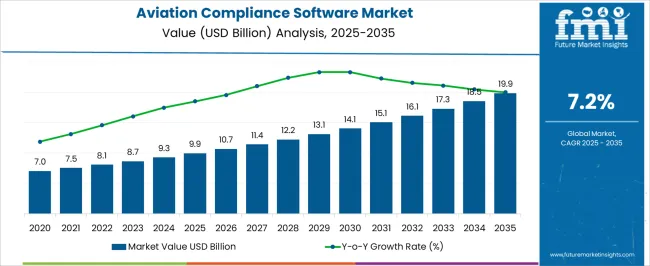

The Aviation Compliance Monitoring Software Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 19.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Aviation Compliance Monitoring Software Market Estimated Value in (2025 E) | USD 9.9 billion |

| Aviation Compliance Monitoring Software Market Forecast Value in (2035 F) | USD 19.9 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The aviation compliance monitoring software market is advancing steadily, supported by the growing complexity of aviation regulations and the need for digital solutions to ensure operational safety and compliance. Airlines, maintenance organizations, and aviation authorities are increasingly adopting specialized software to streamline audits, inspections, and regulatory reporting.

Industry updates and aviation technology publications have highlighted that cloud-based platforms are transforming compliance monitoring by providing real-time data access, automated alerts, and centralized reporting tools. The rising global air traffic volume and fleet expansions have further amplified the demand for compliance software that can manage risk and ensure adherence to international safety standards.

Investor briefings and company announcements have underscored strong investments in software development, focusing on cybersecurity, integration with existing enterprise systems, and AI-driven analytics. Looking forward, market growth is expected to be driven by increasing reliance on cloud infrastructure, the adoption of digital compliance ecosystems by large enterprises, and the integration of predictive analytics to enhance safety management and regulatory readiness.

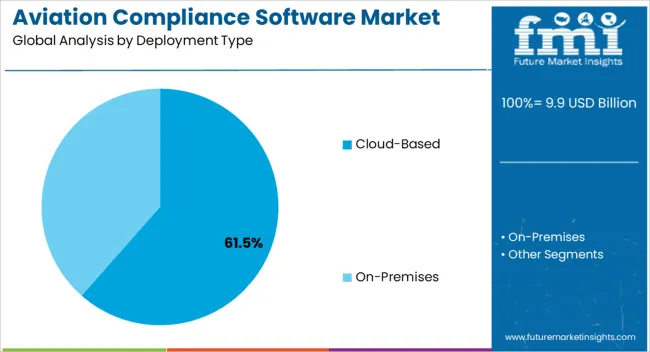

The Cloud-Based segment is projected to account for 61.50% of the aviation compliance monitoring software market revenue in 2025, maintaining its leadership position. This dominance has been shaped by the increasing preference for scalable, flexible, and cost-efficient deployment models in the aviation industry.

Cloud-based platforms have enabled real-time data synchronization across multiple geographies, which is critical for multinational airlines and maintenance organizations. Aviation stakeholders have valued the ability of cloud systems to support remote audits, streamline compliance workflows, and reduce IT infrastructure costs.

Furthermore, software developers have increasingly prioritized cloud-native solutions to enhance integration with aviation enterprise resource planning (ERP) systems and safety management platforms. Cybersecurity enhancements and compliance with aviation data protection regulations have further strengthened confidence in cloud adoption. With the growing demand for seamless collaboration and digital transformation initiatives, the Cloud-Based segment is expected to sustain its dominant share in the market.

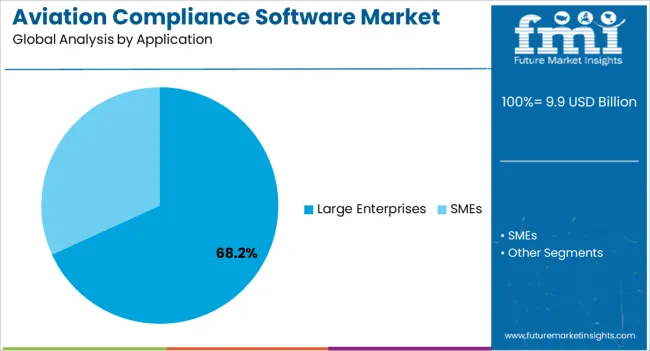

The Large Enterprises segment is projected to contribute 68.20% of the aviation compliance monitoring software market revenue in 2025, securing its role as the leading application segment. Growth of this segment has been driven by the operational scale of large airlines, airport operators, and maintenance organizations, which necessitate comprehensive compliance frameworks.

These enterprises manage vast fleets and operate across multiple jurisdictions, requiring software solutions capable of consolidating data from diverse sources and ensuring alignment with global aviation regulations. Industry reports have emphasized that large enterprises have the resources to invest in advanced compliance systems, integrating predictive analytics and automated risk assessment tools.

Additionally, regulatory authorities have heightened scrutiny on major carriers and operators, compelling them to adopt sophisticated monitoring systems. The demand for enterprise-grade solutions that can handle complex audits, cross-border operations, and real-time performance tracking has reinforced the segment’s dominance. As large-scale aviation players continue to expand and modernize their fleets, the Large Enterprises segment is expected to retain its leading position in the adoption of compliance monitoring software.

As per the aviation compliance monitoring software market research by Future Market Insights to a market research and competitive intelligence provider, historically, from 2020 to 2025, the market value increased at around 8.3% CAGR.

Factors including the surge in air traffic levels, the size of the global fleet, and aircraft utilization are among the key market drivers. Additionally, it is anticipated that more aircraft will be produced due to rising passenger and business air travel, which would significantly impact the industry. Technology such as aviation compliance monitoring software helps aviation businesses keep thorough records of their flight activities. This aids the company in upholding legal criteria as well as improving flight safety standards.

Increased demand for cloud-based solutions, rising acceptance of compliance monitoring software by SMEs, and an increase in aviation sector regulations are the key growth drivers of the aviation compliance monitoring software market. Additionally, market growth is anticipated to be fuelled by introducing the next compliance monitoring software in the coming years.

Increased aviation compliance monitoring software spending is expected to open up new business opportunities. Service tracking, logbook tracking, flying time monitoring, administration of service bulletins, work scheduling, budget forecasting, digital task card administration, and work order management are the key components of aviation compliance software. In May 2024, India saw large foreign direct investments across various industries, including compliance monitoring software in aviation. This occurred as foreign businesses concentrated on acquiring billions of dollars’ worth of aviation compliance software. As a result, it is anticipated that investments and acquisitions will produce profitable market prospects.

The aviation compliance monitoring software provides capabilities that support regulatory compliance with entities like the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA). Moreover, the increased demand for older aircraft and environmental concerns highlight the need for ongoing monitoring of older aircraft, and compliance need arises, giving the industry momentum.

The North American aviation compliance software monitoring market prevails to achieve sustainable objectives. The largest fleet of airplanes lies in North America, which creates a sizable need for compliance software. Due to this area's strict safety regulations and rules, entry into the aviation business has very high obstacles. However, compliance software finds this market appealing due to the widespread accessibility and simplicity of deployment of sophisticated technologies.

Asia Pacific is anticipated to experience significant expansion in the compliance monitoring software market for aviation over the forecast period. The key reason for the growing demand for maintenance professionals and compliance software, is the growth inpassenger traffic, particularly in nations like India, Japan, China, and Singapore. Given several significant aviation compliance software suppliers in this region, the industry is also anticipated to experience rapid expansion.

The United States is expected to account for the largest market share of USD 19.9 billion by the end of 2035. The USA has a large number of compliance monitoring software producers, which supports strong growth throughout the forecast period. The two key factors influencing growth are the growing market for commercial aircraft and the rising importance of regulatory compliance with safety requirements established by various governing agencies like the ICAO and EASA in Europe and the FAA in North America.

The cloud-based deployment of Aviation Compliance Monitoring Software is expected to account for the highest CAGR of 7.5% by the end of 2035. Software-as-a-service or cloud-based solutions are offered as a service, with the ERP vendor managing the data and the services being accessed via a web browser. The market has more recently embraced a hybrid model where cloud software is housed on a business's private servers.

On-premises aviation compliance monitoring software deployment refers to the integration of the system into the company's internal network. Key corporations and SMEs with fleet sizes of 100 or more aircraft employ these systems to manage their data for air operations, staff scheduling, and maintenance duties. In terms of improving access control and security, the installation is centralized at a particular spot within an organization's network.

In 2025, revenue through SMEs is expected to grow at the fastest pace in the aviation compliance monitoring software market. It is expected to account for a 7.3% CAGR during the forecast period. SMEs have smaller personnel and fewer resources. By offering them automated tools and procedures for monitoring, managing, and informing on their safety performance, aviation compliance monitoring software can assist SMEs in controlling their aviation safety risks. By automating tasks like data collecting and reporting, aviation compliance monitoring software can also assist SMEs in lowering the cost of complying with regulatory requirements. Aviation compliance monitoring technology can help SMEs enhance team member communication regarding safety concerns and best practices.

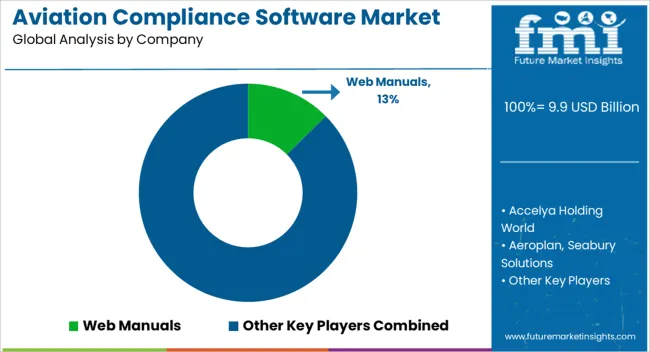

Web Manuals, Comply365, Merlot Aero, Vistair, Accelya Holding World, Aeroplan, Airline Software, BERNS Engineers, Seabury Solutions, Infotel Group, and Ideagen, are a few of the major companies operating in the global aviation compliance market.

Some of the Recent Developments in the Aviation Compliance Monitoring Software Market are:

Similarly, the team at Future Market Insights has tracked more recent developments related to companies in aviation compliance monitoring software market services, which are available in the full report.

The global aviation compliance monitoring software market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the aviation compliance monitoring software market is projected to reach USD 19.9 billion by 2035.

The aviation compliance monitoring software market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in aviation compliance monitoring software market are cloud-based and on-premises.

In terms of application, large enterprises segment to command 68.2% share in the aviation compliance monitoring software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Biofuel Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

5G in Aviation Market – Future of In-Flight Connectivity

Compliance Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Compliance Testing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA