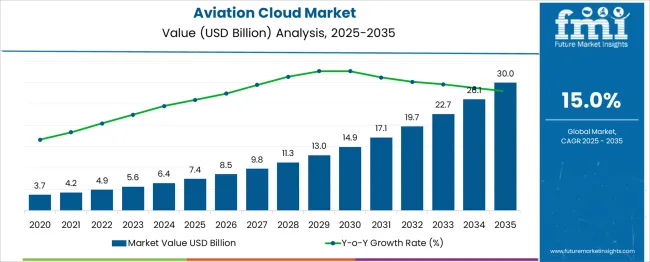

The Aviation Cloud Market is estimated to be valued at USD 7.4 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period. Examining the Growth Contribution Index using the yearly data highlights key phases of expansion and their relative contributions to overall market growth. In the initial years, 2025 to 2027, the market value increases from USD 7.4 billion to USD 9.8 billion, contributing moderately to growth as early adopters integrate cloud technologies for operational efficiencies. This early stage accounts for approximately 20% of the total value increase over the forecast period. From 2028 to 2031, growth accelerates significantly, with market value rising from USD 11.3 billion to USD 19.7 billion.

This phase contributes nearly 50% of the total increase, reflecting rapid adoption driven by increased cloud capabilities, enhanced data security, and real-time analytics critical for aviation operations. The sharp rise in this period underscores the substantial impact of technological advancements and regulatory support. In the final years, 2032 to 2035, the market grows from USD 22.7 billion to USD 30.0 billion. This phase represents the remaining 30% of growth contribution, indicating continued but moderated expansion as the market reaches maturity with broader cloud adoption and integration across aviation segments. The Growth Contribution Index highlights that mid-period growth is pivotal, marking this phase as a strategic focus for stakeholders targeting maximum impact within the market.

| Metric | Value |

|---|---|

| Aviation Cloud Market Estimated Value in (2025 E) | USD 7.4 billion |

| Aviation Cloud Market Forecast Value in (2035 F) | USD 30.0 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The aviation cloud market is experiencing accelerated adoption due to the sector's need for real-time data accessibility, enhanced operational efficiency, and cost reduction across global airline operations. Airlines and aviation service providers are increasingly turning to cloud platforms to streamline flight operations, ground handling, maintenance, crew scheduling, and customer engagement.

With fluctuating fuel prices and operational costs, cloud-based models offer scalability, faster deployment, and lower capital expenditure. Regulatory agencies are also pushing for data transparency and compliance, which cloud infrastructure readily supports.

Additionally, the growing demand for predictive maintenance and AI-enabled analytics is fueling investment in advanced aviation cloud services. Increased digital transformation, especially post-pandemic, has made cloud computing an essential element of aviation IT modernization strategies, with future growth poised to benefit from edge-cloud integrations and cybersecurity enhancements tailored to aerospace ecosystems.

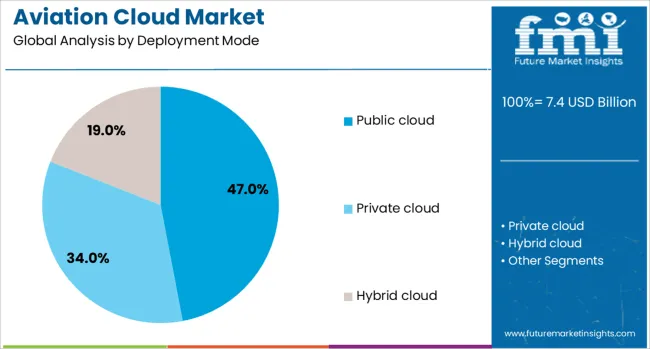

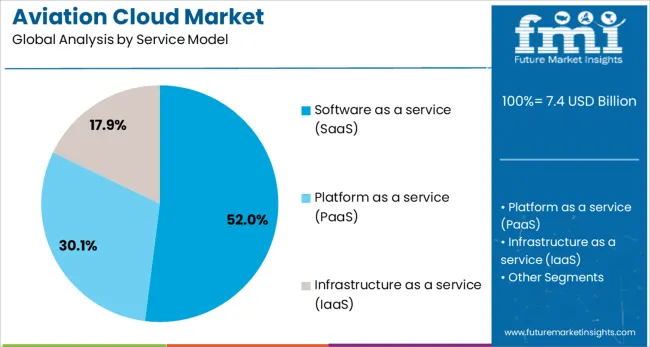

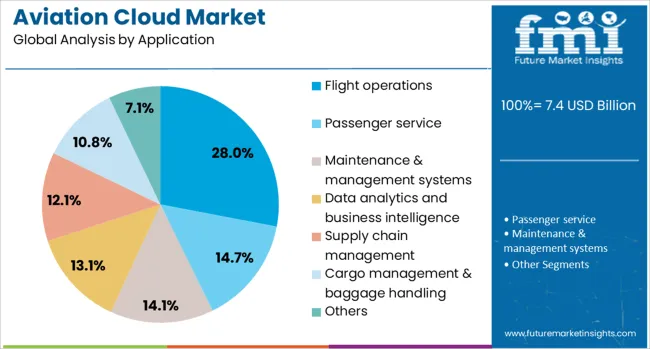

The aviation cloud market is segmented by deployment mode, service model, application end user, and geographic regions. The deployment mode of the aviation cloud market is divided into Public cloud, Private cloud, and Hybrid cloud. In terms of the service model, the aviation cloud market is classified into Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). The aviation cloud market is segmented into Flight operations, Passenger service, Maintenance & management systems, Data analytics and business intelligence, Supply chain management, Cargo management & baggage handling, and Others. The end users of the aviation cloud market are segmented into Airlines, Airports, Maintenance, Repair, and Overhaul (MRO) providers, and OEMs. Regionally, the aviation cloud industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Public cloud is projected to hold 47.00% of the revenue share in the aviation cloud market by 2025, making it the leading deployment mode. Its dominance is being attributed to its cost-efficiency, flexibility, and ease of scalability, which are critical factors for airlines managing complex operations across geographically dispersed networks.

Public cloud environments enable seamless data sharing between stakeholders, including airports, airlines, and regulators, without the need for heavy infrastructure investment. As aviation players increasingly adopt SaaS and PaaS solutions for core operations like passenger processing and real-time fleet tracking, public cloud offerings provide the agility to deploy and scale these services rapidly.

Additionally, the enhanced security, disaster recovery, and global availability of leading public cloud platforms have increased trust and adoption, especially among commercial carriers and MRO providers with diverse IT requirements.

Software as a Service (SaaS) is expected to account for 52.00% of the aviation cloud market by 2025, making it the most prominent service model. This leadership is being driven by SaaS’s ability to provide modular, subscription-based access to critical aviation applications without the need for extensive on-premise infrastructure.

Airlines are leveraging SaaS to modernize passenger service systems, airport resource management, crew scheduling, and ticketing, while benefiting from automatic updates and lower maintenance overhead. The shift to digital platforms for managing day-to-day operations has made SaaS attractive to both low-cost and full-service carriers seeking to increase agility and reduce IT complexity.

SaaS also supports integration with mobile devices and wearables used by ground and cabin staff, improving operational responsiveness and customer experience. As the aviation industry faces increasing regulatory scrutiny and performance expectations, SaaS models offer a secure, compliant, and scalable route to modernization.

Flight operations are projected to lead the aviation cloud market application landscape with a 28.00% revenue share in 2025. This position is being strengthened by the critical need for real-time data processing and analytics to support scheduling, flight planning, dispatch, and fuel optimization.

Cloud-based flight operation platforms enhance collaboration between pilots, dispatchers, and ground staff, enabling better route management and quicker decision-making during disruptions. Airlines are adopting cloud tools to meet efficiency targets, reduce fuel consumption, and manage air traffic complexities.

These platforms also facilitate regulatory reporting and performance monitoring, helping carriers stay compliant while improving operational KPIs. As air travel demand increases and airline networks expand, the requirement for scalable, integrated flight operation systems continues to grow, making this application segment central to aviation cloud strategy.

The aviation cloud market has been shaped by the growing demand for digital transformation within the airline and aerospace sectors. Cloud computing solutions have been leveraged to enhance operational efficiency, improve passenger experience, and enable real-time data sharing among stakeholders. These platforms have facilitated seamless integration of flight operations, maintenance scheduling, and customer service applications, driving enhanced decision-making capabilities. Adoption has been accelerated by the need to reduce IT infrastructure costs, support big data analytics, and improve collaboration across airline alliances and airport authorities. The shift towards hybrid cloud models and edge computing has further expanded the capability of aviation cloud services to handle complex, latency-sensitive applications, positioning the market for sustained growth as airlines seek agile and scalable technology solutions.

Cloud-based platforms have enabled airlines and ground service providers to centralize data management, streamline workflows, and automate routine tasks. Real-time access to flight status, crew scheduling, and maintenance logs has reduced delays and operational disruptions. Predictive analytics powered by cloud computing has allowed airlines to optimize fuel consumption, route planning, and asset utilization. Cloud solutions have supported integration with Internet of Things (IoT) devices onboard aircraft and within airports, facilitating proactive maintenance and enhancing safety protocols. Moreover, collaborative platforms hosted in the cloud have improved communication between pilots, air traffic controllers, and ground operations teams. This digital integration has lowered operational costs while improving reliability and service quality across the aviation ecosystem.

Passenger-facing applications hosted on cloud platforms have transformed the travel experience by enabling personalized services, mobile check-ins, and real-time updates. Airlines have utilized cloud analytics to tailor offers, loyalty programs, and ancillary services based on passenger behavior and preferences. Cloud-enabled self-service kiosks, baggage tracking, and biometric verification systems have reduced wait times and improved security processes at airports. Additionally, inflight entertainment and connectivity services have been enhanced through cloud streaming, allowing passengers to access content seamlessly. The scalability and flexibility of cloud infrastructure have allowed airlines to rapidly deploy new customer engagement tools and respond to fluctuating demand, thus elevating satisfaction and brand loyalty.

Despite significant advancements, the aviation cloud market has faced challenges related to data security, regulatory compliance, and system integration. Protection of sensitive flight, passenger, and operational data against cyber threats has required robust encryption, identity management, and threat detection measures. Compliance with aviation and data privacy regulations across multiple jurisdictions has complicated cloud deployment strategies. Integration of legacy systems with modern cloud architectures has presented technical hurdles, requiring specialized expertise and migration planning. Additionally, concerns regarding vendor lock-in and service availability have influenced cloud adoption decisions. Addressing these challenges through standardized protocols, hybrid cloud approaches, and collaborative industry frameworks will be essential to unlocking the full potential of cloud computing in aviation.

Continuous innovation in cloud-native applications, artificial intelligence, and edge computing has accelerated the development of aviation-specific cloud solutions. Partnerships between technology providers, airlines, airports, and regulatory bodies have fostered ecosystem-wide digital transformation. Cloud platforms have supported the deployment of digital twins, virtual training simulators, and real-time weather analytics to enhance operational planning and safety. Investment in 5G connectivity and satellite communication infrastructure has complemented cloud adoption by enabling low-latency data transmission. Emerging trends such as blockchain for secure transaction management and autonomous aircraft operations are being integrated into cloud strategies. These developments, coupled with growing demand for cost-effective, scalable IT solutions, are expected to sustain robust growth in the aviation cloud market globally.

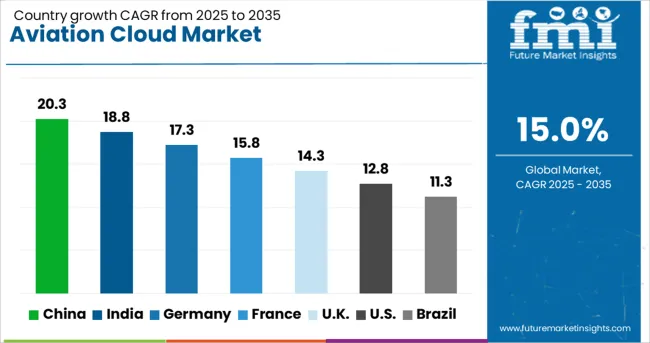

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The market is expected to grow at a CAGR of 15.0% from 2025 to 2035, driven by the need for real-time data sharing, improved operational efficiency, and enhanced passenger services. China leads with a projected CAGR of 20.3%, supported by its rapid modernization of airports and adoption of cloud-based air traffic management systems. India follows at 18.8%, fueled by increasing digitization in airline operations and infrastructure upgrades. Germany, growing at 17.3%, benefits from investments in secure cloud platforms and regulatory compliance. The UK, with a 14.3% CAGR, focuses on integrating cloud services with aviation cybersecurity and data analytics. The USA, expanding at 12.8%, advances through innovation in cloud-native applications and connected aircraft technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 20.3% between 2025 and 2035 in the aviation cloud market, driven by rapid adoption of cloud-based flight operations management and data analytics platforms. Major airlines and airports are investing in scalable cloud infrastructure to enhance real-time data sharing, improve fleet management, and optimize maintenance schedules. Collaboration between cloud service providers and aviation technology firms is accelerating the deployment of AI-enabled predictive maintenance and passenger experience solutions. Expansion of domestic and international flight networks is increasing demand for integrated cloud platforms to streamline operations.

India is projected to grow at a CAGR of 18.8% in the aviation cloud market, supported by modernization of airport infrastructure and digitalization of air traffic control systems. Cloud-based platforms are being implemented for passenger data management, cargo tracking, and flight scheduling to improve operational efficiency. National carriers and regional airports are investing in hybrid cloud models for secure data handling and scalability. The integration of AI and machine learning algorithms is facilitating dynamic route optimization and predictive analytics. Increasing government focus on smart airport initiatives is further boosting market expansion.

Germany is anticipated to grow at a CAGR of 17.3% in the aviation cloud market, emphasizing secure cloud environments compliant with stringent data protection regulations. Cloud platforms are deployed for real-time aircraft monitoring, maintenance documentation, and crew scheduling, enhancing operational resilience. The aviation sector is collaborating with cybersecurity firms to safeguard sensitive data and ensure regulatory compliance. Advanced analytics on cloud are supporting fuel efficiency and emission reduction strategies. Integration of cloud with IoT devices across ground operations is improving airport turnaround times.

The United Kingdom is projected to grow at a CAGR of 14.3% in the aviation cloud market, driven by investments in cloud-based passenger engagement platforms and digital airport services. Airlines are leveraging cloud solutions to enhance baggage tracking, ticketing, and loyalty program management. Airports are deploying cloud analytics for crowd management and facility optimization. The market benefits from partnerships between aviation companies and cloud service providers delivering scalable and flexible platforms. Emphasis on passenger experience and operational agility is supporting cloud platform diversification.

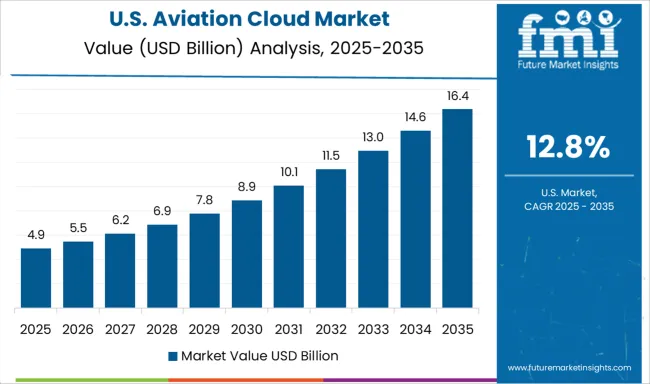

The United States is expected to grow at a CAGR of 12.8% in the aviation cloud market, with major airlines and cargo carriers adopting cloud-native architectures for improved scalability and data integration. Investments in cloud-enabled predictive maintenance, crew management, and customer service platforms are increasing. The development of multi-cloud strategies is helping aviation firms mitigate risks and optimize costs. Integration of cloud with artificial intelligence and big data analytics is enhancing decision-making capabilities across operational and commercial functions. Focus on reducing downtime and improving passenger satisfaction is driving technology adoption.

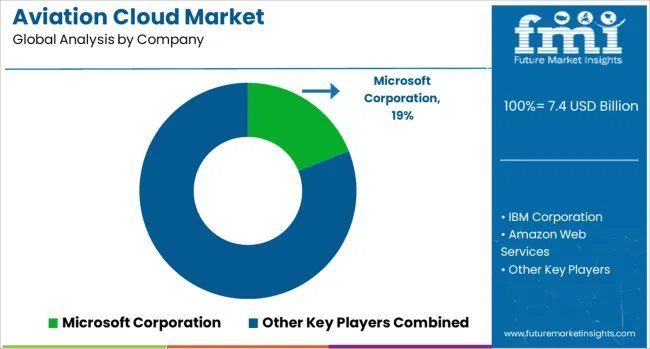

The market is evolving rapidly as airlines, airports, and aerospace manufacturers adopt cloud-based solutions to improve operational efficiency, data management, and customer experience. Cloud technologies enable real-time analytics, predictive maintenance, and seamless communication across complex aviation networks. Market players focus on offering scalable, secure, and compliant cloud platforms tailored to the unique demands of the aviation sector, including regulatory adherence and data privacy. Microsoft Corporation leads with its Azure platform, providing aviation-specific cloud services that integrate AI and IoT for fleet management and passenger services. Amazon Web Services (AWS) offers a comprehensive suite of cloud computing solutions facilitating big data analytics, digital transformation, and operational resilience for aviation clients. IBM Corporation emphasizes hybrid cloud environments and blockchain integration to enhance supply chain transparency and cybersecurity.

Oracle Corporation delivers cloud applications supporting airline revenue management, crew scheduling, and maintenance tracking, leveraging its enterprise software expertise. Google provides advanced machine learning tools and scalable infrastructure for data-driven decision-making in flight operations and customer engagement. SAP SE integrates cloud ERP systems with aviation-specific modules, enabling streamlined finance, procurement, and asset management. The competitive landscape is shaped by the ability to provide industry-specific customization, seamless integration with legacy systems, and adherence to stringent aviation safety and security standards. Providers investing in innovation, partnerships, and global cloud infrastructure are well positioned to capitalize on the digital transformation accelerating within the aviation ecosystem.

Core strategies in the Aviation Cloud Market prioritize optimizing operational workflows and data management through scalable cloud infrastructures. Market participants focus on embedding advanced analytics and AI capabilities to streamline flight operations and maintenance processes. Strategic alliances between cloud providers and aviation firms facilitate innovation while ensuring adherence to regulatory frameworks. Emphasis on robust cybersecurity protocols safeguards critical flight and passenger information.

Furthermore, the implementation of hybrid cloud models enables agile resource allocation and real-time data accessibility across international networks. These approaches collectively drive cost efficiencies, enhance safety standards, and elevate operational performance within the aviation industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.4 Billion |

| Deployment Mode | Public cloud, Private cloud, and Hybrid cloud |

| Service Model | Software as a service (SaaS), Platform as a service (PaaS), and Infrastructure as a service (IaaS) |

| Application | Flight operations, Passenger service, Maintenance & management systems, Data analytics and business intelligence, Supply chain management, Cargo management & baggage handling, and Others |

| End User | Airlines, Airports, Maintenance, Repair, and Overhaul (MRO) providers, and OEMs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Microsoft Corporation, IBM Corporation, Amazon Web Services, Oracle Corporation, Google, and SAP SE |

| Additional Attributes | Dollar sales by service type and deployment model, demand dynamics across commercial airlines, defense aviation, and business jets, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in edge computing integration, real-time data analytics, and secure aviation-grade cloud platforms, environmental impact of data center energy use and network infrastructure, and emerging use cases in predictive maintenance, in-flight connectivity enhancements, and air traffic management optimization. |

The global aviation cloud market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the aviation cloud market is projected to reach USD 30.0 billion by 2035.

The aviation cloud market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in aviation cloud market are public cloud, private cloud and hybrid cloud.

In terms of service model, software as a service (saas) segment to command 52.0% share in the aviation cloud market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Biofuel Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Adoption Analysis of 5G in Aviation Market Size and Share Forecast Outlook 2025 to 2035

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA