers, healthcare procurement networks, and online medical platforms. The market benefits from strong focus on preventive diagnostics and integration of high-throughput assay solutions in hospitals and research centers.

Brazil is expected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increasing awareness of cardiovascular and kidney disorders and expansion of clinical diagnostic laboratories. Adoption is supported by both public and private healthcare institutions upgrading laboratory infrastructure. Manufacturers are introducing temperature-stable and cost-efficient ACE assay kits suitable for regional conditions. Growing collaborations with international diagnostic companies ensure access to high-quality reagents and kits. Expansion of preventive health programs and clinical research activities further supports market growth. Hospitals and private diagnostic centers in major cities are increasingly adopting automated ACE assay systems to improve throughput and accuracy.

The United States market is projected to grow at a CAGR of 7.0% during 2025–2035, driven by advanced diagnostic infrastructure, high prevalence of cardiovascular disorders, and increasing use of automated ACE assay systems. Hospitals, research laboratories, and clinical diagnostic centers adopt high-precision kits to ensure accurate monitoring of patient health. Manufacturers focus on developing kits compatible with high-throughput analyzers and rapid result reporting. Adoption is further supported by preventive healthcare initiatives, insurance coverage for diagnostic tests, and continuous R&D in cardiovascular and renal disease studies. Early detection of hypertension and chronic kidney disorders drives steady demand across clinical laboratories and hospital networks.

The United Kingdom is expected to grow at a CAGR of 6.3% from 2025–2035, driven by rising awareness of cardiovascular health monitoring and adoption of advanced diagnostic technologies. Hospitals, clinical laboratories, and research centers are increasingly utilizing ACE assay kits for routine screenings, hypertension studies, and cardiovascular risk assessment. Manufacturers focus on precision, reproducibility, and compliance with EU diagnostic standards. Distribution channels include laboratory suppliers, hospital procurement networks, and online medical platforms. Expansion of preventive healthcare programs and clinical research initiatives further supports market penetration. Technological collaborations and kit customization for specific population segments enhance adoption.

Japan is projected to grow at a CAGR of 5.6% from 2025–2035, reflecting steady demand in hospitals, clinical laboratories, and research institutions. Adoption is driven by increasing cardiovascular and renal disorder prevalence, as well as government initiatives promoting early disease detection. Japanese manufacturers emphasize high-quality reagents, automation compatibility, and reproducibility. Distribution occurs through medical suppliers, hospital networks, and online platforms. Clinical trials and preventive healthcare programs contribute to consistent kit adoption. Hospitals and laboratories are integrating ACE assay kits for monitoring hypertension, chronic kidney disease, and related cardiovascular risks. Market growth is further supported by technological collaborations with international diagnostic companies.

Revenue from angiotensin converting enzyme assay kits in China is projected to exhibit outstanding growth with a CAGR of 10.0% through 2035, driven by rapidly aging population demographics and comprehensive government support for healthcare infrastructure development and advanced diagnostic capabilities. The country's massive healthcare market and increasing focus on cardiovascular disease prevention are creating substantial opportunities for specialized diagnostic solutions. Major domestic and international biotechnology companies are establishing comprehensive distribution and manufacturing facilities to serve the expanding clinical diagnostics market.

Government initiatives supporting healthcare modernization and substantial investment in laboratory infrastructure are driving accelerated adoption of advanced diagnostic assays throughout major healthcare regions.

Healthcare system expansion and aging population care requirements are supporting increased deployment of cardiovascular diagnostic tools among hospitals, clinics, and research institutions nationwide.

Revenue from angiotensin converting enzyme assay kits in India is expanding at a CAGR of 9.3%, supported by growing healthcare accessibility initiatives, increasing prevalence of cardiovascular diseases, and expanding diagnostic laboratory capabilities. The country's substantial population base and commitment to healthcare improvement are driving demand for advanced diagnostic solutions. International biotechnology companies and domestic manufacturers are establishing partnerships to serve the growing demand for specialized diagnostic technologies.

Rising investment in healthcare infrastructure and diagnostic capability development are creating significant opportunities for advanced assay technologies across hospital, clinic, and research applications.

Growing healthcare provider education and diagnostic awareness campaigns are supporting increased utilization of cardiovascular biomarker testing among medical professionals and healthcare facilities.

Revenue from angiotensin converting enzyme assay kits in Germany is projected to grow at a CAGR of 8.5%, supported by the country's leadership in precision diagnostics and comprehensive cardiovascular care systems. German healthcare providers and laboratory professionals consistently adopt advanced diagnostic technologies through established clinical protocols and evidence-based medicine frameworks. The market is characterized by clinical excellence, comprehensive quality standards, and established relationships between diagnostic companies and healthcare providers.

Precision diagnostics leadership and cardiovascular care excellence are supporting continued adoption of advanced assay technologies throughout leading healthcare institutions and diagnostic laboratories.

Research institution collaboration and clinical innovation are facilitating advancement of diagnostic applications while ensuring superior analytical performance and clinical utility.

Revenue from angiotensin converting enzyme assay kits in Brazil is projected to grow at a CAGR of 7.8% through 2035, driven by healthcare system expansion, increasing awareness of cardiovascular health, and growing adoption of advanced diagnostic technologies. Brazilian healthcare providers are increasingly recognizing the importance of specialized biomarker testing in cardiovascular disease management and prevention.

Healthcare infrastructure development and diagnostic capability expansion are supporting increased deployment of advanced assay systems across diverse healthcare settings and patient populations.

Growing collaboration between international diagnostic companies and local healthcare providers is enhancing technology access and supporting development of domestic diagnostic capabilities.

Revenue from angiotensin converting enzyme assay kits in the USA is projected to grow at a CAGR of 7.0%, supported by established clinical research infrastructure, continued innovation in diagnostic technologies, and comprehensive cardiovascular care programs. American healthcare institutions and biotechnology companies maintain consistent advancement of diagnostic technologies through established research protocols and clinical validation programs.

Clinical research leadership and cardiovascular care innovation are driving continued investment in advanced diagnostic technologies throughout leading healthcare institutions and research facilities.

Technology innovation programs and clinical research collaboration are supporting continued advancement in assay performance and clinical application capabilities.

Revenue from angiotensin converting enzyme assay kits in the UK is projected to grow at a CAGR of 6.3% through 2035, supported by National Health Service diagnostic programs and comprehensive cardiovascular care pathways. British healthcare providers emphasize evidence-based diagnostic solutions within integrated care frameworks that prioritize patient outcomes and cost-effectiveness.

NHS diagnostic pathways and cardiovascular care programs are supporting systematic adoption of validated assay technologies across primary care and specialist cardiovascular services.

Healthcare innovation programs and clinical excellence initiatives are maintaining high standards for diagnostic technology utilization while supporting optimal patient care outcomes.

Revenue from angiotensin converting enzyme assay kits in Japan is projected to grow at a CAGR of 5.6% through 2035, supported by the country's advanced healthcare system and comprehensive approach to aging population healthcare needs. Japanese healthcare providers and diagnostic companies emphasize technology-driven diagnostic solutions within established frameworks that prioritize clinical effectiveness and analytical precision.

Advanced healthcare system coordination and aging population support programs are supporting continued utilization of cardiovascular diagnostic technologies across diverse healthcare settings.

Technology innovation capabilities and healthcare system integration are maintaining leadership in diagnostic development while supporting optimal clinical outcomes and analytical excellence.

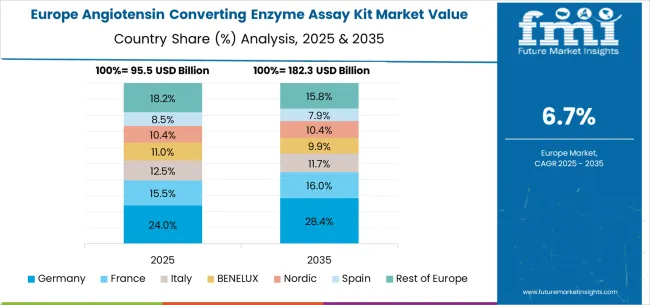

The angiotensin converting enzyme assay kit market in Europe is projected to expand steadily through 2035, supported by established healthcare systems, comprehensive cardiovascular care programs, and ongoing innovation in diagnostic technologies. Germany will continue to lead the regional market, accounting for 29.4% in 2025 and rising to 30.2% by 2035, supported by strong diagnostic technology capabilities, advanced healthcare infrastructure, and comprehensive cardiovascular care systems. The United Kingdom follows with 18.7% in 2025, increasing to 19.0% by 2035, driven by NHS diagnostic programs, clinical excellence initiatives, and systematic healthcare technology adoption.

France holds 16.3% in 2025, edging up to 16.6% by 2035 as healthcare providers expand diagnostic capabilities and demand grows for specialized cardiovascular testing. Italy contributes 12.9% in 2025, remaining stable at 13.1% by 2035, supported by healthcare system modernization and growing adoption of advanced diagnostic technologies. Spain represents 9.8% in 2025, moving upward to 10.0% by 2035, underpinned by expanding cardiovascular care programs and increasing investment in diagnostic capabilities.

Nordic countries together account for 8.1% in 2025, maintaining their position at 8.2% by 2035, supported by advanced healthcare systems and early adoption of innovative diagnostic technologies. The Rest of Europe represents 4.8% in 2025, declining slightly to 2.9% by 2035, as larger markets capture greater investment focus and established healthcare infrastructure advantages.

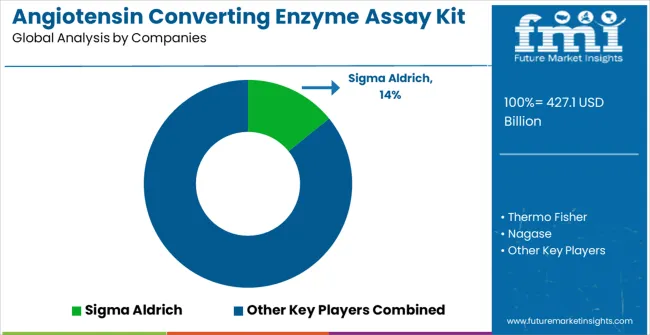

The market is highly competitive, driven by accuracy, sensitivity, and reproducibility of enzyme measurement across research and clinical applications. Sigma Aldrich, Thermo Fisher, and Abcam lead with well-established global distribution networks and validated assay kits that ensure reliable performance for drug discovery, cardiovascular research, and diagnostic testing. Their competitive advantage lies in rigorous quality control, extensive technical support, and broad product portfolios that cater to both academic and pharmaceutical laboratories. Brochures highlight assay sensitivity, specificity, ease of use, and compatibility with multiple sample types, reinforcing trust among end users.

Mid-sized companies such as Nagase, Abbexa, and STEMCELL Technologies compete by providing specialized kits with high precision and flexible formats. STEMCELL Technologies emphasizes reproducibility and user-friendly protocols, while Abbexa and Nagase focus on targeted applications such as high-throughput screening and enzyme kinetics studies. Sangon Biotech, Life Origin Biotech, BIOSINO, and CELL RESEARCH differentiate through rapid delivery, cost-effective solutions, and regional customer support, appealing to emerging markets and smaller research institutions.

Smaller players including Beijing Shijiwode, Epizyme, Biosharp, and Dalian Meilunhelper focus on niche applications, customized assay configurations, and local regulatory compliance. Their brochures highlight sensitivity ranges, storage stability, and assay versatility for various research needs. Competition in this market is shaped by product reliability, ease of use, and technical support. Leading firms invest in assay optimization, workflow integration, and validation studies, while regional suppliers leverage affordability and application-specific customization. Continuous innovation in detection technology and enzyme assay performance remains central to maintaining market leadership in the market.The angiotensin converting enzyme assay kit market is characterized by competition among established biotechnology companies, specialized diagnostic manufacturers, and innovative assay development firms. Companies are investing in assay sensitivity enhancement, automation compatibility, strategic partnerships, and clinical validation to deliver high-performance, reliable, and clinically relevant ACE assay solutions. Technology development, regulatory compliance, and customer support strategies are central to strengthening competitive advantages and market presence.

Sigma Aldrich leads the market with significant expertise in biochemical assay development and laboratory reagent manufacturing, offering comprehensive ACE assay kit solutions with focus on analytical performance and research applications. Thermo Fisher provides established life sciences capabilities with emphasis on diagnostic assay development and clinical laboratory solutions. Nagase delivers advanced biotechnology products with strong focus on enzyme assay technologies and laboratory automation. Abcam focuses on specialized antibody and assay technologies with comprehensive research and diagnostic applications.

Abbexa operates with focus on innovative assay development and protein analysis technologies. STEMCELL Technologies provides comprehensive cell biology and assay solutions with emphasis on research applications. Sangon Biotech, Life Origin Biotech, BIOSINO, CELL RESEARCH, Beijing Shijiwode, Epizyme, Biosharp, and Dalian Meilunhelper provide diverse technological approaches and regional market access strategies to enhance overall market development and diagnostic capability advancement.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 427.1 bBillion |

| Classification | Continuous Monitoring Method, FAPGG Substrate Method, Others |

| Application | Hospital, Clinic, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Sigma Aldrich, Thermo Fisher, Nagase, Abcam, Abbexa, STEMCELL Technologies, Sangon Biotech, Life Origin Biotech, BIOSINO, CELL RESEARCH, Beijing Shijiwode, Epizyme, Biosharp, Dalian Meilunhelper |

| Additional Attributes | Dollar sales by assay method and application, regional adoption trends, competitive landscape, clinical research partnerships, integration with laboratory automation, innovations in assay sensitivity and specificity, clinical validation analysis, and diagnostic utility optimization strategies |

The global angiotensin converting enzyme assay kit market is estimated to be valued at USD 427.1 billion in 2025.

The market size for the angiotensin converting enzyme assay kit market is projected to reach USD 872.2 billion by 2035.

The angiotensin converting enzyme assay kit market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in angiotensin converting enzyme assay kit market are continuous monitoring method, fapgg substrate method and others.

In terms of application, hospital segment to command 62.4% share in the angiotensin converting enzyme assay kit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwovens Converting Machine Market

Toilet Roll Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Converting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Tissue Paper Converting Machine Industry

Tissue Paper Converting Machine Market Trends – Growth, Demand & Forecast 2025-2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitting Robots Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Kitten Milk Replacer & Formula Market

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA